Types of taxation for individual entrepreneurs in 2020

Today in Russia the following types of taxation for individual entrepreneurs apply:

- The general taxation system (OSNO) is a taxation system with a high tax burden that can be applied to any type of activity;

- The simplified taxation system (STS) is the most popular tax regime, which minimizes the tax burden and allows you to save on deductions;

- The Unified Agricultural Tax (USAT) is a special tax regime that was created specifically for producers of agricultural products;

- Unified tax on imputed income for certain types of activities (UTII) is a taxation system with a fixed amount of tax payment;

- The patent taxation system (PTS) is a special taxation regime in which the simplified tax is paid in advance.

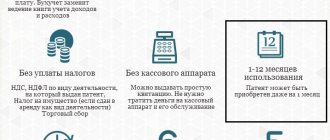

Entrepreneurial activity without cash register

If you do not use a cash register in your business activities, you may be interested in the following amendment. A law was adopted (Federal Law No. 337 of November 27, 2017) defining cases in which individual entrepreneurs applying these tax regimes can operate without using cash registers. Until July 1, 2020, the following categories of individual entrepreneurs can work without a cash register:

- the types of activities of which are listed in subparagraphs 1 - 5, 10 - 14 of paragraph 2 of Article 346.26 of Part Two of the Tax Code of the Russian Federation (pay a single tax on temporary income);

- whose types of activities are listed in subparagraphs 6 - 9 (retail trade and public catering) of paragraph 2 of Article 346.26 of Part Two of the Tax Code of the Russian Federation and do not have employees with employment contracts;

- the types of activities of which are listed in subparagraphs 1 - 15, 18 - 28, 30 - 44, 49 - 58, 60 - 63 of paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation (apply the patent taxation system);

- whose types of activities are listed in subparagraphs 45 - 48 (also retail trade and public catering) of paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation and do not have employees with employment contracts.

According to the amendments to the law, if entrepreneurs in the field of retail trade and public catering enter into an employment contract with employees, they are required to register a cash register within 30 days from the date of conclusion.

A separate clause in the law stipulates that the sale of tickets for matches of the 2020 FIFA World Cup, as well as documents giving the right to receive tickets, can be carried out without a cash register, subject to compliance with the forms approved by the government.

General taxation system for individual entrepreneurs

Conditions of use

In 2020, the use of the general taxation system is possible:

- By default (if the individual entrepreneur has not chosen a different tax regime within 30 days from the date of registration of the individual entrepreneur);

- If an individual entrepreneur does not have the right to work for the simplified tax system, unified agricultural tax, UTII or PSN.

Tax exemption

If the amount of revenue of an individual entrepreneur for the previous 3 months (quarter) does not exceed 2 million rubles, the entrepreneur is exempt from paying VAT.

Advantages of OSNO for individual entrepreneurs:

- Suitable for any type of activity ;

- There are no restrictions on profits ;

- Possibility of hiring any number of employees ;

- Possibility of renting any number of premises ;

Cons of OSNO for individual entrepreneurs:

- High tax burden ;

- Mandatory maintenance of tax and accounting records ;

- Strict requirements for document storage and reporting .

Innovations in taxation of individual entrepreneurs without employees for 2020

1) Since August 2020, a law has come into force according to which an individual entrepreneur who opened an enterprise in the period from December 1 to December 31 will report for the first tax period. The month of December will be included in the tax return of the next calendar year.

2) Individual entrepreneurs on the PSN now do not have to worry about the patent expiration (previously this led to an automatic transfer to the OSN): if the entrepreneur did not manage to renew the patent on time, he will not lose his right to use the PSN. But there is a penalty for late payment.

If it seems to you that filling out all the documents yourself is too difficult, or you do not want to waste time and understand the legal intricacies of filling out documents, but at the same time want to submit reports yourself, you can use automatic document preparation services.

Such services work like a questionnaire - all data is entered into special fields, and then the program inserts them into the necessary parts of statements, decisions/protocols and charters - that is, you can prepare the entire package of documents at once. One of the most famous such services on the Internet is the free resource “My Business” - www.moedelo.org

Simplified taxation system for individual entrepreneurs

Conditions of use

Application of the simplified tax system in 2020 is possible if:

- The number of hired employees of individual entrepreneurs does not exceed 100 people ;

- The income of an individual entrepreneur does not exceed 150 million rubles. ;

- The residual value of fixed assets of an individual entrepreneur does not exceed 150 million rubles.

Tax exemption

In 2020, individual entrepreneurs using the simplified taxation system are exempt from paying the following taxes:

- Personal income tax (in relation to income from business activities);

- Property tax for individuals (on property used in business activities);

- Value added tax.

Advantages of the simplified tax system for individual entrepreneurs:

- Reduced tax burden ;

- No obligation to maintain accounting records ;

- Opportunity to work with legal entities and government agencies ;

- Minimum reporting .

Disadvantages of the simplified tax system for individual entrepreneurs:

- Limited number of permitted activities ;

- With high incomes, the amount of tax paid increases .

INSTRUCTIONS FOR COMPLETING A TAX RETURN ACCORDING TO THE STS

Individual entrepreneurs using the simplified tax system choose the object of taxation - “income” (6%) or “income minus expenses” (15%). 6% and 15% are the maximum tax rates for the simplified system. Since 2015, local authorities have independently decided on the size of tax rates. Based on this, the tax must be calculated based on the rates in force in your region. The procedure for filling out a tax return also depends on the chosen object of taxation.

Let's look at how an individual entrepreneur's tax return is filled out under the simplified tax system in 2018 for 2020, depending on the selected taxation object.

When using the simplified tax system for income, you must fill out and submit the following declaration sheets - “Title Sheet”, sections: 1.1, 2.1.1 and 2.1.2 (upon payment of the trade fee).

When using the simplified tax system – income minus expenses, you need to fill out and submit: “Title Page”, section 1.2 and 2.2.

Section 3 is filled out by those taxpayers of the simplified tax system who have targeted funding.

The peculiarity when filling out the columns with advance payments is that they must record the amounts due for payment in each reporting period, and not the amounts actually paid.

First, section 2 is filled in, and then section 1.

State registration of an individual as an individual entrepreneur is carried out with the tax authority at the place of his residence, that is, at the place of registration indicated in the passport. An individual entrepreneur can conduct its activities throughout the entire territory of Russia. You can find out the address, work schedule and telephone numbers of your tax office using the service “Determining the details of the Federal Tax Service”.

Unified agricultural tax for individual entrepreneurs

Conditions of use

In 2020, the Unified Agricultural Tax can be used by:

- Individual entrepreneurs producing agricultural products (that is, crop products, agriculture and forestry, livestock, and so on);

- Individual entrepreneurs engaged in fishing of aquatic biological resources;

- Individual entrepreneurs providing services to agricultural producers in the field of crop and livestock production.

Note! The share of income from the sale of the listed services must be at least 70%.

Tax exemption

Individual entrepreneurs on the Unified Agricultural Tax are exempt from paying the following taxes:

- Personal income tax (in relation to income from business activities);

- Property tax for individuals (on property used in business activities);

- Value added tax.

Advantages of Unified Agricultural Tax for individual entrepreneurs:

- Simplified accounting ;

- Possibility of combining with other tax regimes ;

- Minimum reporting .

Disadvantages of Unified Agricultural Tax for individual entrepreneurs:

- Responsibility for maintaining full accounting records .

Single tax on imputed income for individual entrepreneurs

Conditions of use

A complete list of activities for which an individual entrepreneur can use UTII can be found in paragraph 2 of Art. 346.26 Tax Code of the Russian Federation.

Tax exemption

In 2020, individual entrepreneurs using UTII are exempt from paying the following taxes:

- Personal income tax (in relation to income from business activities subject to a single tax);

- Property tax for individuals (on property used in business activities subject to a single tax);

- Value added tax.

Advantages of UTII for individual entrepreneurs:

- Fixed tax amount ;

- Possibility to reduce the amount of tax by 50% of paid insurance premiums for employees;

- Simple accounting and tax accounting .

Disadvantages of UTII for individual entrepreneurs:

- The obligation to pay a fixed tax even in the absence of income ;

- Restrictions on types of activities ;

- Linked to the size of the rented area .

What income should be taken into account to determine the right to reduced tariffs under the simplified tax system?

Payers on the simplified tax system can pay contributions at reduced rates if the following inequality is observed (clause 6 of article 427 of the Tax Code of the Russian Federation):

Income from the type of activity from paragraphs. 5 p. 1 art. 427 Tax Code of the Russian Federation / Total income ≥ 70 %

Law No. 335-FZ clarified exactly what income must be taken into account when determining these indicators. Changes in paragraph 6 of Article 427 of the Tax Code of the Russian Federation came into force on November 27, 2017 and apply to legal relations that arose from January 1, 2017 (clause “c” of paragraph 76 of Article 2, Part 9 of Article 9 of Law No. 335-FZ) .

Now the Tax Code states that in total income the following must be taken into account:

- income from sales;

- non-operating income;

- income listed in Article 251 of the Tax Code of the Russian Federation (despite the fact that they do not increase the base under the simplified tax system). For example, this is targeted financing and targeted revenues.

As for income from “preferential” activities (the numerator of the formula), according to the amendments, when determining it, income related to the implementation of such activities is taken into account.

From this formulation it is not entirely clear whether it is necessary to take into account amounts not subject to the single tax? In our opinion, it is necessary.

However, it is possible that the tax authorities will think differently and will adhere to the position that amounts not subject to a single tax under the simplified tax system should be taken into account only when determining the total amount of income.

Disputes on this issue have been going on for a long time and are resolved, mainly, not in favor of the taxpayer. Until 2020, the courts sided with the regulatory authorities.

Unfortunately, Law No. 335-FZ did not solve this problem. We believe that in order to avoid claims from tax authorities, it is more advisable for payers to take into account amounts not taxed under the simplified tax system when determining only the total amount of income.

Patent taxation system for individual entrepreneurs

Conditions of use

In 2020, the right to use the patent taxation system is available to entrepreneurs whose average number of employees does not exceed 15 people.

Note! A complete list of activities for which PSN can be applied is listed in the relevant law of your constituent entity of the Russian Federation.

Tax exemption

Individual entrepreneurs on PSN are exempt from paying the following taxes:

- Personal income tax (in relation to income from business activities, in respect of which the patent tax system is applied);

- Property tax for individuals (on property used in carrying out types of business activities in respect of which the patent taxation system is applied);

- Value added tax.

Advantages of PSN for individual entrepreneurs:

- Simple accounting reporting ;

- The cost of a patent depends on the type of activity ;

- Exemption of an individual entrepreneur from a number of taxes ;

- Lack of strict requirements for storing documentation and reporting ;

Disadvantages of PSN for individual entrepreneurs:

- Limited list of activities ;

- Restrictions on the average number of employees .

IP services

To open an individual business, according to the law, you must register with the tax office and obtain a certificate of registration as an individual entrepreneur. A sample application form can be found at the place of registration. It should be understood that before completing documents at the tax office, you need to have with you ready-made documents on registration of individual entrepreneur services.

Individual entrepreneur for various types of activities

The procedure for registering an individual entrepreneurship is the same for most types of activity, be it an individual entrepreneur for a store, an individual entrepreneur for cargo transportation, or an individual entrepreneur providing other types of services. However, before you choose this particular organizational and legal form, you should outline its advantages.

What are the advantages of individual entrepreneurs for services?

1. Small number of reports compared to LLC.

2. You can write off all fees that an entrepreneur pays for himself. If a businessman works without employees, then the financial authorities of the Russian Federation pay his contributions.

3. When providing services, the amount of UTII, tax on the simplified tax system and OSNO is zero.

4. A businessman uses a reduced personal income tax rate of 13%.

5. Less penalties.

6. Registration costs are lower.

7. The package of documents for registration is not large.

8. The entrepreneur independently manages his income.

Where can I turn for help to open an individual entrepreneur for a store or an individual entrepreneur for cargo transportation? Although individual entrepreneurship is the most common form of doing business, future businessmen still have a lot of questions regarding registration. If something is unclear when collecting a package of documents for individual entrepreneur services or you have problems at the registration stage, you can get advice from a lawyer of our company absolutely free of charge. And if you have no desire to deal with the procedure yourself, then it is preferable to immediately arrange for experienced specialists to complete the package of documents for you.

Our company has extensive experience in registering various organizational and legal forms for business. The work is completed in the shortest possible time, and the cost of services is favorable, given the fact that, first of all, you save your time.

The process of starting your own business is not only a business plan, investments, working with people, finding clients and suppliers, but also legal issues. One of them is the procedure for registering individual entrepreneurs. Without this, you can run a business, but it is unlikely that you will be able to continue for long enough: inspections will begin, and everything may end in fines. In addition, not all partners will agree to cooperate, and not all potential clients will want to contact a businessman who does not work officially.

Difficulties of self-registration of individual entrepreneurs

It is quite difficult for an unprepared person to officially register his entrepreneurial activity. Even those who do this not for the first time often get confused about the order of actions. Many businessmen like this option of registering an individual entrepreneur remotely, since it does not require personal participation and almost completely frees you from queues, paperwork and personal study of the topic. This is doubly convenient for beginners. As an example, you can evaluate what those who decide to do everything themselves have to go through.

Initially, there is a need to understand all the intricacies. And there are two ways.

1. Do everything yourself. A person opens the Internet and... is faced with the fact that articles and advice contradict each other, and it is unclear who to believe and what to do first.

2. Go directly to the Federal Tax Service office and find out the procedure there. But even here people are faced with a common practice in our country: employees simply do not have time for them. Therefore, their instructions are unclear, very brief and often also contradictory. The result is a lot of wasted time.

This could be simplified if online sole proprietor registration was chosen. But for many, initial difficulties do not stop them. And now the entrepreneur goes around all the authorities that he was advised to visit, collecting the necessary pieces of paper. But here it turns out that the chosen visiting order is not the right one. And walking from one organization to another and back begins... as a result, the process drags on, and the businessman goes through long lines one after another, the business itself stands idle, but could already be generating income.

Advantages of remote registration of individual entrepreneurs

If you choose to register an individual entrepreneur electronically, time is saved significantly, and the procedure for the entrepreneur is simplified significantly. This is why most people starting their own business today choose this option. And those who have already done everything on their own at least once no longer want to repeat it and immediately choose the remote approach. You can get help from us at any stage of registration. Just contact our company with your task!

Key changes to tax legislation in 2018

The following changes await us in 2020:

- The final transition to new online cash registers from July 1, 2020;

- The emergence of a tax deduction for the purchase of new cash registers for individual entrepreneurs on PSN and UTII;

- Extension of the validity period of UTII until 2021;

- Translation of all strict reporting forms (SRF) into electronic format ;

- Determination of fixed contributions for individual entrepreneurs from January 1, 2020: contributions for pension insurance will amount to 26 thousand 545 rubles, for medical insurance - 5 thousand 840 rubles.

Individual entrepreneur contributions for himself

In order to provide citizens with pensions, free medical care, sick leave payments, and maternity benefits, insurance contributions from working citizens were introduced. Collections are carried out according to the following principle: all employers are obliged to calculate contributions from employee remuneration at approved rates.

The main distinguishing feature from income tax is the fact that the amount of contributions is not included in wages, but is calculated separately.

It is unacceptable to classify mandatory contributions for pension and health insurance as taxes, but they must be transferred to the budget regardless of the chosen form of taxation. Previously, control over contributions was carried out by funds (PFR, FFOSS), but now the administrative function is assigned to the tax authorities. The value of contributions is not tied to the minimum wage since 2020, but is fixed at a certain amount, regardless of the level of income received or economic indicators.

So, the following values are set:

- OPS - 26545 rubles;

- Compulsory medical insurance – 5840 rub.

This means that entrepreneurs in any case need to deduct 32,385 rubles. The exception is the situation when the income for the year exceeded 300 thousand rubles. If the total earnings are higher, you will have to deduct an additional 1% of the excess amount. For example, if the amount of income for the year is 1,000,000 rubles, then the amount of the additional contribution will be 7,000 rubles. (1000000-300000) x 1%.

Legislation allows you to reduce the amount of tax payment by the amount of contributions deducted by the entrepreneur for himself and his employees. Up to 100% in the first case and 50% in the second.

The amount of individual entrepreneur contributions for himself is the same for all categories of business entities. So, the meaning is the same for individual entrepreneurs working alone and those who are employers.