From this article you will learn: who must submit information on the average number of employees (ASN) in 2020, what is the deadline for submitting the report, how to fill out a report on the average number of employees in 2020, how you can do this quickly and correctly in the free Federal Tax Service software.

Also see:

- Reporting schedule for 2020

- Changes in legislation since 2020

Information on the average number of employees, deadlines for submitting information

Form KND 1110018 “Information on the average number of employees for the previous calendar year” (approved by order of the Federal Tax Service dated March 29, 2007 No. MM-3-25/) must be submitted to the tax authority no later than the 20th day of the month following the reporting year.

Newly created or reorganized organizations report no later than the 20th day of the month following the month in which the organization was created (reorganized). At the same time, based on the results of less than a full year, they also transmit this information within the general time frame - until January 20.

Therefore, you need to report on the SSC for 2020 no later than January 20, 2020.

How to fill out the average number of employees when opening an individual entrepreneur

The only calculated figure in the report may be the headcount indicator for the average list for the previous year. It must be entered in whole numbers. To accurately calculate data, use the example of calculating the average number of employees.

Don't be fooled by the actual date of your report. In the case where the company is going through a reorganization process, the report is submitted by the twentieth day of the next month after completion of all processes.

Part-time workers are counted in proportion to the time worked. Rounding of numbers is carried out in accordance with mathematical rules (since fractional values are often obtained): a decimal point of 5 or more is rounded to a larger value (that is, a whole unit is added), less than 5 - to the side of a smaller value. The report puts a whole number.

Each company has its own accounting features. When filling out the tax payer identification number field (abbreviated as TIN), which is assigned to legal entities and individuals, start entering the code numbers from the leftmost square cell. The “Checkpoint” column is intended only for organizations. Individual entrepreneurs do not need to fill out this field.

However, in 2014, some changes were made to the requirements for individual entrepreneurs, according to which businessmen working independently are now freed from this need. This is quite logical, since if the individual entrepreneur does not have employees, there is no one to apply for the average number of employees.

Current report form and recommendations for filling it out

The form can be filled out on a computer or manually. If you choose to fill by hand, use black, blue, or purple ink. Corrections using corrective means are prohibited.

Now let’s learn more about the rules for filling out the contents of the KND form 1110018. The following are required to be filled out:

- Basic details of the organization: INN, KPP, full name or INN and full name. individual entrepreneur.

- Details of the territorial division of the Federal Tax Service to which the report is submitted: full name of the department and four-digit code.

- The date as of which the main indicator was calculated. Many questions arose about this, and now the form itself contains a hint: if the report was prepared for the past calendar year, it is necessary to indicate January 1 of the current year, and recently registered enterprises indicate the first day of the month following the month of registration.

- The number of employees, calculated taking into account the requirements of the Instructions approved by Rosstat Order No. 772 dated November 22, 2017.

The report is certified by signature and seal (if available). The lower right block is intended to be filled out by a tax authority employee; it does not need to be filled out.

You can get acquainted with the detailed rules for filling out the KND form 1110018 “Average number of employees” in the letter of the Federal Tax Service of the Russian Federation dated April 26, 2007 No. CHD-6-25/

Who represents and how

There are two ways to form legal entities: reorganization of existing enterprises and establishment from scratch. When using both methods, it is considered newly created. Tax legislation requires the submission of information regardless of the form of the company - joint stock company or limited liability and the composition of participants - individuals and firms, government agencies.

Initial information about the average headcount of a newly created organization is necessary for the Federal Tax Service to establish the status of the enterprise and determine the method of obtaining reports. A staff of up to 100 employees defines a company as a small or micro-enterprise with benefits for the preparation and transmission of reports:

- It is possible to submit declarations (excluding VAT), payments on paper through personal presentation, or by post; remember that a number of reports (2-NDFL certificates, form 4-FSS) can be submitted in paper form only if there are no more than 25 employees;

- A simplified package of forms for financial statements.

If at the time of generation the report on the average headcount of the newly created organization contained the number of working personnel within 100 units, then it can be transmitted on paper.

Attention! The absence of staff does not exempt you from submitting information (letter of the Ministry of Finance No. 03-02-07/1/4390 dated 02/04/2014). The provision is based on the mandatory presence of a manager in legal entities at the time of registration.

Free program for preparing declarations

To quickly and correctly prepare a reporting form, there are many special programs. The Federal Tax Service recommends us one of these free software - Taxpayer Legal Entities. Next, we will consider the algorithm for filling out a report in this resource.

The first step is to check if there has been a new update for the program since it was installed on your computer. It is no secret that some tax changes are constantly being made, and naturally, the program is being finalized.

The most reliable way to check this is to go to the official website of the federal tax service. Here you can download the installation file of the current version of Taxpayer Legal Entity.

There is a small caveat: if you download the latest update, it may not install on your version. Therefore, the current version must be installed before updating. As of the end of 2020, the root version 4.64 and the update to it 4.64.3 are current.

Algorithm for filling out the SSC using the Taxpayer Legal Entity program

When the desired employer is selected (entered), we set the reporting period. To do this, click the change reporting period button in the upper right corner of the main window. In the table that opens, select the following parameters: 2020: exactly the year, since the report is annual and not quarterly (otherwise the required form will not open).

Then in the right part of the top panel select “Documents”, and in the menu that opens - “Tax reporting”

Next step: Click the “Create” button and open a table of all annual reporting forms. Select: Information on the average number of employees for the previous calendar year.

Double-click on the selected form or click the “Select” button at the bottom right. The required form opens in front of us with the basic details already filled out.

There are literally two lines left to be filled in manually.

There should be no difficulties in filling out the date, since below under the asterisk it is clearly written that you must indicate January 1 of the current year. Therefore, when preparing a report for 2020 in 2020, you need to indicate 01/01/2020 (the report is prepared at the end of the reporting year).

The most interesting thing remains - to calculate the average number of employees. To do this, we determine the number of employees in each month of the year, sum them up, and divide by 12.

The average number of employees for the month is calculated by summing the number of employees for each calendar day of the month (including weekends and holidays) and dividing the resulting amount by the number of calendar days of the month.

More details about the calculation methodology can be found in the Instructions approved by Rosstat Order No. 772 dated November 22, 2017.

Important! The calculation of the average headcount for the Federal Tax Service does not include all categories of employees that an enterprise or individual entrepreneur may have. In order not to make a mistake in the MSS figure, we recommend that you first familiarize yourself with the rules and examples of calculations.

Formulas and examples of calculations for the average number of employees are presented in our article

How to calculate the average number of employees (formula)

To calculate the average number of personnel for a calendar year, you must first make a calculation separately for each month:

Step 1. Calculate the number of full-time employees

To do this, we use the following formula:

Ch1 = Chm / Dm

World Cup

– the sum of the average number of employees for each day of the month (that is, it is necessary to calculate the average number of employees for each day of the month and add it up);

Dm

– the number of calendar days in a month.

The result does not need to be rounded

.

The number of employees for a weekend or holiday is taken to be equal to the number for the previous working day.

When calculating the average payroll number, they are not taken into account

:

- External part-time workers (employees whose main place of work is another organization).

- Individuals working under GPC agreements (of a civil nature).

- Women on maternity or child care leave.

- Employees on study leave without pay.

If an employment and civil law contract is concluded with an employee at the same time, then he must be taken into account as one person in the calculation.

Employees working part-time at the initiative of the employer

(probationary period and homeworkers), as well as workers for whom the law establishes

a shortened working day

(including disabled people), are taken into account as

whole units

.

Step 2. We count the number of employees who worked part-time

Employees working under an employment contract part-time (including those who did not come to work due to illness or business travel) are taken into account in proportion to the time worked

.

This is done according to the following formula:

Ch2 = Total / Trd / Drab

Total

– the total number of man-hours worked by these employees in the reporting month.

Trd

– length of the working day, based on the length of the working week established in the organization. For example, with a 40-hour five-day work week, this figure will be 8 hours, with a 36-hour week - 7.2 hours, and with a 24-hour week - 4.8 hours.

Drab

– the number of working days according to the calendar in the reporting month.

The result does not need to be rounded

.

Example

. The employee worked part-time (4 hours) for 22 working days per month, while the working day in the organization is 8 hours. The average number in this case will be equal to:

0,5

(88 / 8 / 22).

Step 3. Calculate the average number of employees for the calendar year

To calculate the average number of employees, it is necessary to add up the headcount indicators ( Ch1

and

Ch2

) for all months of the year and divide the result by

12

months.

If the result is a non-integer number, it must be rounded

(discard less than 0.5, and round 0.5 or more to the whole unit).

Calculation example

Initial data

LLC "Company" has a 40-hour, five-day work week.

In 2020, from January to November, 15 people

(in December there were 11 of them left, since 4 people were laid off due to staff reduction).

For September and October, fixed-term part-time employment contracts were concluded with 5 new employees, according to which they worked 4 hours daily.

Throughout the year, the organization employed 3 external part-time workers who are on the payroll of another company.

Calculation of average headcount

In each month (from January to November) the average number of full-time

, was equal to

15 people

(external part-time workers are not taken into account in the calculation).

In December, the number of such workers was 11 people

.

part-time during the year

:

There were 22 working days in September and October, so the number in each of these months is:

(4 hours x 5 workers x 22 working days) / 8 hours / 22 working days = 2,5

Below is a table of the average number of employees for each month, taking into account the results obtained:

| Month | Average headcount | Month | Average headcount |

| January | 15 | August | 15 |

| February | 15 | September | 17,5 (15 + 2,5) |

| March | 15 | October | 17,5 (15 + 2,5) |

| April | 15 | November | 15 |

| May | 15 | December | 15 |

| June | 15 | Total | 181 people |

| July | 15 |

Thus, for 2020 the average number of employees is: 15 people

(181 people / 12 months).

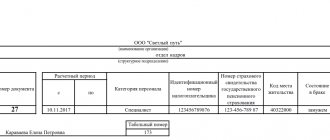

Information on the average number of employees 2019 sample

The program provides a preliminary check for the correctness of filling out the document. To do this, on the main panel you need to click the “Control” button.

Once the form has been completed correctly and verified, it can be saved, printed, or downloaded to be sent electronically.

Information on the average headcount of an organization should, as a general rule, be submitted electronically, but if the organization employs less than 25 people, reports can be submitted both via the Internet and on paper.

Average headcount when opening an individual entrepreneur

When calculating, you need to take into account only those employees who work for the company under an employment contract. And if a person performs duties in accordance with the GAP, then he is not displayed in the SSC report.

A report on the average number of individual entrepreneurs without employees was also traditionally filled out in accordance with these rules.

This is a general formula; there are many details of the calculation. For newly formed societies, it is important to take into account that despite the fact that it may have worked for less than a full year, the denominator “12” is still used in the formula. SSC is a small report that represents data on the number of workers in an enterprise: those employed by a personal entrepreneur or in an organization. Information on the average number of individual entrepreneurs without staff was constantly submitted using the same form, the form looks quite simple, but you need to know the specifics of calculating the number of workers.