Home / Salary disputes / In what cases and when is the employer obliged to pay settlement upon dismissal?

Upon dismissal, the employer is fully obliged to pay the employee. If this is not done, he may suffer the punishment provided for in such cases. What payments are due, when the calculation takes place, as well as some nuances of dismissal - more about this below.

Features of the dismissal procedure

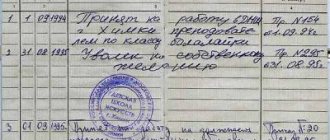

The day of dismissal is also considered the last working day. An exception is if the management of the enterprise, for one reason or another, retains a position for a non-working employee. The article under which the contract is terminated is entered into the work book, its part and clause are indicated. The peculiarity of the dismissal procedure is that the employer is obliged to pay the employee in full, pay him all the money due and issue documents. You must not miss the moment when you must pay wages upon dismissal.

The grounds for termination of an employment contract are contained in the Labor Code of the Russian Federation (Article 77). The initiative can come from both the employee and the management of the enterprise. Reasons for dismissal include :

- Agreement of both parties;

- Employee's intention;

- The employer's desire to part with his subordinate;

- Refusal of personnel to transfer to work in another district/region;

- Violation of the terms of the employment contract;

- Other circumstances, including those that do not depend on the will of the parties.

If the initiative comes from an employee, he only needs to submit a letter of resignation. Further, if the management of the enterprise insists, you have to work for two weeks and receive a payment. An exception is an employee’s urgent move to another location or serious illness. Then the dismissal procedure occurs quickly.

If the initiative comes from the employer, he will have to prove that the grounds for forced dismissal are significant . Their full list is given in the legislation (Article 81 of the Labor Code of the Russian Federation), these include:

- Liquidation, bankruptcy, reorganization of an enterprise;

- Professional unsuitability of the employee;

- Repeated violation of labor discipline;

- Failure to comply with the terms of the employment contract, ignoring the duties assigned to the employee;

- Committing unjustified, hasty actions that caused material damage to the enterprise.

Any reason for dismissal at the initiative of the company's management must be documented.

This is an incomplete list of grounds that give an employer the right to forcibly dismiss an employee. Additionally, you can specify absenteeism, theft, disclosure of trade secrets, and others.

Common Myths

It is best for parents to discuss any concerns about their child’s health with their pediatrician. The topic of narrowing of the fontanelles, their area at birth and later, is full of fictitious facts and naive misconceptions. Here are some common myths that young mothers do not need to listen to from kind-hearted friends and neighbors.

In this short video, Dr. Komarovsky destroys the main myths about the fontanel:

A large fontanel in a newborn is a sure sign of rickets

Wrong conclusion. When a child has rickets, the shape of the head changes, the frontal and parietal lobes of the skull enlarge, the edges of the membrane on the top of the head are flaccid, flexible, and the gap between the axes of the window may not narrow at all.

The size of the fontanel is small, so it is impossible to get vitamin D, even if rickets is diagnosed

If rickets is detected, you need to take medications to heal bone tissue. The size of the window does not matter when identifying pathology. The suture on the skull will not close faster due to this drug therapy necessary for the child.

When the fontanel closes, the brain stops growing

The head and internal parts of the skull continue to develop and increase in size long after the fontanelles have closed. But at a less rapid pace. You can check this fact by measuring the head circumference of a child before adolescence. The stitches will heal completely by age 20.

Children's mental abilities suffer from rapid tightening of the fontanel

It is not true. The brain continues to grow and develop due to the mobility of the cranial sutures. The characteristics of abilities and intelligence do not change due to premature overgrowing of windows at an early age.

The brain can be damaged if you touch the fontanel

No, of course, you shouldn’t put too much pressure on the gap between the vaults of the skull. But you can kiss, touch, feel. The brain is tightly protected by non-ossified tissue.

You need to carefully look after the fontanel, wear thick hats so that the baby does not bump into a corner or side of the bed with it

The fontanelle of a newborn does not require specialized care. A child’s skull should be protected from impacts at any age. Hitting a head with an overgrown crown is also dangerous. You cannot wear a thick hat in the warm season, as this disrupts the heat exchange of the child’s body.

Correctly measuring the size of the fontanel is possible only with the help of hardware research

Ultrasound and neurosonography determine the diameter, circumference and size of the cranial windows more accurately than a doctor using a tape. But the interval between the indicators is small, a fraction of a millimeter. You can get a holistic picture of your baby’s health based on both measurements.

If the fontanel begins to overgrow too late, the diameter decreases very slowly in six months, the child has hydrocephalus

Taking as an example the age norms for closing the spaces between the cranial vaults is not entirely correct. These are averages. And to make a diagnosis - microcephaly, hydrocephalus, rickets - more serious reasons are needed than the period of overgrowth and the size of the soft crown.

With increased intracranial pressure, the newborn has a headache and cries. With hydrocephalus (excess water in the brain), the baby's head grows at a rapid pace, and the edges of the skull vaults diverge.

The fontanel should be overgrown by 24 months. If this does not happen, then the child is sick

In 5% of children, the vaults of the skull are covered with bone tissue after 2 years. By how many years the process will end depends on the characteristics of the organism. This is normal in the absence of other indicators of developmental disabilities.

The spring on the crown of the head is depressed due to a fall

No, this feature is not explained by the fact that the baby could have hit him hard. An increase in the depression inside the skull occurs due to lack of moisture, sweating, and overheating of the baby. Do the test, let the child drink enough. Offer water more frequently for two to three days. The crown will restore its correct position.

If a child was born with a small fontanel, the gap should heal faster and vice versa

By what time the soft area on the head will begin to heal depends on the individual developmental characteristics of the baby. The size of the film in this case does not matter.

In order for the crown to grow faster at normal rates of development, you need to start taking vitamin D and calcium on your own

Home therapy will only harm the child. We recommend that mothers do not interfere with the natural processes of child development by engaging in self-diagnosis. If you have concerns or unrealistic problems, please consult your pediatrician. He knows exactly what to do and when to start treatment.

If the fontanel turns red, the child hits himself or there is a cerebral hemorrhage

Redness may be due to an allergic reaction to detergents, or brushing the head too thoroughly with a hard brush. The symptom has nothing to do with the brain; the scalp reacts to external stimuli.

To dispel all doubts and myths, watch the video with a lecture by the experienced and famous Dr. Komarovsky.

When should the employee receive the money?

Labor legislation unambiguously indicates when wages must be paid upon dismissal and the calculation procedure (Article 140 of the Labor Code). Thus, the employee is required to pay all amounts due to him :

- On the day of dismissal;

- If he is absent from the workplace within the specified period - the next day after the employee submits a request to calculate it.

Violation of these conditions entails administrative liability. This may be a fine of up to 50 thousand rubles. (for organizations), and in case of repeated actions - disqualification of the head of the enterprise for a period of 3 years.

General information about non-payment of wages upon dismissal is described in this article.

If on the day of dismissal an employee does not show up for payment, the employer has cause for concern. He needs to document that it is not his fault for the late payment. To do this you need:

- Send the employee a written notification of the date of calculation and issuance of the work book.

- Draw up an act of absence from work (especially if it is absenteeism) for each day.

- On the day of appearance, document the employee’s request for payment - an explanatory note and a statement from him or an act of refusal.

- Make the payment no later than the next day.

If there are violations of the procedure for paying a dismissed employee, the employer may be held administratively liable within a year (rather than two months). The basis may be a complaint from a dismissed employee or the results of a labor inspection inspection.

Procedure for granting release from work

Of course, to understand how long maternity benefits are paid, you need to know how to arrange the leave itself.

Back to contents

Pregnancy and childbirth

Temporary disability does not occur from the first weeks of pregnancy, but approximately seventy days before birth - that is, approximately at the thirtieth week. Why is the vacation start date important? Because it depends on her when maternity benefits should be paid.

It is believed that the doctor sets the vacation date - and this is partly true, because it is he who will issue the document (temporary disability certificate) according to which the employer will release the employee from the workplace. However, if such a need arises, you can go on maternity leave earlier or later than expected.

For example, the expected date of birth is the eighth of August, which means that the vacation should begin around the second of June. But by agreement with the management, you can leave even on the twenty-fifth of May, even on the first of August - the main thing is that the total number of days (one hundred and forty) remains unchanged.

Of course, along with the shift in the date of leaving work, the deadline for maternity pay will also shift. According to the law, the calculation and payment of benefits must be made within ten days after the employee submits all the necessary documents. In this case we are talking about sick leave.

Back to contents

Staying at home to care for a child

Immediately after the end of the period of temporary disability due to pregnancy, you can take leave to look after your newborn until he reaches the age at which he will be accepted into a preschool educational institution. This could be either three years or one and a half.

The period after how many days maternity benefits are accrued is the same in both cases, but the amount of payments differs significantly: when released from work to care for a child up to one and a half years old, forty percent of the average salary is paid monthly; When taking leave to care for a child from one and a half to three years old, fifty rubles are paid monthly.

Back to contents

Delay and further compensation

So, on the day when salaries are due upon dismissal, the employer is obliged to fully pay the employee, pay him not only money for the last month, but also compensate for unused vacation, and issue severance pay. If this requirement is violated due to the fault of the enterprise, then the dismissed person has the right to demand monetary compensation for the delay. Its size is 1/150 of the Central Bank's discount rate of refinancing of the amount of debt for each day of its existence.

Calculating and transferring compensation along with other payments is not the right, but the obligation of the employer in the event of a delay due to his fault (Article 236 of the Labor Code).

For example, the last working day of Averina A.V. – May 3, 2018. The total amount due to him during the calculation is 110 tr. On the day of his dismissal, Averin was at work, but never received the money. The final settlement with him was made on June 5, 2018, i.e. in 33 days. The refinancing rate for this period is 7.25%. The amount of compensation is 0.0725×33×1/150×110 t.r.=1754.5 rub. In total, Averin was paid 111,754.5 rubles on June 5.

You can read more about compensation for delayed wages in a special article prepared by our editors.

If the company refuses to pay an employee on the day of dismissal, the debt to him is not repaid, the penalty increases, the employee has the right to file a complaint :

- To the labor inspectorate;

- To the prosecutor's office;

- To court.

You can first send an application to your employer. The limitation period for such disputes is 1 month from the date of receipt of the work book. A complaint must be filed with Rostrud no later than three months. The appeal is made in writing, in two copies. Submitted personally through the office or official of the institution or sent by a valuable letter with a list of the attachment.

You may find the following information interesting: where to go if your salary is not paid upon dismissal?

When is maternity leave paid?

Along with wages. If at an enterprise money is issued in person through a cash register, you will need to come and receive it; if it is transferred to an employee’s bank account, the funds will arrive on the day of transfer.

Back to contents

Violations of deadlines

So, the deadlines for maternity leave should be listed:

- for pregnancy and childbirth - within ten days the employer must make a calculation and pay the benefit on the next day after the accrual of wages;

- for child care - on the day of payment of wages (monthly).

Since benefits are issued at the expense of the Social Insurance Fund, some employers do not comply with the deadlines for paying maternity benefits, justifying themselves by saying that the business of the enterprise is only to calculate the total amount, and then everything depends on the Fund.

In fact, this is fundamentally wrong: the employer is obliged to make a calculation, transfer the information to the Fund and, if the funds from there do not arrive in the employer’s account on time, pay the benefit from its own reserves, and then cover its “loss” using the above. Therefore, employees should not depend on when maternity benefits will be transferred from the Fund.

If the head of an enterprise delays payments and hides behind such excuses, you can safely contact the labor commission, the local branch of the Social Insurance Fund, or even the prosecutor’s office.

We hope our article helped you understand when maternity benefits are paid.

Was the information interesting or useful?

Yes550

No30

Share online