Since 2020, the tax service has been administering insurance premiums and accepting reports on them. The only exceptions are contributions for insurance of employees against injuries and occupational diseases - they still remain under the responsibility of the Social Fund. To report on contributions paid, all employers submit Form 4-FSS, you will learn about it from our article.

Who submits 4-FSS

4-FSS is represented by everyone who uses the labor of individuals and pays “injury” contributions for them. This category includes organizations and entrepreneurs, as well as citizens without individual entrepreneur status who hire personnel, for example, a personal driver.

4-FSS is submitted quarterly. Its type - paper or electronic - is selected depending on the number of insured people. If there are more than 25 people, then it is necessary to send the calculation to the Social Insurance Fund in electronic form. With fewer employees, you can choose the submission form yourself.

Deadlines for submitting reports to the Federal Tax Service in 2020

| Type of reporting | Submission period | Submission deadline |

| Certificates 2-NDFL | For 2020 | No later than 03/02/2020 |

| For 2020 | No later than 03/01/2021 | |

| Calculation of 6-NDFL | For 2020 | No later than 03/02/2020 |

| For the first quarter of 2020 | No later than 04/30/2020 | |

| For the first half of 2020 | No later than 07/31/2020 | |

| For 9 months of 2020 | No later than 02.11.2020 | |

| For 2020 | No later than 03/01/2021 | |

| Calculation of insurance premiums | For 2020 | No later than 01/30/2020 |

| For the first quarter of 2020 | No later than 04/30/2020 | |

| For the first half of 2020 | No later than 07/30/2020 | |

| For 9 months of 2020 | No later than 10/30/2020 | |

| For 2020 | No later than 02/01/2021 | |

| Information on the average number of employees | For 2020 | No later than 01/20/2020 |

| For 2020 | No later than 01/20/2021 | |

| Income tax return (for quarterly reporting) | For 2020 | No later than 30.03.2020 |

| For the first quarter of 2020 | No later than 04/28/2020 | |

| For the first half of 2020 | No later than July 28, 2020 | |

| For 9 months of 2020 | No later than October 28, 2020 | |

| For 2020 | No later than March 29, 2021 | |

| Income tax return (for monthly reporting) | For 2020 | No later than 30.03.2020 |

| For January 2020 | No later than 02/28/2020 | |

| For January – February 2020 | No later than 30.03.2020 | |

| For January – March 2020 | No later than 04/28/2020 | |

| For January – April 2020 | No later than 05/28/2020 | |

| For January – May 2020 | No later than 06/29/2020 | |

| For January – June 2020 | No later than July 28, 2020 | |

| For January – July 2020 | No later than 08/28/2020 | |

| For January – August 2020 | No later than September 28, 2020 | |

| For January – September 2020 | No later than October 28, 2020 | |

| For January – October 2020 | No later than November 30, 2020 | |

| For January – November 2020 | No later than 12/28/2020 | |

| For 2020 | No later than March 29, 2021 | |

| VAT declaration | For the fourth quarter of 2020 | No later than 01/27/2020 |

| For the first quarter of 2020 | No later than 04/27/2020 | |

| For the second quarter of 2020 | No later than July 27, 2020 | |

| For the third quarter of 2020 | No later than October 26, 2020 | |

| For the fourth quarter of 2020 | No later than 01/25/2021 | |

| Journal of received and issued invoices | For the fourth quarter of 2020 | No later than 01/20/2020 |

| For the first quarter of 2020 | No later than 04/20/2020 | |

| For the second quarter of 2020 | No later than July 20, 2020 | |

| For the third quarter of 2020 | No later than October 20, 2020 | |

| For the fourth quarter of 2020 | No later than 01/20/2021 | |

| Tax declaration under the simplified tax system | For 2020 (represented by organizations) | No later than 03/31/2020 |

| For 2020 (represented by individual entrepreneurs) | No later than 04/30/2020 | |

| For 2020 (represented by organizations) | No later than 03/31/2021 | |

| For 2020 (represented by individual entrepreneurs) | No later than 04/30/2021 | |

| Declaration on UTII | For the fourth quarter of 2020 | No later than 01/20/2020 |

| For the first quarter of 2020 | No later than 04/20/2020 | |

| For the second quarter of 2020 | No later than July 20, 2020 | |

| For the third quarter of 2020 | No later than October 20, 2020 | |

| For the fourth quarter of 2020 | No later than 01/20/2021 | |

| Declaration on Unified Agricultural Tax | For 2020 | No later than 03/31/2020 |

| For 2020 | No later than 03/31/2021 | |

| Declaration on property tax of organizations | For 2020 | No later than 30.03.2020 |

| For 2020 | No later than 30.03.2021 | |

| Transport tax declaration (for organizations only) | For 2020 | No later than 02/03/2020 |

| Land tax declaration (for organizations only) | For 2020 | No later than 02/03/2020 |

| Single simplified declaration | For 2020 | No later than 01/20/2020 |

| For the first quarter of 2020 | No later than 04/20/2020 | |

| For the first half of 2020 | No later than July 20, 2020 | |

| For 9 months of 2020 | No later than October 20, 2020 | |

| For 2020 | No later than 01/20/2021 | |

| Declaration in form 3-NDFL (only for individual entrepreneurs) | For 2020 | No later than 04/30/2020 |

| For 2020 | No later than 04/30/2021 |

Composition and procedure for filling out the form

Currently, Form 4-FSS is in force, approved by order of the fund dated September 26, 2016 No. 381. The same document also provides instructions for filling out the calculation. In accordance with it, it is mandatory to fill out the following sections: title page, Table 1, Table 2 and Table 5. Data in the remaining tables are indicated if there are relevant transactions in the reporting period:

- Table 1.1 – if personnel are temporarily sent to another employer (contributions are calculated according to its tariffs);

- Tables 3 and 4 - if there were cases of occupational diseases or injuries.

Let's take a closer look at the current Form 4-FSS and instructions for filling it out in 2020.

Free accounting services from 1C

Title page

On the first sheet the following fields are filled in:

- number of the policyholder in the Social Insurance Fund;

- subordination code – 5-digit code of the FSS department;

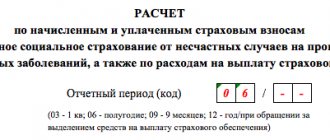

- adjustment number – for initial submission “000”;

- reporting period. The field is filled out as follows: if the form is submitted for 1 quarter, “03” is written in the first two cells, “06” for six months, “09” for nine months, “12” for a year. If the form is submitted for reimbursement of expenses, then the serial number of the application in the format “01” is entered in the last two cells.

- reporting year;

- termination of activity - if the policyholder is liquidated, the letter “L” is indicated;

- name of the company or name of the entrepreneur;

- main codes – TIN, KPP (for organizations), state registration number, OKVED. If the enterprise is budgetary, the corresponding code is entered;

- telephone and address;

- average number of personnel, highlighting disabled people and people employed in hazardous and hazardous industries;

- number of calculation pages and applications.

In the lower block on the right, the policyholder confirms the accuracy of the information entered, puts his signature and indicates the date. Here you need to reflect:

- code of the person who signs the document: 1 – director of the company or the entrepreneur himself, 2 – authorized representative, 3 – legal successor;

- Full name of the person signing the form;

- in the last lines - details of the power of attorney (if the signature is signed by a representative).

Table 1

Let's look at how to fill out the first table. It calculates the basis for calculating contributions. Lines 1-4 are filled out in total for the period and broken down for each of the last three months. They need to indicate:

- amounts of payments to individuals;

- non-contributory amounts;

- base, that is, the difference between these indicators;

- payments in favor of disabled people.

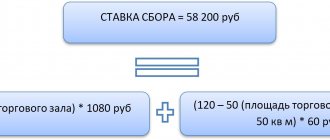

In lines 5-9 the insurance rate is calculated:

- 5 – basic tariff;

- 6 – discount for it;

- 7 – allowance;

- 8 – date of assignment of the allowance;

- 9 – final tariff amount.

Table 1.1

If during the period the policyholder sent its employees to other companies, then in Table 1.1 it reflects the data that is needed to calculate premiums for them. Information is entered line by line for each entity where workers were sent. Columns 1-5 of the table indicate:

- 1 – serial number of the record;

- 2 – registration number of the receiving entity;

- 3 – his TIN;

- 4 – its OKVED code;

- 5 – number of sent workers.

In columns 6-12 the base for insurance premiums is calculated. The following information is entered:

- 6 – base from the beginning of the period;

- 7 – database for disabled people;

- 8-13 – breakdown of amounts for each of the last three months, highlighting amounts for disabled people.

Column 14 indicates the base tariff, and column 15 the final tariff (including discounts and surcharges).

table 2

This table, consisting of two parts, reflects calculations for contributions “for injuries”. The following information is entered on the left side of the table:

- 1 – debt of the policyholder to the Social Insurance Fund at the beginning of the period;

- 1.1 – debt to the liquidated person;

- 2 – the amount of contributions accrued for payment: at the beginning of the period, in total for the last 3 months and broken down by month;

- 3 – additionally accrued contributions after inspections;

- 4 – amounts that the FSS did not accept for offset;

- 5 – accrued contributions for previous periods;

- 6 – amounts of compensation received from the Social Insurance Fund;

- 7 – amounts returned to the fund or offset;

- 8 – the sum of all the above indicators;

- 9 – fund debt at the end of the period, including: 10 – amount of excess expenses;

- 11 – the amount of overpayment of contributions by the policyholder.

The second part of the table reflects the fund's debt to the policyholder. Here you need to reflect line by line:

- 12 – debt at the beginning of the period, including:

- 13 – due to excess costs,

- 14 – due to overpayment;

- 14.1 – amount of debt from the Social Insurance Fund to the policyholder;

- 15 – insurance costs “for injuries”: total for the period, for the last 3 months in one amount and broken down for each of them;

- 16 – the amount of contributions paid at the beginning of the period and for the last 3 months in a single amount, as well as for each month separately (you must indicate not only the amount, but also the number and date of payment);

- 17 – the amount of debt that the Social Insurance Fund wrote off;

- 18 – the amount of the insured’s debt for the period (you need to add up the indicators from lines 12, 14.1, 15-17);

- 19 – debt due to the policyholder at the end of the period;

- 20 – arrears on contributions (included in the amount of line 19).

Tables 3 and 4

Table 3 calculates the amounts of benefits for occupational diseases and accidents, if any. The lines need to reflect:

- 1 – sick leave for accidents, including part-time workers (line 2) and persons who were injured in another organization (line 3);

- 4 – sick leave for occupational diseases, including part-time workers (line 5) and employees assigned to other insurers (line 6);

- 7 – payment for sanatoriums (in addition to annual leave), including for those injured on the territory of other employers (line 8);

- 9 – costs of paying for measures to reduce injuries and occupational diseases;

- 10 – the amount of expenses from lines 1, 4, 7 and 9;

- 11 – the amount of benefits that are accrued but not paid.

When filling out Table 3 on lines 1-8, not only the amount, but also the number of days is indicated.

Table 4 reflects the number of people affected during the reporting period. The following data is entered into the lines:

- 1 – victims of accidents;

- 2 – including the dead;

- 3 – victims of occupational diseases;

- 4 – total number of victims (line 1 + term 3);

- 5 – including the number of victims who received temporary disability.

Table 5

When filling out Table 5 of Form 4-FSS, you must indicate the results of a special assessment of working conditions. In line 1, in columns 3-6, the results of the SOUT are entered:

- 3 – total number of jobs;

- 4 – the number of places in respect of which a special assessment was carried out, including those classified as hazard classes 3 (line 5) and 4 (line 6).

In line 2, only columns 7 and 8 are filled in:

- 7 – the number of employees who must undergo medical examinations (harmful and dangerous working conditions);

- 8 – the number of employees who underwent such medical examinations at the beginning of the year.

Calculation according to Form 4-FSS (reporting for employees in the Social Insurance Fund) in 2020

In the field “ Adjustment number”

" is put: "

000

" (if the declaration is submitted for the first time for the tax period (quarter), "

001

" (if this is the first correction), "

002

" (if the second), etc.

Note

: the updated calculation is submitted in the form that was in force in the period for which errors were identified.

In the field “ Reporting period (code)

» the code of the period for which the report is submitted is indicated:

- I quarter – 03;

- Half-year – 06;

- 9 months – 09;

- Calendar year – 12.

The number of requests from the policyholder for the allocation of the necessary funds to pay insurance compensation is designated 01, 02, and so on.

In the “ Calendar year”

» indicates the year for the reporting period for which the Calculation is submitted (updated Calculation).

Field “ Discontinuation of activity”

» is filled out only in case of termination of activity due to the liquidation of an organization or closure of an individual entrepreneur.

In this case, the letter “ L

” is placed.

Further

The full name of the organization is indicated in accordance with the constituent documents. Individual entrepreneurs fill out the last name, first name, patronymic (in full, without abbreviations, in accordance with the identity document).

In the " TIN"

» Individual entrepreneurs and organizations indicate the TIN in accordance with the received certificate of registration with the tax authority. For organizations, the TIN consists of 10 digits, so when filling it out, you must put zeros in the first 2 cells (for example, “001234567891”).

Field " Checkpoint"

» IP is not filled out. Organizations indicate the checkpoint that was received from the Federal Tax Service at the location of the organization (separate unit).

Field “ OGRN (OGRNIP)

" Individual entrepreneurs and organizations indicate their OGRN (OGRNIP) in accordance with the received state registration certificate. For organizations, the OGRN consists of 13 digits, so when filling in the first 2 cells you must put zeros (for example, “001234567891234”).

Field " OKVED code"

" Individual entrepreneurs and organizations indicate the code according to the All-Russian Classifier of Types of Economic Activities OK 029-2014 (NACE Rev. 2). Newly created organizations - insurers for compulsory social insurance against industrial accidents and occupational diseases indicate a code according to the state registration authority, and starting from the second year of activity - a code confirmed in the prescribed manner in the territorial bodies of the Fund.

In the “ Contact phone number”

» indicate the landline or mobile phone number with the city code or mobile operator. You cannot use the dash and parenthesis signs (for example, “+74950001122”).

In the fields separated to indicate the registration address

:

- Organizations indicate a legal address.

- Individual entrepreneurs indicate the registration address at the place of residence.

In the field “ Number of average number of employees”

»:

- Organizations indicate the average number of employees.

- Individual entrepreneurs indicate the number of insured individuals to whom payments were made as part of their employment relationship.

In other cells

it is necessary to indicate the number of disabled people working and employed in work with harmful and (or) hazardous production factors.

In the field “ Calculation is presented on

"indicates the number of pages that make up the 4-FSS report (for example, “006”). If copies of documents are attached to the report (for example, a representative’s power of attorney), then their number is indicated (if they are missing, put dashes).

Block “ Reliability and completeness of information”

»:

In the first field you must indicate the person's code

, confirming the accuracy and completeness of the information in the calculation: “

1

” (policyholder), “

2

” (representative of the policyholder) or “

3

” (successor).

Further, depending on who confirms the information, the surname, name, and patronymic of the head of the organization, individual entrepreneur, representative or legal successor are indicated (in full, without abbreviations, in accordance with the identity document).

In the “Signature” and “Date” fields, enter the signature of the payer (successor) or his representative and the date of signing the Calculation (if there is a seal, it is placed in the MP field).

If the declaration is submitted by a representative, then it is necessary to indicate the type of document confirming his authority. If the representative of a legal entity is an organization, then its name must be indicated in the appropriate field.

When to submit 4-FSS

The deadline for submitting 4-FSS depends on the form of submission. There are two deadlines for submitting calculations: the 20th and 25th of the month following the reporting month. If the form is submitted on paper, then it must be submitted to the Social Insurance Fund by the 20th, if electronically - by the 25th. If the reporting deadline falls on a weekend or holiday, the period is extended to the next working day.

However, in 2020, the coronavirus made its own adjustments to the reporting periods. In this regard, 4-FSS for the 1st quarter had to be submitted before May 15. The remaining deadlines for submitting the form are as follows: for half a year – July 20/27, for 9 months – October 20/26, for 2020 – January 20/25, 2021.

Changes in 2020: functions of the Social Insurance Fund

Enterprises (organizations), instead of the usual quarterly declarations to extra-budgetary funds, from the first quarter submit a new consolidated report to the Federal Tax Service.

However, extra-budgetary funds retained some control functions:

- The Pension Fund of Russia is responsible for collecting monthly data on employees (SZV-M report), annual collection of individual information about the earnings and length of service of insured persons (SZV-STAZH and others).

- The Social Insurance Fund is responsible for collecting information on accruals, controls the payment of contributions for insurance against occupational diseases and injuries at work, and the costs of paying security in the event of injury, illness or death in the workplace.

On September 26, 2020, the Social Insurance Fund issued Order 381, according to which employers are required to submit a quarterly report in the new edition of Form 4-FSS. The document also approved the deadline for submitting 4-FSS.

In 2020, social insurance also retained the function of confirming the main type of economic activity of enterprises that were registered with the Social Insurance Fund in previous reporting periods (until 2020). Has the deadline for submitting 4-FSS to reporting authorities changed? We'll find out now.