A budget is a complete diagram of the income and expenses of a particular object. This applies not only to the state, but also to business, a certain organization, family and other areas where financial resources are taken into account. Budget is one of the most important aspects in both microeconomics and macroeconomics, that is, government planning. The science that studies what a budget is is called finance.

The state budget

The state budget is one of the most important documents in the country. It contains financial estimates of any departments, services of broad importance, programs that implement matters relating to the government and management of the country. It outlines the full range of needs of all structures of society, which must be realized at the expense of the treasury. This document also includes all the sources from which regular payments come with the exact amounts of money, which also regulates the federal budget.

General budget structure

| General structure of the federal budget | ||

| 4,285 | ||

| 2007 | 7,781 | 5,987 |

| 2008 | 9,276 | 7,571 |

| 2009 | 7,338 | 9,660 |

| 2010 | 8,305 | 10,118 |

| 2011 | 11,368 | 10,926 |

| 2012 | 12,856 | 12,895 |

| 2013 | 13,020 | 13,343 |

| 2014 | 14,497 | 14,832 |

| 2015 | 13,659 | 15,620 |

| 2016 | 13,460 | 16,427 |

| 2017 | 15,089 | 16,420 |

| 2018 | 19,455 | 16,709 |

| 2019 | 20,189 | 18,214 |

| 8,375 | ||

| 2007 | 13,368 | 11,379 |

| 2008 | 16,169 | 14,157 |

| 2009 | 13,600 | 16,048 |

| 2010 | 16,032 | 17,617 |

| 2011 | 20,855 | 19,995 |

| 2012 | 23,435 | 23,175 |

| 2013 | 24,443 | 25,291 |

| 2014 | 26,766 | 27,612 |

| 2015 | 26,922 | 29,742 |

| 2016 | 27,747 | 30,889 |

| 2017 | 31,047 | 32,396 |

| 2018 | 37,320 | 34,285 |

| 2019 | 39,498 | 37,382 |

Budget system

The following types of financial planning are included in the budget system of the Russian Federation:

- Federal budget.

- Many regional budgets that belong to the constituent entities of the Russian Federation.

- Local budget, that is, financial issues related to municipal formations.

Article 215.1 of the Budget Code of the Russian Federation makes the Federal Treasury responsible for execution and cash services, which affects the budget of the Russian Federation. There is a term called "fiscal surplus". This applies to those issues in which the planned budget expenditures are less than the received budget revenues. When expenses exceed income, this process is characterized by the term “budget deficit.”

If the planned level of the budget deficit during its planning becomes irrelevant and expenses exceed this indicator, as well as in cases in which expenses are too high, then the authority responsible for these processes may decide to reduce expenses at its own discretion. When expenses have already been planned, and they are reduced for the reasons given above, this process is called sequestration.

Federal budget

Federal budget balance

| Year | Surplus(+)/Deficit(–) (trillion rubles) | Non-oil and gas deficit (trillion rubles) |

| 2006 | 1,994 | -0,949 |

| 2007 | 1,795 | -1,103 |

| 2008 | 1,705 | -2,684 |

| 2009 | -2,322 | -5,306 |

| 2010 | -1,812 | -5,643 |

| 2011 | 0,442 | -5,200 |

| 2012 | -0,039 | -6,493 |

| 2013 | -0,323 | -6,857 |

| 2014 | -0,335 | -7,768 |

| 2015 | -1,961 | -7,824 |

| 2016 | -2,956 | -7,800 |

| 2017 | -1,331 | -7,303 |

| 2018 | 2,746 | -6,272 |

| 2019 | 1,974 | -5,950 |

Federal budget revenues

| Year | Oil and gas revenues (trillion rubles) | Non-oil and gas revenues (trillion rubles) | Oil and gas revenues (% of revenues) | Non-oil and gas revenues (% of revenues) |

| 2006 | 2,944 | 3,335 | 46,89 | 53,11 |

| 2007 | 2,897 | 4,884 | 37,23 | 62,77 |

| 2008 | 4,389 | 4,887 | 47,32 | 52,68 |

| 2009 | 2,984 | 4,354 | 40,67 | 59,33 |

| 2010 | 3,831 | 4,475 | 46,12 | 53,88 |

| 2011 | 5,642 | 5,726 | 49,63 | 50,36 |

| 2012 | 6,453 | 6,402 | 50,19 | 49,80 |

| 2013 | 6,534 | 6,486 | 50,18 | 49,82 |

| 2014 | 7,434 | 7,063 | 51,28 | 48,72 |

| 2015 | 5,863 | 7,797 | 42,92 | 57,08 |

| 2016 | 4,832 | 8,628 | 35,90 | 64,10 |

| 2017 | 5,972 | 9,117 | 39,57 | 60,42 |

| 2018 | 9,018 | 10,437 | 46,35 | 53,65 |

| 2019 | 7,924 | 12,264 | 39,25 | 60,75 |

Detailed structure of non-oil and gas revenues of the federal budget (2015-2019)

| Income item | 2019 (trillion rubles) | 2018 (trillion rubles) | 2017 (trillion rubles) | 2016 (trillion rubles) | 2015 (trillion rubles) |

| 1. Related to domestic production | 6,39 | 5,431 | 4,742 | 3,781 | 3,468 |

| 1.1. VAT (domestic) | 4,258 | 3,575 | 3,07 | 2,657 | 2,448 |

| 1.2. Excise taxes | 0,947 | 0,861 | 0,91 | 0,632 | 0,528 |

| 1.3. Income tax | 1,185 | 0,996 | 0,762 | 0,491 | 0,491 |

| 2. Import related | 3,645 | 3,212 | 2,729 | 2,54 | 2,404 |

| 2.1. VAT on imported goods | 2,837 | 2,442 | 2,067 | 1,914 | 1,785 |

| 2.2. Excise taxes on imported goods | 0,09 | 0,096 | 0,078 | 0,062 | 0,054 |

| 2.3 Import duties | 0,717 | 0,673 | 0,583 | 0,564 | 0,565 |

| 3. Other | 2,23 | 1,794 | 1,647 | 2,296 | 1,925 |

Federal budget expenditures

| Expense item | 2019 (trillion rubles) | 2018 (trillion rubles) | 2017 (trillion rubles) | 2016 (trillion rubles) | 2015 (trillion rubles) |

| National issues | 1,364 | 1,257 | 1,162 | 1,096 | 1,118 |

| National Defense | 2,997 | 2,827 | 2,852 | 3,775 | 3,181 |

| National Security and Law Enforcement | 2,083 | 1,972 | 1,918 | 1,899 | 1,966 |

| National economy | 2,827 | 2,402 | 2,46 | 2,302 | 2,324 |

| Department of Housing and Utilities | 0,282 | 0,149 | 0,12 | 0,072 | 0,144 |

| Environmental protection | 0,198 | 0,116 | 0,092 | 0,063 | 0,05 |

| Education | 0,827 | 0,723 | 0,615 | 0,598 | 0,611 |

| Culture, cinematography | 0,122 | 0,095 | 0,09 | 0,087 | 0,09 |

| Healthcare | 0,713 | 0,537 | 0,44 | 0,506 | 0,516 |

| Social politics | 4,883 | 4,582 | 4,992 | 4,589 | 4,265 |

| physical Culture and sport | 0,081 | 0,064 | 0,096 | 0,06 | 0,073 |

| Mass media | 0,104 | 0,089 | 0,083 | 0,077 | 0,082 |

| Servicing state and municipal debt | 0,731 | 0,806 | 0,709 | 0,621 | 0,519 |

| Interbudgetary transfers of a general nature to the budgets of the Russian budget system | 1,003 | 1,096 | 0,791 | 0,672 | 0,682 |

Budget law

When there is a question: “What is a budget from a legal perspective?” - you need to remember that this is the name of the entire range of legislative norms involved in regulating relations that determine the procedure for the formation, distribution and use of various budgets of national or municipal importance.

Parliamentary budgetary law has the concept that everything is done after obtaining consent from parliament. Without this, it is impossible to make a change or even a small amendment to old taxes, you cannot take a loan from the state, and you will not be able to finance a state program.

When budgetary law is exercised, the people's representatives receive greater powers. These persons can not only take a direct part in the process of public administration, but also exercise supervision over all government actions related to planning and distribution of financial resources. This is how Moscow’s budget is formed.

The responsibilities and powers of the Ministry of Finance of the Russian Federation include drafting bills, which contain preliminary estimates reflecting both state budget revenues and expenses. Budget planning briefly refers to the process by which a budget is developed. After approval, the bill is submitted for consideration to the Government of the Russian Federation, where specialists finalize it and, if necessary, clarify some details. The government submits the project to the State Duma. There it must undergo consideration during three readings. From the first to the last stage, the verification and understanding of the project is carried out in more and more detail.

If the received bill is rejected by a majority vote of the State Duma, sometimes a conciliation commission is created, which includes many members of government agencies. Representatives of the Government of the Russian Federation, the Federation Council and the State Duma will be present. In order for the budget bill chosen by all government agencies to be approved and put into execution, all the necessary papers must be signed by the President of the Russian Federation.

Sometimes there are cases when the government does not have time to approve all provisions relating to the country's budget, and the president can also veto the budget. The definition of such a situation presupposes the presence of a budget crisis, since the necessary actions cannot be carried out on time, that is, many organizations and individuals suffer. Usually the entire state budget is calculated in advance, and the data obtained is compiled a year in advance. Planning documentation is also created, which covers the next 2 years, but is often subsequently adjusted. The budget of the Russian Federation begins each new financial year on January 1, but not all countries adhere to this date.

State budget deficit and surplus

A state budget deficit is an excess of expenditures over revenues, a surplus is an excess of revenues over expenditures.

There are few countries in the world with budget surpluses. Most people spend more than they earn. Even such economically powerful states as the USA (minus almost 0.9 billion dollars!), China (-475 billion dollars).

Creating an ideal budget for the year ahead is not easy. The revenue side includes potential revenues (expectations from customs duties, taxes, oil prices, national currency quotes, etc.), but they may change. The currency may devalue more than expected, fewer taxes will be received due to a slowdown in GDP growth, etc.

What should the state do if there is a state budget deficit?

- cut costs (reduce salaries for public sector employees, cut benefits, cancel benefits, curtail financing of social and infrastructure projects);

- increase external debt through obtaining loans or issuing bonds;

- empty gold and foreign currency reserves;

what to do if there is a surplus:

- increase expenses through increased salaries and benefits, additionally finance important social and infrastructure projects, etc.;

- transfer excess funds to the next year;

- direct excess funds to gold and foreign currency reserves by purchasing gold or foreign currency.

Structure

To ensure that budget items easily fall into a specific hierarchy, a complex and detailed budget structure is created. There are provisions that regulate this process:

- Responsibility is distributed to varying degrees among structural units. All submitted articles are subject to regular clarification and modernization. All departments can work both with information related to the country’s budget and with a specific clarifying article that is intended specifically for their department.

- Understanding and recording income and expenses together. With the help of these actions, a truly necessary and significant hierarchy of items is created, which is used in any actions relating to the state budget.

- The calculation and assignment of budget funds are carried out in order to ensure proper order and control over the movement of funds.

We study the categories of expenses and income of the family budget in detail

The family budget of any family consists of expenses and income. In one of the previous articles, I wrote about where to start maintaining a family budget and how to determine income and expense items. In this article, we will continue to explore the basics of home finance and take a closer look at each income and expense category.

In the table below, I indicated what the categories of expenses and income of our family look like, according to which my wife and I keep track of our personal finances.

I will comment on each point and start with income:

Husband's salary, wife's salary and other sources.

These are income categories. In an ordinary average family, there are few such income items, so I think everything is clear here. We indicate how much the husband received and how much the wife received. In the Other sources section, I indicate everything that came to me from other sources. These are all kinds of pranks, birthday gifts in the form of money, the sale of any items, such as a car or an old laptop. I even had such a case when in 2007 I was involved in two small car accidents where I was the injured party. Fortunately for me, these were minor accidents and in those cases I did not repair the car, but asked the insurance companies to transfer me funds for repairs to my bank account. After which, having withdrawn this money, he quite logically carried out this operation in his “ Family Budget ” as Income - Other Sources.

Mandatory expenses

| Mandatory expenses | |

| Credit | |

| Rent | |

| Internet | |

| Connection | |

This is a category of family budget expenses that we can’t escape from, no matter how much we want to. Here I included such expense transactions as rent, payment of telephone bills, Internet and loan payments. These are expenses that I practically cannot adjust, unlike others. Except for just paying for the phone. Of course, you can refuse to talk, but the savings will be dubious. And since I am an active person in life and associate many of my business qualities with mobility and efficiency, I need fast communication, which I include a mobile phone and the Internet, like air. Moreover, my direct income largely depends on these mandatory expenses. Family Budget may include other mandatory expenses; they can easily be determined after one to three months of accounting.

Products

| Products | |

| Meat fish | |

| Vegetables fruits | |

| Milk products | |

| Sweet | |

| Beverages | |

| Rest | |

This is a rather difficult category to fill out. Sometimes even boring. But still necessary for any family budget. The larger the breakdown into Subcategories you make, the clearer the situation with your grocery expenses will be. And the easier it will be for you to adjust your food expenses in the future. For example, one summer I noticed that our family budget had increased expenses for such types of products as drinks and sweets. Having analyzed the expenses of the family budget recently, I realized that they are connected with hot weather. It was July-August. At that time, spending on soft drinks, ice cream, milkshakes, etc. increased. Seeing that by mid-August I was overspending on my family budget for Food and Drinks, I realized that by the end of the month, if I didn’t take action, the overspending would increase. The first thing that came to my mind was to limit my consumption of drinks. But I immediately discarded this idea, since in hot weather the head thinks about something completely different and a dehydrated body simply will not give a chance to refuse soft drinks. I found the solution quite quickly. I bought dried fruits from a wholesale warehouse, from which my wife made tasty, healthy and thirst-quenching compotes. And they saved the family budget and quenched their thirst.

The same applies to the rest of the Subcategories of our family budget. Effective management of personal finances allows you to keep yourself within limits, spend money on food within reasonable limits, save profitably and be in good financial shape!

Automobile

| Automobile | |

| Fuel | |

| Repair | |

| Washing | |

| Insurance | |

| Taxes, fines | |

Here, we see expense items that are quite familiar to every motorist, such as fuel costs, repairs and maintenance, washing, insurance and taxes. Maintaining a family budget allows you to wisely distribute the financial burden of car maintenance throughout the year. For example, I always take out insurance in January. And in August I pay transport taxes. In the summer, I try to spend less money on car washes and wash the car myself more often. I'm going through a technical inspection in February. In April and October I try to change the engine oil and other “consumables” as necessary. In winter, fuel consumption increases, which causes adjustments in my financial plan. Well, accordingly, I try to plan some serious work related to the maintenance and repair of the car for the remaining months “free” from financial stress, unless of course it is some very urgent repair.

In the above text, I have already indicated such months as expensive for the family budget as January, February, April, August, October. This also includes the winter months: November, December and March. May, June, July remain free. During these months, I try to plan the family budget expenses related to car repairs. I do something myself, especially since in the summer it can be done outside. Sometimes I involve my father or friends. Well, if the matter is complicated, then I take the car to a service station. In the summer I buy winter tires, since during this period they have the lowest prices. Accordingly, I try to buy summer tires in winter, usually November or December.

Thanks to this approach, the load on the family budget under the item Car is usually evenly distributed throughout the year. And not the way it worked out for me before, when I didn’t plan such things in the family budget. Sometimes I could spend my entire salary on a car in one month because I didn’t calculate the workload. In such situations, it was often necessary to go into debt, since there was no money left for living, food, etc. Effective management of personal finances implies comfortable spending of your own funds, and not constant sharp changes from plus to minus, and vice versa.

Entertainment

| Entertainment | |

| Restaurant | |

| Pizza | |

| Sushi | |

| Movie | |

| coffee house | |

For a person to be productive throughout his life, he needs not only to work mentally and physically, but also to relax and have fun. Life is given to us once, so we must live and enjoy life, get pleasure from it. It is imperative to do what gives you pleasure and brings joy. Otherwise, life will become gray and boring and lose all meaning. But you also need to spend money wisely on entertainment. Effective family budget management will help you spend your money profitably. However, often people, in pursuit of entertainment, lose their goal in themselves and turn life into complete entertainment, which is dangerous in itself. You can't make entertainment the meaning of life. The fullness of life lies in this, that everything should be within reasonable limits.

In our family budget there is an expense item “Entertainment”. Proper management of personal finances allows us to control and keep ourselves within limits, but at the same time do what we like. For example, every weekend we try to entertain ourselves in different ways. In the table, I tried to indicate the most interesting ways of spending leisure time for our family. The family budget helped us determine how much money is needed for this or that entertainment. For example, based on two people, we usually spend 500 - 700 rubles on a movie. For sushi 700 - 1000 rubles, pizzeria 200 - 500 rubles, coffee shop 300 - 700 rubles, restaurant 800 - 2500 rubles, disco 1000 - 2000 rubles.

Here, as in other categories, we try to maintain an even distribution of costs throughout the year. Of course, there are situations when we go beyond our planned expenses. But maintaining a family budget helps us out here too. In such cases, we plan cheaper entertainment for the next weekend or sometimes refuse them and spend the weekend either outdoors or at home at the lowest cost. There was such a case when we went on vacation, which lasted from mid-September to mid-October.

During this vacation, we had a great rest, tanned, swam in the sea, gained strength and health, went to discos and restaurants every day, in general, had as much fun as we could, again within the framework of pre-planned money (we will talk about planning in more detail in the following articles). Of course, they paid well for it. Therefore, upon returning home, my wife and I decided that by the end of the year we would try to save our family budget under the Entertainment item, since we had a great vacation. And, from mid-October until the end of the year, there were practically no serious expenses for Entertainment in our family budget. This did not affect our psychological state at all, quite the contrary. We were able to save more money to invest in our future, which we were very happy about.

Self-care

| Self-care | |

| Beauty saloon | |

| Cloth | |

| Medicine | |

| Cosmetics | |

Organization budget

In this case, the budget is a document that explains the activities of the CFA or a specific functional area, usually responsible for certain transactions or processes. All information is evaluated in a quantitative sense, that is, either in terms of value or quantity. Sometimes this information is summarized and a full report is compiled.

The functional budget is drawn up personally by employees of the Central Federal District in a specific area for which they are directly responsible. In planning, the Central Federal District is limited only by the limiting factor. For manufacturing central federal districts, this factor is sales volume. Production volume is considered a limiting factor for those enterprises that purchase products.

Management budget

The budget becomes managerial when it reaches the upper level. Typically, experts use this term to refer to a combination of three types of budgets. This applies simultaneously to both income and expenses, and the entire process of moving financial resources together with the budget on the balance sheet. Three types of budget data are collected from information processed and provided by the Central Federal District.

When there is a question about what a budget is, you should remember: it is an important aspect in financial planning, therefore they pay special attention to it and do not spare personnel in any area of business or even a government-scale structure. If the budget is calculated correctly, order and exact compliance with any requirements are ensured in any area.

Revenues and budget surplus

The government’s explanatory note to the draft federal law “On the federal budget for 2020 and the planning period of 2021 and 2022” provides a forecast for a decrease in oil and gas budget revenues in relation to GDP from 7.6% of GDP in 2020 to 6.0% of GDP by 2022 year due to lower energy prices, a reduction in the share of the oil and gas sector in the structure of GDP against the backdrop of lagging growth rates in physical volumes of production and export of these products, as well as an increase in lost income associated with benefits provided to enterprises in the fuel and energy complex. As a result, the share of oil and gas revenues in total federal budget revenues will decrease from 40.8% in 2020 to 35% in 2022.

Question and answer Which regions of the Russian Federation receive the most money from the state budget?

The drivers of economic growth and, accordingly, the revenue side of the Russian federal budget will be export-oriented branches of the manufacturing industry (chemical complex, food industry, mechanical engineering) and the construction sector. Starting from 2020, against the backdrop of the first results of the implementation of structural reforms and the deployment of investment projects with government participation, growth rates are expected to accelerate. Economic growth will also be facilitated by the projected increase in household incomes, which will stimulate consumer activity within the country. Due to the sustainable growth of the most significant components of the population’s income (wages, pensions, social benefits), real disposable incomes of citizens, after near-zero values in 2020 (0.1%), will switch to a growth trajectory and will accelerate to 2.4% by 2024.

Budget Formatting

In any structure, even when it comes to the family budget, there is always the formation of a budget. It is especially important to draw up a budget for income and expenses, since this aspect affects the economic part of the entire enterprise. In order to draw up a competent budget structure, it is necessary to determine the principles for grouping items, indicate the composition and degree of detail of all financial movements.

The budget format is a free form that is approved in the system of a particular enterprise. A scale is determined on which a clear relationship between income and expenses emerges, and based on the data obtained, a plan for the further functioning of the system is drawn up.

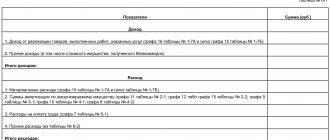

How is BDR formed?

This form of financial reporting allows you to make an accurate economic forecast based on an assessment of the current situation. Nowadays there are automatic programs that compile

such an analysis. This helps eliminate possible errors in its preparation and reduce the time for its preparation.

Before you begin creating this type of reporting, you need to systematize the organization’s local budgets. This can be production, cost, management and others. The BDR is a generalization of the obtained data.

Approaches to compilation

There are two ways to compile a report - top-down and bottom-up.

Top down

-financial items are set in accordance with the requirements set by management. The main disadvantage is that each stage can be too voluminous.

Down up-

First, all the data of the various articles is entered. The disadvantage is that the list of stages is difficult to unify. Articles that are repeated are difficult to identify. In such a situation, the budget will be overloaded.

To prevent this from happening, it is customary to combine two approaches and perform analysis using this algorithm

:

- Guided by the requirements of your superiors, set the structure of the articles. Then determine the criteria that are necessary for analysis and managerial generalization;

- Each responsibility center must have a list in which each item will be assigned an economic function.

Where to create a BDR?

We are confident that it is most rational to generate a report using a tabular report in Finoko. With its help, you can convert tables with calculations, combine reports from several departments, and compare data.

Items of income and expenses

The universal budget for all organizations has a common structure of articles.

Income structuring:

- from the main type of activity. These are all funds received that relate to the business of the company.

- revenue received from third-party activities not related to the main areas of work;

- Non-operating income can be received from participation in activities not related to the main one.

Cost structure:

- the total cost of all manufactured products

. This group includes all expenses associated with the production of goods. If the enterprise is large, then this may include the cost of purchasing raw materials, paying employees associated with the manufacturing process, and paying for electricity. Trading companies include in this section the finances spent on purchasing materials for sale. The presence of various articles in this section depends on the specifics of the company’s work. - business expenses

are associated with the provision and management of all activities of the organization. These articles are not included in other types. For example, rent payments, salaries of personnel not related to production, repair costs, business expenses. - other costs

may include interest on loans, fines, and differences in exchange rates.

Stages of compiling a report

Stage I - cost accounting.

This step is the main one, since it is from the accounting of expenses that all the main financial activities of the company are based.

The consumable part consists of:

- production costs;

- business expenses;

- cost of running a business;

- wages and money to pay taxes;

- other expenses.

Stage II - calculation of the revenue part

In this part, all financial receipts and assets of the company are calculated, these include

:

- sales income;

- funds received from the provision of services;

- money from rent;

- what is received through operations unrelated to the main activity - interest on loans, compensation payments.

Each company has different sources of funds, so different organizations at this stage have a structure

report may vary.

Stage III - determining the profit received

Here the difference between the company's income and expenses is calculated. For favorable financial development of the company, the value must be positive. If a negative figure is received, the business is considered to be incurring losses and operating at a loss. A critical forecast of further development has been obtained. Subsequently, a financial analysis must be carried out and the work adjusted.

Stage IV - drawing up a profit plan

The main task of the entire enterprise is to maintain and increase profits.

Professional work at this stage will speed up this process.

The second goal is to reduce expenses and at the same time get maximum profit. Here it is worth paying attention not to optimizing costs by reducing product quality. Rationalization and reduction of production costs must be carried out.

The purpose of planning is to ensure the existence and development of the organization:

- wages and funds to stimulate employees;

- raising money to improve and increase production volumes;

- obligations to partners and investors of the organization;

- increasing profitability and payback;

- work on competitiveness.

This work is influenced by the detailed work carried out on accounting for income and expenses.

Stage IV - reporting

The manager can entrust these operations to his financiers. This is also done by third party organizations. If you entrust this work to them, you can be sure of maximum objectivity. They can also provide a management report. It will take more time, but everything will be done professionally.

This approach to obtaining the BDR result makes it possible to assess the effectiveness of the company’s financial activities.

Budget of income and expenses of the second level

To assess the cost structure and determine the profitability of products sold, it is necessary to enter second-level expense items. Management should actively participate in this work, since it is the results of this analysis that determine what management decisions should be made.

First you need to analyze which items relate to the main activity and which to other activities. A structure of income and expenses must be developed by type of goods produced, by type of market, by type of currency.

Detailed budget items for income and expenses

The main criterion for this will be the structure of the company. Decide what functions each responsibility center performs. For each center you need to set income and expense criteria. Thanks to this approach, it will be possible to develop a structured system of lower-level articles. It will be clear to the heads of these centers. This is convenient, since they will be the ones who will plan work to improve performance in the future.

Planning based on a financial model

One of the most important activities of any organization is planning. This operation should be given special attention in order to complete the work and achieve the expected profit. To implement it, you need to use a set of certain tools.

Planning must be based on analysis. It should contain data for previous periods of time and expert opinion. Experts make a forecast for the future period. They also assess the state of the sales market, seasonality, and pricing. You can add costs to this report based on a number of factors:

- forecast of changes in the cost of raw materials;

- increase in utility costs;

- increase in prices for components.

The planning should also include employee salaries.

In this case, you need to take into account their number and its change over the selected time period, as well as the prices for their services. Pay attention to plans to increase or decrease monetary remuneration for work, and also do not forget about bonuses. Planning is carried out on the basis of a financial model. If the financial model of the business is drawn up and the income plan is determined, you can plan a system of actions to achieve the desired profit. It is recommended to draw up such a planning model not for the company as a whole, but for individual types of activities.

How does the budget process work?

The principles of the budget process are formed according to a certain structure:

- Checking compliance with all operating budgets and indicators obtained from the latest calculations.

- Determining priority and designating limiting items in order to finally control the movement of all funds, even regarding the issue that opens the family budget.

- Setting and justifying the main guidelines, and at the same time designating target indicators, discussing the plan for achieving them.

When grouping budget items that determine the income and expenses of an enterprise, specialists use the established budget classifier. It helps to clearly define management tasks, as well as identify business processes occurring in the present time.

Revenue part of the budget

When the revenue side of the budget is formed, the following aspects are taken into account:

- Sales volume of the main type of product or those goods that are produced in the largest quantities.

- The full amount of income from other activities.

- Forecast of income that should be realized in the future, as well as calculation of the difference at the national currency exchange rate. This value is determined depending on information on its change during the sale of gross output.

- Calculation of interest for loans and credits.

All income and expense items, if necessary, are detailed to any level, including not only the inventory side, but also services, contracts, projects and other aspects of budget planning. The narrow specificity of activities aimed at the production and sale of certain elements is taken into account. To determine the correctness of the tasks set and the analyzes performed, they resort to the concepts of economic feasibility, guided by previous calculations.

Consolidated budget

Consolidated budget

– a set of budgets of the Russian budget system in the corresponding territory (with the exception of the budgets of state extra-budgetary funds) without taking into account interbudgetary transfers between these budgets[1].

Balance of the consolidated budget

| Year | Deficit(-)/Surplus(+) (trillion rubles) | Non-oil and gas deficit (trillion rubles) |

| 2006 | 2,251 | -0,963 |

| 2007 | 1,990 | -0,907 |

| 2008 | 2,012 | -2,377 |

| 2009 | -2,449 | -5,342 |

| 2010 | -1,585 | -5,415 |

| 2011 | 0,861 | -4,781 |

| 2012 | 0,260 | -6,193 |

| 2013 | -0,848 | -7,382 |

| 2014 | -0,846 | -8,279 |

| 2015 | -2,820 | -8,682 |

| 2016 | -3,142 | -7,986 |

| 2017 | -1,349 | -7,321 |

| 2018 | 3,036 | -5,982 |

| 2019 | 2,115 | -5,809 |

Consolidated budget revenues

| Year | Oil and gas revenues (trillion rubles) | Non-oil and gas revenues (trillion rubles) | Oil and gas revenues (% of revenues) | Non-oil and gas revenues (% of revenues) |

| 2006 | 2,944 | 7,682 | 27,71 | 72,29 |

| 2007 | 2,897 | 10,471 | 21,67 | 78,33 |

| 2008 | 4,389 | 11,780 | 27,14 | 72,86 |

| 2009 | 2,984 | 10,616 | 21,94 | 78,06 |

| 2010 | 3,831 | 12,201 | 23,90 | 76,10 |

| 2011 | 5,642 | 15,214 | 27,05 | 72,95 |

| 2012 | 6,453 | 16,982 | 27,54 | 72,46 |

| 2013 | 6,534 | 17,909 | 26,73 | 73,27 |

| 2014 | 7,434 | 19,332 | 27,77 | 72,23 |

| 2015 | 5,863 | 21,059 | 21,78 | 78,22 |

| 2016 | 4,844 | 22,903 | 17,46 | 82,54 |

| 2017 | 5,972 | 25,075 | 19,24 | 80,76 |

| 2018 | 9,018 | 28,303 | 24,16 | 75,84 |

| 2019 | 7,924 | 31,573 | 20,06 | 79,94 |

Detailed structure of non-oil and gas revenues of the consolidated budget (2015-2019)

| Income item | 2019 (trillion rubles) | 2016 (trillion rubles) | 2018 (trillion rubles) | 2016 (trillion rubles) | 2015 (trillion rubles) |

| VAT | 7,095 | 6,017 | 5,138 | 4,571 | 4,234 |

| Excise taxes | 1,792 | 1,59 | 1,521 | 1,356 | 1,068 |

| Income tax | 4,543 | 4,1 | 3,29 | 2,77 | 2,6 |

| Personal income tax | 3,956 | 3,654 | 3,252 | 3,019 | 2,808 |

| Import duties | 0,717 | 0,673 | 0,589 | 0,564 | 0,565 |

| Insurance contributions for compulsory social insurance | 8,167 | 7,477 | 6,784 | 6,326 | 5,636 |

| Others | 5,302 | 4,792 | 4,501 | 4,732 | 4,149 |

Expenditures of the consolidated budget

| Expense item | 2019 (trillion rubles) | 2016 (trillion rubles) | 2018 (trillion rubles) | 2016 (trillion rubles) | 2015 (trillion rubles) |

| National issues | 2,335 | 2,132 | 1,953 | 1,85 | 1,848 |

| National Defense | 2,999 | 2,828 | 2,854 | 3,778 | 3,183 |

| National Security and Law Enforcement | 2,234 | 2,111 | 2,034 | 2,011 | 2,072 |

| National economy | 5,172 | 4,443 | 4,332 | 3,89 | 3,774 |

| Department of Housing and Utilities | 1,575 | 1,324 | 1,21 | 0,993 | 0,98 |

| Environmental protection | 0,25 | 0,148 | 0,116 | 0,084 | 0,072 |

| Education | 4,051 | 3,669 | 3,264 | 3,103 | 3,035 |

| Culture, cinematography | 0,588 | 0,528 | 0,493 | 0,423 | 0,396 |

| Healthcare | 3,79 | 3,316 | 2,821 | 3,124 | 2,861 |

| Social politics | 13,023 | 12,402 | 12,023 | 10,914 | 10,48 |

| physical Culture and sport | 0,376 | 0,332 | 0,327 | 0,262 | 0,255 |

| Mass media | 0,156 | 0,137 | 0,127 | 0,12 | 0,126 |

| Servicing state and municipal debt | 0,835 | 0,916 | 0,842 | 0,772 | 0,661 |