What is OKVED

OKVED is a classifier of codes, with the help of which the individual entrepreneur selects the area in which he plans to work. For convenience, this classifier is divided into letter sections, classes, groups, subclasses and subgroups.

The tax system of an entrepreneur depends on the selection of OKVED, this is especially important when choosing UTII or a patent, where the permitted list of activities is strictly regulated. The code is entered into the registration documents of the individual entrepreneur and is indicated when submitting reports and opening a current account.

How is the code deciphered?

OKVED itself is a set of numbers that can consist of 2 or 6 characters depending on your choice. The structure of each code is as follows:

- XX.XX.XX – type of activity;

- XX.X – subgroup;

- XX – group;

- X – subclass;

- XX – class.

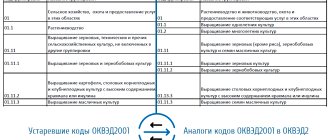

This can be clearly seen in the diagram:

As you can see, the numbers “go” from the general to the specific: for example, 45.1 (subclass) - preparing a site for construction, and 45.11 (class) - dismantling buildings and their demolition, 45.11.2 (subclass) - carrying out work with land, respectively.

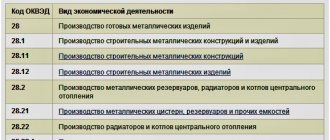

Some other OKVED codes can be found in the table:

Thus, under each paired numbers there is a drop-down list, and the task of the entrepreneur/organization is to correctly select from this list the type of activity that corresponds to the work performed. The code is approved by the statistics authority.

Directory of OKVED codes for individual entrepreneurs for 2020 with decoding

In our online selector, we use the current 2020 list of OKVED 2 codes for individual entrepreneurs . All codes are structured, divided into sections and have a detailed explanation.

To select OKVED codes, check the boxes and these codes will appear in the table below the list. Opposite there will be a transcript of OKVED.

Our service for preparing documents for individual entrepreneur registration integrates this OKVED code selector and you can automatically insert them into the P21001 application for individual entrepreneur registration.

The smart service generates documents for individual entrepreneur registration in 15 minutes, but you submit them yourself. More details Go to service

- You enter all the data yourself, and the service generates a package of documents for individual entrepreneur registration.

- You submit documents to the tax office or MFC yourself.

- You pay a state fee of 800 rubles. before submitting documents, but you don’t have to pay if you submit through the MFC.

- The service contains tips on taxes, selection of OKVED and other stages.

- The service fills everything out without errors, the results are verified by the Federal Tax Service.

- The service is also free.

Scheme of work In 15 minutes, you generate documents in the service: an application on form P21001, a notification about the transition to the simplified tax system (if necessary) and a file with instructions for further actions. Next, you print them out, pay the state fee, and submit the documents to the Federal Tax Service or the MFC. 3 working days after submission you will receive individual entrepreneur status. Collapse Go to service

List of documents for registration of OKVED

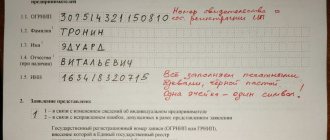

Many entrepreneurs have questions about how many documents are required when registering codes. In order to correctly follow the form, you must familiarize yourself with the sample application attached below. To register a new individual entrepreneur indicating OKVED, the entrepreneur will need to have a passport with him.

If changes are made to the codes or they are supplemented, then on the basis of the completed application, a photocopy of the passport and a certificate of registration of the individual entrepreneur are attached.

Documents for adding OKVED for individual entrepreneurs

The main documents that may be required when entering OKVED are:

- applicant's passport;

- application written in form P24001.

If the action is carried out through a representative, then a notarized power of attorney is attached.

Documents for changing OKVED for individual entrepreneurs

When changing codes, the same set of documents is required. Additionally, a previously received certificate of registration of the person as an individual entrepreneur is attached. When changing OKVED, you do not need to pay a state fee.

When to submit an application to choose OKVED

For the first time, an entrepreneur reports the selected OKVED to the tax office when registering an individual entrepreneur. The codes are indicated in the application on form P21001.

The application must indicate at least four numbers from the classifier group that are most suitable for the future business. This can be the code of an entire group, if the individual entrepreneur plans to do a little of everything, or a separate component of it, when choosing a narrow focus of the business. In this case, it is important to determine the main and additional codes, indicating them in the necessary lines of the application.

If you decide to change the direction of your business after creating an individual entrepreneur, you need to inform the tax office about this by submitting a special application on form P24001 to change OKVED.

To correctly enter OKVED in the application for registration of individual entrepreneurs, use our service.

Go to service

Encoding selection

The meaning of making the right choice

When opening a company or organizing the start of a business activity, each founder or individual entrepreneur must correlate his activities with the available codes in the classifier and enter this information into the registration application. Each structure can have a large number of types of activities, but there is always a main type and additional ones (there can be as many of them as you like).

In addition to the application for registration, these encodings must be included in the organization’s Charter.

Do not try to reflect all kinds of numbers at the very beginning, even those that you will not do yet, but plan to do in the future, since later you can make changes, add and remove code values. It is better to enter 1-3 encodings, but being absolutely sure that you did everything correctly.

OKVED influence some aspects of successful entrepreneurial activity:

- State statistics bodies reflect the codes you specified in the classifier of individual entrepreneurs and legal entities, determining the industry of your permanent activity;

- using coding, you can immediately find out whether a specific structure or individual entrepreneur is engaged in activities prohibited for them and stop it if necessary;

- establishing the types of activities subject to licensing and compliance with all declared parameters of specific entrepreneurs;

- establishing types of activities that are not available to individual entrepreneurs;

- statistical codes influence the amount of taxes and off-budget deductions.

If the codes chosen by the entrepreneur turn out to be incorrect, incorrect or untrue, this will entail unreasonable expenses, as well as the possibility of bringing the individual entrepreneur to administrative liability. In case of deliberate misrepresentation of information, fines may be imposed.

How to choose codes?

The first step is to decide what the main activity of the entrepreneur will be. A clear direction should be chosen at the stage of preparation for registration. When you have chosen your field of activity, it’s time to look into the OKVED Directory and find the desired section. To date, there are 17 sections. All of them are designated by Latin letters (A, B, C, D, E, etc.). For example, the letter D stands for manufacturing. Subsections are designated by another Latin letter. For example, DA is the production of food products.

When you have decided on a section, it’s time to find the specific encoding that best suits your activity. If the exact wording is not available, then the one that most suits the meaning of your activity will do. Be sure to study detailed information about the chosen direction and only then enter data into the application.

When you have decided on the main type, then similar actions are performed with additional areas of activity, if any.

It is legally established that statistical codes must be entered into documents, each of which is displayed in a set of at least 4 characters, since this is the minimum number that allows information to be processed electronically.

How many OKVED codes can I indicate when registering?

As mentioned earlier, an entrepreneur must decide on one main activity and several additional ones. Moreover, if the main code is required to be filled in, then there may not be any additional ones at all or there may be a lot of them. To ensure that the encoding you choose fully corresponds to reality, try to specify it as much as possible, i.e. choose fully appropriate meanings with a large number of characters.

You should not include a huge number of statistical codes in the initial documents. They can be adjusted, removed or new ones added at any time. An acceptable quantity is considered to be no more than 20 pieces.

An oversaturation of registration application codes can work against you. So, the list of activities that you entered in the column of additional areas of work may include one that requires obtaining a license, and this will entail additional problems - after some time you will be required to report on the work done. Thus, the maximum set of statistics codes has not been established, but there is a minimum - the main type of activity and the corresponding encoding.

Choosing the main activity

The main type of activity is indicated first in the application form P21001. This column should reflect the encoding that assumes the activity that is the main source of income for the individual entrepreneur. Also, this type of activity must take into account the taxation regime.

For example, in the case when the main line of activity falls under UTII, and taxes are paid according to another system, this may lead to the imposition of penalties when organizing tax audits in your individual entrepreneur.

If the main type of activity does not correspond to the actual work of the entrepreneur, then this may cause increased interest in you from state control authorities (FSS, etc.).

Additional statistical code

In principle, an entrepreneur has the right to limit himself to a competent and single basic statistical code. The Civil Code of the Russian Federation, namely Article 23 and Article 49, paragraph 1, establish that an entrepreneur who does not form a legal entity has the right to engage in the type of activity that he wants, with the exception of certain types that require licensing in accordance with legislative acts.

If a citizen plans to engage in licensed areas, then he must reflect information about them in additional encodings. Entering such data will help avoid unwanted conflicts with government agencies and problems with the law in the future.

How many OKVED codes can you choose when registering an individual entrepreneur?

When registering, an individual entrepreneur can choose several OKVED . There are no restrictions in this regard in the law. However, we do not advise you to thoughtlessly choose everything. Enter only those types of activities that you will be engaged in, then related ones, and then those codes that theoretically may suit you someday in the future.

Remember that at any time you can apply to add additional codes or change the main one.

If you are in doubt about choosing OKVED when registering an individual entrepreneur, we recommend free registration of individual entrepreneurs without paying state fees and going to the tax office. A specialist will fill out all the documents for you and submit them to the tax office online.

Experienced specialist Everything is done for free by a lawyer, documents are submitted online, without paying state fees. More details Go to service

- The registration specialist does everything for you.

- You do not go to the tax office; documents are submitted via the Internet.

- A specialist will advise on taxes and select OKVED codes himself.

- You are given a 100% guarantee of successful IP registration.

- You pay nothing before, during or after registration.

Scheme of work You leave a request. The specialist fills out the documents, helps with OKVED and issues a free digital signature for online submission of documents to the Federal Tax Service. 3 working days after submission you will receive individual entrepreneur status. Collapse Go to service

Why is it important to choose the right OKVED codes? Responsibility for violations

Let's figure out what responsibility is provided for incorrectly selected OKVED codes, and why these codes are not just a formality.

Why is it important to choose the right OKVED codes:

- They are directly related to the type of taxation that an individual entrepreneur or organization can apply. For example, for some types of activities there are tax benefits and Social Insurance tariffs.

- Some types of activities require additional reporting to various authorities, obtaining permits, licenses or sending notifications. We will talk about this in detail later in the article.

Responsibility for choosing incorrect codes

As such, the legislation does not provide for punishment for incorrectly entered OKVED. But if regulatory authorities identify a discrepancy between the OKVED standards specified in the documents and your actual activities, they may impose a fine of 5,000 rubles and change the taxation system applied to you .

If you apply a simplified tax system, then they may try to recognize income received from activities not specified in OKVED as income not subject to the simplified tax system. Accordingly, you may be required to pay additional taxes. However, such claims can be fought off in court with the help of competent lawyers.

How to choose the right OKVED for individual entrepreneurs: instructions

In order not to make a mistake and choose the right OKVED, we recommend following the selection instructions:

- We open our online selector at the beginning of the page and find the section that most fully describes the future business.

- In the selected section we look for the desired class, then the subclass, group, subgroup.

- We determine the digital code of the appropriate type of activity.

Important! When choosing OKVED, you need to take into account whether the activity is subject to licensing or not and whether it is included in the list of prohibited individual entrepreneurs.

To correctly enter OKVED in the application for registration of individual entrepreneurs, use our service.

Go to service

Below, using examples, we will consider which OKVED codes are best to choose for individual entrepreneurs in the most popular types of business.

Example: OKVED codes for retail trade

For trade, the OKVED code classifier provides section G. It concerns wholesale and retail at the same time. For example, you are going to be involved in food retail. We have decided on the section. Next, the individual entrepreneur needs to select the appropriate class. Its number will be 47 “Retail trade”.

The next step is to select the desired subclass or group. Since the proposed list is quite large, and you do not want, for example, to limit yourself to any specialization, in the application you can indicate 47.11 “Retail sales primarily of food products” as the main code, and 47.19 “Other retail sales” as an additional code. An additional code will be needed when expanding the range of goods sold.

If you plan to define your area of activity in more detail, you can add a subgroup to the priority codes. These will be the fifth and sixth digits, after the main ones. For example, 47.11.3 “Retail sales primarily of food products.”

Example: OKVED for wholesale trade

For wholesale trade, an individual entrepreneur can choose OKVED from class 46 “Wholesale trade”. We discussed the principle of selection above. This code is suitable for individual entrepreneurs who carry out wholesale sales on a contractual basis, for a fee, at their own expense, in the domestic and foreign markets.

The next step is to select a subclass. Let's say it will be 46.3 “Wholesale sales of food products.” Next, select a group, for example, 46.31 “Wholesale trade of fruits and vegetables.” This code can be applied for by individual entrepreneurs planning wholesale supplies of fresh, canned fruits, and vegetables.

When engaged in other wholesale trade, an individual entrepreneur selects from the proposed list the code that is most suitable for himself, choosing either the whole group or a narrower subgroup.

OKVED list for individual entrepreneur online store

For an online store, an individual entrepreneur can declare one of the seven proposed by the legislator as the main OKVED code, and select the rest as additional ones. Six of them are registered in class 47, the seventh in class 62.

The codes are suitable for individual entrepreneurs selling retail via Internet sites, television and radio advertising, online auctions, telephone sales, with delivery of goods to the buyer’s door. Below is their complete list:

- 47.99 — Other retail trade outside shops, tents, markets.

- 47.91 — Retail mail sales or via the Internet.

- 47.91.1 - Postal retail sales.

- 47.91.2 — Internet retail trade.

- 47.91.3 — Retail sales through online auctions.

- 47.91.4 - Retail trade through television, telephone, radio.

- 62.09 - Other activities using information technology.

How to choose OKVED for an individual entrepreneur providing services

Each service provided by an individual entrepreneur may have its own OKVED. To choose it correctly, you need to go through the sections of the classifier and focus on the ones most suitable for your activity. Then open them one by one and select the desired code from the list provided.

For example, when leasing, you must declare code 68.20 “Rental and management of own or leased real estate.” When providing hairdressing services. If an individual entrepreneur plans to work in a taxi, this will be code 49.32 “Taxi activities”.

List of OKVED for individual entrepreneurs in the field of design

When planning activities in the field of design, the individual entrepreneur must also select the appropriate OKVED. It can be selected from section M - Professional, technical, scientific activities, class 71. This code is intended for individual entrepreneurs planning to provide services for the production of drawings, construction surveys, testing, with the issuance of a conclusion on their analysis, as well as a list of other services related with this activity.

The OKVED list for individual entrepreneurs in the field of design consists of two subclasses and three groups, each of which has a detailed explanation. For example, you decide to provide architectural services. How do you choose the right OKVED? Let's look at the classifier. The first class directly indicates architectural activities, engineering research, design work, and cartography services. Thus, the code we need is 71.1. Next, select a group. This will be 71.11 “Architectural activity”. It includes the development of design architectural solutions, as well as consulting on these issues.

You can declare a general group code to the tax office or take one of the two proposed ones, for example, 71.11.1, which excludes territorial planning.

OKVED for cargo transportation

OKVED for cargo transportation can be found by individual entrepreneurs in section H “Transportation and storage.” This section contains several class codes: 49-52. All of them relate to transportation by various modes of transport, warehouse and auxiliary activities.

We can select the required OKVED code from class 49 codes “Land and pipeline transport services”. Since the individual entrepreneur plans to engage in cargo transportation, he can declare 49.41 “Road freight transportation” as the main code, and select an additional one from the list proposed by the classifier.

Codes for individual entrepreneurs engaged in construction

An individual entrepreneur planning to engage in construction must select the appropriate OKVED code from section F “Construction”, which is divided into three classes:

- 41 - Construction of buildings.

- 42 — Construction of engineering structures.

- 43 - Specialized construction work.

If the individual entrepreneur has not yet decided which of the proposed codes will be the most profitable for him, you can stop at 41 and declare it as the main one. It will allow individual entrepreneurs to engage in the construction of buildings and structures, their reconstruction, ongoing repairs, and preparation of construction projects.

This class is divided into two subclasses - 41.1 and 41.2. One of them concerns only the development of projects, and the other concerns construction itself. Thus, one of the groups can be indicated as a predominant type of activity - 41.20 “Construction of residential and non-residential buildings”, the second as an additional one - 41.10 “Development of construction projects”. This will allow individual entrepreneurs, along with construction, to take orders for design and selection of technologies and thereby receive additional income.

What is the OKVED code: decoding the concept

To officially register your business, an individual entrepreneur must inform the state what exactly he will do. This information is needed for statistics, as well as for calculating taxes and contributions. To avoid confusion and to avoid having to study all documents manually, a unified classification system was created.

OKVED stands for “All-Russian Classifier of Types of Economic Activities” . Essentially, this is a catalog that lists all types of production and types of services, and each specific area of work is assigned a unique identifier - a code.

The classifier has a clear hierarchical structure. The latest edition consists of 21 sections:

- Section A. Agriculture, forestry, hunting, fishing and fish farming.

- Section B. Mining.

- Section C. Manufacturing industries.

- Section D. Providing electricity, gas and steam; air conditioning.

- Section E. Water supply; water disposal, organization of waste collection and disposal, pollution elimination activities.

- Section F. Construction.

- Section G. Wholesale and retail trade; repair of vehicles and motorcycles.

- Section H. Transportation and storage.

- Section I. Activities of hotels and catering establishments.

- Section J. Information and Communication Activities.

- Section K. Financial and insurance activities.

- Section L. Real estate activities.

- Section M. Professional, scientific and technical activities.

- Section N. Administrative activities and related additional services.

- Section O. Public Administration and Military Security; social Security.

- Section P. Education.

- Section Q. Health and Human Services Activities.

- Section R. Activities in the field of culture, sports, leisure and entertainment.

- Section S. Provision of other types of services.

- Section T. Activities of Households as Employers; undifferentiated activities of private households in the production of goods and provision of services for their own consumption.

- Section U. Activities of extraterritorial organizations and bodies.

This list is for convenience and quick navigation. In practice, letter names of sections are not used: in all documents, combinations of numbers indicating specific areas of business are indicated.

How to choose codes for individual entrepreneurs online

We tried to tell you in detail about the OKVED classifier. However, when registering an individual entrepreneur, difficulties may arise in selecting a suitable code. This is especially true for individual entrepreneurs planning to provide services, where it is easy to get lost in the codes.

To help, we can recommend using our OKVED selector at the very beginning of the article. All codes in it are divided into sections and have a decryption. All that remains is to choose the one you need. All codes will have a description, so making the wrong OKVED choice is unlikely.

To correctly enter OKVED in the application for registration of individual entrepreneurs, use our service.

Go to service

Use when registering an entrepreneur

Some individual entrepreneurs do not even try to figure out the codes on their own and go to lawyers who select statistical values instead. There is even such a separate service and it costs almost the same as the registration procedure.

In fact, there are no difficulties in OKVED. You can quickly and easily understand it, especially when you consider that there are already many online services on the Internet that provide free and automatic selection of codes for all categories of activity. There are also sites in which codes are already grouped for the most popular areas of activity of individual entrepreneurs.

Specific codes

First, the entrepreneur must familiarize himself with the lists of specific codes. Since OKVED is common for both entrepreneurs and organizations, individual codes cannot be used by individuals. This applies to activities prohibited for an individual. There are more than forty such areas, but almost all of them are included in the following types of activities:

- production and distribution of narcotic and psychotropic substances, alcohol;

- space exploration;

- air transportation and aircraft equipment;

- pyrotechnic products;

- activities in the military sphere (for example, weapons production);

- explosive substances;

- production of medicines;

- employment abroad for Russian citizens;

- sale of electrical energy.

To carry out such activities, it is necessary to register an organization, since any individual entrepreneur will be refused when entering codes for the above activities.

According to No. 99-FZ, there are 49 types of activities that are subject to licensing. That is, for their implementation it is necessary to obtain special permission, as well as fulfill the obligations provided for by Federal Law. The most common codes relate to:

- private investigative and security activities;

- private transportation (sea and rail);

- chemical activity;

- pharmaceutical activities.

For violation of No. 99-FZ, entrepreneurs may be punished with administrative fines.

For certain categories of codes, a certificate from the police, permission from the sanitary and epidemiological service, the Ministry of Emergency Situations, and other organizations may be required. It is better to check each code entered in advance to see if the future individual entrepreneur has obligations under it in order to avoid refusal of registration or administrative fines due to ignorance.

We’ll talk about how to choose OKVED when registering an individual entrepreneur, as well as how to open additional codes below.

How many OKVED codes can be specified when registering an individual entrepreneur?

The values are entered in sheet A of application P21001. This sheet has 57 empty fields to fill in with codes, but you can use two, three, or even more sheets if the individual entrepreneur so desires. The state sets only one limitation regarding the number of OKVED statistical values - at least 1 code must be indicated.

- The first code is always considered the main activity code. The main one is the one for which the individual entrepreneur receives the maximum amount of income. It is by the main code that the Social Insurance Fund rates are calculated and the tax regime is selected.

- Additional activities are provided for by all those codes that are entered after the first one. It is important that when you enter a group, that is, a four-digit statistical value, into sheet A, all subgroups and types that detail this code are automatically included. Therefore, their additional contribution is not mandatory.

- It is considered optimal to enter up to 20 statistical OKVED values. If an individual does not know whether he will carry out activities under a code that does not bring him any additional obligations described above, it should be added to the registration sheet. If additional code requires a license or certificates, it is better to refuse it. It can be added at any time using form P24001.

We’ll talk about how to correctly indicate OKVED codes when registering an individual entrepreneur below.

A specialist will tell you how many and which OKVEDs to choose when registering an individual entrepreneur in the video below:

Rules for entering codes

When filling out sheet A, you must not forget only one rule: you need to enter at least four-digit codes. Since the system allowing the use of a subclass when designating activities was in place until 2013, some samples and statistical documents contain three-digit codes.

- From 2020, you can only register using codes with a level of detail of up to 4 or more digits. Starting from 2020, you can only use the new OKVED 2020, and specifically the second edition.

- In 2020, government agencies will automatically transfer all existing statistical data from OKVED-1 to OKVED-2, but this applies only to those persons who are already registered and operating. Only registrants must register under the new rules.

Does the tax amount depend on the choice of OKVED

If an individual entrepreneur plans to use UTII or a patent taxation system, his main tax will depend on the selected OKVED. In this case, the tax base is taken as imputed (potential) income, which presumably can be obtained by working on a particular code. For OSNO, simplified tax system and unified agricultural tax, the choice according to OKVED does not affect the amount of the future basic tax. The only exception is payments for injuries from employee salaries. The interest rate on them for individual entrepreneurs depends on the declared activity code.

Selecting OKVED for individual entrepreneurs on the simplified tax system

The Simplification Law does not contain a specific list of types of activities. However, when choosing a simplified tax system when opening, an individual entrepreneur must know that there is a list of OKVED codes that he cannot apply in this tax system. Among them:

- 64.91, 64.92, 64.99 - banking and financial activities;

- 65.11, 65.12 - insurance activities;

- 65.30 - participation in Pension funds;

- 64.30 — investment activity;

- 66.11, 66.12 - participation in the securities market;

- 69.1 - provision of notary and lawyer services;

- 64.92.6 - pawnshop services;

- 92.1 - organization of gambling;

- production of excisable goods, for example, code 12.0 (tobacco products);

- mining and trading of minerals.

In other cases, the individual entrepreneur can choose the desired OKVED according to the principles discussed above.

Which OKVED to choose for an individual entrepreneur on a patent

On a patent, an individual entrepreneur has the right to choose any of the 63 types of activities permitted by law. You can view them on the tax website, because... their list changes periodically. Each of them corresponds to its own OKVED.

Activities and taxes

The choice of OKVED also affects what taxes and at what rates the entrepreneur will have to pay. The Russian tax system has 5 tax regimes, 4 of which are preferential and intended for small businesses. For the application of each of them, different conditions have been introduced, for example, the maximum number of employees, the maximum annual income. This choice directly depends on the type of activity. These tax regimes are:

- Basic system (OSNO). An entrepreneur can use it for any activity. You will have to pay tax on income minus expenses at a rate of 13%, as well as VAT at a rate of up to 20%, which is often unprofitable.

- Simplified system (STS). You can choose one of two options - pay 6% on all income or 15% on the difference between income and expenses. The types of activities of individual entrepreneurs under the simplified taxation system can be almost any, although there are still minor restrictions (clause 3 of Article 346.12 of the Tax Code of the Russian Federation). The simplified tax system cannot be used in the production of excisable goods, extraction and sale of minerals, with the exception of common ones. This system is also not used in financial activities - banking, insurance, investment, pawnshop, microcredit. But we have already said that for individual entrepreneurs all this activity is prohibited in any case.

- Unified tax on imputed income (UTII). Paid at a rate of 15% of the amount of theoretical income from a specific activity, calculated using a special formula. The benefit here is that the tax amount does not depend on income. However, UTII can only be applied to strictly defined activities, the general list of which is given in paragraph 2 of Article 346.26 of the Tax Code of the Russian Federation. In addition, the imputed tax does not apply everywhere; it is introduced by decision of local authorities. In Moscow, for example, it does not exist.

- Patent system (PSN). As with UTII, the tax does not depend on the amount of income, but on the type of activity. The cost of a patent is calculated at a rate of 6% of the potential income of an individual entrepreneur in the chosen field. The list of activities for which the patent system is suitable is given in Article 346.43 of the Tax Code of the Russian Federation. PSN is introduced by the municipal authorities of the constituent entity of the Russian Federation, so it is necessary to take into account the peculiarities of regional legislation.

- Unified Agricultural Tax (USAT). Applicable only to agricultural producers. These are organizations and individual entrepreneurs that are engaged in livestock farming, crop production, as well as industrial processing of agricultural products. The details of the activities for which the unified agricultural tax can be applied are given in Article 346.2 of the Tax Code of the Russian Federation. The tax rate is 6% of the difference between income and expenses, but in addition to this, from 2020 you need to pay VAT.

So, the possibility of applying preferential tax regimes, as well as the size of UTII and the cost of a patent, directly depends on the type of activity. In addition, for individual entrepreneurs using the simplified tax system and special tax system, regional authorities can introduce “tax holidays” - reducing the tax rate to zero. Again, the ability to take advantage of the benefit depends on the type of activity. Vacations are allowed only for entrepreneurs in the production, scientific and social spheres, as well as in the sphere of consumer services.

How to notify the tax office about the new OKVED

An individual entrepreneur can declare the opening of a new OKVED, adding or excluding old information. To do this, you need to fill out page 1 of sheet E of form P24001. Her form is approved by app. Federal Tax Service of Russia No. ММВ [email protected] dated January 25, 2012.

If, according to the new OKVED, an individual entrepreneur plans to receive more profit than before, he enters it into clause 1.1, thereby making the code the main one. If the selected code for an individual entrepreneur is additional, he writes it in clause 1.2.

The completed form is sent to the tax office. This must be done no later than 3 days from the date of commencement of the new activity. The application can be sent by registered mail, sent through the personal account of the Federal Tax Service, delivered in person or sent through a representative.

I don’t have such an OKVED code, so what?

How many OKVED codes do you need for peace of mind?

OKVED codes cover everyone, according to the code they meet and see you off. Even the tax burden calculator is tailored to OKVED codes. But if, in addition to core activities, there are side activities or one-time transactions, how many OKVED codes do you need to have? And what happens if these codes are not added?

No OKVED code - will you be fined 5,000 rubles?

Organizations and individual entrepreneurs have a direct obligation to notify the registering Federal Tax Service within three working days of changes in the OKVED codes declared during registration. Violation is subject to administrative liability in the form of a warning or a fine of 5,000 rubles.

In practice, I myself witnessed one such fine. When registering a legal entity, they provided a lease agreement from a friendly individual entrepreneur. During the inspection, it turned out that he had rented out the premises, but had missed the code. He didn't have this code. An administrative violation protocol was drawn up, which resulted in a fine. But this is still an exceptional case, where it was possible to get close to the start of the activity right on its heels. In addition, in this situation, if you tried, you could avoid a fine.

Here's the thing. 129-FZ establishes the obligation to report them to the registering Federal Tax Service within three working days from the start of new activities. Otherwise - a warning or a fine under Art. 14.25 Code of Administrative Offenses of the Russian Federation. But the statute of limitations is two months (Article 4.5 of the Administrative Code). It turns out that the secret should become obvious to the tax authorities after three days and two months from the start of this type of activity. In ordinary life, such a hit is still unlikely. You have to be a sniper medium in the service of the Federal Tax Service. And then, the very concept of “beginning” is vague, without reference, for example, to revenue. We have concluded some kind of agreement - this is the beginning for you. In general, the possibility of administrative liability for the lack of OKVED is more of a phantom threat than a real one.

There is no required OKVED code, the activity will not fall under the simplified tax system?

The use of simplification does not depend on the presence or absence of OKVED codes. But even if such a question may arise, it will only be in relation to individual entrepreneurs. The reason is a whole scattering of letters from the Ministry of Finance stating that the income of individual entrepreneurs subject to the simplified tax system includes income from activities included in the Unified State Register of Individual Entrepreneurs. Here is a link to some of these letters(1). But these letters cannot be considered in isolation from the context, since they all relate to the controversial division of income into business and “own” personal and the role of OKVED in this matter. For example, property sales.

If the property is personal and has not been involved in business activities, then even the presence of the appropriate OKVED code will not force you to pay “entrepreneurial” taxes. On the contrary, the absence of OKVED for the sale of property, if such property was used in business activities, will not protect against the chosen taxation system (2). A simplification has been chosen, which means that the tax must be calculated based on this regime. That is, the status and history of the property are primary, and OKVED is, rather, a help, but not a decisive factor.

OKVED codes for one-time transactions - are they needed?

OKVED are codes of economic activity, which means that a one-time transaction is also an economic activity that must be designated by an OKVED code. On the other hand, in practice, the tax authorities associate these codes with business activities that are systematic in nature, and if, for example, the sale of property can be regarded as a single transaction, then a special OKVED is not needed for it.

The Tax Code of the Russian Federation has, although not for our case, criteria for a one-time transaction (paragraph 2, clause 9, article 105.7 of the Tax Code of the Russian Federation). Firstly, this must be a truly single transaction, that is, carried out on a one-time basis. Secondly, the economic essence of this transaction must differ from the main activity of the enterprise.

For example, an agricultural producer decided to sell its equipment. The main activity of such a company is the production of agricultural products, and this is what the equipment is used for. But receiving benefits from the useful properties of this equipment, money for its sale, is not directly related to agricultural activities - this is a one-time transaction, and OKVED is not needed.

There is still a whole layer of issues related to the confirmation of the insurance rate “for injuries”, but still it concerns the main type of activity, and not side branches.

Have you, colleagues, encountered negative experiences of not having OKVED?

- Letter of the Ministry of Finance of Russia dated November 22, 2017 N 03-04-06/77155; Letter of the Ministry of Finance of Russia dated October 25, 2017 N 03-11-11/70108); Letter of the Ministry of Finance of Russia dated July 18, 2016 N 03-11-11/41910; Letter of the Ministry of Finance of Russia dated July 14, 2016 N 03-04-05/41193.

- Determination of the Supreme Arbitration Court of the Russian Federation dated March 21, 2014 No. VAS-2475/14 in case No. A73-15778/2012.

Andrey Zhiltsov, head of the Multi-Accountant service

What happens if OKVED does not correspond to the activity

If an individual entrepreneur does not work according to the declared OKVED, he may be held administratively liable for submitting false information to registration documents. The fine will be 5 thousand rubles. The tax office also has the right to refuse a VAT refund if it turns out that the sales were not made using open source code.

The Social Insurance Fund has the right to recalculate the accrued amount of contributions for injuries if it finds that the interest rate does not correspond to the main OKVED code, according to which the individual entrepreneur receives the greatest income.

How to choose OKVED?

Here is a summary of the rules for choosing a code for your activity, which is relevant for all organizations:

- You are allowed to select several codes, but no more than 20.

- If an organization has been opened and the main activity code has been selected, but after some time you plan to expand, you must open an additional code, otherwise the activity may be considered illegal. How to insure yourself? Analyze your work and open several codes at once on possible areas of development for your business.

- If you cannot find a description of the desired business according to the code, then select “Other services”.

- If the main + additional activity is chosen, but the additional one brings more income, then the “alignment of forces” needs to be changed. It must be remembered that in large organizations any change in OKVED, as well as its assignment, is reflected in the company’s Charter. But if the Charter states that the organization has the right to engage in other types of activities, changes to the Charter will not be required.

- If you decide to change your business activity, you must notify the tax service of your decision within three days by submitting an application.

Since July 2020, there has been a change in classification codes, so it is necessary to indicate a new code, otherwise the application will be declared invalid (consideration of the application by the tax authorities takes no more than 7 days), and in 2020 the updated classifier will come into force.

How to find out OKVED codes

You can find out your OKVED codes or the codes of any other entrepreneur on the tax website by requesting an extract from the Unified State Register of Individual Entrepreneurs/Unified State Register of Legal Entities. The ordered extract will list the main and additional OKVED codes that are currently used to conduct business.

The smart service generates documents for individual entrepreneur registration in 15 minutes, but you submit them yourself. More details Go to service

- You enter all the data yourself, and the service generates a package of documents for individual entrepreneur registration.

- You submit documents to the tax office or MFC yourself.

- You pay a state fee of 800 rubles. before submitting documents, but you don’t have to pay if you submit through the MFC.

- The service contains tips on taxes, selection of OKVED and other stages.

- The service fills everything out without errors, the results are verified by the Federal Tax Service.

- The service is also free.

Scheme of work In 15 minutes, you generate documents in the service: an application on form P21001, a notification about the transition to the simplified tax system (if necessary) and a file with instructions for further actions. Next, you print them out, pay the state fee, and submit the documents to the Federal Tax Service or the MFC. 3 working days after submission you will receive individual entrepreneur status. Collapse Go to service

Confirmation of the main business area in the Social Insurance Fund

Employees registered to carry out their job duties on the basis of an employment agreement are subject to compulsory social insurance against industrial accidents and occupational diseases. This norm is enshrined in Federal Law No. 125. The contribution is transferred every month. The calculation is based on tariffs, which are determined by professional risk class.

For each company, the size is approved annually based on information provided by the company. The process of transferring information is defined in the Procedure for confirming the main type of economic activity, approved by Order No. 55.

For the purposes of the Social Insurance Fund, the main type of operation is the one from which the highest income was acquired during the previous reporting period. If you do not report within the established period on the actual predominant direction of business and income, then the calculation is made based on high tariffs for the types of activities that are determined for the company, even if business is not conducted in this area. Thus, “extra” codes can play a role and turn out to be unnecessary.

For the purposes of calculating the insurance premium, specific criteria for approval of the main type of operation have been established:

- for commercial companies - the overwhelming share in the total volume of goods produced or sold;

- for non-profit firms - the prevailing number of employees working in a particular industry.

Work in the prevailing area of activity is confirmed every year - until April 15. Companies that attract workers submit acts to the Social Insurance Fund that truly indicate the predominance of one of the business areas. Organizations must submit relevant information annually. For entrepreneurs, this obligation arises when the key activity is transformed.

The tariff amount is approved by the Social Insurance Fund. It can range from 0.2 to 8.5% depending on the class of professional risk.

Confirmation of the prevailing type has special features if the policyholder conducts business in several sectors of the economy at once.

In this case, there are two options:

- The share of one area of activity prevails over others: the class of professional risk corresponding to this area is taken into account in the calculations.

- The types of activities are equivalent in total weight: for the purposes of calculating the insurance premium, the one from the areas of functioning that is characterized by the highest class of professional risk is accepted.

Not confirming the predominant area of business is not a reasonable decision at all, since the entrepreneur will have to bear unnecessary costs for insurance premiums at the highest rate.

To confirm the main type of business, LLCs are required to submit the following documentation to the Social Insurance Fund:

- an application in the form determined by the legislator;

- confirmation certificate;

- explanatory note to the balance sheet (exception: not required for small businesses).

Profit is calculated according to a formula approved by the legislator: proceeds after sales in a specific area are divided by the total profit from all sectors of the market. We multiply the resulting total by 100%.

Activities with a prevailing share are the main ones for the company in this reporting period.

Calculation example:

specializes in 2 types of activities - film rental and video copying. The total profit for the previous period was 1.5 million rubles. Of these, for the first type - 500 thousand rubles, and for the second - 1 million rubles.

The specific gravity is calculated using the above formula:

— for rental – 500000/1500000*100% = 33%

— for copying – 1000000/1500000*100% = 67%

The data obtained indicate that the second area of the company’s work brings it more significant revenue, and therefore, the occupational risk class is calculated according to the tariff approved for the corresponding OKVED code.

We remind you that payments for injuries are also made by entrepreneurs who have chosen the simplified tax system. The specified category of payers must also confirm the prevailing type of activity.

The legislator has provided exceptions for some entrepreneurs.

These categories are not required to prove the main direction of economic activity:

- Individual entrepreneurs (send a written request and the required documentation to the Social Insurance Fund if they change the main type of activity);

- Newly formed companies that have been operating for less than a year.

Companies and individual entrepreneurs are notified of the established tariff no later than 14 days from the date of transfer of documentation. The notification form is approved by the legislator. Until this point, payments are calculated at the rates that were in effect in the previous period.

An ambiguous situation arises when an LLC or individual entrepreneur has transformed the predominant area of business during the year. The legislator established that in such a situation the tariff would not be revised. Transformations will follow only next year.

Some entrepreneurs try to avoid unnecessary expenses by confirming with the Social Insurance Fund a type of activity with a low level of insurance payments. This trick is easily detected, since businessmen are required to submit, in addition to other documentation, a balance sheet.

Is it possible to indicate OKVED codes from different groups/sections

The OKVED directory describes almost all possible types of activity: from agriculture to the activities of government agencies.

The legislation does not contain restrictions on the choice of codes for only one group. Thus, if the main code involves activities in the field of agriculture, then you have the right to indicate codes from other groups, for example, transport services.

But, it should be taken into account that the rule of correspondence and simple logic. For example, if, again, your main code is related to agriculture, then it is not logical to indicate the provision of legal services in additional codes. See statistics of the 50 most popular OKVED codes.