Registration of relations with an employee: options

Choosing a contract

You can formalize your relationship with an employee using an employment or civil law contract.

The only acceptable form of agreement is a written form of the agreement, with the personal signature and seal of the employer and the signature of the employee. When concluding an employment contract, the enterprise issues a corresponding order; the GPC agreement does not provide for the issuance of such an order. Registration under the GPC agreement occurs without formalities; after signing the agreement form, the employee can immediately begin performing the task assigned to him.

An example is a contract concluded between builders and a specific organization that is temporarily in need of this type of service. A similar agreement is concluded with programmers and persons whose work activities are required by the enterprise from time to time. Seasonal workers also have the right to enter into a GPC agreement, since their task is not routine activity, but harvesting, based on the results of which remuneration is paid.

General provisions

To understand whether signing a civil agreement is appropriate in a particular situation, you need to understand what a civil contract with an employee is. A document called a civil contract is an agreement between the parties (individuals and organizations) aimed at formalizing, changing, terminating civil rights, and establishing the obligations of the parties.

The parties to the GAP are:

- individuals;

- individuals and legal entities;

- legal entity.

The subject of the contract is the performance of work, the execution of which is confirmed by an acceptance certificate. Since the document implies the performance of certain actions on the part of the performer, the parties can be recognized as an employee and an employer, to whom all the norms of the Civil Code of the Russian Federation apply.

The document is drawn up in accordance with the civil norms adopted in the Russian Federation, and the main requirement for the content of the document is the absence of contradictions with the provisions of the Civil Code of the Russian Federation.

Types of document

The application of GPA is wide, since it covers different types of relationships:

- on the transfer of property (deed of sale, deed of gift, supply agreement, exchange);

- performance of work (agreement with the contractor);

- provision of services (storage, insurance, transportation).

A sample civil law contract with an employee is used based on the specific needs for services from the organization.

Download a sample civil contract with an employee (63.0 KiB, 8,349 hits)

How is it different from an employment contract?

If the application of labor and civil law contracts were equivalent, employers would often prefer to enter into a civil contract, since there is much less liability under it. It is necessary to determine what a civil contract with an employee is, and what are the main differences, advantages and disadvantages.

There are some peculiarities in drawing up a UGS agreement, a sample of which requires the presence of:

- The scope of work is specified in advance and assumes a one-time need for services.

- There is no requirement to include a new unit in the staffing table.

- The priority of the performer is the result of the activity.

- The parties to a contractual relationship are in an equal position; the principle of subordination does not work.

- The process of fulfilling obligations by the employer is not regulated; only the result of the work that is performed by the contractor at his own expense is important.

- An employee under the GAP is not obliged to act personally; he has the right to attract additional labor resources if necessary.

- Payment for the work is made only at the end, when the employer has accepted it. The salary is called remuneration, paid after signing the certificate of surrender.

- The period of recruitment is limited, the exact period is indicated in the document.

- Labor law guarantees do not apply to the performer.

GPC with individuals: pros and cons

The GPC agreement, drawn up with both individuals and legal entities, contains a number of features in relation to the former:

Agreement with individuals

- There is no entry in the work book. The employee must be prepared for the fact that another entry will not appear in the work book. This form of agreement does not require maintaining a work record book; this is beneficial for the employer.

- The insurance period is taken into account. An individual who has entered into a GPC agreement does not have to worry about a future pension. Despite the different wording of the contract, the length of service does not disappear or be interrupted. An employee who has entered into this type of contract has the right to count on a retirement pension in the usual manner.

- Contributions to the Pension Fund. The employer makes the same contributions to the Pension Fund as under the employment contract.

- Regulated by the Civil Code. Relations arising as a result of the signing of a GPC agreement are regulated by the Civil Code, as a result of which an individual is less protected before the law. The employer can deceive both the employee and the tax authorities.

- It is concluded between the customer and the contractor. The parties to this form of legal contract are not the employee and the employer, but the customer and the contractor, the organization and the individual.

- Working hours are not defined. When agreeing to sign a GPC, an individual must understand that in this case his work schedule may differ from the daily routine of other employees operating in accordance with the staffing table and work schedule. The contractor’s working day is regulated independently; the main thing is not being at the workplace, but the result of the work.

- Working conditions may be unsafe for the employee. Concern for the safety of the working conditions of an employee hired under a GPC agreement is not the responsibility of the entrepreneur. This condition may be included in the contract, but usually this does not happen.

- Payment is made after completion of work. The employee receives payment for work only after completing all work and receiving approval from the customer who is satisfied with the result. If the result is unsatisfactory, payment may not follow.

- Business trips and vacations, including those for study and pregnancy, are not paid. According to the GPC agreement, the employer does not have the right to send an employee on a business trip. If the contractor must leave, he must do so at his own expense. The employer can allocate the necessary amount, but exclusively on personal initiative. In addition, individuals studying part-time are not granted or paid leave for the period of the session. Pregnant women do not receive maternity benefits or maternity benefits. To receive such a benefit in the minimum amount, they will have to contact the social protection authorities of citizens.

- Is urgent. When concluding a contract with an individual, an expiration date is established, which is also the deadline for the work to be completed. The deadline is set individually and depends on the complexity of the work performed.

- The employer has the right to give a negative answer to the applicant without giving reasons. When applying for a job by signing a GPC agreement, the applicant may be refused without explanation. The Civil Code allows you to do this on completely legal grounds.

The GPC agreement is a simplified version of regulating the relationship between employees and employers; it allows you to get rid of paperwork and burdensome payments of benefits and bonuses for the employer.

Judicial practice and civil law relations

Cases involving persons who have entered into a civil contract with each other have long been nothing new in Russian courts. In this case, the plaintiff is the employee and his main requirement is that this document be recognized as an employment contract. The main criterion that determines the success of a decision in favor of the plaintiff is the term of the civil law agreement.

The court also takes into account the relationship between the employer and the contractor, the terminology of the contract and the wording specified in it. At the same time, the presence (or absence) of acts of work performed, the presence in the enterprise documentation of documents on the activities of a temporary employee (time sheets, orders of material liability) are subject to consideration.

During the course of the proceedings in court, it may become clear that the employee performed official duties in the employer's organization. That is, he:

- had a personal workplace,

- received consumables, equipment, various inventory to achieve the desired result of their activities,

- completely obeyed the established work schedule.

Further, the plaintiff usually says that the drawing up of a civil contract was initiated by the employer so that he could evade fulfilling his duties. In view of this, the court finds itself on the side of the employee and decides to reclassify the civil contract into an employment contract. This court decision automatically obliges the defendant to fulfill all the obligations and conditions specified in the Labor Code of the Russian Federation.

What are the differences between a GPC agreement and an employment contract?

It is customary to conclude an employment contract with employees who work on a permanent basis. Peculiarities of the employment contract - setting the salary, determining the work schedule, normalized working day, number of days off, etc.

A GPC agreement is concluded with employees to perform a specific action, upon completion of which the agreement is terminated.

Distinctive features are also:

Difference between contracts

- method and time of work

- Insurance premiums under a civil contract are not paid

- time to receive reward

- the presence of an entry in the work book and personal card in the employment contract and the absence of such in the civil process agreement

- the GPC agreement does not contain a clause on the regulation of the work schedule, time spent at the workplace, or an indication of the availability of vacations and days off

- The GPC agreement does not stipulate the employer’s obligation to provide and equip the employee’s workplace; the employment contract requires the employer to create comfortable conditions for each employee

- when drawing up a GPC, there is no need to issue an employment order or maintain an employee’s personal card

- Accounting statements under the GPC agreement are maintained and reflected in account No. 76 in the section of settlements with other debtors and creditors

- accounting information related to relations arising as a result of the conclusion of an employment contract is reflected in account 70, in the section of settlements with personnel for wages

Obviously, the conclusion of a GPC agreement suits organizations, since it gives them a chance to refuse to pay for vacations, sick leave, maternity leave, bonuses and other expenses. An employee can work at the enterprise, but he will not be listed on the staff, the workplace is not assigned to him, and no entries are kept in the work book. He has no right to count on paid leave, sick leave, or funds for the treatment of work-related injuries. The employer is exempt from all of the above.

Employees are recommended to enter into an employment contract, since after signing it, their rights are protected by the Labor Code; the employer does not have the right to unreasonably refuse to hire such an employee, or dismiss him without grounds and reasons. If the employee’s interests are affected, he has the right to go to court. When concluding a GPC agreement, court intervention is possible, but it is much more difficult to prove your own innocence.

Types of GPC agreements

Let us list the main types of civil legal contracts under the Civil Code of the Russian Federation:

| Type of civil contract for the performance of work (provision of services) | Article of the Civil Code of the Russian Federation regulating these legal relations |

| in a row, incl. for individuals | Art. 702 Civil Code of the Russian Federation |

| paid provision of services | Art. 779 Civil Code of the Russian Federation |

| shipping | Art. 784 Civil Code of the Russian Federation |

| transport expedition | Art. 801 Civil Code of the Russian Federation |

| storage | Art. 886 Civil Code of the Russian Federation |

| order | Art. 971 Civil Code of the Russian Federation |

| commission | Art. 990 Civil Code of the Russian Federation |

| agency | Art. 1005 Civil Code of the Russian Federation |

In addition to the briefly listed types of civil legal contracts, GPA also includes other contracts, the subject of which is the performance of work (provision of services), not directly established by civil legislation (clause 2 of Article 421 of the Civil Code of the Russian Federation). After all, the Civil Code of the Russian Federation provides for freedom of contract.

What does a GPC agreement consist of?

We continue the conversation about civil legal contracts: concept, types, content. Let us dwell in detail on the terms of the GPC agreement.

| Basic conditions | Article of the Civil Code of the Russian Federation |

| The contract is concluded in writing | Art. 161 Civil Code of the Russian Federation |

| The parties to the contract are the customer and the contractor | Art. 702 Civil Code of the Russian Federation |

| When concluding a civil contract, it is not the process of work that is important, but its result, which the contractor is obliged to deliver to the customer. | clause 1 art. 408 Civil Code of the Russian Federation |

| The main responsibility of the customer is to pay the established cost of the work within the terms stipulated by the contract | clause 1 art. 702 Civil Code of the Russian Federation |

| The concluded agreement may provide for the possibility of involving third parties to carry out the customer’s instructions. | Art. 706 of the Civil Code of the Russian Federation, resolution of the Federal Antimonopoly Service of the Moscow District dated June 19, 2009 No. KA-A40/5330-09) |

| The customer bears responsibility to the contractor as provided for in Chapter 25 of the Civil Code of the Russian Federation. For example, he must compensate the contractor for losses caused by non-fulfillment or improper fulfillment of his obligations | clause 1 art. 393 Civil Code of the Russian Federation |

| The contractor bears responsibility to the customer as provided for in Chapter 25 of the Civil Code of the Russian Federation. For example, he is obliged to compensate the customer for losses caused by non-fulfillment or improper fulfillment of his obligations | clause 1 art. 393 Civil Code of the Russian Federation |

| If the work is completed and accepted, then the contractor’s obligations to the customer under this agreement terminate | clause 1 art. 408 Civil Code of the Russian Federation |

An example where GPC is used

- perform work: submit a report, deliver goods, etc.

- renovate a rented building;

- clear the roof of the house from snow;

- repair company vehicles;

- repair a broken computer.

GPC with an individual entrepreneur

A GPC agreement concluded with an individual entrepreneur is no different from the same agreement, but concluded with an individual.

The only difference is the obligation of an individual entrepreneur to pay personal income tax on his own, which he can do according to a simplified scheme.

GPC with IP

Organizations that have entered into an agreement with an individual entrepreneur can take advantage of this, since it is their responsibility to pay this tax themselves. Funds for payment are withheld from the remuneration of the person with whom the contract is concluded. Moreover, such payments can be quite large, which makes their payment extremely unprofitable and forces entrepreneurs to look for ways out of the situation that are not always legal.

Thus, a fairly common scheme for reducing deductions is an offer from the hiring organization to become an individual entrepreneur. In this case, personal income tax deductions will be several times less than required, which is due to the simplified taxation system.

Naturally, this fraud is well known to the tax authorities, but it is not always possible to track and prevent its use in a timely manner. If the scheme is nevertheless discovered, the tax authority has the right to apply to the court with a demand to recognize the agreement concluded with an individual entrepreneur as an ordinary employment contract concluded with an individual.

But even in this case, the employer can avoid punishment; for this it is only necessary that the individual entrepreneur refuses to conclude an employment contract. According to current legislation, the court does not have the right to require citizens to conclude an agreement in a specific form; individuals and individual entrepreneurs have the right to independently decide how their ability to work will be used.

Forcing the use of an employment contract instead of a civil contract is a punishable crime. The affected citizen has the right to go to court.

Personal income tax on payments under civil contracts

Remuneration under a contract is the income of an individual that he receives from the organization, therefore, by virtue of paragraphs. 6 clause 1 art. 208 of the Tax Code of the Russian Federation, such income is subject to personal income tax.

If we are talking about tax in relation to an individual who is not an individual entrepreneur, then the organization (tax agent) paying the remuneration to the individual must calculate, withhold and transfer personal income tax on the amounts of remuneration paid. Tax legislation provides for liability for failure to comply with this requirement.

If an organization cooperates with an individual entrepreneur, then it should not withhold personal income tax from the remuneration amount. In this case, the organization is not recognized as a tax agent.

If the individual entrepreneur is on the general taxation system, then on the basis of Art. 227 of the Tax Code of the Russian Federation, he pays personal income tax independently.

Individual entrepreneurs under special tax regimes (USN, UTII) do not pay personal income tax on income received from business activities. From paragraph 3 of Art. 346.11 and paragraph 4 of Art. 346.26 of the Tax Code of the Russian Federation it follows that taxes paid in accordance with these special regimes replace personal income tax on income received from business activities.

The contract must indicate that the contractor is an individual entrepreneur, that is, indicate the details of the individual entrepreneur’s certificate in the preamble of the agreement and attach a copy of the certificate to the agreement. Then the inspectors will not have questions about why the tax was not withheld, and the amount of remuneration was transferred to the counterparty in full.

Distant work

Freelancer

Remote work is labor activity away from the workplace, for example, at home, or in the territory of another state. In this case, the results of the work are sent to the employer by e-mail or in any other way. When drawing up a GPC agreement with an employee working remotely, the employer is not obliged to pay personal income tax and other taxes, but only if the employee is located in the territory of a foreign state.

Remote work is a legal type of income, officially permitted in Russia. To be hired, it is enough to send the employee the required documents, in this case a civil contract, by mail. A job seeker can come to the company office and sign documents in person.

Typically, journalists, writers and translators engage in remote work. There are other forms of remote earnings. All of them are completely official and legal as long as the employer agrees to pay the appropriate taxes.

Naturally, having decided to earn money remotely, citizens risk being left without payment, but this happens quite rarely, since formalized labor relations still protect them from unlawful actions on the part of employers.

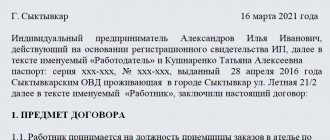

Structure of drawing up a civil agreement

Hiring under a civil contract consists of signing a document that must be drawn up in accordance with established requirements.

The very structure of this agreement practically coincides with the structure of the employment contract and includes certain clauses.

- Subject of the agreement. This paragraph must indicate the work to be performed by the employee and the final result expected from the employee’s activities.

- Duration of the agreement. This section consists of indicating the period given to the contractor to complete the work (basically, this paragraph characterizes the civil contract as a one-time document).

- Duties, responsibilities and rights of both parties. The very essence of this clause is that the employee undertakes to complete his work on time and present the employer with the final (expected by the employer) result. In turn, the employer guarantees to accept the result of the subordinate’s work and pay for his work. In addition, the employee has the right to involve third parties in his work, whose payment is not the responsibility of the employer.

- Conditions for making possible changes or termination of a civil agreement. Here it should be indicated that the contract is terminated upon expiration of the period allotted for completing the work to achieve the desired result.

- Details of both parties.

Documents for concluding a civil agreement

At the time of signing a civil legal agreement, the employee must have the following documents with him:

- passport or any other document that proves his identity}

- a copy of your taxpayer identification number (it is advisable to take the original of this certificate with you)}

- certificate of pension insurance}

- a document confirming education, qualifications or the presence of the necessary special knowledge (at the request of the employer).

Outsourcing or agency labor

Outsourcing

Not all employers are ready to employ workers whose labor they need from time to time. For this purpose, there is so-called outsourcing, which is agency labor. One employer literally borrows several workers from another. At the same time, he does not pay taxes, does not maintain accounting records and does not bear any responsibility for the fate of these employees, with whom an exclusively civil contract is concluded.

All legal responsibility, as well as blame for accidents occurring with employees, falls on the official employer with whom the employment contract was concluded.

Starting from January 1, 2014, there have been some changes in the legislation, for example, Federal Law No. 116-FZ prohibits agency labor, and a new definition is introduced into the legislation - “activities for providing labor to workers.” From now on, workers can only be provided by private employment agencies. Workers cannot go to the enterprise if:

- a strike was declared at the enterprise

- the company went into downtime

- the company has reduced working hours

- the company declared itself bankrupt

- The company withholds wages for more than 15 days

In addition, workers do not have the right to be sent to hazardous and harmful production, work that requires an activity license, as well as work related to sea and river transportation. External workers with whom an employment contract has not been concluded cannot be present among the crews of sea and river vessels, as well as mixed-type vessels. This category of workers must work on a permanent basis, since the lives of other people depend on the degree of their competence.

Employment contract or civil agreement?

Experts who are involved in the regulation of labor relations note the fact that recently controversial situations very often arise between the employer and the contractor, which are very similar to conflicts after signing an employment contract. This feature is explained by the fact that, like an employment contract, a civil agreement implies the performance of some specific work.

When choosing a civil legal agreement, the employer and employee should be aware of some important points. First of all, the very fact of applying for a job under a civil contract consists of signing this agreement. Also, this agreement is concluded for a certain limited period, after which the cooperation between the employer and the contractor ends. In addition, it is important that if the work was not completed on time and the employer did not receive the expected result within the established time frame, then this agreement can be terminated unilaterally without paying the remuneration specified in it.

Re-qualification of GPC agreements into employment contracts

Re-qualification of a GPC agreement into a labor agreement is possible at the request of regulatory authorities or the employees themselves. The need for such actions arises in the following situations:

Renewal of contracts

- The employee adheres to the staffing schedule and internal regulations, moreover, this is his responsibility. In this case, he has the right to demand the reclassification of the GPC agreement into a labor agreement with the ensuing benefits for himself.

- Salaries are paid regularly. A sign of a GPC agreement is payment for labor based on its result, or upon completion. If wages are paid on a regular basis, at least twice a month, the employee and the inspection authorities may require re-qualification of the GPC agreement into a labor agreement. The employee himself may also require this.

- An employee occupies a specific position with a certain type of permanent responsibilities. Assigning a responsible position to an employee, providing him with a workplace and equipment may serve as the basis for requalifying the contract.

- The employee is financially responsible. Under the GPC agreement, the contractor is not financially liable for losses incurred by the employer. If such liability arises, then it may be necessary to re-register this contract as an employment contract.

- The employer arranges the workplace and provides the employee with the right to use official transport and housing, and other opportunities available exclusively to citizens working under an employment contract. Having discovered something like this at an enterprise, the tax service may require re-issuance of the contract, in connection with which many employers warn employees in advance about the audit in order to remove all such evidence from prying eyes.

If the employer insists exclusively on the execution of a civil labor agreement, and the employee is not against it, it is not at all easy for the regulatory authorities to prove the opposite and demand a different form of labor relations.

It is always possible to prove that the employee is not a permanent employee, but appears at the enterprise exclusively for a short period of time to perform a certain type of work.

Differences between an employment contract and a civil agreement

At the moment when an employer offers a hired applicant to enter into a civil law contract instead of an employment contract, the employee has a question about what it is and how these two documents differ from each other. A civil legal contract is an agreement concluded between an employee and an employer, and has a whole list of differences from an employment contract.

- According to the employment contract, a person hired undertakes to perform a certain labor function in a given enterprise. At the same time, the employee is subject to all established rules for conducting labor activities in the organization.

The civil contract states that the employee must perform some kind of work or service, and is not subject to internal labor regulations. In accordance with this, it is unacceptable in this document to indicate that a person hired is obliged to comply with the established labor regulations of the organization.

- An employment contract indicates that the employee occupies a subordinate position in relation to his employer.

A civil contract guarantees equality of both parties in labor relations.

- The employment contract contains a clause stating that the employee must receive his salary at least 2 times a month.

A civil contract does not limit the number of payments of monetary remuneration for work, and wages are freely regulated by agreement between both parties.

- The employment contract clearly states that the person hired performs a certain function at the enterprise (for example, an accountant or engineer).

A civil contract does not indicate what function is assigned to the employee. It indicates only the result that is expected from the work performed. Therefore, when concluding this agreement, it is unacceptable to include in it such wording as “The person performs the functions of an accountant in the organization.”

- The duration of the employment contract may be limited only in some cases regulated by the Labor Code of the Russian Federation.

A civil contract is concluded for a certain period or its validity terminates at the moment the result is received from the employee’s work.

The right to choose the option of formalizing labor relations

Each employee can independently choose which employment option suits him. Is he satisfied with the GPC or is an employment contract required? Neither the employer himself nor even the court has the right to impose a form of contract on an employee.

The employee is free in where and how he wants to work, whether he is ready to have a permanent income or a temporary part-time job, and whether he agrees to limit his interests and rights to please the employer and salary.

No one has the right to deprive an employee of the right to choose, therefore regulatory authorities may recommend that he conclude one form of contract or another if fraud on the part of the employer is detected. Whether or not to renew the contract is up to the employee to decide.

Top

Write your question in the form below