Throughout life, people borrow money from each other until payday, help out friends and close relatives. Many citizens are ready to take their word for it that a person they know will repay the debt. However, it would be useful to have some guarantees of receiving your money. It is important to draw up the loan agreement correctly so that the document guarantees payment of funds.

The concept of a loan agreement

The definition of such an agreement is enshrined in Article 807 of the Civil Code of the Russian Federation. By law, the person transferring funds is called the lender, and the person accepting the money is called the borrower.

A documentary agreement between both entities, as a result of which one party transfers an amount of funds to the other party for personal purposes, is called a loan agreement. In turn, the payer is obliged to repay the loan within a certain period.

Having received funds in hand, the client has the right to spend them at his own discretion. To limit the rights of the payer, the lender issues a targeted loan. Its essence lies in the specific expenditure of money for specific purposes (purchase of an apartment or vehicle).

A completed agreement with the signatures of the parties to the transaction does not indicate the fact of its conclusion. The paper comes into force only after the actual transfer of finances from one person to another. The borrower must provide a written receipt on his or her behalf that the funds have been received.

Debt obligations are issued in ruble equivalent. When a loan is issued in dollars or euros, the debt is still paid in rubles. In this case, the current official exchange rate of this currency on the date of payment is taken into account. The parties to the transaction may establish in the agreement a different rate and the date for its determination.

Features of creating a receipt

In the process of drawing up a loan agreement, it is important to draw up a receipt. It is a significant document, so you need to know how to draw it up correctly so that it has legal force and can be used by each party as proof of its innocence if any disagreements arise.

The receipt is drawn up immediately upon the formation of the loan agreement. It must be formed in accordance with the registration rules, since this determines whether it will be possible to repay borrowed funds with its help in the future. The receipt is effectively used in court, serving as evidence that the funds under the agreement were actually transferred to the borrower, therefore he is obliged to return them in full, as well as accrued interest according to the terms of the agreement.

You must write a receipt even if a notarized document is being drawn up. It confirms the very fact of transfer of money from the lender to the borrower.

What are the requirements for a receipt?

A receipt for a loan of money must be written in accordance with certain requirements and rules in order for it to have legal force, so the following points are taken into account:

- the place where the document was drawn up is indicated, the address must be reliable and accurate;

- the full name of each person participating in the transaction is written down, and this applies to both the lender and the borrower, and information is indicated without any abbreviations, and they must fully correspond to the data that is available in citizens’ passports;

- the full amount of the loan transferred from one person to another is written, and it is also advisable to duplicate the numbers in written words to prevent forgery;

- the date when the funds were transferred to the borrower is indicated;

- at the end of this document the borrower puts his signature, which fully corresponds to the signature in the passport;

- if a receipt is made on a computer, then at the bottom of the text the borrower must write his full name by hand. and sign.

It is not difficult to draw up a receipt, and the parties may additionally agree to include additional requirements in this document, which include:

- The exact date by which the funds must be fully returned. In this case, the possibility of returning the money in partial payments or in full at the end of the specified period may be indicated. It is advisable to indicate the exact date to avoid confusion. If there is no such date on the receipt, then the borrower must return the money within 30 days after the lender requests it.

- The amount of interest accrued for the use of borrowed funds. As a rule, a monthly rate is determined, but it is possible to set a rate for any period.

- A fine or penalty is indicated if the borrower violates the basic requirements of the contract, as a result of which he does not pay the funds on time. The fine is a fixed amount, and the penalty is calculated depending on the selected percentage.

Thus, a correctly written document acts as a guarantee for the lender that the funds issued to the borrower will be returned in accordance with all conditions agreed in advance. It is the agreement and receipt that are used in court, so if they are available and thanks to the correct writing, no problems with collection through the court will arise.

How money is returned using a receipt

If this document is drawn up, then it is important to understand in advance how the money lent is returned under it. If there is a trusting relationship between the two parties, then usually no problems arise. If they are strangers to each other, then difficulties often arise with the return of funds. For example, a borrower may lose his job or get sick, but the lender still demands the debt back.

If the borrower does not return the money in accordance with the data contained in the agreement and receipt, then the lender has the right to go to court for forced collection. If all the documents are official and correctly drawn up, no difficulties arise in court, so a decision that is positive for the creditor is made. Enforcement proceedings begin, according to which bailiffs have the right to use various methods to facilitate the repayment of the debt.

Thus, when transferring funds on loan to an individual or legal entity, a loan agreement is drawn up. Along with it, a receipt should be made as proof of the transfer of money. These documents must be drawn up only in accordance with certain rules and requirements, since only then will they have legal force and therefore can be used in court by the creditor. It is best to notarize them, since in this case, if one of the parties violates the clauses of the agreement, the other has the right to go to court, where the agreement and receipt will serve as evidence.

Loan agreement form

The Civil Code of the Russian Federation provides for two main forms of concluding an agreement on borrowing money:

- oral;

- written.

The last form is considered necessary in cases where the loan amount is more than 1000 rubles or 10 minimum wages.

A financial agreement on the transfer of funds in debt between legal entities or from an individual organization must be formalized in writing. Moreover, it does not matter for what amount of money the specified agreement is drawn up.

Lawyers advise to draw up a written document in any situation. This will make it possible to prove your rights in court, since it will be impossible for the lender to provide other evidence. It is worth noting that the court will not be able to accept testimony under the terms of a written financial agreement.

Important! An alternative to the loan agreement can be a manual receipt from the borrower. This paper indicates the total amount, the loan period and the procedure for repaying the debt.

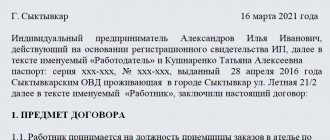

Interest-free loan agreement between individuals

Moscow January 01, 20__

Citizen ____________________________________________________________, (full name) passport: series _____ No. __________, issued by _________________________________, (when, by whom) residing at the address: ___________________________________________________, hereinafter referred to as “Lender”, on the one hand, and citizen ____________________________________________________________, (F. I.O.) passport: series _____ No. __________, issued by _________________________________, (when, by whom) residing__ at the address: ___________________________________________________, hereinafter referred to as the “Borrower”, on the other hand, collectively referred to as the “Parties”, individually the “Party”, concluded this Agreement (hereinafter referred to as the Agreement) on the following:

1. Subject of the agreement General provisions

1.1. The Lender transfers to the Borrower the ownership of funds in the amount of ______ (____________) rubles (hereinafter referred to as the loan amount), and the Borrower undertakes to return the loan amount to the Lender in the manner and within the terms stipulated by the Agreement. Funds received by an individual under a loan agreement are not income subject to personal income tax.

1.2. No interest is paid for using the loan amount (interest-free loan).

1.3. The agreement is considered concluded from the moment the money is transferred to the Borrower.

2. Transfer and return of the loan amount

2.1. Transfer of loan amount

2.1.1. The loan amount is transferred to the Borrower in cash.

2.1.2. The transfer of the loan amount is confirmed by a receipt from the Borrower, which is provided to the Lender. If the loan is disputed due to lack of funds, the amount of the borrower’s obligations is determined based on the amounts transferred to him (clause 3 of Article 812 of the Civil Code of the Russian Federation).

2.1.3. The parties agreed on the form of the Borrower's receipt (Appendix No. __ to the Agreement).

2.2. Repayment of the loan amount

2.2.1. The loan amount must be fully repaid to the Lender no later than “__” ___________ 20__.

2.2.2. Repayment of the loan amount is carried out in cash and is confirmed by a receipt from the Lender, which is transferred to the Borrower.

2.2.3. The borrower has the right to repay the loan amount ahead of schedule in whole or in part. When repaying the loan amount in full, the Lender must return the Borrower's receipt. If it is impossible to return the Borrower's receipt, the Lender makes an entry about this in the Lender's receipt. In case of partial repayment of the loan amount, a receipt from the Lender is issued for each part of the amount.

2.2.4. The parties agreed on the form of the Lender's receipt (Appendix No. __ to the Agreement).

3. Borrower's responsibility

3.1. If the Borrower violates the deadline for repaying the loan amount or part thereof, the Lender has the right to demand payment of a penalty in the amount of ______ (___________)% of the amount not returned on time for each day of delay. Penalties are accrued from the day the loan amount should have been repaid until the day it is returned to the Lender. Payment of the penalty is made within ___ (________) business days from the date the Lender submits the relevant request.

3.2. Payment of penalties does not relieve the Borrower from repaying the loan amount.

3.3. Payment of penalties is made in cash and is confirmed by the issuance of a receipt from the Lender for the amount of penalties paid or a corresponding entry in the Lender's receipt. If the loan amount was repaid in installments, then the corresponding entry is made in the Lender’s last receipt.

4. Final provisions

4.1. The Agreement is drawn up in two copies, one for each of the Parties.

4.2. The following are attached to the Agreement:

- Borrower's receipt form (Appendix No. ___);

- Lender's receipt form (Appendix No. ___).

5. Addresses and details of the parties

Lender: gr. ________________________________ (state of citizenship, full name of citizen), Passport: series _____ No. ____________, issued by _________________ (when, by whom), residing at the address: _________

_____________/_____________________ (signature) (full name)

Borrower: gr. ________________________________ (state of citizenship, full name of citizen), Passport: series _____ No. ____________, issued by _________________ (when, by whom), residing at the address: _________

_____________/_____________________ (signature) (full name)

Sample receipt from the borrower for an interest-free loan

Borrower's receipt

Place of compilation: ______________________________»__» ____________ 20__

I, a citizen of the Russian Federation ______________________ (full name), passport of the Russian Federation series _____ number ______, issued _________________ date of issue “__” _________ ____, place of residence: _____________________ (hereinafter referred to as the Borrower), received ownership from citizen of the Russian Federation ______________ (full name), passport of the Russian Federation series ______ number ______, issued _______________________ date of issue “__” ______ ____, place of residence: _____________________ (hereinafter referred to as the “Lender”), funds in the amount of _______ (______________) rubles (hereinafter referred to as the loan amount).

The loan amount must be repaid no later than “__” __________ 20__ in accordance with the terms of the interest-free loan agreement dated “__” __________ 20__.

Borrower:

__________________/___________________________/ (signature) (full name)

Interest on the loan agreement

A correctly drafted agreement gives the owner legal grounds to transfer funds or other valuables to the recipient. At the same time, the party who received the loan undertakes to repay the money within the specified time frame.

According to the terms of the agreement, interest accruals are subject to full or partial payment during the term of this agreement. If there is no information about interest in the paper, this means that the loan does not provide for interest charges.

The total amount of interest charges is determined by the final decision of the National Bank, in the event that the parties to the transaction do not agree on other conditions.

The interest rate can vary constantly, so it needs to be kept under control. As for the discount rate, it can only apply in a single case - when the loan was received in the national currency of the Russian Federation.

Agreement to the loan agreement

If necessary, the parties to a financial transaction can make changes to the document drawn up by him on the basis of a specific agreement. Moreover, its terms are also easy to terminate if there is mutual agreement.

The agreement must include the following information:

- a new date when the payer is obliged to return previously taken funds;

- changed interest rate for using finance;

- the amount of penalties for violations of debt payments.

Once the document is signed by both parties, it becomes part of the loan agreement. Specialists are required to carry out any clarification taking into account the data specified in the agreement. The paper is drawn up in a similar form as the main financial document on the issuance of funds. In the absence of agreements between the parties to the transaction to amend or terminate the loan agreement, further issues regarding it are considered in court.

Procedure for calculation and payment of interest

When drawing up a loan agreement, the parties can agree on any interest rate that the debtor will pay for the use of the funds received.

If the interest rate is not reflected in the contract, then the refinancing rate adopted by the Central Bank of the Russian Federation is applied, in accordance with Art. 809 of the Civil Code of the Russian Federation. The agreement also requires to display the rules for calculating interest. If too high interest rates are collected from the borrower, he has the right to challenge this in court. In practice, there are cases when the court makes a ruling to recalculate interest and reduce the amount of debt.

Interest accrual under a loan agreement can be carried out in two ways:

- Simple

- Difficult

The first method involves calculating interest on the total amount of debt transferred to the borrower. When the loan is repaid in monthly installments, interest is recalculated on the outstanding balance.

The second method involves calculating interest not only on the principal debt, but also on the amount of unpaid interest.

Interest accrual begins the next day after the transfer of funds to the borrower and stops immediately after the debt is repaid.

Also, the terms of the loan may stipulate a fine or penalty for late repayment of debt, which are regulated by Art. 395 of the Civil Code of the Russian Federation.

To independently calculate the interest on the loan, you can use the data from the agreement.

To do this you will need the following data:

- The total amount of funds transferred.

- Set interest rate.

- Interest calculation method: daily, monthly or annually.

- Time to use the loan.

- The number of days for which interest accrues.

- Amount of penalty for failure to meet payment deadlines.

Responsibility of the parties

When executing a loan transaction, the participants usually stipulate the conditions for the return of the deposit and sanctions if the terms of the contract are not fulfilled.

If the obligations under the agreement are not fulfilled, measures may be taken against the violator in accordance with the regulations of the Russian Federation, which are aimed at recovering damages from the injured party by contacting law enforcement agencies. Specific responsibilities may be reflected in the agreement. Such events include:

- Collection of the principal amount of debt.

- Collection of fines or penalties.

- Collection of interest.

- Early termination of the agreement.

In addition, criminal and administrative liability may be applied to the violator of the agreement on the basis of:

- Art. 159 of the Criminal Code of the Russian Federation (fraud).

- Art. 177 of the Criminal Code of the Russian Federation (malicious evasion of debt repayment).

- Art. 14.11 Code of Administrative Offenses of the Russian Federation (illegal acquisition of a loan).

To restore the rights of the injured party to the loan transaction, a claim should be filed in the courts of general jurisdiction.

Force Majeure

Force majeure refers to emergency situations that cannot be foreseen or prevented.

Such situations include natural disasters, military operations, epidemic diseases, strikes, man-made disasters, etc. Force majeure circumstances do not include crises in financial markets, price increases, or currency fluctuations.

In force majeure situations, the borrower is not responsible for failure to comply with the agreement if he promptly notifies the lender of the incident and then provides evidence that the failure of the agreement occurred due to force majeure.

It is not necessary to stipulate force majeure situations in the agreement, since they are regulated by regulations of the Russian Federation. But at the request of the parties, a clarifying list can be prescribed.

Dispute Resolution

To reduce the likelihood of conflict situations and avoid disagreements in the interpretation of the terms of the agreement, it is better to reflect the procedure in the agreement. It is necessary to provide in the agreement that conflicts are resolved by a peace agreement. The most comfortable way would be to agree on the time of response to the letter of claim and on the procedure for filing a lawsuit at the defendant’s place of residence, if a peaceful resolution of the conflict is impossible.

Amendment and early termination of the loan agreement

When adjusting the loan agreement, the parties to the transaction must be guided by the legislation of the Russian Federation.

Typically, the terms for adjusting the provisions of the main agreement are reflected in the additional agreement. By signing such a document, the participants acknowledge that the additional agreement is a mandatory part of the original loan contract. You can also terminate the loan contract. The reason for termination may be if one of the parties does not comply with the terms of the agreement. Therefore, at the request of the other participant, the loan agreement can be terminated prematurely. The procedure for terminating the loan agreement is reflected in Art. 450 Civil Code of the Russian Federation. Termination can be carried out:

- By agreement of the parties, when both parties come to a decision to terminate the contractual relationship.

- Through a court decision, when one of the participants does not agree to terminate the agreement. Here, the participant who wishes to terminate the loan agreement must provide compelling arguments for his decision.

Repayment of debt under a loan agreement

The process for paying off the debt must be determined by the participants and recorded in the document. Both parties have the right to determine for themselves the appropriate procedure and duration for the return of money. Funds may be subject to a one-time or monthly payment. As for interest, the client is obliged to pay it every month, unless the agreement provides for other conditions.

In the absence of deadlines and payment procedures, the contract for the transfer of money is considered to be of unlimited duration. According to its terms, the lender has the right to demand payment from the client at any time, and the borrower himself undertakes to repay the money within a month from the date of acceptance of this demand.

In the case of an interest-bearing loan agreement, early payment of payments can only be made with the consent of the lender. An exceptional case may be a situation in which the payer issued funds for purposes unrelated to business.

Important! Reimbursement of debt payments must be made in writing. When transferring money, the borrower is required to draw up a receipt. Non-cash payment can be confirmed by bank statements.

Interest-bearing loan agreement between individuals

Moscow January 01, 20__

Citizen ____________________________________________________________, (full name) passport: series _____ No. __________, issued by _________________________________, (when, by whom) residing at the address: ___________________________________________________, hereinafter referred to as “Lender”, on the one hand, and citizen ____________________________________________________________, (F. I.O.) passport: series _____ No. __________, issued by _________________________________, (when, by whom) residing__ at the address: ___________________________________________________, hereinafter referred to as the “Borrower”, on the other hand, collectively referred to as the “Parties”, individually the “Party”, concluded this Agreement (hereinafter referred to as the Agreement) on the following:

1. The Subject of the Agreement

1.1. Under this Agreement, the Lender transfers to the Borrower the ownership of funds in the amount of _____ (__________) rubles (hereinafter referred to as the Loan Amount), and the Borrower undertakes to return to the Lender the Loan Amount and the interest accrued on it in the amount and terms stipulated by the Agreement.

1.2. The loan amount is provided in cash. 1.3. The interest rate under this Agreement is _____ percent per annum of the Loan Amount.

2. Procedure for provision and repayment of the loan amount

2.1. The Lender transfers the Loan Amount to the Borrower by "___"__________ ____. The fact of transfer of funds is certified by the Borrower's receipt of the Loan Amount (Appendix No. ___) (hereinafter referred to as the Borrower's Receipt).

2.2. The Borrower returns the Loan Amount and interest due to the Lender no later than "___"__________ ____ 2.3. The loan amount is repaid by the Borrower by _________________________ __________________________________________________________________________. (transfer of cash, crediting of funds to the lender’s account, or indicate another method).

2.4. The Loan Amount is considered repaid from the moment the Lender's receipt is issued to the Borrower for receipt of the Loan Amount (Appendix No. ___) and the interest accrued on it (hereinafter referred to as the Lender's Receipt).

2.5. The Lender gives (does not give) consent to the early repayment of the Loan Amount and interest without additional receipt by the Borrower of written approval in this regard.

3. Interest on the use of the loan amount

3.1. For the use of the Loan Amount, the Borrower pays the Lender interest at the rate of _____ percent per annum. Interest is accrued from the day following the day the Loan Amount is provided until the day the Loan Amount is repaid, inclusive.

3.2. Interest for using the Loan Amount is paid simultaneously with the repayment of the Loan Amount. (Option: Interest for using the Loan Amount is paid no later than the _____ day of each month, starting from the month following the month the loan amount was provided. Interest accrued for the last period of using the Loan Amount is paid simultaneously with the return of the Loan Amount.)

4. Responsibility of the parties

4.1. For late repayment of the Loan Amount (clause 2.2 of the Agreement), the Lender has the right to require the Borrower to pay a penalty (penalty) in the amount of _____ (__________) percent of the unpaid Loan Amount for each day of delay.

4.2. For violation of the terms for payment of interest, the Lender has the right to demand from the Borrower payment of a penalty (penalty) in the amount of _____ percent of the amount not paid on time for each day of delay.

4.3. Collection of penalties and interest does not relieve the Party that violated the Agreement from fulfilling its obligations in kind.

4.4. In all other cases of failure to fulfill obligations under the Agreement, the Parties are liable in accordance with the current legislation of the Russian Federation.

5. Force majeure

5.1. The parties are released from liability for non-fulfillment or improper fulfillment of obligations under the Agreement if proper fulfillment turned out to be impossible due to force majeure, i.e. extraordinary and unavoidable circumstances under given conditions, which are understood as: _________________________ (prohibited actions of the authorities, civil unrest, epidemics, blockade, embargo, earthquakes, floods, fires or other natural disasters).

5.2. If these circumstances occur, the Party is obliged to notify the other Party about this within _____ days.

5.3. A document issued by _________________________ (authorized government agency, etc.) is sufficient confirmation of the presence and duration of force majeure.

5.4. If force majeure circumstances continue to apply for more than _____, then each party has the right to terminate the Agreement unilaterally.

6. Dispute resolution

6.1. All disputes related to the conclusion, interpretation, execution and termination of the Agreement will be resolved by the Parties through negotiations. 6.2. If disagreements are not resolved through negotiations, the dispute is referred to court in accordance with the current legislation of the Russian Federation.

7. Final provisions <2>

7.1. The Agreement is considered concluded from the moment the Lender actually transfers the Loan Amount to the Borrower in accordance with clause 2.1 of this Agreement.

7.2. The Agreement is valid until the Borrower fully fulfills its obligations to repay the Loan Amount, which is confirmed by the Lender’s Receipt.

7.3. All changes and additions to the Agreement are valid if made in writing and signed by both Parties. The corresponding additional agreements of the Parties are an integral part of the Agreement.

7.4. The Agreement may be terminated early by agreement of the Parties or at the request of one of the Parties in the manner and on the grounds provided for by the current legislation of the Russian Federation.

7.5. For all other issues not regulated by this Agreement, the Parties are guided by the provisions of the current legislation of the Russian Federation.

7.6. The Agreement is drawn up in two copies having equal legal force, one copy for each of the Parties.

7.7. Applications: 7.7.1. Receipt of the Borrower for receipt of the loan amount (Appendix No. ___).

7.7.2. Receipt of the Lender for receipt of the Loan Amount (Appendix No. ___).

8. Addresses and signatures of the parties

Lender: gr. ________________________________ (state of citizenship, full name of citizen), Passport: series _____ No. ____________, issued by _________________ (when, by whom), residing at the address: _________

_____________/_____________________ (signature) (full name)

Borrower: gr. ________________________________ (state of citizenship, full name of citizen), Passport: series _____ No. ____________, issued by _________________ (when, by whom), residing at the address: _________

_____________/_____________________ (signature) (full name)

Information for your information:

- <1> An agreement is considered concluded if an agreement is reached between the parties, in the form required in appropriate cases, on all the essential terms of the agreement. The condition on the subject of the contract is an essential condition of the contract (clause 1 of Article 432 of the Civil Code of the Russian Federation). The essential terms of the contract are the conditions that are named in the law or other legal acts as essential or necessary for contracts of this type (paragraph 2, paragraph 1, article 432 of the Civil Code of the Russian Federation). The loan amount is an essential condition of the loan agreement (Clause 1, Article 807 of the Civil Code of the Russian Federation).

- <2> Along with the condition on the subject of the contract, as well as the conditions that are named in the law or other legal acts as essential or necessary for contracts of this type, the essential terms of the contract are all those conditions regarding which, at the request of one of the parties, an agreement must be reached (paragraph 2, paragraph 1, article 432 of the Civil Code of the Russian Federation). Thus, the parties have the right to define for themselves any condition as essential, in the absence of which the contract cannot be considered concluded.

Sample receipt from the borrower for an interest-bearing loan

Receipt for receipt of loan amount

g. _______________ “__”___________ ____ g.

I ________________________________ (full name of the borrower), Passport: series _____ No. ____________, issued by _________________ (when, by whom), residing at the address: _________ received from ________________________________ (full name of the lender), Passport: series _____ No. ____________, issued by _________________ (when, by whom), residing at the address: _________

funds in the amount of _____ (____________) rubles (hereinafter referred to as the Loan Amount) and undertake to return to the Lender the Loan Amount and interest accrued on it in the manner established by clause _______ of the Agreement dated “__”______________ ____, No. _____, within the period until “__ "__________ ____ G.

This receipt is made in two copies having equal legal force, one for each of the Parties.

"__"___________ ____ G.

Borrower:

__________________/___________________________/ (signature) (full name)

Sample receipt from the lender for the repayment of the loan and interest

Receipt from the lender for receipt of the loan amount and interest accrued on it

______________ "___"_________ ____

I am ________________________________ (full name of the lender), Passport: series _____ No. ____________, issued by _________________ (when, by whom), residing at the address: _________ received from ________________________________ (full name of the borrower), Passport: series _____ No. ____________, issued by _________________ (when, by whom), residing at the address: _________

funds in the amount of _____ (________________) rubles, including interest in the amount of _____ (__________) rubles in accordance with clauses 1.1 and 1.3 of the Loan Agreement No. _____ dated “___”__________ ____.

I have no complaints against _________________________________ (full name of the Borrower).

This receipt is made in two copies having equal legal force, one for each of the Parties.

"___"__________ ____ G.

Lender: ___________________/_____________________/ (signature) (full name)

How to challenge a loan agreement?

The payer has the right to challenge the agreement due to his lack of funds, in other words, to prove that he did not receive the loan or the amount was incomplete.

If, after a trial in court, a decision is made that the document on the transfer of money is non-cash, the claims will be refused. An additional scenario would be to reduce the amount when the funds were not received in full.

Getting the paperwork in writing will prevent the possibility of challenging her lack of money with the help of witness testimony. Exceptions may include cases caused by fraudulent or violent acts.

By mutual decision of the parties to the agreement, it is permissible to replace debt obligations with non-payment under documents of purchase and sale or lease of real estate, or other papers indicating the need for reimbursement of funds.

Dispute Resolution

Malicious failure to comply with the terms of the loan agreement leads to a conflict situation. The best way to resolve it would be to resolve the issue peacefully. It is worth agreeing to postpone the date of repayment of the debt, reduce interest or change the method of repaying the loan. The parties may also be satisfied with this option: instead of repaying the debt in monetary terms, the borrower provides some services or work.

If negotiations are unsuccessful, the issue is resolved in court. You need to be prepared for the fact that the trial will not be completed quickly. In addition, it involves additional costs on the part of the lender: payment of state fees and possible legal services for filing a claim or representation in court. The execution of the received court decision is carried out by bailiffs.

When a loan is formalized in writing (notarial or in simple written form), legal proceedings are carried out in a simplified manner and in a shorter period of time. Only competent formalization of the relationship for the transfer of funds on loan will help to minimize the lender's losses in case of violation of the agreement by the borrower.