What is a legal address

According to established practice, a legal address should be understood as an indication of the place where the head office of an individual entrepreneur is located. In another way they say that this is the actual address.

Certificate of registration of individual entrepreneur

Not all entities receive a legal address for registration of individual entrepreneurs. It is usually mandatory for those entrepreneurs who employ a staff and rent office space. The same applies to entities that have partners - large organizations. In this regard, there is a need to conduct active business correspondence and make special demands on counterparties. The last name is not as important as the other components.

For your information! For limited liability companies, an office is required; in the case of entrepreneurs, such requirements are waived. In the details of any documents, it is allowed to use the address at the place of residence or not indicate anything at all. The difference is almost unnoticeable.

Does the individual entrepreneur have a legal entity? address

If we talk about legislation, there is no such concept. Instead, state authorities mean the place of residence of an individual who has been registered with the status of an individual entrepreneur. It is to this address that business and any official correspondence is sent. An on-site tax audit is also carried out at the same place when the need arises.

Actual location

Often, an individual entrepreneur operates not at his place of residence, but in rented non-residential premises. The place where the entrepreneur directly works is the actual address.

Unlike legal persons, an individual entrepreneur is not obliged to notify the Federal Tax Service of the place of actual activity.

It is important to know: There are no sanctions provided by law for discrepancies between the legal and actual addresses of an individual entrepreneur.

In this case, the individual entrepreneur may indicate the actual location in advertising brochures or informal letters.

At what address is an individual entrepreneur registered?

Individual entrepreneur by TIN - how to find and verify an individual entrepreneur

Registration of individual entrepreneurs usually takes place at the tax office, which controls the current location of the individual receiving the status. Usually indicate the place of registration corresponding to the current address.

Registration online

Important! If there is no permanent registration, you can use the address where temporary registration is registered. As soon as its term ends, the status of an individual entrepreneur is lost automatically. Registration for temporary addresses is a solution only for extreme situations.

There are other rules that deserve special attention:

- registration address of individual entrepreneur or legal entity. persons are only residential premises, for example, an apartment or room, a house;

- A citizen is also allowed to register at the location of the hostel and official housing;

- It is impossible to open an individual entrepreneur if you are using an office or other similar objects not intended for permanent residence. OGRN, OGRNIP in this case are also not assigned.

Most entrepreneurs do not conduct their main work at home. Real business operates where goods and services are sold. It is easy to obtain information about the location of such an object.

Note! Only the place of residence is recognized as the official address of an individual entrepreneur; other indicators cannot be considered legal in order to be registered.

Can an individual entrepreneur use a temporary registration for registration?

Beginning entrepreneurs in some cases wonder whether it is possible to register as an individual entrepreneur by providing a temporary registration certificate to the tax authority. Yes, this is possible, but it is worth remembering that temporary registration entails a number of certain inconveniences and it must be renewed periodically. Registration of an individual entrepreneur with a temporary registration is possible if a certificate of temporary registration for a period of at least 6 months, certified by a notary, is attached to the standard package of documents for state registration of an individual entrepreneur. In addition, the passport of the future individual entrepreneur should not contain a stamp indicating registration at the place of permanent residence.

Attention! After the expiration of the temporary registration period, the individual entrepreneur will be automatically removed from tax registration, so the temporary registration must be renewed in a timely manner and the local tax office must be notified about this.

For your information! Wherever an individual entrepreneur is registered, he can conduct commercial activities anywhere in Russia. However, he is obliged to submit reports to the tax office that registered him. Now this is not particularly difficult: you can send documents either through Russian post or via the Internet. All of the above equally applies to those who are registered as individual entrepreneurs under temporary registration.

How to find out the legal address of an individual entrepreneur

Responsibilities of an individual entrepreneur and his rights - the possibilities of an entrepreneur under the law

The Federal Tax Service inspection at the place of residence of a business is the main body that people turn to in order to obtain maximum information about where this or that entity is currently located. You can issue USRIP extracts, but they charge an additional fee. Finding information later will not be difficult.

Certificate

By TIN

Unified State Register of Entrepreneurs is a special register where all information about an entrepreneur is entered. This applies not only to the address, but also to other directions:

- individual tax numbers or TIN. Rosstat also applies them;

- personal data in the form of full name;

- activities. Each of them also has a number.

Personal information and Taxpayer Identification Number are the main means of identifying any business owner. Personal data may change, but the payer identification code remains the same throughout life. To get an answer to the question about the address according to the TIN of an individual entrepreneur, there are two main ways:

- filing a special application to the tax office. After this, an extract is issued. The service is paid, as mentioned above;

- visiting the tax office website, entering the relevant data. In this case, the document is issued free of charge. Changes are also recorded if necessary.

An extract from the Unified State Register of Individual Entrepreneurs is an official legal document. It can be used, including when going to court is required. Data from the Internet will be enough in the case of ordinary claims; they cannot be changed so easily.

Important! You can pay extra to have the extract issued urgently. Then the fee for the service doubles.

Another option is to use specialized sites. But under such circumstances they only give out general information. You cannot expect to receive any official papers. Nothing can be changed in this regard either.

You will need to act as follows:

- Visit the website of the state tax office online.

- Search for a special line where personal data is entered, if necessary, TIN.

- All you have to do is click on the search button, after which all information regarding the entrepreneur known to date will open.

By last name

In this case, the tax office website remains one of the accessible and easiest options for checking information. Thanks to it you can find out a lot of information:

- Is the entrepreneur officially registered?

- Did the individual entrepreneur have liquidation and bankruptcy procedures?

- Does the actual activity correspond to the information specified in the documents? Or does something need to be changed?

Knowing your full name, you can obtain data even for those entities who have just submitted documents for registration. Visitors to the site can find out whether a citizen is, in principle, allowed to engage in entrepreneurial activity, and whether he has the right to manage an organization. You are allowed to view any information.

Note! Upon request, any Arbitration Court operating in Russia has the right to issue information. Typically the information relates to proceedings involving a specific person, either commenced or completed. It is better to use the so-called file of arbitration cases to conduct an audit. They also allow postal delivery.

Another acceptable source of information is the portal of the Federal Bailiff Service. But here they give out a description of cases in which a decision has already been made and a writ of execution has been issued.

There are various commercial enterprises that also provide information after sending any request. All information in this case is available in one window, this is the main feature and advantage.

What do the details mean and which ones are mandatory?

Some people ask: “What are IP details?”

This is information on the basis of which it became possible to identify the counterparty and verify the accuracy of the information provided.

Often, an individual entrepreneur indicates details in contracts and other documentation.

At the legislative level, two options for information are provided. Mandatory information is always indicated; its absence often indicates a number of violations in the conduct of business activities. Specifying optional details remains at the discretion of the business owner.

If such information is missing, this raises a number of suspicions, which are based on the fact that the individual entrepreneur is engaged in dishonest work, which is why the information is hidden.

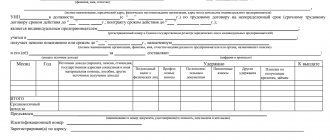

An entrepreneur has a number of mandatory details that are indicated on documentation and contracts.

For example:

- data of the business owner according to the passport, namely, full name and registration address, which in turn acts as the legal address for the individual entrepreneur;

- the main number of the entrepreneur (OGRNIP - assigned during the registration process, when information about the entrepreneur is entered into the register, consists of 15 characters);

- tax payer code (TIN is also assigned upon registration).

As you can see, the list of information is not so extensive, but in its absence, entrepreneurs face a number of serious problems.

Why is an address needed for an individual entrepreneur?

How to find out OKATO IP by TIN: what is it and why is it needed

Entrepreneurs need addresses if they carry out serious work with clients and suppliers. Here are just a few situations when such information will definitely be needed:

- generation of reporting where accommodation is organized;

- filling out documents and registers;

- execution of contracts with counterparties;

- opening a current account. Then you will have to check all the information.

Legal entity address

The place of registration is important when calculating the correct tax in relation to a particular entity. When officially registering a legal address, it is considered that the entrepreneur secures certain obligations. This applies to interactions with regulatory authorities, settlements with clients, and fulfillment of obligations under the contract.

Other additional functions are implemented at the legal address:

- submission of reports and declarations;

- submission of information when making adjustments to constituent documents;

- conducting inspections;

- processing various requests.

In case of non-compliance with obligations to counterparties, the entrepreneur is liable with his property.

Bank details of individual entrepreneurs

This separate group of details contains the information required to make a non-cash payment to the individual entrepreneur’s account. These include:

- the entrepreneur's current account number, often indicated on the letter as r/s;

- name of the bank, if applicable - number or other identifier of the office, branch and branch of the bank in which the account is opened;

- BIC is a bank identification code used for internal bank identification. Usually, not only the head office of the bank, but also each of its branches, except for operating cash desks/offices and cash offices, has its own BIC. In this case, you need to indicate the BIC of your branch;

- number of the bank's correspondent account with the Bank of Russia (Central Bank of the Russian Federation), where every Russian bank has such an account. Usually in everyday life it is called a correspondent account, and in writing it is denoted as k/s;

- TIN and KPP of the bank.

When communicating with bank employees, if you need to clarify the details, it is better to use the abbreviated and commonly accepted designations they are familiar with - BIC, correspondent account, etc.

Every entrepreneur should know their bank details by heart.

In some cases, the bank details may include the address of the bank or a specific branch.

Before signing an agreement and issuing invoices, you can contact the counterparty’s accounting department and clarify which set of details for your account they need for payment. Various specialized accounting services, for example, 1C, My Business and others, help you prepare accounts correctly.

What to do when changing your actual address

Typically, in this case, the tax service itself receives all the information through interdepartmental communication channels. The Migration Service sends a description of the new address within a maximum of 10 working days after the move has actually taken place. Under such circumstances, a new entry in the Unified State Register of Individual Entrepreneurs is made without the participation of the individual himself. He doesn't need to do anything.

Note! It’s another matter when the tax office is changed due to the registration of a new address. Then the regulatory authorities themselves transmit information to each other, also without the participation of the business owner.

With such algorithms, it is possible that errors may appear on one side or another. You need to contact the tax authorities for clarification if the information has not yet been entered or has been entered but not completely.

Important! Sometimes, in order to speed up the procedure for changing address, applications are submitted using form P24001. But this requirement is not mandatory. The entrepreneur is not responsible for the fact that the old address is displayed in the Unified State Register of Entrepreneurs.

If tax inspectorates change, it is easier to reconcile in advance so that fewer problems arise during interaction later. It takes the tax authorities from 10 to 15 working days. Do not forget about interaction with contractors and other similar partners. A citizen’s international passport also contains important information.

In case of changing the actual address without adjusting the legal address, there are no direct tax consequences, but there are some risks:

- failure to receive important legal documents. And such violations cannot be challenged if necessary;

- permissible fine of up to 5,000 rubles* for providing false information. Punishment is applied to the leader.