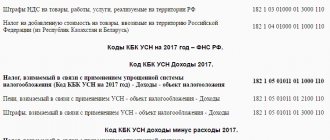

Legal basis

The Constitution of the Russian Federation, Article 57, obliges to pay the fiscal fees established by law. The procedure for paying tax payments is regulated by the Tax Code of the Russian Federation. The Tax Code of the Russian Federation provides for liability for non-payment or late payment of fiscal payments. The following sanctions are applied to an unscrupulous taxpayer:

- accrual of penalties;

- fines;

- forced collection of debts.

The penalty is paid for each day of delay and is calculated as a percentage of the arrears. Penalty for late payment of taxes is a way to ensure that the taxpayer fulfills his obligation to transfer taxes to the budget. Its collection is intended to compensate for budget losses from untimely receipts of funds into the state treasury. How to calculate tax penalties is stated in Article 75 of the Tax Code of the Russian Federation.

Instructions for calculating penalties for individuals. persons

You can calculate the amount of such a penalty either manually or using a special online calculator. In the latter case, the procedure will be as follows:

- In the first paragraph of the calculator, you need to select the section “Penalties for taxes, fees and insurance contributions.”

- Next, you must indicate the legal status of the taxpayer.

- Enter the amount of debt incurred.

- Indicate the date when it was necessary to transfer money to the budget and the day of actual payment.

- After the calculator form is filled out, you must click on the “Calculate” button. The result of the calculation will be displayed on the screen.

The penalty calculator is provided by the website calcus.ru

It is worth noting that when determining the amount of tax penalties for individuals, the calculator automatically uses the following formula:

Penalty = Amount of debt * Number of days of delay * discount rate/300

It should be borne in mind that in case of evasion of payment of the penalty, it may be collected by force. In this case, the required amount will be debited from the debtor’s current account or collected from his property.

For what period is it calculated?

In case of delay in transferring tax payments, tax penalties are calculated for each calendar day of late payment. The accrual of the penalty begins on the day following the due date for payment of the fiscal payment. The last day of accrual is the day on which the arrears to the budget are repaid.

For example, an organization is required to pay the first VAT payment for the 3rd quarter on October 25. In fact, VAT was paid on October 31. For late payment of VAT, the company is charged a penalty for 6 calendar days: from October 26 to October 31 inclusive.

Penalties on insurance premiums

Just as in the case of taxes, penalties for late payments of contributions are paid in addition to the amounts of the contributions themselves and penalties.

Let us note that the Law of July 24, 2009 No. 212-FZ does not provide for advance payments for insurance premiums. During the billing period (that is, the calendar year), the payer pays insurance premiums in the form of monthly mandatory payments.

Attention

Filing an application for a deferment (installment plan) or an investment tax credit does not suspend the accrual of penalties.

Let us remind you that payments to extra-budgetary funds are due no later than the 15th day of the calendar month following the one for which the calculation is made. If the specified payment deadline falls on a weekend or non-working day, the end date of the payment period is considered to be the next working day following it.

Penalties for late payment of insurance premiums are accrued for each calendar day of delay in fulfilling the obligation to pay them. The account begins on the day following the due date for payment of insurance premiums.

Penalties for each day of delay are determined as a percentage of the unpaid amount of insurance premiums. In this case, just as when calculating penalties for late payment of taxes, the interest rate of penalties is taken equal to 1/300 of the refinancing rate of the Bank of Russia in force on those days.

To calculate penalties for insurance premiums, you should use the same formula as for calculating penalties for taxes.

Penalties are not charged on the amount of arrears that the payer of insurance premiums could not repay due to the following reasons: – by a court decision his transactions in the bank were suspended; - his property was seized.

Penalties are not accrued for the entire period while these circumstances exist.

It should be noted that there is another situation, not described in the legislation, in which penalties are not charged. This is exactly the case if the arrears arose as a result of the execution of written explanations on the application of legislation on insurance premiums. But only when such explanations were given to a specific policyholder or an indefinite number of persons by the body monitoring the payment of insurance premiums or another authorized government body (an authorized official of this body) within its competence. These circumstances are established in the presence of a corresponding document from this body, the meaning and content of which relates to the settlement (reporting) periods for which the arrears arose, regardless of the date of publication of such a document - for example, a letter from the Ministry of Health and Social Development, the Social Insurance Fund or the Pension Fund.

However, if the specified written explanations are based on incomplete or unreliable information provided by the payer of insurance premiums, then penalties are subject to accrual and payment.

Penalties are paid simultaneously with the transfer of insurance premiums or after payment of such amounts in full. Penalties can be forcibly collected from bank accounts, as well as from other property.

At what rate is it calculated?

The amount of tax penalties is calculated separately for each calendar day. This is due to the fact that the penalty is calculated based on the refinancing rate of the Central Bank of the Russian Federation in effect on the day of calculation. The interest rate for calculating tax penalties for individuals and legal entities is set differently. For individuals and individual entrepreneurs, the rate is 1/300 of the refinancing rate.

For organizations, the calculation procedure is as follows:

- for the first 30 calendar days - based on 1/300 of the refinancing rate for each day of late payment;

- starting from 31 days - based on 1/150 of the refinancing rate for each day of late payment.

Please note that as of January 1, 2016, the Bank of Russia does not set the refinancing rate. Starting from this date, its size is taken equal to the value of the current key rate. See its current meaning in our reference material.

Calculation of the amount of penalties

Of course, penalties can be calculated in a couple of minutes using special calculators, of which there are many on the Internet. However, it is still necessary to know the basic calculation rules and formulas.

The following indicators are used to calculate penalties :

- the amount of unpaid tax or fee on which they are accrued;

- billing period, that is, the number of days of accrual;

- key rate of the Central Bank of the Russian Federation (currently the refinancing rate).

Note! If during the period of delay the rate of the Central Bank of the Russian Federation changed, this must be taken into account.

The calculation formula will be different for individual entrepreneurs and organizations.

Calculation for the company

For the first 30 days of delay, penalties are calculated using the formula:

Amount of arrears * (Key rate of the Central Bank of the Russian Federation / 300) * 30

Starting from the 31st day of delay, the following formula applies:

Amount of arrears * (Key rate of the Central Bank of the Russian Federation / 150) * Number of days of delay from 31 days

The resulting values are then added together.

Example. Romashka LLC had to pay tax in the amount of 30,000 rubles by April 25, 2018. However, in fact, the debt was repaid only on August 1. Let's calculate the penalties.

The total period of delay, taking into account the date of payment, is 98 days . During this time, the rate of the Central Bank of the Russian Federation was 7.25% and did not change.

For the first 30 days of delay, penalties will be: 30,000 * 30 * 7.25% / 300 = 217.50 rubles.

For the period from the 31st to the 98th day of delay, that is, 68 days, penalties will be: 30,000 * 68 * 7.25% / 150 = 986 rubles.

The total amount of the penalty is: 217.50 + 986 = 1203.50 rubles.

Note! The current procedure for calculating penalties for organizations (with an increase in the rate from the 31st day of delay) applies to arrears that arose after October 1, 2017 . If an underpayment is revealed that arose before this date, then penalties are calculated in the same way as for entrepreneurs.

Calculation for individual entrepreneurs

For individual entrepreneurs, penalties are calculated regardless of the period of delay according to the formula:

Amount of arrears * (Key rate of the Central Bank of the Russian Federation / 300) * Number of days of delay

If we assume that in the example above the person involved is not a company, but an individual entrepreneur, then the amount of penalties will change: 30,000 * 98 * 7.25% / 300 = 710.50 rubles.

When penalties are not charged

Exemption from payment of penalties, in accordance with Article 75 of the Tax Code of the Russian Federation, is used very rarely. Such cases include:

- impossibility of repaying arrears due to the seizure of the taxpayer’s property by decision of the tax authority;

- impossibility of repaying arrears due to the suspension of transactions on the taxpayer's accounts by court decision;

- the arrears arose as a result of the implementation of written explanations on the procedure for calculating taxes and fees given by a tax or other authorized government agency. This type of exemption does not apply if the explanation is based on incomplete or incorrect information provided by the taxpayer.

A little about tax penalties

As for penalties for taxes and fees, even the most respectable accountants and entrepreneurs are faced with paying them from time to time. They are accrued if the payment is overdue or paid on time, but not in full.

Penalties may be assessed by the tax authority if it identifies an underpayment and presented to the taxpayer for payment along with the amount of the debt. If the company (IP) knows about the arrears and is going to pay it off, then it should independently calculate and pay penalties.

Example of calculating tax penalties

LLC "Company" is a VAT payer. Based on the results of the 4th quarter of 2020, VAT payable in the amount of RUB 30,000 was calculated.

Thus, the organization had to transfer to the budget:

- 10/25/2019 - 10,000 rubles;

- 11/25/2019 - 10,000 rubles;

- 12/27/2019 — 10,000 rub.

LLC "Company" transferred the first and third payments on time, and the second payment (due on November 25, 2019) was transferred only on December 28. For late transfers, a tax penalty will be collected from the organization in the following order:

- from November 26 to December 25 - in the amount of 1/300 of the key rate of the Central Bank of the Russian Federation;

- from December 26 to 27 - in the amount of 1/150 (since the period of delay exceeded 30 days).

In addition, during this period the Central Bank changed the rate. Until December 16, it was 6.5%, and starting from December 16, 2019 it was reduced to 6.25%.

Using the table, we calculate the amount of penalties for late payment of taxes:

| Calculation period | Number of calendar days | Refinancing rate | Calculation | Result |

| 26.11–16.12 | 21 | 6,5 | 10 000 × 6,5% × 1/300 × 21 | 45,5 |

| 17.12–25.12 | 9 | 6,25 | 10 000 × 6,25% × 1/300 × 9 | 18,75 |

| 26.12–27.12 | 2 | 6,25 | 10 000 × 6,25% × 1/150 × 2 | 8,33 |

| Total | 72,58 |

Use the same formula if you want to understand how to calculate penalties for late payment of personal income tax and any other tax.

Overdue tax advances

If an organization must make advance payments of tax during a tax period, then the obligation to make advance payments of tax is recognized as fulfilled in the same manner as established in relation to the tax as a whole for the period.

Thus, if advance tax payments are paid at a later date than those established by law, then penalties are charged on the amount of the debt on advances.

Let us remind you that advance payments are provided, in particular, for the following taxes.

Corporate income tax. At the end of each reporting period, firms usually calculate the amount of the advance payment based on the tax rate and profit calculated on an accrual basis from the beginning of the year to the end of the reporting period.

Organizational property tax. The amount of the advance payment for property tax is calculated based on the results of each reporting period in the amount of 1/4 of the product of the tax rate and the average value of property determined for the reporting period.

Transport tax. Organizations calculate the amount of advance tax payments at the end of each reporting period in the amount of 1/4 of the product of the corresponding tax base and tax rate. The legislation of a particular subject of the Russian Federation may cancel the obligation to make advance payments.

Land tax. The amounts of tax advances are calculated by those taxpayers for whom the reporting period is defined as a quarter. They determine these payments at the end of the 1st, 2nd and 3rd quarters of the current tax period as 1/4 of the tax rate as a percentage of the cadastral value of the land plot. The obligation to pay advance payments may be waived by local authorities.

If, at the end of the period, the amount of the calculated tax is less than the amount of advance payments payable during the specified period, then the “advance” penalties are subject to a commensurate reduction. This is stated in letters of the Ministry of Finance of Russia dated January 19, 2010 No. 03-03-06/1/9, dated March 18, 2008 No. 03-02-07/1-106, as well as in the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 26, 2007 No. 47.

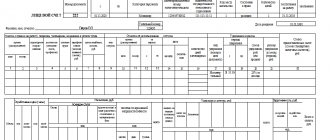

How to reflect in accounting

In accounting, to reflect the accrual of penalties, accounts 68 and 69 of the Chart of Accounts are used (Order of the Ministry of Finance dated October 31, 2000 No. 94n). To make it easier to control the calculations of penalties, separate sub-accounts are opened to record them or provide analytical accounting in the context of fiscal payments for which penalties and other sanctions are assessed.

The accrual of penalties is reflected in the credit of accounts 68 and 69, and their payment is reflected in the debit. Amounts accrued for payment are reflected:

- on the calculation date, if calculated by the taxpayer independently;

- on the date of entry into force of the inspection decision, if the accrual is made as part of an on-site or desk inspection.

| Operation | Debit | Credit |

| Penalties accrued: | ||

| on taxes | 99 | 68 |

| on insurance premiums | 99 | 69 |

| Accrued amounts are transferred to the budget | 68, 69 | 51 |

In tax accounting, when calculating income tax, no tax sanctions are recognized as expenses (clause 2 of Article 270 of the Tax Code of the Russian Federation).

The role of penalties for individual entrepreneurs

The essence of the concept of “charge of penalties” is to provide government bodies with a guarantee that an individual entrepreneur will fulfill his obligations exactly by the appointed deadline. In legal relations with the state, the amount of the penalty is determined by the laws in force on the territory of the Russian Federation.

A penalty can also serve as security for obligations assumed under an agreement, if we are not talking about the relationship between an individual entrepreneur and the state: in this case, the agreement must be concluded in writing, for example, between two different individual entrepreneurs, or between an individual entrepreneur and an LLC, or between an individual entrepreneur and an individual face.

ATTENTION! The oral conclusion of the contract does not oblige the parties to assign and pay a penalty. The contract must specify exactly the amount of the penalty, otherwise it will not be possible to collect it.

A penalty is an amount of money that must be paid (and which will be collected) in the event that contractual or tax obligations to a counterparty or the state are not fulfilled or are overdue.

The accrual of penalties related to taxation is regulated by the Tax Code of the Russian Federation (Article 75), and in the case of ensuring legal requirements for penalties not specified in the agreement - Art. 395 of the Civil Code of the Russian Federation.

Possible fines

For failure to pay taxes, you may be subject to fines. The penalty is 20 percent of the unpaid tax amount. If the inspection proves that you did not pay the tax intentionally, then the amount of the fine will increase to 40 percent (Article 122 of the Tax Code of the Russian Federation).

It is important to know that in order to hold you accountable, the tax authority must have evidence that confirms that an offense has been committed. Namely, have documents stating that the inspectorate calculated the tax in accordance with the law, sent you a tax notice and demand, and has confirmation of the fact and date of receipt of the notice.

Deadlines for paying taxes by law

The deadlines for paying taxes for individuals and legal entities are different.

Taxes are an obligatory part of expenses for both employees and business owners. With their help, the state replenishes the budget and supports the functioning of social and public institutions. According to the Law of the Russian Federation, everyone must pay taxes, but the deadlines for different categories of citizens will differ.

For individuals

Individuals pay insurance contributions to the Pension Fund, personal income tax and property taxes on land, real estate and transport. It is important to adhere to certain deadlines.

- The declaration in form 3-NDFL must be submitted no later than April 30, and paid before July 15 of the year following the expired tax period.

- The deadline for payment of transport, land and property taxes is until December 1.

For individual entrepreneurs and legal entities

For businessmen, payment terms are different:

- If a business owner is registered as an individual entrepreneur, then the law obliges him to pay only personal income tax and insurance payments, the amount and timing of which depend on the taxation system.

- Insurance premiums must be transferred no later than the 15th day of the month following the month of receipt of profit.

- Personal income tax for the previous year is paid no later than the first working day following the day of actual payment of income.

Penalties for non-payment

A penalty is a sum of money that will be charged to you for the amount of tax debt if you pay the tax late (Clause 1, Article 75 of the Tax Code of the Russian Federation). Penalties are calculated according to the formula (clauses 3, 4, Article 75 of the Tax Code of the Russian Federation):

Amount of tax not paid on time x Number of calendar days of delay x 1/300 of the Bank of Russia refinancing rate in force at that time.

If you do not pay your tax on time, the tax office will send you a demand for payment of arrears of tax and penalties. Such a requirement must contain: the amount of tax debt; the amount of penalties at the time of sending the claim; tax payment deadline; deadline for fulfilling the requirement; also tax collection measures that will be taken in case of non-compliance with the requirement. You must pay the amounts specified in the request within eight working days from the date of receipt of the demand, unless a longer period is specified in it (clause 4 of Article 69 of the Tax Code of the Russian Federation).

If a request is sent by registered mail, it is considered received after six days from the date of sending this letter (Clause 6 of Article 69 of the Tax Code of the Russian Federation).

Formula and calculation procedure

The penalty is calculated quite simply. Its calculation begins from the day following the day the obligation to pay the tax occurs, that is, from the last day when the law provides for the obligation to pay the tax. A penalty is charged for each day of delay, its size is 1/300 of the refinancing rate . This rate is a constant value and is revised every few years. Today its size is 8.25%. This size has been set since 2012. To ensure accurate calculations, the rate is checked on the website of the Central Bank of the Russian Federation.

To calculate the penalty, you need to carry out several simple algebraic operations using the formula:

Penalty = amount of tax debt * number of days of delay * refinancing rate (8.25%) * 1/300.

If you are not used to counting by hand, you can also try using a calculator on the Internet. You enter the necessary data, and then the calculator will do everything for you. The official website of the Federal Tax Service of the Russian Federation provides a convenient and simple service. First, you set the start and end dates of the period for which you are counting the debt in the calendar, then indicate its amount in a special window and click the calculate button. Your attention will be presented to the amount of the penalty in rubles, as well as its decoding.

There are other sites, finding them is not difficult, you can simply ask such a request in any search engine.

Read about the process of calculating penalties at the refinancing rate here.

If you are interested in how to check tax debt using your TIN online, read this article.