Salary for the last month

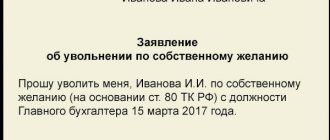

The resigning employee is entitled to payment for the days worked in the month of dismissal. The calculation is made on the day of dismissal (Article 140 of the Labor Code of the Russian Federation) , indicated:

Payment cannot be made later than this date, even if the employee and employer have agreed to this in writing. Such an agreement will be considered invalid.

In case of delay, the employer will have to pay the employee compensation - calculated upon dismissal for delay. The size of this transfer depends on the period for which the payment was delayed.

Important! The salary upon dismissal, if established by the employment contract, includes unpaid bonuses and allowances (overtime, etc.).

It should be noted that the day of dismissal is considered a working day and is paid in the same way as other working days.

Compensation for unused vacation

Another mandatory payment, regardless of the reason for dismissal, is the calculation of unused vacation pay. This rule was established by Letter of the Ministry of Labor of the Russian Federation No. 14-1/B-1074.

In accordance with Art. 126 of the Labor Code of the Russian Federation, vacation can be replaced with monetary compensation, and Art. 127, in turn, regulates the employee’s right to leave upon dismissal. He can:

- receive compensation for unused vacation days;

- go on vacation with subsequent dismissal (vacation pay will be paid in the general manner, and the day of termination of the employment contract will be considered the last day of vacation).

The calculation is the difference between the number of vacation days that the employee would have been entitled to count on if he had not quit, and the number of vacation days he had already used.

Unlike wages and other compensation, the monetary sale of unused vacation is subject to taxation in accordance with clause 3 of Art. 217 of the Tax Code of the Russian Federation (vacation pay minus personal income tax) and clause 1 of Art. 422 of the Tax Code of the Russian Federation (insurance premium is calculated).

Possible guarantees and compensations

If voluntary dismissal involves only two payments - wages and unused vacation, then upon termination of the employment contract by mutual desire of the employee and the head of the organization, severance pay is also paid (if this was specified in the contract). This type of compensation will be discussed in more detail below.

Important! In exceptional cases, an employee is entitled to guarantee payments upon termination of an employment contract.

The law understands these to be payments in favor of employees who did not actually fulfill their job duties for legitimate reasons (in this case, dismissal due to circumstances beyond the employee’s control). One of these payments includes the payment of average monthly earnings for the period of employment.

A wide range of payments is intended for persons dismissed due to the liquidation of an enterprise:

- wages and vacation compensation;

- severance pay in the amount of average monthly earnings (Article 178 of the Labor Code of the Russian Federation);

- additional compensation for early dismissal (with the employee’s consent) in the amount of average monthly earnings, calculated in proportion to the time before the expiration of the two-month period (Article 180 of the Labor Code of the Russian Federation);

- payment of average monthly earnings for the third month of the employee’s employment period, if he contacted the employment service no later than within 2 weeks after dismissal (Article 178 of the Labor Code of the Russian Federation).

An employee dismissed due to layoff, in addition to basic payments, has the right to count on:

- for severance pay (Article 178);

- for additional compensation proportional to the time before the expiration of the employee’s notice of dismissal due to reduction.

Severance pay

This payment is regulated by Art. 178 of the Labor Code of the Russian Federation and represents the payment of a sum of money in connection with the liquidation of an enterprise, staff reduction, dismissal of management due to a change of owner or without explanation, as well as in certain other cases established directly by the employment contract or legislative acts of the Russian Federation, for example:

- conscription of an employee for military service;

- recognition of him as unfit for work by a medical commission;

- the employee refused to transfer to work in another area, etc.

In case of liquidation or reduction of staff, severance pay is calculated in the amount of average monthly earnings and paid for 2 months (payment for 3 months is possible if you contact the employment agency in a timely manner).

The increased amount is established by agreement of the parties.

Other charges

Other payments (accruals) to a dismissed employee include compensation established by an employment contract or established for certain categories of employees (persons working in the Far North, etc.).

Other payments to those resigning are also due:

- upon dismissal due to health conditions that do not allow continuing to carry out certain activities;

- if your health condition has deteriorated due to the employer’s fault (Article 212 of the Labor Code of the Russian Federation);

- when a local act or employment contract establishes financial assistance to an employee.

Determining the amount of payments due upon termination of an employment contract

Depending on the reason for termination of the employment contract, the amounts of all payments will be added up. But before you start adding up, you need to determine the amount of average monthly earnings, and the HR and accounting departments must adhere to a clear algorithm.

Calculation upon dismissal consists of the following steps:

Step 1. Drawing up a time sheet by the HR department (according to form T-13).

As a rule, a separate time sheet is drawn up for the employee with whom the employment contract is terminated, which includes the following:

- days worked by him during the year;

- number of days of sick leave;

- number of vacation days;

- business trips;

- overtime days.

Step 2. Signing the timesheet.

The head of the HR department, having agreed with the head of the organization, signs the time sheet and transfers it to the accounting department.

Step 3. Calculation.

For calculations, the accountant uses the following formula:

Salary = (Salary + bonus + other allowances) x (number of days worked / number of days in a month)

In addition to wages, it is necessary to make calculations for unused vacation. In accordance with Art. 115 of the Labor Code of the Russian Federation, every employee who has worked for at least 11 months has the right to go on vacation for 28 days.

Thus, the calculation is made using the following formulas.

- If the employee has worked for less than a year:

Unused vacation days = 28 / 12 x number of months worked - number of vacation days used

- If he worked for several years:

Unused vacation days = number of years worked x 28 + 28 / 12 x number of months worked - number of vacation days used

- If an employee has worked for 6 to 11 months, but his dismissal is due to layoffs, liquidation of the organization, or conscription into the army:

Unused vacation days = 28 - number of vacation days used

The payment itself is calculated as follows:

Payment for unused vacation = unused vacation days x average daily earnings

If severance pay is due upon dismissal, the following algorithm is used:

Severance pay = (amount of salary in the pay period / number of days worked) x number of days in the next month

Thus, the accountant is required to:

- set earnings for the last month + payments, bonuses and supplements;

- calculate unused vacation days;

- calculate severance pay;

- add up the resulting amount.

The calculation period is established by Art.

140 Labor Code of the Russian Federation. The employer is obliged to pay the entire due amount no later than the day of dismissal specified in the application of one’s own free will, agreement of the parties or notice of the employer’s desire to terminate the employment contract, as well as in the Order.

It is important to note that within the specified period only the amount that is not disputed by the dismissed employee is paid.

Determination of average daily earnings

When making calculations, the concept of average daily earnings is often used. This is the average amount calculated from the employee's annual salary. It includes:

- salary for time worked;

- earnings in kind;

- interest on revenue;

- remuneration and maintenance accrued to certain categories of employees;

- fees;

- surcharges and allowances;

- overtime, etc.

The following will not be taken into account:

- one-time payments;

- social benefits;

- compensation (travel, accommodation, etc.).

In cases of dismissal, average daily earnings are used to calculate unused vacation and take it into account in the total amount of payments.

Average earnings are calculated using the following formula:

Average salary = salary amount for 12 months / 12 / 29.3

29.3 is the coefficient established by the Government of the Russian Federation in Resolution No. 922.

If an employee has worked an incomplete pay period, the formula will change slightly and the calculation will be made in two stages:

- Determine the number of days in an incompletely worked period:

Number of days in an incompletely worked period = 29.3 / number of days in a month x number of days actually worked

- Calculate average daily salary:

Average salary = salary amount for the billing period / (29.3 x number of fully worked months) + number of days in the not fully worked period

Example

Petrov got a job on January 1 and quits at his own request on November 20. He used only 14 days of vacation (from July 1 to July 14). In November he was given a bonus of 5 thousand rubles. His salary every month was consistently 30 thousand rubles, and November was no exception. Average daily earnings amounted to 1,024 rubles.

Thus, upon dismissal he will receive the following amount:

- The salary will be equal to:

(30 thousand + 5 thousand) x 20 / 30 = 23,333 rub. 33 kopecks;

- Number of unused vacation days:

28 / 12 x 10 – 14 = 9.3 days;

- Amount for unused vacation:

9.3 x 1,024 = 9,532 rubles. 20 kopecks

- Full calculation:

RUB 23,333 33 kopecks + 9.532 rub. 20 kopecks = 32,865 rubles. 53 kopecks

Dismissal of an employee who has worked for 2 weeks, 1 month, 5 months, 6 months, 11 months

There are situations when an employee has to be fired at his own request or on the initiative of the employer, when he has worked very little, or has worked for less than a full month, or has not stayed at the enterprise until the end of the working year.

In such cases, the employer must competently carry out the dismissal procedure, otherwise the employee’s rights will not be respected. Most often, the dismissal of an employee who has worked only 2 weeks occurs:

- on their own initiative,

- based on the results of the probationary period (option for those dismissed after 2 weeks and 1 month of work).

This is also important to know:

How to formalize the dismissal of an employee by way of transfer to another position or to another organization

If it was decided to formalize the dismissal of an employee as having failed the test, you need to remember that for this a probationary period had to be assigned, and it could last no more than a month. Labor legislation does not establish an employer’s obligation to prescribe tests, and therefore, if the company’s policy does not provide for any testing of a candidate’s abilities for a job, then it will be possible to fire him only for absenteeism and violations, or at will.

If a decision is made to formalize the dismissal as a resignation of one’s own free will, the employee is obliged to notify about this 2 weeks in advance, which will subsequently have to be worked out if the employer requires it (if desired, the parties can agree on dismissal on any day without working out the required period). It happens that work is not possible due to the employee moving to another region, pregnancy, etc.

Payments upon dismissal at one's own request:

- issue wages for the time actually spent at work;

- make calculations and accrue compensation for vacation that could have been used, but which never came to pass (on average, for a month of work, the right to 2 days of rest arises, therefore, for 2 weeks of work and for 1 month of work, 1-2 days should be compensated non-vacation).

Dismissal after 5, 6 and 11 months of work can be motivated as follows:

- The employee himself wished to leave the workplace.

- The duration of the urgent contact has expired.

- An employee is transferred to a new position in another company.

- Staff reduction.

- Liquidation of the enterprise.

- Allowing employees to regularly violate labor discipline.

Even when an employee has not worked for a full six months or a year, he will be entitled to compensation for unused rest days. And if there has been a reduction in staff, or the employee’s departure from work was initiated by the employer for another reason, the employee is entitled to other types of compensation for early termination of employment.

Salary for less than a month of performance of official duties is calculated:

- By the nominal number of days in a month (the average number of days in a month is determined by regulatory documents, in 2020 it is 29.4 days):

Salary = full salary: 29.4 x ChOD, where

- Salary - salary calculated based on the nominal number of days,

- FZP - actually assigned salary,

- CHOD - number of days worked.

- Based on the actual number of days in a month:

ZP = FZP: KDM x CHOD, where

- Salary - salary calculated based on the actual number of days in the month,

- FZP - actual salary of the employee,

- KDM - number of days in a month,

- CHOD - number of days worked.

Additionally, holidays, weekends, days of absence are taken into account with the same salary.

Financial assistance for such an employee

In accordance with the local regulations of the organization, the employer can establish additional payments in support of a certain category of employees or specify them separately when concluding an employment contract with specific employees.

A dismissed employee is paid financial assistance only in special cases, for example:

- as an additional payment in case of liquidation or reduction of staff before the employee is hired for a new job;

- dismissal for health reasons;

- dismissal of military personnel or civil servants, if it is not related to their guilty actions;

- retirement;

- the employee has worked for many years and made a significant contribution to the development of the organization;

- the employee was harmed by a natural disaster;

- difficult financial situation in the family, etc.

Important! The amount of financial assistance can be expressed in a specific amount or as a percentage of the basic salary.

This amount is taxable unless it is related to the following events:

- the payment was made in connection with damage caused to the employee by a natural disaster;

- the benefit was assigned in connection with the death of a family member of the employee;

- the amount of material support did not exceed 4 thousand rubles.

Table of benefit amounts depending on the circumstances of dismissal

| Grounds for dismissal | Benefit amount |

| Liquidation of a company | In the amount of average monthly earnings for all categories of workers, with the exception of those specified in Art. 178 Labor Code of the Russian Federation:

|

| Reduction in headcount or staff | __//__ |

| Refusal to transfer for medical reasons | Average earnings for two weeks. |

| Conscription into the army or alternative service | __//___ |

| Due to the reinstatement of an employee who previously performed work, by a court decision or labor inspectorate | __//___ |

| Refusal to transfer together with the organization to another location | __//___ |

| Recognition based on a medical report as completely incapable of performing relevant duties | __//___ |

| Refusal to work under new conditions | __//__ |

| Violation of the rules for concluding an employment contract established by law, which occurred through no fault of the employee, if such a violation precludes transfer or continuation of activity | Average monthly earnings. |

Are bonuses given to departing employees?

As a rule, the bonus is included in the employee’s salary, paid as the balance for the days worked before termination of the employment contract , if it is due to the dismissed employee.

Payment of a dismissal bonus is not made only if the employee is dismissed due to his own guilty actions (regular violation of discipline, committing gross violations once, theft of the organization’s property, etc.).

It is also important to note that premiums exceeding 4 thousand rubles are subject to taxation.

Types of compensation for dismissed employees

What is paid upon dismissal?

- Compensation for dismissal of an employee due to poor health.

- Payments upon dismissal at the initiative of the employee.

- Payments upon dismissal by agreement of the parties.

- Payments upon dismissal of an employee due to staff reduction.

For any reason for staff leaving the enterprise, the employer must make payments for annual leave that the workers did not have time to take. When leaving work occurred on the initiative of the authorities, those dismissed are also entitled to severance pay (in addition to payment for the time actually spent at the workplace while performing official duties).

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Compensation for early termination of an employment contract

Dismissal in case of early termination of an employment contract must be preceded by notification by the employer to the employee 2 months before the date of his actual departure from work. The employer does not have the right to force an employee to write a letter of resignation of his own free will, since this is beneficial exclusively to the employer, who will not have to pay his employee severance pay.

When reducing staff, the law generally prohibits specifying the reason for dismissal as “personal desire of the employee,” since two grounds for leaving work cannot arise simultaneously. In addition, an entry in the work book upon dismissal due to staff reduction is more beneficial for the worker both in terms of finding a new job and in terms of obtaining various benefits.

This is also important to know:

Dismissal at will: article of the Labor Code

The procedure for such dismissal is as follows:

- The employee receives a notification and agrees to it.

- The employer instructs the accounting department to pay the employee for the amount of compensation for unprovided vacation and severance pay.

- The employee receives a compensation payment for early termination of his employment contract.

Additionally, compensation is assigned for the period remaining until the end of the notice period. In total, the fired person will receive his due salary with all allowances, compensation for rest that was not given, severance pay and compensation salary for the time that he could still work before the dismissal, but agreed not to work.

The purpose of imposing an obligation by law on an employer to pay severance pay is to provide a means of livelihood for an employee who, through no fault or unwillingness, has lost a source of income while he is looking for a new employer.

It is worth keeping in mind that any misconduct in the workplace that would not have been taken into account before, before dismissal, can serve as a reason for manipulation on the part of the employer in order to force the employee to resign of his own free will. At such a time, you should not allow lateness or other, even minor, disciplinary violations.

Compensation for vacation that the employee did not have time to take

For whatever reason, an employee leaves work, among the obligatory payments for him will be compensation for annual leave not provided before the date of dismissal. Moreover, if he had the right to vacation twice, but did not go on vacation for two years in a row, he will receive double compensation.

However, working for 2 years in a row without rest is illegal, and therefore the employer must give an explanation about this, except in cases where the employee has done something wrong. The procedure is this because compensation for unused vacation is not paid if the employee is fired for serious violations. The day of actual departure from the enterprise will be the last day of rest, and before that the employee will already be given all the compensation due to him for unused vacations.

Employee compensation for staff reductions

The dismissal of employees when reducing the company's staff is recognized by law as independent of the wishes of management and subordinates. Extra-budgetary funds are involved in the implementation of social programs aimed at providing for citizens who have lost their jobs through no fault or initiative.

Dismissed employees receive wages with the allowances and bonuses they are entitled to for the time actually spent at work, compensation for annual rest not provided (if any), severance pay, which is certainly paid in two cases:

- upon closure of the enterprise,

- when staffing is reduced.

The average salary is retained by a dismissed employee only until (but not more than 3 months, and only after such a decision is made by the Employment Service) he signs a contract with a new employer. And if we are talking about a part-time worker who still has a second job, then he is not entitled to severance pay at all.

If there is no part-time job, the dismissed employee contacts the Employment Service within 14 days and leaves an application to find a new job. And in the event that the Employment Center does not find a suitable position at another enterprise, it will receive from the former employer the amount of its average earnings for 3 months instead of the standard two.

Compensation for police officers upon dismissal

Police officers are entitled to full compensation for each vacation not used on time until January 1 of the year in which the dismissal took place (the reason does not matter). Compensation amounts for rest that the police officer did not take during the year of dismissal will be paid:

- upon length of service at which the right to pension payments arises, upon reaching the age limit, upon dismissal due to staff reduction or deterioration of health (for annual leave in full, and for other types of rest - in proportion to the length of service in the year of departure from service in the amount of 1/12 of the vacation for 1 full month of work);

- for all other reasons (for each entitled type of rest in the amount of 1/12 of the duration of leave for 1 full month of service based on the average salary).

This is also important to know:

The dismissal procedure under the Labor Code

When a police officer leaves service, he is entitled to:

- Salary for the entire period of service.

- Quarterly bonus calculated based on actual time served.

- Compensation equal in value to at least two salaries for the year (if it was not paid in the relevant year).

- A one-time financial incentive based on the results of 12 months is proportional to the time actually spent in service.

- Compensation for vacation not provided before dismissal.

- One-time benefit in the amount of:

- 5 average monthly salaries (dismissal due to age, health reasons, staff reduction, illness, after 10 years of service),

- 10 average monthly salaries (with 10-14 years of service),

- 15 average monthly salaries (with 15-20 years of service),

- 20 average monthly wages (with more than 20 years of service),

- 40% of the transferred amounts (if dismissed for other reasons),

- the transferred amounts + 2 salaries (if the policeman was awarded an order during his service or was awarded an honorary title).

The salary is the one that was assigned at the time of dismissal. Years of service are not rounded to full years. If dismissal occurs upon re-employment, payments are calculated with the offset of previously paid amounts for length of service. If the total length of service was less than 15 years, and the policeman was dismissed without the right to a pension, his salary is retained for 12 months after leaving service (annual indexation is taken into account).

When retiring

When retiring, an employee can receive not only compensation for vacations and wages.

He may also be entitled to additional payments. But only if the collective agreement specifies special conditions under which accruals are made to employees leaving due to retirement age. Sick leave after dismissal in 2020, according to the Labor Code, must be paid by the employer within a month.

Sick leave pay after dismissal

A former employee has the right to claim sick leave payment through the company from which he was dismissed, provided that no more than a month has passed from the date of registration of the event. Only those citizens who have not been employed since the termination of their employment contract should contact the head of a business entity. The certificate of incapacity for work must be presented no later than 6 months from the date of termination of the employment relationship. When calculating the amount of payment, length of service is not taken into account, and when determining its size, the salary is adjusted to 60 percent. If the sick leave was issued to a close relative, then it is not payable.

Dismissal during illness

In case of serious illness, the employee may be on sick leave for a long time. During this period, he has the right to resign for his own reasons or by agreement of the parties, due to the initiative of the employer due to the need to perform duties by a constantly absent person and assign them to a new employee.

The procedure for dismissing a person on sick leave is no different from terminating a contract with a working employee. He must notify the employer of his desire, and after two weeks receive a payment. For a dismissed employee with an open sick leave certificate, the payment amount can be calculated only after receiving a closed sick leave certificate issued by a medical institution. Payments are made on the nearest payday.

How are deductions made and in what amount?

The employee's debts to the employer are also taken into account in the final calculation. These include:

- unearned advance payment issued against salary or travel allowances;

- amounts overpaid as a result of an error;

- vacation provided in advance.

The head of the organization does not have the right to assign debt on additional grounds. The situations presented above are the only ones in which a withholding can be made.

The total amount cannot exceed 20% of the salary of the dismissed employee.

Most often, deductions are made for unworked vacation. Accounting must complete three steps:

- calculate the number of unworked days;

- calculate the amount of unearned vacation pay;

- adjust tax reporting (reflect data when preparing a report on calculations for dismissal).

The number of unworked days is calculated using the following formula:

Unused vacation = number of vacation days used for the entire period of work - (28 / 12 x number of months of work in the organization)

The amount is calculated as follows:

Amount of vacation pay debt = number of unworked vacation days x average daily earnings

In what cases can the final amount be revised?

Situations cannot be ruled out when accounting is forced to recalculate (and even deduct), including in favor of an employee who has already been fired or is about to quit:

- the overpayment was made by mistake;

- the employee had a debt (this was discussed above);

- it turned out that part of the salary was once unpaid;

- payment of premiums late.

In these cases, the employer makes calculations using new data. The amount received is deducted from the first calculation. Depending on the situation, the employer or the dismissed employee will have to return the amount of money received.

Important! An employee who learns about an error must contact the employer with a written request to recalculate.

If the head of the organization does not agree to fulfill the requirements, the employee has the right to contact the labor inspectorate, which will oblige the employer to pay the missing amount.

The employer also has the right to demand from the employee his debt or the excess amount accrued by mistake. If the organization refuses to return the money, it has the right to file a lawsuit.

When is the calculation made?

The next important nuance is when a person receives the money from the employer that is due to him by law. Every subordinate needs to remember this.

Payments after voluntary dismissal are provided on the day the order to terminate the employment relationship enters into force. You cannot demand funds immediately after submitting an application of the established form. After all, throughout the entire period of work, the employee may change his mind and withdraw the document.

If at the time of termination of the employment relationship the person was not at work, the payment is made no later than the next day after the former subordinate applied for the due money.

When is it profitable to quit your job and what is the best way to do it?

If the question is about how to profitably quit your job and when is the best time to do it, then we are talking about a vacation with subsequent termination of the employment contract or about a regular dismissal with payment of vacation by the employer in the general manner.

In the first case:

- the employee is granted leave, and until its end he is on the payroll, without working the required 14 days;

- the amount of vacation pay is calculated in the usual manner, without rounding to whole numbers, as is the case with compensation;

- An employee cannot withdraw his resignation letter.

The second case seems to be the most profitable, since compensation for unspent vacation days will be slightly more than the vacation pay itself , and the employee has a chance to withdraw the application even on the last day before dismissal, thereby remaining in his position.

The method of dismissal by agreement of the parties also seems advantageous (Article 78 of the Labor Code of the Russian Federation), but only if the employment contract or written agreement contains a clause on severance pay, which is not taken into account in dismissal at one’s own request.

Reference. If you are dismissed due to redundancy, it is advantageous to terminate the employment contract before the expiration of the two-month period.

The employee is also advised not to delay contacting the employment service - then he can count on the payment of the average salary for not two, but three months.

Who will be paid for 14 days

A dismissal benefit in the amount of two weeks' average earnings is due in the following cases:

- Upon termination of an employment contract for medical reasons. If an employee is recognized as completely disabled or for any reason does not want to transfer to a new workplace, then he is entitled to severance pay upon dismissal for health reasons, two weeks’ pay and wages for the time actually worked. It is important to note that if an employee quits due to health reasons, but at his own request, then compensation is not paid.

- Severance pay upon leaving the army. Compensation in the amount of two weeks' earnings is paid upon conscription into the army or assignment to an alternative service that replaces it.

- In case of dismissal upon reinstatement of the employee in service by a court decision.

- If an employee refuses to take a position when the company moves to another city or region.

- If you disagree with changes to the terms of the employment contract in accordance with Article 74 of the Labor Code of the Russian Federation.

What if there is a dispute regarding the final amount?

The employee may not agree with the amount of dismissal established by management. He has three ways to restore his violated rights:

- contact the employer directly with a written application for recalculation;

- contact the labor inspectorate with a complaint if the head of the organization refused the application;

- file a lawsuit.

In the latter case, one should be guided by Art. 392 Labor Code of the Russian Federation. If the employee does not agree with the amount already paid, he, in accordance with Part 1 of this article, has 1 month from the date of receipt of a copy of the Dismissal Order to file a statement of claim.

If the employer has not paid or underpaid the amount due, the employee has 1 year to appeal.

Responsibility for violation of terms and amounts of payments

In accordance with Article 236 of the Labor Code of the Russian Federation, in case of violation of the due date for payment of wages, vacation pay, payments upon termination of an employment contract and other payments due to the employee, the employer will pay them with interest in the amount of not less than 1/150 of the key rate of unpaid on time in amounts for the day of delay, starting from the next day after the established payment deadline, up to and including the day of actual settlement. In case of non-payment, workers have the right to appeal to the state labor inspectorate, the prosecutor's office and the court to hold employers accountable.

To eliminate errors and make a correct calculation of severance pay upon dismissal, you should first contact a specialist to obtain advice on the application of the law. With this purpose, it is necessary to save all payment forms, employment contracts and other personnel documents issued by the employer during the course of employment. It is possible to obtain free consultations from representatives of government agencies, for example, federal or regional social protection authorities. Phone numbers and other details of these bodies are freely available on administration websites, etc.

It is necessary to take into account the date of dismissal, since the absence of benefits or its insufficient amount can be challenged only within three months from the moment the employee received news of a violation of his rights (Article 392 of the Labor Code of the Russian Federation).