Home Finance Business

Currently, there are about three million individual entrepreneurs in our country and their number is constantly increasing. People want to be free and independent, to make a profit from their activities.

The increase in the number of individual entrepreneurs in our country today is facilitated by the emergence of programs with state support for individual entrepreneurs and preferential lending to small businesses. The economic growth emerging in the country is also important.

Due to the fact that an individual entrepreneur does not have a legal address, many inconveniences arise - all official documents of the entrepreneur will be sent to the place of registration of this person, and not to the address of the actual place of residence.

According to the legislation of the Russian Federation, registration of individual entrepreneurs must be carried out at the place of registration of the citizen. However, it is also possible to register an individual entrepreneur in another place when engaging in activities that are possible under taxation under the UTII system.

The place of residence is usually confirmed officially only by registration - the presence of a stamp in the passport.

Registration under a temporary registration registration is carried out only for the validity period of this registration. After this period, the individual is deregistered with the Federal Tax Service and the individual entrepreneur must not continue his activities.

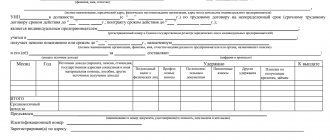

The registration process for opening an individual entrepreneur under temporary registration is similar to the registration procedure for permanent registration, only the application (Form P21001) indicates the address of temporary registration.

Advantages and disadvantages of individual entrepreneurs

Let's consider the advantages:

- lack of a special legal address. The opportunity to engage in business in any region of the country is provided;

- a simple form for starting a businessman;

- you can work from home without having an office - saving money;

- the opportunity to use a special, simplest form of taxation - a patent;

- at any time you can withdraw money, top up your personal account without documenting or explaining the reasons for withdrawing funds;

- During the first two years, in certain areas of activity, exemption from taxes and fees is possible (information is presented on the Federal Tax Service website for the current year).

The main disadvantages of IP:

- it is more difficult to attract investment for your business;

- restrictions on certain types of activities (selling alcohol, pyrotechnics is not allowed, you cannot open a bank, a pawnshop, and much more);

- the need to pay contributions to various fund organizations - it does not matter whether a profit is made or not.

Legal requirements

According to Law No. 129-FZ, registration of an individual entrepreneur is allowed only in the locality where he is registered. To do this, you must submit an application on form P21001, a copy of your passport and a receipt confirming payment of the duty to the local tax office. You can download a blank form of form P21001 here.

An adult citizen of the Russian Federation has the right to submit the documents necessary for registration of an individual entrepreneur either personally or through an intermediary, confirming his authority with a power of attorney certified by a notary. It is also possible to submit an application by mail or via the Internet. In addition, notaries can also submit documents at the request of an individual. The price set for this service is 1,000 rubles.

This information answers the question of how to register an individual entrepreneur not at the place of residence.

When opening an individual entrepreneur, one of the tax systems that is most convenient and profitable for him is selected.

After registration, the individual entrepreneur receives:

- certificate;

- notification indicating the number of registration with the Pension Fund;

- notification of the completion of an account with the tax office.

The tax authority must register an individual entrepreneur within 3 working days from the moment the citizen submits all documents.

What exact actions need to be taken to complete the registration procedure?

Necessary:

- choose an industry for your activity. First, familiarize yourself with consumer demand in the market in the region. On the website “Business Navigator” (https://smbn.ru/) you can get acquainted with the relationship between supply and demand in the desired region;

- accept a business plan. It must be well calculated and thought out. Success in work and reduction of unnecessary costs depend on the quality of its preparation. The plan will help you avoid many mistakes in future work. When drawing up a business plan, you can also use the services of the mentioned site;

- register your activities. Registration is carried out with the Federal Tax Service in accordance with the legislative procedure;

- choose a tax calculation system. Linking to a specific system is necessary to control the timely payment of taxes and mandatory payments to government funds.

There are currently 5 different taxation systems: OSN (set at registration, unless another type is specified in the application), simplified tax system, UTII, unified agricultural tax, patent system.

The choice of one or another tax regime depends on the type of activity, the amount of annual revenue and some other factors:

- determine the codes for your type of activity (according to the current edition of OKVED).

The documents required for registration of an individual entrepreneur and their execution can be found on the portal for entrepreneurs 1C-Start (free).

Law's opinion

Law 129-FZ contains an algorithm of actions when preparing documents for registration of a new individual entrepreneur. In the standard version, in addition to filling out the application P210001, the future entrepreneur must provide a copy (for an adult citizen of the Russian Federation).

Article 22.1 determines that, relying specifically on , the registrar must approve the place of registration of the individual entrepreneur at the registration address. And only if such information is missing in the passport for some reason, another address is selected for registration activities. Then it is possible to register an individual entrepreneur at the place of residence.

Required documents for the Federal Tax Service

You can prepare the documents yourself, or you can turn to specialists - lawyers who know their business well. Some banks can prepare documents themselves (free of charge) when opening a current account with them.

Having a personal account for an individual entrepreneur is not necessary, but it is generally accepted and quite convenient - for paying payments and tracking funds online.

This requires:

- fill out form P 21001 (you can download it on the Federal Tax Service website). When submitting documents not personally, but by an authorized person, you must provide a power of attorney. It must first be certified by a notary office;

- provide a copy of your passport (the original will be required when submitting documents);

- provide a copy of the TIN (if available);

- when choosing a simplified tax system, you must indicate your intention to use it (passport, TIN required);

- You can pay the state duty: on the website of the Federal Tax Service, through a bank or terminal at the tax office itself and present a receipt.

Then you need:

- the inspector of the Federal Tax Service must certify copies of documents based on the originals provided, provide a receipt for receipt of the documents;

- obtain state registration certificates, an extract from the Unified State Register of Individual Entrepreneurs, TIN (if it has not been previously received);

- Receive certificates of registration with the pension fund and health insurance by mail.

The place of economic activity of an individual entrepreneur and his place of residence may often not coincide. That is why future businessmen are concerned about the possibility of opening their own business in another city without registration.

Introduction

When a businessman opens an LLC, he does not have to work in the place of opening. Without any problems, he can open a branch in another region, create a representative office or a new division thousands of kilometers from the place of registration. At the same time, the new branch is registered with the tax office exactly where it plans to conduct its activities, and, accordingly, pays taxes there.

Individual entrepreneurs can operate under different taxation schemes

When a businessman registers as a private (individual) entrepreneur, he is registered at the place of his registration. If he hires employees, he registers them again at the place of registration, drawing up the necessary applications to the Pension and Insurance Funds. Accordingly, all payments are made at the place of residence of the individual entrepreneur and his employees.

Attention:

According to the law, individual entrepreneurs cannot open representative offices and branches; this is the prerogative of the LLC. It is also impossible to sell an individual entrepreneur or appoint a manager.

Registration of an individual entrepreneur not at the place of registration

If an individual was previously registered as an individual entrepreneur at his place of permanent residence, but he needs to acquire a patent in order to then work in another city. To do this, he must apply to the tax office for the issuance of a patent in the city in which his business will be carried out.

If a businessman uses one of the taxation options, such as the simplified taxation system, OSNO or unified agricultural tax, then he can work in any region of the Russian Federation, even without having either permanent or temporary registration. In this case, he is registered only with the Federal Tax Service at his place of permanent residence. Registration at the place of actual activity is not required.

Please note that it is not always necessary to open an individual entrepreneur in another city, even if you start activities in a different locality where you are permanently registered.

In this case, it is necessary to pay taxes in UTII (it is also possible to issue special offers - a patent or an imputed tax).

When paying using the UTII system, you must ensure the following conditions:

- the type of commercial activity must be on the list of permitted types for its use in the given area.

The governing bodies of each region independently determine the possibility of using one or another type of taxation system.

Please note that even if the UTII system is in effect in the city in which the individual entrepreneur intends to engage in activities, but in the city of registration this system does not operate, it is not possible for an entrepreneur to take advantage of the UTII system.

When choosing a UTII tax system, you must register, submit reporting documents, and pay taxes at your place of residence.

When switching to any other type of taxation, all documents must be submitted exactly to the tax authority in which the registration procedure was previously carried out. This simplifies the transition procedure and reduces registration time. If you apply at your place of business, the processing time for your application will increase significantly.

When applying preferential taxation - special regimes, you must write an application.

In this case, it is necessary to additionally register when carrying out activities not only in another region, but also at the place of your permanent registration.

If an individual entrepreneur operates in another area, then he can register with the tax office using UTII or a patent.

Individual entrepreneur registration procedure

According to current legislation, state registration of an individual entrepreneur is carried out at the place of his registration. This is done in order to tie the entrepreneur in paying taxes and other payments for his business activities to a certain tax office and various state funds. It is also a control to ensure that there is no evasion of mandatory payments. Even if the entrepreneur plans to open many branches in different cities. Therefore, the future individual entrepreneur is obliged to contact the tax office at his place of registration, which almost always corresponds to his place of residence. But there are cases when a person changes housing, or he specifically comes to another city for the purpose of doing business without creating a legal entity. Despite the strict registration conditions, there is a way out of any situation that arises.

Registration of a patent

A distinctive feature of a patent is that it is issued at the place of activity.

To receive it, you need to write an application to the tax office. The patent can be obtained in 5 working days. The patent is paid at the place of receipt. There is no need to submit reports to the tax authorities.

According to the law, it is valid in the subject of the federation where it was received.

Insurance premiums are paid to funds also at the place of registration of the individual entrepreneur.

It is important that laws apply to individual entrepreneurs only those that exist in the region of its registration. For example, if the tax rate in the city in which an individual entrepreneur is registered is lower than in the city of his work, he can enjoy a lower tax rate.

When registering under a general or other tax calculation system, you can do business in several other cities at the same time, but you must submit all reports to the exact branch of the Federal Tax Service where registration took place.

According to the current law, individual entrepreneur can be registered:

- at the place of permanent residence;

- at the place of business activity;

- at the location of your enterprise.

Moreover, with each type of registration, you can work successfully, pay taxes and other mandatory fees.

Let's look at registration for different types of registration.

How to register an individual entrepreneur in another region

Registration of an individual entrepreneur not at the place of registration is not permitted by law: sub. "b" clause 1 art. 23 of Law No. 129-FZ provides for refusal to provide this public service due to the submission of documents to the wrong department of the Federal Tax Service. That is, there is a territorial connection of the registration authority to the applicant’s place of residence.

If the applicant cannot come to the appropriate department of the Federal Tax Service in person, he can submit documents in other ways:

- Entrust the registration of individual entrepreneurs in another region (as an example) to a trusted person.

- Send documents by mail (the signature on the application must be certified by a notary).

- Generate and send electronic documents (to do this, you need to register on the official website of the Federal Tax Service or the State Services portal).

In this case, a problem may arise with paying the state duty, because the money must go to the right department. Read about this in our articles:

- “Receipt for payment of state duty upon registration of individual entrepreneurs”;

- “State duty for registration of individual entrepreneurs in 2020.”

NOTE! If an entrepreneur is registered in one region and operates in another, he must submit reports on his business at the place of registration of the individual entrepreneur.

Currently, departments are working to cancel the territorial reference. Read more about this here: “What documents are needed for self-registration of an individual entrepreneur?”

Registration of individual entrepreneurs with temporary registration

According to the law, you can register under one of the following conditions:

- lack of registration (no stamp in passport);

- upon deregistration upon registration.

With permanent registration, you can register an individual entrepreneur only in this region. Temporary registration can replace permanent registration in another city.

For people from other regions, this question is most relevant. They are required to obtain a temporary residence permit and cancel the current one in another region.

Required for registration:

- submit an application to the FMS;

- prepare a copy of your passport, TIN;

- pay the appropriate fee;

- submit all specified documents to the tax office at your temporary registration address;

- receive a registration notification from the Federal Tax Service.

An individual entrepreneur registered with a temporary residence permit is linked to the Federal Tax Service branch where all primary documents were drawn up.

If there is no registration in the passport

Some citizens do not have any permanent registration in their passport.

The case is not too common, but it does occur in practice. Is it possible to register an individual entrepreneur in this case? To answer this question, you need to go back to the beginning of the article. We found out that having a place of residence is a prerequisite for registering an individual entrepreneur. If there is no stamp in your passport, you need to register at your place of temporary stay. Practice shows that the Federal Tax Service registers entrepreneurs with temporary registration for a period of 6 months. It should be remembered that as soon as its term expires, the entrepreneur will be removed from the register.

If you do not have a permanent or temporary registration, you will not be able to become an entrepreneur. However, this is quite logical, because any business entity had to be attached to some address, and through it to the tax authority. With organizations, the issue is resolved differently - they are required to have a legal address. This is not provided for individuals, since registration is an analogue of a legal address. So the only way to open an individual entrepreneur without registration is to obtain temporary registration at your place of residence.

Remote registration of individual entrepreneurs in the region with permanent residence

Many people want to start working as an individual entrepreneur in a new place, as they think they will be more successful.

In case of registration in your native region, but when staying in another region, the following is required for registration:

- prepare the necessary documents;

- write an application (indicate whether you have a residence permit in another city);

- send by registered mail to the tax office, which must register the individual entrepreneur;

- provide power of attorney to a friend or relative. The power of attorney must be certified by a notary. In this case, the registration will be carried out without the participation of the individual entrepreneur, on behalf of the individual entrepreneur;

- You can submit documents online.

- seek help from professional lawyers, conclude an agreement, entrust the registration of your business.

You can obtain documents:

- personally;

- through a person who, having a notarized power of attorney, will receive the documents and forward them to the entrepreneur.

Methods for registering an individual entrepreneur if a person is not at his place of residence

Despite the fact that the state requirements for registering an individual entrepreneur are quite strict, it can be opened in another locality, and at the same time successfully carry out its activities, paying taxes and other mandatory fees. But for this you need to understand some subtleties.

There are such situations:

- a person who wants to open an individual entrepreneur and do business in a certain region of our country has a place of residence and registration in another region or locality, and he does not have the opportunity to go to his place of registration to do everything according to the law;

- a person who wants to become an individual entrepreneur does not have permanent registration, or changes his place of residence, but has a desire to engage in business.

Of course, the situations are not standard, but each has legal solutions, and they will be discussed below.

Re-registration of individual entrepreneurs when changing the registration address

According to our legislation, the following is required:

- reflect immediately in the unified state register (USRIP) all its changes according to the registration data of the individual entrepreneur;

All data must be true. The stated information is checked and if inaccuracies are found, changes will not be made.

- report a change of address to the Federal Tax Service (application form R 24001);

- receive an extract from the Unified State Register of Individual Entrepreneurs;

If you change your place of residence in the same region, while maintaining your previous place of registration, no changes are made to the documentation.

- notify the tax office. Necessary changes are made to all registration funds upon notification by the tax inspectorate itself. At the same time, the entrepreneur retains the TIN and OGRN;

- notify clients and partners about the change of registration address (this will be done by the tax authorities who update the register of individual entrepreneurs).

Note that usually the re-registration or initial registration of a business with us is still accompanied by unjustified paperwork, but gradually with the introduction of electronic services the registration process is gradually becoming simpler.

What to do if you do not have an official address in the Russian Federation

Let's consider a situation where you have neither permanent nor temporary registration on the territory of the Russian Federation. For example, you live outside the Russian Federation, although you are a Russian citizen.

Is it possible to open an individual entrepreneur without registration? Unfortunately, no, because in this case the tax office simply will not be able to register you, either permanently or temporarily. But if you are determined to start a business in Russia, then there is a way out of this situation - registering an LLC. The organization is registered at a legal address, which may be a suitable non-residential premises. And the founder of the company is not required to officially reside in the Russian Federation.