The performance of an employee directly depends on the level of remuneration he receives for the work he performs. The basis of remuneration is the official salary, which is supplemented by various additional payments, allowances, and compensation depending on working conditions. What is included in an employee’s salary and its level are determined by the complexity and volume of work performed, the level of qualifications, and the professionalism of the employee.

What is official salary

The concept of official salary

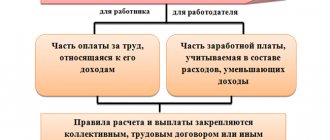

For work performed, each employee receives a monetary reward. At the legislative level, it is determined that wages consist of at least three main components:

- the main part, formed on the basis of the salary (rate);

- compensation payments due to an employee for performing actions under certain conditions;

- incentive part, which is awarded as various additional cash bonuses in order to increase interest in the work performed.

As a rule, the most “weighty” part of the remuneration is the official salary (tariff rate), which, depending on the employee’s field of activity, ranges from 40 to 90% of the total level of all remuneration due.

Official salaries are displayed in the company's remuneration system. Their formation is carried out taking into account the hierarchy of positions, the complexity of the work performed in a certain area, the specifics of the functions assigned to the employee, the necessary skills and qualifications.

As a rule, the remuneration system provides for a range of official salaries for each position in order to be able to set the level of basic income for a new specialist, taking into account his professionalism.

Remember, an official salary is a fixed amount of remuneration for work activity, which is established for an employee upon hiring and is reflected in the employment contract.

Considering that the range of official salaries usually provides a gap of 5 to 20% between the upper and lower levels, you should be interested in the size of the basic remuneration during the job interview process.

Legal regulation of surcharges and allowances

The Labor Code does not contain a definition of additional payments and allowances. This contains an indication that allowances and additional payments are part of remuneration for work activities, therefore information about them must be specified in the employment contract, which is signed with employees. This rule is given in paragraph. 5 hours 2 tbsp. 57 Labor Code.

All allowances and surcharges under Art. 135 of the Labor Code are divided into two large groups:

- Incentives that motivate employees to improve their work skills, conscientious or long-term work. Examples of such bonuses are bonuses for qualifications and experience.

- Compensatory , which are designed to compensate the employee for working conditions that differ from normal ones. This is, for example, additional payment for overtime work and for the traveling nature of the work.

According to Part 2 of Art. 135 of the Labor Code, compensation payments can be established at the enterprise by local regulations, collective agreements and labor law norms. So, according to Art. 21 of the Law “On State Secrets” of 1993 No. 5485-1, provides for an allowance for employees of structural units that protect it. Allowances for public sector employees are prescribed in Regulations from the Ministry of Finance No. 102n.

As for incentive bonuses, their introduction at the enterprise is the right, not the obligation of the employer. But if these were installed in the company and registered in local documents, then the employer will be obliged to pay them regardless of the financial situation.

The employer determines the types of allowances and additional payments independently at his own discretion, with the exception of those situations when he is obliged to provide them according to the norms of the Labor Code. In particular, the following types of mandatory additional payments are listed here:

- for work in harmful and dangerous conditions - under Art. 147 Labor Code;

- for combining professions or performing the duties of an absent person - under Art. 151 Labor Code;

- for expanding the service area and scope of work - under Art. 151 of the Labor Code.

Athletes who have received a sports injury receive an additional payment to the disability benefit up to the average earnings under Art. 348.10 of the Labor Code.

For work in areas with special climatic conditions or for shift work, employees are entitled to an allowance in accordance with the norms of Art. 148, 317 and 302 of the Labor Code. In Art. 317 of the Labor Code provides for additional payment to employees for work in the Far North. This article contains a reference to local regulations, which determine the amount of such a premium.

The Labor Code does not contain instructions on the amount of supplements and additional payments that an employer must pay to its employees. It only says that the employer determines the amount of payments at his own discretion, but taking into account the minimum values under the Labor Code.

So, for example, for work in harmful or dangerous conditions, the employer must add 4% of the tariff rate or salary, but he has the right to provide a larger bonus.

Other types of allowances and additional payments that are not specified in the Labor Code are provided by the employer in his organization at his own discretion. In particular, the employer may provide additional payments for length of service, professionalism, work with information that constitutes a trade secret, etc.

What does remuneration consist of?

The overall level of remuneration for work depends on many factors. Of course, the lion's share of the remuneration comes from the size of the established official salary, which will then be used to supplement other money due to the employee. The final level of income of a citizen will be influenced by:

- presence of harmful and dangerous working conditions;

- the need to work at night or overtime;

- long period of work in one place;

- exceeding established production plans or other indicators by which the company makes a profit;

- actual time worked (salary is paid for the monthly standard of working hours, if they are not worked, payment will be made proportionally);

- the presence of legislative or regulatory documents regulating the conditions of remuneration (for military personnel, civil servants, employees of internal affairs bodies, and other officials).

Other allowances and compensations

Also, according to Art. 151 of the Labor Code, employees are entitled to an additional payment for combining and expanding the service area. In Art. 144, 148 of the Labor Code stipulate compensation for hard work, work in dangerous conditions, difficult conditions, difficult climatic conditions.

Additional payment is due to employees under Art. 147 of the Labor Code, if working conditions do not comply with legal requirements. Thus, employees are entitled to additional pay for working at night, on weekends, etc.

According to Art. 147 of the Labor Code of the Russian Federation, the main condition for the accrual of such allowances is the non-compliance of working conditions with the requirements of labor legislation (section 10 of the Labor Code of the Russian Federation).

For certain categories of employees, special additional payments and allowances may be established . For example, for employees of the prosecutor’s office they are introduced on the basis of the Law “On the Prosecutor’s Office of the Russian Federation” of 1992 No. 2202-1.

The most common payments of this kind include additional payments for access to state secrets, work experience, knowledge of a foreign language, the presence of a certain rank or class, professional level, etc.

Some bonuses are established in the presence of certain merits to the state, for example, for pensioners or citizens with the title of Hero of the Russian Federation or the USSR. The last category under Art. 2 of the Law “On Additional...” of 2002 No. 21-FZ can count on monthly maintenance in the amount of 415% of the social pension.

The amount of veteran's allowances based on Art. 22 of the Law “On Veterans” No. 5-FZ is determined by regional regulations and varies depending on the region.

For military personnel participating in mine clearance, the amount of additional payment is determined to be 1-2.5% of salary . For employees of the Ministry of Internal Affairs, when performing duties in conditions of increased risk, the bonus is 100% of the salary (based on Federal Law-247 “On Social Guarantees...”).

How to use coefficients to calculate salary

Application of coefficients when calculating salaries

In the process of forming basic remuneration, many companies use a system of coefficients that take into account the individual characteristics of the employee’s work, his level of workload, responsibility, and the complexity of the final result. The application of coefficients may vary. Let's look at the most common ways to calculate salary using coefficients.

The remuneration system is based on coefficients. In some cases, in order not to recalculate the entire salary grid, employers introduce a system of coefficients for each position.

In this case, the actual calculation of the official salary is based on the minimum salary of an unskilled worker of the company, which is initially charged at a coefficient of 1.0. In the future, when wages rise, the level of the base salary simply changes, and all other salaries are simply recalculated by mathematically multiplying this indicator by coefficients.

Types of personal allowances

A personal salary supplement can be of the following types:

- a fixed sum of money that is added to the employee’s basic salary;

- percentage of the established amount (salary, full salary, bonus, etc.)

Moreover, one employee can be provided with several types of bonuses at once, both percentage and in a fixed amount.

A personal salary supplement is a monetary amount that can be expressed either as a fixed amount or as a percentage. It is established by internal documents of the company or the employment contract of a particular employee. In addition, an order for the bonus is issued, which serves as the basis for its calculation when calculating wages.

unified form T-11 for ordering a personal allowance and see an example of how to fill it out here.

Salary supplements

What salary supplements can you apply for?

As incentive payments for employees, incentives such as bonuses are provided. They are paid as a percentage of the basic (basic) salary. Typically, such remuneration is due to an employee for having certain skills that distinguish him from other employees occupying similar positions.

For example, bonuses can be paid:

- for a high level of qualifications;

- presence of professionalism in the robot;

- loyalty to the company (for length of service or long time of work);

- knowledge of foreign languages;

- for scientific title;

- performing additional work at the same time as main work.

What it is

A personal bonus is an individual incentive payment intended for a specific employee.

This incentive is not a mandatory payment, but, if available, it is part of the remuneration.

The possibility of making such payments must be included in the local internal documents of the enterprise, for example, regulations on remuneration, as well as in labor agreements with employees, individual and collective.

Such stimulation can play an important role both on an individual level (the employee will try to reach greater heights) and on a large scale, since its presence awakens healthy competition among subordinates.

Coefficient for calculating vacation pay

An officially employed employee has the right to paid leave of 28 days.

To calculate funds, a formula is used that includes the vacation pay coefficient. In 2017, it is 29.3, reflecting the average number of days in a month and is used when calculating daily earnings. You will also need to use the appropriate coefficient in the case where there has been an increase in wages. However, the following conditions must be met:

- the increase occurs during the billing period, right before going on vacation or during vacation;

- salaries are increased for all employees of the enterprise, its branch or structural unit.

This increase rate has no set value. It is calculated from the ratio of the new salary to the previous one. Along with tariff rates, the amount of allowances may change. In this case, to determine the increase coefficient, divide the amount of the new salary and bonuses by the amount of the same payments according to the old values.

The salary increase procedure does not affect all payments at the enterprise. Only those values that are calculated depending on the amount of earnings are indexed. Indexation does not apply to premiums with a fixed amount or multiples of the tariff rate.

Using an example, we can consider how the increase factor affects the accrual of vacation pay. Let's assume that an employee works at the enterprise during the entire billing period from May 2020 to April 2020. During this time, for six months his salary remained unchanged and amounted to 30,000 rubles. After this, the amount was increased to 32,000 rubles, and in February - to 34,000. No allowances or bonuses were awarded to the employee. He is going on vacation for 14 days.

- Finding the increase factor. The last salary increase was in February. This means that you need to find the ratio of this value to the amount of payments last month. From May to October the indicator is 34,000 / 30,000 = 1.13. From November to January the value will be 34,000 / 32,000 = 1.06.

- We index employee payments. For the period from May to October: 30,000 * 1.13 * 6 = 203,400; from November to January: 32,000 * 1.06 * 3 = 101,760.

- We find the total earnings: 203 4000 * 3 = 407 160.

- We calculate the average daily earnings: 407,160 / 12 / 29.3 = 1,158.02.

- Now we calculate the amount of vacation pay: 1,158.02 * 14 = 16,212.28.

To calculate vacation pay, a coefficient is used that reflects the average number of days in a month. Previously, it was considered equal to 29.4, but in 2014, due to an increase in the number of days off, a new value was set - 29.3. Also, coefficients are required after salary increases. Indexation of average earnings is important for calculating vacation pay.

Recommended reading

Chart of accounts as the basis for organizing accounting

Calculation of vacation pay after maternity leave

Salary indexation, associated with an increase in the minimum wage and the level of inflation, is carried out annually in most companies. Whatever the reason, every change in salary requires a recalculation of average earnings. This is especially important when calculating mandatory payments to an employee. Average earnings are the main parameter that affects the final amount during the recalculation of vacation pay when salaries are increased.

The basic rules for vacation pay are contained in Chapter 19 of the Labor Code (hereinafter referred to as the Code). Instructions for calculating average earnings can be found in Decree No. 922 dated December 24, 2007. Based on the listed documents, we will summarize the information necessary for further calculations. The following indicators influence the amount of vacation pay:

- average earnings per day,

- duration of vacation,

- billing period.

Let's look at each of them in more detail. Let's start with average earnings. The basis for it is the payments provided for a specific employee. Among them:

- actual salary accrued for hours worked,

- remuneration (including royalties),

- premiums to tariff rates and additional payments (including coefficients for special working conditions or the nature of the work),

- awards.

When forming average earnings, the amount of salary for a certain period of time is used. The Code specifies a year as the calculation period, but it is adjusted depending on the circumstances (if the employee has worked for less than a year, it is calculated based on the actual time worked using a special formula).

- periods of maintaining average earnings,

- receiving FSS benefits (for temporary disability, etc.),

- downtime due to the fault of the employer or for reasons beyond the control of the employer’s employee,

- paid days off to care for disabled children or those disabled since childhood,

- provision of financial assistance that has already been paid previously.

The duration of leave is set individually for each employee. The minimum for most is 28 days. When calculating the required leave, it is necessary to take into account the type of activity, working conditions and place of performance of duties by the employee. For certain categories of employees, the duration and specifics of the provision are specified in Articles 114, 116, 255 - 256 and 173 - 176 of the Code.

The amount of payments in general cases is determined according to the established form. It is equal to the quotient of dividing the total salary for the calculation period by twelve and by 29.3. Recalculation of vacation pay when salaries increase takes place according to a slightly different scheme. And it depends on the period when the increase occurred. There can be three of them in total:

- during the billing period,

- at the end of the billing period, but before the occurrence of the event of interest (in this case, vacation),

- while maintaining average earnings.

Paragraph 16 of the Resolution contains recommendations for determining the amount of payment in these cases. Let's look at each of them using specific examples. For convenience, we present below four basic formulas by which calculations are made.

CI - indexation coefficient, NO - new salary, SO - salary before increase

HC = (CO x RPs x KI NO x N), where

УУ - taken into account payments, РПs - billing period with the old salary, N - number of months with an increased salary

SZ = (UV/RP/29.3), where

SZ - average earnings per day, RP - billing period, 29.3 - average number of calendar days in a month

RO = NW x DO, where

RO - amount of vacation pay, DO - duration of vacation

In this case, the calculation is quite simple. First, we determine the amount of wages that was accrued for the reporting period before the increase. Then, multiply it by the increase factor. We calculate the average earnings per day. We multiply the resulting amount by the estimated number of vacation days.

Example 1. Increase once per calculation period

Sokolov A.O. regular leave is granted, the duration of which is 28 days. Start date: February 9, 2020. The salary is 24,000 rubles. There were no exclusion days during the billing period. It is equal to 12 months - from February 1, 2014 to January 31, 2015.

From February to December 2014, wages remained unchanged. In January 2020, it was increased by 5,000 rubles. We calculate the coefficient: 29,000/24,000 = 1.208. Now, using the formula, we determine Sokolov’s average earnings: (24,000 × 1.2 × 11 months 29,000 × 1 month). (29.3 × 12) = 983.50 rubles. The amount of vacation pay will be: 983.50 × 28 = 27,538 rubles.

Example 2. Several salary changes during the calculation period

Romanov I.E. from February 5, 2020, vacation was granted equal to 28 days. The billing period from February 1, 2014 to January 31, 2020 is 12 months. Salary from February to May 2014 - 22,000 rubles, from June to October 2014 - 29,000 rubles, from November 2014 to January 2020 - 28,000 rubles. There were no excluded periods. Let's do the calculations.

We determine the coefficient: 29,000/22,000 = 1.3 coefficient No. 2: 28,000/29,000 = 0.96. We use them to adjust the amounts taking into account indexation (22000×1.3×4 months 29000×0.96×5 months 28000×3 months). (29.3 × 12) = 960.18 rubles of average earnings. Accordingly, the amount of vacation pay will be: 960.18 × 28 = 26,885 rubles.

Example. Leave to Ignatiev A.A. provided since March 9, 2020. This is another 28-day vacation. Salary for the last 12 months - from March 1, 2014 to February 31, 2015 - amounted to 240,000 rubles. There are no days for exclusion in the billing period. The salary increase took place on March 1, 2020. The coefficient was 1.25.

Let's calculate the payments. Average earnings according to formula No. 3: (240,000/11/29.3) = 744.65 rubles. We take into account the coefficient of the new salary. Amount for vacation pay: (744.65 × 28 × 1.25) = 26,167.75 rubles. Taking into account the adjustment, the employee will receive 26,167.75 rubles.

Example. Sokolov R.D. goes on vacation on March 10, 2020. Duration - 28 days. Over the last 12 months - 150,000 rubles (from 03/1/2014 to 02/31/2015). The calculation period does not contain days to exclude. From March 19, 2020, wages increased by 1.23.

Let's make the necessary calculations. Using formula No. 3, we determine the average earnings: (150,000/12/29.3) = 426.62 rubles. We calculate the amount of vacation pay, taking into account the increase. From March 10 to March 18, 2015 - for 9 days - it turns out 3839.58 rubles (426.62 × 9). From March 19 to April 5, 2020 - for 19 days - the amount will be 9970.10 rubles (426.62 × 1.23 × 19). The final amount of payments is 13809.68 rubles (3939.58 9970.10).

After the accountant has accrued vacation pay to the employee, it would seem that you can breathe easy. But that was not the case; here another unpleasant surprise may lie in wait for the accountant (and, conversely, a very positive one for the employees) - an increase in wages.

The indexation of vacation pay for salary increases is carried out not only when it took place in the billing period, but also during the vacation itself. How to recalculate correctly?

Conversion algorithms

Personal coefficient

1. Is it necessary to notify the employee about the reduction in the personal increase coefficient? For what period?

1.1. The employer has the right to introduce changes to the wage system, which may lead to a reduction in the final wages of employees. But no financial difficulties, for example, a decrease in revenue, can be a basis for such actions. The employer has the right to exercise the above powers if, due to the deterioration of the financial situation, he has already begun to change the organizational or technological working conditions (improvement of workplaces based on their certification, structural reorganization of production (clause 21 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 N 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation”). Thus, you can, having warned 2 months in advance, notify employees against signature (Article 74 of the Labor Code of the Russian Federation), reduce the PPC, but there must be a strict, clear argumentation for your actions, i.e. j. Judicial practice in these cases sides with the Employee.

2. Is it possible to get acquainted with the order of the chief physician on the appointment of a personal increase coefficient for other employees, since I was deprived of it without an order.

2.1. You can get an extract from the order. As an employee, you have the right to familiarize yourself with an extract from the order as a local regulatory act adopted by the organization (Article 8 of the Labor Code of the Russian Federation) and affecting your rights, but they will familiarize you with the extract from the order, because there is personal data of other employees (Article 3 of the Federal Law of July 27, 2006 N 152-FZ “On Personal Data”).

2.2. Labor Code of the Russian Federation Article 8. Local regulations containing labor law norms Issues of application of Art. 8 of the Labor Code of the Russian Federation Employers, with the exception of employers - individuals who are not individual entrepreneurs, adopt local regulations containing labor law norms (hereinafter referred to as local regulations), within their competence in accordance with labor legislation and other regulations containing labor law norms, collective agreements, agreements. In cases provided for by this Code, other federal laws and other regulatory legal acts of the Russian Federation, collective agreements, agreements, the employer, when adopting local regulations, takes into account the opinion of the representative body of employees (if there is such a representative body). A collective agreement or agreements may provide for the adoption of local regulations in agreement with the representative body of workers. Norms of local regulations that worsen the situation of workers in comparison with established labor legislation and other regulations containing labor law norms, collective agreements, agreements, as well as local regulations adopted without observing the procedure for taking into account the opinions of the representative body of workers established by Article 372 of this Code , are not applicable. No, you won't be able to read it. You can contact the labor inspectorate and the prosecutor's office to conduct an inspection; documents will be requested to verify good luck to you and all the best.

2.3. Of course it is possible. This order concerns you. Therefore, you have the right to know its contents (Article 8 of the Labor Code of the Russian Federation)

2.4. Hello Dmitry! You can, because Equality of rights and opportunities for workers is enshrined in Article 2 of the Labor Code of the Russian Federation.

2.5. YOU can familiarize yourself with documents that in one way or another affect your rights in accordance with Article 8 of the Labor Code of the Russian Federation. Therefore, if this order concerns you directly, you have the right to demand familiarization with it.

2.6. Hello, it is unlikely that they will provide you with information about other employees, at least they are not obliged to do so. A personal increasing coefficient is assigned taking into account professional training, the complexity of the work performed, and the degree of responsibility of the employee. It is determined in accordance with Order of the Ministry of Health and Social Development of the Russian Federation dated August 28, 2008 N 463 n (as amended on August 2, 2011) “On the introduction of a new system of remuneration for employees of federal budgetary scientific institutions that have clinical units subordinate to the Ministry of Health and Social Development of the Russian Federation” 2.2 . The following increasing coefficients can be established for the recommended minimum salary for the relevant PKG for a certain period of time during the relevant calendar year and taking into account the provision of financial resources: - increasing coefficient for the salary for the position held; — increasing coefficient to the salary of the institution (structural division of the institution); — personal increasing coefficient to salary. 2.3. The amount of payments based on the increasing coefficient to the salary is determined by multiplying the employee’s salary by the increasing coefficient. The application of all increasing factors to the salary does not form a new salary and is not taken into account when calculating compensation and incentive payments. 2.4. The recommended amounts of increasing coefficients for salary for the position held, established for all employees of the institution depending on the assignment of the position to the qualification level of the PKG, are given in Appendix No. 1 to these Regulations. 2.5. The recommended sizes of increasing coefficients for salaries for an institution (structural unit), established for all employees of an institution, are given in Appendix No. 2 to these Regulations. 2.6. A personal increasing coefficient for salary can be set for an employee taking into account the level of his professional training, the complexity or importance of the work performed, the degree of independence and responsibility in performing assigned tasks and other factors. The decision to establish a personal increasing coefficient for the salary and its amount is made by the head of the institution personally in relation to a specific employee.

3. I have the following problem: I had a salary supplement in the form of a personal coefficient; when I went on maternity leave, the girl working for me, naturally, was not paid this supplement. And after I returned from maternity leave, they stopped paying me too, which I found out a month later when I received my salary. I pointed out the fact of violation to the personnel officer, after which she brought me additional information. an agreement that stated that I would be paid this bonus within two months. But she didn’t give me any notification about the salary change. Is she right or wrong?

3.1. Rights - what? According to the text, they forgot to pay part of the salary on time, they offered to agree that the unpaid part would be returned within two months. What should I notify?

4. Legality of removing the allowance. For me and a number of employees, a personal coefficient (pc) was set from 1.01 for the year. In November the PC was accrued and paid. On 12/15 an order was issued to stop paying PCs from 11/01. The PC withheld the salary paid in November to the December salary. And for December the PC was not credited. Is this legal?

4.1. Judging by the above - quite. The procedure and conditions of remuneration, including its parts, are determined not by law, but by the employer or owner of the institution, unless otherwise agreed in the terms of the employment contract. And the employer is not limited in his powers by his order, which he, in the same order, can cancel or change at any time.

5. The employee had a personal coefficient established by an additional agreement until June 30, 2017. On July 1, 2017, the employee went to work for a new company, which was formed by merging two. He was given a notice of transfer with the previous terms and conditions of remuneration retained. The employee received his salary in July with the accrual of a personal coefficient. In the month of August, the personal coefficient was not accrued. Question: Is the employer obliged to notify the employee and issue an order that from now on the employee will not receive a personal coefficient?

5.1. If the additional payment according to the coefficient was established precisely by an additional agreement to the employment contract, then when companies merge, the new company must fulfill the obligations undertaken by the first company; Federal Law dated 02/08/1998 N 14-FZ (as amended on 07/29/2017) “On Limited Liability Companies” (as amended and supplemented, entered into force on 09/01/2017) “” Article 52. Merger of companies 1 A merger of companies is the creation of a new company with the transfer to it of all rights and obligations of two or more companies and the termination of the latter.5. When companies merge, all rights and obligations of each of them are transferred to the company created as a result of the merger, in accordance with transfer acts.

5.2. Obliged, because this is a condition of the employment contract, and any change to it, as a general rule, is possible only by agreement of the parties.

6. Can pregnant women have their personal salary increase reduced? For what reasons?

6.1. Due to pregnancy, working conditions and wages cannot be worsened. If this happens, you must immediately file a complaint with the labor inspectorate or prosecutor's office.

7. Can an employer reduce the personal salary coefficient without the knowledge of the employee? I am a young specialist (27 years old), working for the first time after graduating from university, I was paid 200% for the first year, then reduced to 150%. And is it worth considering that PPC is an incentive, which can subsequently be reduced for a reprimand (being 40 minutes late for work). and if so, for how long? Do they charge?

7.1. It is necessary to look at your employment contract and the Regulations on remuneration. If this is really an incentive payment, then everything depends on the employer: if he wants, he will pay, if he doesn’t, he won’t (Article 135 of the Labor Code of the Russian Federation)

8. The organization undergoes certification of employees for the size of the personal salary increase coefficient. Can an employee refuse certification due to the fact that his salary is paid up to the minimum wage?

8.1. If the employer has established an obligation to undergo certification, then you have no choice but to pass it. The employer sets the frequency of certification independently, taking into account the regulations of the region, territory, district on certification issues for the relevant position in the relevant field. In this case, the temporary nature of the work does not matter. If you refuse certification, then you automatically refuse to perform the job function specified in the employment contract, which entails dismissal.

9. Is it legal to reduce wages in the form of deprivation of a personal increasing coefficient? to the boss (they were left with a bare salary) after notification of the layoff in order to reduce the amount of compensation payments, if no one canceled the workload after the notification. (The coefficient is not reflected in the employment contract; it is assigned by an additional order)

9.1. Hello! Reducing wages in this case is not legal, file a complaint with the labor inspectorate. All the best, I wish you good luck!

10. Is it legal to reduce wages in the form of deprivation of a personal increasing coefficient? to the boss (they were left with a bare salary) after notification of the layoff in order to reduce the amount of compensation payments, if no one canceled the workload after the notification.

10.1. Hello! Reducing wages is not legal, file a complaint with the labor inspectorate (LIT) All the best, I wish you good luck!

10.2. Good day! The reduction is illegal if these payments are specified in the employee’s employment contract and the organization’s collective agreement. File a complaint with the labor inspectorate.

11. Question on the payment of an increasing personal coefficient in the public sector.

11.1. Not here. The procedure and conditions of remuneration, including its parts, are determined not by law, but by the employer or owner of the institution.

12. Does the employer have the right, without changing working conditions, to lower the personal increase coefficient, citing financial difficulties?

12.1. No, he does not have such a right.

13. The employee was given a personal increase coefficient for additional work, and an additional agreement to the work was concluded. According to the agreement, now we need to reduce the pers. Increase Coef. from 5,000 to 3,000 rubles, do you need to notify the employee two months in advance, or? which is correct? Thank you!

13.1. You must always notify.

14. Please tell me, should orders for a long-service bonus or a personal increase coefficient be issued on the last day of the month or, for example, on the first day of the next month? Thank you.

14.1. Hello! This procedure must be established by a local act of the organization, for example, the Regulations on Remuneration. If we set a personal increasing coefficient based on the results of work for July, then it will be more convenient to issue an order at the end of the month and pay this amount in August in the salary for July. If we set it for a future time, for example, for a quarter (July, August, September), then it is more convenient to issue an order in early July. An order for a long service bonus is usually issued on the day the right to this bonus is obtained.

15. Please explain what a personal increasing coefficient is. What factors does it depend on and can it be different if the professional category, salary, and workload are absolutely the same for education employees. Thank you in advance!

15.1. Familiarize yourself with the local regulations of your enterprise.

16. Is it possible to reduce an employee’s personal increasing coefficient to his official salary if it is specified in the employment contract and the employment contract is concluded for an indefinite period.

16.1. By agreement of the parties, it is possible under the Labor Code of the Russian Federation, Article 72. Changes in the terms of the employment contract determined by the parties (as amended by Federal Law No. 90-FZ of June 30, 2006) (see the text in the previous edition) Guide to personnel issues. Questions of application of Art. 72 of the Labor Code of the Russian Federation Changing the terms of an employment contract determined by the parties, including transfer to another job, is allowed only by agreement of the parties to the employment contract, except for cases provided for by this Code. An agreement to change the terms of an employment contract determined by the parties is concluded in writing.

16.2. If the employee unconditionally agrees with this, then yes, by making changes to the work. agreement! if not, then dismissal.

17. When revising the system of personal increasing coefficients for teachers, is it necessary to take them into account in such a way that the resulting salary is greater than the amount before the revision?

17.1. Not necessary. If the system is revised for the purpose of saving, then the salary may be reduced, but employees must be notified of this no later than two months before the introduction of these changes.

18. Can a teacher’s personal coefficient be lowered if he works in two classes, his own and a substitute (teacher in session). Last month in one class the increasing coefficient was 0.5, and this month in two classes it was 0.25

18.1. Hello! No, you cannot. Increasing coefficients for salary (official salary), wage rate are established for a certain period of time during the corresponding calendar year. Consequently, the legislation does not provide for a reduction in the personal increase coefficient for employees. This coefficient is set for a certain time and in a certain amount.

19. The manager reprimanded me and, based on it, reduced my personal coefficient by 1 point until the end of the year (from 04/01/16 to 12/31/16). on organization of p.k. established by order from 03/01/16 to 12/31/16 on the eve of the reprimand specifically, although before this p.c. was established by order for a month. (I’m a single mother, I lose 5,000 rubles monthly). Was this one punishment for disciplinary action? Should I contact the labor inspectorate?

19.1. no, a reduction in allowances is not a punishment, but you can still appeal it - Art. 392 TK allows

19.2. Deprivation of a coefficient is not considered a disciplinary punishment by the labor code. And you should look at the regulations on the coefficient for the organization

20. I work at a cultural information center as an artist. I have a personal coefficient for my salary. We are paid a monthly incentive in the form of bonuses. But when distributing bonuses, they refuse me, citing a personal coefficient. At first they paid me these bonuses, but then they forced me to return this amount, since I have a personal coefficient. Is accounting correct?

20.1. Such issues are regulated by the organization's VNA.

21. Is it possible to reduce the personal increasing coefficient for the presence of a disciplinary sanction (reprimand) for 9 months (from 04/01/16 to 04/31/16)?

21.1. No you can not. The same offense cannot be punished twice.

22. Is it possible for an employee to have a reprimand to reduce the personal increase coefficient by 1 point until the end of the year (from 04/01/16 to 12/31/2016)

22.1. Hello. These issues are regulated by the internal documents of the enterprise (institution). Contact your employer.

23. Should the manager justify the reduction of the personal coefficient?

23.1. Mandatory

24. If I have a salary, they charge a little more than the minimum wage, taking into account the regional coefficient, personal coefficient and increasing coefficient. Is this legal? Thank you.

24.1. Hello, if it’s more than the minimum wage, then it’s ok. According to the Labor Code of the Russian Federation, salary should not be lower than the minimum wage.

25. Is it legal for the employer to reduce the personal increase coefficient to the salary without warning the employee about it?

25.1. Is it legal for an employer to reduce a personal salary increase without notifying the employee about it? - appeal this action of his in court

26. A personal increasing coefficient is calculated on the salary. I took 3 days without pay. The salary amount decreased, and the amount of the personal increasing coefficient was calculated from it, and not from the full salary. This is right?

26.1. Of course, that’s correct. The calculation is proportional to the amount of the accrued salary.

26.2. Yes. this is right.

27. Can a manager not pay a personal coefficient to an employee at all?

27.1. Hello! NO, of course it can't GOOD LUCK TO YOU

27.2. What field of activity are we talking about?

Fresh materials

- Increasing transport tax coefficient Increasing transport tax coefficient - what is it? The increasing coefficient of transport tax (TN) was introduced...

- Territorial correction factor correction factor See what a “correction factor” is in other dictionaries: COEFFICIENT K1 - correction factor of the base...

- Payroll coefficient Payroll number of personnel: which employees to take into account Determination of the payroll number of employees is carried out on the basis of the provisions enshrined in ...

- Current liquidity ratio Current liquidity ratio: formula for calculating the balance sheetFormulaTo quantitatively measure the liquidity ratio, the following formula is required: Klt=OK/TO, where Klt–...

Who gets a personal allowance and who doesn’t?

Additional personal benefits can be assigned to any full-time employee of the organization, since they are added to his salary, often calculated as a percentage of his salary. At the same time, the registration of an employee on the staff does not have much significance; the following may qualify for a personal allowance:

- an employee who has entered into a regular employment contract;

- "conscript";

- part-time worker.

It is not customary to assign personal bonus payments to the following categories of workers:

- freelancers;

- workers working under a contract;

- who have concluded civil contracts.