Why do you need to use this service if you still have to go to the tax office?

This method can save time and save the entrepreneur from one extra trip to the Federal Tax Service:

- You submit an application on the tax website.

- After 3 working days (if everything was filled out correctly), bring the rest of the documents in person with your passport.

- Some time later, on the same day, you receive ready-made constituent documents of the individual entrepreneur.

But be ready

to the fact that if at the stage of submitting the application you make any mistakes or your residence address turns out to be complex (for example, it will contain both a building and a structure), then the tax office will refuse to consider the application and you will lose even more time compared to the usual way of registering an individual entrepreneur.

At the same time, you should not expect help from the technical support of the Federal Tax Service, because most of their employees do not really understand how all these online services should work.

How to open a current account?

The individual entrepreneur must visit the bank's representative office. To reduce the waiting time for service and avoid standing in queues at the bank, clients are invited to submit an application to agree on the time and date of the visit. The manager will contact the applicant and arrange a meeting:

An additional service from Sberbank is the ability to arrange a meeting between a bank employee and an individual entrepreneur in a place convenient for the client, for example, in his office or apartment, to sign documents. In advance, the bank manager will tell you by phone about the necessary documents and agree on the place and time of the meeting. The procedure will take no more than 1 hour, you will be able to use your account immediately, and your online banking and SMS notification will be connected at the same time. You can use the service in Moscow, St. Petersburg, Samara, Volgograd, Novosibirsk, etc. A complete list of cities where the service operates can be found on the bank’s website by following the link.

How to open a current account at a bank office:

- If necessary, reserve an account in advance. Documents can be submitted to the bank within 1 month;

- Collect all required documents and information;

- Choose which service package is more convenient to use. You can connect additional services: Internet banking, Self-collection, etc.;

- The bank verifies the individual entrepreneur’s documents and opens the possibility of using the full functionality of the current account.

Clients can reserve a bank account immediately after receiving registration documents. To do this, fill out a special form:

- The account type is indicated;

- Information about the individual entrepreneur: OGRN, INN;

- Contact phone number;

- E-mail address.

The individual entrepreneur will be provided with an account number, which can be immediately indicated in supply contracts, in auction documentation, and can be used to make incoming transactions. Debit transactions on the account will become available only after opening a bank account.

In a credit institution, you can open a current account for an entrepreneur via the Internet, even if he is the first one.

The service is available to registered users in the Sberbank online system who meet the following requirements:

- Have a biometric passport issued no earlier than 2009;

- There is SNILS and a civil passport;

- Availability of a smartphone with Android 5.0 and above and NFC technology.

How to open an account in the Sberbank ID system:

- Log in to the system, enter your credentials and personal data;

- Study the offered service packages and choose the optimal one;

- Enter the data in the proposed application form;

- Documents are signed electronically in the ID Point application;

- Incoming transactions on the account can be performed immediately, expenditure transactions will be available after the client is verified by the credit company.

New clients can first register in the system, then open an account as an individual entrepreneur.

You can open a second individual account via the Internet, without visiting a bank representative. The procedure in this case will be as follows:

- In the Sberbank Business online system, a request is created for online opening of a current account;

- Select a service package and account currency;

- The request is sent for consideration;

- After processing the request, the client receives a notification about opening an account and connecting it to the Sberbank Business Online service with the ability to carry out debit transactions.

How to submit an application for registration of an individual entrepreneur through the service on the tax website

First you need to create an account in the service and log in to the site:

Next, select the “Individual Entrepreneurs”

and click on the button

“Fill out a new application”

:

After this, add a checkbox that confirms your consent to the processing of personal data and click on the link with the application form P21001

:

A service will open in front of you, which consists of 5 steps

. We did not describe in detail how to fill out each of the steps, because... Everything in the service is quite clear, and if you have questions, you can always read the information blocks on the right:

Is it possible to open an individual entrepreneur online via the Internet?

The procedure for opening an individual entrepreneur comes down to registration with the Federal Tax Service. Initially, to do this, you had to contact the tax office yourself, fill out and submit an application. Sometimes it was also necessary to contact a notary, for example, if the entrepreneur himself did not want to waste time in queues when visiting the Federal Tax Service. This approach led to the fact that it was not easy to open your own business and register as an individual entrepreneur.

The development of modern technologies has made opening an individual entrepreneur online accessible. To do this, you do not need to contact the Federal Tax Service in person or visit a notary.

Step-by-step list of actions for registering an individual entrepreneur online on the Federal Tax Service website

To register a turnkey individual entrepreneur online you must:

- Prepare documents for opening an individual entrepreneur.

- Buy and set up a qualified electronic signature (EDS).

- Download a special program for forming a transport container from the official website of the Federal Tax Service.

- Create a transport container with documents for individual entrepreneur registration.

- Upload the transport container to the Federal Tax Service website and send documents online.

- Receive ready-made constituent documents in your personal account on the Federal Tax Service website.

Let's look at each stage of using the service in more detail.

Requirements for clients

Sberbank puts forward a number of requirements for persons wishing to register an individual entrepreneur:

- Age restrictions apply. Persons over 18 years of age can apply.

- When registering, you must have the originals of the following documents: passport of a citizen of the Russian Federation and SNILS.

- You must have a profile in the Sberbank Online service. To register an individual entrepreneur, you will need your personal data: login and password.

- An electronic digital signature is required. It will be useful both at the stage of company registration for signing documents, and in the future when working with invoices.

- You need an electronic device with which you can immediately track changes in your personal account.

Necessary documents for registering an individual entrepreneur on the Federal Tax Service website

To open an individual entrepreneur on the Federal Tax Service website, prepare the following documents:

- Application for registration of individual entrepreneurs (form P21001).

- Original receipt for payment of state duty in the amount of 800 rubles.

- Notification of the transition to the simplified tax system (if you plan to use Simplified taxation).

- Original passport + photocopies of all pages (even blank ones).

- A copy of the TIN certificate ( optional

, but some Federal Tax Service Inspectors may ask for it).

You can generate the above documents for free using this service.

Pros and cons of online registration of individual entrepreneurs through government services

The advantages include the following:

- You can register an individual entrepreneur online without leaving your home. You only need to fill out an application, upload documents, sign an electronic signature and receive registration documents electronically or “on paper”.

- Quick registration. By submitting a registration application through this portal, you can become an individual entrepreneur in just a couple of days. The quick registration period is due to the fact that you do not have to go anywhere or take/pick up documents.

- Discounted state duty. If you open an individual entrepreneur through government services and immediately pay the state fee on the same website, you can take advantage of a 30% discount on the cost of the state fee. Instead of 800 rubles, you will need to pay only 560 rubles.

The following shortcomings immediately stand out:

- It is imperative to have a verified account on the state portal.

- an electronic digital signature is required , which costs some money (about 2,500 rubles per year). It will not be possible to send an application without a digital signature.

- You must be able to create multi-page TIFF format . Also no more than a certain size.

Everyone can decide for themselves which method is more suitable and which one to use. But we can definitely say that for most Russians the most suitable way to register an individual entrepreneur online via the Internet is to submit documents through the Federal Tax Service portal.

And in conclusion, in order to understand the material in the article, we recommend watching the video instructions for registering an individual entrepreneur online:

Required links:

- State registration of legal entities and individual entrepreneurs

- Application for state registration of an individual as an individual entrepreneur (form No. P21001)

- Sample of filling out an application (Form No. P21001)

- OKVED codes 2020 with explanation

- Payment of state duty

- Step-by-step scheme for registering individual entrepreneurs

- Simplified taxation system

Purchase and installation of an electronic signature (EDS)

To send documents online, an entrepreneur needs to purchase and set up a qualified electronic signature (EDS). The cost of an electronic signature is on average 3,000 rubles, but it may vary depending on its functionality and the specific certification center.

The electronic signature certificate must be installed on your computer. The tax office website has detailed installation instructions. However, you should know that setting up stable operation of the digital signature in conjunction with programs from the Federal Tax Service is not the easiest

. At the same time, tax technical support employees, in response to non-trivial questions, refer to third-party developers.

Rates

In addition to the reliability of the bank, the main criterion when choosing a service organization is the amount of the amount for opening a bank account and its monthly maintenance. The latter depends on:

- account maintenance fees;

- number of payment orders per month;

- commissions for transfers and deposits of funds;

- cash withdrawal fees;

- cost of SMS notification.

For convenience, the bank has developed different service packages. For all of them, the payment day lasts from 1 am to 24 pm (for transactions with Sberbank accounts) and until 19:30 pm for other transactions.

“Easy start”

“Easy Start” is the only package with free service, suitable for beginner businessmen.

Fees and conditions:

- Unlimited number of transfers to bank clients. The first 3 payments to clients, legal entities to other banks - 0%, then 199 ₽ for each transaction.

- Transfers to individuals up to 150 thousand rubles - 0%, then from 1 to 8% depending on the amount.

- Cash deposits through ATMs and cards – 0.15%, cash desk – from 1% (depending on the deposit amount).

- Cash withdrawal through an ATM – 3%, cash desk – from 5%.

- You can get a “Momentum” business card, annual maintenance is free.

- SMS notifications on transactions – 199 ₽, on a business card – 60 ₽.

“Good season”

Suitable for those who may not have operations during the month, for example, a seasonal business. If there is no movement of funds, then they will not charge anything for service, otherwise - 690 ₽ per month.

Fees and conditions:

- The first 5 payments are 0%, then 49 ₽ for each transfer to legal entities.

- Payments to individuals up to 150 thousand rubles - 0%, then from 1 to 8% depending on the amount.

- Cash deposits through ATMs and cards - up to 50 thousand rubles per month free of charge, above this amount - 0.3%, through a cash register - from 0.3% (depending on the deposit amount).

- Cash withdrawal through an ATM – 3%, cash desk – from 4%.

- Annual maintenance of a business card – 250 ₽.

- SMS notifications on transactions – 199 ₽, on a business card – 60 ₽.

“Good earnings”

For those who actively use cash payments. Monthly maintenance – 1,090 ₽.

Fees and conditions:

- The first 10 payments are 0%, then 8 ₽ for each transfer to a bank client and 35 ₽ to clients and legal entities of other banks.

- Transfers to individuals up to 150 thousand rubles - 0%, then from 1 to 8% depending on the amount.

- Cash deposits through ATMs and cards are up to 100 thousand rubles per month free of charge, above this amount – 0.15%, through a cash register – from 0.3% (depending on the deposit amount).

- Cash withdrawal – from 3%.

- Annual maintenance of a business card – 250 ₽.

- SMS notifications on transactions – 199 ₽, on a business card – 60 ₽.

“Active settlements”

It is profitable to open an individual entrepreneur with a large number of non-cash payments. Maintenance per month – 2,490 ₽.

Fees and conditions:

- The first 50 payments – 0%, then 16 ₽ for each transfer to legal entities.

- Transfers to individuals up to 150 thousand rubles - 0%, then from 1 to 8% depending on the amount.

- Cash deposit by any method – from 0.3%.

- Cash withdrawal – from 3%.

- Annual maintenance of a business card – 250 ₽.

- SMS notifications on transactions – 199 ₽, on a business card – 60 ₽.

“Great opportunities”

Servicing such an account costs more than all packages - 12,990 ₽ per month.

Fees and conditions:

- Unlimited number of transfers to bank clients with 0% commission. Other clients and legal entities can make up to 100 payments free of charge. From the 101st payment the commission is 100 ₽ per operation.

- Payments to individuals up to 300 thousand rubles - 0%, then from 1.7 to 8% depending on the amount.

- Cash deposits through an ATM up to 500 thousand rubles - 0%, above this amount - 0.3%. Through the cash register – from 0.3%.

- Cash withdrawal through an ATM up to 500 thousand rubles is free, over 3%. Through the cash register – from 3%.

- Annual business card maintenance and SMS notifications are free.

Programs for generating a transport container with individual entrepreneur documents

To send scanned documents to an individual entrepreneur via the Federal Tax Service website, they must be added to the transport container (archive) and signed with an electronic signature. You can prepare a container using this program on the Federal Tax Service website:

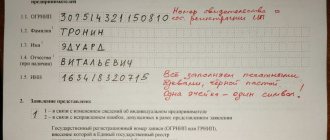

On the tax portal you can download another program for creating a container with individual entrepreneur documents, which is called: “Preparation of documents for state registration”

:

The program is quite difficult to use

, after installation, an error is often displayed, to correct which you need to separately download and register the paths to the database of Russian addresses. In addition, you will not be able to form a full-fledged transport container, because... The program does not provide a receipt for payment of the state fee:

Advantages and disadvantages of opening an individual entrepreneur in Sberbank

Registration of an individual entrepreneur with Sberbank has the following positive aspects:

- it is possible to register a business completely online, without a trip to the tax office;

- the process takes no more than 15 minutes;

- errors in filling out documents are excluded;

- the completeness of the documentation is observed;

- quick opening of an individual entrepreneur (within 5 days);

- no need to pay for the work of lawyers to prepare documents;

- When registering online, you do not need to pay a state fee.

It would be a stretch to call a disadvantage of registration that to successfully register a business you must have minimal skills in using a computer and a mobile application.

Registration of individual entrepreneurs step by step instructions in 2020

Since 2020, new administrative regulations have appeared on the procedure for registering a business (including individual entrepreneurs); now you can submit documents for registration through the MFC. At the same time, the need to notarize the signatures of persons who can confirm their identity when submitting documents has disappeared. From 2020, the limits on the simplified tax system for income up to 150 million rubles have been increased.

- Selection of OKVED codes

- Choosing a tax system

- Submitting documents to the tax office via the Internet

- Receive documents from the tax office

- Obtain a registration number from the Pension Fund of Russia

- Get codes from Rosstat (optional)

- Send a notification to the supervisory authority

- Open a bank account

- Send registered letters to the tax office and the Pension Fund about opening an account (not necessary from 05/02/2014)

- Order a print (optional)

- Enter into agreements with companies that pay you money

- Submit information on the average number of employees by January 20 (if there are employees)

- Pay contributions to the Pension Fund by December 31

- On the simplified tax system, pay advance tax quarterly by the 25th day of the month following the quarter

- Pay tax at the end of the year by April 30 of the next year

- Submit your tax return using the simplified tax system by April 30 of the following year.

Selection of OKVED codes

You need to select OKVED codes in advance for the activity that you are going to conduct. Without these codes, you will not be able to fill out an application for individual entrepreneur registration. Read more about OKVED codes in my article.

Choosing a tax system

In addition to OKVED codes, you still need to decide on the taxation system. Most use the simplified tax system of 6% or 15% (simplified), which means paying 6% of income, or 15% of the difference in income minus expenses. Naturally, I chose 6%, because I have almost no expenses, like most of those who earn money on the Internet or remotely. There are other tax systems (OSNO, UTII, PSN), but I won’t write about them here, read here.

Submitting documents to the tax office via the Internet

You can submit documents to the tax office via the Internet, which is what I used. You can submit either through the tax office website here or through government services. It seems that this does not depend on the region, at least government services provide a choice of any city. I chose the first method.

A description of the registration process, as well as answers to basic questions, is available on the tax website in a special section.

Documents required for registration of individual entrepreneurs:

- Passport

- TIN

First you need to fill out a form on the website; you don’t need to enter any specific data here, except for your TIN. If you don't know him, you can recognize him right away. But if you haven’t received it yet, then I don’t know whether it’s allowed to submit an application without it, I haven’t checked. You can also get a TIN via the Internet, but you will probably have to go to get it first. And if you submit in person, and not via the Internet, then an application for a TIN is also attached, only the period increases from 5 days to 10. By the way, as far as I understand, now you do not need to file documents when submitting in person.

Then in the next step you will need to enter the pre-selected OKVED codes. Just keep in mind that this must be done quickly, the session time runs out quickly.

The application with number F4130909226611 has been sent to the tax authority for consideration. No later than three working days, a message about the results of consideration of the application will be sent to the email address specified in the application.

Then you pay the state fee via Internet banking (for example, Sberbank-Online) or by receipt at the bank. Now you just wait for an invitation to the tax office in 3 working days (I waited 4 days along with the day of filing the application), it’s faster than filing in person (in this case they wait 5 days). Please note that if you paid the state duty via the Internet, you will need to print out an extract from the Internet bank, because confirmation of payment will need to be brought to the tax office anyway.

Receive documents from the tax office

The email received:

In the period from September 13 to September 17, a person registered as an individual entrepreneur can contact the Interdistrict Inspectorate of the Federal Tax Service of Russia No. 46, address: 125373, Moscow, Pokhodny Proezd, house ownership 3, building 2. Reception regarding state registration of individuals as individual entrepreneurs is carried out: from Monday to Thursday from 9-00 to 18-00, on Friday from 9-00 to 16-45.

When contacting the tax authority, you must submit: - an original and a copy of an identity document, - an original and a copy of a document confirming your place of residence (if this information is not contained in your passport), - a document confirming payment of the state duty.

If, after registering as an individual entrepreneur, it is intended to apply a simplified taxation system, it is also necessary to submit an application for the transition to a simplified taxation system. After the specified period, application F4130909226611 is canceled.

After receiving an invitation by email, come at the appointed time to the 46th tax office (for Moscow). A fork is given in 3 days, if you do not show up, the application will be cancelled. And, if you have chosen the simplified tax system, then in addition to your passport and its copy, you also need to have an application for transition to the simplified tax system in two copies (form). At the tax office you will receive:

- Certificate of state registration of an individual as an individual entrepreneur (OGRNIP)

- Extract from the Unified State Register of Individual Entrepreneurs (USRIP)

- Unified State Register of Individual Entrepreneurs (I have two documents: 1st on making an entry for tax registration, 2nd on the acquisition of individual entrepreneur status)

- Notification of registration of an individual with the tax authority

- Notification of registration of an individual with the territorial body of the Pension Fund of Russia

- Notification of assignment of statistics codes (from Rosstat)

The last two documents may not be given (they didn’t give me). Everything went quickly, the queue was electronic, I waited for 5 minutes at first, then I signed the papers, and waited another half hour for the documents to be completed, the second time without a queue. And there are a lot of people at the 46th tax office, but most likely they are on other issues. And there were almost no one like me who submitted documents via the Internet.

Registration of individual entrepreneurs in the 46th tax office

Registration of individual entrepreneurs via the Internet - a separate coupon

The Federal Tax Service congratulates you on registering as an individual entrepreneur based on the electronic application F4130909226611 and thanks you for using the electronic service of the Federal Tax Service of Russia.

The application contains a certificate of state registration generated electronically and signed electronically by a tax authority official, an extract from the Unified State Register of Individual Entrepreneurs and a notice of registration with the tax authority as an individual entrepreneur.

Obtain a registration number from the Pension Fund (if it was not issued by the tax office)

If you have not been given a notification from the tax office about registration with the Pension Fund, then there are several options. You don’t really need the letter from the Pension Fund; you need the registration number and details for paying contributions. Therefore, you need to either wait until the letter arrives by mail (about 2-4 weeks), or call your PFR department by phone, or go to the territorial PFR department yourself. You can also get a registration number through My Business via an extract from the Unified State Register of Individual Entrepreneurs if you have a paid account there, but you must first wait at least a couple of weeks, because this information does not immediately appear in the registry. You will need this number in order to pay your fees.

Registration with the Pension Fund is mandatory! Even if you are not active, you will have to pay contributions anyway. And if you have employees, you will also need to register as an employer.

Get codes from Rosstat (optional)

Likewise, if the tax office didn’t give it, then you need to get it yourself, but this is for the case when the individual entrepreneur is included in the sample and needs to submit reports to Rosstat (that is, if necessary, it will not be immediately after registering the individual entrepreneur). A letter with statistics codes is optional. It's easy to get codes - everything can be done online. Here on this page there are various links to various government sites where you can find out. Perhaps someone will have to go in person, for example, someone (and immediately after registration) who will need the original letter from Rosstat. For example, some banks require it to open a current account.

I tried the next day after registration to get codes for Moscow, but it said “nothing found”, apparently it was not yet in the database. But I don’t need the codes; my bank didn’t require it. 4 days after registration, the codes via the link were received

Send a notification to the supervisory authority

For some types of activities, you will need to send a notification to the supervisory authorities (registered letter with an inventory and return receipt): Roszdravnadzor (social services), Rospotrebnadzor (trade, household services, public catering), Rostransnadzor (transportation services, activities of road freight transport). But all this activity has nothing to do with freelancing. More details in this resolution, there is a list there. Notification must be given one day before the start of such activities. My Business provides a completed notification, and they also send it if an electronic signature is made.

Notification form

Open a bank account

If you haven’t decided on a bank yet, I recommend Tinkoff, I’ve been with it for quite a long time and I like everything. Tariff for only 490 rubles. Also read my post at this link with an up-to-date comparison of tariffs of all banks. Then choose for yourself what suits you best.

If you plan to work only with cash, then you have every right not to open a current account. Otherwise, go to the websites of banks in your city, look for Cash Services there in the section for legal entities or corporate clients, and look at the tariffs. A list of all banks in Russia and reviews of them is available on the website banki.ru. Remember, the bank must have Internet banking, otherwise how else to manage your account.

Tinkoff account + 2 months free →

Normal prices are as follows: opening an account 1000 rubles, maintaining an account 0-1000 rubles, transfer via Internet banking to a personal account of an individual in the same bank 0 rubles, transfer via Internet banking to a personal account of an individual in another bank 20-50 rubles for payment. Of those banks in Moscow whose tariffs I looked at, the costs, plus or minus, are as I said: Tinkoff, Modulbank, Tochka, in order of increasing service costs. In some banks, such as Tinkoff and Modul, you don’t even need to go to the office; an employee will come to your office or home.

Many banks also provide integration with My Business, which is quite convenient - all transactions will be automatically loaded into your My Business account. For me, it is necessary to delegate everything that is possible to the maximum, so that there is time to deal directly with your business. Online accounting services also include taxes, contributions, consultations, etc. Cheap option for your own accountant.

Rates Moye Delo →

Elbe prices →

Important point . As a rule, you bring to the bank your OGRNIP, an extract from the Unified State Register of Individual Entrepreneurs, a notice of registration with the tax office, Rosstat codes, a passport and a card with your signature (!) certified by a notary. But many banks can certify such a card themselves for an additional fee (or even free) and on the spot, this is more convenient. In any case, it is better to call the chosen bank and find out the procedure for opening an account for an individual entrepreneur. Read more in my article Opening a current account for individual entrepreneurs.

There is no need to notify the tax and pension fund about the opening/closing of a current account since 2014, thereby the procedure for registering an individual business has been slightly simplified.

Order a print

For an individual entrepreneur, printing is completely optional; you can simply use a signature on documents without a seal. The standard cost of printing is about 500 rubles.

Enter into agreements with companies that pay you money

Since you are now an individual entrepreneur, you cannot get money just like that. You need to enter into contracts with everyone, both legal entities and individuals, and also, after completing the work or rendering the service, send the customer a certificate of work performed or services provided (read about the primary documents). Therefore, you will need to contact each of the affiliate programs and conclude an agreement with them, after which you will receive money not to Webmoney or the personal account of an individual, but to the current account of an individual entrepreneur. It may not be possible to do this with everyone, and some of the money will still come to Webmoney, so you will need to enter into an agreement with the Guarantee Agency, which will allow you to withdraw money as an individual entrepreneur and to a current account.

Registration of individual entrepreneurs with the help of a notary

To register an individual entrepreneur online, it is not necessary to receive your electronic signature. You can contact a notary, who has the right to submit documents to the tax office electronically using his digital signature.

True, not all notary offices provide this service, so first you need to find out the necessary contacts. Also, clarify whether you need to fill out form P21001 yourself or whether the notary will do it himself. In this case, the state fee for registering an individual entrepreneur is also not charged, but you will have to pay for notary services. Depending on the city, the cost can reach 2,000 rubles.

Both registration options using an electronic signature are convenient in cases where the applicant is not located in the city where he is registered. It often turns out to be more profitable to register an individual entrepreneur online, spending money on your digital signature or a notary, than to go to the tax office at your place of registration.