Labor relations between the employer and employees are established by local regulatory acts of the organization, based on labor legislation. One of the important points is remuneration for work. Its size, terms of payment, incentives, penalties must be specified in the contract concluded with the employee and other documents regulating the parameters of the organization’s activities.

Briefly about compensation for delay in payment of funds, see the video above.

It is legally established that wages must be paid at least twice a month. In this case, the employer can set the dates independently, maintaining a time interval between parts of the salary of at least 15 calendar days.

Due to some circumstances or dishonesty, the employer does not always make the payment due to employees for work on time. This is a violation of the law and threatens the employer with a number of problems. In addition to imposing fines, he may be required to pay compensation to employees for each day of non-payment.

What is compensation for delayed wages?

The Labor Code, Article 136, obliges organizations of any form of ownership to accrue and pay wages at least once every 15 days. If these deadlines are violated, the employer is obliged to calculate compensation for each day of delay. This payment will compensate for material damage caused to employees due to late payment.

The standard for calculating compensation applies to all payments that were not made on time:

- wages;

- temporary disability benefits and other social benefits;

- vacation pay amounts;

- allowances and additional payments established by the employer’s regulations;

- compensation payments upon dismissal;

- other payments in favor of the employee.

The employer's financial liability in the event of untimely payment to staff of the amounts of the above types of payments is given in the text of Article 236 of the Labor Code of the Russian Federation :

If the employer violates the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee, the employer is obliged to pay them with interest (monetary compensation) in the amount of not less than one hundred and fiftieth of the key rate in force at that time of the Central Bank of the Russian Federation from amounts not paid on time for each day of delay starting from the next day after the established payment deadline until the day of actual settlement inclusive. In case of incomplete payment of wages and (or) other payments due to the employee on time, the amount of interest (monetary compensation) is calculated from the amounts actually not paid on time.

In this case, the amount of compensation may be higher if this is established by local acts of the organization or secured by an employment or collective agreement.

Consequences of non-payment of wages

The very first thing an employee can do is not go to work. To prevent this from being counted as absenteeism, the following conditions must be met :

- The period of delay in payment must be at least 15 days.

- The management of the enterprise must be notified in writing of the employees’ intention not to go to work.

The fact that a notification letter was sent must be documented. Ignoring this requirement allows you to fire an employee for absenteeism.

In order to return personnel not to the enterprise, the employer must:

- Notify employees in writing about payment of wages.

- Demand that work be resumed.

Employees are required to comply with the requirements of the enterprise management if the arrears of payments are repaid. Release day is the next business day after receiving the letter. For example, if employees receive notification on Friday, their salary has been paid in full, they must report to work on Monday. But receiving a letter on Thursday will oblige them to appear at the enterprise on Friday.

Simultaneously with absenteeism from work, the management of the enterprise can be brought to administrative responsibility (Article 5.27 of the Administrative Code). Sanctions provided for late payments to staff :

- Fine;

- Suspension of activities (disqualification).

These sanctions hit legal entities harder than individual entrepreneurs who did not register the organization (fine up to 50 thousand rubles instead of 5 thousand rubles). Disqualification is applied for a period of up to three months, and if the violation is repeated within a year - up to three years.

You can be involved in administrative activities within 2 months from the date of violation. A prerequisite is the presence of guilt in the actions of the subject of the offense.

Further delay in delaying wages makes it possible to bring the management of the enterprise to criminal liability under Article 145.1 of the Criminal Code of the Russian Federation. This is resorted to if mandatory payments are delayed:

- Partially – from 3 months;

- Completely – from 2 months.

Those guilty of crime are punished:

- Fine – up to 500 rubles;

- Imprisonment - up to 1 year;

- Forced labor or other types of restrictions (engage in activities) – up to 3 years.

The application of these sanctions - from absence from work to the initiation of criminal proceedings against the employer - gives the affected personnel tools to influence the management of the enterprise. But this must be done competently; incompetent actions can harm employees and lead to dismissal under the article.

Penalty

The provisions of civil law (Article 330 of the Civil Code of the Russian Federation) mean by this term, including fines and penalties. Characterized by the following :

- Provided for by agreement or law;

- Paid if obligations are not fulfilled in whole or in part;

- Relieves the creditor of the obligation to prove the infliction of losses.

The amount of the penalty may be included in the terms of the employment contract. If this is not done, then for each day of delay in payment of wages, the employer is obliged to pay 1/150 of the key refinancing rate multiplied by the amount of the debt.

The amounts are small. For example, for a delay in salary of 35-45 tr. within 30 days you will have to pay a penalty of 650-750 rubles. This is not much, but in addition you can recover other losses incurred by the employee due to late payment :

- Compensation for moral damage;

- Accrual of penalties by a credit institution for late payments;

- And others.

If the infliction of damage when claiming a penalty does not need to be proven, then other losses, for example, due to infliction of moral damage, will have to be justified in court.

To substantiate claims for additional compensation, it is recommended to seek the help of lawyers specializing in labor disputes. They will help you draw up a competent appeal, both to the employer and to regulatory organizations and the court.

When is compensation paid?

Compensation is calculated and paid regardless of the circumstances that caused the delay in wages and other payments in favor of the employee. The number of days of late payment is calculated for the entire period and starts from the day following the date established as the day of settlement with the employee. In this case, the date of actual issuance of the amounts is subject to inclusion in the total period of delay.

The accounting department is obliged to calculate compensation and pay it along with the due amount of wages even for one day of delay.

Amount of compensation for salary delays in 2020

To correctly calculate the amount of compensation, you will need knowledge of the general principles of calculation. Its size in 2020 is at least 1/150 of the key refinancing rate according to the Central Bank and is calculated regardless of:

- reasons for the delay;

- the presence of guilt of a manager or other official;

- seizure of company accounts, etc.

The amount of compensation cannot be limited to any limit. If the delay is any period of time, then the accounting department is obliged to calculate compensation for all types of unpaid amounts for all days of delay. Accordingly, the longer the employer delays the funds, the higher the amount of compensation will become. Over a long period, employees have the right to initiate a process of inspection of the enterprise and a more severe punishment from the administration.

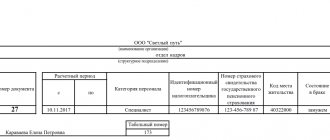

Sample calculation of salary arrears for the court

There is no exact form in which the document must be drawn up. The calculation of interest on salary arrears in 2020 is carried out in accordance with the requirements prescribed in the current legislation of the Russian Federation. The statement of claim must contain the following information:

- Details of the parties (information about the employer, information about the employee, etc.).

- Name of the judicial organization.

- Full calculation of the debt, the amount of compensation indicating the components (penalty period, refinancing rate, etc.).

- Claim.

- Date, signature.

You can attach any evidence confirming your case to the application form. These could be certificates from the accounting department, bank statements, etc. If you make the correct calculations and correctly draw up a statement of claim, then the likelihood of a successful outcome of the case will be very high. As practice shows, the court often takes the side of the workers, since it is extremely difficult to artificially simulate such a case.

Formula and calculation example

The minimum amount of compensation for late payment of wages, other monetary rewards for work, social benefits, vacation pay, etc. calculated using the following formula:

K = NE × SC / 150 × D, where

- K – compensation;

- SV – the amount of payments due to the employee, minus personal income tax;

- SP – the rate of the Central Bank, which was in effect during the period of delay;

- D – the number of days of delay, starting from the day following the established payment deadline, ending with the day of payment to the employee of the amounts due.

Compensation is not subject to taxation, but the amount of the delayed payment from which it has already been calculated is taken for calculation. The basis for this are two letters: the Federal Tax Service dated 06/04/2013 N ED-4-3/10209 and the Ministry of Finance dated 01/23/2013 N 03-04-05/4-54. But the employer is obliged to pay insurance premiums for it.

Example: Let’s take the case of a delay in salary, which was not paid on the date set by the organization’s regulatory documents on the 6th. The total payment that was supposed to be transferred to the employee amounted to 15 thousand rubles for the second half of March.

In fact, the funds were transferred on April 15, thereby the number of days of delay was 9 days (for the period from April 7 to April 15). Compensation must be calculated regardless of the reason why such a situation has arisen.

One of the input parameters is the key rate of the Central Bank; its size for this period was 7.25%. Additionally, we will withhold personal income tax from the accrued amount:

15 thousand rubles – 13% = 13,050 thousand rubles.

Let's apply the calculation formula and get the following amount of compensation:

K = 13,050 × 7.25% / 150 × 9 days = 56.77 rubles.

This amount is the minimum. Although it will not be noticeable for a specific employee, for the organization as a whole, where the staff is large enough, it can result in decent results.

Compensation calculation

Now let's move on to the most important thing. The law states that the amount of compensation should not be less than one hundred and fiftieth of the key rate of the Central Bank of the Russian Federation, which is in effect at the time of calculation. These percentages are applied to the amount of the resulting salary arrears. Compensation is calculated for each day of delay.

It’s quite easy to calculate the amount of compensation yourself; you don’t even need a special calculator. Here's an example.

Let’s imagine that Svetlana did not receive her salary of 50,000 rubles on October 1, 2020. She received the payment only on October 7, 2020. The law requires that we begin the countdown on the day after the date on which the traditional payment would have occurred. The law also specifies that the calculation must include the day when the long-awaited salary payment occurred.

Based on these requirements, it turns out that our delay was 6 days, which included October 2, as well as the 3, 4, 5, 6 and 7.

Let us remember at what level the key rate of the Central Bank of the Russian Federation is today. To be 100% sure, you can go to the regulator’s website. At the top of the main page, immediately after the inscription “Central Bank of the Russian Federation,” the size of the key rate is indicated, as well as the date from which this rate began to be applied.

At the time of writing, the key rate was 7%. We divide it into 150 parts and get 0.0466% per day. Since we have a delay of 6 days, we multiply the received rate by this amount. We get 0.28%. All that remains is to apply these percentages to the amount of wages that were supposed to be paid on October 1. We receive the amount of compensation at the level of 140 rubles.

And here is the formula for calculating compensation:

(Key rate of the Central Bank of the Russian Federation as a percentage) / 150 x Number of days of delay x Amount of overdue wages

When calculating, you need to remember that the Labor Code of the Russian Federation specifies the minimum level of interest for delayed wages. The employer has the right to pay at a higher rate, thereby covering the costs of its employees.