There are actually many ways to acquire the required amount. Conventionally, they can be divided into four types - gratuitous subsidies from the state, initial capital in debt, equity participation and capital earned independently. Let's look at each method in detail.

Take a loan

Most businessmen who start their own business from scratch use bank lending as a source of funds to open a company. However, this source of funds is not as easy to use as it might seem at first glance.

- Firstly , Russian banks put forward quite stringent requirements for borrowers, including:

- Having resident status.

- Preparation of a detailed business plan.

- Ideal credit history.

- No criminal record, including those legally expunged.

- Secondly , interest rates on bank loans are quite high and amount to about 15-20% per year.

Taking into account the high risks of financing a new company, many banks oblige their borrowers to provide them with collateral or a guarantee.

At the same time, it is fashionable to obtain a bank loan in just a few days, and in the amount that is necessary to create your own business.

Initial capital in debt

will give the business a good start, however, the debt will have to be repaid, and if it fails, you can lose a lot. In practice, it's like a sandwich that always lands on the wrong side, and the time to repay a loan always comes at the wrong time. This is a huge risk, and you should not take it under any circumstances if you do not have experience and a clear understanding of what you are going to do. It's worth taking a risk if you are sure that your business idea is 100% working. No theoretical reasoning or numbers on paper are suitable for assessing the viability of an idea. The only real way to check is niche testing. Either at low speeds or at idle: find clients, and then apologize for the inconvenience and say that you were just testing a niche.

If you are confident in your abilities, you can borrow starting capital from family, friends, and acquaintances. Surely your family and friends will agree to lend you money with interest significantly lower than bank interest, or without interest at all. But you will still have to repay the debt, and if you cannot do it in full within the agreed time frame, this may have a bad effect on your relationship. Are you willing to risk it?

A bank loan means huge interest rates and/or property secured as collateral. If you fail, you can lose everything; the court's decision will definitely not be in your favor. If the creditor is unable to pay the debt, he is declared bankrupt. In the future, even with good solvency, getting a loan to develop your business with such a feature in your biography becomes almost impossible.

Borrow from friends

If such a possibility exists, then this option is extremely beneficial because:

- The interest rate will be minimal or non-existent.

- Friends will not require an extensive package of papers, collateral or surety.

- The debt can be repaid in a single payment at the end of the term.

However, it is important to take into account some of the negative aspects of attracting a deputy through your friends:

- Delay in payment of a debt can cause a serious disagreement.

- If friends suddenly urgently need funds, they will have to return them, which may negatively affect the functioning of the business.

Important point: You can protect yourself from negative aspects by issuing a simple receipt for receipt of the amount of funds, indicating the terms of their use. This document is subsequently certified by a notary office.

Credit

The modern banking system does not seek to connect its activities with novice entrepreneurs. Why? It’s simple: their abilities, capabilities and skills do not have documentary evidence, and the basis for starting their own business is the banal desire to easily earn big money.

Considering this type of lending to be a high-risk operation, the banker, if he agrees to consider an application for a loan, will do so only under certain conditions.

Don't know where to get money to start a business? Read how to open a business without investment - /otkryt-biznes-bez-vlozhenij/

Business lending terms

1) An individual applying for a loan for a planned business must meet the strict requirements of the bank:

- the borrower must be a resident of the country;

- previous work activity must be associated either with organizational functions, or must have a close connection with the upcoming area of activity;

- no criminal record or suspicion of fraud;

- impeccable credit history.

2) Counting on receiving financial support from a banking institution, the potential borrower is obliged to provide the bank with a complete package of documents in accordance with the requirements of this financial institution.

Through bank paperwork to starting your own business

3) To confirm his competence in the field of proposed business activity, the borrower offers bankers a detailed business plan for consideration.

It should cover in detail the following areas:

- the exact amount of the initial investment;

- stages of business development;

- associated costs;

- depreciation;

- expected income and possibility of further development.

4) Since every loan must have its own collateral, not a single bank will offer its client money without liquid and sought-after pledged property.

To obtain a loan in an amount exceeding the size of the average loan, the borrower is required to pledge his own property, the value of which, in the opinion of a specialist appraiser, will exceed the requested amount by more than twice.

This collateral will subsequently be subject to a ban, the purpose of which is to prevent the borrower from reselling the collateral.

When considering a loan application, scrupulous bankers will look for a possible catch in the plan of an enterprising person, suspecting him of fraud. But after making sure of the seriousness of his intentions and making sure of the accuracy of his calculations, they will offer a loan, the amount of which will be limited to the expected profit and the cost of the collateral.

A significant disadvantage of lending is the inflated interest rate , which turns such assistance into a long and tedious return of the borrowed monetary resource.

Read how to open a successful pizzeria here: /otkryvaem-picceriyu-s-chego-nachat-i-chto-uchest/

Accumulate

A rather difficult path that only a few choose for themselves. This is due to the fact that hoarding always involves withdrawing part of your current income into a piggy bank and austerity.

What you should do to save for your business as quickly as possible:

- First , determine exactly how much starting capital is needed.

- Secondly , determine how much of your current income can be saved.

- And finally , calculate the period during which the required amount will be collected.

How to create start-up capital to start a business

With the development of a market economy in Russia, more and more people are trying themselves to create “their own business” in small businesses. Of course, before creating something from scratch, it is necessary to draw up a business plan, assess potential risks, possible profitability of the business, and development prospects. The most pressing question, which is often asked much later than others: “How to create start-up capital for starting a business”?

First of all, you need to decide on the timing of starting your business. Do you want to start your own business as soon as possible or are you ready to remain an employee for some time? It is also important to understand the specific amount of money you will need. Please note that when starting a business, “hidden” costs may arise - therefore, it is advisable to organize a small reserve to the calculated amount - an additional 10-15%.

Based on the timing and the required amount, you need to understand which financial instruments to choose for savings. If you plan for short investment periods, then when saving it is better to avoid instruments with high risks. If you have enough time, you can pay attention to instruments with a higher risk. If you want to organize a business “here and now,” think about lending.

Savings and investments

When creating start-up capital, you can use the following financial instruments:

- For short-term investments (term – less than 1 year):

Deposits. One of the most reliable tools for saving money. In the short term, the impact of inflation on your capital will be insignificant.

Bonds. It is also a fairly reliable instrument, and some bonds can provide results that can outpace inflation.

Structural products with full protection. Products based on stock market instruments with minimal risks: in the worst case scenario, you will get your money back without loss.

- For medium- and long-term investments (term – more than 1 year):

Shares of reliable companies;

Structural products with partial and conditional protection.

In any case, if you decide to invest your funds, you should contact a financial advisor who will help you draw up an investment plan.

At the same time, it is not recommended to invest all the capital that you accumulate during your savings into business.

You need to remember the rule of asset diversification: your business is also an asset, part of your investment portfolio. You cannot invest money in a business for the sake of the process itself: investments are made in order to receive a return. It is important to remember that this process carries high risks, which is why only part of your personal finances should be allocated to business investments, and the other part should be designated for creating financial reserves.

Loans

Of course, there are also arguments that encourage you to open your own business “here and now” with the help of appropriate loan programs.

Inflation rates in Russia are quite high. Due to the high level of growth in prices for goods and services, after some time you will need much more money to open a business. If the borrower skillfully builds his business, there is a chance that the level of income from it will increase from year to year, and accordingly, the percentage of his own income for repaying the loan will decrease.

For many people, having their own business is an absolute value. They are willing to take risks and give up a stable, permanent job for the sake of “financial independence.”

Advice for those who are planning to take out a loan to create a small business

1. Select several banks that are convenient for you with attractive small business lending programs, analyze the main parameters (i.e., not only the interest rate and the size of the monthly contribution, but also, for example, ease of repayment, the possibility of early repayment without penalties, etc. ) – make a decision only after careful analysis.

2. Remember that a lower interest rate is usually given for a shorter period, which reduces the risk of a significant overpayment. But do not forget to adequately assess other risks and remember that the maximum monthly loan payment should not exceed 40% of your planned monthly income.

Adequately assess the current situation. It is common for any person to think about everything in the world, except that something might happen to him.

3. And judging by the number of failures when starting a business and, as a result, damaged credit histories, troubles still happen. Therefore, the most important thing to do before making decisions about purchases on credit is to soberly assess your current financial situation by answering the questions:

- How high are the risks that your business will bring you a loss (or will “work at zero” for some time)?

- How are things going with the protection of your life and health?

- How big is your personal emergency fund? Is there enough money in the reserve fund to live without difficulty for at least six months?

- Do you have any other outstanding loans?

If you are confident in the answer to all the questions posed, then, having once again weighed the pros and cons and drawn up a business plan, you can try to open your own business on credit. In the future, when the business brings you regular income, do not forget about replenishing your reserve fund: from 10-20% of this income.

St. Mira, 8

(473) 264-9393

bcspremier.ru

As an advertisement

Photo: Arkady Stepanov

Sell gold

Many citizens have gold jewelry, coins and even bars at home. When starting your own business, you can always sell them to a pawnshop, at specialized auctions or to private individuals.

Important point: In the second half of 2020, it was possible to sell 1 gram of gold in Russian pawnshops for 350-2000 rubles (depending on the standard). That is why such a transaction can become a source of funds to cover part of the costs of starting a business.

Mortgage an apartment

An apartment is an extremely valuable asset. Selling your own apartment in order to open a company is an extremely risky undertaking. But presenting it as collateral is quite realistic. With such an impressive collateral, even banks will provide a loan to a beginning entrepreneur at a favorable rate and in a large amount.

At the same time, we should not forget that at any time the mortgaged apartment can be taken away for debts.

Find investors

Even experienced entrepreneurs recognize this method as an effective source of obtaining funds for starting a company.

The essence of the method is as follows:

- An aspiring businessman generates an idea for a future business.

- Based on it, a business plan is drawn up with a reasoned and convincing justification.

- The project is presented to investors who may be interested in it and invest their funds in it.

Important point: Large investors will never agree to finance hackneyed and dubious ideas. They are mainly interested in innovative and promising startups with a detailed study of income and costs, as well as ways to protect against risks.

Initially, most of the profits will go to investors. However, gradually an entrepreneur can buy out the part of the business he needs and earn a lot of money from it.

Where can I find money?

We are accustomed to expecting regular bans, restrictions, increases in taxes, rates, etc. from the state. However, not everything is so bad and it is not always worth listening to those who constantly complain and scold the country in which they live. Despite popular opinion, the state nevertheless makes attempts to support small and medium-sized businesses. Even if not to the extent that we would like and according to our own rules, the fact remains that in each region there are a number of measures, competitions, grants, benefits and subsidies that aspiring entrepreneurs can apply for. You should look for information about these support programs on the websites of state committees for the support of small and medium-sized businesses, in various funds and the Ministry of Economy of a particular region.

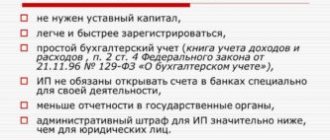

The amounts that are provided free of charge to beginning entrepreneurs vary from region to region, as do the conditions for receiving them, and the requirements for the entrepreneur himself and his future business. For example, one of the common mandatory requirements for an applicant for a grant or subsidy is his registration with the employment center (which, by the way, also provides free funds for starting a business), as well as the registration of an individual entrepreneur or LLC.

Free funds from the state are provided not only for creating a business, but also for reimbursement of costs. There are also competitions for preferential rental rates or reduced interest rates for leasing. In addition, emerging business incubators and business accelerators not only provide financial assistance and support, but also provide the necessary knowledge about business, which is often lacking for budding entrepreneurs. Master classes, seminars, legal and accounting consultations are an excellent opportunity to take advantage of useful information presented on a silver platter for free.

However, in order to receive all these privileges from the state, you will have to try and run around - prepare all the necessary documents, calculations, data, business plan, etc. But it will be worth it if you still manage to take advantage of government support.

Naturally, even the state will not provide you with the entire amount to start your own business. It is quite logical that, along with government support, you, as a business owner, invest your own funds in its launch, and will also have to show that the government money allocated to you was spent on the purchase of the necessary material assets or fixed assets.

Apply for a government subsidy

This option can be considered as the optimal way to form start-up capital. The fact is that the state is interested in unemployed citizens of the Russian Federation finding work or realizing themselves in entrepreneurial activity.

That is why the Russian budget annually allocates funds to subsidize new companies.

The main advantage of a government subsidy is that there is no need to repay the funds; and its disadvantage is a small amount of funds (usually up to 300,000 rubles).

To receive government funding you may need to:

- Submission of a package of documents to government agencies (entrepreneur’s passport, Taxpayer Identification Number, etc.).

- Development of a business plan indicating its payback period and financial viability.

An important point: The state most often provides subsidies to those entrepreneurs who propose projects that are significant for the economy or social life of individual regions.

Receiving start-up capital from the state

In addition to the methods listed above, you can receive start-up capital from the state.

The main advantage of government funding is that it is free of charge; you do not have to repay the funds with interest. The benefit to the state is to develop the economy, as you will provide jobs and pay taxes.

- Grant – money from the city or regional budget. The amount of such assistance cannot exceed 300 thousand rubles. A grant can be provided if the business owner himself is willing to invest at least 50% of the required amount.

- Subsidies for entrepreneurs. They are often given to experienced businessmen to expand their projects so that they provide even more jobs. Subsidies are given for the purchase of equipment or other resources. The maximum amount reaches 10 million rubles and no more than 90% of the required investment.

- Assistance to farmers for agricultural development. If you are a farmer, then the state is ready to help you and provide funds for the purchase of necessary equipment, livestock, and infrastructure development.

Getting money from the state is not so easy; you will need an approved business plan, spelled out in detail. It must indicate:

- the amount returned in the future through tax payments;

- the number of new jobs provided by the business project;

- level of relevance and demand for this type of service/product.

In addition to a business plan, before applying to the state, you must register your business activity in advance.

Each region of the country has its own programs. To get help, you need to participate in the competition, since there are many people who want it.

Receive an inheritance

Many aspiring businessmen dream of receiving an inheritance from a rich uncle. However, this method of enrichment may seem fabulous only at first glance.

In practice, the newly-minted heir may encounter some difficulties:

- Firstly , registering an inheritance is a long and complex procedure that requires the involvement of professional lawyers.

- Secondly , when accepting an inheritance, a person takes on not only the property, but also the debts of the deceased relative.

With all this, this method of enrichment cannot be written off.

Important point: Before accepting someone’s inheritance, you should make sure that the testator has no serious debts.

general information

You should not give up ahead of time, since many successful businessmen started their businesses with practically nothing.

There are several categories of people with brilliant ideas and plans who call themselves “start-ups.” Among them the following groups of people can be distinguished:

- Final year students. Thoughts about starting their own business and implementing an idea are often instilled in them by teachers and classmates. Many representatives attend seminars and special business development meetings. But only a small part brings the project to life.

- Programmers. These people very often search for partners to start a startup or join a group of like-minded people who want to implement and promote an idea.

- Managers. They are very often inspired by get-rich-quick stories where people achieve success from the very beginning.

- Corporate startupers located in unique entrepreneurial corporations. This direction is popular and actively developing. Startups with minimal investment are quite possible; interesting ideas and tips can be found at the link.

You can watch how to start a business with minimal starting capital in this video:

Methods for accumulating initial capital

Among all the existing options for finding initial capital, the most common and effective ones should be highlighted:

- Relatives or friends

This method is the simplest and fastest, since to implement it you will have to take a certain amount of money from a relative or friend. You can also interest your friends, but many of them will want to receive some percentage of the income acquired over time.

You can unite like-minded people into a group of startup investors, which is a very fashionable and effective idea now. It is worth remembering that in this matter it is very important to have a professional approach and responsibility. You will have to justify not only your hopes, but also the expectations of others.

Investors can be conditionally divided into those who are driven by the desire to invest and support a new promising project; such people have an interest and desire to help in any endeavor.

The other group is interested only in profit, in the benefits that it can receive in the future. Very often, such people immediately demand a guaranteed percentage of future profits, the value of which reaches 50%. Here you will learn what PAMM investing is, what its pros and cons are.

You can also not count on their trust, because many demand the immediate establishment of clear time frames and collateral.

The main disadvantage is the conditions themselves, because you can lose your entire existing business due to the fact that you will have to give most of your income to other people instead of investments and investments.

- Subsidies

The next source of investment is payments provided only to people living in large cities or capitals. Subsidies are issued by the Department of Science and Enterprise.

This process is very problematic to implement, but is quite possible. The main advantage is the absence of corruption.

Provided that a ready-made project already exists and is functioning, you can take part in any competitions for its further successful sale.

This will help promote the project and test your own capabilities, as well as acquire new potential investors. The result of the competition may also provide the winner with financial support, necessary contacts and office space.

- Funds

This direction is considered very popular and actively growing in our time. All funds are divided into accelerator funds and those that provide late financing.

What sources of start-up capital are there?

The second type of fund places special hopes on the startuper in terms of sales dynamics.

The modern market includes examples of large funds such as Farminers, InCubeAccelarator, Glavstart, etc. Venture funds are also an excellent way to accumulate capital, which requires certain knowledge and experience from you.

- Business incubators

Strategic investors are also worthy of mention. They are constantly financing well-promoted projects that are no longer startups.

Business incubators are investment options; they can also significantly contribute to the development of a business of any level.

The idea is that a novice entrepreneur can receive services such as renting a building, consulting, accounting, etc. for free, but only on preferential terms.

The advantage of an incubator is the fact that there are always like-minded people nearby who can exchange ideas with you, give advice and help solve some common problem.

It is worth paying special attention to such a point as the ability to properly conduct a conversation with an investor. Many people mistakenly believe that it is very simple, but they are wrong.

Failure to communicate with investors and convey your thoughts clearly to them can lead to delayed results or even have the opposite effect. Here you will learn how to become an investor yourself and how much you can earn from it.

Provided that the startup team has its own person with high communication skills, it can send him to all negotiations with investors for a successful outcome. If not, then you can use the services of investment brokers; the price for their services is not so high.

Earning start-up capital yourself

It is quite possible to earn start-up capital on your own, although this method has many nuances and key points. First of all, it must be said that this may not be easy at all, you need to spend a lot of time and effort even before starting a business.

The main advantage of this method is the absence of a sense of obligation and responsibility to anyone other than yourself. It is necessary to have such qualities as patience, self-discipline and a reserve of motivation.

The technique is suitable for people who have a vague idea; the process of earning capital can help them decide on many points and specify the idea.

For example, if a person wants to open his own beauty salon, he should start by trying to provide various services at home (only with special skills and knowledge).

And before you start opening a clothing store, you can try to create your own online store. This gradual movement from small to large-scale goals will help you become 100% confident in your preferences and aspirations.

You should not regret the time spent, because this way you can gain valuable experience and hone your skills.

Ask your parents

One of the easiest ways to obtain initial capital to open a company.

However, from a moral point of view , attracting parents’ savings does not look so attractive: they already had to invest a lot in their child. However, if there are no other options, you should use this method, but subject to full repayment of the borrowed funds.

Sell home appliances

If the issue of creating your own company is urgent, then it makes sense to consider the possibility of selling home appliances. You can start with those devices that are used less often.

How can you sell equipment? You can place ads on thematic forums and sell it to individuals, hand it over to consignment stores or pawn shops.

Finding investors to start your business

You can find an investor who will be interested in the project and want to make a profit.

But these guys are very careful. They will not invest money in an “empty” project.

Investors give money not out of kindness, but solely because of their own benefit. Without a clear business plan with a development strategy, it makes no sense to even call an investor.

Find treasure

Luck never leaves resourceful entrepreneurs who believe in the success of their business. Perhaps one of them will be lucky enough to find, if not a treasure chest, then a rare ancient coin or other artifact.

Important point: If a treasure is found on a plot owned by a person, then he is reimbursed 100% of the value of the treasure, in any other places - only 50%. It is better to transfer the treasure to the state legally, and not try to sell it on the “black” market, since criminal liability is completely unnecessary for a novice entrepreneur.

Make money on stocks

This method does not imply the possibility of turning a novice entrepreneur into an experienced trader. Here we are talking about the sale of those shares that he has. In Russian practice, there are cases where grandparents left shares they received during privatization as an inheritance to their grandchildren.

Important point: You can sell shares on the stock market or offer to buy them back to the joint stock company itself.

Make extra money on the Internet

Making money on the Internet has long become a source of additional income for hundreds of people around the world. If the basic salary provides a person’s current livelihood. Then the funds earned on the Internet will be able to accumulate and accumulate in order to form start-up capital.

How can you earn money online? Write texts, create and promote websites, draw banners, maintain your own blog, act as an intermediary for large trading platforms, etc.

Investors

Business angels, various types of venture capitalists, private lenders or crowdfunding can be excellent financial resources to help you realize your idea. It wouldn’t hurt to remind you of this simple thing: a ready-made business is much more attractive to investors than a “pig in a poke.” Your business plan must be truly outstanding to be able to attract the interest of the people you need.

As a rule, money is not given for “just an idea,” with the exception of people who have already proven themselves in this area of economic relations. For example, there is a known case when a person raised 2,000,000 dollars, just under his name and team. Those. he didn’t even voice what they would do - “me and my brilliant people will come up with something!” But this is truly a special case.

In most cases, you need a working prototype of the proposed idea, if the project is in a new niche, or positive successful experience of similar projects. For example, the applicant had already opened a shawarma kiosk/built a business center and this project was successful and allowed the investment in it to be returned with a profit.

Crowdfunding

Raising funds for the implementation of the project on the Internet. The funds can be either absolutely irrevocable, if the project is positioned as a “civilization-wide” one, for example, cleaning up some area from garbage, or under the obligation to supply a “product/service”, for the launch of which funds are collected from those invested in this project. As a rule, such inverters are interested in the appearance of such a product/service for themselves and for this reason are ready to invest/buy a “future” product/service.

Rent out an apartment/car

Having additional living space in the form of an apartment or a car, you can rent it out for a while. All proceeds are deposited into a bank account until the amount required to open a business is reached.

Important point: When leasing such expensive property, it is extremely important to draw up and sign an agreement with the tenant and have it certified by a notary office in order to avoid unpleasant incidents.

First financial preparations

So how much startup capital is needed for a business? There is no universal answer that allows you to find a certain amount and count on success and profit. Approximate investments will be discussed here. Business enthusiasts are sure: you need to have money to buy the first batch of goods - and a decent income awaits the newly formed company. This opinion is wrong. To start a business you need investments consisting of:

- Legal registration with the Federal Tax Service.

- Opening a current account.

- Obtaining all kinds of permits, for example, from the Sanitary and Epidemiological Station. Additional registration costs will be required if excisable products are sold.

You need to allocate about 15,000 rubles for these items. An important expense item is employee salaries for the first time. The enterprise will not pay off in the first months - this is worth remembering when distributing finances. If you plan not to hire staff, but to work independently, also allocate money for personal needs.

You need to leave the money for 3 months for yourself - for your own needs until you receive the expected income. Mandatory expenses – from 100,000 rubles. It is advisable to have this kind of money before starting a business.

Use partners' money

In the end, you can start a business not alone, but find serious and wealthy partners. In this case, you can propose your idea, take care of all registration formalities, and resolve organizational issues, while the partners will provide financing for the project.

Important point: In order to avoid disagreements in the future, it makes sense to immediately conclude an agreement with the partners, which will contain information on the exact distribution of shares in the business between the participants.

Thus, the lack of start-up capital cannot be a reason for refusing to create your own company. After all, there are at least sixteen very real ways to obtain funds to open a company.

Business ideas that do not require start-up capital

Intermediary sales of goods

Mediation is one of the most common types of business activities. To engage in intermediary trading, it is not necessary to make any investments.

To make money from sales, you can sell other people's goods. For example, many companies sell their products through agents. The agent enters into an agreement with the company, finds clients for it and receives a percentage of sales. There is no need to invest anything. Most often, cosmetic companies sell their products in this way.

Trading using the dropshipping system

Dropshipping is a type of intermediary trade that does not require investment. From English the word “dropshipping” is translated as “direct delivery”. When trading under this scheme, the goods are sent directly from the manufacturer to the recipient.

An intermediary acts as a link between the manufacturer and the buyer. He does not purchase goods, but only sells them via the Internet. The intermediary independently sets the size of the markup and the final cost of the goods. His task is to find a buyer. The manufacturer is responsible for packaging and delivery of the goods.

The main advantage of dropshipping is the absence of risks. An entrepreneur does not purchase goods, but only sells them. The disadvantage of such a system is the complexity of implementation. You will have to compete with other online stores.

Tutoring

Information is one of the most valuable products of our time. Finding truly good and useful educational materials is increasingly difficult, and you need to spend a lot of time on it. Therefore, tutoring is becoming an increasingly popular way of learning.

Paid lessons are a profitable business, the organization of which does not require initial capital. The main thing is knowledge.

Popular areas for tutoring:

- singing lessons, playing musical instruments;

- foreign language lessons;

- drawing lessons;

- martial arts training;

- preparing schoolchildren for the Unified State Exam and entrance exams.

Class options:

- home visit;

- at home;

- in schools;

- via the Internet - for example, via Skype.

Classes can be either individual or group.

Organization of dispatch service for cargo transportation

Freight transportation is one of the most important supply chains for goods. In addition, there is a high demand for private cargo transportation.

The market for such services is still developing, so every entrepreneur can take his place in it. To organize such a business you do not need a truck.

The task of the dispatch service is to find orders for drivers, charging them a percentage for intermediation. The only difficulty at the initial stage is to attract drivers with their own cars.

To open a small dispatch service you will need:

- computer;

- stable internet;

- dispatch program;

- telephone.

The advantage of such a business is the ability to quickly expand and increase turnover.

To start a business it is not necessary to have a large start-up capital. There are many ways to attract investment, as well as business ideas that do not require any investment. The advantage of such startups is the absence of risks, high profitability and the possibility of rapid expansion.