How to fill out a payment order for penalties in 2020

If the company misses the tax payment deadline, the company will have to pay penalties. To do this, you will need to draw up a payment order for penalties in 2020. The example we have provided for you will help you do this correctly. Before drawing up a payment order for penalties in 2020, a sample of which is presented below, the organization must determine the amount of penalties.

File information If the arrears arose before October 1, 2020, the amount of penalties can be calculated using the formula: SP = N x Kd x 1/300 x SR, where SP is the amount of penalties; N – the amount of tax not paid on time; Kd – number of days of delay; SR – refinancing rate valid during the period of delay. In this case, the number of days of delay is counted from the day following the day when the tax should have been transferred to the budget. And ends with the day of actual payment of the arrears.

If the arrears arose after October 1, 2020 and later, in particular in 2020, then penalties for the first 30 days of delay are calculated according to the above formula. And for the subsequent ones (31st day and beyond), instead of 1/300, an increased coefficient of 1/150 is taken. For example, on February 6, the company paid wages for January 2017. And her personal income tax is 25,800 rubles. paid to the budget only on February 27th.

The delay is 20 days. Since the tax had to be transferred to the budget the next day after the payment of wages (clause 6 of Article 226 of the Tax Code of the Russian Federation). The refinancing rate these days was 10%.

Thus, the amount of penalties will be 172 rubles. (RUB 25,800 x 20 days x 1/300 x 10%). Look at what companies are facing.

To fill out a payment order for penalties in 2020, some details can be taken from the tax payment slip.

The following data will be the same:

- bank details of the organization (fields 10, 9, 11 and 12);

- order of payment (field 21);

- OKTMO (field 105).

- name of the organization, its tax identification number and checkpoint (fields 8, 60 and 102);

- name of the recipient, his TIN and KPP (fields 16, 61 and 103);

- payer status (field 101);

- recipient's bank details (fields 13, 14, 15 and 17);

Now let's talk about those details that are different. KBK (field 104). The BCC for the tax and the BCC for penalties for this tax are similar.

Only the code of the subtype of income differs (14 – 17 digits of the KBK). For tax it is 1000, and for penalties – 2100. For example, BCC for payment of personal income tax by a tax agent is 182 10100 110, and BCC for payment of penalties on personal income tax is 182 10100 110. Basis of payment (field 106). When paying tax, the company will put TP in this field.

When paying a penalty, it will have one of the following values:

- AP – when paying penalties according to the inspection report.

- TR - when paying penalties at the request of the Federal Tax Service;

- ZD – upon voluntary payment of penalties;

Tax period (field 107).

When paying penalties of one's own free will (the basis of the AP), 0 is indicated in field 107. The same should be done if the penalties are paid according to the inspection report (the basis of the AP). If penalties are listed for a specific period, then it should be reflected in field 107.

So, when paying penalties for January 2020, in field 107 you must put MS.01.2018.

How to fill out a payment order for fines (nuances)?

> > > August 27, 2020 All story materials How to fill out a payment order for fines?

Every accountant faces this question from time to time. Drawing up such a document has its own nuances. How to properly fill out a payment order to pay a fine?

What are the features of filling out payments for the transfer of sanctions for insurance premiums? Where can I find a sample of filling out a tax payment form?

We will look at the answers to these and other questions in the material below. Documents and forms will help you: You can find out how to correctly fill out a payment slip to pay a fine from our video instructions: The main regulatory document that determines the procedure for filling out payment slips is Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n (Appendix 2). Let's look at the main points.

- Detail 104 indicates the KBK (20-digit budget classification code), which can be found in Appendix 6 to Order No. 65n of the Ministry of Finance dated July 1, 2013 (you need to select codes that begin with 182). It should be noted that, according to paragraph. 7 p. 4 sec. II of the same order, for fines the income subtype code 3000 is used (14–17 digits of the code).

For example, KBK:

- fine related to personal income tax: 182 1 0100 110.

- fine related to income tax credited to the regional budget: 182 1 0100 110;

- for a fine related to income tax credited to the federal budget: 182 1 0100 110;

For the payment of fines for all types of taxes, see KBC from ConsultantPlus.

Remember that the BCC for arrears, penalties and fines for the same tax are different, which means you need to issue separate payments to pay them. The amount of fines can be found in the article.

- Detail 108 indicates the requirement number; the symbol No. does not need to be inserted.

- The “Code” detail indicates a unique accrual identifier (UIN); it must be contained in the tax demand that it made for payment of fines. If this code is not present, then 0 is entered.

- Detail 110 has not been filled in since January 1, 2015 (this is due to the fact that clause 11 of Order No. 107n was canceled by Order of the Ministry of Finance No. 126n dated October 30, 2014).

- Indicator 109 contains the date of the document, the number of which is reflected in detail 108, in the format “DD.MM.YYYY”.

- Requisite 106 - value of the payment basis - 2 letters. In case of payment of a fine, the letters TR are used (which means a requirement when the tax office issued this document under Article 69, 101.3 of the Tax Code of the Russian Federation).

- Props 107 (tax period) has a value of 0.

- In detail 105, OKTMO is filled in - the code of the territory of the municipality where funds from paying fines are collected.

IMPORTANT!

- The “Purpose of payment” detail must contain the following information: type of payment and its basis.

- Details “Payment order” - 5.

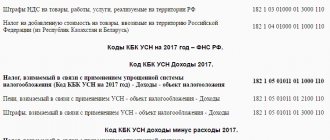

KBK USN

Current for 2016-2017. In 2020, the BCC was not changed.

| Payment | BCC for tax | KBK for penalties | BCC for fine |

| Single tax with simplified income | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Single tax simplified from the difference between income and expenses | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Minimum tax when simplified (for 2020 this BCC is not applied and is paid on the BCC when simplified from the difference between income and expenses) | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

Payment order for penalties in 2020

Author of the article Victoria Ananina 3 minutes to read 3,903 views Contents Often, errors or inaccuracies may occur in the work of an accountant.

When composing or reproducing a payment order on paper, you can fill out the code on 2 or more lines.

Cases vary, and it is not always possible to resolve the issue without paying penalties.

A payment order for penalties and fines is drawn up when the organization receives a resolution through the taxpayer’s personal account demanding payment. Or the company itself checked with the inspectorate and calculated that it must pay a penalty for some reason. In the economic world, three concepts of debt are used, namely: penalty, penalty and fine. Let's try to understand their differences.

(click to expand) Penalty Penalty Fine In fact, a fine is the same penalty, only more applicable by tax authorities and is also accrued for each day of delay as a percentage according to the formula. Penalty is used to pay off a debt from one legal entity to another, it is the most common method of resolving disputes and is provided when an agreement is concluded between counterparties.

It is calculated either as a percentage or a specific amount is indicated. The actual penalty or penalty in the narrow sense is established, as a rule, for a continuing violation, calculated as a percentage of the amount of the unfulfilled obligation or in a fixed sum of money; the fine is paid one-time and must be initially agreed upon in the contract.

The fine is collected for a one-time or ongoing violation in a fixed sum of money or as a percentage of the amount of the unfulfilled obligation. The penalty, as a rule, is paid by one counterparty to another.

Penalty is applied, as a rule, to debts of enterprises, as a measure of punishment for delay in monetary obligations. It is a type of penalty and is paid for each day of delay. According to tax legislation, penalties are charged for delays in paying taxes, as well as advance payments on them. If the company does not transfer the fine on time, its account may be blocked.

Since the payment of penalties is given a certain period specified in the tax requirement and in case of its violation, a notification is sent to the bank about blocking the account and writing off the required amount. Important! If your organization has several accounts, then one bank fulfills the tax requirement.

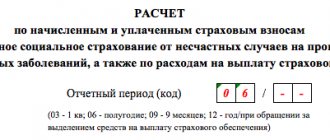

Accrual of penalties on the simplified tax system

The tax period for the simplified tax system is considered to be a year, but entrepreneurs must make advance payments quarterly. This is done before the 25th day of the month, which begins the next quarter. Payment of the final annual payment is required before April 30.

For violation of tax payment deadlines, penalties and fines are provided. If you are late in paying the advance or the tax itself, a penalty is charged every day, amounting to 1/300 of the Central Bank refinancing rate.

There are no penalties for non-payment of advances. But in case of late payment of the annual tax, a fine of 20% of the amount of non-payment will be charged.

Important! If the tax authorities manage to prove that the delay was intentional, the fine will increase to 40%.

Penalties are accrued not only when payments are delayed, but also as a result of incorrect calculation of advances or the tax itself. Representatives of the tax department can identify arrears by examining the declaration under the simplified tax system. Then the payer will be sent a request to pay the debt and penalties, and, if necessary, submit an updated declaration.

Individual entrepreneurs who use the simplified tax system and maintain accounting must post transactions for accrual of penalties and additional tax charges. The calculation of penalties is entered into the accounting statement. The amount is calculated as follows:

- DT 99 Kt 68 “STS - accrual of a certain amount in the form of penalties for tax arrears. The posting date corresponds to the date of the tax authorities’ request or indicated in the accounting certificate.

- DT 68 “USN” Kt 51 - transfer of the amount of penalties to the budget.

Penalties do not reduce the tax base for the simplified tax system.

The simplified form is allowed to be combined with UTII and the patent system. In such situations, different records are kept for each regime to calculate taxes separately. The simplified tax system cannot be used simultaneously with the general OSNO regime.

It is considered that the tax has been paid in arrears if, by the end of the last day for payment of the fee, the entrepreneur has not generated a payment order to transfer funds through a bank cash desk or his current account. Penalties are calculated until the day the arrears are fully repaid.

Payment order for penalties in 2020 - 2020 - sample

> > > August 22, 2020 All story materials A payment order for penalties must be issued if the deadline for payment of mandatory payments (taxes, fees, contributions) is overdue. In this article we will talk about the features of preparing a payment order for the payment of penalties and provide a sample of it.

Documents and forms will help you: We have prepared video instructions for you on how to fill out a payment form to pay penalties.

First of all, let us remind you that through penalties the timely payment of mandatory payments is ensured. At the same time, a penalty is not a sanction, but an interim measure.

Read more about tax penalties here. You can calculate penalties using. A payment order for penalties has both similarities with a payment order for the main payment (it states the same status of the payer, indicates the same details of the recipient, the same income administrator), and differences. Let's look at the latter in more detail.

So, the first difference is KBK (field 104). For tax penalties, there is always a budget classification code, in the 14th–17th digits of which the income subtype code is indicated - 2100. This code is associated with a significant change in filling out payment orders: since 2015, we no longer fill out field 110 “Payment Type” .

We recommend reading: How often do you need to pay tax on simplified tax?

Previously, when paying penalties, the penalty code PE was entered in it. Now we leave this field empty, and the fact that this is a penalty can be understood precisely from the KBK. ATTENTION! Since 2020, the procedure for determining the BCC is regulated by a new regulatory legal act - Order of the Ministry of Finance dated 06/08/2018 No. 132n.

Order No. 65n dated July 1, 2013 has lost force. But this will not affect the general procedure for assigning penalties to BCC. The 2nd difference in the payment for penalties is the basis of the payment (field 106).

For current payments we put TP here. Regarding penalties, the following options are possible:

- We calculated the penalties ourselves and pay them voluntarily. In this case, the basis for the payment will most likely have a code ZD, that is, voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the Federal Tax Service, because we, as a rule, transfer penalties not for the current period, but for past ones. Payment of penalties at the request of the Federal Tax Service. In this case, the payment basis will have the form TP. Transfer of penalties based on the inspection report. This is the basis of payment to AP.

All three of the above cases are discussed in detail in ConsultantPlus. Samples of filling out payment forms are provided for each of them.

Read more about payment details in this. Depending on what served as the basis for the payment, the filling of this field will differ: In case of voluntary payment of penalties (the basis for the payment), there will be 0 here, because penalties do not have a frequency of payment, which is inherent in current payments. If you are listing penalties for one specific period (month, quarter), it is worth indicating it, for example, MS.08.2020 - penalties for August 2020.

When paying at the request of tax authorities (basis of TR) - the period specified in the request. When paying off penalties according to

Sample payment document and its features for penalties on certain taxes

Below we will look at some points that should be taken into account when paying penalties on certain taxes.

Penalties for personal income tax

The 2020 sample payment slip for penalties for personal income tax, which we have provided, was created for the most common type of these payments - for penalties paid voluntarily by the tax agent. Let us recall that the voluntary payment of penalties accompanying the additional payment of tax when updating previously filed reports exempts the tax agent from a fine for failure to transfer tax amounts on time if such an error is identified by the tax agent before it is discovered by the tax authority (Clause 2 of Article 123 of the Tax Code of the Russian Federation).

When generating a sample payment order for 2020 for personal income tax penalties paid in response to a document issued by the Federal Tax Service, you will have to choose a different order of payment, use other codes for the reason for payment and be sure to fill out fields 107–109.

Also, in the sample 2020 payment slip for personal income tax penalties, in addition to the BCC, selected based on who exactly pays the tax, you need to pay attention to the code in field 101 in the upper right corner of the document, which reflects the status of the compiler. In relation to personal income tax, it can be like this:

- 02 - for tax agents (organizations and private practitioners) paying tax withheld from individuals;

- 09, 10, 11, 12 - for individual entrepreneurs, notaries, lawyers, self-employed persons, respectively;

- 13 - for ordinary individuals - taxpayers on their declared income.

Code 01, which characterizes the payer-legal entity in relation to taxes transferred by him for himself, is not used in the payment for penalties for personal income tax.

VAT penalties

When issuing a payment order for VAT penalties in 2020, on the contrary, originator code 01 will be used by legal entities much more often than code 02, which characterizes the tax agent. Individual entrepreneurs working with VAT will use code 09, and they will use it more often than the tax agent code.

Otherwise, the execution of a payment invoice for VAT penalties will not differ from the document created for personal income tax penalties.

Sample payment order when applying the simplified tax system

Agafonova Polina Author PPT.RU April 15, 2020 A sample payment order under the simplified tax system is a document confirming the payment of tax by organizations and individual entrepreneurs applying the special tax regime of the simplified tax system, which provides for the payment of three advance payments during the year and payment of the tax at the end of the year.

ConsultantPlus TRY FOR FREE Taxpayers with the object “income minus expenses” at the end of the year calculate the minimum tax and compare it with the amount of tax in connection with the simplified tax system, calculated at the rate in force in the region.

The larger of the two amounts received is paid to the budget.

An important change: from 2020, the minimum tax is paid not on a separate BCC, as before, but on the BCC for the simplified tax system “income minus expenses”. If the simplified tax system is paid for 2020, the payment order may contain only two BCC values, depending on the selected taxation object. The simplified tax system with the object “income minus expenses” and the minimum tax should be calculated and paid according to the following BCC:

- 18210501021011000110 - tax;

- 18210501021013000110 - fines.

- 18210501021012100110 - penalties;

- 18210501021012200110 - interest;

The simplified tax system with the object “income” should be accrued and paid according to the following BCC:

- 18210501011012200110 - interest;

- 18210501011013000110 - fines.

- 18210501011011000110 - tax;

- 18210501011012100110 - penalties;

The sample payment system for the simplified tax system “income minus expenses” 2020 contains details that are applicable both for paying tax in connection with the simplified tax system and for paying the minimum tax calculated at a rate of 1% of annual income.

The only difference will be in the purpose of payment. When paying tax in connection with the simplified tax system, in the purpose of payment we write:

“Tax in connection with the application of the simplified tax system for the 1st quarter of 2020”

.

When paying the minimum payment, the following text is appropriate in the purpose of payment: “Minimum tax for 2020.”

The minimum tax is calculated at the end of the year; at the end of the quarter, advance payments are made according to the simplified tax system.

Period Deadline 2020 04/01/2020 - legal entity, 04/30/2020 - individual entrepreneur Q1. 2020 04/25/2020 1st half-year 2020 07/25/2020 9 months 2020 10/25/2020 2020 04/30/2020 When filling out a payment order to pay tax in connection with the simplified tax system, organizations and individual entrepreneurs use the same tax details with the exception of two fields:

- field 101 “Payer status”, in which the organization puts code 01, and individual entrepreneur - 09.

- the “Payer” field, in which the organization indicates its name, and the individual entrepreneur - the name plus the registration address;

Since the minimum tax is paid only at the end of the year, field 107 should always contain the value KV.04.2018; For advance payments, use the value of the quarter for which the payment is made.

The sample payment system for the simplified tax system “income” 2020 contains the same values for fields from 104 to 110 for both organizations and individual entrepreneurs. Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n determines the mandatory details for paying taxes and insurance premiums:

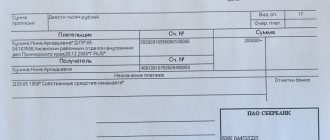

Sample payment slip

From 2020, tax contributions can be clarified if the bank name and the recipient's account are correct.

The remaining contributions must be returned and paid again (subclause 4, clause 4, article 45 of the Tax Code of the Russian Federation). Starting from 2020, someone else can pay taxes for an individual entrepreneur, organization or individual. Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; “Purpose of payment” – INN and KPP of the payer for whom the payment is made and the one who pays; “Payer status” is the status of the person whose duty is performed. This is 01 for organizations and 09 for individual entrepreneurs.

From February 6, 2020, in tax payment orders, organizations in Moscow and Moscow Region will have to enter new bank details; in the “Payer’s bank” field, you need to put “GU Bank of Russia for the Central Federal District” and indicate BIC “044525000”.

Taxes, unlike contributions, are calculated and paid rounded to whole rubles.

Purpose of payment: Advance payment for the simplified tax system for 2020.

Payer status: Payer status: 01 - for organizations / 09 - for individual entrepreneurs (if paying their own taxes).

TIN, KPP and OKTMO should not start from scratch.

In field 109 (date, below the “reserve field”, on the right) enter the date of the declaration on which the tax is paid. But under the simplified tax system and all funds (PFR, FSS, MHIF) they set 0.

Rice. .

Starting from 2020, someone else can pay taxes for an individual entrepreneur, organization or individual. Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; “Purpose of payment” – INN and KPP of the payer for whom the payment is made and the one who pays; “Payer status” is the status of the person whose duty is performed. This is 01 for organizations and 09 for individual entrepreneurs.

Fig. Sample of filling out a payment order for the payment of Income Tax in Business Pack.

Filling out a payment order for penalties

To reduce the number of photographs with samples of filling out payment slips according to the simplified tax system for individual entrepreneurs, we divided them into two different blocks. This page contains examples of filling out payment orders for entrepreneurs with the object of taxation of income, when the tax is paid at a rate of 6%.

It separately shows how to correctly fill out a payment form for taxes, penalties and fines under the simplified taxation system. Where this is necessary, a table has been added with indicators of the main details of the form in different payment options. Please pay attention to filling out the “Tax period” field.

The tax period is a year, and the billing periods are the first quarter, half a year and 9 months, respectively.

However, the detail “107” does not indicate the tax or billing period itself, but the frequency of payments, that is, how often and regularly the taxpayer is obliged to pay them under the legislation on taxes and fees.

For the simplified tax system, this indicator is a quarter, or a specific date. For each quarter, the advance payment is transferred no later than the 25th day of the month following the billing quarter. Therefore, in cell No. 107 we indicate the quarter for which we pay the tax.

You can't go wrong with KBC. It is indicated correctly in the table. Filling out the basic details of the order form according to the simplified tax system Field No. Name of the details Contents of the details 101 Payer status 09 18 Type of transaction 01 21 Order of payment 5 22 Code 0 104 18210501011011000110 105 OKTMO 106 Basis of payment TP 107 Tax period KV.01. 2014; KV.02.2014; KV.03.2014; KV.04.2014 108 Document number 0 109 Document date 0 (if advance payments are made for the 1st quarter, 2nd quarter, 3rd quarter) DD.MM.YYYY - date of signing the declaration (payment for the 4th quarter) 110 Payment type 0 Sample payment order for 2014 for individual entrepreneurs for six months in or Excel If you are listing a tax debt that you discovered yourself, you should pay attention to the following points. However, in the tax period indicator, you should indicate the one for which the payment or additional payment is being made.

However, in order to reduce the amount of penalties for late payments from previous years, you do not need to indicate the quarter in this field. Enter the value of the year in the declaration “107” in which you made changes.

If advance payments were underpaid, then we write a quarter.

Let's look at the table. Filling out the main details for the debt of the simplified tax system income Field number Name of the details Contents of the details 101 Payer status 09 18 Type of transaction 01 21 Payment order 5 22 Code 0 104 Budget classification code (KBK) 18210501011011000110 105 OKTMO OKTMO code in which the individual entrepreneur is registered at the place of residence (preb yings ) 106 Basis of payment PO 107 Tax period 108 Document number 0 109 Document date 0 110 Payment type 0 (from March 28, 2020, the value of detail 110 is not indicated)

arrears under the simplified tax system income sample of filling out a payment form 2014 for

Payments made under the simplified tax system in 2019

According to the current requirements of the Tax Code of the Russian Federation, payers of the simplified tax system “income minus expenses” make the following payments:

- quarterly payment of tax advances (no later than the 25th day after the end of the reporting period);

- payment of tax based on the results of the year - the amount calculated based on the results of the year, minus the advances paid;

- or payment of the minimum tax (1% of the amount of income for the year) - transferred if the annual tax amount was less than 1% of the “simplified” revenue.

Tax for the year (or minimum tax) must be transferred no later than March 31 - to organizations, April 30 - to individual entrepreneurs.

Sample payment form for the simplified tax system “income” for 2020

USN: Income Expand the list of categories Subscribe to a special free weekly newsletter to keep abreast of all changes in accounting: Join us on social media. networks: VAT, insurance premiums, simplified tax system 6%, simplified tax system 15%, UTII, personal income tax, penalties We send letters with the main discussions of the week > > > September 23, 2020 All materials of the story Payment of the simplified tax system - income for 2020 - sample document for paying a single tax at a simplified version will be presented in our article.

Let's look at the rules for processing payments and tell you about payment deadlines. Documents and forms will help you: In accordance with paragraph 7 of Art. 346.21 of the Tax Code of the Russian Federation, payment of advance payments according to the simplified tax system is made until the 25th day of the month following the reporting period.

Payment of the final simplified tax must be made in the next year after the reporting year: by organizations by March 31, individual entrepreneurs by April 30. If they coincide with public holidays, the deadline must be postponed to the next later working day.

The basic details of the payment document must contain the following information:

- data on the territorial affiliation of the payer;

- data identifying the tax, type, type, order of payment;

- general information about the payment: date, document number, and purpose of payment.

- information about the payer and recipient: their name, TIN, KPP, information about banks;

Thus, when filling out a payment order, you must indicate the following:

- Name of the local body of the federal treasury: UFK.

- Account number: account numbers of the Federal Tax Service and the payer.

- Recipient of payment: tax authority.

- INN/KPP: the corresponding number and code of the tax authority.

- BIC: BIC of the recipient and payer banks.

Where to get the Federal Tax Service details to fill out a tax payment form, see

.

- Payment order: 5.

- Tax period: quarter for advance payments (KV.01.2019; KV.02.2020, etc.) or calendar year (YY.00.2018).

- UIP code: 0 (when paying tax) or the code specified in the request (when paying debt based on the request of the tax authority).

- KBK: 182 1 0500 110.

- OKTMO: code of territorial affiliation of an organization or individual entrepreneur.

- Name, INN/KPP of the taxpayer: the relevant details of the organization are indicated.

- Taxpayer status: legal entity - 01, individual entrepreneur - 09.

- Document date: 0 (for advance payments and for payment of debt) and 03/31/2019/04/30/2020 (for payment of the annual tax amount).

- For individual entrepreneurs: Full name, address of residence.

- Basis of payment: TP (for current payments), ZD (for debt), TP (for payment on demand).

- Operation type: 01.

- Purpose of payment: tax for 2020 or advance payment for the 1st quarter, 2nd quarter, 3rd quarter of 2020.

Read more about the CBC used in simplified taxation in the article. Tax for 2020 -

Income minus expenses ↑

When an enterprise fills out an order using a simplified form with the object “income reduced by expenses,” the information in the paragraph will differ to reflect the purpose of the payment.

So, for example, you need to write: the tax that is levied on the taxpayer who chose “income minus expenses” as an object for the 2nd quarter of 2020.

For the rest, you should focus on the general rules for processing a payment order.

New filling rules

If you need to pay a tax or fee, you should use a payment order form.

When registering, you should use the form, number and names of points that are indicated in Appendix 3 to the document, which was approved by the Central Bank of the Russian Federation dated June 19, 2012 “383-P”.

It also contains a list of all necessary details (Appendix 1). You should focus on the rules that were approved by Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n.

Such features should be taken into account by all payers of taxes and fees who transfer funds to the budget.

In accordance with the new law, the instructions indicate:

| Code | |

| 104 | KBK |

| 105 | The OTKMO code (previously used OKATO), which consists of 8 digits for a municipality and 11 for a populated area. There is a table in which the old OKATOs are listed. The first 2 digits in the codes match |

| 106 – 109 | Enter data in accordance with the rules for filling out paragraphs 104 – 110 |

| 110 | Now you don't need to fill it out, because... tax is transferred |

Previously, they entered 01, 08, 14 in the paragraph to reflect the status. Now they indicate only 08. The indicator of line 21 has changed - they enter 5 instead of 3 (Article 855 of the Civil Code).

This is necessary for the banking institution to process the payment. Paragraph 24 indicates additional information related to the payment of funds to the budget.

So, when paying the insurance premium, you can enter the short name FFS, FFOMS. When transferring a tax, you should indicate its name and the periods for which the funds are paid.

How to calculate the simplified tax system of 6%, see the article: calculation of the simplified tax system.

An example of accounting for the minimum tax under the simplified tax system Income minus expenses.

The number of characters used is a maximum of 210 (in accordance with Appendix 11 of the Regulations of the Central Bank of the Russian Federation dated June 19, 2012 No. 383-P).

Paragraph 22 must contain information about the UIN identifier. They simply write 0 if the payment is made personally by the payer, and not according to requirements (Letter of the Federal Tax Service of Russia dated February 21, 2014 No. 17-03-11/14–2337)

When filling out personal data, you should use the symbol “//”, which will separate the full name, address, etc. In lines 8 and 16, the number of characters should not exceed 160 (PFR letter No. AD-03-26/19355 dated December 5, 2013 .).

Payment Order for Usn Income LLC in 2020 Sample

- general information about the payment: date, document number, and purpose of payment.

- data on the territorial affiliation of the payer;

- information about the payer and recipient: their name, TIN, KPP, information about banks;

- data identifying the tax, type, type, order of payment;

Previously, when paying penalties, the penalty code PE was entered in it.

Now we leave this field empty, and the fact that this is a penalty can be understood precisely from the KBK.

Subscribe to our accounting channel Yandex.Zen In 2020, the rules for filling out instructions for paying penalties have not been changed. Entities performing financial transactions according to a simplified concept are required to provide a completed declaration at the end of the current semester. In December, it is necessary to recalculate all payments and pay the final tax amount, taking into account all previous advance payments made for the entire reporting period. According to the regulations of the Tax Code of the Russian Federation, Art. 346.21 paragraph 7, the deadline for the payment of final contributions for entrepreneurs and commercial companies, are completely different.

We recommend reading: Direction sign no dead end

In the first case, the final tax according to the simplified tax system is paid until April 30, and in the second - until March 31.

Sometimes you can extend these deadlines: if they fall on a general day off. For example, this factor was taken into account in 2020, so the dates were moved to 05/03/2018 for individual entrepreneurs, and to 04/02/2018 for companies.

- The entire amount of income received by the individual entrepreneur for the quarter is taken (six months, nine months or a year - the tax period for a simplified year is yearly), and advance payments are calculated on an accrual basis. Be careful – income does not include depositing your own funds into the individual entrepreneur’s account.

- If you have already paid advance payments this year, then subtract them from the resulting amount.

- The resulting figure is multiplied by six percent. For example, revenue amounted to 140,000 rubles, then the advance payment under the simplified tax system is 140,000 x 6% = 8,400 rubles.

And now what can please you is that every entrepreneur annually pays a fixed contribution “for himself” to the Pension Fund and the Health Insurance Fund.

Its value is different every year and since 2020 it has been approved by the government. This year the contribution is 32,385 rubles. You can pay it all at once or in installments throughout the year, the main thing is that the payment goes out before December 31st.

But usually, the fee is divided into four parts and paid quarterly. This is due to the fact that the amount of the fixed payment paid in the quarter for which you are calculating the simplified tax system reduces the advance tax payment. If an individual entrepreneur does not have hired personnel, then up to 100% (in our example, this is 8400 - (32385: 4) = 303.75 - the amount that needs to be transferred according to the simplified tax system), if there are employees, then up to 50%. So, difference 1 -е - KBK (field 104).

For tax penalties there is always a budget classification code, in the 14th–17th digits of which the income subtype code is indicated - 2100.

This code is associated with a significant change in filling out payment orders: as of 2020, we no longer fill out field 110 “Payment Type”.

- We calculated the penalties ourselves and pay them voluntarily.

Deadlines for payment of the simplified tax system “income” in 2018-2019

Tax for 2020 - no later than:

- for organizations - 04/01/2019 (postponed from Sunday, 03/31/2019);

- IP - 04/30/2019.

Advance payments in 2020 must be transferred no later than:

- for the 1st quarter - 04/25/2019;

- 2nd quarter - 07/25/2019;

- 3rd quarter - 10/25/2019.

Tax for 2020 - no later than:

- for organizations - 03/31/2020;

- IP - 04/30/2020.

The principles for filling out a payment order for 2020 have not changed.

You can check whether you are ready to submit annual reports according to the simplified tax system for 2018 using our checklist.

Payment order for penalties according to the simplified tax system

Contents If you miss the tax payment deadline, the company will have to pay penalties. To do this, you will need to draw up a payment order for penalties in 2020. The sample that we have provided for you will help you do this correctly. Before drawing up a payment order for penalties in 2020, a sample of which is presented below, the organization must determine the amount of penalties. If the arrears arose before October 1, 2020, the amount of penalties can be calculated using the formula: SP = N x Kd x 1/300 x SR, where SP is the amount of penalties; N is the amount of tax not paid on time; Kd is the number of days of delay; SR is the refinancing rate in effect during the period of delay. In this case, the number of days of delay is counted from the day following the day when the tax should have been transferred to the budget.

And ends with the day of actual payment of the arrears.

If the arrears arose after October 1, 2020 and later, in particular in 2020, then penalties for the first 30 days of delay are calculated according to the above formula.

And for the subsequent ones (31st day and beyond), instead of 1/300, an increased coefficient of 1/150 is taken.

For example, on February 6, the company paid wages for January 2017. And her personal income tax is 25,800 rubles.

paid to the budget only on February 27th. The delay is 20 days. Since the tax had to be transferred to the budget the next day after salary payment (clause

6 tbsp. 226 of the Tax Code of the Russian Federation). The refinancing rate these days was 10%. Thus, the amount of penalties will be 172 rubles.

(RUB 25,800 x 20 days x 1/300 x 10%). See what fines and penalties the company faces for errors in line 120 of Form 6-NDFL. To fill out a payment order for penalties in 2020, you can take some details from the tax payment slip. The following data will be the same:

- OKTMO (field 105).

- order of payment (field 21);

- bank details of the organization (fields 10, 9, 11 and 12);

- recipient's bank details (fields 13, 14, 15 and 17);

- payer status (field 101);

- name of the recipient, his TIN and KPP (fields 16, 61 and 103);

- name of the organization, its tax identification number and checkpoint (fields 8, 60 and 102);

Now let's talk about those details that differ. KBK (field 104).

The BCC for the tax and the BCC for penalties for this tax are similar. Only the code of the subtype of income differs (14 – 17 digits of the KBK). For tax it is 1000, and for penalties – 2100.

For example, BCC for payment of personal income tax by a tax agent is 182 101 02010 01 1000 110, and BCC for payment of penalties for personal income tax is 182 10100 110. Basis of payment (field 106). When paying tax, the company will put TP in this field. When paying a penalty, it will have one of the following values:

- AP – when paying penalties according to the inspection report.

- TR - when paying penalties at the request of the Federal Tax Service;

- ZD – upon voluntary payment of penalties;

Tax period (field 107).

When paying penalties of one's own free will (the basis of the AP), 0 is indicated in field 107. The same should be done if the penalties are paid according to the inspection report (the basis of the AP). If penalties are listed for a specific period, then it should be reflected in field 107.

So, when paying penalties for January 2020, in field 107 you must put MS.01.2018.

Payment of the simplified tax system for 2017

Taxpayers using the simplified system must pay the simplified tax system in advance at the end of each quarter during the year. And at the end of the calendar year, which is the tax period for the simplified tax system, they must calculate and pay the final tax amount, taking into account all the advance amounts paid during the year.

At the same time, Russian legislation provides for different deadlines for paying annual payments under the simplified tax system for organizations and individual entrepreneurs (clause 7 of Article 346.21 of the Tax Code of the Russian Federation). Organizations must make the final tax payment at the end of the year by March 31, and individual entrepreneurs by April 30. Sometimes it is possible to extend this period until the next working day if these dates fall on a national holiday. So, in 2018, the deadline will be postponed, for companies to 04/02/2018, and for individual entrepreneurs - until 05/03/2018.

But the terms for paying advances under the simplified tax system are the same for everyone - at the end of the reporting quarter until the 25th of the next month.

How to fill out a payment order for penalties in 2020

- /

- /

June 26, 2020 1 Rating Share Filling out a payment document for penalties with the Federal Tax Service has a number of features that distinguish this process from the procedure for filling out a payment document for taxes.

Details are in our material. Penalties intended for payment to the Federal Tax Service are the amount resulting from the later payment of taxes to the budget compared to the deadlines established for this (clause

1 tbsp. 75 of the Tax Code of the Russian Federation). They are transferred to the same inspectorate where the corresponding taxes are paid. The document for payment of penalties is drawn up according to the same principles as for the tax payment itself, but with a number of nuances.

Just like for tax payments, the following is entered into it:

- name, TIN, KPP and bank details of the tax authority;

- purpose of payment.

- priority of payment, OKTMO, basis for payment;

- name, TIN, KPP and bank details of the payer;

With its own characteristics, the payment of penalties reflects:

- Basis of payment.

Here there is not always enough reason for payment (there are several of them for penalties). Data may be required about the period for which the payment is made and the document against which the payment is made. - Purpose of payment. It is indicated that penalties are paid and for what tax; there may also be a need for other information.

- Sequence of payment.

Her choice will depend on the basis for which the payment is made. - KBK. The basic set of numbers for penalties is always similar to that used for the tax for which penalties are paid, but signs 14–17 are necessarily 2100, indicated only for penalties.

The rules for issuing payment orders for the payment of penalties on taxes from 2020 also apply to insurance premiums subject to the Tax Code of the Russian Federation.

But when paying penalties on contributions for injuries that remain under the jurisdiction of the Social Insurance Fund, you will also have to take into account a number of features. The basis for the payment indicated in the payment document for penalties depends on whether it is made voluntarily or according to a document issued by the Federal Tax Service:

- On the demand for payment. According to it, in field 106 you should enter the letters TR, and in the fields following it - the payment period specified in the request (field 107), the request number (field 108) and its date (field 109).

- Checking act. In relation to it, the letters AP will appear in field 106 and, just as for the demand, you will need to enter the payment deadline specified in the act,

- The voluntary nature of the payment will be indicated by the letters ZD entered in field 106. Their presence allows you not to make other notes related to the basis of the payment (about the payment period, number and date of the document), and limit yourself to putting numbers in the fields intended for them (107–109) 0. If the amount paid can be linked to a specific tax period, then in field 107 you can make a link to it in the format MS.05.2020 or KV.02.2020.

- Documents drawn up by the Federal Tax Service regarding penalties are divided into:

- On the demand for payment. According to it, in field 106 you should enter the letters TR, and in the fields following it - the payment period specified in the request (field 107), the request number (field 108) and its date (field 109).

- Checking act. In relation to it, the letters AP will appear in field 106 and, just as for the demand, you will need to enter the payment deadline specified in the act,

Algorithm for filling out a payment order

The payment order form itself can be downloaded here, and a completed sample can be downloaded from this link. This form is established in Bank of Russia Regulation No. 383-P dated June 19, 2012; it is given in Appendix 2.

The document is not very large, there are not many columns, so filling it out usually does not cause difficulties. Moreover, in the sample payment order according to the simplified tax system Income 2020, individual entrepreneurs and organizations use the same details, except for two fields:

- When it is necessary to indicate the payer, the legal entity indicates the name, and the individual entrepreneur - the name and registration address.

- The payer status (to the right of the payment type) can be either 01 or 09, depending on whether the organization or individual entrepreneur fills out the sample, respectively.

Otherwise everything is the same:

- At the top of the sample payment according to the simplified tax system, the date of filling out the document and its number are indicated.

- The payment type is not filled in, as in the samples.

- It is easy to indicate the amount of the contribution to be paid in words, the main thing is not to forget to add “00 kopecks” if the number is an integer.

- Next, you will need information about the simplified tax system payer and the recipient - TIN, KPP, account numbers. It is important to note that information about the payers and recipients themselves, as well as their banks, is entered into the payment order separately. Here you will need to indicate the BIC; it is better to find out in advance. Usually the recipient is indicated as the UFC in the region.

- Nearby you need to indicate OKTMO - it is not difficult to find out, since this can be done on the Federal Tax Service website.

- The type of operation is indicated by code – 01.

- The order of payment is 5 for voluntary payment. If it is carried out at the request of the tax authorities, the code will be 3.

- The UIP code is usually 0, unless another is specified in the debt payment request.

- The basis for payment is also indicated by a code. There are three options here - TP, ZD and TR. That is, current payments, debts and payment on demand.

- The tax period is either the year GD.00.2020, or quarters if we pay advances, which are marked as KV.01.2020, KV.02.2020 or KV.03.2020.

- The document date is indicated as 0 if the payment is in advance, and 03/31/2020/04/30/2020 if the payment is annual.

- The purpose of the payment is written in the words - Single tax according to the simplified tax system for 2019 or advance payment for the 1st quarter (six months, 9 months) of 2020.

All that remains is to sign and submit the payment order to the bank, where it will be checked and completed by a specialist.

To learn more about the nuances of filling out the document, you should familiarize yourself with all the Appendices of the Bank of Russia Regulations proposed above. It is also worth reading the Order of the Ministry of Finance of Russia dated November 12, 2013, No. 107n, and especially the second Appendix to it.

It is also worth noting that now the simplified form can be filled out using a convenient electronic form on the Federal Tax Service website. You just need to follow the link, enter all the necessary data, following the instructions, and then receive your electronic or paper version of the document, which you only need to print.

This will allow you to avoid mistakes as much as possible in the process of filling out the template, so you won’t have to worry about the fact that the payment made according to the sample will go in the wrong place.

A sample payment order for the simplified tax system for income in 2020 can be downloaded here. A sample USN payment form for income minus expenses 2020 is available for download here.