The dispatcher in the field of cargo transportation is one of the central actors.

His responsibility is to assist the owner of the cargo in finding freight transport for transportation and, most importantly, this business idea does not require financial investments.

That is, the dispatcher is between the owner and the carrier, taking into account not only the specifics of the cargo, but also the nature of its transportation. The specialist is obliged to provide the client with suitable transport in the shortest possible time, thereby providing the car owner with a profitable order.

In addition, the dispatcher assumes the obligation to organize interactions between several orders during the delivery of consolidated cargo. Thus, joint activities with the dispatcher are beneficial for both senders and carrier companies.

OKVED concept

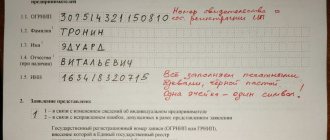

After registration, companies are assigned individual numbers and codes that reflect the selected type of activity in a digital designation. It is called OKVED - the all-Russian classifier of types of economic activity. Codes are also assigned to companies engaged in cargo transportation and transport services.

Variety of modes of transport to provide services

What should a business owner consider before choosing an OKVED code from the classifier?

- The OKVED code is needed by government agencies so that they have an idea of what the entrepreneur does.

- Information about the types of activities is entered into the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs.

- When registering, an entrepreneur has the right to indicate several OKVED encodings; their maximum number is not limited. However, he is not obliged to engage in all selected activities immediately after registration.

- You can add new codes and remove unnecessary ones from the Unified State Register of Legal Entities (USRIP) at any time.

- Carrying out an activity for which the OKVED code was not specified during registration is a serious violation. Having started a new activity, you need to inform the Federal Tax Service about it within 3 days in order to enter new OKVED codes into the Unified State Register of Legal Entities/Unified State Register of Legal Entities (Clause 5, Article 5 of the Law on State Registration of Legal Entities and Individual Entrepreneurs No. 129-FZ of 08.08.2001). If the tax office reveals such a violation, the entrepreneur or head of the company may be held administratively liable and fined 5,000 rubles. (clause 3 of article 14.25 of the Code of Administrative Offenses of the Russian Federation).

Rules for choosing economic codes

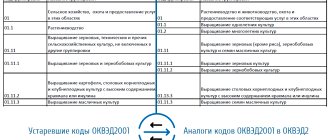

According to OKVED, cargo transportation can be carried out by different modes of transport. Accordingly, the codes will differ depending on the specific type of activity, as well as the transport used to provide the service. They mostly coincide in the Russian Federation, the Republic of Belarus and the Republic of Kazakhstan. In Belarus and Kazakhstan, some are different, as they are adapted to local legislation.

Attention! The OKVED directory for cargo transportation has not changed in 2020. At the moment, the numerical designations remain the same as they were.

In 2020, transport services are assigned OKVED numbers immediately after registration of a legal entity or individual entrepreneur. The company is obliged to conduct its trucking operations in strict accordance with this code. If the direction of activity changes, you need to contact the Federal Tax Service within 3 working days and report the changes. Subsequently, the enterprise is assigned a new code corresponding to its current activity profile.

In accordance with OKVED, transport services are provided in different ways. In general, such activities are divided into transportation and storage. The first numerical designation indicates the type of vehicle:

- 49 – land or pipeline;

- 50 – water;

- 51 – air (or space, but such transport services are not provided by logistics LLCs or individual entrepreneurs).

It is also envisaged that firms will provide additional services:

- 52 – auxiliary transport services, mainly provided in the field of agriculture;

- 53 – public postal or private courier services.

The indicated numerical designations correspond only to class affiliation: just these 2 numbers will not be enough. A more detailed identification of activities by profile will definitely be required.

How to choose the right OKVED code for courier activities

What will the OKVED code “Courier activities” be in 2020? The code selection will be carried out as follows:

- In the directory OK 029-2014 (NACE Rev. 2), you need to select the appropriate section. In our case, this will be section “H”, which is called “Transportation and Storage”.

- Now in section “H” you need to find class “53”.

- Next you need to find go to subclass 53.2. It contains the types of activities that interest us.

Let's consider which OKVED codes for courier activities were included in the classifier in 2019:

- 53.20 – other postal and courier activities;

- 53.20.3 – courier activities;

- 53.20.31 – courier delivery by different modes of transport;

- 53.20.32 – home delivery of food;

- 53.20.39 – other courier activities.

Class 53.20 does not include delivery by freight transport.

Thus, in the OKVED-2 classifier, group 53.20 is allocated for courier activities.

Read also: List of licensed activities 2020 according to OKVED

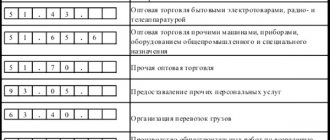

For road transport

Note! According to OKVED statistics, cargo transportation by road in 2020 is the most popular direction among the variety of transport services.

Therefore, the first in the digital designation will be 49; a subclass is also selected - 49.4, which means that the enterprise provides relevant services in road transport, mainly related to the transportation of passengers or goods. Ordinary vehicles can also be used if a very small load needs to be delivered.

Any vehicle can be used

But the above 3 numbers are not enough to register an enterprise officially. Subclass 49.41 - road freight transport is also divided into:

- …1 – use of specialized vehicles;

- …2 – use of non-specialized vehicles;

- …3 – use of trucks driven by a corporate driver.

Subclass 49.42 is transportation-related services.

The list of OKVED codes for freight transportation in 2020 for individual entrepreneurs and LLCs has been supplemented with additional items:

- 52.10 – storage;

- 52.21 – auxiliary services on land vehicles, including the use of a truck or other large-scale transport;

- 52.24 – processing;

- 52.29 – other ancillary services related to the transportation of goods.

Also, the numerical series is supplemented if services are provided by couriers:

- 53.20.3 – delivery by courier;

- 53.20.31 – delivery by courier by car, taxi or other transport;

- 53.20.39 – other courier delivery services.

Where to start organizing a business using freight dispatcher services

To properly organize a business, it is better to act simultaneously in several directions:

1. Registration of business as individual entrepreneur and LLC . Registering an LLC will allow you to work with legal entities who prefer to pay by bank transfer with VAT added. To cash out funds, you will need the services of a legally competent accountant.

At the same time, registering an individual entrepreneur will allow you to cooperate with carriers who work only in cash without VAT.

2. Workplace equipment . If you plan to work from home, you can organize a personal office for yourself, but it is still advisable to draw up a lease agreement and calmly move into the premises, bringing in furniture and the necessary equipment.

To operate the dispatcher you will need:

- permanent cellular connection with registration of a direct city number;

- landline telephone with the ability to receive and send faxes;

- PC or laptop with Internet connection;

- ready-made contract forms, invoices and waybills;

- manufactured seals and stamps for two enterprises: individual entrepreneur and LLC;

- office;

- automobile code of the Russian Federation, maps of roads and highways.

3. Finding clients usually does not cause much trouble . You need to send your data to several transport companies that have their own fleet of vehicles. Next, you can register on city or regional websites related to cargo transportation.

It would be a good idea to advertise through newspapers and radio. As time has shown, saving on advertising is undesirable. A well-executed advertising campaign will quickly pay off, and the first orders will soon begin to arrive.

The next step is to search for organizations whose activities may require the transportation of goods. Most of these enterprises have their own proven dispatchers, but they are often ready to take the data of newcomers for backup.

4. Constant monitoring and assessment of the market allows us to collect available data on various transport companies or private enterprises. This will allow you to analyze the key areas in the work of enterprises, their routes in the city and beyond.

It will be important to familiarize yourself with the tariffs and be aware of their changes. All this data will help you respond as quickly as possible and offer the client several possible options. Speed and communication skills have a positive impact on the dispatcher’s reputation, which leads to an expansion of the client base.

5. Maintaining documentation . You should always start working with a customer by concluding a contract. This is a guarantee of decent wages. You need to take document management very seriously.

It is advisable to take into account all the little things so that serious problems and misunderstandings do not arise during work. In any case, if questions arise or doubt arises, it is necessary to clarify or ask again.

The documents drawn up must clearly indicate the following data: the type of car and its license plate number, the driver’s passport details, the name of the cargo, its quantity and type of packaging.

6. Own website . Creating and promoting your own website will allow you to find not only customers, but also performers (car owners). When operating this way, it is important to find decent drivers.

The principle of operation here will be the same as before: the driver, having received the order, delivers the cargo, unloads it and immediately calls the dispatcher, clarifying in which area of the city he is located. The dispatcher’s task is to find a load in the specified or nearby area and send his released driver there.

7. Payback . Profits will start flowing in within the first week. This is the maximum delivery time for cargo within the country. In many ways, your income will depend on the cost of transportation, but for fruitful work it is advisable to check prices on specialized websites.

Further work depends entirely on desire and capabilities. Do not forget that a business will regularly make a profit only if it plays fair.

There is a lot of competition in this field of activity, and few people will work with a poorly proven dispatcher.

For cargo transportation by other modes of transport

Since cargo is delivered not only by road transport, but also by other means, there are other groups/subgroups in the OKVED list.

Nautical

When an enterprise plans to provide transportation-related services through the use of sea cargo or other vessels, it is assigned code 50.20. The group includes:

- Standard sea transportation.

- Transportation by towing.

- Renting ships (possibly with your own onboard crew) for cargo transportation.

Inland waterway

To provide services within the framework of inland water freight transportation, companies receive code 50.40. The group includes:

- Transportation along inland waterways and water areas.

- Mixed transport, for example, partly by rivers and seas.

- Transportation of nuclear weapons or waste across waters.

- Rental of vessels for the provision of services within the framework of mediation activities.

Air

For the transportation of goods by air, code 50.21 is selected.

Note! The group includes independent and separate transportation, as well as rental of transport in general, or a luggage compartment in particular for the provision of the corresponding service.

OKVED logistics

Logistics refers not so much to freight or other transportation as to planning and creating suitable routes.

An example of how many factors need to be taken into account when creating competent logistics for transporting goods

Such activities are called auxiliary activities and are assigned code 52.29. The group includes the following areas:

- sending cargo according to schedule;

- preparation for departure, organizational activities, forwarding;

- work with transport documents, various waybills and others;

- distribution and activities related to the optimal sorting of goods for fast and profitable transportation;

- brokerage customs activities, consultations and professional information support for clients;

- intermediary service;

- auxiliary services for preserving or preparing various items for transportation, for example, strengthening packaging or placing items in protective film to prevent contact with water.

This group does not include the following types of services:

- postal or courier deliveries (53);

- insurance of transport or cargo (65.12);

- travel services, including transportation of passengers to attractions, airport transfers or similar (79.11, 79.12, 79.90).

Also included in the group and subgroup is code 63.40. This includes:

- transport or forwarding services provided within one company;

- private or corporate activities of customs brokers or forwarders;

- drawing up the best and most optimal routes.

Logistics companies can offer a wide range of services simultaneously.

Note! Most often, clients are interested in transfer products.

For example, they want to send a single or large shipment to another country or even to another continent. In this case, they hire logisticians who draw up competent routes with possible transfers of cargo from one type of transport to another.

New OKVED codes for transport services, taxis, cargo transportation 2020

The article uses new OKVED 2020 codes with decoding (OKVED 2)

We invite you to use a ready-made set of OKVED codes compiled for transport services, taxis and cargo transportation. The set of codes is suitable for both LLC registration and individual entrepreneur registration.

If necessary, in the case of a more expanded scope of activity of your company, you can independently supplement it with other codes corresponding to the type of activity of your future company.

52.24 Cargo handling

This grouping includes:

- loading and unloading of cargo and luggage of passengers, regardless of the type of transport used for transportation;

- loading and unloading of dangerous goods on railway transport;

- stevedoring activities;

- loading and unloading of freight railway cars

This group does not include:

- terminal activities, see 52.21, 52.22 and 52.23

49.31.25 - Transportation of passengers by funiculars, cable cars and ski lifts that are part of an urban or suburban transport system 49.32 - Taxi activities

This class also includes rental of cars with driver

49.39 — Activities of other land passenger transport, not included in other groups

This grouping includes:

- other transportation of passengers by road: bus transportation subject to a schedule in intercity and international traffic, charter transportation, excursion and other irregular automobile (bus) transportation, transportation of passengers by express trains going to the airport;

- transportation of passengers by funiculars and other cable cars, if they are not part of urban or suburban transport systems

This group also includes:

- transportation by school and service buses;

- transportation of passengers by vehicles driven by using people or animals as draft force

49.41 — Activities of road freight transport

This grouping includes:

- all types of cargo transportation by road on roads: dangerous goods, large and/or heavy cargo, cargo in containers and transport packages, perishable goods, bulk bulk cargo, agricultural cargo, construction industry cargo, industrial cargo, other cargo

This group also includes:

- rental of trucks with driver;

- activity of transporting goods by vehicles driven by people or animals as draft force

49.41 Activities of road freight transport

This grouping includes:

- all types of cargo transportation by road on roads: dangerous goods, large and/or heavy cargo, cargo in containers and transport packages, perishable goods, bulk bulk cargo, agricultural cargo, construction industry cargo, industrial cargo, other cargo

This group also includes:

- rental of trucks with driver;

- activity of transporting goods by vehicles driven by people or animals as draft force

49.41.3 - Rental of freight vehicles with driver 52.29 - Other auxiliary activities related to transportation

This grouping includes:

- dispatch of goods;

- preparation or organization of transportation of goods by land, water or air transport;

- organizing the dispatch of consignments of goods or individual shipments by land, air or water transport (including the collection and distribution of goods);

- preparation of transport documentation and waybills;

- provision of customs brokerage services;

- activities of sea freight and air transport forwarders;

- intermediary operations for the freight of cargo space on a ship or on an airplane;

- transport handling of goods, for example, temporary crating to ensure protection of the goods during transport, unloading, sampling and weighing of goods

This group does not include:

- postal and courier activities, see 53;

- activities related to insurance of land, water, air and space assets, see 65.12;

- activities of tour operators and travel agencies, see 79.11, 79.12;

- activities related to the promotion of tourists, see 79.90

To carry out your activities, you must select OKVED codes. There may be several of them, but there is only one main one! The OKVED classifier contains codes under which your activity will be required to have licensed status and you will be required to obtain the appropriate license. Therefore, when registering your company and choosing the main type of activity, do not forget to look at the list of licensed activities.

Transport services

Classes of OKVED codes for transport services:

- 49 – land;

- 50 – water;

- 51 – air and space;

- 52 – auxiliary (for example, storage);

- 53 – courier.

Areas of activity that are not related to transport services:

- technical service of cars and other types of transport;

- vehicle repair;

- car rental without hiring drivers;

- construction of tracks, highways, railways, aircraft runways and landing strips, as well as maintenance and servicing of these communications.

All about OKVED codes

If you want to carry out international transportation, you need an OKVED code. International transportation is a complex matter that requires competent preparation. You can contact for advice. implements international delivery of goods by various modes of transport: road transport, air transport, as well as sea transport and railway. Our specialists will provide you with advice on foreign trade issues, as well as help with customs clearance and provide many other services.

Types of OKVED codes

There are the following types of OKVED codes for cargo transportation and auxiliary activities:

- Storage of goods, as well as their transport handling - 63.1.

- Carrying out cargo handling – 63.11. This includes loading and unloading operations on various types of transport.

- Carrying out transport handling of containers - 63.11.1.

- Carrying out transport processing of other types of cargo - 63.11.2.

- Storage and warehousing of all types of cargo - 63.12. Storage is carried out in warehouses, granaries, bunkers, refrigerated warehouses, etc. This also includes the performance of warehouse operations in seaports.

- Storage and warehousing of refrigerated and frozen cargo - 63.12.1.

- Warehousing, as well as storage of liquid and gaseous cargo - 63.12.2.

- Warehousing and storage of oil and petroleum products - 12/63/21.

- Storage and warehousing of gas and gas processing products - 12/63/22.

- Storage, as well as warehousing of other gaseous and liquid cargoes - 12/63/23.

- Storage and warehousing of grain - 63.12.3.

- Other auxiliary transport activities - 63.21.

- Organization of cargo transportation - 63.40.

International transportation of goods from door to door along with customs clearance in 3 days. Place your order by phone +7(495)133-8780

Organization of cargo transportation

Organization of cargo transportation (63.40) includes:

- The work of freight forwarding agencies, as well as forwarding services for cargo of various configurations on all types of transport.

- Organization of transportation by water, air and land transport.

- Acceptance of individual and group consignments of cargo.

- Preparation of transport documentation, as well as waybills.

- Organization of group shipment of goods by water, land, and also by air.

- Activities of customs agents.

- Activities of freight forwarders and freight agents.

- Cargo transportation operations.

carries out delivery of the following types of cargo:

- General.

- Dangerous.

- Fragile.

- Large-sized.

- Urgent.

- Bulk.

- Long.

- Heavy.

- Liquid.

- Containerized.

- Valuable.

- Perishable.

- Bulk.

will provide competent advice on foreign trade activities, as well as quickly and efficiently deliver your goods.

For more accurate information about OKVED codes, international transportation and customs clearance, call +7(495)133-8780

UTII and features

UTII (unified tax on imputed income) is a taxation format in which an entrepreneur will need to pay a fixed amount to the state treasury, regardless of the amount of income he received. For large forwarding organizations, such a tax is more profitable than a simplified one.

The main feature of “imputations” is that the entrepreneur pays a fixed amount. If his income increases, this does not affect the tax. The simplified tax rate directly depends on income, and if the company does not receive it, then no tax is paid. This option is more profitable for a small entrepreneur who is just starting his work.

Main and additional OKVED: what is the difference?

How does the main activity differ from additional activities? Let's find out! So:

The main OKVED is a code for the type of economic activity that most accurately reflects the specifics of your business;

Important! When filling out form P11001 or P21001, you can indicate only one main type of activity.

Additional OKVED are codes that reflect related activities.

Important! The current legislation of the Russian Federation does not limit the number of OKVED codes that you can indicate when registering an LLC or individual entrepreneur.

Which code to choose

Managerial employees of the enterprise must select a code when registering an individual entrepreneur, LLC or other legal entity

You cannot choose the OKVED code you want: there is a system according to which the selection is made

The encoding includes the following levels:

- 2 digits – levels;

- 3 – sublevels;

- 4 – groups (for example, 49.41, 49.42, 60.24);

- 5 – subgroups;

- 6 – type of activity.

The encoding must be complete, including all 6 numbers of this digital series. The classification is reviewed and changed from time to time.

Attention! Some 2020 codes are no longer relevant in 2020. Therefore, entrepreneurs are advised to always follow the latest news to avoid problems.

Thus, in order to legally carry out business activities, it is necessary to choose the correct OKVED code. If a businessman cannot do this on his own, it is permissible to contact the relevant authorities and describe the potential work of the company. They will select the appropriate code based on the law and experience.

Which tax system to choose?

How to change the tax system for individual entrepreneurs and how often can this be done?

The correct choice of taxation method will allow individual entrepreneurs to make cargo transportation more efficient and profitable.

UTII

In this case, tax is paid not on real, but on imputed income. An important feature of the taxation system under consideration is that individual entrepreneurs with different income levels pay the same tax to the state. This is an example of a situation where legal requirements are beneficial to the individual entrepreneur.

In order to work this way, you must meet the following requirements:

- There are restrictions on the number of equipment used, including for passenger or cargo transportation. This number includes not only those cars that are owned, but also those that are received for use in some way (for example, through rent). An individual entrepreneur on UTII cannot have more than 20 units of equipment.

- The number of employees is limited to a limit of 100 people.

It is important to consider that an individual entrepreneur may have several types of activities, not just one. In this case, the tax will be considered separately for each of them. This cut can be used in conjunction with the simplified tax system.

Self-employed drivers have the right to transport goods

The disadvantage of this method is that the tax must be paid in full even when freight transportation services were not provided at all. The amount of payments depends on the region or region.

USN (Simplified)

Simplified tax regime. When using it, you must choose one of two options:

- Calculation of taxes based on income received without taking into account expenses. In this situation the rate will be 6%.

- Work on the “income minus expenses” system. In this case, to calculate the mandatory payment, documented out-of-pocket expenses are subtracted from the total income received. In this case, the tax base will be smaller, but the rate will be 15%.

An individual entrepreneur cannot refuse the simplified form until the end of the calendar year.

Working on the patent system may be more profitable. than on the general

This method of taxation can be beneficial for road freight transport, but it can only be used by those who meet the following conditions:

- The total number of the workforce can be no more than one hundred people.

- The reporting period here is the calendar year. The total amount of income for this period cannot be more than 150 million rubles.

- The residual value of fixed assets, according to reporting, cannot exceed 150 million rubles as of the beginning of the 4th quarter.

- In the first 9 months, the funds received should not exceed 112.5 million rubles.

Those who use this option receive a number of advantages:

- There are two options from which you can choose the most suitable one.

- Minimal effort is required to maintain accounting records. He doesn't need to keep a cash register.

- When paying the appropriate amounts to the Pension Fund, they can be deducted from personal income tax when paying for the year.

Despite restrictions on the number of people and revenue, this system is preferable in many cases. In this case, there is almost no need to fill out accounting documents.

You can start with one machine and create a profitable business

BASIC

The general system requires full accounting. It is suitable for those whose business is quite developed. With such activities, there are no restrictions on the number of trucks or the amount of income. In this case, it is convenient to work with those individual entrepreneurs who are VAT payers and legal entities.

However, in this case there are the following disadvantages:

- In the process of working as an individual entrepreneur, transportation requires the preparation of a significant number of documents.

- It will not be possible to maintain reports and fill out forms on your own and you will need to hire a professional accountant for this.

- You will need to pay VAT. However, you can refuse this by writing a corresponding application to the tax office.

Such a system is often not profitable enough for beginning entrepreneurs. In this regard, it is recommended to consider switching to one of the special taxation systems.

Patent (PSN)

Payment for a patent is carried out for a period of 1 to 12 months.

At the same time, a patent for cargo transportation implies the following restrictions for individual entrepreneurs:

- No more than 15 employees.

- Revenue during the period of validity of the document cannot exceed 60 million rubles.

- The area used during the entire period cannot be more than 50 square meters. meters.

Note! A patent must be obtained separately for each type of activity.