Features of agency agreements

An agency agreement is concluded between a principal and an agent. In accordance with the conditions, the latter undertakes to carry out legal and actual transactions on behalf of the customer (principal). Provides remuneration for the performer.

Agent powers

The agent carries out all transactions at the expense of the customer, and he can act:

- on his own behalf, then the rights and obligations under the contract with third parties are acquired by the agent himself;

- on behalf of the principal, in which case he will be the owner of the rights and obligations under the terms of the agreement.

The agent's authority to conduct transactions on behalf of the principal is indicated in the text of the document. In this case, when concluding a transaction, the customer will not be able to challenge the intermediary’s right to perform the work.

How remuneration is paid

The procedure and amount of remuneration are prescribed in the document. Unless otherwise stated, payment for the agent's actions is made within a week from the date of reporting. When there is no information about the amount of remuneration, it is determined according to clause 3 of Art. 424 Civil Code. According to this article, remuneration is paid in an amount equal to the cost of payment for similar services in similar circumstances.

Reporting and attraction of subagents

The report is provided to the customer:

- according to the terms of the contract (if the relevant clause is specified);

- upon execution of an order;

- upon expiration of the document.

The principal is obliged to notify of any claims within 30 days from the date of receipt of the report. If no objections are received, the result is considered accepted.

Under the terms of the agreement, it may be possible to attract subagents who will enter into transactions on behalf of the agent. The contractor will be responsible for their work to the principal.

What to include in the text of the document

When concluding an agreement, the following points must be stated:

- Item. This specifies what exactly the performer will do. The clearer the mediator's responsibilities are, the fewer questions will arise later.

- Authority. It is indicated on whose behalf transactions will be concluded, who acquires rights and obligations in relation to third parties.

- Rights and obligations of the parties.

- Procedure for payment of intermediary services.

- Reporting.

- Possibility of connecting subagents to the execution of orders.

- Duration of the terms and conditions.

- Cases of automatic termination of the agreement.

Basics of mediation

In situations where, when carrying out a transaction, there is a need to transfer authority to perform certain functions to a third party (whether it is an organization, an individual entrepreneur, or an individual), this type of GPC agreement is used as an agency agreement. Agency came to Russia from English and American law and is legislated in the Civil Code of the Russian Federation (Chapter 52). The essence of the agreements between the parties to the agreement for execution is as follows: the intermediary (agent, commission agent, attorney), on the basis of instructions from the customer (principal, principal, principal), performs legal or actual actions for a certain fee.

Variation is allowed in the powers of the intermediary:

- the agent can act on behalf and at the expense of the person who initiated the transaction;

- An agent has the right to act on his own behalf, but at the expense of the person who has involved him in the transaction.

How commission agreements are concluded

Commission agreements, unlike agency agreements, are concluded between the principal and the commission agent. The contractor can make one transaction or several (for example, in terms of sales), however, he does not perform legal operations. The commission agent works at the expense of the principal, but on his own behalf.

Duties of the parties

The intermediary acquires rights and obligations under concluded agreements with third parties. In this case, the commission agent is not responsible to the principal for the failure of a third-party entrepreneur to fulfill his obligations under the concluded agreement. This condition does not apply only in cases where the commission agent was not careful when choosing an employee or took a guarantee - del credere.

Goods transferred by the customer to the intermediary or purchased at his expense are considered the property of the principal. For their loss or damage caused to them, the commission agent is liable to the principal. The latter undertakes to pay the intermediary:

- Remuneration according to the terms of the document.

- Additional payment for taking del credere.

- Reimbursement of expenses for carrying out orders.

Additional points in the content

The following additional points can be added to the content:

- duration of the agreement;

- territory for carrying out the assignment;

- product range;

- the obligation not to involve a sub-commissioner in the execution of an order, who will act at the expense of the principal.

If the terms of a specific agreement allow, the contractor can involve a subcommissioner in the work. In relation to this person, the commission agent will acquire the rights of a principal. He is responsible to the customer for the actions of the subcommissioner.

Payments and reporting of the commission agent

Legislative norms (Article 410 of the Civil Code) allow the commission agent to withhold from the funds received from the principal the amount that is due to him under the terms. If the customer provides credit funds, the lenders will have priority over their claims. They can request the amount due to them from the money withheld by the commission agent.

When the task under the contract is completed, the contractor submits to the principal a report on his work and hands over the funds received as a result of the transactions. The customer has the right to submit all claims within 30 days from the date of receipt of the documents. Otherwise, the work is considered accepted.

What does “agent”, “commission agent” mean?

Let's look at the second side of the contractual relationship. An agent can act both on his own behalf, then the agreement will be similar to the model of a commission agreement, and the concepts of agent and commission agent will become identical, and on behalf of the principal, then the concepts of agent and commission agent can no longer be identical. We can say that the concept of “agent” is broader than the concept of “commission agent” and includes it. Now it should be clearer what a principal (principal) is and what a commission agent (agent) is.

Difference between agency and commission agreements

- Under the terms of the agency agreement, when concluding transactions, both the customer and the intermediary can receive rights and obligations. If we talk about a commission agreement, the responsible person here is always the commission agent.

- Another fundamental difference is reporting on the results of the transaction. If a commission agreement is signed, the intermediary is not responsible for the refusal of a third party to fulfill its obligations. There are only two exceptions to this rule, as discussed above. The agent is always responsible for the work performed.

- Only for commission agreements is it possible to take del credere. This is a guarantee that goods purchased from the consignor will be paid for. If the buyer turns out to be insolvent, the commission agent undertakes to make up the missing amount himself.

- At the same time, the terms of the agency agreement leave the contractor greater freedom of action. If the commission agent carries out only transactions that do not have legal consequences, then the agent carries out both actual and legal transactions. In this case, the legislation does not establish a clear framework, so such conditions are suitable for many entrepreneurs who want to increase sales or find suppliers.

Features of the terms of mediation may be beneficial for one of the parties to the agreement. To choose the most suitable option, it is important to agree on the rights and obligations of the customer and the intermediary.

Read more: How to deprive a guardian of guardianship over an incapacitated person

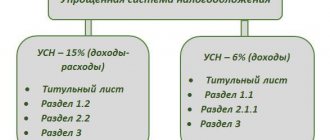

In the modern economic situation, commercial organizations are trying to use all opportunities to achieve the maximum volume of sales of products, goods, works, and services. One of these possibilities is the use of intermediaries:

- under commission agreements,

- agency agreements,

- agency agreements.

Despite the fact that these forms of mediation have much in common, there are also differences due to the peculiarities of the current legislation. The accounting procedure for transactions carried out through intermediaries very much depends on the terms of the contracts concluded. At the same time, one of the main points is the condition on the non-participation of an intermediary in settlements with buyers of products, goods, works, and services. However, regardless of the terms of the agreement, for the purposes of both accounting and tax accounting, the intermediary’s income will be only the intermediary fee due to him under the terms of the transaction.

Accordingly, intermediaries will be subject to taxes (VAT, income tax) only on the amount of remuneration under intermediary agreements.

The principal, principal and principal recognize the proceeds from the sale in full, without reducing these amounts by the amounts of intermediary fees.*

*In accordance with the provisions of the Tax Code of the Russian Federation, amounts of remuneration paid under commission agreements, commissions and agency agreements are subject to accounting as expenses for income tax purposes and will serve as sources of input VAT for the purposes of this tax (if, of course, the intermediary is a taxpayer VAT).

In our article we will talk about the legislative framework of intermediary agreements, as well as some features of accounting for transactions carried out through intermediaries.

What does “committent”, “principal” mean?

This is how the party initiating the contractual relationship is called within the framework of intermediary agreements. The concept seems to be the same, but the names are different. Does this mean that the concepts are identical? Committent, principal - who is it?

Principal – a person who acts with instructions to perform any actions for a fee. A principal is a person who authorizes another person to act as an agent. The concepts are close. The agent and the principal appear in the agency agreement. The principal and the commission agent are in the commission agreement. Therefore, the committent (principal) - who is it? This is the person who initiates the relationship, assigning certain tasks to be performed for a fee.

Can we say that the principal and the principal are the same thing? Despite the fact that the concepts are close in meaning, they cannot be said to be identical. They appear in various agreements. This means that there is a difference between the concepts of “principal” and “committent”.

The principal may instruct the agent to act both on his own behalf and on behalf of the principal. The principal can instruct the commission agent to act only on his own behalf. We can say that the principal and the principal are one and the same, only under certain conditions. In general, the second concept is somewhat broader.

Civil legislation regulating intermediary agreements

1. Agency agreement.

Legal relations arising from the agency agreement are regulated by the provisions of Chapter 49 of the Civil Code of the Russian Federation.

According to Article 971 of the Civil Code of the Russian Federation, under an agency agreement, one party ( the attorney ) undertakes to perform certain legal actions on behalf and at the expense of the other party ( the principal ). The rights and obligations under a transaction completed by an attorney arise directly from the principal.

A contract of agency may be concluded with an indication of the period during which the attorney has the right to act on behalf of the principal, or without such an indication.

In cases where the agency agreement is related to the implementation of entrepreneurial activities by both parties or one of them, the principal is obliged to pay the attorney a remuneration, unless otherwise provided by the agreement.

- personally carry out the assignment given to him;

- inform the principal, upon his request, all information about the progress of the execution of the order;

- transfer to the principal without delay everything received from transactions completed in pursuance of the order;

- upon execution of an order or upon termination of an agency agreement before its execution, immediately return to the principal a power of attorney that has not expired, and submit a report with supporting documents attached, if required by the terms of the agreement or the nature of the order.

In turn, the principal is obliged (Article 975 of the Civil Code of the Russian Federation):

- the attorney has a power of attorney (power of attorney) to perform legal actions provided for by the agency agreement;

- reimburse the attorney for expenses incurred (unless otherwise provided by the contract);

- provide the attorney with the funds necessary to execute the order;

- without delay, accept from the attorney everything he has performed in accordance with the contract;

- pay the attorney a fee if, in accordance with Article 972 of the Civil Code of the Russian Federation, the agency agreement is compensated.

2. Commission agreement

Chapter 51 of the Civil Code of the Russian Federation is devoted to commission agreements.

In accordance with the provisions of Article 990 of the Civil Code of the Russian Federation, under a commission agreement, one party ( the commission agent ) undertakes, on behalf of the other party ( the principal ), for a fee, to carry out one or more transactions on its own behalf , but at the expense of the principal .

Under a transaction made by a commission agent with a third party, the commission agent .

A commission agreement can be concluded:

- for a specific period or without specifying the duration of its validity,

- with or without indicating the territory of its execution,

- with the commitment of the principal not to grant third parties the right to carry out transactions in his interests and at his expense, the execution of which is entrusted to the commission agent, or without such an obligation,

- with or without conditions regarding the range of goods that are the subject of the commission.

The law and other legal acts may provide for the specifics of certain types of commission agreements.

In accordance with the provisions of Article 993 of the Civil Code of the Russian Federation, the commission agent is not liable to the principal for failure by a third party to fulfill a transaction concluded with him at the expense of the principal, except in cases where the commission agent:

- did not exercise the necessary care in choosing this person,

- accepted guarantee for the execution of the transaction (del credere)*.

* Delcredere (German Delkredere - guarantee, Italian del credere - on faith, from faith) is a guarantee of the commission agent to the principal under a commission agreement for the fulfillment by a third party of obligations under the transaction that the commission agent concluded for the principal with this third party in pursuance of instructions committent.

Thus, the commission agent who undertakes del credere not only sells the goods, but also guarantees their payment , even if the buyer turns out to be insolvent.

It should be noted that del credere is typical only for a commission agreement; in accordance with the provisions of the Civil Code of the Russian Federation governing agency, the agency agreement does not provide for del credere .

The commission agent has the right, in order to execute this agreement, to enter into a subcommission agreement with another person, remaining responsible for the actions of the subcommissioner to the principal (unless otherwise provided by the commission agreement).

Under a subcommission agreement, the commission agent acquires the rights and obligations of the principal in relation to the subcommission agent.

Upon execution of the order, the commission agent is obliged to submit a report to the principal and transfer to him everything received under the commission agreement.

The principal who has objections to the report must report them to the commissioner within 30 days from the date of receipt of the report, unless a different period is established by agreement of the parties. Otherwise, the report, in the absence of another agreement, is considered accepted.

The commission agent has the right, in accordance with Article 410 of the Civil Code of the Russian Federation*, to withhold the amounts due to him under the commission agreement from all amounts received by him at the expense of the principal. However, the creditors of the principal, who enjoy priority over the mortgagees in relation to the priority of satisfaction of their claims, are not deprived of the right to satisfy these claims from the amounts withheld by the commission agent.

*In accordance with Article 410 of the Civil Code of the Russian Federation, the obligation is terminated in whole or in part by offsetting a counterclaim of the same type, the due date of which has come or the due date of which has not been specified or is determined by the moment of demand. For offset, a statement from one party .

According to Article 1000 of the Civil Code of the Russian Federation, the committent is obliged to:

- accept from the commission agent everything performed under the commission agreement;

- inspect the property acquired for him by the commission agent and notify the latter without delay of any shortcomings discovered in this property;

- release the commission agent from the obligations assumed by him to a third party for the execution of a commission order.

Read more: Woman on Tver Ozernaya Street scratched friend’s car

Please note: Items received by the commission agent from the principal or acquired by the commission agent at the expense of the principal are the property of the principal (Article 996 of the Civil Code of the Russian Federation).

The commission agent is responsible to the principal for loss, shortage or damage to the principal's property in his possession (Article 998 of the Civil Code of the Russian Federation).

The principal is obliged, in addition to paying the commission, and, in appropriate cases, additional remuneration for the del credere, to reimburse the commission agent for the amounts spent by him on the execution of the commission order.

At the same time, the commission agent does not have the right to reimbursement of expenses for storing the principal’s property in his possession (unless otherwise provided in the law or the commission agreement).

3. Agency agreement

Chapter 55 of the Civil Code of the Russian Federation “Agency” is devoted to the regulation of legal relations under an agency agreement.

In accordance with Article 1005 of the Civil Code of the Russian Federation, under an agency agreement, one party (agent) undertakes, for a fee, to perform legal and other actions on behalf of the other party (principal):

- on its own behalf, but at the expense of the principal (as in a commission agreement),

- or on behalf and at the expense of the principal (similar to an agency agreement)*.

*This is how an agency agreement differs from a commission agreement. In the latter, transactions are made on behalf of the commission agent and the possibility of making them on behalf of the principal is not provided for by law.

In a transaction made by an agent with a third party on his own behalf and at the expense of the principal:

- an agent acquires rights and becomes obligated , even if the principal was named in the transaction or entered into a direct relationship with a third party for the execution of the transaction.*

*In the same way as a commission agent - in a transaction made by him with a third party.

In a transaction made by an agent with a third party on behalf and at the expense of the principal:

- rights and obligations arise directly from the principal .

In cases where an agency agreement concluded in writing provides for the general powers of the agent to carry out transactions on behalf of the principal, the latter, in relations with third parties, does not have the right to refer to the agent’s lack of appropriate powers, unless he proves that the third party knew (should was aware) about the limitation of the agent's powers.

An agency agreement can be concluded for a specific period or without specifying its validity period.

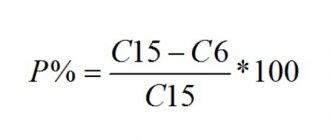

According to Article 1006 of the Civil Code of the Russian Federation, the principal is obliged to pay the agent remuneration in the amount and in the manner established in the agency agreement.

And in the case when this information is not in the contract and the amount of the agent’s remuneration cannot be determined based on the terms of the contract, the remuneration is payable in the amount determined in accordance with paragraph 3 of Article 424 of the Civil Code of the Russian Federation*.

*Execution of the contract must be paid at the price that, under comparable circumstances, is usually charged for similar goods, works or services.

If there are no conditions in the contract on the procedure for paying the agency fee, the principal is obliged to pay the fee:

- within a week from the moment the agent submits a report for the past period, unless a different procedure for paying remuneration follows from the essence of the agreement or business customs.

During the execution of an agency agreement, the agent is obliged to submit reports to the principal in the manner and within the time limits provided for by the agreement. If they are not specified in the contract, then reports are submitted by the agent as he fulfills the contract or upon expiration of the contract.

The agent's report must be accompanied by the necessary evidence of expenses incurred by the agent at the expense of the principal (unless otherwise provided by the agency agreement).

The principal who has objections to the agent’s report must notify the agent about them within 30 days from the date of receipt of the report, unless a different period is established by agreement of the parties. Otherwise, the report is considered accepted by the principal.

The agent has the right, in order to fulfill the contract, to enter into a subagency agreement with another person, while remaining responsible for the actions of the subagent to the principal*.

*Unless otherwise provided by the agency agreement.

An agency agreement may provide for the agent's obligation to enter into a subagency agreement, with or without indicating the specific terms of such an agreement.

Please note: The rules provided for in Chapter 49 or Chapter 51 of the Civil Code of the Russian Federation are respectively applied to relations arising from an agency agreement, depending on whether the agent acts under the terms of this agreement on behalf of the principal or on his own behalf, unless these rules contradict the provisions of 52 chapter of the Civil Code of the Russian Federation or the essence of the agency agreement.

Committent and commission agent

Commission trading is a fairly common type of business activity. It has a number of advantages, but there are also fundamental aspects. We will talk about this in the article. We will also understand what a committent and a principal are, and what is the difference between them.

Commission contract and agency contract

The essence of the contract is that one party, for a fee, enters into transactions with third parties on its own behalf, but acts in the interests of the second party. Receives the discussed remuneration for the work done.

Such a contract is classified as an intermediary one. In other words, the commission agent (agent) enters into an agreement with the principal (principal) to sell products. There are agency contracts and mandate contracts. What is the difference between them?

In a commission agreement, the commission agent acts on his own behalf. In a contract of agency, the attorney acts not on his own behalf, but on behalf of the principal.

The difference from an agency contract is that the agent does both legal and actual acts, and the commission agent does only legal ones.

What does “committent”, “principal” mean?

This is how the party initiating contractual matters is called within the framework of intermediary agreements. The concept seems to be the same, but the names are different. Does this mean that the concepts are identical? Committent, principal - who is it?

Principal – a person who acts with an order to perform any acts for a fee. A principal is a person who authorizes a second person to act as an agent. The concepts are close.

An agent and a principal exist in an agency agreement. The principal and the commission agent are in the commission agreement.

As follows, the committent (principal) - who is this? This is the person who initiates the relationship, assigning certain tasks to be done for a fee.

Can we say that the principal and the principal are the same thing? Despite the fact that the concepts are close in meaning, it cannot be said that they are identical. They exist in various agreements. This means that there is a difference between the concepts of “principal” and “committent”.

The principal may instruct the agent to act both on his own behalf and on behalf of the principal. The principal can instruct the commission agent to act only on his own behalf. We can say that the principal and the principal are one and the same, only under certain criteria. In general, the second concept is somewhat broader.

What does “agent”, “commission agent” mean?

Let's look at the second side of the contractual relationship.

An agent can act both on his own behalf, then the contract will be similar to the commission contract model, and the concepts of agent and commission agent will become identical, and on behalf of the principal, then the concepts of agent and commission agent can no longer be identical. We can say that the concept of “agent” is broader than the concept of “commission agent” and includes it. Now it should be clearer what a principal (principal) is and what a commission agent (agent) is.

Payment methods

Commission trading provides two possible options. The commission agent may or may not participate in payments for the product between the principal and the buyer.

If a scheme is chosen without the role of a commission agent in settlements, then payment from the end buyer goes directly to the principal’s bank account, bypassing the intermediary. The commission agent only receives his remuneration based on the results of his work.

The scheme with a role in settlements assumes that buyers pay the commission agent for the product, and then the accumulated amounts are transferred to the principal’s account. With all this, the commission agent has the opportunity, without the help of others, to withhold the amount of his own remuneration, and also to compensate for the expenses incurred in the process of executing the order.

COMMISSIONER

a party to a commission agreement who undertakes, on behalf of the other party (the principal), for a fee, to conclude a transaction with a third party on his own behalf, but in the interests and at the expense of the principal.

Rate the definition:

Agency agreement, commission agreements and assignments. Similarities and differences

comissio - commission) - in civil law - a party to a commission agreement, which undertakes, on behalf of the other party (the principal), for a fee, to conclude a transaction with a third party on its own behalf, but in the interests and at the expense of the principal.

Rate the definition:

Commissioner

Party to the trade commission agreement (see). On behalf of the other party (the principal), the commission agent, for a certain commission, undertakes to carry out one or more transactions on his own behalf for the principal and at his expense.

In transactions made by the commission agent with third parties, rights and obligations arise between the commission agent and the third party, however, the commission agent, unless otherwise established by agreement of the parties, is not responsible to the principal for the execution by a third party of the transaction made by the commission agent at the expense of the principal.

Rate the definition:

Accounting for transactions carried out through intermediaries

- Off-balance sheet account 004 “Goods accepted on commission”* - with an intermediary (commission agent, agent, attorney).

- Balance sheet account 45 “Goods shipped”* - with the owner of the goods (principal, principal, principal).

*Order of the Ministry of Finance of the Russian Federation dated October 31, 2000. No. 94n “On approval of the Chart of Accounts for accounting of financial and economic activities of organizations and Instructions for its application.”

Account 004 “Goods accepted on commission” is intended to summarize information about the availability and movement of goods accepted on commission in accordance with the contract. This account is used by commission agencies.

Goods accepted for commission are accounted for in account 004 “Goods accepted for commission” at the prices stipulated in the acceptance certificates. Analytical accounting for account 004 “Goods accepted for commission” is carried out by type of goods and organizations (persons) - consignors.

The principal, principal, principal records goods transferred to the intermediary for sale (until the transfer of ownership of them to the buyer) on account 45 “Goods shipped”, because such goods should not be written off from the balance sheet and are subject to accounting.

Account 45 “Goods shipped” is intended to summarize information about the availability and movement of shipped products (goods), the proceeds from the sale of which cannot be recognized in accounting for a certain time.

This account also records finished products transferred to other organizations for sale on a commission basis.

Goods shipped are accounted for on account 45 “Goods shipped” at a cost consisting of the actual production cost and expenses for shipping products (goods) (if they are partially written off).

Read more: Duly certified copies of documents are

The amounts accepted for accounting under account 45 “Goods shipped” are written off to the debit of account 90 “Sales” simultaneously with the recognition of revenue from the sale of products (goods) or upon receipt of a notice from the commission agent about the sale of products transferred to him.

In the case when the goods are not transferred to the intermediary, but are in the owner’s warehouse, there is no need to use accounts 004 and 45, since there is no real movement of goods.

Accordingly, the intermediary’s accounting does not reflect any operations on the movement of goods. In this case, the intermediary keeps accounting records of settlements with the principal, principal, and principal in full.

In the accounting records of the owner, the sale of goods through an intermediary will be reflected in the general manner.

If, through a commission agreement, the commission agent assumes a guarantee for the execution of the transaction by a third party (del credere), then the principal reflects in the accounting records the guarantees received to secure the obligations.

These guarantees are accounted for in off-balance sheet account 008 “Securities for obligations and payments received.”

The principal will write off the security amounts from account 008 as the debt is repaid:

- or receiving payment from buyers for goods,

- or repayment by the commission agent of obligations in accordance with del credere (payment by the commission agent of the debt to the principal instead of the buyer).

In the accounting of the commission agent, guarantees issued to secure obligations are recorded in off-balance sheet account 009 “Securities for obligations and payments issued.”

If the guarantee does not specify the amount, then for accounting purposes it is determined based on the terms of the contract.

The amounts of collateral recorded in account 009 “Collateral for obligations and payments issued” are written off as the debt is repaid.

If the commission agent receives additional remuneration for del credere, then for the purposes of the commission agent’s accounting, these amounts are recognized as revenue and are income from ordinary activities.

Sometimes an organization, for various reasons, cannot engage in certain activities.

Alternatively, it may choose to cooperate with another company under a commission agreement, the parties to which are the principal and the commission agent.

It is often used in trade.

Commission agreement and its participants

8 — Moscow 8 — St. Petersburg

or if it’s more convenient for you, use the online consultant form!

All consultations with lawyers are free.

This is a mediated agreement. Participants: commission agent and committent.

The first conducts activities (sells goods, provides services) at the direction of the second, but on its own behalf.

The proceeds and property are the property of the principal. This means that he bears the risks and obligations for them.

The contractor receives a commission for his activities. Additional income is divided equally between the participants.

Another feature of such an agreement is the transfer of the assets of the principal (committent) for long-term use to the agent (commission agent). The commission agent does not include them as his income; interest is not accrued for the period of use.

Since there are no established requirements for the contract, it may include the following conditions:

- validity;

- place of fulfillment of obligations;

- list of goods;

- obligations of the principal not to enter into transactions with third parties on orders carried out by the commission agent.

You can download a sample agreement between the principal and the commission agent here.

In this area, the concept often comes up - del credere. It implies a guarantee from the commission agent to the principal for a transaction with third parties.

When guaranteeing, an additional commission is assigned, which is often higher than the main remuneration. True, there are also “pitfalls” hidden here.

The agreement is terminated in the following cases:

- Refusal by one of the parties to fulfill the agreement (the partner must be notified 30 days in advance). If the validity period of the contract is established, the commission agent can terminate the contract only for specified reasons or if this is provided by law.

- Bankruptcy, death or incapacity of the commission agent.

The principal and the principal are – Legal assistance from a lawyer

According to Article 999 “Report of the commission agent” of the Civil Code of the Russian Federation, upon execution of the order, the commission agent is obliged to submit a report to the principal and transfer to him everything received under the commission agreement.

The principal who has objections to the report must report them to the commissioner within thirty days from the date of receipt of the report, unless a different period is established by agreement of the parties. Otherwise, the report, in the absence of another agreement, is considered accepted.

Similar rules are contained in Article 1008 of the Civil Code of the Russian Federation in relation to the agency agreement and the agent’s report.

The fact of transfer of goods under a commission or commission agreement in accordance with the Instructions for using the chart of accounts... is reflected in the accounting records of the principal, principal or principal by an entry in the debit of account 45 “Goods shipped” and the credit of account 41 “Goods” or account 43 “Finished products” on the accounting value of the transferred assets.

Since there are no established requirements for the contract, it may include the following conditions:

- validity;

- place of fulfillment of obligations;

- list of goods;

- obligations of the principal not to enter into transactions with third parties on orders carried out by the commission agent.

You can download a sample agreement between the principal and the commission agent here. In this area, the concept often comes up - del credere.

Attention

It implies a guarantee from the commission agent to the principal for a transaction with third parties.

When guaranteeing, an additional commission is assigned, which is often higher than the main remuneration. True, there are also “pitfalls” hidden here. It is important to know: if the counterparty fails to fulfill the agreements, the commission agent himself is responsible to the principal.

Ipc-zvezda.ru

If a scheme is chosen without the participation of a commission agent in settlements, then payment from the final buyer goes directly to the principal’s bank account, bypassing the intermediary. The scheme with participation in settlements implies that buyers pay for the goods with the commission agent, and then the accumulated amounts are transferred to the account of the principal.

In this case, the commission agent has the opportunity to independently withhold the amount of his remuneration, as well as compensate for expenses incurred during the execution of the order.

Accounting Keeping records under commission trading is easier.

All incoming goods are reflected in off-balance sheet account 004. All movements in goods are also reflected in off-balance sheet account. Only the amounts of commission fees are reflected in accounting; they are included in the income of the commission agent.

Principal and commission agent - the essence of the concepts

Important

The principal and the commission agent are in the commission agreement. Therefore, the committent (principal) - who is it? This is the person who initiates the relationship, assigning certain tasks to be performed for a fee.

Can we say that the principal and the principal are the same thing? Despite the fact that the concepts are close in meaning, they cannot be said to be identical.

They appear in various agreements. This means that there is a difference between the concepts of “principal” and “committent”.

The principal may instruct the agent to act both on his own behalf and on behalf of the principal. The principal can instruct the commission agent to act only on his own behalf.

We can say that the principal and the principal are one and the same, only under certain conditions. In general, the second concept is somewhat broader.

What does “agent”, “commission agent” mean? Let's look at the second side of the contractual relationship.

Who is a principal and agent?

After all, what is a committent (principal)? This is a person who provides his goods for trade.

The next advantage is the ease of processing a return. If it turns out that the product is defective, its sales period has expired, or for some reason it “did not go,” then it is easy to return it, because it does not belong to you, but to the consignor. In classical trade, returning goods creates many difficulties, ranging from paperwork to taxation.

Within the framework of a commission agreement, subcommission agreements can be concluded. Another significant advantage is that accounting and taxation for an intermediary is much simpler than for someone who sells their own goods. Payment Methods Commission trading has two possible options.

The commission agent may or may not take part in settlements for the goods between the principal and the buyer.

Agency agreement, commission agreements and assignments. similarities and differences

If a scheme is chosen without the participation of a commission agent in settlements, then payment from the final buyer goes directly to the principal’s bank account, bypassing the intermediary. The commission agent only receives his remuneration based on the results of his work. The scheme with participation in settlements implies that buyers pay for the goods with the commission agent, and then the accumulated amounts are transferred to the account of the principal.

In this case, the commission agent has the opportunity to independently withhold the amount of his remuneration, as well as compensate for expenses incurred during the execution of the order.

Accounting Keeping records under commission trading is easier.

All incoming goods are reflected in off-balance sheet account 004.

All movements on the product are also reflected in the off-balance sheet account. Only the amounts of commission fees are reflected in accounting; they are included in the income of the commission agent.

Committent

These rules provide for different procedures for issuing invoices depending on whose name the sale of goods, works, services is carried out: If an agent purchases goods, works, services on behalf of the principal and on his behalf, then the seller must issue an invoice in the name of the principal, on the basis of which the principal has the right to make an entry in his purchase book and submit VAT for deduction.

As a result, she acted as a representative of the plant, which independently sold vodka, on the conditions that the plant would pay a certain reward for finding buyers, registering with them, etc.

n. The attorney is obliged to act in strict accordance with the instructions of the principal. Moreover, the law requires that these instructions be “legitimate, feasible and specific” (Clause 1 of Article 973 of the Civil Code of the Russian Federation). The principal and the commission agent are the essence of the concepts. This means that he bears the risks and obligations for them.

The principal is the principal

Under a commission agreement, one party (the commission agent) undertakes, on behalf of the other party (the principal), for a fee, to carry out one or more transactions on its own behalf, but at the expense of the principal.

«»

Under a transaction made by a commission agent with a third party, the commission agent acquires rights and becomes obligated, even if the principal was named in the transaction or entered into direct relations with the third party for the execution of the transaction.

2. You instructed me under a commission agreement to sell to a certain N, for example, a chair, I sold it and then the rights and obligations under the agreement with N will arise for me. And you and I will have our own agreement - a commission agreement, under which I will be obliged to pay you, for example, a percentage of the sale. And if N has any complaints, he will go to present them to me, and not to you.

The principal and the principal are

Civil Code of the Russian Federation, the principal is obliged to pay the agent remuneration in the amount and in the manner established by Art.

Vredina Profi (648) 8 years ago This is something related to imprisonment.

In my opinion, the one with whom you conclude it. Very Nice Guru (3327) 8 years ago Playing on the trading exchange without leverage only with your own money Nikolay Pro (791) 8 years ago When a deal is concluded, the seller is written first, and the buyer second.

Agency agreement: accounting between the principal and the agent The agent makes settlements with the principal after the receipt of funds from the customer to the agent's bank account, withholding the remuneration due to him.

What is the procedure for document flow between the parties in this situation? What is the procedure for accounting and tax accounting of cash receipts from customers for the principal and the agent? Chapter 52 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation) regulates the relationship between the parties under an agency agreement.

Source: https://dipna5.ru/komitent-i-printsipal-eto/

Rights and obligations of the principal

Not only a legal entity, but also an individual can act in this capacity.

Responsibilities:

- Pay agent fees.

- Reimburse the costs incurred by the contractor in fulfilling his obligations.

- When purchasing property, the principal is obliged to notify the contractor about existing defects.

- Accept property from a commission agent.

- Remove the obligations of the contractor to third parties that he assumed when executing the agreement.

- If the principal has any objections to the contractor’s report, notify him of this within a month.

Rights:

- Terminate the contract by reimbursing the commission agent for the costs incurred.

- Specify the conditions that must be observed when concluding transactions.

- Require submission of a report to the accounting department.

- Demand the transfer of property received under the agreement.