From this material you will learn:

- What is severance pay for staff reduction?

- The regulatory framework for severance pay in case of reduction according to the Labor Code of the Russian Federation

- Are severance pay subject to personal income tax and insurance contributions upon reduction?

- What payments are due to an employee upon dismissal?

- How to calculate severance pay for layoffs in 2020

- How to formalize the dismissal of an employee during staff reduction in 2019

- What threatens an employer if he does not pay severance pay?

An employee usually learns about what severance pay is during a layoff only upon dismissal. Retrenchment is not the easiest procedure, especially if the employer wants to save money on the departure of an employee, but he does not know about his rights.

But in fact, it is extremely important for the employer to fulfill its obligations to departing employees, because in some cases payments have to be made for more than one month and deviation from this procedure is fraught with serious fines. We will describe in detail below what is necessary for everything to go according to the law and for the employee who has been laid off to receive all the payments required by law.

What is severance pay for staff reduction?

Severance pay is a sum of money that is intended for an employee being dismissed due to staff reduction to compensate for lost income due to loss of employment. Its value is calculated in accordance with the average monthly earnings.

Please note: the average monthly income is fixed for the possibility of paying an employee during absence of employment only for a two-month period starting from the day on which he was dismissed.

It should be borne in mind that payment of severance pay in case of layoff is the responsibility of the employer. The money must be credited to the account on the day the employee leaves. An employee has the right to appeal to regulatory authorities when this law is not observed. At the same time, he will also be able to obtain compensation for the fact that the organization delayed payment.

Benefits paid to retrenched employees include:

- an amount equal to average monthly earnings;

- full salary;

- reimbursement for holidays that were not used.

The employee must receive all of the above directly on the last working day. You should not waste time waiting if payments were not made at all or the amounts were not paid in full. In accordance with the law, an employee can go to court within three months, so it is advisable to start acting as early as possible.

According to the Labor Code of the Russian Federation, a person can claim compensation in the amount of the average salary in the next month after dismissal if he cannot find another job.

We recommend

“Personnel adaptation: how to help an employee join the team” Read more

To do this, you must present the dismissing employer with a work record book without records of new employment.

We recommend contacting the employment center within two weeks after layoff in order to be able to receive payment even in the third month after dismissal, provided for by the Labor Code of the Russian Federation in exceptional cases. To do this, if they cannot help you find a job, present to your previous employer your work book without new marks and a certificate from the employment center confirming your application there.

Calculation example

Let's calculate the severance pay of accountant M.A. Skvortsova, who is being laid off due to layoffs, and whose salary is 25,000 rubles/month. Skvortsova worked on a five-day workweek schedule. There are no features of the calculation of the employment contract and collective agreement regarding Skvortsova M.A. does not contain. The day of her dismissal is January 15th. We will calculate the average daily earnings for the period for the year preceding the dismissal. 12 * 25,000 = 300,000 rubles was earnings per year. According to the production calendar, 247 days were worked. Average daily earnings 300,000 / 247 = 1214.57 rubles.

Severance pay = number of workers. days in the first month after dismissal * average daily earnings.

We take the month from January 16 to February 15. Number of working days – 22. Severance pay = 1214.57 * 22 = 26720.54 rubles.

Skvortsova M.A. officially has unemployed status. From January 16 to February 15, she was unable to find a job, but subsequently found a job. The new employment contract is valid from March 3. Average monthly earnings for 16.01-15.02 are compensated by crediting severance pay, i.e. no additional charges are made. From February 16 to March 2, the layoff organization must pay the average monthly salary to M.A. Skvortsova. Working days – 10. Average monthly earnings 1214.57 * 10 = 12145.70 rubles.

Let us now consider the case when Skvortsova agreed to resign earlier than 2 months from the date of receipt of the warning. The day of her actual dismissal is January 15, and the two-month period expires only on January 31, this is the day of the alleged dismissal. She will receive severance pay in the amount of 26,720.54 rubles. From January 16 to January 31, Skvortsova will be paid compensation for 12 slaves. days. RUB 1,214.57 * 12 = 14574.48 rub. Upon dismissal, she will receive: 14574.48 + 26720.54 = 41295.02 rubles. Since after the dismissal in this example Skvortsova M.A. She found a job immediately; she was not entitled to the average daily salary during the period of unemployment.

Briefly

- When laid off, the employee receives, in addition to wages and vacation compensation, special payments. First of all, this is a mandatory severance pay. Most often it is calculated based on average earnings for the month after dismissal.

- If the employee agreed to the administration’s proposal and quit earlier than 2 months after the warning, he will be compensated for working days between the actual and estimated date of dismissal.

- If after dismissal the employee is not employed, the first month of unemployment is compensated with severance pay, the second is paid additionally. If a citizen acquired the status of unemployed within 2 weeks after dismissal and continues to remain so, in the 3rd month he can also receive compensation based on a certificate from the employment service.

Regulatory basis for severance pay in case of reduction according to the Labor Code of the Russian Federation

The employee is entitled to compensation for the period of forced incapacity for work, the reason for which is dismissal due to staff reduction. This type of compensation was not canceled in 2018. Also, in 2020, no significant changes were introduced to the procedure for its calculation. Today there is a standard procedure that will be relevant this year.

Please note: the calculation takes into account earnings for the year preceding dismissal.

The calculation of severance pay upon dismissal due to reduction is regulated by the following regulatory documents:

1. The main legislative act is the Labor Code.

A number of articles of the Labor Code of the Russian Federation contain instructions on how to correctly assign and pay compensation to an employee:

- according to Article 81, an employee dismissed due to the reduction or liquidation of a company is entitled to compensation corresponding to the amount of wages;

- Article 178 provides for the possibility of receiving benefits in the amount of the average monthly salary without presenting documents other than the employee’s application;

- in accordance with Article 236, the employer will be obliged to pay a fine in case of untimely transfer to the employee of the amount of money required by law;

- Article 139 sets out the procedure for calculating the amount of severance pay in the event of a layoff;

- Article 129 contains regulations on types of financial assistance;

- Article 164 specifies the general principles according to which compensation is awarded for periods of involuntary unemployment.

2. The legislative act establishing tax benefits related to severance pay is the Tax Code.

These issues are regulated on the basis of the following articles:

- according to Article 217, compensation to a laid-off employee is exempt from personal income tax;

- in accordance with Article 255, employers are entitled to a reduction in the tax base by the amount of payments made to employees.

3. Government Decree No. 922 of December 24, 2007 indicates the types of income on the basis of which the amount of severance pay is calculated in case of reduction.

4. Letter of Rostrud No. 2184-6-1 dated July 22, 2010 regulates the specifics of accounting for the last period of working time before dismissal for calculating the average salary.

general information

Severance pay in 2020 in Russia is the financial assistance specified in Article 178 of the Labor Code of the Russian Federation, provided to people who are fired not because of criminal acts, absenteeism or drunkenness at the place of work. All groups of dismissed workers specified in the law can count on receiving this benefit.

This fact does not depend on the position they held, work experience, job functions, social status, and so on. Assistance is also provided to working pensioners after retirement, who have equal rights with able-bodied citizens in terms of age.

Failure to pay pensioners money after layoffs is considered discrimination against employees based on age, and therefore may lead to sanctions against the administration of the institution.

Severance pay is paid to financially support people being laid off while they look for another job. This type of support is provided for the loss of a position not due to the “fault” of the employee (for example, a benefit upon dismissal due to staff reduction or due to the company changing its location, as a result of which the employee lost the ability to get to it).

This is important to know: How to register a child in an apartment: necessary documents and procedure

» alt=”Calculation, terms and procedure for payment of severance pay when an employee is laid off”>

Is severance pay subject to personal income tax and insurance contributions during layoffs or not?

1. Is there any income tax?

In accordance with Art. 178 of the Labor Code of the Russian Federation, when an employee is laid off, severance pay is not subject to personal income tax in the following cases:

- the organization where the dismissed employee worked went through liquidation procedures;

- the dismissal occurred due to a reduction in the number or staff of employees;

- an employee resigns due to refusal to transfer to another job due to illness or due to the company moving to another location;

- a person is unexpectedly called up to serve in the Russian army;

- the employee who was subjected to unlawful dismissal is reinstated in the same position;

- complete loss of ability to work by an employee who previously performed his duties conscientiously;

- the employee’s refusal for various reasons to comply with new requirements of the employment contract when they arise;

- dismissal of an employee holding a managerial position at the request of the owner of the enterprise.

Recommended articles on this topic:

- Competitive advantages of a company: how to form and develop

- How to make a business successful and not become a “firefighter” for your company

- Company marketing strategy: from development to analysis

The employer is legally allowed to indicate in any type of contract special conditions, in accordance with which it will be possible to pay benefits and increase the amount of payments.

In the absence of additional instructions in the contract, the severance pay of a laid-off employee will be subject to personal income tax on a general basis.

2. Are there insurance premiums?

Amounts paid as redundancy pay are subject to taxation similar to other types of compensation. An exception to this rule is compensation for unused vacation. In this case, insurance premiums are deducted only if the amount of payments exceeds a certain limit.

Retained funds are transferred:

- to the Social Insurance Fund of the Russian Federation

. This is an extra-budgetary organization whose task is to implement a compulsory insurance program for the population of Russia; - to the Federal Compulsory Health Insurance Fund

. The purpose of this state organization is to protect the health and social protection of citizens of the Russian Federation. This fund is off-budget. It provides the population of the country with free medical care within the framework established by law; - to the Pension Fund of the Russian Federation

. This is the largest government organization designed to generate and distribute financial resources to provide pensions to the country's citizens, as well as provide the population with the necessary social support measures.

What payments are due to an employee upon dismissal?

Retrenched employees must receive:

1. Standard charges that are transferred to the account on the last business day:

- salary for the period of time worked, as well as due allowances, bonuses and other payments;

- compensation for unused vacation days;

- severance pay, the amount of which is not less than the average monthly salary for one month, unless a different amount of this payment is specified in the employment or collective agreement;

- additional compensation paid in the event of dismissal ahead of the time specified in the notice of layoff. The amount of this compensation is equal to the average salary for a given period. Thus, an employer can dismiss an employee only with the latter’s consent.

We recommend

“How to resolve conflicts with employees - instructions for managers” More details

2. Benefits due to non-employment from the moment of dismissal in case of staff reduction (not paid to employees hired for less than two months):

- payment of sick leave if temporary disability occurred within a period of up to 30 calendar days from the last working day;

- payments in the amount of the average salary for the second and third months if it is impossible to find a job (the amount for the first month is transferred on the last working day), if the employee provides documents confirming the lack of work.

To receive unemployment benefits for the second month from the date of dismissal, you must fill out an application and present your work record book at your former place of work. Severance pay for the third month in the amount of the average salary is accrued only under special circumstances.

To do this, the following conditions must be met:

- the employee does not have material resources;

- disabled family members are dependent on the person;

- the employee contacted the employment center within 14 days from the date of dismissal, and they could not find him a job;

- availability of a decision on the right to receive this payment, issued by the employment service.

What payments are taken into account for calculation purposes?

To establish the amount of average earnings, you will need to determine the period used for the calculation, as well as the total designation of income during this time. The calculation period takes into account a period of 12 months. The year preceding the termination of relations with the employee is taken into account.

For example, when dismissal on the basis in question is made in mid-January 2020, the calculation period should be considered the beginning of January 2020 and the end of December of the same year. Please note that the month in which the relationship is terminated will not be taken into account.

The exception is the situation when the reduction is made on the last day of the month.

When calculating the average level of earnings, you will need to establish what time is considered calculated and add up the citizen’s income for the specified period. Everything related to wages is subject to accounting:

- earnings in monetary terms;

- bonuses, reflected as a percentage or a fixed amount, related to work activities;

- various types of incentive payments, which are awarded depending on the results of work.

The charges take into account the regional coefficient, which increases the amounts. However, this value does not apply to all regions of the country. This depends on the region of residence of the citizen and the location of the company where he works.

This is important to know: How to apply for child support: what documents are needed and how to prepare them correctly

When calculating the average salary, the following amounts are not taken into account:

- payment of compensatory value, for example, to pay for housing, study;

- social benefits, for example, maternity benefits;

- financial assistance paid on various grounds;

- vacation payments;

- payment for business trip time;

- other accruals that depend on the average wage.

A period of one year is used for calculation. The time preceding the calculations is taken into account. Which benefits will be taken into account is reflected above. There is no need to take into account the time while the person was on or was on a business trip.

Calculation of severance pay for layoffs in 2020

1. In 2020, the amount of severance pay for layoffs is calculated using the formula:

VP = NW * RD

Wherein:

RD

- number of working days in the month following dismissal,

NW

- average daily earnings, to calculate which you can use the formula SZ = GD / 730, where the variable GD means the total income for the last two annual intervals

When calculating SZ, it is necessary to exclude periods of vacation, temporary disability, etc. However, this indicator must contain all additional payments - bonuses and various allowances.

You should also take into account that some categories of laid-off employees have special privileges. Consequently, the calculation of severance pay for them will have certain features.

2. Calculation procedure

The accountant’s responsibilities include calculating the amount of payments using a formula based on available data and entering the resulting amounts into the documentation.

Calculation of severance pay is carried out separately for each employee, since its amount depends on total income, which is not the same. The standard payment is calculated in relation to the month following dismissal.

The time period for calculating the average monthly salary is one year. This indicator must contain salary, wages, all types of additional allowances and bonuses. At the same time, the calculation time period does not include days on which the employee did not perform his duties due to being on vacation, on a business trip, or due to temporary disability.

Along with other types of payments, severance pay must be transferred to the employee on the last day before dismissal.

To carry out all calculations, specially developed formulas are used to simplify the calculations. It is recommended to use the following standard algorithm:

- the amount of annual income minus payments for sick leave, etc. is calculated;

- the number of actual working days is calculated;

- the amount of earnings for one day of work is calculated;

- daily earnings are multiplied by the number of days in the month following dismissal;

- the resulting amount is recorded in the accounting documentation;

- severance pay in case of layoffs and other payments are transferred to the employee on his last working day.

Calculation in accordance with the standard algorithm is used for most groups of workers, with the exception of socially protected ones. For these categories, there are a number of legally regulated features that must be taken into account when making calculations.

3. Consider an example

Employee Petrov is being laid off. The number of days he worked, without exception, for the annual period is 250. Total annual income is 700 thousand rubles.

We calculate average earnings: income is divided by days, resulting in 2800 rubles. This number is multiplied by the number of working days in the month following dismissal. So, if there are 20 working days, then the severance pay will be 56,000 rubles.

This amount must be paid to the employee along with other due payments.

4. Some details

Severance pay and compensation differ significantly from each other. The first is a priority payment along with salary and compensation for unused vacation days. Compensation, on the contrary, is supposed to be transferred to the employee monthly for two months.

The amount of severance pay is equal to the amount of compensation. These payments are applied to various reduction options, which should be taken into account when calculating funds.

Please note: some groups of employees have special rights that determine the specifics of the calculation.

If mistakes are made when laying off an employee, then this employee, resuming work in his previous position by court decision, is not obliged to return the money received upon dismissal. Therefore, the employer must strictly comply with all the requirements specified in the legislation.

Classification of employees and maximum allowable amount of payments

Currently, there are special categories of employees, when laying them off, the law provides for other calculation rules. Thus, civil servants are paid the average salary for the last three months of work.

This procedure applies in the event of a regular layoff or bankruptcy of an organization. In this case, the amount of this payment is calculated without taking into account the severance pay itself.

In addition, if it is impossible to employ this civil servant in a position corresponding to his professional skills and qualification level, he will be included in a special reserve present in the register of civil servants of the Russian Federation.

The service of employees in this category will not be interrupted for one year after dismissal.

A collective labor agreement can further strengthen the position of an employee belonging to this group.

Since only the minimum amount is determined by law, the maximum payment amount can be specified in such an agreement, and its value can be any.

Please note: in accordance with the law, personal income tax is not deducted from the above payment, equal to three months’ income.

Such severance pay is subject to income tax only when the total payment exceeds the amount allocated. Personal income tax is withheld only from the difference between these amounts.

For people working in adverse climate zones, the total tax-free benefit is doubled by law. Its value is equal to six monthly earnings.

The procedure for paying average earnings after layoffs

Average earnings are also paid to all employees, except those hired under a contract for up to 2 months (Article 178, Article 318 and Article 292 of the Labor Code of the Russian Federation). For seasonal workers, this average income is severance pay for 2 weeks .

The procedure for paying average earnings (provided that the employee has provided all the necessary confirmation of the absence of employment) is as follows:

- for the first month – you do not need . The employee has already been paid severance pay on the day of dismissal;

- for the second month - average earnings, if the employee confirmed that he did not get a job (with a work book or information about his work activity);

- for the third month after dismissal, the average salary is paid after the employee presents a decision from the employment service.

For workers in the Far North, the procedure is the same, but the deadlines are extended in accordance with the Labor Code of the Russian Federation.

Severance pay in case of layoff for the second month

The amount for the second month is compensation for layoffs. Its value is equal to the amount of severance pay. It is paid only if the person has not yet found a new job. A prerequisite for this is registration with the employment service and searching for employment options.

If there are currently no vacancies corresponding to the specialty of the person who has been laid off, there is the possibility of receiving compensation - a second payment. To do this, it is necessary to notify the previous employer about this situation through the labor exchange.

You cannot receive payments or refunds for the third month. At the same time, there are a number of features that are significant for the dismissal process. They must be taken into account when making reductions. In case of dismissal by agreement, the amount of all payments is determined by the amounts specified in the agreement.

This document may also stipulate that upon dismissal the employee does not receive any payments at all.

How to calculate two-week severance pay during layoffs

This payment is assigned when the basis for dismissal is not staff reduction or liquidation of the organization, but other reasons. However, the rules for calculating two-week severance pay remain the same.

The calculation algorithm corresponds to the principle of calculating the amount during reduction. First, the average income per working day is calculated. The resulting number is multiplied by the number of days.

There are the following grounds for calculating two-week severance pay:

- the employee refuses to move to a new position due to contraindications for health reasons;

- the company does not have conditions for the transfer of an employee;

- the employee is called up for military or alternative civilian service;

- a person refuses to move to a new job associated with the need to move to another locality;

- the employee who previously held the position of the resigning employee is reinstated in the workplace;

- a person terminates an employment contract due to a change in work responsibilities;

- dismissal for medical reasons.

Please note: the employer may establish in the local regulations of the organization additional conditions for calculating a two-week compensation and increasing its amount.

The nuances of severance pay when dismissed due to disability and on maternity leave

- For persons with disabilities Forced dismissal of employees with disabilities is not permitted. In the event of a deterioration in health, the employer is obliged to offer the employee a transfer to a position that provides more benign working conditions. If this possibility does not exist, the parties to the employment relationship must negotiate termination by agreement.

Upon dismissal, an employee must provide a certificate of disability on an official form, a sample of which and the requirements for registration are specified in Resolution of the Ministry of Health of the Russian Federation No. 41.The amount of severance pay for people with disabilities must meet the standard. To calculate it, you must follow the contents of Article 178 of the Labor Code of the Russian Federation. Payments to disabled people are calculated in the same way as to healthy employees. When dismissal is not due to layoffs, but due to health reasons, two weeks' compensation is paid.

In 2020, payments to employees with disabilities are calculated in accordance with the standard algorithm: the average earnings for one day are multiplied by 14, i.e. by the number of days making up the compensation period.

Please note: when a disabled person resigns at his own request, severance pay is not paid.

- For women on maternity leave

Women on maternity leave cannot be fired due to layoffs. Dismissal becomes possible only in the event of liquidation of the company. If the organization is undergoing a downsizing process, the employer is obliged to provide the woman with another position.When it is desirable to lay off a maternity leave due to the reorganization of an enterprise, she should receive a full package of payments. At the same time, in order to be retrenched, consent to dismissal must be obtained.

The list of payments remains unchanged: it includes severance pay and standard compensation. In addition, the woman will have to register with the employment center.

We recommend

“Employee time tracking: when time really is money” Read more

How to formalize the dismissal of an employee during staff reduction in 2019

When dismissing personnel due to a reduction in numbers or staff, the requirements established by the Labor Code of the Russian Federation must not be violated. They are spelled out in Articles 179 and 180. Even a minor violation of the procedure may result in the employee being reinstated in his position with payment for forced absence in accordance with Article 394 of the Labor Code of the Russian Federation.

The employer must follow the following algorithm:

- issue an order to reduce numbers or staff;

- find out whether any employee has a priority right to keep his job;

- draw up a list of positions (employees) that need to be reduced;

- write a notice of dismissal;

- offer the laid-off employee an alternative in the form of a transfer to another place;

- approve the transfer of employees who have agreed to another position;

- notify the labor exchange and trade union organization of the upcoming layoff;

- coordinate with the trade union a resolution on the dismissal of its members;

- make payment of compensation and severance pay;

- dismiss employees who refuse to be transferred to another location.

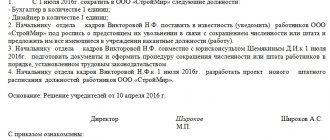

Sample order for reduction:

Downsizing procedure

Before considering the payments that an employee will receive, it is necessary to understand the procedure for dismissal to reduce the number and staff in stages.

- The company's management decides to reduce the number of employees.

- In case of mass layoffs, the trade union and employment agency must be notified 3 months in advance.

- 2 months before the date of dismissal, the employee must be familiarized with the layoff order against signature.

- According to Part 1 of Article 180 of the Labor Code of the Russian Federation, before dismissal, the employer offers the laid-off persons to take other positions in the organization. The employee will be notified of any suitable vacancies up to and including the last day of work. If an alternative for the person is not found, then an order is issued with a mandatory indication of the date of dismissal.

- On the last day of work, which is considered the day of dismissal, a work book and other documents are issued in accordance with Article 84.1 of the Labor Code of the Russian Federation.

- In accordance with Article 178 of the Labor Code, on the day of layoff, the employee must receive a full cash payment, incl. payment in the amount of one average salary per month (AMS).

This is important to know: Labor protection requirements: basic rules and regulations