There are certain rules for the storage and subsequent disposal of official papers classified as cash documents.

Accounting legislation clearly regulates the terms, procedure and conditions for storing documents certifying the completion of operations (transactions) with cash. Business entities must strictly adhere to the established rules, since failure to comply with the requirements may lead to the imposition of penalties.

How long should cash register papers be kept? What principles and standards should be followed in this regard?

What is the procedure for destroying cash register documentation? All these issues need to be considered in more detail.

Tax deadlines

Tax legislation provides for a four-year retention period for financial papers reflecting tax/accounting information.

This rule is clearly established by the Tax Code of the Russian Federation, namely, Article 23 of this regulatory legal act (subparagraph 8 of paragraph 1).

A similar storage period is regulated by this law (Tax Code of the Russian Federation) in relation to documents recording the income/expenses of an economic entity.

Accounting aspect

Accounting legislation strictly requires that an economic entity maintain financial (accounting) statements for at least five years, counted from the end of the corresponding reporting year.

This norm is contained in the Law of the Russian Federation “On Accounting”, registered on December 6, 2011 under number 402-FZ.

The same regulatory legal act obliges a business entity to create adequate conditions to ensure the safety of financial documentation throughout the entire period of its storage.

In addition, a business entity has the right to independently create archives outside the place of implementation of its business activities in order to store important documents, if this is necessary to ensure their integrity/safety.

Requirements of the Ministry of Culture

The requirements of the Ministry of Culture of the Russian Federation regulate the storage period for cash register papers, which is also 5 (five) years. The rule is approved by order of this ministry, registered on August 25, 2010 under number 558.

Salary documentation

As for salary cash documents - pay slips - these papers must be stored for 75 (seventy-five) years, if salary recipients do not have accounting (personal) accounts, or for a standard five-year period, if there are such personal accounts.

The storage period is counted from the first day of the year following the year of formation of this document.

These standards are established by the above-mentioned order of the Ministry of Culture of the Russian Federation.

Litigation

If any cash records of a business entity are involved in ongoing legal proceedings or disputes, these documents should be carefully preserved until the final verdict is rendered by the court.

How long are cash documents for salary payments kept?

The list of documents used in cash transactions includes those used to issue salaries and other payments to employees. These include payroll and payroll statements. Based on the storage periods for documents approved by Rosarkhiv (clause 295 of the List), they must be stored for 6 years, and if there are no personal accounts:

- 50 years - if the documents were completed after 01/01/2003;

- 75 years - if documents were completed before 01/01/2003.

The deadlines are counted from January 1 of the year following the year in which the document was generated.

If there are unresolved legal disputes and proceedings in which these documents appear, they are stored until the final decision is made.

Order and rules

The head of the business entity is responsible for organizing and implementing the procedure for storing all cash documentation.

It is he who determines suitable places (zones) to ensure the safety of financial securities, and also establishes the procedure for such storage for a regulated period in accordance with the requirements of current legislation.

The storage procedure can be carried out either using the archival capacities of the organization itself, or by third-party contractors who specialize in this area and provide appropriate services on a paid (contractual) basis.

Basic rules for storing cash papers:

- Daily binding of documents (every day).

- Selection of stapled papers in ascending numbering of the corresponding accounting accounts.

- Numbering of all sheets that make up a specific stitch.

- Formation of a proper inventory when transferring the stitching directly to the archive. The number of sheets and the name of the stitch itself are indicated.

Destruction procedure

When cash papers reach the end of their regulated shelf life, they are liquidated by the business entity.

This procedure is carried out at the enterprise according to the established procedure:

- Confirmation of the fact that the period regulated for storing papers has expired.

- Checking the actual availability of papers that are no longer relevant at the moment and are subject to destruction.

- Formation and work of an enterprise expert commission authorized to check the real value of cash papers. Its composition is determined by the head of the economic entity. The results of the activities of such a commission are documented by drawing up the appropriate minutes (minutes of the meeting).

- Drawing up an act of liquidation of cash papers, approved by the head of the organization.

- The papers specified in the liquidation act are actually destroyed. This fact is confirmed by the preparation of a separate document.

Responsibility for improper storage of cash books

As mentioned earlier, filling out and storing cash books is mandatory for many companies. But what will happen if, for some reason, a tax audit reveals damage to this document or its absence?

Improper storage of cash books, leading to their loss or damage, as well as violation of the required storage periods can lead to unpleasant consequences in the form of fines. Moreover, such a measure of punishment can be applied both to the official guilty of the crime and to the organization as a whole.

Thus, if a specific person is guilty of improper storage, he will be punished. In this case, he will be charged with a fine of up to 10 thousand rubles for the first violation, and up to 20 thousand rubles for repeated violations. If the guilt of a specific person could not be proven, or if the company’s management is guilty, a fine for failure to comply with cash accounting is imposed on the organization as a whole. The amount of such punishment can vary from 50 thousand rubles for a single violation, to 200 thousand rubles for repeated incidents.

conclusions

Thus, guided by the requirements of regulations, it can be argued that cash documentation should be stored at the enterprise for a minimum period of five years.

This applies to both paper and electronic documents. An exception is payroll records, which, in the absence of accounting (personal) accounts, are stored by the organization for seventy-five years.

The procedure for such storage must comply with generally binding regulatory requirements. The head of the business entity is directly responsible for the proper storage and subsequent destruction of cash papers.

Main types of documents

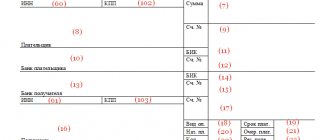

As of 2014, registration of any cash transactions is carried out on the basis of 6 main documents:

- receipt orders in form No. KO-1 , intended for registration of cash receipts to the cash desk;

- expense orders in form No. KO-2 , recording the issuance of cash from the cash register;

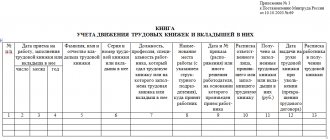

- cash book in form No. KO-4, which provides generalized information about the company’s cash transactions;

- book of accounting of funds accepted and issued by the cashier in form No. KO-5 , which is used to register the movement of funds between the main and other cashiers or proxies;

- payroll used for calculating and paying wages;

- payroll.

All these and other cash documents are subject to mandatory storage for the periods established by the archival legislation of the Russian Federation.

Storage period for garage cooperative documents

The consumer society is obliged to store the following documents at the location of the consumer society council:

The retention periods for these documents are not specified in the law; therefore, they are stored for the entire period of the cooperative’s activities. report on the financial condition of the consumer society or union of consumer societies and recommendations of the observer;

| conclusions of the audit organization (individual auditor) and the audit commission of the consumer company; |

On consumer cooperation (consumer societies, their unions) in the Russian Federation

After the liquidation of the cooperative, the documents are transferred to the archive; the periods of archival storage are determined by other laws.

documents confirming the rights of the consumer company to the property on its balance sheet;

Duration of storage of a lease agreement for non-residential premises

What are the storage periods for lease (sublease) agreements for non-residential (office) premises concluded for 11 months (without registration with the State Bureau of Investigation)? And the terms of storage of lease agreements that have passed registration, and at the end of those terminated in the State Bureau of Investigation. What regulatory documents say this? Best regards, Olga.

In particular, the following storage periods are defined for individual primary documents:

primary documents and appendices to them that recorded the fact of a business transaction and were the basis for accounting records (including cash, bank documents, bank checkbook counterfoils, orders, acts of acceptance, delivery, write-off of property and materials, receipts, counterfoils to them , invoices, invoices, advance reports, etc.) - five years, and in the event of disputes, disagreements, investigative and judicial cases, they are preserved until a final decision is made (clause 150 of the List of standard management documents);

| powers of attorney to receive money and inventory items, including revoked powers of attorney - for five years, and in the event of disputes, disagreements, investigative and judicial cases, they are preserved until a final decision is made (clause 155 of the List of standard management documents); |

The head of the organization is responsible for organizing the storage of accounting documents, accounting registers and financial statements. The organization's chief accountant is responsible for the safety of primary accounting documents.

documents (acts, information, correspondence) on mutual settlements and recalculations between organizations - five years (clause 151 of the List of standard management documents);

documents for the issuance of wages, benefits, fees, financial assistance and other payments - five years, and in the absence of personal accounts - 75 years (clause 155 of the List of standard management documents);

How long should individual entrepreneurs' cash receipts be kept?

Contents Checks are not durable things. However, they are accounting documents, which means they need to be preserved, and for a certain period. The standard storage period for documents related to cash register equipment, according to the Decree of the Government of the Russian Federation dated June 23, 2007.

N 470, is at least five years from the date of termination of their use. The exceptions are used cash receipts and copies of sales receipts.

They are kept by financially responsible persons for at least 10 days from the date of sale of goods based on them and verification of the goods report by the accounting department.

However, this is also a deadline. And receipts issued by modern cash registers fade over time. They no longer show the date, amount, or any other information. As children, to read the information on a cash register receipt, we held it to a light bulb.

When heated, the treasured letters and numbers appeared on it.

It is clear that such a method cannot be presented to the tax inspectorate or accounting department.

But the problem of faded checks can be solved by photocopying. Photocopies can also prove expenses. To do this, copies of checks must be certified by the signature of an official, as well as the seal of the organization.

The originals, even if faded, should be kept with them.

But checks are not so bad. Z-reports are printed on the same cash register tape. They, in accordance with the regulations on the use of cash registers when making cash payments to the population (approved by Decree of the Government of the Russian Federation dated July 30, 1993 No.

N 745), unlike checks, must be stored for at least five years, like all primary documents. In five years, the Z-report can fade. Therefore, he can also photocopy. However, it must be stored together with the cashier-operator’s certificate-report according to the unified Form N KM-6 about the revenue for the shift, since, in fact, it is an appendix to it.

Typically, Z reports are attached to the back of the certificate.

However, the rules for document flow of cash documents still need to be reflected in the organization’s accounting policies.

At the same time, a cash receipt is not a primary document, but a Z-report is considered to be one.

What receipts and receipts should I keep? And how long?

https://www.znak.com/2019-04-01/cheki_i_kvitancii_kakie_i_kak_dolgo_sleduet_hranit_v_semeynoy_buhgalterii

2019.04.01

Carli Jeen / unsplash.com

The purchase of any product or service must leave a financial trail - in the form of a check or receipt.

Along with these documents, you receive a certificate that you paid for the purchase, and at the same time the guarantees provided under the consumer protection law.

But does it make sense to keep all these receipts and checks? And if so, for how long? And what if the check printed on the cash register tape is physically preserved for less than its legal validity period? We turn to experts for advice.

Take it and take care of it

The question is whether to accept checks that sellers bounce with the words “Thank you. Come again" is given to you with every purchase? On average, everyone hears these words several times a day, but not every check ends up in our pocket. And if this happens, then almost certainly the financial document accidentally found there is destined to go to the trash bin.

And in vain, Igor Fainman, a specialist in personal finance and investments, is sure. Igor is a convinced supporter of the fact that almost everything that is given to us through cash registers and payment terminals should be stored, and for as long as possible.

His personal accounting is no longer an abstract figure of speech after 10 years ago, the founder of the Chelyabinsk Academy of Finance and Exchange purchased a fireproof cabinet.

There all this time its owner places checks, receipts, contracts meticulously arranged in folders...

All this may be required in case your relationship with the counterparty is not limited to a specific transaction, the expert explains.

The counterparty is the store where you bought new jeans a couple of weeks ago, or the restaurant where you had a business lunch. If the jeans do not fit, the receipt will help you exchange them for a suitable product.

And if you feel unwell after visiting a restaurant, the fiscal document will serve as evidence that you can attach to a lawsuit.

Ivan Lemzyakov, Chairman of the Ural Chamber of Consumer Protection, recalls that the Russian law on the protection of consumer rights still does not oblige us to keep checks and receipts.

According to the law (clause 5 of article 18), you can present other evidence of making and paying for the purchase, including witness testimony (clause 43 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated June 28, 2012 N 17 “On the consideration by courts of civil cases in disputes over the protection of rights consumers").

There is established judicial practice, where consumers prove the fact of purchasing a product not only with witness testimony, but also, for example, with photo and video recordings that were made when purchasing the product, confirms Gennady Loktev from the European Legal Service.

From this point of view, a simple solution becomes obvious: photograph receipts on a smartphone or make scanned copies of them, then saving them on your devices or in cloud storage. If the need arises, you can contact the seller with a pre-trial claim (demand) in writing and, by attaching this photo, let him know that the law is on your side.

But, notes Ivan Lemzyakov, the original document is still the best argument. If so, then the habit of keeping receipts - at least until the warranty period or service life of the product expires - can be very useful. And a fireproof cabinet with similar contents no longer looks like some kind of extreme.

The consumer is not required by law to keep receipts.

But their presence will speed up the resolution of unpleasant issues that may arise with the paid productViktor Pogontsev / Russian Look

The presence of documented confirmation of the purchase simplifies the interaction between the buyer and the seller, agrees Elena Leonova, managing director of the Citilink retail chain in the Sverdlovsk and Tyumen regions. Yes, the law is on the consumer’s side: when returning money due to a significant defect in the product, the client writes a statement about the loss of the cash receipt and the seller is obliged to return the money without further discussion. In addition, today many stores and retail chains can not only restore a receipt, but also determine that the product was actually purchased from them - by its serial number. Knowing these nuances, you don’t have to bother storing receipts. But the process of identifying a purchase and resolving issues related to replacing a product or returning funds is faster with a receipt.

“In this regard, I would recommend keeping receipts for goods at least during the warranty period,” summarizes Elena Leonova.

The more expensive, the stricter

Tamara Kasyanova, managing partner of 2K JSC, which provides auditing and legal services, definitely advises taking care of storing checks and receipts that can confirm your rights as a purchaser of expensive goods and services.

Director of the legal service “Unified Center for Protection” Konstantin Bobrov clarifies that such documents should be stored not only during the warranty period or the shelf life of the product, which the buyer is informed about before concluding the sales contract.

The arithmetic here is completely simple: to the warranty period you add a three-year limitation period, during which you also have the right to directly file claims against the seller regarding the discovery of a defect that affected the consumer properties of the product. And you get the time that the check should be kept.

That is, if a conditional microwave oven has a two-year warranty, then, taking into account the statute of limitations, keep the documents for it for five years from the date of purchase. The same applies to services provided to you (work performed for you).

However, keep in mind that if you do not file a claim within the warranty period, the burden of proof will fall on you to prove that the defects became apparent during the warranty period. And after the statute of limitations expires, not a single court will take your side.

Obviously, you should also keep the receipt for payment for street parking - in case you suddenly decide to be fined for non-payment. The statute of limitations for such cases is three years. Yaromir Romanov / Znak.

com

Ivan Kollegov, head of the fiscal solutions department, which produces cash register equipment and software for it, in the case of expensive acquisitions, suggests not limiting yourself to checks and warranty cards. Until recently, sellers of household appliances strongly recommended taking care of the packaging - in case of a warranty case.

Not all consumers liked this, for obvious reasons. And as a result, such recommendations soon stopped being made in stores. But for the sake of objectivity, preserved packaging is another argument in your balance.

The good news is that there is a compromise option: you don’t have to keep the entire box - just cut out the part of it that has the barcode read at the time of purchase.

Igor Fainman from the Academy of Finance and Exchange advises storing several other types of financial documents for as long as possible. For example, it is useful to keep documents that, if necessary, will indicate that you are in settlement with the bank from which you took out the loan.

It is advisable that this is not just a stack of checks from the ATM through which you made monthly payments, but a certificate from a credit institution stating that the debt has been repaid and the bank has no claims against you. This should be issued at the bank upon request.

Taking into account the statute of limitations, it is reasonable to keep this document for at least three years.

It is good to keep receipts for vehicle repairs and maintenance. If you decide to sell, it will be easier for the buyer to understand the history of what he is buying, and it will be easier for you to convince him that the car was serviced properly. Keep your utility bill receipts for up to five years.

Even if you have long been using online banking, electronic payment systems, the State Services portal and other delights of the digital economy, in which all your financial actions a priori leave their mark, lawyers are still conservative.

And they warn: there are still plenty of such retrogrades, who believe only a piece of paper with a bank seal, both in housing offices and in the courts...

Russians are increasingly using electronic payment services, finding advantages in this from the point of view of protecting consumer rightsNatalya Khanina / Znak.com

More numbers

However, progress cannot be stopped. Slowly but surely we are moving to electronic document management, which means that now you can try to get a virtual safe for financial documents that should be kept for as long as possible. In fact, there are more and more checks and receipts in our lives.

And it’s becoming more and more difficult for a layman without special training to sort out their systematization and storage. Moreover, checks have a disgusting property - fragility, and the law does nothing to combat this.

The lifespan of the thermochemical layer, that is, the very “ink” applied to a paper check, is not established by law.

But, as Ivan Kollegov from , from 2020 reminds, any consumer has the right to request an additional copy of the receipt at the checkout - electronic (clause 2 of Article 1.2. 54-FZ “On the use of cash register equipment.”

To do this, just tell the seller your mobile phone number or email address - and after payment, the document will be sent to you in the form of an SMS or email.

Anton Rumyantsev, director of the fiscal data operator OFD.ru, clarifies: the store does not have the right to refuse such a request, otherwise it will face a fine. But there is only one condition - the buyer must provide his information to receive an electronic check strictly before the moment of payment.

“With electronic receipts, home bookkeeping is much easier. They can be downloaded and saved in a separate file. An electronic receipt does not fade, tear or get wet, and is much more difficult to lose.

If you need to return or replace an item, an electronic receipt or its printout will be accepted without questions, just like a paper one,” says Anton Rumyantsev about the advantages of the alternative.

And he gives one more simple piece of advice: when buying a technically complex or simply expensive product, consider receiving an electronic receipt.