This term has other meanings, see Exchange (meanings).

New York Stock Exchange, 1963

Exchange

(Dutch beurs, German Börse, French bourse, Italian bórsa, Spanish

bolsa

) is a legal entity that ensures the regular functioning of the organized market for exchange goods, currencies, securities and derivative financial instruments. Trading is carried out using standard contracts or lots (lots), the size of which is regulated by the regulatory documents of the exchange.

The outdated meaning of the word is a place or building where traders, intermediaries, and stockbrokers gather at certain hours to conclude transactions in securities or goods[1].

Before the era of computerization, the parties agreed on transactions orally. Nowadays, trading is mostly carried out electronically using specialized programs; many exchanges have abandoned trading floors[2]. Brokers, in their own interests or the interests of their clients, submit orders for the purchase or sale of exchange commodities to trading systems. These bids are satisfied by counter bids from other traders. The exchange keeps records of executed transactions, implements, organizes and guarantees settlements (clearing), and provides a “delivery versus payment” interaction mechanism.

Typically, exchanges receive a commission fee from each transaction concluded with their help, this is the main source of their income. Other sources may include membership fees, fees for access to trading, and the sale of exchange information.

Etymology

The history of the emergence of exchanges dates back to the 12th-15th centuries. and begins with bill fairs in Venice, Genoa, Florence, Champagne, Bruges, London.[3] In Bruges (West Flanders), bill sales took place in the square where the house of the ancient Van Der Burse family stood, whose coat of arms depicted three leather bags (wallets). Meetings of merchants in the square were called "Borsa", which means "wallet". It was there, on the territory of modern Belgium in 1406, that the first stock exchange was founded[4].

Objectives of the stock exchange

The main objectives of the stock exchange are:

- creating conditions for the existence of a permanent securities market

- setting prices for financial instruments

- ensuring the transfer of ownership rights

- ensuring that all conditions of the transaction are met

The stock exchange offers great opportunities for obtaining a stable income from trading securities. In order to succeed with its help, you need to start small and undergo training with the help of the right brokerage company. The stock exchange has its own functions and tasks, rules for conducting transactions. And if you choose the optimal strategies for trading financial instruments, you can soon achieve excellent results.

Author Ganesa K.

A professional investor with 5 years of experience working with various financial instruments, runs his own blog and advises investors. Own effective methods and information support for investments.

Story

- In the 16th century, the first two stock exchanges opened and closed - in Antwerp and Lyon. On these exchanges, trading took place not only with bills, but also with government loans. Official exchange rates were also established.

- The world's oldest stock exchange, the Amsterdam Stock Exchange, was created in the 17th century.

- At the end of the 17th century, the London Stock Exchange (LSE) was created. It was here that the concepts of “bulls” and “bears” first appeared as players on the stock exchange.

- The New York Stock Exchange (NYSE) was founded on May 17, 1792.

- The Tokyo Stock Exchange was founded in 1878.[3]

The stock exchange is

For those who do not understand the issues of trading stocks, bonds and other securities, the stock exchange remains just a platform for speculation. It is believed that this is another option for earning money out of thin air. However, in reality this is not the case. The current stock exchange, online trading and its other varieties, represent a secondary market for stocks, bonds and other securities. As part of the auction, only a redistribution of property rights occurs. The circulation of such assets cannot be normalized without an institution specially developed for this purpose. The modern world is the stock exchange.

The stock exchange is the most convenient place for transactions with stocks, bonds, and futures.

Games

| Check for compliance with encyclopedic criteria. Perhaps the content of this article or section is an arbitrary set of loosely related facts, instructions, a catalog or insignificant news information. Please improve it in accordance with the rules for writing articles. The talk page may have more details. |

Several games have been created that simulate the stock exchange. Among them:

- Shareholder (game)

- Broker (game)

- Broker +1 (game)

- Strong Hold (game)

History in Russia

The first exchange in Russia

In Russia, the first stock exchange was created by Peter I in 1703 in St. Petersburg.[5].

During the NEP

The first Soviet stock exchanges appeared in the USSR in the summer of 1921 - Saratov, Perm, Vyatka, Nizhny Novgorod and Rostov.

They were cooperative, but with the appearance at the end of December 1921 of the Moscow Central Commodity Exchange of the Supreme Economic Council and the Central Union, the cooperative exchange was replaced by a “mixed” exchange with the bodies of the Supreme Economic Council, and in the first half of 1922 all exchanges were reformed in accordance with the charter of the Moscow Exchange.

Soviet exchanges were tasked with identifying supply and demand, regulating trading operations, and monitoring the correctness and economic feasibility of transactions.

On January 2, 1922, the Supreme Economic Council issued an order on the participation of state enterprises and organizations in exchange transactions and opened schools of “trade literacy,” but at first enterprises avoided participation in exchange transactions. Quotation on the Moscow Exchange began 10 months from the date of its formation; until the summer of 1922, quotation was carried out on only 24 of the 39 existing exchanges. Private individuals could not be members of the Soviet exchanges, although they were allowed to attend exchange meetings if they were regular visitors and paid an annual fee. As a result, the share of private capital in exchange transactions was significantly inferior to the share of government agencies. In 1923, the average annual percentage of private capital in stock exchange turnover did not exceed 15.5%, and its growth rate was significantly lower than government turnover: 11% versus 45%.

In 1923, there were already 70 exchanges in the USSR.

But the state viewed them as a tool for “capturing the market” and ousting private traders from the economic sphere.

In September 1922, the STO obliged government agencies to compulsorily register on the stock exchange transactions made outside the stock exchange. Since exchanges charged higher fees for registering over-the-counter transactions compared to exchange transactions, this resolution contributed to an artificial increase in exchange turnover[6].

At the beginning of 1927, the Council of People's Commissars and the Council of Labor and Defense made a decision limiting the operation of exchanges, and as a result, out of 70 exchanges, 56 remained, and in 1929-1930. and they were closed.

After the restoration of capitalism

With the rollback to capitalism in Russia, stock exchanges began to appear, the number of which grew very quickly. In the short term, the number of registered exchanges in Russia exceeded the total number of operating exchanges in the world. However, not all of them actually worked.

Since January 1, 2014, Russian legislation does not provide for the division of exchanges into currency, commodity and stock exchanges; to denote all of the above types, the term “exchange” is used (Clause 6, Article 29 of the Federal Law of November 21, 2011 N 325-FZ (as amended on December 21, 2013) “On Organized Trading”), and their activities are regulated by the Federal Law “On organized auctions" and other regulations.

How to trade on the stock exchange for beginners?

If a beginner thinks that trading on the stock exchange is so easy, then he is deeply mistaken. In order to master all the nuances, you must first study a large amount of information and know basic information about the work of this economic institution. In order to become a successful market participant, it is important to learn how to trade on the stock exchange.

Information about the exchange

The essence of the activity of any exchange is the purchase and sale of shares of various companies. The main thing for a novice trader is to choose the optimal platform for himself to start trading. It is necessary to choose its optimal option. You should pay attention to the exchange commission percentage and market liquidity. It is these indicators that make each type of exchange attractive to traders with different levels of experience.

The exchange itself is a kind of center where all bids from trading participants flow through the Internet. Individuals can send them only with the help of brokers. They cannot submit applications directly.

Choosing a broker

For a novice trader, it is very important to choose the right broker. This could be an InstaForex broker or any other. It is a financial organization licensed to conduct financial activities and trade transactions in securities, currencies and other instruments.

Such companies usually offer traders a variety of terms of cooperation:

- opening a trading account via the Internet

- withdrawal of funds and making deposits

- access to markets

- education

Traders can choose their own broker for cooperation. It is very important to pay attention to some points.

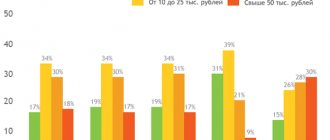

Minimum deposit amount

Brokers can be both large and small. The size of the deposit is largely determined by how developed the company is. To open an account, you will need to deposit an amount ranging from $5 to $2,000, depending on the broker you choose.

Trading conditions

Trading conditions for all brokers are different. Transaction prices may vary. Some brokers offer to open cent accounts, where transaction amounts may be low. The following tools are offered:

- currency pairs

- binary options

- securities

- gold Silver

- oil.

Brokers are always ready to provide leverage. Thanks to borrowed capital, traders have the opportunity to open significantly larger positions.

Fees for payments

When a person tries to choose a broker, it is very important to pay attention to what methods he offers in order to withdraw earned funds. Most of these companies offer to top up your balance and withdraw earnings for free. However, you can also come across brokers who will charge a commission for each transfer. When a contract is concluded with a company, it is important to pay attention to all commission fees so that there are no surprises later.

Reviews

If you choose a broker based on the advice of your friends, then this is just great, because in most cases you can trust their opinion. Especially if they have been cooperating with a specific broker for a long time. If you don’t have such acquaintances, then online reviews will always come to the rescue. You can trust them too.

Today there are a large number of traders who share their experience of working with certain brokers. In their blogs or just articles they share their impressions. When choosing between brokers, you should listen to reviews and opinions. After all, choosing the right company guarantees the opportunity to receive a stable income in the future.

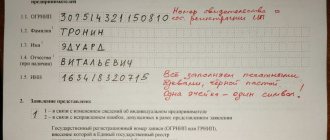

Opening a personal account

In order to subsequently carry out transactions with various financial instruments, you will need to open a personal account. It is also called a brokerage account. Previously, in order for its opening to take place, it was necessary to visit the broker’s office in person. Now all this is done using the Internet. Thanks to such an account, traders can receive tax benefits.

We study the principles of working on the trading terminal

In order for you to have access to the market, brokers offer to use a special software package called a trading terminal. Thanks to it, you can monitor the behavior of charts and take part in transactions.

Very often, such trading terminals are available for use on mobile devices thanks to special applications.

Selection of strategy

The selection of a strategy plays an important role in successful trading. Traders' methods and strategies may be different. In order to choose the best option, you can use a demo account.

Many brokers use a hedging method that allows them to insure themselves against currency risks. A hedge fund is available to a narrow circle of investors.

Start of trading

In order to start trading on the stock exchange, it is important to first enter into an agreement with a broker. Next, undergo training and use the trading tools offered by him.

From a technical point of view, playing on the stock exchange is a completely simple process. First, you need to install the stock exchange terminal program on your computer or mobile device. With its help, you can track the decline and rise in stock prices. As soon as the right moment comes, you can make a purchase.

Notes

- Small encyclopedic dictionary of Brockhaus and Efron.

- “Iron Broker: How Robots Are Displacing Traders from Exchanges Around the World” dated November 8, 2017

- ↑ 1 2 Eric Nayman

Small encyclopedia of a trader. — M.: Alpina Publisher. — 2002. - Kulisher I.M. History of the exchange (as presented) // Banking Encyclopedia. Kyiv: Bank. encycl., 1916. T.II. pp. 40-75.

- Economic theory. 4th edition. Textbook for universities. A.I. Popov (page 64). Publishing house "PETER".

- “NEP Russia” (edited by A. N. Yakovlev) - M, 2002.