Tax breaks for small businesses - how to get a deferment on payments. Who is eligible for benefits in 2020? Preferential types of business and deferments due to coronavirus.

Events caused by the coronavirus pandemic are dealing a big blow to small and medium-sized businesses. The state has developed a number of measures to support entrepreneurs. One of these measures is tax holidays, which will help businessmen overcome the crisis.

The article will tell you how to take advantage of the tax deferment for small businesses, who is eligible for benefits and when entrepreneurs will have to pay contributions.

How to earn passive income on websites

How to buy a website with income and receive from $10 to $3000, even despite the pandemic and its consequences. How much does a profitable website cost and how to start investing with 10,000 rubles or more in your pocket

More about the course

Who will be given a deferment on taxes and contributions in 2020

In 2020, the Russian Government decided to provide tax benefits to small and medium-sized businesses. Individual entrepreneurs will have their taxes and loan rates reduced and will be freed from inspections.

Benefits for small businesses

At the beginning of their journey, everyone chooses the most suitable preferential tax program. This is due to the number of employees, field of activity and sales area.

In 2020, there are 7 tax regimes in Russia. Let's briefly describe each of them:

- Simplified taxation system (STS, income) - depending on the region of registration of the company, the rate ranges from 1 to 6% of all income received. The number of employees on staff should not exceed 100 people, the enterprise’s turnover should not exceed 150 million rubles.

- Simplified taxation system (income minus expenses) - in each region the rate varies from 5 to 15%. If the expenditure side exceeds the revenue side, the rate will be fixed - 1%. The number of employees on staff should not exceed 150 people, and turnover should not exceed 150 million rubles.

- Patent taxation system (PTS) - an entrepreneur buys a patent for a certain period without paying additional taxes. The maximum number of employees of the company is no more than 60 people, and income should not exceed 15 million rubles.

- Single tax on temporary income - paid on the basis of planned profit, and not based on the results of completed activities. Depends on the rented area and the number of employees, not exceeding 100 people.

- The Unified Agricultural Tax (USAT) is a system provided for farmers and producers of agricultural products. According to the Unified National Social Economy, a rate of 6% applies, while a businessman is exempt from paying property tax and personal income tax on income from business activities.

- The special tax regime for self-employed people is a relatively new regime introduced in 2020. This system proposes to pay business tax on income from independent activities at a preferential rate of 4 or 6%. The regime is suitable for both individuals and individual entrepreneurs, who receive the right to officially earn money without the risk of receiving a fine from the Federal Tax Service.

- The general tax system (OSNO) is the most complex system to which individual entrepreneurs and organizations that do not choose the regime are automatically transferred. OSNO requires payment of all fees. This method of reporting is relevant for organizations engaged in the import of goods and wholesale trade, as well as when the company interacts with counterparties on the same taxation system.

Tax deferment

An entrepreneur who finds himself in a difficult situation has the right to apply for a tax deferment. This decision was made as part of the small business assistance program. Such assistance allows the individual entrepreneur to be fully or partially exempt from paying contributions or receive a deferment.

It will be possible to defer the payment of taxes for individual entrepreneurs in the following situations:

- business in a pre-bankruptcy state;

- the activity is carried out seasonally;

- the entrepreneur's property suffered damage as a result of a fire or other man-made disaster.

In such cases, the state meets halfway, exempting the affected business in whole or in part from paying taxes and providing a deferment on them without penalties.

Tax holidays

Individual entrepreneurs registered from 2020 to 2020 have the right to count on tax holidays within 2 years after the start of activities under the following conditions:

- The individual entrepreneur must not have been previously registered as an entrepreneur before the law on tax holidays came into force;

- the tax regime corresponds to the PSN or simplified tax system;

- The activity is included in the register of SMEs (small and medium-sized enterprises) dated March 1, 2020.

Regional authorities are given the opportunity to independently determine the list of activities that are subject to tax holidays.

Reference! The law will be in effect throughout 2020. For example, if an entrepreneur wants to open holidays at the end of 2020, they will last until 2022.

Regional tax incentives

At the regional level, local authorities have the right to adjust the timing and types of activities of individual entrepreneurs. They are introducing additional incentives for small business taxes in 2020.

Each individual entrepreneur, before counting on such support, must check what discounts are offered in the region of registration of his company. A company developing the district's infrastructure receives a reduced rate, exemption from tax deductions and other privileges.

Benefits for individual entrepreneurs

A pensioner registered as an individual entrepreneur has the right to apply for preferential holidays. Like any private businessman, he can reduce taxation if he works in the following areas:

- production of products;

- scientific activity;

- provision of household services to individuals.

There are no other separate benefits for retired entrepreneurs.

List of activities affected by the epidemic

Decree of the Government of the Russian Federation No. 434 of 04/03/2020 approved the list of industries that have suffered the most due to the coronavirus and therefore require the greatest support from the state.

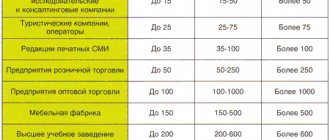

The list includes the activities of industries:

What benefits were introduced for emergency medical services in 2020 due to COVID-19?

For small and medium-sized businesses, many support measures have already been approved; below is a list of them. In addition, additional relaxations and benefits are planned to be considered.

Benefits for small businesses affected by the coronavirus epidemic in the Russian Federation:

- Tax holidays in the form of deferment of tax payments for small and medium-sized businesses engaged in activities that have been hit hardest by the coronavirus. Depending on the type of tax and loss of income, the deferment period can vary from 3 months to 1 year. Read more about tax holidays for small businesses.

- Installment payment of taxes in case of losses in income for a period of up to 3 years, and for city- and system-forming, strategic and largest taxpayers for a period of up to 5 years.

- Deferment of payment of insurance premiums for 6 months for micro-enterprises (according to V.V. Putin’s latest address dated 04/08/2020, this support measure is also planned to be extended to small businesses) - more about the benefit.

- Reducing contribution rates by 2 times - details here.

- Deferment of reporting for all enterprises, including all types of activities - read the details.

- Suspension of all tax audits until May 31, 2020.

- Cancellation of tax sanctions for violations during the period from March 1 to May 31, 2020.

- Deferment of loan repayments for small businesses in the form of credit holidays.

- Providing benefits on loans for salary payments - issued by banks at 0% from 04/08/2020.

- Deferment of rent payment - either for the period of the disaster period and emergency, or until October 1, 2020.

All of the benefits and assistance and support measures for small businesses are discussed in more detail below.

The basis for these benefits and support measures for small and medium-sized businesses are the following legislative documents:

- Resolution No. 409 of 04/02/2020 - deferment of taxes, contributions, reporting, installments, tax audits.

- Federal Law No. 106-FZ of 04/03/2020 - amendments to the law “On the Central Bank of the Russian Federation (Bank of Russia)”.

- Federal Law No. 102-FZ of 04/01/2020 - amendments to the Tax Code of the Russian Federation.

- Decree of the Government of the Russian Federation No. 439 of 04/03/2020 - on deferment of rental payments.

Tax holidays

Resolution No. 409 of 04/02/202 established that small enterprises whose main activities are included in the list of those most severely affected by the coronavirus (list here) have the right to receive a deferment in paying taxes (tax holidays) for up to 6 months.

The activities of a small business entity are determined according to OKVED. The benefit can be used provided that the affected activity is the main one for the enterprise, and the organization itself is included in the register of SMEs.

Tax deferment period

- 6 months — income tax, Unified Agricultural Tax, simplified tax system for 2020;

- 3 months — Personal income tax for individual entrepreneurs for 2020;

- 6 months — taxes and advances for 1 sq. and March 2020 (except for VAT, personal income tax on employees, professional taxes);

- 4 months — taxes and advances for the 2nd quarter, half of 2020 (except for VAT, personal income tax for employees, professional taxes);

- 4 months — PSN for 2 quarters. 2020;

- payment deadline is 10.30.2020 - for advances on transport, property and land taxes for the 1st quarter of 2020 (if regions provide for advance payments);

- The payment deadline is December 30, 2020 - for advances on transport, property and land taxes for the 2nd quarter of 2020.

Deferment and installment payments for taxes

Resolution No. 409 of 04/02/2020 approved the Rules for providing support measures for small businesses in the form of deferment and installment plans for payments of taxes and contributions, the payment deadline for which falls in 2020 (except for excise taxes and mineral extraction tax).

Small and medium-sized businesses whose main type of activity coincides with those included in the list of victims of coronavirus are eligible for this benefit.

Also, this right can be obtained by organizations whose activities are not included in this list, but the enterprise can be classified as city-forming, system-forming, strategic, and they also suffered from the coronavirus.

To take advantage of this support measure in the form of a deferment or installment plan, you must submit an application to the Federal Tax Service before December 1, 2020.

The deferment period for organizations engaged in activities affected by coronavirus is:

- 1 year - if income is ↓ by 50% or more or there are losses when income is ↓ by 30% or more;

- 9 months - if income is ↓ by 30% or there are losses when income is ↓ by 20%;

- 6 months — if income ↓ by 20%;

- 3 months — other cases (income ↓ by 10%, sales income ↓ by 10%, the presence of a loss, provided that there was no loss in the same period in 2019).

The installment period is 3 years, provided that the organization has an activity from the list of those affected by coronavirus and at the same time income has decreased by 50% or there is a loss if income has decreased by 30%.

Relaxations on insurance premiums

Small (and medium) businesses receive benefits until the end of 2020 in the form of reduced rates on insurance premiums - the general rate of 30% is reduced to 15% on the part of wages above the minimum wage.

That is, from April 1, 2020, contributions are calculated according to the following rules:

- part of the salary within the minimum wage is taxed at the same rates (22% - compulsory health insurance, 5.1% - compulsory medical insurance, 2.9% - VNIM, total 30%);

- part of wages above the minimum wage is taxed at reduced rates (10% - OPS, 5% - Compulsory Medical Insurance, 0% - VNiM, total 15%).

These support measures in the form of reductions in insurance premium rates are enshrined in Law No. 102-FZ of 04/01/2020. Its goal is to provide companies with additional funds to pay employees.

As for the deadlines for paying contributions, a deferment is introduced only for micro-enterprises whose main activities are included in the list of those most affected by the coronavirus. The last address of the President of the Russian Federation V.V. Putin dated 04/08/2020 gave hope that this benefit will also be extended to small businesses. The video of the appeal can be viewed at the bottom of the article.

For micro-enterprises there is a deferment on the payment of contributions (all - for compulsory medical insurance, compulsory health insurance, VNiM, NSiPF):

- 6 months — for March-May 2020;

- 4 months — for June-July 2020.

Reporting delay

According to paragraph 3 of Resolution No. 409, due to the coronavirus epidemic, all enterprises, including small businesses, have extended reporting deadlines:

- for 3 months — for all declarations, financial statements, the filing deadlines of which fall within the period from March to May 2020

- until May 15, 2020 - for the VAT declaration for the 1st quarter of 2020 and the calculation of insurance premiums for the 1st quarter of 2020.

Relaxations during tax audits

According to clause 4 of Resolution No. 409, measures to support small businesses are being introduced in the form of suspension until 05/31/2020 :

- on-site and repeated tax audits;

- making decisions on conducting inspections;

- deadlines for inspections;

- conducting inspections of currency transactions;

- making decisions on blocking bank accounts.

Cancellation of tax sanctions

According to clause 7 of Resolution No. 409, tax sanctions will temporarily not be applied to violations committed from 03/01/2020 to 05/31/2020.

The deadlines for sending requests for payment of taxes, contributions, penalties and fines and debt collection are extended by 6 months.

Credit holidays

According to Article 7 of Law No. 106-FZ dated April 3, 2020, a small or medium-sized business has the right to apply to the bank to change the terms of the loan agreement in the form of:

- providing a grace period - deferment of loan payments for up to 6 months (so-called credit holidays);

- reducing monthly loan payments for up to 6 months.

Small businesses (and medium-sized ones) can apply for this measure of support from banks if several conditions are met simultaneously:

- the loan agreement with the bank was concluded before Law No. 106 came into force;

- the organization contacted the bank before September 30, 2020;

- the company's main activities must be included in the approved list of industries affected by coronavirus;

A small business entity in its application to the bank indicates:

- type of benefit desired - reduction of payments or their suspension;

- the period of credit holidays is no more than six months;

- the start date of the deferment period.

During the entire period of the credit holiday, sanctions in the form of fines, penalties, and penalties are not applied to the borrower.

The company can stop the grace period at any day and resume repayment of the loan, or even close all obligations to the bank ahead of schedule.

It is important that banks do not forgive loans to small businesses. During a certain period, the organization does not pay the loan, but later it is obliged to repay all funds due under the loan agreement in accordance with its terms. During the credit holiday period, interest continues to accrue on the debt, which will also have to be paid later. In order to pay those payments that had to be transferred to the bank for the grace period, the expiration date of the loan agreement is shifted by the time required to close the loan.

Additional support measures from banks

Small businesses that are engaged in activities affected by the coronavirus epidemic can also receive support in the form of loans to pay salaries to employees at 0%.

The list of banks to which the Central Bank has already transferred funds for issuing loans at 0 percent is Sberbank, VTB, Promsvyazbank, Alfa Bank, Gazprombank, Otkritie, SME Bank. This list will be supplemented by other banks, which will also be given subsidies to issue interest-free loans to help affected companies in order to retain staff.

These credit institutions can begin issuing preferential loans to small businesses and micro-enterprises to pay wages at zero percent as early as April 8, 2020. Some banks began issuing loans last week (Sberbank, VTB).

Deferment and reduction of rental payments

Another type of support for small businesses affected by the coronavirus is a deferment in making rent payments under a lease agreement, as well as the possibility of reducing fees due to non-operation and holidays established by the President of the Russian Federation.

The rules for providing this benefit to small businesses are established in Decree of the Government of the Russian Federation No. 439 of 04/03/2020.

This Resolution establishes requirements for landlords to provide deferrals and reductions in rent payments for tenants who are small businesses affected by the coronavirus epidemic.

This benefit applies only to small and medium-sized businesses and only if the main activity is an industry from the approved list.

The essence of the benefit:

- Providing a deferment until October 1, 2020 for the payment of lease payments (in this case, the resulting rent debt will need to be paid gradually in installments from 01/01/2021 to 01/01/2023, and the size of each part should be no more than half the monthly lease payment amount. That is you will not have to pay off the entire debt at once at the end of the deferment period).

- Providing a deferment for the duration of the high alert or emergency situation (PH and emergency), while the accumulated rent debt will need to be repaid until October 1, 2020, and the amount of rent for the period of PH and emergency will be 50% of the rent for this time.

The landlord has the right, on his own initiative, to reduce the rent to the tenant, but he does not have the right to introduce additional fees in connection with the introduction of a deferment, as well as to impose fines, penalties and interest, even if they are provided for in the loan agreement.

The deferment does not apply to utility bills that the tenant must pay under the lease agreement.

In general, according to the Resolution, the parties are invited to independently agree on the terms of the benefit - a reduction in payments and the conditions for granting a deferment.

Preferential types of business

First of all, companies in the following industries will receive assistance:

- agro-industrial sector;

- ecological tourism;

- Production of goods;

- sale of essential products;

- folk art;

- scientific and technical sphere;

- social entrepreneurship;

- Department of Housing and Utilities.

The government has introduced a six-month moratorium on filing bankruptcy applications for firms that have suffered due to the coronavirus. Debt collection from them is stopped for the same period.

Tax holidays: benefits for start-up entrepreneurs in 2020

The government has developed a law according to which all newly opened individual entrepreneurs can count on preferential taxation during the first two years of their activity.

Tax holidays are a period during which a new entrepreneur has the right not to pay taxes.

This law is popularly called tax holidays. However, there are nuances - in each region, the decision on tax holidays is made independently (through Resolutions of local authorities, regional Dumas and Governments of the constituent entities of the federation). If there are tax holidays in your region or territory, you can find out about this at the nearest branch of the tax inspectorate of the Federal Tax Service. Depending on the region, preferential income tax rates may vary.

General rules for tax holidays (applicable everywhere) in 2020:

- Only individual entrepreneurs who use a simplified procedure or have purchased a patent are eligible;

- LLC, JSC CJSC and other legal entities are not entitled to tax holidays;

- Individual entrepreneurs using OSNO or UTII are also not subject to tax holidays;

- The validity period of tax holidays cannot be more than 2 years;

- There are types of activities to which tax holidays do not apply (depending on the region).

Also on topic:

- Minimum wage from January 1, 2020

- Apartment from the state free of charge for work

Deferment conditions for small businesses due to coronavirus

The consequences of the pandemic have affected almost all areas of business. Representatives of the tourism, trade and service sectors are suffering. In this regard, the Russian Government at the end of March developed a number of anti-crisis measures to support small and medium-sized businesses. They involve the introduction of tax holidays for a period of six months and the suspension of inspections by the Federal Tax Service.

Important! Deferrals are not provided for VAT, professional income and tax transfers from tax agents, including personal income tax.

The deadlines for taxes that were due in the first quarter of 2020 are postponed by 6 months, and in the second quarter - by 4.

Who and under what conditions falls under the “tax holiday” program?

In a pandemic situation, businesses are divided into the following groups:

- Companies forced to suspend operations for a period of “non-working days.” The deferment will apply to them for the entire quarantine period.

- Organizations continuing to operate during the pandemic. For them, taxes are paid on time without changes.

- The most affected enterprises.

An official list of industries that have been affected by the coronavirus has been developed and will automatically receive a tax deferment. There will be no additional applications or queues. The only condition is that the fees will still have to be paid, but later.

List of affected business sectors:

- air and road transportation;

- culture and organization of leisure;

- sports activities;

- tourism;

- hotel business;

- catering services;

- provision of household services to the population;

- companies organizing exhibitions and conferences;

- healthcare.

Small and medium-sized businesses are not exempt from taxes - it means paying off the debt in equal installments over 1-2 years.

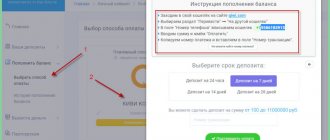

Advice! To find out whether your area of activity is covered by the program of benefits due to coronavirus, we recommend going to the service launched by the Federal Tax Service of Russia. To obtain accurate information, you only need to enter your TIN or OGRN.

Under the simplified system, firms that meet the following requirements are entitled to receive a deferment:

- the company's income decreased by more than 10% compared to the previous similar period;

- The reporting period for 2020 turned out to be unprofitable, which was not the case in 2019.

These indicators are presented in Government Decree No. 409 dated April 2, 2020.

How will coronavirus affect small businesses?

Of course, the coronavirus epidemic in the Russian Federation and the mass closure of enterprises will negatively affect small and medium-sized businesses. The impact can be devastating if the non-operational mode lasts for a significant period of time.

In this regard, a lot of measures are proposed to support small businesses, a large number of regulations and federal laws are adopted aimed at easing the situation of enterprises.

Assistance measures and types of benefits are offered both at the federal level and at the level of individual regions, depending on the situation with each individual subject of the Russian Federation.

The last speech of the President of the Russian Federation V.V. Putin took place on April 8, 2020; his address can be viewed at the bottom of this article. The President proposed a number of other measures to support small businesses, appealed to regional authorities to introduce additional benefits for affected industries, and delve into the affairs and problems of each enterprise.

Below are the types of benefits that have already been approved as of April 8, 2020, as well as a number of additional measures that are planned to be taken at the federal level based on the latest address from the President.

How to take advantage of tax holidays

To take advantage of the 2020 small business tax holiday, the entrepreneur must be a “newbie.” This means that no more than 2 years have passed since the registration of its activities. From 2015 to the end of 2020, individual entrepreneurs have the right to take advantage of credit holidays.

To activate the service, it is enough not to pay taxes for the entire legally established period of time. However, a declaration under the simplified tax system will still have to be submitted once a year. It indicates all expenses and income, and enters 0 as the interest rate.

Where to go and what documents will be needed

Before taking advantage of tax breaks, it is important to thoroughly study regional requirements. If the company meets all the conditions, they contact the Federal Tax Service.

To do this, write an application through the State Services, MFC or Federal Tax Service on the application of a zero rate under the simplified and patent taxation system. Within 30 days after registration, the entrepreneur must notify the Federal Tax Service of the transition to the “simplified” system, if the previously chosen regime was different.

The procedure should not require any additional documents other than the application.

Tax benefits for enterprises employing disabled people

Tax benefits for enterprises employing disabled people

In Russia, there is a rather complex system of benefits for enterprises that employ disabled people, and not everyone will be able to understand it. Organizations belonging to a certain form of ownership that employ a certain number of disabled people :

- public organizations of disabled people (the number of members of the organization who have the status of disabled people must be more than 80%);

- organizations whose authorized capital consists of contributions from public organizations;

- organizations in which disabled people work (at least 50% of full-time employees are disabled and at least 25% of the salary fund goes to their salaries);

- institutions created to achieve educational, cultural, medical, health, physical education, sports and other social goals. The benefit is provided if all the property of such institutions is owned by public organizations of disabled people.

Organizations that fall under the criteria specified in the list above can count on the following government guarantees, falling under Article 218 of the Tax Code :

- individual entrepreneurs, lawyers, notaries (private practice) who are disabled people of groups I, II or III can receive an exemption from paying the unified social tax, in terms of income from their business and other professional activities (the restriction applies to the total amount of income which should not exceed 100 000 rub.);

- an organization that accepts a disabled person can reduce income tax and receive benefits for unified social tax and insurance premiums for injuries;

- Property tax is eligible for the exemption.

The exception is pension contributions, for which there are no benefits.

What will you have to pay and when?

During the holidays, individual entrepreneurs are not exempt from all payments. He will have to take care of timely payment of insurance premiums, which are constantly changing and depend on the minimum wage:

- Contributions for yourself and your employees to the pension fund of the Russian Federation, which individual entrepreneurs have the right to pay in installments throughout the year or pay the entire amount in full. The main thing is to do this before December 31st.

- Contributions to the social insurance fund.

Deadlines for payment of payments to the Federal Tax Service

Areas of activity included in the SME register and affected by the coronavirus pandemic have the right to apply for a postponement of the date of payments to the Federal Tax Service. Let's look at how the timing has changed.

New deadlines for payment of insurance premiums

The employer is required to pay insurance premiums from employee income to the tax office. Previously, individual entrepreneurs made such payments monthly no later than the 15th, but everything has changed for companies affected by the pandemic and included in the SME register as of March 1, 2020.

All deadlines for payment of insurance premiums from employee salaries for March, April and May are postponed by 6 months, for June and July - by 4 months. The deadline for transfer is November 2020.

New tax payment deadlines

To support small businesses, it was decided to extend the deadline for paying taxes for 2020 by 6 months, and for personal income tax for individual entrepreneurs - by 3 months.

Extension of the tax payment period by 6 months for companies and individual entrepreneurs included in the SME register applies to:

- income tax,

- single agricultural tax (UST),

- tax according to the simplified system (STS),

- advance payments for March 2020, excluding VAT, special income tax and taxes paid by tax agents.

Taxes on advance payments and patents are extended for 4 months. The opportunity to receive a 3-month deferment has been implemented for individual entrepreneurs when paying personal income tax on income in 2020.

Additional assistance measures

All the above benefits and measures to support small businesses have already been introduced, and the relevant legislative documents have been adopted.

On April 8, 2020, V.V. Putin addressed the country and regional heads with a new appeal, according to which it is proposed to introduce additional new types of benefits, concessions and assistance measures:

- extending the deferment of payment of insurance premiums for 6 months also to small and medium-sized enterprises (for now this measure is valid only for micro-enterprises);

- preventing a situation where, at the end of the tax deferment, enterprises would have to immediately pay both the debt and payments for the last reporting periods - the President demanded the introduction of a smooth, gradual debt repayment in equal monthly payments over a period of at least a year;

- the introduction of additional support measures from banks, with priority assistance provided to companies that retain their employees.

Essence and functions of the tax system

State power carries out its functions of managing processes in society, as well as protecting the citizens of its country.

The activities of the authorities exclude the implementation of commercial activities that could provide its financing. For the purpose of generating income for the state treasury, the tax system is used. It represents the relationship between the government and an individual or legal entity in terms of the appointment and collection of mandatory tax payments.

Each country has its own specific tax system. Any intervention by government authorities in the taxation process must always be scientifically justified and appropriate. When reforming the tax system, the country's leadership must follow certain principles of its construction. The tax burden should be equally distributed among all taxpayers, based on the principles of fairness. Tax procedures must be clear and accessible to all payers. The principle of economy of the system is expressed in the proportionality of tax rates to the costs of collecting them.

Finished works on a similar topic

- Coursework Tax benefits for business 430 rub.

- Abstract Tax benefits for business 220 rub.

- Test work Tax benefits for business 250 rub.

Get completed work or advice from a specialist on your educational project Find out the cost

The tax collection system is an instrument of government influence on economic and social processes in society. Functionally, the system solves the following issues:

- collection of taxes and fees from payers and generation of budget revenue;

- impact on the most important indicators of the economy;

- creation of cash flow, capital, income from financial activities;

- stabilization of social life;

- influence on economic trends;

- control over the sufficiency of cash receipts to the budget.

Note 1

Tax is an instrument of interaction between the state and payers. It represents a mandatory amount for payment of part of the property in favor of a power entity. It is important to distinguish between taxes and fees. The tax is levied free of charge, in turn, the tax provides certain advantages to the payer over others.

Any actions regarding taxation are regulated by the laws and regulations of the country.

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

Deferment of tax payment

Small businesses that find themselves in a difficult situation will be given a deferment of sales tax. This decision was made as part of the program for preparing assistance to small businesses.

This benefit implies full or partial exemption from taxes, or an installment plan for payment of tax payments.

Tax deferment or exemption for individual entrepreneurs applies when:

- The business was in a pre-bankruptcy state;

- The entrepreneur's property has suffered significant damage due to a man-made disaster, fire or other natural disaster;

- The business is seasonal (for example, farmers).

In all these cases, the state and the tax service meet the businessman and are obliged to provide him with either a complete exemption from excessive taxes, or a temporary deferment of taxes without applying fines to him. On the part of the entrepreneur, all that remains is the obligation to document what happened to him.

Unified agricultural tax (unified agricultural tax)

As you know, the agricultural sector is one of the priority areas in the development of our country. They even developed a special tax regime for agricultural producers. Recently, those who provide these same producers with services related to crop and livestock production also received the right to use the Unified Agricultural Tax.

Among the disadvantages of the Unified Agricultural Tax is that income from the sale of agricultural products must exceed 70% of the total. This limitation forces many farmers to switch to a simplified system according to the “income minus expenses” scheme - for taxes the result is almost the same.