General requirements for document flow

According to general rules, any operation is documented.

To ship goods or provide services and work, the company draws up the appropriate primary form. For example, an invoice for the supply of products or an act of completion of work or services. The company then generates an invoice to present payment requirements to the customer. This document is the basis for calculating value added tax and has a unified form.

But this document flow procedure is not the only one. Officials have provided a simplified algorithm in which, instead of invoices and invoices, only one form is generated - a universal transfer document (UDD).

Reflection of UPD with status “1” in tax accounting

Let's look at how the seller and buyer can determine income and expenses in tax accounting when applying UTD with status “1”.

Seller's income tax

Let us recall that for the purpose of calculating income tax when the taxpayer uses the accrual method, the date of recognition of income received by the seller is the date of sale of goods, work, services, property rights (clause 3 of Article 271 of the Tax Code of the Russian Federation).

Taking into account the rules of Article 39 of the Tax Code, this is the date of transfer on a paid basis (including the exchange of goods, works or services) of ownership of goods, the results of work performed by one person for another person, the provision of services for a fee by one person to another person, regardless of the actual receipt of funds (other property, work, services, property rights) in payment for them.

Income is determined on the basis of primary documents or other documents confirming income received, as well as tax accounting documents (clause 1 of Article 248 of the Tax Code of the Russian Federation).

Attention

UPD with status “2” is equated to a simple primary document, and therefore is reflected in tax accounting in the usual manner.

Let’s apply these rules to the UTD with status “1” and it turns out that the date of recognition of income for inclusion of revenue in the tax base for income tax will be considered:

- the date of registration of the release of the cargo (line indicator (1) or a later line indicator [11]), if ownership of the transferred cargo passes at the moment of transfer of the thing by the seller to the buyer (customer) or his authorized person, or the carrier;

- the date of registration of receipt of the cargo (line indicator [16]), if ownership of the transferred cargo passes at the moment the item is delivered to the buyer or his authorized person;

- date of registration by both parties of the fact of acceptance and transfer of services, property rights, work results, that is, the latest value of the indicators of lines (1), [11] and [16]

In all of the above cases, if there are other documents confirming these facts, for tax purposes the seller (performer, copyright holder) will apply the earlier date resulting from the other document.

How it works in practice

A budget organization sells services to a third-party company under a contract. At the time of provision of services, the parties are required to sign a certificate of services rendered. Only after the customer accepts the completed actions does the budget organization have the right to make payment demands. That is, generate an invoice.

General document flow is not always convenient. For example, if the customer and the contractor are located in different localities or even regions. These are additional costs for organizations.

A simplified method of document flow will allow you to reduce costs: the budgetary institution will generate a UPD, which replaces both the act and the invoice at the same time. The customer, having checked the quality and volume of services provided, will sign the form and immediately submit it for payment. This will significantly reduce the time of settlements between the parties.

Which form to use at work?

There is no single form for a universal transfer document. Organizations have the right to independently develop forms of primary documentation. The rule was introduced in 2013, with the entry into force of the Law “On Accounting” No. 402-FZ. An institution has the right to develop its own UPD structure, which meets the characteristics and specifics of its activities. It is allowed to use the recommended form approved in Appendix No. 1 to the Letter of the Federal Tax Service of Russia dated October 21, 2013 No. MMV-20-3/. Or modify the Federal Tax Service form with your own columns and fields. But the template recommended by the Federal Tax Service is convenient and reveals all the required details. This ensures that the UPD is filled out correctly, which is why companies most often use it.

If an organization decides to use a self-developed form, keep two rules in mind:

- The form must disclose all mandatory details of the primary document (Article 1, 9 of Law No. 402-FZ).

- The form and rules for filling out the UPD in 2020 should be approved in the accounting policy.

Without this, you cannot use your own form. Tax authorities will not accept documents for registration, which will lead to additional taxes and fees and the application of penalties.

Who uses UPD and when?

Any organization and individual entrepreneur, and even public sector employees, have the right to use the universal primary system. It makes no difference which taxation regime an economic entity applies. The organizational and legal form, as well as the form of ownership, also does not matter. Use UPD when processing transactions:

- Implementation. For example, if an organization sells goods, products, services, works.

- Transfer of property rights over the company's own assets.

- Registration of transactions regarding intermediary operations.

The list of individual operations and transactions is fixed in the Letter of the Federal Tax Service dated October 21, 2013 No. ММВ-20-3/.

Instructions for filling

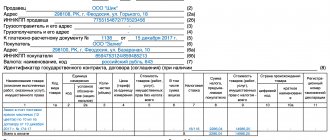

Since there is no unified form of the document, let’s consider an example of filling out the UPD recommended by the Federal Tax Service. The procedure and rules for completing the form are set out in the second appendix of the Federal Tax Service Letter.

| UPD line | Contents and recommendations for filling |

| Document status | There are two filling options:

|

| Lines 2 to 7 | We register identification information about the customer and the contractor under the contract. We record the names of the parties, INN and KPP, addresses. If necessary, fill in information about the shipper. |

| Unit | We indicate code 643 - Russian ruble. All transactions in accounting are reflected in ruble equivalent! |

| Table | We detail information about the subject of the contract in a sample on how to correctly fill out the UPD. For example, if a supply agreement is concluded between the parties, then it is necessary to indicate information about the product. For a contract or provision of services, we record information about the services and work provided. |

| Signatures of responsible employees | This part of the UPD must be certified by the head and chief accountant of the organization. Or other persons authorized to perform such actions, by proxy. |

| A document base | This is an agreement, contract or agreement. Enter its details and the date of signing. |

| Signatures of the parties | Responsible persons from the customer and the contractor affix signatures. Thereby confirming the fact of transfer of goods, provision of services, performance of work. Indicate the date of signing, full name. and the position of the responsible employee of each party. It is not necessary to put a stamp on the universal transfer document. |

Drawing up and form of UPD

The recommended UPD form is given in the letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3/ [email protected]

Now let’s look at how to fill out the UPD form line by line in Table 2:

| Name of the line (columns) in the UPD | String value, columns |

| 1 | 2 |

| "Status" | Possible values: "1" and "2". They are selected depending on the purpose of using the document: “1” - UPD replaces the invoice and the transfer deed; “2” - UPD replaces only the transfer act (i.e. it is primary) |

| Lines (1)-(7) columns 1-11 | For UPD with status “1” they all must be filled out. If invoices in an organization are signed not by the director, but by another person authorized to do so by order (power of attorney), then this document or the position of the authorized person can be indicated on the invoice. It is allowed to clarify the indicators on lines (3) and (4) with information about the TIN, checkpoint of the consignor and the TIN, checkpoint of the consignee. For UPD with status “2”, you can fill in lines (1), (1a), (2), (6), (7), columns 1, 2 or 2a, 3 and 9 to reflect the fact of economic life and the amount of natural and monetary measurements. And also fill in the indicators that clarify the conditions for the fulfillment of a fact of economic life in lines (2a), (2b), (3), (4), (5), (6), (6a), (6b), columns (4) , (5), (6), etc. |

| Column A “Item No.” | The serial number of the entry in the table is indicated |

| Column B “Code of goods/works, services” | If a product is reflected in the UPN, then you need to indicate its article number. If works or services are reflected - then OKVED, or OKUN |

| Line [8] “Grounds for transfer (delivery)/receipt (acceptance)” | It is necessary to indicate information identifying the emerging relations of the parties: types of relations, details of contracts, agreements, instructions, etc. |

| Line [9] “Data about transportation and cargo” | It reflects the details of transport documents (bill of lading, waybill), instructions to forwarders, warehouse receipts and other clarifying information about transportation. For example, you can indicate the name of the organization that bears the transportation costs. The line also reflects information about the cargo: net/gross weight |

| Line [10] “Product (cargo) transferred/services, results of work, rights handed over” | A signature is affixed indicating the surname and initials: - the position of the person who made the shipment; - or a person authorized to act on a transaction for the transfer of work results (services, property rights) on behalf of an economic entity. If a person is simultaneously a person authorized to sign invoices and has signed the document on behalf of the manager (chief accountant), then this line indicates only information about his position and full name. without repeating the signature |

| Line [11] “Date of shipment, transfer (handover)” | It is necessary to indicate the date of the fact of economic life, that is, the actual date of shipment of goods, provision of services, transfer of results of work performed, transfer of property rights |

| Line [12] “Other information about shipment, transfer” | This line provides additional information. For example, data on passports, product certificates. If there are integral annexes to the UPD, indicate the number of these documents and their type |

| Line [13] “Responsible for the correct execution of the transaction, operation” | Here you need to write down the position of the person responsible for the correct execution of the transaction (operation) on the part of the seller, his signature indicating his last name and initials. If this person is at the same time the person who made the shipment or is authorized to act on the transaction on behalf of the economic entity (line [10]), then (if there is a signature in line [10]) only his position and full name can be indicated in this line . without repeating the signature. If this person is simultaneously the person authorized to sign invoices and signed the document on behalf of the manager (chief accountant), then only his position and full name are also indicated in this line. without repeating the signature. If several persons are simultaneously responsible for the correct execution of the transaction, then an additional line ([13a]) must be entered into the document to indicate the position, full name. and signatures of the second responsible person. |

| Line [14] “Name of the economic entity - the document preparer (including the commission agent (agent)" | The name and other details identifying the economic entity that drew up the document on the part of the seller may be indicated. This line indicates: - information about the economic entity maintaining the seller’s accounting records on the basis of the agreement; - or information about the commission agent (agent), if he transfers to the principal (principal) goods, results of work, services purchased from the seller on his own behalf (in this case, line [8] indicates the details of the agreement between the principal (principals) and the intermediary). The line may not be filled in if there is a seal containing the full name of the economic entity that compiled the document. |

| Line [15] “Goods (cargo) received/services, results of work, rights accepted” | The position of the person who received the cargo and (or) authorized to accept services, results of work, rights under the transaction of transfer of results of work (services, property rights) on behalf of the buyer is indicated; as well as his signature indicating his last name and initials |

| Line [16] “Date of receipt (acceptance)” | It indicates the actual date of receipt of the goods (cargo), acceptance of the results of the work performed, receipt of property rights by the buyer or another person authorized by the buyer. Please keep in mind that the date of receipt cannot be earlier than the date of preparation of the UTD (line 1) and the date of transfer recorded by the seller in line [11] |

| Line [17] “Other information about receipt, acceptance” | This line reflects information about the presence or absence of claims; as well as data on documents drawn up by the buyer (customer) upon receipt of goods (work, services, property rights), which are integral annexes to the UPD. For example: no complaint. If there are complaints, indicate information about additional documents drawn up upon receipt/acceptance of goods |

| Line [18] “Responsible for the correct execution of the transaction, operation” | The position of the person responsible for the correct execution of the transaction, operations on the part of the buyer, his signature indicating the surname and initials are indicated. If the person responsible for processing the transaction is at the same time a person authorized to act on the transaction on behalf of the economic entity (line [15]), then only information about the position and full name should be filled in this line. without repeating the signature. If several persons are simultaneously responsible for the correct execution of the transaction, then an additional line must be entered into the document ([18a]) to indicate the position, full name. and signatures of the second responsible person |

| Line [19] “Name of the economic entity - the document preparer” | The line may indicate the name and other details identifying the economic entity that drew up the document on the part of the buyer (participant in the transaction, operation). For example, information about the person maintaining the accounting records of an economic entity on the basis of an agreement. The line may not be filled in if there is a seal containing the full name of the economic entity taking part in the preparation of a specific bilateral document. |

| "M.P." | The stamps (or INN/KPP) of the economic entities that compiled the document are affixed. However, the absence of stamps (if all the required details are present) will not be grounds for refusal to accept a document for tax registration |

Filling samples

The principles for filling out a universal transfer document differ depending on the subject of the agreement. For example, when selling products or goods, use the following example of filling out a universal transfer document:

When outsourcing work or services, draw up a universal transfer document using the following model:

UKD number

In line 1 of the adjustment invoice issued when the cost of shipped goods (work, services, property rights) changes, the serial number must be indicated (clause 5.2 of article 169 of the Tax Code of the Russian Federation, paragraph “a” of clause 1 of the Rules for filling out adjustment invoices - invoices, approved by Resolution No. 1137). Numbers of adjustment invoices and invoices are assigned in general chronological order

For separate divisions (partnership participant, trustee), a special numbering procedure has been defined.

The number of the primary accounting document is not specified as a mandatory detail (Article 9 of Law No. 402-FZ).

Thus, when filling out the UCD form with status “1”, the number is assigned in accordance with the chronology of invoice numbering.

In the UCD with status “2” (in the case where there is no adjustment invoice, but only consent to the adjustment), the number is assigned in accordance with the chronology of the numbering of the primary documents for the adjustment.