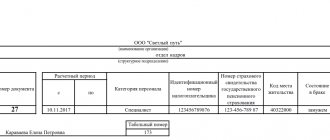

Basic salary

Salary is the remuneration of an employee for the work he has performed. This concept includes payment for actual time worked, compensation accruals, as well as additional incentive payments in the form of allowances, bonuses, and additional payments.

The base salary is the base amount an employee is guaranteed to receive each month.

The following table illustrates the types of basic salary.

| Remuneration system | What is |

| Monthly salary | In this case, the employee is paid a fixed amount monthly in accordance with the employment agreement |

| Basic salary | Represents the minimum amount of payment for a specific position, used for state and municipal employees |

| Application of tariff schedule | This option involves assessing the working hour; before payment, the working time is summed up and the basic salary is calculated based on this |

Payout Features

The specifics of calculating and assigning additional payments and allowances are specified in legislative and local regulations. Using several examples, we can consider the specifics of this procedure.

Maternity leave calculation

Determined on the basis of Federal Law-81 “On state benefits for citizens with children,” adopted back in 1995, and by-laws. For the calculation, the average earnings for the two previous years are taken (personal income tax is not deducted). However, there is a limit on the amount that income must not exceed. A working woman has the right to receive benefits for the specified period, amounting to 100% of the result received. Experience doesn't matter.

In less than a month

Income is determined in proportion to the time worked, which is quite logical and follows from the interpretation of labor law norms. With a piece-rate system, calculations are greatly simplified, because income directly depends on the completed quota. If a day or shift worked is taken as a basis, then the number of such days or shifts must be multiplied by the established rate.

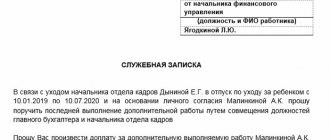

At the same time

The norms of the Labor Code of the Russian Federation do not contain any special features for this category of workers regarding payment. With a time-based system, calculations are made in proportion to the actual time worked. However, you should remember the minimum wage. Based on the size of the indicator established for the current year, it is necessary to set, in accordance with a certain rate, wages not lower than the minimum wage. For example, if an employee’s main job combines 1 rate and 0.5 rates, the salary in the latter case should not be less than 0.5 minimum wage.

Additional salary: what is it?

In addition to the basic salary, the Labor Code provides for an additional one. It is awarded to an employee for harmful conditions in the workplace, for being required to work overtime, or when the employer wishes to recognize the employee for a job well done.

Additional payments are mandatory, and can also be an act of goodwill on the part of the employer. Reasons for charging mandatory additional payment include:

- overtime work;

- attraction to work at night;

- difficult working conditions;

- dismissal with subsequent payment of severance pay;

- long service accruals;

- payment of sick leave.

Additional payment at the initiative of the owner occurs:

- For the length of service and special merits of the employee.

- In the role of incentive payments for completing or exceeding work.

Incentive payments

Voluntary incentive payments to the basic salary can come as an additional payment or an increase to the established minimum salary. These methods are used to increase labor productivity. Based on the name, it is obvious that the employee has an incentive to do more work and receive a correspondingly higher income.

Most often, this method is applicable to the amount of work performed during a normal work shift or longer temporary work hours per shift. The conditions of incentive payments are formulated depending on the type of work, field of activity, and skill level of the employee.

Categories

Main themes

Product costing tasks

The difference between planned costing and actual costing

The procedure for calculating costs for products (works, services)

Including costs in costing

Cost Analysis

Product costing tasks

One of the fundamental tasks of managing the cost of products (works, services) is its calculation. Calculation of the cost of products (works, services) is the calculation of manufacturing costs per unit of products (works, services) associated with the use of raw materials, materials, labor resources in the process of its production, as well as other costs for its production and sale. Enterprise costing is necessary to calculate the actual or planned cost of production and estimate production costs.

Note!

Planned costing determines the average cost of products (works, services) for the planning period. The main task when drawing up a planned cost estimate is to assess the feasibility of further production of products or performance of work (services). In addition, thanks to a well-designed cost calculation, it becomes possible to set the optimal price for contracting with contractors.

The actual cost estimate is compiled according to accounting data on the actual costs of production and reflects the actual cost of finished products or work performed. In addition to the expenses provided for by the plan, the actual costing also reflects expenses not included in the planned costing.

Important!

Actual costing is necessary for cost analysis, assessing the deviation of actual indicators from planned ones and allows for correct planning in the future.

We make a calculation: what expenses should be included in it?

Let's consider the actual calculation of the cost of production of Alpha LLC, which is engaged in the repair and maintenance of cars.

First of all, the calculation includes expenses that should be attributed to the cost according to accounting data.

Calculation at any enterprise is organized in accordance with certain principles, the main of which is the validity of attributing cost items to cost and their inclusion in the price.

In general, the calculation has the following form (Table 1).

Table 1

Actual costing (repair of unit A)

| No. | Name of calculation items | Amount, rub. |

| 1 | Total materials costs | 34 718,00 |

| Including: | ||

| 2 | raw materials and basic materials | 7112,00 |

| 3 | auxiliary materials | 0,00 |

| 4 | purchased semi-finished products | 0,00 |

| 5 | returnable waste (subtracted) | 0,00 |

| 6 | components | 27 606,00 |

| 7 | transportation and procurement costs | 0,00 |

| 8 | fuel for technological purposes | 0,00 |

| 9 | energy for technological purposes | 0,00 |

| 10 | container (non-returnable) and packaging | 0,00 |

| 11 | Total labor costs for key production workers | 210 795,00 |

| Including: | ||

| 12 | basic salary | 210 795,00 |

| 13 | additional salary | 0,00 |

| 14 | Insurance premiums | 63 238,50 |

| 15 | Costs for special technological equipment | 0,00 |

| 16 | Overhead costs | 314 207,00 |

| 17 | General expenses | 583 219,00 |

| 18 | Production cost | 1 206 177,50 |

| 19 | Non-production costs | 0,00 |

| 20 | Full cost | 1 206 177,50 |

For your information

The calculation presented is for advisory purposes only. For each enterprise, cost items can be completely different, it all depends on the specifics of the activity. For example, in our case, such cost items as “Services of third parties”, “Travel expenses of main production workers”, etc. are not indicated.

Let's look at each expense item included in the calculation.

Material costs

This article includes the costs of raw materials and basic materials, auxiliary materials, purchased semi-finished products, components and other costs minus the cost of sold waste.

Waste is the remains of materials generated during the production process and which have lost their consumer qualities.

To achieve the best results, enterprises often approve material consumption standards and set expense limits. The consumption rate is the maximum allowable amount of materials consumed to produce a unit of product.

In practice, so-called limit cards for writing off materials (Table 2), which, in fact, set a limit on materials. If a larger amount of materials is needed, exceeding the established limit, they write memos for the required excess amount of materials, justifying the reason for their need, and issue them on a separate request.

table 2

Limit card for materials

| No. | Name of goods and materials | Unit | Limit | Released | ||

| date | quantity | recipient's signature | ||||

| 1. Raw materials and basic materials | ||||||

| 1.1 | Oil A-154 | l | 1,50 | 07.03.2015 | 1,50 | |

| 1.2 | Soil S-7112 | kg | 0,25 | 07.03.2015 | 0,25 | |

| n | Varnish BP717 | kg | 0,05 | 07.03.2015 | 0,14 | |

| 2. Accessories | ||||||

| 2.1 | Cotter pin 2×0.14 | PC. | 35,00 | 07.03.2015 | 35,00 | |

| 2.2 | O-ring 2×10.3 | PC. | 21,00 | 07.03.2015 | 21,00 | |

| n | O-ring 4×8.7 | PC. | 18,00 | 07.03.2015 | 18,00 | |

A limit card is necessary primarily to ensure that during the release of each product there are no cases of “forgotten” materials and components, as well as to monitor compliance with the write-off limit for materials. Also, thanks to the maintenance of such cards constantly and for each product or job, the work of the accounting department when writing off materials for production is simplified.

Labor costs for key production workers

This article includes the basic and additional wages of production workers attributable to the production of specific products or the provision of services as direct costs.

The basic salary of production workers includes:

- labor costs charged for performing work for specific categories of workers directly involved in the production process or provision of services;

- incentive accruals, bonuses, allowances to tariff rates and salaries provided for by the remuneration system in a particular organization;

- labor costs for work in conditions deviating from normal, as well as allowances due to regional regulation of wages associated with special work hours and working conditions in accordance with the legislation of the Russian Federation, etc.

Additional wages are compensations that include accruals for unworked time established by the enterprise’s collective agreement or other local regulations in accordance with labor legislation.

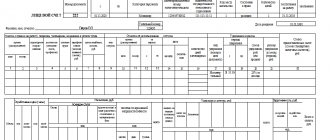

In the case of preparing a planned cost estimate for manufacturing enterprises with several workshops and an established time-based wage system, as in Alpha LLC, where the standard labor intensity for performing specific operations has been approved, the following breakdown of labor costs for the main production workers can be compiled (Table 3) .

Table 3

Labor costs for key production workers

| Type of work | Labor intensity and wages taken into account when preparing the cost estimate | ||

| labor intensity, standard hours | standard hour cost, rub. | basic salary (payroll fund), rub. | |

| Flushing | 17,00 | 500,00 | 8500,00 |

| Dismantling unit A | 34,00 | 500,00 | 17 000,00 |

| Checking unit A on a stand and repairing | 71,00 | 500,00 | 35 500,00 |

| Unit installation | 68,00 | 500,00 | 34 000,00 |

| 177,00 | 500,00 | 88 500,00 | |

| Total time-based | 367,00 | 500,00 | 183 500,00 |

| Incentive accruals | — | — | — |

| Accruals for work in conditions deviating from normal | — | — | — |

| Charges due to regional regulation | — | — | — |

| Total labor intensity, basic salary (wage fund) | 367,00 | 500,00 | 183 500,00 |

Insurance premiums

Insurance premiums are paid to:

- Pension Fund of the Russian Federation (PFR) - for compulsory pension insurance;

- Social Insurance Fund of the Russian Federation (FSS RF) - for compulsory social insurance in case of temporary disability and in connection with maternity, as well as for compulsory social insurance against industrial accidents and occupational diseases;

- Federal Compulsory Medical Insurance Fund (FFOMS) - for compulsory health insurance.

In accordance with the legislation of the Russian Federation, the insurance premium rate for Alpha LLC is 30%, including:

- in the Pension Fund - 22%;

- in the Federal Social Insurance Fund of the Russian Federation - 2.9%;

- in the Federal Compulsory Medical Insurance Fund - 5.1%.

For your information

Provided that the base for calculating insurance premiums in favor of a specific employee is reached during the year, recourse is applied:

- over 711,000 rub. in the Pension Fund of Russia the tariff will be 10%;

- over 670,000 rub. in the Federal Compulsory Medical Insurance Fund - 0%.

There is no maximum base for contributions to the FFOM; in any case, the tariff is 5.1%.

Costs for special technological equipment

This item includes the costs of manufacturing, purchasing, repairing and maintaining in working condition technological equipment for specific purposes, directly related to the production of specific products.

Overhead costs

General production costs include costs for maintenance and production management, including costs for:

- depreciation of buildings, structures, production equipment, vehicles, repairs of buildings and structures for industrial purposes, maintenance and operation of property;

- wages of the workshop management staff and insurance premiums;

- maintenance of vehicles engaged in the movement of goods on the territory of the enterprise;

- rental payments for fixed assets for workshop purposes, etc.

In accordance with the accounting policy adopted by Alpha LLC, general production costs are distributed between individual products (services, orders, works) in proportion to the basic wages of production workers.

For your information

When preparing a planned cost estimate, you can use the proportion for the past period and distribute costs as a percentage between manufactured products.

To distribute actual expenses, accounting data for account 25 is used (Table 4).

Table 4

Distribution of overhead costs

| Check | Cor. check | Debit | Credit |

| Expenditures | |||

| 25 | Opening balance | ||

| Depreciation of fixed assets | Opening balance | ||

| 02 | 410 967,63 | ||

| 20 | 410 967,63 | ||

| Turnover | 410 967,63 | 410 967,63 | |

| Closing balance | |||

| Property rental | Opening balance | ||

| 20 | 167 912,86 | ||

| 60 | 167 912,86 | ||

| Turnover | 167 912,86 | 167 912,86 | |

| Closing balance | |||

| Wear of workwear in excess of standard standards (SPI > 12 months) | Opening balance | ||

| 10 | 4,58 | ||

| 20 | 4,58 | ||

| Turnover | 4,58 | 4,58 | |

| Closing balance | |||

| Tools, consumables for industrial purposes | Opening balance | ||

| 10 | 57 283,64 | ||

| 20 | 57 283,64 | ||

| Turnover | 57 283,64 | 57 283,64 | |

| Closing balance | |||

| Travel expenses | Opening balance | ||

| 20 | 395 822,40 | ||

| 60 | 69 557,50 | ||

| 71 | 326 264,90 | ||

| Turnover | 395 822,40 | 395 822,40 | |

| Closing balance | |||

| Salary | Opening balance | ||

| 20 | 1 308 487,61 | ||

| 70 | 1 308 487,61 | ||

| Turnover | 1 308 487,61 | 1 308 487,61 | |

| Closing balance | |||

| Occupational safety and health | Opening balance | ||

| 10 | 16 944,91 | ||

| 20 | 18 639,83 | ||

| 60 | 1 694,92 | ||

| Turnover | 18 639,83 | 18 639,83 | |

| Closing balance | |||

| Maintenance and operation of transport | Opening balance | ||

| 10 | 4 380,87 | ||

| 20 | 35 865,92 | ||

| 60 | 31 485,05 | ||

| Turnover | 35 865,92 | 35 865,92 | |

| Closing balance | |||

| Maintenance and operation of premises and territory | Opening balance | ||

| 10 | 624,26 | ||

| 20 | 624,26 | ||

| Turnover | 624,26 | 624,26 | |

| Closing balance | |||

| Property insurance (mandatory and voluntary) | Opening balance | ||

| 20 | 3 049,23 | ||

| 97 | 3 049,23 | ||

| Turnover | 3 049,23 | 3 049,23 | |

| Closing balance | |||

| Insurance premiums | Opening balance | ||

| 20 | 392 531,29 | ||

| 69 | 392 531,29 | ||

| Turnover | 392 531,29 | 392 531,29 | |

| Closing balance | |||

| Fare | Opening balance | ||

| 20 | 115 254,24 | ||

| 60 | 115 254,24 | ||

| Turnover | 115 254,24 | 115 254,24 | |

| Closing balance | |||

| FSS - NS | Opening balance | ||

| 20 | 2 568,89 | ||

| 69 | 2 568,89 | ||

| Turnover | 2 568,89 | 2 568,89 | |

| Closing balance | |||

| Turnover | 2 909 012,38 | 2 909 012,38 | |

The total for account 25 “General production expenses” must be distributed among the work performed in proportion to the basic salary of production workers (Table 5).

Table 5

Distribution of overhead costs

| No. | Manufactured products (products, services provided, etc.) | Amount of wages of main production workers, rub. | Distribution of overhead costs, rub. | Distribution of overhead costs, % |

| 1 | Repair of unit A | 210 795,05 | 314 207,00 | 10,801 |

| 2 | Unit B repair | 714 561,49 | 1 065 111,45 | 36,614 |

| 3 | Unit B repair | 498 529,28 | 743 098,04 | 25,545 |

| 4 | Repair of unit G | 527 711,09 | 786 595,88 | 27,040% |

| Total | 1 951 596,91 | 2 909 012,38 | 100,00 | |

General expenses

This article includes the costs of managing and servicing production as a whole - the cost of paying administrative and managerial staff plus insurance premiums, travel expenses, postal expenses, costs of office supplies, labor protection, compliance with safety regulations, information and consulting services, Internet services -providers, rental of office space, etc.

In accordance with the accounting policy adopted by the enterprise, general operating expenses of Alpha LLC are distributed between individual products (services, orders, works) in proportion to the basic wages of production workers (similar to the distribution of general production expenses). To distribute actual general business expenses, accounting data for account 26 is used (Table 6).

Table 6

General running costs

| Check | Cor. check | Debit | Credit |

| Expenditures | |||

| 26 | Opening balance | ||

| Property rental | Opening balance | ||

| 20 | 480 000,00 | ||

| 60 | 480 000,00 | ||

| Turnover | 480 000,00 | 480 000,00 | |

| Closing balance | |||

| Internet | Opening balance | ||

| 20 | 13 770,44 | ||

| 60 | 13 770,44 | ||

| Turnover | 13 770,44 | 13 770,44 | |

| Closing balance | |||

| Information and consulting services | Opening balance | ||

| 20 | 74 551,97 | ||

| 60 | 74 551,97 | ||

| Turnover | 74 551,97 | 74 551,97 | |

| Closing balance | |||

| Office expenses | Opening balance | ||

| 10 | 24 831,36 | ||

| 20 | 24 831,36 | ||

| Turnover | 24 831,36 | 24 831,36 | |

| Closing balance | |||

| Travel expenses | Opening balance | ||

| 20 | 190 599,90 | ||

| 60 | 83 668,90 | ||

| 71 | 106 931,00 | ||

| Turnover | 190 599,90 | 190 599,90 | |

| Closing balance | |||

| Salary | Opening balance | ||

| 20 | 3 297 432,37 | ||

| 70 | 3 297 432,37 | ||

| Turnover | 3 297 432,37 | 3 297 432,37 | |

| Closing balance | |||

| Occupational safety and health | Opening balance | ||

| 10 | 10 264,34 | ||

| 20 | 18 214,34 | ||

| 60 | 7 950,00 | ||

| Turnover | 18 214,34 | 18 214,34 | |

| Closing balance | |||

| Postage | Opening balance | ||

| 20 | 8 040,16 | ||

| 60 | 5 783,21 | ||

| 71 | 2 256,95 | ||

| Turnover | 8 040,16 | 8 040,16 | |

| Closing balance | |||

| Software (office) | Opening balance | ||

| 20 | 469,63 | ||

| 97 | 469,63 | ||

| Turnover | 469,63 | 469,63 | |

| Closing balance | |||

| Professional training, education | Opening balance | ||

| 20 | 16 800,00 | ||

| 60 | 16 800,00 | ||

| Turnover | 16 800,00 | 16 800,00 | |

| Closing balance | |||

| Connection | Opening balance | ||

| 20 | 10 279,71 | ||

| 60 | 10 279,71 | ||

| Turnover | 10 279,71 | 10 279,71 | |

| Closing balance | |||

| Certification, licensing | Opening balance | ||

| 20 | 8 000,00 | ||

| 60 | 8 000,00 | ||

| Turnover | 8 000,00 | 8 000,00 | |

| Closing balance | |||

| Maintenance and operation of transport | Opening balance | ||

| 10 | 13 761,70 | ||

| 20 | 45 854,23 | ||

| 60 | 28 692,53 | ||

| 71 | 1 400,00 | ||

| 73 | 2 000,00 | ||

| Turnover | 45 854,23 | 45 854,23 | |

| Closing balance | |||

| Maintenance and operation of office equipment | Opening balance | ||

| 20 | 400,00 | ||

| 60 | 400,00 | ||

| Turnover | 400,00 | 400,00 | |

| Closing balance | |||

| Maintenance and operation of premises and territory | Opening balance | ||

| 10 | 4 239,10 | ||

| 20 | 4 919,10 | ||

| 60 | 680,00 | ||

| Turnover | 4 919,10 | 4 919,10 | |

| Closing balance | |||

| cellular | Opening balance | ||

| 20 | 15 860,00 | ||

| 60 | 15 860,00 | ||

| Turnover | 15 860,00 | 15 860,00 | |

| Closing balance | |||

| Special literature | Opening balance | ||

| 10 | 41 734,30 | ||

| 20 | 41 734,30 | ||

| Turnover | 41 734,30 | 41 734,30 | |

| Closing balance | |||

| Property insurance (mandatory and voluntary) | Opening balance | ||

| 20 | 1 583,75 | ||

| 97 | 1 583,75 | ||

| Turnover | 1 583,75 | 1 583,75 | |

| Closing balance | |||

| Insurance premiums | Opening balance | ||

| 20 | 1 137 952,70 | ||

| 69 | 1 137 952,70 | ||

| Turnover | 1 137 952,70 | 1 137 952,70 | |

| Closing balance | |||

| FSS - NS | Opening balance | ||

| 20 | 8 303,53 | ||

| 69 | 8 303,53 | ||

| Turnover | 8 303,53 | 8 303,53 | |

| Closing balance | |||

| Turnover | 5 399 597,49 | 5 399 597,49 | |

The total for account 26 “General expenses” must be distributed among the work performed in proportion to the basic salary of production workers (Table 7).

Table 7

Distribution of general business expenses

| No. | Manufactured products (products, services provided, etc.) | Amount of wages of main production workers, rub. | Distribution of overhead costs, rub. | Distribution of overhead costs, % |

| 1 | Repair of unit A | 210 795,05 | 583 219,01 | 10,801 |

| 2 | Unit B repair | 714 561,49 | 1 977 019,13 | 36,614 |

| 3 | Unit B repair | 498 529,28 | 1 379 310,16 | 25,545 |

| 4 | Repair of unit G | 527 711,09 | 1 460 049,18 | 27,040 |

| Total | 1 951 596,91 | 5 399 597,49 | 100,00 | |

Components of the total cost:

| Full cost | = | Production cost | + | Non-production costs |

Production cost is the current costs in monetary terms, caused by the use of natural, labor, material and financial resources for the production of products (works, services), calculated as the sum of costs reflected in costing items on lines 1, 11, 14, 15, 16, 17.

Non-production costs are expenses associated with the sale of products (for preparation for transportation (containers, packaging, etc.), delivery of products, loading, etc.).

We analyze planned and actual costing

Having studied the cost items of the calculation and determined which costs are included in each of them, it is necessary to analyze the cost by comparing the planned and actual calculations. This type of analysis allows you to effectively evaluate the activities of the enterprise; it is necessary when developing plans for its further development, as it allows you to find ways to reduce costs and, accordingly, increase the profitability of the enterprise.

3 main goals of comparative analysis of planned and actual calculations:

1) check the validity of the planned calculation, the degree of deviation of the planned calculation indicators from the actual ones;

2) study the reasons for the deviation;

3) develop ways to reduce costs (if possible).

Analysis of the cost structure of the calculation is carried out on the basis of accounting data when comparing planned indicators with actual ones. Let us conduct a comparative analysis of the planned and actual calculations of Alpha LLC using the example of the repair of unit A.

Table 8

Comparative analysis of planned and actual costing

| No. | Name of calculation items | Planned costing, rub. | Actual costing, rub. | Deviations of actual indicators from planned ones, rub. | Deviations of actual indicators from planned indicators, % |

| 1 | Total materials costs | 25 614,00 | 34 718,00 | 9 104,00 | 35,54 |

| Including: | |||||

| 2 | raw materials and basic materials | 3413,00 | 7112,00 | 3699,00 | 108,38 |

| 3 | auxiliary materials | 0,00 | 0,00 | 0,00 | |

| 4 | purchased semi-finished products | 0,00 | 0,00 | 0,00 | |

| 5 | returnable waste (subtracted) | 0,00 | 0,00 | 0,00 | |

| 6 | components | 22 201,00 | 27 606,00 | 5405,00 | 24,35 |

| 7 | transportation and procurement costs | 0,00 | 0,00 | 0,00 | |

| 8 | fuel for technological purposes | 0,00 | 0,00 | 0,00 | |

| 9 | energy for technological purposes | 0,00 | 0,00 | 0,00 | |

| 10 | container (non-returnable) and packaging | 0,00 | 0,00 | 0,00 | |

| 11 | Total labor costs for key production workers: | 183 500,00 | 210 795,00 | 27 295,00 | 14,87 |

| Including: | |||||

| 12 | basic salary | 183 500,00 | 210 795,00 | 27 295,00 | 14,87 |

| 13 | additional salary | 0,00 | 0,00 | 0,00 | |

| 14 | Insurance premiums | 55 050,00 | 63 238,50 | 8188,50 | 14,87 |

| 15 | Costs for special technological equipment | 0,00 | 0,00 | 0,00 | |

| 16 | Overhead costs | 275 250,00 | 314 207,00 | 38 957,00 | 14,15 |

| 17 | General expenses | 550 500,00 | 583 219,00 | 32 719,00 | 5,94 |

| 18 | Production cost | 1 089 914,00 | 1 206 177,50 | 116 263,50 | 10,67 |

| 19 | Non-production costs | 0,00 | 0,00 | 0,00 | |

| 20 | Full cost | 1 089 914,00 | 1 206 177,50 | 116 263,50 | 10,67 |

In general, the deviation of the actual cost from the planned one (10.67%) is not critical (according to the Russian Ministry of Economic Development, inflation in 2020 is 12%). Deviations are observed for each cost item in the calculation, and the largest are for the items “Raw materials and basic materials” (2 times!) and “Components”. This sharp increase is due to rising prices for materials, which was difficult to predict at the beginning of the period.

Given the constant increase in prices for materials, it is worth exploring options for reducing this cost item (for example, revising the company’s contracts with suppliers or finding suppliers with more acceptable terms of delivery, payment and lower prices). This type of expense should not be underestimated - it is one of the fundamental ones in industrial enterprises.

4 effective ways to reduce costs under the item “Raw materials and basic materials”:

- reduce purchasing costs by concluding contracts with manufacturers directly, bypassing intermediaries or reducing their number;

- purchase large quantities (in this case, you can negotiate individual discounts with the supplier);

- choose cheap raw materials. A dangerous way: you can win on the price of raw materials, but lose a lot on quality;

- produce some materials yourself (if possible). But you need to remember that sometimes independent production is more expensive than purchasing a ready-made one.

For your information

The option of purchasing a large batch of goods is suitable for enterprises that have free financial flows and premises for storing a large batch of materials. In addition, you can agree with another buyer of the same supplier to jointly purchase materials and thus receive a discount for a large purchase volume.

The costs of paying key production workers and insurance premiums are difficult to reduce. This problem can be solved by automating processes. But in this case, labor costs will be lower, but production maintenance will cost several times more.

It is possible to reduce the number, but this is a painful process for everyone. Often, enterprises, in order not to reduce the number of personnel, reduce the basic salary by a certain percentage for each employee or working hours with a simultaneous reduction in pay in order to prevent discord in the team that occurs during mass layoffs.

General production and general expenses have the largest share in the cost of production. There are expenses here that you can start reducing, since this will not affect the production process - office, Internet, consulting and information services, training of administrative and managerial staff, etc.

conclusions

- Enterprise costing is necessary to calculate the actual cost of production and estimate production costs.

- The main task when drawing up a planned cost estimate is to assess the feasibility of further production of products or performance of work (services).

- Analysis of costs and product costs based on planned and actual costing data as a whole allows you to see the problem areas of the analyzed enterprise and determine the possibilities of changing the current situation.

Modern additional payment schemes

The modern labor market includes various ways of supplementing the basic salary. The most common forms of additional remuneration are:

- Piece-bonus scheme - an employee who exceeds the minimum amount of work is awarded a cash payment. The labor or collective agreement must indicate work standards and the amount of the bonus for fulfilling the standard.

- Piece-progressive scale - the enterprise establishes a plan that the employee must fulfill and receive a bonus for this.

- Time-based additional payment - used in places where it is not production that is important, but the time worked at the site.

- The system of deprivation of bonuses consists of establishing a minimum amount of work, without which a person is deprived of an additional salary.

- Lump-sum payment is a system of additional payments provided that the employee adheres to time limits and product quality.

Additional salary standard

The rates of additional payments vary depending on the reason for the accrual of such salaries. Let's consider the main amounts for compensation payments:

- Article 152 of the Labor Code of the Russian Federation indicates that for the first two hours of work above the norm, payment is one and a half times more than the usual amount, further time is considered at a double rate;

- performing work in special climatic conditions, such as the north of Russia, in accordance with Art. 148 of the Labor Code of the Russian Federation obliges the employer to pay for labor at higher rates;

- harmful conditions also entail additional charges, according to Art. 147 of the Labor Code of the Russian Federation, in this case the employee is paid an additional 4%;

- work at night according to Art. 96 of the Labor Code of the Russian Federation obliges the employer to pay an additional 20% to the regular daily rate;

- work on non-working days must have double pay or additional rest is provided as compensation instead of time worked on a legal day off; these provisions are enshrined in Art. 153 Labor Code of the Russian Federation.

The standards for additional incentive payments at each enterprise are individual. Each employer independently sets the amount of voluntary contributions. In some cases, the standard may be specified in an employment contract, collective agreement, or solely by decision of the employer himself.

How to calculate additional wages - calculation example

As an example, let’s calculate the salary of a worker at an enterprise:

Let’s say an employee’s salary is 10,000 rubles. It is necessary to calculate the monthly salary, having the following data: he has worked the norm of 168 hours, he is entitled to additional pay for harmful activities, he has worked 40 hours at night and 24 on holidays.

Calculations:

- The main part is 10,000 rubles (since they have worked out the norm).

- For harmfulness - 10,000 * 0.04 = 400 rubles (4% of salary).

To calculate holiday and night holidays, you need to know the cost of a working hour: divide the basic salary by the number of hours worked by the employee:

10000/168=59.5 r/hour

Salary for holidays - 59.5 * 24 * 2 = 2856 rubles (since on holidays there is double payment, we multiply the cost of one hour determined above by 24 holidays worked, and by 2).

The salary for night shifts will be 59.5*40*0.2=476 rubles (night shifts are calculated as 20% of the cost of each hour).