Home / Labor Law / Payment and benefits / Wages

Back

Published: 05/04/2016

Reading time: 10 min

0

6565

Accounting accounts and payroll entries are the main accounting tool, with the help of which the method of double-entry data is implemented for various business transactions that occur in the company. For different types and groups of such operations, various accounts and postings are used.

It is worth considering a group of entries that are used when accounting for wages accrued and paid to employees, because wages are the most significant item of expense for almost every enterprise .

- Sequence of actions when accounting for salaries

- Settlements with company employees for wages

- Displaying accrued wages in transactions

- Displaying deductions made from wages in postings

How to organize accounting

The chart of accounts (Order of the Ministry of Finance No. 94n dated October 31, 2000) provides account 70 “Settlements with personnel for wages” to reflect accruals and payment of wages and deductions from it. It is on this basis that salary accrual entries are generated in correspondence with other accounts. The account is passive, and its loan balance reflects the amount of wages the organization owes to its employees. The credit of the account reflects the accrual of fees for performing labor duties. The debit reflects a transfer from a current account or a posting for the payment of wages from the cash register, reflecting the amount of deductions.

Analytical accounting should be organized for each employee separately. This will allow you to receive up-to-date information on accruals and debts for each individual employee of the company at any time.

The main stages of organizing payroll accounting include:

- Calculation of wages.

- Calculation and accounting of deductions from salaries.

- Calculation of insurance premiums.

- Payment of wages.

- Transfer of personal income tax and insurance premiums.

The accountant repeats all stages every month, and for each case its own posting is generated. We will describe in detail everything that an accountant should know in 2020 about the correspondence of accounts that are used most often.

Insurance premiums

Deductions are made only in the month to which they relate, made by their employer. They go to subaccount 69 in:

- Pension Fund.

- FFOMS.

- To a temporary disability fund, which is created to pay sick leave.

- Into a fund intended for payments for disability due to maternity.

To create an accounting entry, a credit to account 69 and a debit to accounts 20, 26, 29, 44 , since insurance premiums are not deducted from wages, but are included in the cost of production. For example:

- Debit 20 Credit 69.

How to correctly calculate the financial stability ratio - see this material. How to prepare an extract from the minutes of the general meeting - read here.

How to reflect in accounting

The accrual of wages is reflected in the credit of account 70. Corresponding accounts when calculating wages reflect the direction of cost accounting depending on the labor functions performed by the employee. Also, the credit of account 70 reflects the accrual of fees for the time the employee is absent due to illness or vacation.

| Debit | Credit | |

| Posting accrued wages to employees of the main production | 20 | 70 |

| Workers of auxiliary production | 23 | 70 |

| Employees of departments serving the main production | 25 | 70 |

| Posting payroll to management personnel | 26 | 70 |

| The construction work of the new administrative building is being carried out on our own. | 08 | 70 |

| Calculated salaries of employees of a trade organization | 44 | 70 |

| Calculated payment for sick leave at the expense of the employer (first three days) | 20, 25, 26, 44 | 70 |

| Calculated payment for certificates of incapacity for work at the expense of the Social Insurance Fund | 69 | 70 |

| Reflects accrued payments that are not directly related to work activities (for example, an employee’s anniversary bonus) | 91 | 70 |

| If a reserve is formed for vacation pay | ||

| A deduction was made to the reserve on the date when wages were accrued | 20, 25, 26, 44 | 96 |

| Vacation pay accrued | 96 | 70 |

Postings in a budget institution

Budgetary institutions have a different Chart of Accounts than commercial enterprises.

The table presented below contains transactions for the calculation and issuance of salaries in budgetary organizations.

| Debit | Credit | Operation designation |

| 040120211 | 030211730 | Earnings accrued to employees of budgetary organizations |

| 030211830 | 030301730 | Personal income tax withheld from salary |

| 030211830 | 020134610 | Salaries were issued in cash from the organization's cash desk |

| 040120213 | 030310730 | Contributions to the Pension Fund have been accrued |

| 040120213 | 030302730 | Contributions to the Social Insurance Fund have been accrued |

| 040120213 | 030307730 | Contributions to the Compulsory Medical Insurance Fund have been accrued |

| 040120213 | 030306730 | Contributions from the National Tax Service at work have been accrued |

| 030211830 | 030402730 | Salary that was not paid on time was deposited |

| 030211830 | 020111610 | Salaries were transferred to employee card accounts |

| 030211830 | 030403730 | Deductions were made according to the writ of execution |

| 030302830 | 030213730 | Sick leave benefits have been accrued (at the expense of the Social Insurance Fund). |

| 040120213 | 030213730 | The benefit was accrued at the expense of the budget organization (3 days). |

You may be interested in:

Account 20 in accounting “main production”: what is it used for, characteristics, subaccounts, postings

Salary deductions

Deductions from wages are reflected in the debit of account 70. The main ones are:

- personal income tax;

- alimony, other deductions under writs of execution;

- contributions to a trade union organization;

- compensation to the enterprise for damage or loss.

| Debit | Credit | |

| Personal income tax calculated | 70 | 68 |

| Payments under writs of execution (alimony, fines) are withheld | 70 | 76 |

| Amounts of compensation for shortages and damages due to the fault of the employee are withheld | 70 | 73 |

| Upon dismissal, payment for unworked vacation days is withheld, reversal | 96 (20, 25, 26, 44) | 70 |

Read more: Calculation and withholding of alimony

Payment of wages

Salaries, at the employee’s request, are issued to him in cash or by bank transfer. Regardless of whether it is transferred to the card or issued from the cash register, the posting of paid wages is generated by the debit of account 70.

| Debit | Credit | |

| Salaries were paid from the bank account to employee cards | 70 | 50 |

| Posting wages issued from the cash register | 70 | 51 |

| Alimony and other deductions under writs of execution have been paid | 76 | 51 |

How can an organization pay wages to employees from a current account?

Salaries can be transferred to employees from a current account in two ways:

- send money yourself using payment orders as part of a transfer to physical cards. persons;

- entrust this procedure to the bank by concluding an agreement on a salary project.

The second method is more profitable and simpler, but in the article we will analyze both options in detail.

Personal income tax and insurance premiums: calculation and payment

From payments to employees, employers are required to calculate and transfer to the state:

- personal income tax (rate for residents - 13%);

- insurance premiums (22% - OPS, 5.1% - Compulsory Medical Insurance, 2.9% - OSS).

To generate entries for accounting of tax payments, the Chart of Accounts provides account 68, and for the calculation and accounting of insurance premiums - account 69.

| Debit | Credit | |

| Personal income tax calculated | 70 | 68 |

| Insurance premiums have been calculated | 20, 23, 25, 26, 44 | 69 |

| The withheld personal income tax was transferred to the budget | 68 | 51 |

| Insurance premiums transferred to the budget | 69 | 51 |

Read more: Deadlines for personal income tax payment

Read more: Basic information about insurance premiums

Tax payment transactions

Personal income tax must be withheld from the employee's salary. In addition, contributions to social funds and injuries are assessed for the entire amount of earnings.

Contributions are accrued to the same cost accounts as the employee's salary. Transfer of such obligatory payments occurs only by non-cash method within the time limits established by law.

| Debit | Credit | Operation designation |

| 70 | 68 | Personal income tax has been removed from earnings |

| 73 | 68 | Personal income tax is withheld from material assistance (if its amount is more than 4,000 rubles) |

| 68 | 51 | The tax was transferred to the budget |

| 20, 23, 25, 26 | 69/PF | Contributions to the pension fund have been accrued |

| 20, 23, 25, 26 | 69/SOC | Social security contributions accrued |

| 20, 23, 25, 26 | 69/MED | Health insurance premiums accrued |

| 20, 23, 25, 26 | 69/TRAUMA | Contributions to the Social Insurance Fund for injuries have been accrued |

| 69/PF | 51 | Contributions to the pension fund have been transferred |

| 69/SOC | 51 | Social security contributions transferred |

| 69/MED | 51 | Medical insurance contributions listed |

| 69/TRAUMA | 51 | Contributions to the Social Insurance Fund for injuries have been paid |

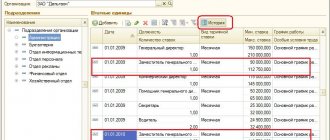

Reflection of PO transactions in accounting registers

Forms of registers for recording business transactions are developed and approved by a commercial organization independently. They must ensure that they can obtain up-to-date information about the company's assets and liabilities at any time.

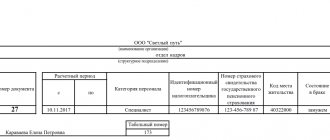

As mentioned above, the payroll accounting register is required to provide detailed data for each employee. It is also advisable to detail the data on the types and amounts of charges, deductions and payments. Such detailed accounting is organized in an independently developed form or using the T-54 form approved by the State Statistics Committee in Resolution No. 1 of 01/05/2004. The basis for calculating wages and filling out registers for its accounting are:

- time sheets;

- employment contracts;

- bonus orders;

- vacation orders;

- writs of execution and statements of deductions;

- other documents on labor standards and remuneration.

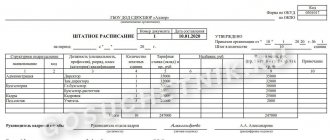

Form T-54

Also, according to Article 136 of the Labor Code of the Russian Federation, the employer is obliged to notify staff about accruals and deductions before transferring wages. This can be done by issuing a pay slip to the employee. Its form should be clear and allow the employee to know about accruals, deductions and amounts to be received. The organization has the right to inform an employee both on paper and in electronic form, for example, by sending a pay slip by email.

Pay slip form

Read more: Procedure and deadlines for issuing pay slips

Accrual example: calculation and postings

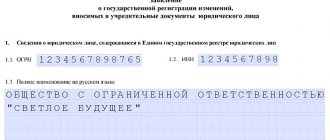

Let's look at an example of the procedure for generating transactions for payment of remuneration to employees. LLC "Company" employs two people. The organization is engaged in wholesale trade, and wage entries for the director and all other employees are generated and assigned to account 44. Salaries are paid on the 10th of the next month. On the same day, personal income tax and alimony are transferred. Insurance premiums were transferred on December 14, 2020.

Manager Petrov P.P.

pays alimony according to the writ of execution - 25% of the salary. Everyone is tax residents, that is, the personal income tax rate for everyone is set at 13%. The organization pays insurance premiums at regular rates (22% - OPS, 5.1% - Compulsory Medical Insurance, 2.9% - OSS). All employees are paid salaries via bank cards. Postings for payroll and taxes for November 2020

| FULL NAME. | Job title | Accrued based on salary | Sickness benefit (all payment at the expense of the Social Insurance Fund) | Personal income tax | Alimony | To payoff | Insurance premiums | ||

| OPS | Compulsory medical insurance | OSS | |||||||

| Ivanov I.I. | Director | 40 000 | 10 000 | 6 500 | 43 500 | 8 800 | 2 040 | 1 160 | |

| Petrov P.P. | Manager | 30 000 | 3 900 | 6 525 | 19 575 | 6 600 | 1 530 | 870 | |

| Total | 70 000 | 10 000 | 10 400 | 6 525 | 63 075 | 15 400 | 3 570 | 2 030 | |

The accountant will generate the following entries:

| Sum | Debit | Credit | |

| November 30, 2020 | |||

| Salary accrued | 70 000 | 44 | 70 |

| Disability benefits | 10 000 | 69 | 70 |

| Personal income tax withheld | 10 400 | 70 | 68 |

| Child support withheld | 6 525 | 70 | 76 |

| Insurance premiums accrued (15,400 + 3,570 + 2,030) | 21 000 | 44 | 69 |

| December 10, 2020 | |||

| Salary paid | 63 075 | 70 | 51 |

| Alimony payments listed | 6 525 | 76 | 51 |

| Personal income tax paid to the budget | 10 400 | 68 | 51 |

| December 14, 2020 | |||

| Insurance premiums listed | 21 000 | 69 | 51 |

Accrual

The accrual of monetary compensation earned by the employee during the reporting period (usually for a month) is carried out on the credit of the 70th account . How to choose an account corresponding to it depends on where the employee to whom the amount of money is credited works. If production is primary (maintenance or support functions), then this will be the 20th debit account .

When making transfers to management personnel, you need to post to account 25 or 26 . For sellers of finished products and other people who are engaged in the sale of goods or services, you need to use the 44th account .

An entry must be made to the debit account “08” in the case when workers are engaged in construction or in the construction of any other objects.

For example, the construction of a two-story residential building is underway, for which wages were accrued in the amount of 520,000 rubles, of which:

- 340,000 rubles are allocated for specialists employed in the main production. Posting: Debit 20 Credit 70;

- An amount of 100,000 rubles was received to pay management personnel. Posting: Debit 26 Credit 70;

- managers from the finished product sales department need to allocate 36,000 rubles. Posting: Debit 44 Credit 70;

- workers involved in the construction of an auxiliary warehouse are paid 44,000 rubles. Posting: Debit 08 Credit 70.

Other income from the “other” section is formalized as follows: Debit 91-2 Credit 70. By the way, deductions can be made to this account intended for reserve funds for subsequent salary payments from them.

The procedure for completing earnings transactions in a specialized program is discussed in detail in the following video: