Remote employees working remotely are no longer uncommon today. Nowadays it is not always necessary to be in the office in order to fulfill your work duties. Moving towards progress, legislators made changes to the Labor Code of the Russian Federation regarding remote workers (freelancers).

In the article below we will understand what are the features of accounting for relationships with remote workers, how to draw up an employment contract with them, a sample contract with a remote worker can be downloaded in this article below.

Representatives of the following professions most often work remotely: accountants, lawyers, designers, programmers, webmasters, sales specialists, etc. When drawing up a contract, you need to know what guarantees the employer provides; read in more detail: “Guarantees when hiring under a fixed-term, open-ended employment contract.”

Who benefits from remote work?

Remote work is the dream of any employee, because you can perform work duties at home, in a comfortable environment and receive payment for them. There is no need to get up early in the morning, drive in any weather, stand in traffic jams, waste your time.

Is this convenient for the employer?

Of course, it is also beneficial for the employer to have a remote worker. This significantly reduces the costs of personnel, organizing a workplace, purchasing equipment and furniture for it.

The peculiarities of remote work are that the employee and the employer can be located in different localities, cities and even countries. You can choose a truly competent specialist.

However, this brings with it a more responsible approach by the employer to finding suitable personnel. Not everyone can provide the necessary performance at home.

Federal Law No. 60-FZ of April 5, 2013 introduced an additional chapter 49.1 into the Labor Code of the Russian Federation, which regulates the work of remote workers.

This chapter establishes the concept of “remote work” and “distance worker”.

Remote work is the performance of work duties outside the employer’s location.

A remote worker independently provides himself with a workplace, and maintains contact with the employer via telephone, Internet, or mail.

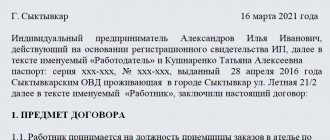

Contract, labor contract, with payroll accountant

Moscow "___" __________ 201_.

Open Joint Stock Company "_________________________________", hereinafter referred to as the "Employer", represented by _________________________, acting on the basis of ________________________________, on the one hand, and citizen ________________________, hereinafter referred to as the "Employee" on the other hand, have entered into this Agreement, hereinafter referred to as the "employment contract" with an employee with an accountant”, about the following:

1. Subject of the employment contract 1.1. The employer instructs and the employee undertakes to perform the work of a payroll accountant. 1.2. Duration of the employment contract with the accountant: 1.2.1. Beginning - "___" __________ 201_. By agreement of the parties, the employee begins work on “___” __________ 201_. 1.2.2. Ends indefinitely. 1.3. Probation period: 3 months. 1.4. Work under this employment contract is the Employee’s main place of work.

2. Rights and obligations of the parties 2.1. The employee has the right to: 2.1.1. concluding, amending and terminating an employment contract with an accountant in the manner and under the conditions provided for by the legislation of the Russian Federation, by-laws, and local regulations; 2.1.2. providing him with work stipulated by this employment contract with the accountant; 2.1.3. timely and full payment of wages in accordance with their qualifications; 2.1.4. rest provided by the establishment of normal working hours, reduced working hours for certain categories of workers. 2.1.5. Other rights of the Employee are determined by the legislation of the Russian Federation, by-laws, and local regulations. 2.2. The employer has the right: 2.2.1. Conclude, amend and terminate an employment contract with an accountant in the manner and under the conditions established by the legislation of the Russian Federation, by-laws, and local regulations. 2.2.2. Encourage the Employee for conscientious work. 2.2.3. Demand that the Employee fulfill his job duties and take care of the Employer’s property, comply with the legislation of the Russian Federation, by-laws, and local regulations. 2.2.4. Bring to disciplinary and financial liability in the manner established by the legislation of the Russian Federation. 2.2.5. For improper performance by the Employee of his duties, apply the following measures to him: 2.2.5.1. comment; 2.2.5.2. rebuke; 2.2.5.3. dismissal, including on the grounds provided for in this employment contract with the accountant. 2.2.6. Other rights of the Employer are determined by the legislation of the Russian Federation, by-laws, and local regulations. 2.3. Obligations of the Employer: 2.3.1. Provide the Employee with work according to the specified labor function. 2.3.2. Provide appropriate technical equipment for all workplaces and create working conditions there that comply with uniform inter-industry and sectoral rules on labor protection, sanitary standards and rules, developed and approved in the manner established by the legislation of the Russian Federation. 2.3.3. Inform the Employee about labor conditions and safety in the workplace, about the significant risk of damage to health, the required compensation and personal protective equipment. 2.3.4. Create the necessary conditions for the Employee to successfully fulfill his obligations. 2.3.5. Ensure timely payment to the Employee of wages, allowances, benefits and other payments in cash. 2.3.6. Ensure the required qualification level of the Employee, advanced training and retraining of personnel, taking into account the development prospects of the enterprise. 2.3.7. Provide the Employee with working conditions provided for by the legislation of the Russian Federation, necessary for effective work. 2.3.7. Carry out mandatory social insurance and social security for the Employee in accordance with the legislation of the Russian Federation. 2.4. Obligations of the Employee: 2.4.1. Start performing your job duties from the date specified in clause 1.1. this employment contract with the accountant. 2.4.2. Perform the work assigned to him in accordance with the requirements of this employment contract, efficiently and on time. 2.4.3. Promptly notify the Employer's administration of the impossibility, for good reasons, to perform the work stipulated by the employment contract with the accountant. 2.4.4. Comply with the legislation of the Russian Federation, the Charter of the enterprise, internal regulations, individual work plan, production and technological discipline, safety regulations and other local regulations. 2.4.5. Do not disclose information about the Employer that has become known to the Employee in connection with the performance of his job functions and is a trade secret of the Employer. 2.4.6. Ensure high efficiency of work performed. 2.4.7. Systematically improve your skill level. 2.4.8. Conclude an agreement on full financial responsibility for commodity, material, monetary and other valuables entrusted by the Employer. 2.5. A payroll accountant must know: 2.5.1. legislative acts, regulations, orders, orders, guidelines, methodological and regulatory materials on the organization of accounting, in particular, payroll accounting, and reporting in this area; 2.5.2. forms and methods of accounting at the enterprise; 2.5.3. plan and correspondence of accounts, in particular for payroll accounting; 2.5.4. organization of document flow in this area of accounting; 2.5.5. the procedure for documenting and reflecting in accounting accounts settlements with personnel when paying for labor; 2.5.6. methods of economic analysis of the economic and financial activities of an enterprise; 2.5.7. rules for operating computer equipment; 2.5.8. economics, labor organization and management; 2.5.9. market methods of management; 2.5.10. labor legislation; 2.5.11. rules and regulations of labor protection. 2.6. Job responsibilities of the Employee: 2.6.1. Performs accounting work in accordance with the provisions of the current legislation of the Russian Federation. 2.6.2. Participates in the development and implementation of activities aimed at maintaining financial discipline and rational use of resources. 2.6.3. Receives and controls primary documentation in this area of accounting and prepares them for accounting processing. 2.6.4. Reflects wage accounting transactions on the accounting accounts. 2.6.5. Calculate taxes arising on this site. 2.6.6. Provides managers, creditors, investors, auditors and other users of financial statements with comparable and reliable accounting information on the relevant area of accounting. 2.6.7. Develops a working chart of accounts, forms of primary documents used for registration of business transactions for which standard forms are not provided, as well as forms of documents for internal accounting reporting, participates in determining the content of basic techniques and methods of accounting and technology for processing accounting information. 2.6.8. Prepares data on the relevant area of accounting for reporting, monitors the safety of accounting documents, draws them up in accordance with the established procedure for transfer to the archive.

Etc…

The entire standard form and sample employment contract with a payroll accountant is available for free download as an attached document option form.

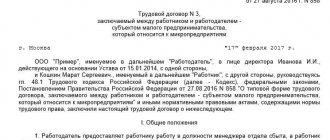

Employment contract with a remote worker

Chapter 49.1 of the Labor Code makes it possible to conclude an employment contract with a remote worker electronically.

The text of the employment contract must include the nature of remote work, that is, it must indicate that the employee must perform his work duties outside the employer’s territory.

According to Article 57, the address of the workplace must be indicated; this can be a home address or any other place where the remote employee plans to perform his work duties.

The length of the working week for remote workers is the same as for regular workers, that is, a 40-hour working week in the standard case. All deviations from the standard working week must be recorded in the contract.

What other information should be included in the employment contract:

- Features of the work schedule;

- Providing resources for work. There are several options here: the employee provides himself with everything himself, the employer provides the employee with his resources, the employer pays the employee for the costs of resources (payment for the purchase of a computer, office rental, payment for cellular communications, the Internet, reimbursement of expenses for fuel and lubricants, depreciation of a car, computer and other equipment used to perform labor duties of equipment);

- Features of submitting reports on work done to the employer (via telephone, Skype, email, in what form, with what frequency).

If you need to transfer working employees to remote work, this can be done by drawing up an additional agreement to the existing employment contract, which sets out changes in the nature of work and the day on which these changes come into force.

If a remote worker needs to be sent to another locality to perform a task related to the organization’s activities (on a business trip), then the employer draws up the same documents as in relation to sending regular employees on a business trip. Read about applying for a business trip here.

All travel expenses for remote workers are accounted for as standard.

How to properly apply for a job as a remote employee

- possible problems with the Internet connection (but this can be specified in the employment contract);

- lack of career growth;

- additional costs for payment to the provider or for the purchase of special programs (you can also provide payment terms in the contract).

Cases of registration

- a company's personnel officer, individual entrepreneur or human resources specialist authorized by a power of attorney contacts the applicant via the Internet and receives from him copies of the necessary documents (including an application for admission to remote work is required);

- a draft agreement is prepared and endorsed by the director;

- within 3 days, the contract in two copies is sent by registered mail (or by courier) to the employee’s address;

- the employee signs both copies and sends one by registered mail back to the company.

We recommend reading: Water Meter Clicks But Doesn’t Turn

The term “part-time work” means performing any paid work in your free time. It is important to remember: in the case of part-time work, the employment contract may be concluded for a fixed-term period.

- date, place of conclusion of the agreement;

- names of the employee and employer;

- subject of the contract;

- contract time;

- rights and obligations of the employee/employer;

- features of remote work;

- compensation and guarantees;

- rest and work schedule;

- terms of payment for the work;

- the right to the results of work;

- grounds and procedure for termination;

- liability of the parties;

- additional conditions;

- list of applications;

- addresses and details of the parties;

- signatures of the parties - with transcript.

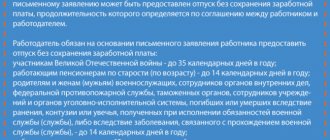

Guarantees

- flexible work schedule;

- lack of connection to a specific workplace;

- no need to follow a schedule;

- significant cost savings, since there are no costs for accommodation, transportation, food, and so on;

- the opportunity to work virtually for yourself, realizing yourself as fully as possible;

- work exclusively for results and without unnecessary paperwork bureaucracy;

- the ability to work at any time of the day - not only in the morning and afternoon, but also in the evening and even at night.

The contract with the accountant must indicate the date and place of its conclusion, the employee’s personal data (last name, first name, patronymic, passport details), information about the employer (name of the employer, his Taxpayer Identification Number, last name, first name, patronymic of the employer’s representative and details of the document, based on which this representative acts).

An employment contract with an individual entrepreneur, the form, must necessarily determine the duration of its validity. It is permissible to conclude an open-ended agreement, that is, the document will not have any time frame. Such a document can be terminated only for certain reasons.

Agreement with an accountant: general conditions

To detail the place of work, it is enough to indicate “IP Primrnaya Anna Alexandrovna, registered at the address: St. Petersburg, st. Approximate, no. 1.” But it is not necessary to indicate the workplace; this detail refers to additional information in the contract.

— demand from the Employee the proper performance of labor duties and careful attitude towards the property of the Employer and other employees, compliance with the Internal Labor Regulations and other local regulations, labor discipline, safety regulations, industrial sanitation and fire protection;

Differences from a regular contract

Recently, the requirements for the content of employment contracts with ordinary employees have become increasingly stringent. The legislator insists that all responsibilities and significant working conditions are listed not in the company’s local regulations, but in each contract individually. This is done, first of all, to protect the rights of employees and prevent illegal actions by employers.

With a remote employee, things are different. The most detailed employment contract on remote work is a mutual necessity. Because, due to the remoteness and, often, long distances, it is unlikely that the parties will be able to quickly agree and adjust the details of the process.

A remote worker differs from others only in the place where duties are performed. Otherwise, he is endowed with all rights under the Labor Code of the Russian Federation.

Pros of remote work

An employment contract with a remote worker has a number of undoubted advantages, both for the employee and for the employer. For business owners, “invisible” employees are attractive, first of all, financially, but for the specialist himself, an employment contract for remote work allows him to count on some “amenities”:

| To the employer | To the employee |

| Clear cost savings on organizing workplaces, renting space, and ensuring safe working conditions | Work in an atmosphere and environment that is convenient for the individual |

| Expanding the scope of search for specialists far beyond the boundaries of the locality in which the production is located | Independent determination of the work schedule if working hours and deadlines are not specified in the employment contract |

| For remote employees, most often, the availability of a social package, as well as the comfort of production and office premises, does not matter | The ability to painlessly combine work for several employers at once |

| The ability to pay only for the time actually spent or the amount of work completed | Searching for customers in several regions and even time zones at once |

Depending on the specifics of the work performed and the specialists hired, each party may find additional arguments in favor of concluding an employment contract with a remote worker in 2020.

Negative sides

The disadvantages of an employment contract with an employee working remotely for management follow from the same distance.

| For employee | For the employer |

| It’s hard for someone to organize their time and distribute the workload without constant supervision from their boss. | It is necessary to spend time and money to implement a control system, exchange of tasks and work results |

| If the payment depends on the load, then the income received will not be permanent. | The candidate for the position, in addition to professional skills, must have experience working in telecommunication networks, as well as the necessary equipment for working at a distance |

| Also relevant is the dependence on technical equipment, uninterrupted operation of the power grid and continuous access to the Internet. | Technical problems may interfere with prompt communication with an employee |

| Attentive attention to details and legal nuances will be required, since there is a high probability of encountering unscrupulous employers. | A remote employee is unlikely to agree, and sometimes simply physically cannot, to carry out urgent or minor tasks not provided for in his contract |

A complete transfer of staff to a remote employment contract may also have a negative impact on the company’s reputation. Having a company with only a virtual office does not inspire much confidence in either clients or employees.

Features of the agreement

The distance separating the employee and the employer determines the special procedure for concluding an employment contract remotely. If the hiring party does not provide for mandatory personal presence when signing the contract, then the documents can only be certified using an enhanced electronic signature and certificate. You need to arrange to receive it in advance. Moreover, effective remote work without this is simply impossible. This is because Article 312.2 of the Labor Code of the Russian Federation puts electronic document management at priority. Paper copies must be sent by mail only after the exchange of originals with crypto signatures.

This form of certification of an employment contract with a remote worker is even more relevant in 2020, when the exchange of protected data via telecommunication channels is spreading everywhere.

- The employer just needs to send a sample contract to the specialist for review and indicate the official email address for a response.

- An employment contract signed by both parties must be sent to the employee in paper form within three days, Art. 312.2 TK.

- The same fully applies to all subsequent additional agreements to the initial contract, as well as all orders and other documents related to the remote employee.

The key to successful work with a remote specialist is the most detailed employment contract.

Subject of the distance contract

In addition to a detailed description of labor tasks, the subject clause in the employment contract should establish the provision that the remote worker’s place of work is located outside the office. Only this clause will give the employee the right to refuse daily presence in the office. Methods for monitoring the completion of tasks and forms of feedback to superiors, the timing of going “on air” and the duration of online presence should also be spelled out in detail here, Art. 312.4 TK.

Responsibility of the parties

An employment contract with an employee that involves remote work requires special attention when writing many clauses. Starting with the item and ending with its expiration date. The section on the responsibility of the parties will not be an exception. There is no need to go too far in listing possible violations in the area regulated by law. The fact is that general cases are still considered through the prism of the Labor, Civil, Administrative and even Criminal Codes.

In the liability clause, it is better to describe special cases that are typical only for a given enterprise or a specific employee:

- How and for what a remote employee can be subject to disciplinary action (lateness, absenteeism or poor performance of duties);

- List of information and data provided for work that are not subject to disclosure;

- Financial compensation for early termination of a fixed-term employment contract with a remote worker, if it was concluded to complete a specific project, and the latter was not completed.

- Other specific cases, the occurrence of which will entail damage to one or the other party.

It is good when the liability clause was studied by the parties only as a matter of familiarization. It would be worse if a remote employment contract, drawn up according to a generally accepted model, had to be put into practice. In this sad case, the accounting department, before deducting fines from the remote specialist’s salary, must remember that they are subject to agreement with the employee. Without written recognition by the employee of the correctness of the deductions, the law allows compensation for material losses unilaterally only by a court decision, Art. 248 TK.

Compensation of expenses

An employment contract for remote work allows you to save on workplace equipment and utility costs, but may add several items of new expenses. Since a remote employee performs his functions using telecommunication networks and, often, additional equipment, when drawing up a contract, the question of compensation for the costs of paying them, fully or partially at the expense of the employer, arises.

Labor and tax legislation adequately assess the need to reimburse these amounts. For these costs to be included in the gross costs, it is enough to simply write them down in the employment contract and justify their connection with the production process, Art. 312.3 TK.

It is best to immediately list what specific amounts are subject to compensation in the employment contract. For example, in a sample remote contract with an accountant, in addition to the costs of paying for the Internet, you can find a line about reimbursement of transportation costs for travel to the tax office, funds or other authorities. Confirmation of these amounts may include tickets and an explanation of the need for such visits.

Sample contract

You can find a clause on the return of funds for the purchase of equipment for an employee if remote collaboration requires special devices or software applications. An alternative option would be to provide this equipment to employees for temporary paid or free use. Methods for returning it or compensating the cost in case of damage should also be specified in the employment contract for remote work, drawn up according to a standard template ().