OKVED - Retail trade outside of stores - decoding

When deciding what type of activity to engage in, every novice businessman considers all possible options that require both lower costs and successful development.

Now there are a huge number of them, and one of these options is reflected in 52.63 OKVED, its decoding means retail trade carried out outside of stores. In fact, this type of trade allows you to cover a significant territory. Most often, this type of trade is used in small towns. By choosing certain localities to sell products and regularly trading there on designated days, each businessman will have his own clients.

Outbound trade OKVED 2020

Below you will find a convenient module “OKVED codes for 2020 with decoding”. The classifier contains a search for codes for individual entrepreneurs and LLCs. Just enter the keyword of your activity in the field below and get a selection of the necessary codes. All codes indicated on the website correspond to the new edition of OKVED 2. If you decipher this abbreviation, it will sound like this: All-Russian Classifier of Types of Economic Activities.

47.76 Retail trade of flowers and other plants, seeds, fertilizers, pets and pet food in specialized stores 47.76.1 Retail trade of flowers and other plants, seeds and fertilizers in specialized stores 47.78.3 Retail trade of souvenirs, folk arts and crafts, objects of cult and religious purposes, funeral supplies 53.20.3 Courier activities 74.10 Activities specialized in the field of design 71.11 Activities in the field of architecture 82.92 Activities for packaging goods This group does not include:

What OKVED codes are needed for trading fruits and vegetables

- 47.11 Retail trade primarily in food products, including drinks, and tobacco products in non-specialized stores

- 46.31 Wholesale trade in fruits and vegetables

- 46.39 Non-specialized wholesale trade in food products, drinks and tobacco products

- 47.19 Other retail trade in non-specialized stores

- 47.21 Retail trade of fruits and vegetables in specialized stores

- 47.81 Retail trade in non-stationary retail facilities and markets in food products, drinks and tobacco products

- 47.89 Retail trade in non-stationary retail facilities and markets of other goods

- 53.20.31 Activities for courier delivery by various modes of transport

- 82.92 Activities for packaging goods

In case of a more expanded type of activity of your company, contact the BUKHprofi company for help; the company’s specialists will not only select OKVED codes, but also register your company on a turnkey basis, quickly and at a minimal cost.

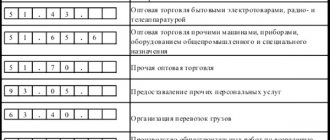

OKVED table for retail trade in 2020

In 2020, the latest amendment was made to the OKVED code. Thanks to this, editions 1 and 1.1 will be canceled this year, and the appearance of the second edition is completely different from the previous ones, which introduces some difficulties in the preparation of documentation among entrepreneurs.

- Classification of organizations, private and individual enterprises and firms of any organizational and legal form according to the type of their activity.

- Assigning a separate code to each type of activity.

- Regulation of this activity.

- Monitoring companies.

- Going international.

- Informing higher authorities.

Current OKVED codes for 2020

ATTENTION! Example: if you are involved, for example, in clothing (sale, manufacturing, etc.), enter “CLOTHING” in the field, and the script will display ALL OKVED codes that are associated with clothing. That is, mentions of clothing in all cases. Try it, it's convenient!

- When choosing OKVED codes, future businessmen, in particular the founders of an LLC, should remember that there must be a 100% coincidence of the types of activities specified in the application and those indicated in the charter, otherwise tax officials can easily refuse registration. But even if the initial stage of registration with the tax service is completed successfully, problems may well arise when opening a bank account, since bank employees check documents no less carefully;

- The law does not in any way limit the number of OKVED codes included in the application for registration of an enterprise. Therefore, businessmen often enter not only those specific types of activities that they actually plan to engage in, but also those that they envision only in theory. The accumulation of codes from the classifier included in title documents entails a number of dangers. Let's give just one fairly common example: some types of activities may be subject to a special UTII tax regime, and in such cases, tax authorities may require an entrepreneur or organization to submit separate reports on them. Thus, experts advise holding back and not adding more than two dozen OKVED codes to the constituent documents and, when choosing them, carefully study the features of each type of activity, including from the point of view of tax legislation;

- It is extremely important to correctly understand and interpret the names of the types of activities listed in OKVED. Otherwise, an incident may arise in which the most necessary and relevant type of activity will not be included in the state register for a given organization or individual entrepreneur. The consequences of such an incident are unpleasant. Firstly, if necessary, it will be impossible to obtain a license, and secondly, it will be impossible to switch to UTII, which operates for strictly defined types of activities at the local and municipal level.

We recommend reading: Calculation of the Social Scholarship in 2020

Codes of types of entrepreneurial activity UTII

- First of all, please note that the application for UTII indicates only two digits of the code, while OKVED codes when registering a business by type of activity have four or more digits.

- Secondly, the classifier of types of economic activity has a complex branched structure of hundreds of different codes having from two to six characters. And there are only 22 activity codes that are indicated in the UTII application.

- Thirdly, the codes are approved by various legal acts:

- by order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/ [email protected] for an application for the transition to imputation;

- by order of Rosstandart dated January 31, 2014 N 14-st for the OKVED classifier.

Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each exceeds 5 square meters

How to choose the type of activity of an individual entrepreneur according to OKVED codes

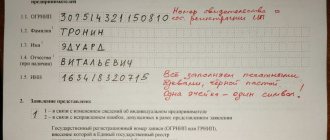

Application P21001 is a simple document to fill out; you only need to indicate the passport details of the future entrepreneur and the direction of business. The OKVED classifier is freely available in legal reference systems, free services for preparing registration documents, and other sources. The main thing is to pay attention to the fact that the OKVED directory you found was approved by order of Rosstandart dated January 31, 2014 N 14-Art.

The group with the OKVED code 56.10 includes a subgroup with the code 56.10.2 (Activities for the preparation and/or sale of food ready for immediate consumption on the spot, from vehicles or mobile benches), and it, in turn, includes a code of the type 56.10 .24 “Activities of market stalls and food preparation stalls.”

08 Feb 2020 juristsib 560

Share this post

- Related Posts

- What kind of battery should be in the entrance?

- Privatization of property in Russia for 2020

- State duty on the sale of land in 2020

- Personal income tax for Ukrainians in 2020

Rules for delivery and peddling retail trade in 2020

During peddling trade, when a seller comes to the buyer with a tray of goods (at home, at work, in transport), food products cannot be sold. Only those food products, confectionery, cakes, chocolate, ice cream, bakery products that are packaged in original packaging are allowed.

We recommend reading: What you need to rent out an apartment

The fair can be organized by state and municipal authorities, as well as legal entities and individual entrepreneurs. The fair organizer develops the rules of the fair, the operating hours, determines the places where distribution and distribution trade will be carried out, determines the payment for the place and for services to sellers (electricity, water, security, cleaning the territory, veterinarian work, etc.).

How to calculate UTII for delivery (distribution) trade

In distribution trade, goods are sold through specialized vehicles, as well as mobile equipment used only with transport. This type of trade includes trade using a car, a car shop, a car shop, a toner, a trailer, a mobile vending machine. This follows from paragraph 17 of Article 346.27 of the Tax Code of the Russian Federation.

- food products (except for ice cream, soft drinks, confectionery and bakery products in manufacturer's packaging);

- medicines;

- products made of precious metals and precious stones;

- weapons and ammunition for them;

- copies of audiovisual works and phonograms;

- programs for electronic computers and databases.

OKVED Handling and Delivery Trade 2020

Therefore, if, after demonstrating a product by an employee of an organization operating in the retail trade sector, a retail purchase and sale agreement is drawn up at the home of a potential buyer and the buyer fully or partially pays the cost of the purchased product, which is confirmed by sales and cash receipts, then such activity can be considered as distribution trade subject to transfer to the taxation system in the form of a single tax on imputed income.

According to the State Standard of the Russian Federation GOST R 51303-99 “Trade. Terms and definitions”, approved by Resolution of the State Standard of Russia of August 11, 1999 N 242-st, delivery trade is retail trade carried out outside a stationary retail network using specialized or specially equipped vehicles for trade, as well as mobile equipment used only included with the vehicle.

Delivery trade on UTII: calculation features, whether a cash register is needed

11) distribution trade - retail trade carried out outside a stationary retail network using specialized or specially equipped vehicles for trade, as well as mobile equipment used only with the vehicle. This type of trade includes trade using a car, a car shop, a car shop, a toner, a trailer, a mobile vending machine;

- Your vehicle must meet the requirements of environmental class no lower than 4 (Euro 4);

- the vehicle must undergo technical inspection;

- the vehicle must be kept in proper sanitary and technical condition;

- according to modern requirements, you will have to equip the vehicle with a mobile geolocation system with the ability to track the vehicle via the Internet;

- the vehicle must be specially equipped for trading. What does this mean? Perhaps we are talking about a vehicle that was originally created for distribution trade, and, perhaps, converted for these purposes through a major overhaul. But in any case, the signs of trade should be obvious. You need to take care of the presence of a display case or counter, refrigeration, cash register and other technological equipment provided for by the requirements of regulations for the sale of products. Do not forget about the equipment of the seller’s workplace - it is necessary to install an umbrella or canopy, a chair, a table to be able to work with the client.

Delivery trade on UTII: features of legislation

The Russian Ministry of Finance clarifies that if an organization invites individuals in advance to demonstrate goods with a view to their subsequent sale on site, then this organization does not have the right to apply UTII to its activities (letter of the Russian Ministry of Finance dated August 26, 2013 No. 03-11-06/3 /34917).

According to the Tax Code, the UTII regime is allowed to be applied to distribution trade. It can also be used when selling goods at retail through objects or points that are not stationary (Clause 2 of Article 346.26 of the Tax Code of the Russian Federation). However, the list of such objects is not specified in the Tax Code of the Russian Federation.

Rebus Company

If an organization sells goods at retail through tents, then it becomes a UTII payer. Taxpayers whose place of tax registration does not coincide with the actual place of carrying out activities subject to UTII are required to register at the place of carrying out such activities (clause 2 of Article 346.28 of the Tax Code of the Russian Federation). Tax legislation does not limit the time during which a taxpayer works: one day, a week or a whole year. The place of activity is understood as the location of physical indicators, in this case, the objects in which business activities are carried out. If the activity is mobile in nature, then such a place is considered to be the place where income is received from this business activity. If a taxpayer carries out activities that are subject to the payment of a single tax on imputed income in the territories of different municipal districts where the tax is introduced, he is required to register with the tax inspectorate of each district. There is no need to re-register only if the municipal districts where the activities are carried out are supervised by one interdistrict tax inspectorate. Tax legislation requires that the taxpayer register with the relevant tax authority no later than five days from the beginning of the activity (in paragraph 2 of Article 346.28 of the Tax Code of the Russian Federation). The tax authority notifies that the taxpayer is registered with a notice of registration with the tax authority. If business activity is terminated, the taxpayer submits an application for deregistration (in any form), indicating the date of termination of activity. The application is accompanied by a previously issued notice of registration with the tax authority at the place of activity subject to UTII taxation. For taxpayers who are engaged in outbound trade in different cities and regions, the procedure for registering as UTII payers is inconvenient and burdensome. Therefore, many try to avoid registration. On weekends, they have many chances to remain “uncaught,” since control purchases and inspections take place mainly on weekdays. However, it should be borne in mind that by evading registration, taxpayers risk being fined under Art. 117 of the Tax Code of the Russian Federation. The fine is 10 percent of the revenue received, but not less than 20,000 rubles. For violating the deadline for registration with the tax authority, the company faces a fine of 5,000 to 10,000 rubles (Article 116 of the Tax Code of the Russian Federation). You also need to pay UTII and submit declarations to each municipal district where retail trade is carried out. Moreover, when calculating the tax (if it is introduced in a given territory), specific values of the K2 coefficient established by local authorities should be used. All taxpayers can adjust K2, regardless of whether such a possibility is provided for by the regulations of municipalities. In paragraphs 3 p. 3 art. 346.26 of the Tax Code of the Russian Federation it is determined that the values of the K2 coefficient specified in Art. 346.27 of the Tax Code of the Russian Federation, or the values of this coefficient, taking into account the specifics of conducting business activities, are established by regulatory legal acts of representative bodies of municipal districts, city districts, and laws of the federal cities of Moscow and St. Petersburg. From 01/01/2020, Federal Law dated 07/22/2020 N 155-FZ, para. 3 paragraph 6 art. 346.29, which provided for the adjustment of the K2 coefficient depending on the actual period of business activity and to some extent regulated the payment of tax if the enterprise did not operate for a full month, or for some reason did not carry out activities. Thus, from 2020, in the case of carrying out activities under UTII one day a week, and even with a temporary suspension of activities under UTII, for example during seasonal work, the organization or entrepreneur must in any case pay UTII in full. This position has been repeatedly confirmed by the Ministry of Finance in official correspondence (Letters of the Ministry of Finance of Russia dated 05/28/2020 N 03-11-09/188, dated 02/12/2020 N 03-11-09/48, dated 11/07/2020 N 03-11-04/3 /498), where it is stated that the UTII payer calculates the specified tax based on potential income, and not actually received. Therefore, the obligation to pay the specified tax and submit a declaration arises regardless of the actual income received from business activities or its suspension. Submission of a “zero” UTII declaration to the tax authorities is not provided for in Chapter 26.3 “Taxation system in the form of a single tax on imputed income for certain types of activities” of the Tax Code of the Russian Federation. In order not to pay UTII when activities are suspended, an organization or entrepreneur must be deregistered with the tax office as a payer of this tax (Letters of the Ministry of Finance of Russia dated December 31, 2020 N 03-11-04/3/585 and dated September 4, 2020 N 03 -11-05/210). To do this, you must submit a corresponding application to your tax office within five days from the date of suspension of activities. Taxpayers registered as UTII payers retain the obligation to submit tax returns for this tax until deregistration (Letter of the Federal Tax Service of Russia dated August 27, 2020 N ШС-22-3/ [email protected] ). Between the start and end of activities subject to UTII, the taxpayer must submit tax returns, including in the absence of actual values of physical indicators of basic profitability for the activity being carried out. In this case, “zero” declarations are submitted to the tax authorities. The transition to UTII is not voluntary (clauses 1, 2 of Article 346.26 and clause 1 of Article 346.28 of the Tax Code of the Russian Federation). The UTII taxpayer receives a stable amount of taxation, and the amount of tax does not depend not only on the results of the taxpayer’s work, but even on whether he works at all. February 2020 Safina Rimma Yakovlevna Arbitration practice in tax disputes Tax disputes in court Accounting and auditing Audit of trade transactions

Retail trade OKVED

- retail sale of goods such as personal computers, stationery, paints or wood, although these products may not be suitable for personal or household purposes. Processing of goods traditionally used in trade does not affect the basic characteristics of goods and may include, for example, only their sorting, separating, mixing and packaging

We recommend reading: The bankruptcy procedure for an individual

- resale (sale without conversion) of new and used goods for personal or household use, or use by shops, department stores, tents, postal trade enterprises, persons delivering goods on a door-to-door basis, traders, consumer cooperatives, etc. d. Retail trade is classified primarily by type of trading enterprise (retail trade in general assortment stores - groupings from 47.1 to 47.7, retail trade outside stores - groupings from 47.8 to 47.9). Retail trade in general merchandise stores includes: retail sales of used goods (group 47.79). For retail sales in department stores, a further distinction is made between retail sales in specialized stores (groups 47.2 to 47.7) and retail sales in non-specialized stores (group 47.1). The above-mentioned groups are further subdivided according to the range of products sold. Sales of goods not through general stores are classified according to forms of trade, such as retail sales in stalls and markets (group 47.8) and other retail sales not through general stores, such as mail order, door-to-door, vending machines, etc. d. (grouping 47.9). The range of goods in this group is limited to goods usually referred to as consumer goods or retail goods. Therefore, goods that are not usually sold in retail trade, such as cereal grains, ores, industrial equipment, etc. are not included in this group

Business Innovation Agency

When delivering and peddling trade, sellers are required to comply with many rules and regulations - from the law on the protection of consumer rights, sanitary and hygienic standards, rules for the use of cash registers, etc. to more private ones, which operate depending on the specific conditions of distribution and distribution trade.

We resolve legal and financial issues

If trade is organized at a market or fair, then the procedure and rules for placing objects of distribution and peddling trade are established by the owners of the market or the organizers of the fair. These rules must comply with current legislation. For example, during distribution trade, the sale of meat that has not passed veterinary control is prohibited.

This is interesting: Artek camp official website prices 2020 azure

This class includes: - retail trade of a wide range of new or used goods, usually carried out along roads or in specially designated areas (kiosks, stalls, auto shops, vans, auto shops, tank trucks, etc. and in markets)

Delivery and distribution retail trade of UTII

First of all, a retail business must offer the right product, the right offer. Good to know: Depending on the product chosen, the location may also be better, depending on the area, these are not necessarily the same products that may work.

If retail trade is carried out through a trade facility indicated as a tray only in title or inventory documents, but if the facility is stationary, connected to utilities and does not have a sales floor, then such trade can be classified as retail trade carried out through a stationary trade facility chain that does not have a sales area. The single tax on imputed income in this case is calculated using the physical indicator “trading place” (letter of the Ministry of Finance of Russia dated January 26, 2007 No. 03-11-05/12).

Carry trade

“On approval of the Rules for the sale of certain types of goods, a list of durable goods that are not subject to the buyer’s requirement to provide him free of charge for the period of repair or replacement of a similar product, and a list of non-food products of proper quality that cannot be returned or exchanged for a similar product of a different size, shape, size, style, color or configuration" When carrying out retail trade at the buyer’s location outside of retail facilities by directly familiarizing the buyer with the product: at home, at the place of work and study, in transport, on the street and in other places (hereinafter referred to as - peddling trade), the sale of food products (with the exception of ice cream, soft drinks, confectionery and bakery products in the packaging of the manufacturer of the goods), medicines, medical products, jewelry and other products made of precious metals and (or) precious stones, weapons and ammunition for him, copies of audiovisual works and phonograms, programs for electronic computers and databases.

Guide to HR issues. The employee’s financial liability is with employees of the small retail network (delivery and distribution trade, trade in tents, kiosks, etc., including those located separately in the sales area), as well as other persons with whom an individual agreement on full financial liability has been concluded;

Class OKVED 47 - Retail trade, except trade in motor vehicles and motorcycles

The service will improve the efficiency of the store by reducing the loss of inventory, significantly speed up the process of revaluations, printing price tags/labels, strictly discipline the cashier’s work and limit his capabilities when working with discounts/sales at a free price.

Since the law on trade regulation provides the most general phrases and definitions relating to delivery and peddle trade, the Ministry of Industry and Trade of Russia has developed detailed guidelines on how to regulate non-stationary, delivery and peddle trade. According to the developers, these recommendations are drawn up in order to eliminate those issues that hinder the development of small businesses.

To determine a family’s ability to obtain low-income status, it is important to know what the maximum family income is that gives the right to receive a subsidy, as well as how to calculate it for each family member.

Street trading is carried out only with the permission of local authorities, which must consider the compliance of the selected trading location with the criteria provided by law.

The editors have at their disposal a letter from the country's main tax department, which explains a very pressing issue: how to correctly calculate the amount of the single tax on imputed income for organizations trading from specially equipped vehicles. The difficulties here stem from the fact that during the tax period this outlet may change location several times.

You must, within 5 working days, write an application for the transition to a special tax regime - UTII, simplified tax system or buy a patent. You can choose any tax system and work like that.

Such activities include peddling and delivery trade, as well as the sale of goods through other objects not related to a stationary retail chain (for example, a vending machine, a tent, other prefabricated structures) (para.

OKVED-2 came into force only in 2020 and is valid until today. A code assigned to a title associated with the revision number included in it. Before this, there were codes 1 and 1.1, which are still valid until this time.

At the same time, the auto trade receives the largest income on the days of city and rural fairs. And it is the presence of “wheels” that allows the retail outlet to move throughout the region and participate in as many fairs as possible.

11) distribution trade - retail trade carried out outside a stationary retail network using specialized or specially equipped vehicles for trade, as well as mobile equipment used only with the vehicle. This type of trade includes trade using a car, a car shop, a car shop, a toner, a trailer, a mobile vending machine;

- when filling out an application for registration of an individual entrepreneur, LLC or organization of another legal form;

- when filling out an application to change the type of activity (adding or deleting);

- When developing a company's charter, OKVED codes must be indicated.

Product: honey, cream honey, honey desserts. I found a supplier with all the necessary documents. They have both honey in jars, that is, factory packaging, and in small containers of 12 liters. As part of this activity, can I sell honey by transferring it into disposable individual containers of smaller capacity?

- retail sale of information and communications technology and equipment, such as computers, peripheral equipment, telecommunications equipment and consumer electronics, in specialized stores

- retail sales in tents and markets: subclass OKVED 47.8;

- other retail sales not through department stores. For example: trade by mail, with door-to-door delivery of goods, through vending machines, etc. (subclass OKVED 47.9).

We invite you to familiarize yourself with the Gazprombank Collective Insurance Agreement.

The procedure for obtaining the status of an entrepreneur involves submitting an appropriate application to the registration authority indicating the codes of future activity, according to the OKVED classifier. If in 2020 a businessman had the right to use codes from the OK 029-2001 system, then, starting from 2016, only numbers from the OK 029-2014 classifier need to be entered.

The main type of activity will be the one you indicate first in the completed registration form, the remaining types will be additional. You can add or remove the necessary types of activities at any time by submitting an application to the tax office.

The state always needs to know how many and what types of activities are carried out on its territory, therefore all enterprises are required to obtain statistics codes. OKVED 2 directories with breakdowns by type of activity are presented on many websites. At the same time, we recommend that you ensure that the data is up to date.

In 2020, the latest amendment was made to the OKVED code. Thanks to this, editions 1 and 1.1 will be canceled this year, and the appearance of the second edition is completely different from the previous ones, which introduces some difficulties in the preparation of documentation among entrepreneurs.

- non-use of cash register systems in cases established by federal laws;

- the use of a cash register that does not meet the established requirements or is used in violation of the procedure and conditions for its registration and use established by the legislation of the Russian Federation;

- refusal to issue, at the request of the buyer (client) in the case provided for by federal law, a document (sales receipt, receipt or other document confirming the receipt of funds for the relevant goods (work, service)).

Whether or not the selected type of activity is subject to licensing. If the main type of activity is subject to mandatory licensing, then it is prohibited to carry out such activities without an appropriate license. See the list of licensed activities.

This class includes: - retail sale of other goods in stalls or markets, such as: carpets and rugs, books, games and toys, household appliances and consumer electronics, audio and video recordings

This class includes: - retail trade of a wide range of new or used goods, usually carried out along roads or in specially designated areas (kiosks, stalls, auto shops, vans, auto shops, tank trucks, etc. and in markets)

at home, at the place of work and study, in transport, on the street and in other places (hereinafter referred to as peddling trade), the sale of food products (with the exception of ice cream, soft drinks, confectionery and bakery products in the packaging of the manufacturer of the goods), medicines is not allowed , medical products, jewelry and other products made of precious metals and (or) precious stones, weapons and ammunition, copies of audiovisual works and phonograms, programs for electronic computers and databases.

“Tax Code of the Russian Federation (Part Two)” dated 08/05/2000 N 117-FZ (as amended on 12/25/2020) (with amendments and additions, entered into force on 01/25/2020) retail trade - retail trade carried out outside the stationary retail network through direct contact between the seller and the buyer in organizations, in transport, at home or on the street. This type of trade includes trade from hands, trays, baskets and hand carts;

Please note that the number of OKVED codes you select is unlimited, but from them you must select one main one, for which the percentage of revenue you receive must be at least 60% of the main amount of income from this activity.

We invite you to familiarize yourself with Principal on the simplified tax system, agent on the simplified tax system