Good afternoon

Today I will talk about one of the basic things for those who want to earn income not only at work, but also by effectively investing their funds in the stock market, and not in a bank at 6% per annum. We are talking about a brokerage account, since it is a kind of entrance ticket to the world of financial markets.

I’ll say a few words about what types of accounts there are, what their advantages and disadvantages are. How to choose a good broker? Do I need to pay anything to open an account? Who has the minimum trading commissions? In general, everything a novice investor needs.

What benefits does it provide?

Thanks to a brokerage account, a trader or investor gains access to financial markets, where he can earn income by making transactions with the following instruments:

- stocks, bonds;

- derivatives market instruments (futures, options, swaps);

- currency;

- structured products (ETF, mutual funds).

The stock market provides a large number of opportunities and advantages even for ordinary private investors who do not have professional knowledge.

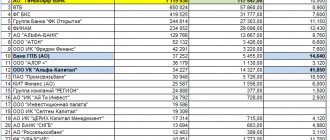

As an example, I will give federal loan bonds (OFZ), which often have a higher yield than the rates of deposits in banks, but at the same time they are more liquid and reliable financial instruments.