The receipt in form 0504510 refers to strict reporting forms. In fact, it replaces the receipt issued when using cash registers. Receipts can be used in their activities by both individual entrepreneurs and organizations, regardless of what area of business they operate in. This type of receipt is in demand not only in commercial, but also in the public sector.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

What is a strict reporting form

A strict reporting form , or BSO for short, is a document proving the transfer of funds from the consumer to the service provider. It is possible to use such a form only when providing various types of services to the population, i.e. BSO cannot be used between organizations, and in relation to the sale of goods, the use of BSO is also prohibited.

It is worth noting that strict reporting forms can be either in a strictly established form (receipt 0504510 refers to them), or in the form of templates developed individually (they must be registered in the company’s accounting policies).

At printing houses, strict reporting forms are issued in series, which contain a certain number of copies arranged in a strictly established chronological order (in the same order, the forms must subsequently be registered in a special enterprise accounting journal).

Why do you need tax receipts?

When paying bills, you should be sure to print individual entrepreneur tax receipts so that in case of problems, use it as a supporting document.

If the entrepreneur has not received written notification of the amount of tax due, he must generate a receipt himself by visiting the Federal Tax Service office or going to the tax office website.

Notice of tax amount

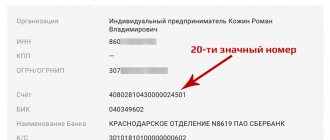

For your information! You can make receipts for payment of insurance premiums for individual entrepreneurs using the “Payment of Taxes” service by entering the Taxpayer Identification Number (TIN).

After filling out the form, the user has the opportunity to generate a payment document with a barcode. The most reliable way that saves a lot of time. You can access the tax service website through your Sberbank personal account or government service portal.

Despite the convenience of using new technologies, to pay such charges it is better to have on hand a payment document with the seal of the bank, postal worker or other organization that accepted the payment. When paying through a terminal, there will be no stamp on the receipts, and it is difficult to store them; it is better to scan them immediately. When paying through the website, you must also print a payment receipt, so that in case of controversial issues or correction of shortcomings, you must document your actions.

If for some reason the tax amount was not credited to the budget, Federal Tax Service employees may make a demand for repayment of the debt that has arisen.

Note! In the absence of payment, the tax office has the right to file a claim in court for forced collection of the tax and the fine accrued during the delay. The penalty is imposed on the funds available in the organization’s accounts, as well as its property.

You can submit an application to the judicial authority within six months from the last date of payment of the tax indicated in the request. In this case, the amount of arrears should not exceed 1,500 rubles*. When the amount of non-payment exceeds the limit, you can go to court within three years from the moment the debt arose.

Thus, you need to store payment documents for paying taxes and amounts to insurance funds for at least four years.

Procedure for using the receipt

When implementing any service, filling out the receipt form 0504510 is the final step. Initially, an organization or individual entrepreneur provides a service to the consumer, after which the client or customer transfers money to an employee authorized to act on behalf of the company (usually either the direct executor of the order, or an accountant or cashier). Then the data on the funds received, along with other mandatory information, is entered into the receipt.

Next, information about the receipt is entered into the payment document register, indicating the form number, the person who paid for the service, and the amount of the paid amount.

It should be noted that the preparation of the receipt should be treated very carefully, errors must be avoided when filling it out, and it is imperative to clearly, in chronological order, enter data on all issued receipts into the journal of document forms.

Otherwise, in the event of a sudden tax audit, failure to comply with these rules may lead to serious penalties from supervisory authorities.

Instructions for filling out online

To avoid languishing in queues at Sberbank of Russia, fill out the receipt at home. To do this you will need a computer and Internet access. No special knowledge or registration required. Follow the step by step instructions:

- Go to the official website of the Federal Tax Service.

- We select the payer status, that is, we determine the category of the person who will make the payment. There are three options available: individual, entrepreneur or legal entity.

Let's look at the features of filling out a ticket for ordinary citizens using a specific example.

Citizen Exemplary Anton Petrovich wishes to pay transport tax for his car in the amount of 2000 rubles. Payment for 2020.

Therefore, select “Individual” and “Payment document”:

- Let's move on. Now you need to enter the budget payment classification code, or BCC. Not many people know him, so we skip the field. Please note that the KBK will be filled in automatically after entering information in other fields of the form.

First, we select the type of payment; according to the conditions of our example, these are taxes on the property of citizens.

Now we select the purpose of payment, in our case it is transport tax.

Determine the enumeration type. Since this is a current payment, and not penalties, fines and penalties, we choose:

As you can see, the budget classification code was generated by the system independently.

Let's move on.

- We register information about the Federal Tax Service, to which the funds should be credited. Then we determine the OKTMO code (from the proposed list). Let's move on.

- We fill in the remaining fields: the basis for the transfer and the tax period: our year is 2020. We write down the amount and continue.

- Now we register information about the payer - an individual. We indicate his full name. and residential address. Let's move on.

- The system is ready to generate a payment document. Online payment is also available on the Federal Tax Service website. That is, you can transfer money to the budget without leaving your home.

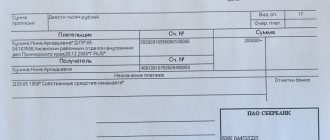

Ready-made PD form of the Federal Migration Service of Russia, sample filling based on example conditions

Rules for registering a journal for recording strict reporting forms

The journal, as well as the receipts themselves, must be kept in a strictly defined order. But first, it should be noted that it can be created within the enterprise according to an individual sample (in this case, its template must be approved in the accounting policy of the organization), or it can be purchased at a specialized store of forms.

The sheets of the journal must be numbered, laced and signed by the chief accountant of the company, as well as its director. It is not necessary to certify the journal with a seal, since since 2020, the use of seals and stamps in the activities of organizations is not required by law. Receipts must be entered in it in strictly chronological order, without omissions or blots.

Rules for filling out a receipt

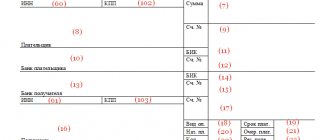

Receipt form 0504510 belongs to the category of unified and mandatory for use. As mentioned above, it is an analogue of a cash receipt, so it must contain the following information:

- name of the organization or information about the entrepreneur,

- actual and legal addresses of the company,

- date of issue,

- information about the consumer (including data from an identity document),

- the exact amount reflecting the cost of the service.

If any errors were made when entering information, there is no need to try to correct them, since crossing out, blurring, etc. adjustments in strict reporting forms are absolutely unacceptable. In such cases, the document is considered irreparably damaged; it should be crossed out and deposited in the same manner as for correctly executed forms. At the same time, information about it is also entered into the journal of payment documents with a note that the form was damaged.

How to prepare a receipt in the Federal Tax Service

The Tax Service has developed a convenient service called “Payment of State Duty”. Follow the link and select the taxpayer category. In addition, you need to select the type of payment document.

If you need a receipt for payment of the state fee for closing an individual entrepreneur for payment in cash or by card, then indicate “payment document”. To pay the fee from the entrepreneur’s current account, the “payment order” option is intended.

At the next step, you need to select the desired value from the drop-down lists, KBK (18210807010011000110) will be entered automatically. If you apply to the tax authority to close an individual entrepreneur, this is how the fields should be filled out.

Now you need to select the address at which the individual entrepreneur is registered. Usually this is a permanent registration in the passport; if it is not there, indicate the address of temporary registration of residence.

Next, provide the full name of the entrepreneur who is ceasing to operate. If you want to pay the state fee online, be sure to enter your TIN.

When choosing an online payment option, the service will prompt you to select a payment method. In our example, this will be the website of a credit institution.

As you can see, the index of the payment document and the recipient of the payment (at the address we indicated is MIFTS Russia No. 46 for Moscow) have already been entered automatically.

Pay attention to the service’s warning: “When paying state fees online, you must request a payment receipt from the bank through which the payment was made. Having a receipt for the payment made is mandatory when applying for state duty services at the Federal Tax Service.”

Below are the logos of credit institutions through which the state duty for the liquidation of individual entrepreneurs is transferred. Select the appropriate one and complete the payment.

How to prepare a receipt for paying the fee through a bank if you do not want to make the payment online? To do this, you do not need to indicate the payer’s TIN in the payer’s details.

As you can see, the service warns that electronic payment is not possible and offers to download the payment document in PDF format. All fields of the receipt are filled in automatically, all that remains is to print the document and pay at the bank in cash or by card.

Rules for issuing and storing receipts

You can fill out the document either in handwritten or printed form, but regardless of which method is chosen, the form must contain “live” signatures of both the recipient and the service provider.

The receipt is always issued in two copies :

- one of which, after entering data about it in the payment document register, is stored for three years in the archives of the enterprise (in case of a tax audit),

- the second is transferred to the consumer of the service who has paid its cost.

After the storage period for strict reporting forms for a certain period of time has expired, it is necessary to draw up an act of writing off documents in free form.

Who issues invoices for payment?

An invoice for payment is always issued by an employee of the accounting department. After the form is completed, the document is handed over to the head of the organization, who certifies it with his signature. It is not necessary to put a stamp on the document, since individual entrepreneurs and legal entities (since 2020) have the right not to use the seal.

An invoice for payment is drawn up in two copies , one of which is sent to the service consumer or buyer, the second remains with the organization that issued it. You can fill out the invoice either on a regular A4 sheet or on the organization’s letterhead. The second option is more convenient, since you do not need to enter information about the company each time.

This document does not have a unified template, therefore organizations and individual entrepreneurs have the right to develop and use their own template or issue an invoice for payment in free form. As a rule, for long-established organizations and individual entrepreneurs the form of the form is standard; only the information about the invoice recipient, the name of the product or service, as well as the amount and date change. Sometimes organizations additionally indicate in the invoice the terms of delivery and payment (for example, percentage or prepayment amount), the validity period of the invoice and other information.