When does it become necessary to issue an invoice for services?

Despite the fact that an invoice for any organization is a particularly important document confirming payment for a product or service, Russian legislation does not prohibit transactions without issuing an invoice. Most often, a legal entity makes payments based on an agreement, in any convenient way, but there are cases when it is impossible to do without issuing an invoice. An invoice must be issued if the contract does not stipulate the specific cost of a product or service, and a prime example of this is the provision of communication services. It is mandatory to issue an invoice:

- a legal entity, including LLC, that received an advance from the customer;

- if the company operates under an agency agreement, sells a product/service, concluding an agreement on its own behalf;

- LLCs and enterprises of other forms of ownership if they are exempt from paying value added tax.

As for issuing an invoice to an individual, when paying in cash or with a credit card, a regular check issued by a cashier in a supermarket, for example, is considered as such. If you work for cash, then a cash receipt or any other document confirming payment frees you from the need to issue an invoice. The situation is different with non-cash payments.

In what situations is an invoice issued?

Before the start of any cooperation, counterparties, as a rule, enter into agreements that stipulate payment terms, amounts and other terms of transactions.

In addition, our legislation does not require transactions without contracts. If the terms of the contract do not stipulate that the seller must issue an invoice for payment, there is no need to do this. In this case, the buyer must pay for the service or product only on the basis of an agreement.

But there are situations when you can’t do without an account. In the event that the terms of the contract do not specify the amount that the buyer must transfer, the seller must issue an invoice without fail.

This may be the case, for example, when paying for communication services: in contracts of this kind, the amount, as a rule, is not specified in advance. An invoice is issued when an organization carries out transactions subject to VAT, and in other cases established by law.

Such an invoice should be issued to the customer (or buyer):

- an organization exempt from VAT (Article 145 of the Tax Code of the Russian Federation);

- an organization that sells goods or services under an agency agreement on its own behalf, subject to the application of the general taxation system, clause 1 of Art. 169 Tax Code of the Russian Federation;

- an organization that has received an advance/partial payment towards the upcoming sale of goods from the customer (Article 168 of the Tax Code of the Russian Federation).

How to issue an invoice to a private person

If you provide a service to an individual with payment on account, you will first have to enter into an agreement with the individual. When paying funds to the account of a limited liability company, the buyer of a service or product will have to indicate the number of this agreement in the payment receipt. The accountant of the enterprise, meanwhile, will have to issue a single copy of the invoice, in which the following data should be indicated:

- serial number of the document and the date of its issue;

- FULL NAME. client, his TIN and address;

- the name of the LLC, its tax number and legal address;

- names of goods or name of services provided indicating units of measurement (pieces, hours, etc.);

- the volume of services supplied, work performed or goods supplied, taking into account the accepted units of measurement;

- if you provide a service at government rates, including tax, you will have to indicate the price of a unit of goods or the tariff for the service provided without tax;

- total cost of goods/services without tax;

- the tax rate and the total amount of tax are also indicated;

- total cost including tax;

- Finally, the country of origin of the goods is indicated.

Since an individual cannot be a VAT payer, it is not necessary to fill out an invoice in two copies.

If you encounter difficulties when filling out an invoice due to the lack of detailed information about the buyer or service user, you can put dashes in some columns. After filling out the document, you must, based on the results of the tax period, register the account properly (in the enterprise accounting journal), and also do not forget to make a corresponding entry in the sales book.

What is the difference between invoices for payment from LLC and individual entrepreneur

The sample received from the “private owner” has one signature. The LLC will issue a paper containing two “autographs” - the chief accountant and the director. Besides:

- Individual entrepreneurs indicate only full name, companies - the name recorded in the charter;

- The individual entrepreneur form contains only the TIN, the organization - TIN and KPP.

Read also: Inventory shortage

There are no other fundamental differences.

Differences when issuing with VAT and without VAT

VAT payers show the tax amount separately.

If the supplier is exempt from the contribution due to the use of a special tax regime (simplified system, single tax, patent), then the VAT amount is not included when writing the document. However, the corresponding mark is still affixed. And the reason must be given. For example, under the simplified tax system it is written:

- for individual entrepreneurs - paragraph 2 of Article 346.11 of the Tax Code of Russia;

- organizations - paragraph 3 of this regulatory act.

Note: if a buyer operating under a preferential tax regime is issued an invoice with VAT, then the entire amount must be paid, but then o.

How to issue an invoice correctly

Given the fact that the invoice in some cases compensates for other documents, it must be filled out correctly, for which any office application is ideal. In the center of the first line, the word “ACCOUNT” is written in capital letters; below is the number of the agreement and the date of its conclusion, full name, company name and bank details of the parties. Next, a table is filled in with data on the name of the product/service, unit of measurement, total quantity of product or volume of work, with each product or service described in a separate line. At the end of the table, the total amount and the VAT amount are indicated, and if the company is not a VAT payer, this fact is also recorded.

Under the table, the words indicate the total amount to be paid, but in words, in rubles, kopecks, or other currency. The document is signed by the director of the LLC and the accountant (if this position is provided for in the staffing table). The original invoice is given in person, delivered by courier or sent by mail, a copy of the document can be sent by fax or email, and this is also a sufficient basis for payment.

Our lawyers know the answer to your question

If you want to know how to solve your specific problem

, then

ask

our duty lawyer online about this.

It's fast, convenient and free

!

or by phone:

- Moscow and region:

+7-499-938-54-25 - St. Petersburg and region:

+7-812-467-37-54 - Federal:

+7-800-350-84-02

How to issue an invoice: sample

An invoice for payment is quite rightly considered one of the most common documents filled out in a variety of options for cooperation between counterparties. An invoice is usually understood as a document issued by the seller of a product or service to the buyer. This is necessary so that the latter has a basis for payment, as well as the seller’s details, which will be required when transferring funds.

The invoice for payment can be filled out both in accordance with the agreement signed by the parties, and in the absence of one. The terms of cooperation determine the time when the document is issued - before the delivery of goods and provision of services or after.

In this case, the invoice can be issued in paper or electronic form. It is quite logical that it can also be transferred to the buyer in any of the possible ways, for example, in person at a meeting or remotely by e-mail.

Invoice for services without VAT

An important point that must be taken into account when filling out an invoice is the inclusion of VAT in the payment document. It does not matter whether we are talking about an individual entrepreneur or a legal entity. In this situation, the only important thing is which taxation system is used by the manufacturer of the product or the provider of the service.

When applying the main tax system, the invoice must include a VAT amount equal to 18% of the cost of the goods or services sold.

Select payment method

Cashless payments.

Individual entrepreneurs or legal entities have a special current account for the organization. A self-employed person is not an organization, but an individual, and instead of a current account he has a bank card.

A business cannot transfer money to a self-employed person using a card number - such a payment will not go through the accounting department. To make a transfer, you need to ask the self-employed for full details:

- Receiver name

- Current account number

- Name of the bank

- BIC

- Correspondent account

- Bank branch code and address

The self-employed can obtain these details from the bank.

Cashless payments have one drawback. The bank sees that the payment goes to an individual, and not to an individual entrepreneur or legal entity, but you do not pay taxes and fees for it. This seems suspicious and the bank may temporarily block the account.

Usually the blocking is easy to remove: just say that you are paying the self-employed and show the bank the agreement. But the account will remain blocked for several days.

Cash.

If you work with a self-employed person not remotely, but in person, it is more convenient to pay him in cash. The main thing is not to forget to enter this operation into the accounting department and ask for a check from the self-employed person. If this is not done, the self-employed can say that there was no payment and demand it again - according to the law, he will be right.

When paying in cash, a self-employed person

can be paid without a contract. To do this, the transaction must be immediate. For example, you, as a legal entity, buy handmade products from a self-employed person and immediately pay for them in cash.

How to fill out an invoice form for payment

The current legislation in Russia does not provide for a single and unified form of invoice for payment, mandatory for all business entities. Each enterprise or individual entrepreneur can develop its own form. However, there are many templates that are often used as a template when preparing invoices. There are also many online services available on the network that provide the opportunity to issue an invoice for payment. This service is provided free of charge; all you need to do is register on the website.

Despite the lack of a single form, any correctly completed payment document must contain several mandatory details. These include:

- document number and date;

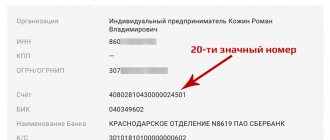

- Full name of the individual entrepreneur or name of the enterprise selling the service or product, legal address, as well as its bank details to which the buyer will transfer funds;

- Full name of the individual entrepreneur or name of the company acting as the buyer, as well as other information about him that the seller has - address, tax identification number, checkpoint, etc.;

- information about the service being sold or the product being supplied: its name, unit of measurement and quantity, as well as cost parameters - price per unit and total cost;

- VAT information;

- signature of the individual entrepreneur and, if available, seal.

The invoice may also include information about the payment deadline if this is provided for in the current contract or agreements of the parties.

Payment from an individual entrepreneur's current account

The simplest and most convenient option to pay an invoice issued to an individual entrepreneur is a bank transfer from a current account. To do this, it is enough to issue a payment order, for which a program is usually used that is used by the entrepreneur for accounting. Drawing up payment orders, colloquially called payment orders, is a mandatory function of any accounting software product.

Then the payment order generated on the basis of the account is delivered to the bank in one of two possible ways:

- in paper form upon personal visit. To do this, you will need to print it and send it to the bank;

- in electronic form using the online bank-client system.

Of course, the second option is much simpler, more convenient and faster, so today it is the one most often used.

Can an individual issue an invoice?

Various types of companies (LLC, PJSC, NPO, etc.), budgetary institutions, and individual entrepreneurs can issue both electronic and paper invoices.

Let's figure out whether individuals can create accounts. If an individual is registered as an individual entrepreneur, then there should be no problems with issuing invoices both on paper and electronically. If a citizen who is not registered as an individual entrepreneur wants to issue an invoice on his own behalf, he is unlikely to succeed.

Such individuals do not pay VAT, and accounts can only be created by those companies or individual entrepreneurs that are payers of value added tax. If an organization receives an invoice prepared by a citizen who is not an individual entrepreneur and does not pay taxes, most likely it will not make payments on it. Therefore, if an individual needs to send an invoice, this can only be done after opening an individual entrepreneur or a company with a different legal form.

If an organization sells goods, work or services to an individual, then there will be no problem in opening an invoice. It is not legally prohibited to issue payment documents to an individual acting as a buyer. In the calculation, the buyer's details include his last name, first name, patronymic and address.

Payment of an individual entrepreneur's bill by an individual

An individual entrepreneur often provides services or sells goods to individuals. In such a situation, he also issues invoices for payment. An individual has the option to either use this account to transfer funds via bank transfer or pay in cash. However, it should be taken into account that an individual entrepreneur has the right to accept cash only in three cases:

- using a cash register;

- using strict reporting forms provided for by law;

- if the individual entrepreneur acts as a payer of UTII.