What is an individual entrepreneur declaration

The declaration of an individual entrepreneur is considered an official document according to which a person reports to the tax service about income for a specific time. It provides financial control over the calculation and payment of taxes. The type of declaration and the specific number of documents depend on the form of taxation of the individual entrepreneur. According to the classical system, he must pay VAT, personal income tax and property tax, and as a result, submit three documents for consideration.

Why do you need an individual entrepreneur declaration?

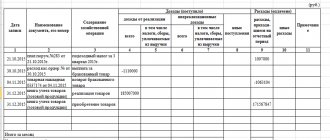

To report on a specific tax, you need to create a tax return for individual entrepreneurs on a specific form, that is, papers of the same type are not submitted for review. However, all declarations have a title page with two sections. The title page contains figures with the final calculations of sections, insurance premiums and the amount of taxes. In the first section, the TIN with personal data, adjustment number, contact number, number and name of the tax authority, tax period codes and OKVED, signatures and date. The second section indicates the BCC with the OKTMO code, the actual address of the business activity, tax calculation and the type of work code.

Declaration title

Rules for filling out a tax form

Declaration of the simplified tax system for individual entrepreneurs - as a sample of registration, where and when to submit

The tax form is filled out according to the standards and requirements presented on the official website of the Tax Service of the Russian Federation, as well as in each branch. The documents are filled out independently by the entrepreneur or employees in accordance with the relevant agreement.

For your information! The most important rule when filling out is to provide accurate information.

The income statement of an individual entrepreneur is filled out in black pen using capital letters or in Courier New font when printed. You need to write without using a proofreader to correct errors, and write each character in a new cell. Empty cells are marked with a dash. The report is not bound or printed on multiple sides.

It is better to start filling out the declaration from the second section. According to experts, it is more convenient to indicate the final results in the title page in order to avoid mistakes. All amounts are, as a rule, rounded. For example, not 10,102 rubles, but 10,100.

Note! The requirement does not apply to the UTII declaration. There the number is rounded to the nearest thousand.

Filling rules

Sample

Samples are given on the official website of the state and territorial tax service. There you can download them without any problems, just like mortgage documents. You can also take a sample during a personal visit to any branch of the Federal Tax Service of the Russian Federation. Available upon request.

Mortgage from Otkritie Bank secured by existing housing

A mortgage under this loan program is suitable for people who want to receive cash for the construction of a residential building, the purchase of part of an apartment or non-standard living space on the secondary real estate market.

According to the terms of lending for these purposes, the minimum rate of Otkritie Bank is 10.5% for a period of 30 years. For the Moscow and Leningrad regions, the maximum loan amount is 30 million rubles; in other regions, a limit of up to 15 million rubles is established. inclusive. The down payment on a mortgage for construction is a minimum of 30%, a maximum of 80%. A prerequisite is the pledge to the bank of real estate owned by the borrower. It can be either an apartment or an apartment. But an important requirement is that the property must not be used as collateral under another mortgage agreement or have other encumbrances.

Under additional conditions, surcharges may be added to the interest rates. In this case, 2.5% is accrued for the period from the moment the loan is issued until the provision of documents to the bank that confirm the actual purpose of using the funds.

What documents does an individual entrepreneur need to submit?

3-NDFL for individual entrepreneurs - what is it, sample form and when to submit

In order to fill out the necessary declarations and submit them to continue business activities without complaints from the state, you need to have the following documents with you:

- TIN;

- details of the Federal Tax Service;

- certificate of registration with the Federal Tax Service;

- statements confirming payment of taxes;

- code OKTMO, KBK, OKATO, OKVED.

You will also need a Russian passport, an application for registration as an individual entrepreneur with a copy of the notice of opening a personal account. Additional other documents may be required.

IP documents

Where to submit the declaration

Declarations are submitted to the territorial office of the Federal Tax Service. This can be done in different ways: through a personal visit or an online service. There is also the option to use intermediary services. When choosing the traditional method - a visit to the department - you need to remember that all documents must be provided in duplicate.

You can access the online service for individual entrepreneurs at the Federal Tax Service of the Russian Federation in three ways:

- by registering an account during a personal visit to the territorial tax office;

- by registering and logging into your personal account through a single portal of State services;

- by authorization in the system through an electronic digital signature.

It is possible to send documents to the tax service by mail. She has only one requirement for sending - a letter with an inventory of the attached documents.

Note! To submit a declaration by third parties, a notarized power of attorney from a legal entity must be provided under Art. 29 of the Tax Code of the Russian Federation. Otherwise the process remains the same.

Regardless of which method of submitting documentation was chosen, the Federal Tax Service may not accept the submitted declarations for the following reasons:

- refusal to present a Russian passport;

- an incorrectly drawn up power of attorney on the wrong form;

- incorrectly selected report form and missing signatures;

- Step-by-step rules for filling out were not followed.

Refusal, as well as late submission of papers, is equivalent to a lack of documents. Administrative measures in the form of fines and imprisonment are used as punishment. The amount of the fine depends on what form of taxation the citizen has, the amount of taxes and the period of delay. As a rule, a person pays a total of 5% of the declaration amount each month, but less than 1,000 rubles*. No more than 30% of the amount.

In addition, if the deadline for submitting documents is more than six months, the tax service may decide to block the businessman’s current account and place it under special control with regular checks of the organization’s work.

Where to submit the declaration

Registration of a Sberbank debit card

Now let’s find out what documents are needed to get a Sberbank card without a credit line. There are much fewer requirements here.

If you need a debit card, then just contact the nearest bank branch with a passport of a citizen of the Russian Federation. The only and main condition for receiving it is only the age of 14 years. It only takes a few days to release. You also have the opportunity to choose an individual card design, but to do this you will need to place an order online through the official Sberbank portal. Upon delivery, you will only need to sign the contract and pay the cost of issue and subsequent banking services.

What to do with zero income

If an entrepreneur has zero income and his activities have been suspended, this does not mean that there is no need to submit reports to the tax service. The declaration form for zero income is the same as the standard one. It must be filled out based on the tax regime. In cases of the general taxation system, an entrepreneur needs to submit a declaration only if the individual entrepreneur has not received any money for the year. It makes no difference whether or not employees received wages with other payments, including social benefits and those stipulated in civil law agreements, from which income tax was deducted.

With a simplified system, the system of filing a zero declaration is possible only when activities are completely stopped and there is a complete absence of income. You must pay imputed tax on UTII, regardless of what income was received. That is, a fixed amount of taxes is paid regardless of the indicators.

Note! Zero declarations under the simplified tax system are also submitted if the nature of the work is seasonal.

Declaration with zero income

Important nuances and pitfalls

When applying for a credit card, it is worth remembering the grace period for using funds. This advantageous option allows you to use credit money and not pay interest if you top up your card account on time.

All actions on the loan are recorded in the bank’s credit history, therefore, if the payment is late in the future, it will be much more difficult for you to get a loan on favorable terms. There are many offers on the Internet to quickly correct your credit history. You should not fall for the tricks of scammers, as this will only lead to empty financial expenses. It is better to immediately contact the bank and get qualified advice and assistance from specialists.

Of course, the bank initially issues a small loan, but if it is repaid in full on time, the credit history will be corrected, which will make it possible to receive a larger amount in the future.

When it comes to debit cards, it is important to monitor your balance and avoid overdrafting. Otherwise, your account may end up in debt. If the situation is not corrected in time, the bank will charge interest. However, Sberbank has disabled this function since the end of 2020 and is available only to cardholders who signed up for the product before this time.

When should it be submitted?

The declaration must be submitted to the Federal Tax Service on time. Since personal income tax on employee salaries is paid monthly, the 4-personal income tax declaration must be filed no later than five days after the end of the reporting month. At the same time, the document must reflect not only the income that was received, but also those payments that are planned, in order to calculate everything individually. The VAT return is prepared based on invoices, purchase and sales books and other documentation. Documents must be submitted no later than the 25th of the month. If an entrepreneur submits a declaration in paper form, such a report will not be accepted, since it must be submitted only through an electronic form.

For your information! In 2020, a new form 6-NDFL appeared. It is handed over every quarter, no later than the 30th of the month. The annual report and declaration on the total amount of funds paid and received are submitted no later than 3 months after the end of the year.

The declaration for the single tax on imputed income is submitted to the authorities no later than the 20th day according to the place of residence of the individual. It contains fields that cannot be skipped. If information is missing, dashes must be added. The amount is rounded to the nearest whole number. If a businessman did not make a profit for a specific period, then he must submit an application to be removed from the register.

Entrepreneurs who are registered under the simplified system must submit a declaration under the simplified tax system at the end of the calendar year.

Important! If at least one invoice is accepted, the entrepreneur must take this into account in the VAT return.

Due dates

Applying for a credit card

The greatest demand these days is for credit cards, which make it possible to make non-cash payments, make purchases via the Internet, etc. Their main difference from debit ones is that the funds present in the account are provided under special conditions put forward by the bank. At the expense of interest, the credit institution makes a profit; therefore, to purchase such a card, you will need to present a number of documents confirming your solvency.

What documents are needed to make a Sberbank card:

- Civil passport of a person confirming the identity, actual age and place of registration of the potential borrower.

- Another document for identification - this can be a military ID, driver’s license, or international passport.

- A certificate confirming the fact of employment, or a copy of the work book or contract certified by a notary (provided whenever possible).

In order to increase the chances of receiving a positive decision from the bank, it is additionally worth preparing:

- a certificate of income received, preferably 2-NDFL. If there is no such thing, then a certificate issued in free form, but with the signature and official seal of the employer, can be used;

- documents evidencing the ownership of valuable property - real estate or a car;

- confirmation that you have a stable additional income - pension benefit, scholarship, investment income, etc.

What documents are needed to obtain a Sberbank card if you have a personal offer? In this case, it is enough to provide only two documents confirming the identity of the person applying. Only existing bank clients can take advantage of this privilege.