A formalized employment relationship ensures that in the event of the birth of a child, the employee is entitled to a number of benefits. This includes payment for sick leave during pregnancy and childbirth, a benefit for early registration at the antenatal clinic, a one-time payment in connection with the birth of a child, as well as a subsequent monthly allowance for child care up to one and a half years old. While maintaining the general principle, the calculation of maternity payments due to changes in amounts is updated annually. Changes in this matter are expected in 2020.

How to calculate maternity benefits

Sick leave for maternity leave is issued at 30 weeks of pregnancy. Initially, it was issued for 140 days, but if the birth occurs with complications, then the woman is entitled to an additional 16 days. If twins are planned, then the total duration of sick leave will be 194 days.

To determine the amount due to the employee, the number of days of sick leave must be multiplied by her average daily earnings, which is determined based on the wages of the two previous calendar years. If during this period there was a change of job, then the current employer must take data on payments for previous places of employment from the certificate of average earnings that is given to employees upon dismissal. The form of this certificate was approved by order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n.

The general procedure for calculating maternity benefits in 2020 does not change. However, the amount of maternity benefit has a certain minimum and maximum that must be taken into account.

The maximum amount of maternity payments is calculated based on the maximum value of the base for calculating insurance contributions to the Social Insurance Fund.

And this amount, in turn, increases annually.

In 2020, this figure was equal to 670,000 rubles, in 2016 – 718,000 rubles, in 2020 – 755,000 rubles. Thus, the calculation of maternity leave in 2020 in its maximum amount for the standard 140 days of sick leave will be 282,493.40 rubles based on the average daily earnings of 2,020.81 rubles (718,000 + 755,000) / 730).

In 2020, sick pay for the same period could not exceed 266,191.78 rubles, and in 2020 - 248,164.38 rubles. You can find out more about the maximum calculation for maternity leave in 2020 here.

Calculation of maternity benefits in 2020, example 1

Employee of Romashka LLC Petrova A.N. provided the employer with a sick leave for pregnancy and childbirth, opened on January 10, 2018 for a period of 140 calendar days. In 2020, Petrova’s salary was 734,680 rubles, in 2020 – 723,500 rubles.

Maternity benefits should be calculated as follows:

(718,000 + 734,680) / 730 x 140 = 278,596.16 rubles.

If the number of sick leave days changes, then the amount of maternity benefits must be calculated accordingly. The maximum amount of maternity benefits in the event of the birth of twins will be 391,455.14 rubles in 2018, and for complicated births - 314,778.36 rubles.

If we talk about the minimum amount of maternity benefits, it is determined based on the current minimum wage.

From 2020, this figure will be significantly increased, from the current 7,800 to 9,489 rubles. The minimum amount of sick pay for pregnancy and childbirth based on this indicator in 2018 will be 43,675.80 (with an average daily minimum earnings of 311.97 rubles (9489 x 24) / 730). In 2020 (from July 1, when the minimum wage was set at 7,800 rubles), this figure was equal to 35,901.60 rubles. Read more about the minimum amount of maternity leave here.

The minimum value in calculating the amount of maternity leave was introduced for situations where the employee’s average earnings for some reason over the previous two years turned out to be less than the minimum wage, for example, if she just started working. In any case, she can count on the minimum sick leave pay, and the employer, in turn, will be obliged to pay it to her.

Types of assistance from the state

The state supports women who decide to have a child. The type and amount of assistance depends on the life situation and the fact of official employment.

Maternity benefits in 2020 have lower and upper thresholds. Let's figure out where to go for money. What amount of payment can women expect in different situations?

The legislative framework

Expenditure of budget and social security funds is carried out exclusively on the basis of the laws of the Russian Federation. Basic principles for calculating benefits:

- Transparency - the amounts of all payments are determined using a single methodology;

- Universality - recipients have the opportunity to check the accuracy of accruals;

- Legality - regulatory authorities check specialists in order to protect the legal rights of women in labor.

Maternity payments in 2020 are calculated based on the following indicators:

- a woman’s average earnings for the last two years of work/service;

- minimum wage (minimum wage) - 11,280 rubles;

- the maximum base of contributions to the Social Insurance Fund (SIF) is 815 thousand rubles;

- students - based on the amount of the scholarship received;

- dismissed due to the liquidation of the organization - 300 rubles/day;

- for military personnel - based on the amount of their salary.

Maternity benefits are accrued by the employer or the social security authority. Financing of this type of state support comes from the following funds:

- budget;

- FSS.

When calculating maternity benefits, a specialist must rely on paragraphs of the following laws:

- No. 81-FZ of May 19, 1995 (when determining the amount of assistance to unemployed women);

- No. 255-ФЗ dated December 29, 2006 (code for calculating payments to citizens insured by the Social Insurance Fund).

Attention!

In addition to these, accountants rely on other laws and government regulations. In particular, they are required to know the minimum wage indicators and the maximum insurance base of the Social Insurance Fund established for a certain period. Download for viewing and printing: Federal Law of May 19, 1995 N 81-FZ (as amended on March 28, 2017) “On state benefits for citizens with children”

Federal Law N255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”

Who is entitled to maternity benefits?

The conditions for calculating state aid to women in labor are established by law. It is provided to women who meet the following criteria:

- employed people for whom contributions to the Social Insurance Fund are paid;

- dismissed due to the liquidation of the organization (within a year by the time of application);

- students and students receiving educational services full-time;

- contract military personnel and law enforcement officers;

- who have adopted a child and belong to the above categories.

Important: the adoptive parent receives the right to this type of payment if the child is less than three months old.

Basis for charges

The main document giving the basis for making calculations is the certificate of incapacity for work. It is issued by a medical organization monitoring the expectant mother. The period of sick leave depends on the severity of labor and the number of fetuses:

| View | Amount of days | Description |

| Ordinary | 140 | Provided if the birth was without complications |

| For complications | 156 | An additional certificate of incapacity for work is issued |

| During multiple pregnancy | 194 | Can be provided immediately or accompanied by an additional document |

Reference! A certificate of incapacity for work is issued at 30 weeks of pregnancy.

Maximum maternity payment for child care up to 1.5 years

And finally, the last benefit is a monthly payment for child care up to 1.5 years. Employers pay this benefit if, after the end of sick leave under the BIR, the employee does not plan to start work and writes an application for parental leave. How to correctly calculate maternity leave in this case? Their amount is calculated as 40% of the average earnings of a female employee.

How to calculate maternity leave, example 2

At the end of sick leave for pregnancy and childbirth, Petrova A.N. wrote an application to grant her maternity leave for up to 1.5 years.

Based on the above salary level for 2016-2917, the amount of the monthly benefit will be:

(718,000 + 734,680)/730 x 30.4 x 40% = 24,198.07 rubles

The child care allowance for children under 1.5 years of age is also limited by upper and lower limits. The maximum calculation of maternity benefits in 2018 for child care, as can be seen from the example, is again determined by the size of the base for calculating insurance premiums and, based on it, cannot exceed 24,536.57 rubles in 2020.

The minimum benefit amount is determined taking into account the type of child born in the family. For the first child, from February 1, 2018, a minimum allowance will be set at 3,163.79 rubles, for the second and subsequent children - 6,327.57 rubles. In 2020, these figures were 3065.69 and 6131.37 rubles, respectively.

How long do you need to work?

The fact that the expectant mother has insurance coverage does not in any way affect her eligibility to receive the benefits in question. This factor affects the amount of payment. This provision is connected by the fact that when calculating the amount, a couple of calendar years that preceded the decree are taken into account. Also of key importance is the size of a citizen’s salary.

Legislative acts define the rules in accordance with which benefits are calculated:

- when the time worked is a couple of years or more, the payment will be equal to forty percent of the employee’s average income;

- if the output is less than this value, then benefits are calculated based on the amount of payment for this time.

This is important to know: Is the stock exchange included in the total length of service?

Sometimes situations arise that the expectant mother has worked partly for the required period of time, and the output is less than a couple of years. In this situation, when calculating, it will be necessary to take into account what level of average wages occurred during the period worked.

When the output is less than six months, the calculations take into account the minimum wage established in the country. As of 2019, this figure is about 11.2 thousand. If the citizen was registered in the Central Taxpayer's Office, this indicates her authority to deduct the amounts in question. The accruals take into account the amount of benefits accrued by the specified service.

Procedure for payment of benefits

Let us remind you that in the question of how to calculate maternity payments, it is important to comply with deadlines. The employer is obliged to make all payments within 10 days from the date of receipt of the necessary documents from the employee. This applies to all four benefits described above.

But the period for applying for benefits established for the employee herself is different - 6 months from the date of the occurrence of one or another event. When calculating sick leave pay according to the BIR, this period is counted from the last day of the sick leave period. At the end of the six-month period, the employer no longer has to make such payments.

The basis for calculating benefits are certain papers that the employee must provide to the employer for their subsequent transfer to the Social Insurance Fund. The list is quite standard: these are applications for the calculation and receipt of each benefit, sick leave, a birth certificate, as well as certificates from the place of work of the father of the born child stating that a lump sum benefit in connection with the birth was not assigned or paid to him by his employer, and also that he was not provided with care leave for up to 1.5 years.

How maternity leave is processed at work

To assign benefits, you must provide the following documents to the manager:

- passport;

- sick leave;

- certificate of early registration (if any);

- application for free leave;

- information from the previous place of work (if necessary): about the average salary;

- about periods that should be excluded from calculations.

Help: if the employer cannot pay for sick leave, then the insurance company will finance it.

What documents are submitted to social security?

Women in labor who were laid off a year before applying apply for benefits to the social security authorities. They need to provide the following documents:

- application (form will be provided on site);

- passport;

- certificate of incapacity for work;

- certificate of registration in the early stages of pregnancy;

- work book (another document confirming the fact of dismissal from the last place of service);

- a certificate from the employment authorities confirming registration as unemployed.

Attention: the application is processed within ten days.

You are allowed to submit a package of documents:

- personally;

- through a representative (power of attorney required);

- by post with a list of attachments;

- through the State Services portal.

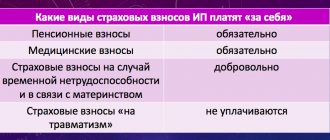

Peculiarities of assigning maternity leave to individual entrepreneurs

According to the law, individual entrepreneurs receive the right to pay sick leave from the Social Insurance Fund only if they have voluntarily transferred contributions to this body for at least six months. In this case, the amount of assistance depends on the minimum wage.

To receive money, individual entrepreneurs apply directly to the Social Insurance Fund. You must provide:

- passport;

- application in free form;

- certificate of registration date;

- sick leave

If an individual entrepreneur additionally works under a contract for another person, then mandatory contributions are made to the Fund for him. Consequently, this person receives the right to maternity benefits as if he were employed.

Important: an individual entrepreneur working under a contract can count on two types of maternity leave:

- Through the Social Insurance Fund.

- Through the employer.