Night shift from a legal point of view

Additionally,

the duration of working hours on the night shift for workers in creative professions (theater performers, members of circus troupes and film crews, media workers) is regulated by the terms of the labor or collective agreement, as well as local regulations.

Article 96 of the Labor Code of the Russian Federation provides an explanation according to which the definition of a night work shift includes labor activities carried out in the time period from 22-00 in the evening to 06-00 in the morning. Thus, if the majority of an employee's working time falls within the specified hours range, the work is considered to be night work. According to this article, the duration of a work shift at night should be one hour less than during the daytime. If daytime work hours are 8 hours, it is acceptable to set a seven-hour work schedule for night work without having to work the missing hour. In some cases, the reduction of working hours at night may not occur when:

- The worker was originally hired to work at night.

- The employee is involved taking into account reduced working hours.

- Employees work in shifts with one day off per week.

Who may be required to work at odd hours

Legal acts define categories of persons who are prohibited from engaging in labor activities at night. The following are not allowed for such work:

- Employees are pregnant.

- Minor employees, except for citizens under 18 years of age participating in the creation or performance of works of an artistic nature, as well as persons indicated in the List approved by Decree of the Government of the Russian Federation No. 252 of April 28, 2007.

Article 96 of the Labor Code of the Russian Federation also identifies categories of employees who can be involved in work at night, but only taking into account their voluntary consent. These include:

- working women with children under 3 years of age;

- women and men raising children under 5 years of age alone (without a spouse);

- employees with disabilities;

- employees with children with disabilities;

- workers caring for a sick family member (subject to an official medical report).

Citizens belonging to the listed categories of employees may be required to work at night if there are no medical contraindications, and there is also the voluntary consent of the employees themselves in writing. This means that these persons’ refusal to work at night cannot be charged as absenteeism.

Who should not work at night?

According to labor legislation, not all people are allowed to work from 10 pm to 6 am.

You cannot work at night:

- pregnant women;

- employees under 18 years of age (with the exception of representatives of creative professions in some cases);

- women with children under three years of age;

- single parents with children under five years of age (both mothers and fathers);

- disabled people

The last three categories of persons can be involved in the relevant employment only with their written consent. In this case, the employer must fulfill an important duty: to familiarize these employees with their right to refuse (in writing). And, of course, payment for night hours is made according to the Labor Code of the Russian Federation if agreed. There is no legally developed form for familiarizing an employee with his rights and giving consent to work, so it is considered quite acceptable to simply write “agree/disagree” on the order.

How is transfer to night work carried out?

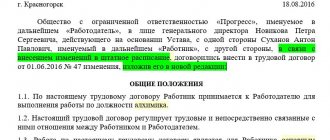

Night time according to the Labor Code of the Russian Federation is the time from 22-00 in the evening of one day to 06-00 in the morning of the next day. If a person is hired for a position initially to work on the night shift, such a clause must be spelled out in the employment contract concluded between the employer and the employee. In a situation where an employee was employed to work during the daytime, and in the process of work it became necessary to transfer the employee to night hours, the employer is obliged to notify the employee of changes in the schedule no later than a month before the actual transfer to non-working hours.

Working shifts at night have a certain advantage in the form of payment, taking into account the premium. Not all employees are aware of what hour of night work the bonus is calculated from. So, for example, when a shift starts at 20-00 pm, the increased rate of remuneration is applied to hours worked after 22-00, while the previous two hours are calculated at the established rate for daytime working hours. Considering that work at night is paid at an increased rate, citizens working at night should be aware of how and from what time night hours are counted, in order to avoid a situation where the employer tries to save money by taking advantage of the fact that employees do not know their right

Please note: in the event of force majeure circumstances, the employer has the right to attract personnel to work at night, regardless of the presence or absence of consent from the employees.

Operating mode

The mode in which the employee will work is determined by agreement with the employer. And this is an important condition of the employment contract, which must be agreed upon and spelled out in advance. It is especially important to fix the work shift schedule for those individuals whose schedule differs from the general one established for the rest of the team members of a given organization or enterprise in terms of working hours. What is the payment procedure for night hours? It is also defined in the employment contract with the employer.

With shift work, usually some part (or all of it) occurs between 10 pm and 6 am. Payment for night shifts is always made at a higher rate than that established for daytime employment.

When concluding an employment contract, pay attention to an important point. The document must indicate which hours of work are considered night hours. The schedule and rotation of shifts are also discussed with the employer. According to the Labor Code of the Russian Federation, the duration of work at night should be shortened by one hour (without further work).

How are night work hours calculated?

The bonus payable to employees working night shifts must be at least 20%. A more precise value is established in an individual organization. According to statistics, on average this figure is around 40%. For example, increased values apply to the following categories of workers:

- organizations carrying out security, watchdog and related activities – 35%;

- employees of the penitentiary system - 35%;

- healthcare workers – 50%.

In other cases, the right to establish a bonus for employees working at night remains with the management of the organization, but the head of the institution must take into account that such a bonus must be at least 20%. In order to understand how to calculate night work hours, you need to divide the amount of the monthly salary by the number of working calendar days. The resulting value is divided by the number of hours in one working day. This value shows how much the employee is entitled to per hour worked during the day. The hourly wage is multiplied by the premium percentage established in a particular organization. This will be the total amount that must be paid to the employee for each hour worked at night. Payroll is calculated in a similar way for employees to whom time-based wages are applied.

In order for the additional payment for night work to be calculated correctly, the employer must very accurately keep records of employees' working hours. Hours worked during the day should be marked with one code (for example, “I”) on the accounting sheet, and hours worked at night with another (for example, “N”). Find out how to mark a business trip on your timesheet here.

Separately, situations should be considered when the night shift falls on weekends and holidays. In such cases, the amount of bonuses is summed up, since, according to the norms of Labor legislation, holidays and weekends are paid in double amount (read more about payment for work on a day off according to the Labor Code here). The exception is employees working on a shift schedule, for whom weekends are normal work shifts, but this rule does not apply to holidays - night shifts that coincide with holidays are paid at double the rate, taking into account the established premium for night work.

The Decree of the Government of the Russian Federation determines that the amount of additional payment for work at night cannot be less than 20% of the employee’s regular salary. Additionally, remuneration for work at night in the Russian Federation can also be regulated by internal regulatory documents of the enterprise (Article 154 of the Labor Code of the Russian Federation). Each employer has the right to offer employees any additional payment for working at night, but not less than 20% of the hourly rate.

Payment for night hours according to the Labor Code of the Russian Federation in 2020 is carried out in accordance with the amount of additional payment established by the regulatory documents of the enterprise and the time worked at night. For example, consider a case in which the employer has not exceeded the minimum allowable amount of additional payment for night hours - 20% and an employee who receives a fixed hourly wage of 500 rubles has worked a total of 10 night hours in one month.

We calculate wages at night:

(Amount of hourly pay)/(Rate of additional payment for work at night (in percent))*Number of hours worked=(500 rubles)/(20%)*10 days=1000 rubles

In this case, a thousand rubles will only be an additional payment for night hours, in accordance with the Labor Code of 2020, and the labor hours themselves are paid separately in accordance with the amount of wages.

If an employee receives a fixed monthly salary, it is necessary to calculate the rate per hour of labor. To do this, you need to divide the monthly rate by the number of hours that a person should normally work in the current month.

Employees who are employed specifically to work night shifts are also entitled to receive additional payment, and this should be taken into account when determining the monthly salary when an employment contract is drawn up with the employee.

Watch the following video for information on pay for night work.

Piece-work payment

Although the law does not have a firm indicator of how monthly wages are paid. But there are two ways to calculate bonuses for time worked:

- This does not depend on the volume of manufactured products. But calculating the rate is possible, since the staffing table has been specially developed. It turns out that night hours are multiplied by the tariff and the percentage of the surcharge.

- At an increased standard. There is a premium for night hours, since each organization has reference indicators. The latter define the amount of earnings accrued for types of work. According to the formula, the premium is calculated by multiplying the indicator of manufactured products by the surcharge percentage and the tariff rate.

Working extra hours at night

When applying for a job, an employment contract is concluded between the employer and the employee, which indicates the number of hours that the employee must work per month in order to receive a full salary. If an employee worked overtime at night, he is entitled to additional payment for work, but in an amount no greater than the payment of overtime hours for work during the daytime. Read more about payment for overtime hours in the article https://otdelkadrov.online/8686-pravila-primer-rascheta-oplaty-sverhurochnoi-raboty-po-tk-rf-v-year-godu.

Please note: you should distinguish between the concepts of overtime work and night work, which many people confuse. Overtime is work that is performed at times not specified by the work schedule, and not at night. And night work is work activity from 22.00 to 6.00, planned by the employer in advance. Sometimes these concepts can overlap each other, in the case where the work is both night and overtime.

Each hour of overtime at night is paid additionally in an amount equal to the average wage of an hour of labor for an employee. Daytime overtime hours are paid additionally in the amount of 50% of the hourly rate for the first 2 hours and 100% for all subsequent ones. However, the employer can independently indicate in the regulatory documents of the enterprise the possibility of higher payment for overtime work at night, since this is not prohibited by the Labor Code of the Russian Federation and other legislative acts.

The calculation of payment for overtime at night is carried out in the same way as the calculation of payment for work at night. In this case, the employee’s hourly rate is multiplied by 200% and the time worked overtime at night. For example, if an employee’s pay is 500 rubles per hour, and he worked an additional 10 hours at night, the employer must pay 10 thousand rubles for this time (at the rate of 500*200%*10).

Calculation example

Let's look at how night shifts are paid according to the Labor Code, using the example of an organization that has a legally established additional payment amount of 20% of the hourly rate (salary).

1. A watchman at the Romashka organization worked 8 daily shifts (192 hours) in a month. His tariff rate is set at 45 rubles per hour. Of the 192 hours worked by a guard, 64 are night shifts.

The calculation of the surcharge in this case will look like this: 45x0.2x64=576 rubles.

The resulting figure is summed up with other types of accruals due to the watchman for the period worked.

2. A process engineer from the same organization has a salary of 8,000 rubles per month.

The monthly standard of hours was 176. By order of management, he was involved in work from 24 hours to 8 am. Of this time, the night period accounts for 6 hours.

The calculation will be like this:

8000/176=45.45 rub. — hourly salary of a process engineer in a given month.

45.45x0.2x6=54.54 rub. - additional payment received.

When calculating wages, this amount is also added to all types of accruals due to the employee for the month.

Taxation of additional payments for night work and overtime

Additional payments for night work and overtime are considered part of the employee’s salary, therefore all payments are deducted from them on a general basis. That is, insurance premiums, as well as pension and social contributions, as well as personal income tax, should be deducted from the amount of additional payments. All deductions are made by the organization’s accounting staff, and the employee is paid the amount taking into account all the changes. Thus, the employee will not have to independently take care of paying taxes and insurance premiums for the overtime worked.

On issues of payment for work at night, a lawyer will advise you in the comments to the article

Withholding taxes

All accruals for work at night are considered in the amount together with wages. It turns out that taxes are levied on the result obtained. The basis is current legislation.

Accruals and deductions are carried out by accountants, and at the end of the year a report on the work done is presented. The employee himself has no reason to worry about tax withholding; everything is done automatically. The payslip shows all the data on accruals and deductions; you can only recalculate. If questions arise about taxation, they can be asked at the legal consultation; based on the answers received, the employee is convinced that the company complies with the requirements of regulations.

In this video you will learn about what is considered night work:

Write your question to a lawyer in the form below: