Why do you need to control your finances?

If a person regularly writes down where he spends money, it will be easier for him to understand what to do to save it.

Constant control over your funds not only disciplines you, but also helps you avoid making unnecessary purchases and leads to increased well-being. But these are not the only reasons why you need to train yourself to record expenses. Reasonable savings and planning help:

- Achieve your goals. You decided to buy a new refrigerator and saved five thousand rubles from each salary for three months. At the end of the fourth month, new appliances will decorate your kitchen. The goal was achieved, and the financial stability of the family was not affected. You know in advance what amount you should not count on and plan your monthly expenses, excluding the deferred five thousand.

- Control cash flow. Forgetting about the car loan, you bought yourself new shoes and a bag. You will have to borrow from friends or relatives for the debt. This means that next month you will need to give double the amount: part to the bank, part to those who gave the money. In order for the family to survive this time, it will be necessary to borrow again or reduce spending and give up most pleasures.

- Optimize funds. You've looked through several lists and are horrified at how many unnecessary things you buy every day. Money spent on nonsense can be used more rationally, for example, put aside for a summer vacation or to buy a coveted mink coat for your wife or a new suit for your husband.

- Decide on unexpected expenses. You will be able to save money. The moment you have to spend it doesn't have to be a bad thing. Friends may invite you to a camp site for a few days, or your daughter may ask for money for a class trip around the Golden Ring of Russia. Yes, you did not expect these events, but you will no longer be able to refuse them for material reasons.

- Strengthen family relationships. The visibility of the lists allows you to understand where you need to cut losses and where to increase your budget. You will be able to spend more on spending time together and less on junk food or unnecessary clothes. The price of a blouse that you put on once is a trip to the cinema for four people, with popcorn and Coca-Cola for everyone.

- Find the pressure lever. Children won’t whine that they haven’t bought anything for a long time, because you can always show them a list of the latest things. For a husband or wife who talks too much about saving, you can show how much money is spent on cigarettes or weekly gatherings with girlfriends in a cafe.

- Stabilize your position. In the modern economy, you cannot be sure that tomorrow you will not be left without work. The optimal distribution of money will make it possible to hold out for some time if a “rainy day” comes unexpectedly.

Newbie mistakes

There is a fine line between saving and greed. Many people, when managing their family budget, begin to infringe on their loved ones.

If you write down expenses in a notebook and see them, this does not mean that you should prohibit your husband from traditional trips to football or stop giving money for your daughter’s dance club. You can pamper yourself by ordering unhealthy but beloved pizza, or occasionally having dinner at a restaurant.

You don’t have to deny yourself chocolate if you can’t live without sweets in order to save 60 rubles, but you can stop buying water in stores. Better buy yourself a nice bottle and take it with you to drink from home.

Saving is one of the goals; you don’t need to put it at the forefront of everything.

Control and accounting of personal funds

It is easy not to keep records of profits and expenses, because the procedure takes a lot of time, which can be spent on entertainment.

Thinking with such criteria, a person aggravates his financial situation. It only takes a few minutes to keep track of your personal finances. Once you start keeping track of your personal expenses and income, you should enter the total amount spent or received each day.

It is recommended to keep daily records of personal finances, since maintaining weekly or monthly records will result in loss of data accuracy.

About ways to manage personal finances: how to write down what to use and how to control personal spending, information below.

Types of family budget

- Joint. All the money is collected in one hiding place or in a bank account, and within a month everyone takes from there as much as they need. Another option is that all finances are concentrated in the hands of one person who manages them. Another gives away everything he earns, leaving himself a small amount for necessary needs.

- Individual. Popular with young couples. Everyone has their own source of income, and purchases and payments for services are made on a first-come, first-served basis.

- Compromise. About 70% of the funds go to the general budget, and everyone takes the rest for themselves.

To start controlling your expenses, choose one of the forms, and then decide with your other half who will distribute the money and monitor its spending.

How to properly manage a family budget

To save money, always ask yourself three questions, the answers to which will help you eliminate unnecessary expenses and save money:

- What am I buying?

- Why am I doing this?

- Can this be avoided?

Consistently answer them every time you want to purchase something. If you definitely answer “Yes” to the last question, feel free to cross this item off your shopping list.

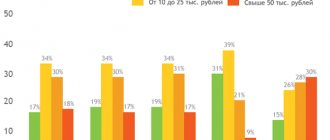

Economists have developed a formula that is used not only for the distribution of the state budget, but is also aimed at maintaining the financial stability of the cells of society. It's called the 50-30-20 rule. According to this tactic:

50% of the total salary should be set aside for things that you cannot do without.

This list includes:

- Food, including payment for school canteen or office lunches.

- Medicines.

- Fuel for transport.

- Public utilities

- Taxes.

- Internet and mobile communications.

- Cloth.

30% is entertainment and relaxation. They consist of the pocket money of each family member. Divide them by the number of people and stipulate that this is the entire amount that they can spend at their own discretion. You can demand a report, or you can give freedom of choice, but do not exceed the limit of the money issued. If the son spent everything in one day, that’s his problem. Teach your family to properly manage what they have.

This figure includes:

- Going to the movies, theaters, bowling, etc.

- Buying additional clothing or accessories.

- Trips.

The remaining 20% goes either to pay off debts, including loans, or is sent to the piggy bank as a reserve.

Tips for beginners

Your main goal is to start spending less than you earn. Ideally, after each distribution you should have a positive balance. It is obtained by subtracting from the available money those that will be spent.

First you will have to go into the negative: don’t be upset and be prepared for this. To quickly achieve the desired result, we suggest using our recommendations:

- Budget planning is a long, painstaking process that requires time and perseverance. You should set aside half an hour every evening to calculate your daily expenses and put them into the system.

- Prepare for the fact that the process of normalizing the home economy will take a long time. You won’t be able to start saving or saving right away. First, you need not only you, but also the other participants to get used to financial discipline and begin to control themselves.

- Record all expenses, keep records of any, even minor, loss of money. Don't miss anything, even packs of tissues and pens. Most of the money is spent on small things.

- Take receipts from stores, it’s easier to track what you’ve purchased.

- Plan big purchases in advance.

- Do not give large sums unless the life or health of someone close to you is at stake. In other cases, it is better to take time to think about the decision and return to the three questions mentioned above. If you can live without an expensive item for some time, postpone its purchase and include it in the next month’s expense sheet. Then the expenditure will move from the category of accidental to the category of planned and will not cause a blow to the budget.

- Open a deposit and put aside the money you can save there. Don't carry them over to the next month, but put them in the bank. This way you can save up for what you dreamed of, and the accumulated interest will pleasantly warm your soul.

- Distribute all debts. When planning expenses, you need to rely only on your own funds.

- Don't skimp on comfort. There is no need to take the subway to avoid buying gasoline. Irritability and fatigue are bad helpers in any situation.

- Refuse loans and any loans.

Learn to get satisfaction from what you do. If you are truly interested in financial transactions, read popular scientific literature on economics, chat with experts on forums. With a competent approach to business, you can not only improve the well-being of your home, but also move from the middle class to the category of wealthy citizens.

Fixed and variable costs

The two main types of costs that exist in an enterprise are fixed

and

variable

costs.

Fixed costs do not depend on output, while variable costs do. Fixed costs are sometimes called overhead. They are produced regardless of whether the firm produces 100 units or 1,000 units. When budgeting, fixed cost items may include rent, depreciation, and executive salaries. Manufacturing overhead can include cost items such as property taxes and insurance. These fixed costs remain the same despite changes in production volume.

On the other hand, variable costs fluctuate in direct proportion to changes in production volume. In the budget classification of manufacturing costs, labor and materials costs are typically variable costs that increase as production volume increases. More labor and material are required to produce more output, so the cost of labor and materials varies directly with the volume of output.

For many service companies, the traditional division of costs into fixed and variable costs does not work. Typically, variable costs are defined primarily as “labor and materials.” However, in service industries, labor is usually paid by contract or management policy and is thus independent of production. Therefore, for these companies it is a fixed cost rather than a variable cost. There is no hard and fast rule about which category (fixed or variable) is appropriate for a particular expense. For example, the cost of office paper in one company may be an overhead or fixed cost because the paper is used in administrative offices to perform administrative tasks. For another company, that same office paper may be a variable cost because the business produces printing as a service for other businesses. Each company must determine based on its own needs whether an expense is a fixed or variable cost to the business.

In addition to variable and fixed costs, some of the costs are considered mixed

. That is, they contain elements of fixed and variable costs. In some cases, the costs of supervision and inspection are considered to be mixed.

Examples of maintaining a family budget

We have selected the most popular options for planning expenses and will tell you how to maintain a family budget in notebooks and Excel spreadsheets, as well as pay attention to modern methods:

In the notebook

Paper home accounting is a classic option. We offer below a few photos that will help you get started. An example of how to keep a family budget in a notebook can be seen below.

You need to make several columns: income, mandatory expenses, balance, unexpected expenses. In income, record all the money that comes into your home, including scholarships, social benefits, alimony, and dividends.

In Excel

This is a popular and convenient way. On the Internet you will find both a basic template and complex variations. The latter reflect different payment methods, cash and non-cash, as well as types of currencies, including electronic money.

We recommend starting with a simple sheet that reflects the needs that are common to most Russian people. You will have to supplement a lot, since each cell of society has different needs and different incomes. One table is filled out for one month, but it’s better to think about what you will have to pay for two to three months in advance. Then you will have a clear plan that you can adjust minimally. Pay attention to the Excel spreadsheet, which shows how to properly and effectively manage a family budget in order to save money.

"Rubbish"

This is an online service convenient for doing home accounting. It allows you not only to make an annual plan, but also to automate many aspects. It is linked to a bank card, so completed transactions immediately fall into the correct column. The service is convenient for people who prefer cashless payments. Several users can be linked to one account, which will simplify joint work on the budget. All family members can contribute their own expenses. The big disadvantage of this service is that it is paid. A subscription costs about 600 rubles and this is one of the purchases that you can do without. But if you are a business person who has no time to fill out papers and tables on the computer, this is an option for you.

Phone apps

The developers in both PlayMarket and the App Store have taken care of you. They have created many programs that allow you to control your spending and the expenses of your household. Download an organizer where you can make notes on product prices. The big advantage of these programs is that you don’t have to struggle with numbers. They will do everything for you. They also tell the owner where too much has been spent and where the amount of funds allocated can be increased. The phone will help you track discounts, promotions, and bonus programs that take place both in large stores and at local locations. There are both paid and free versions of these applications. If you can't decide, try several demo options.

To summarize, we note that we have talked about only some of the ways to exercise budget control. Take one of these and change it to suit your family's preferences. Remember that smart saving is a great way to increase your wealth.

Income and expenses table in Excel

Most people have a fairly good command of a computer, as well as office applications, one of which is Microsoft Excel. This is where you can and should manage your home budget.

There is quite a lot of room for action here. You can create complex formulas and record your income and expenses daily, weekly, monthly, and even year-round. Fortunately, the Excel workbook has many sheets.

For a home budget template in Excel, take one of the simplest forms, which will take into account the following data:

- every month on a separate sheet of Excel workbook;

- in each sheet there is a distinction between the income and expenditure parts and their subsequent summation;

- a summary (summary) table in which you can view all income and expenses for the current year;

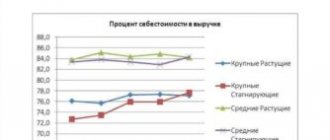

- If desired, you can create charts and graphs to determine your most costly or profitable months.

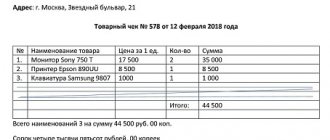

As you can see in the image, the table clearly shows the dates of the financial transaction, the amount of income and expenses, and where or where the money came from.

At the bottom of the table, using formulas, the totals are calculated separately for income and expenses, as well as the final balance (cash balance) at the end of the month.

But in this figure you can see that to analyze money spending, you need to use the “Filter” function to determine where and how much money goes every month. Expense items should be given special attention, since analysis determines where exactly most of the family’s funds go.

In the following figure you can see the summary table for the year. With its help, the annual balance of family finances is determined.

For information. Excel is by far the most accessible and easy-to-use program with which you can easily improve your financial situation in the family by managing all incoming and outgoing transactions.