The set of taxes and fees required to be paid to the budget depends on the taxation regime applied by the entrepreneur. Which individual entrepreneur tax to choose in 2020 depends on many factors. Special regimes (UTII, PSN, simplified tax system, self-employment) help to minimize the fiscal burden, but their use imposes a number of restrictions on the entrepreneur – in terms of income level, in terms of areas of activity. In some cases, switching to a special tax regime may turn out to be more costly than using OSNO (for example, if the profitability of a business is low, paying tax calculated on imputed income is unprofitable - in this case, it is better to use regimes with accrual of obligations linked to actual income).

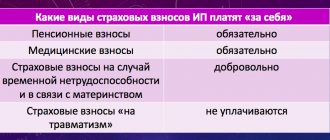

Regardless of the regime applied (except for “self-employment”), an individual entrepreneur is required to pay insurance premiums “for himself”, even if there is no income. Their fixed amount in 2020 is at least 36,238 rubles. (RUB 29,354 – Pension Fund, RUB 6,884 – Compulsory Medical Insurance Fund).

Raising payroll taxes

From January 1, 2020, the federal and regional minimum wage will increase. It will be the cost of living for the 2nd quarter of 2020. These are the requirements of the new minimum wage law. At the moment, the Government has not established a living wage for this period.

Therefore, wages will have to be raised, details in the article “Wage indexation: who should raise salaries and by how much, so that the labor inspector does not find fault.” This means that the tax burden will increase. After all, personal income tax (13% rate) and insurance premiums (30% rate) are paid from your salary.

From January 1, 2020, the maximum base for insurance premiums will increase by 10-15%. This is the salary for the year, from which contributions to the Pension Fund and Social Insurance Fund are paid. This means that businesses will pay more in contributions. Look at the article “Practical tips on how to apply amendments to contributions and personal income tax starting from the new year.”

Increase in personal income tax rate

On March 28, a draft law was submitted to the Duma to increase the personal income tax rate and introduce a progressive tax scale. And already on April 2, the State Duma Committee on Budget and Taxes proposed to accept the project for consideration by the State Duma.

The State Duma Committee on Budget and Taxes proposed accepting the bill for consideration. In the meantime, I have sent requests to the Federation Council, the President, the Government and interested departments to prepare a conclusion.

The bill proposes to establish a reduced personal income tax rate of 5% for citizens with incomes of less than 100 thousand rubles per year.

Those who earn from 100 thousand to 3 million rubles per year will pay tax at a rate of 13%.

If an employee receives from 3 to 10 million per year, the rate will be 18%. And for those who earn more than 10 million rubles. — 25%.

Currently there is a single personal income tax rate of 13% on all citizens’ incomes, regardless of their income level. You can learn more about rates from the article “Personal income tax rates in 2020 (table, changes).”

Urgent: Employers will not increase wages to compensate for the increase in personal income tax rates

Reduced contribution rate

The pension contribution rate will be fixed at 22%. This was announced by Finance Minister Anton Siluanov at a press conference following the Government meeting, at which it was announced that the VAT rate would be increased to 20% and the retirement age would be raised.

“ The Government of the Russian Federation proposes to fix on an indefinite basis the tariff of insurance contributions for compulsory pension insurance in the amount of 22% of the maximum value of the base for levying contributions and 10% above the maximum value ,” Siluanov said.

Siluanov recalled that the current rate of pension contributions under the Tax Code of the Russian Federation is 26%, but for the grace period until 2020 the rate has been reduced to 22%. This rate will be maintained after 2020, the minister said.

simplified tax system

The simplified taxation system is perfect for merchants who do not hire employees. The formulas here are simple and clear. The safest mode would be a 6% rate. The single tax will need to be calculated based on data on all receipts in favor of the payer.

Let's look at the order using an example. Over the course of a year, the entrepreneur received 1,500,000 rubles into his bank account from buyers and customers. Cash revenue for services rendered amounted to another 356,000. In addition, under one of the commercial contracts, payment was made in kind. The customer paid off a debt of 800,000 rubles with a passenger car. The cost of the car was confirmed by a report from an independent appraiser.

The calculation will look like this: (1,500,000 + 356,000 + 800,000) ×6%=159,360 rubles.

Taxes for individual entrepreneurs using the simplified tax system are reduced by fixed insurance premiums actually transferred to extra-budgetary funds. They will be discussed below.

If commercial activity involves numerous costs, you should pay attention to another simplified regime option. When choosing net profit as the object of taxation, the businessman switches to a rate of 15%. The list of costs that are allowed to be taken into account when calculating the tax base is given in Article 346.16 of the Tax Code of the Russian Federation. The conditions for accepting expenses are documentary confirmation and justification.

Important! Costs must be aimed at ensuring economic activity and comply with the principles of sufficiency, expediency and objective necessity. Excessive or thoughtless expenses are excluded from calculations by regulatory authorities, which leads to the formation of arrears.

Let's give an example. A businessman using the simplified tax system with a rate of 15% received an annual income of 3,500,000 rubles. He paid 360,000 for office rent, spent 32,000 on office supplies, and purchased furniture and equipment for 210,000 rubles. The accounting book also included expenses for business trips in the amount of 800,000 and advertising in the amount of 700,000 in domestic currency.

Formally, the calculation of the taxable base should look like this:

3500,000- (360,000+32,000+210,000+800,000+700,000) = 1,398,000 rubles.

The tax will be: 1,398,000 ×15%=209,700 rubles.

However, in practice, such a calculation will raise reasonable doubts among inspectors. The costs of non-material services exceeded the costs of running the business. During the audit, primary reporting on these costs will be subjected to a comprehensive analysis. If the auditors come to the conclusion that expenses are excessive or transactions are fictitious, they will be excluded from the calculation.

Increase in VAT rate

It is already known for sure that from January 1, 2020, the VAT rate will increase from 18 to 20%. The preferential rate on children's and socially significant goods will remain at 10%. See the list of socially significant products.

The announced increase in VAT from 18 to 20% will not affect small businesses. This is due to the fact that small businesses on the simplified tax system, UTII and patent do not pay VAT. This exemption is prescribed in the Tax Code.

Article 346.11 of the Tax Code of the Russian Federation, paragraph 2 The application of a simplified system of taxation by organizations provides for their exemption from the obligation to pay corporate income tax..., corporate property tax. Organizations applying the simplified taxation system are not recognized as taxpayers of value added tax , with the exception of value added tax payable in accordance with this Code when importing goods into the territory of the Russian Federation and other territories under its jurisdiction (including tax amounts subject to payment upon completion of the customs procedure of the free customs zone on the territory of the Special Economic Zone in the Kaliningrad Region), as well as value added tax paid in accordance with Articles 161 and 174.1 of this Code.

- In only 4 cases a small business must pay VAT in 2019

Businesses that currently operate on a common system are thinking about switching to a simplified system starting in 2020. This can be done if the number of employees is up to 100 people and the income for 9 months of 2018 is no more than 112 million rubles.

Simplified people, in addition to VAT benefits, have a number of other advantages. For example, periodical magazines cost less. And today our magazine “Simplified” gives 4 months for a 6-month subscription. Pay for six months, and read for 10 months!

Online cash registers

One of the main changes for individual entrepreneurs in the field of taxation will be the final stage of introducing online cash registers, the date of which is limited to July 1, 2020. They should become a replacement for cash registers, except that all transactions carried out will be regulated via the Internet, and their data (sender and recipient of payment, amount) will be automatically transmitted to the tax authorities. All entrepreneurs working under the patent system or UTII are required to install online cash registers.

In this case, you should know that:

- If there are no employees, online cash registers may not be installed until July 2020.

- For individual entrepreneurs working in the field of trade or public catering and having employees, a deferment is not provided. Although this right is granted in the absence of hired personnel.

- For individual entrepreneurs involved in trading activities or catering that hire their first employee, the use of the online cash register should begin no later than 30 days after signing an employment contract with him.

- For individual entrepreneurs engaged in trading through machines (vending activities) and do not have employees, the deadline for installing an online cash register has been postponed until July 1, 2020.

The state offers entrepreneurs a tax deduction in the amount of 18,000 rubles. to compensate for the costs associated with the implementation of an online cash register: the purchase of the device itself, a fiscal drive, software and payment for work on setting up new equipment.

Time frame for transition to product labeling

We will announce the deadlines by which all entrepreneurs must switch to mandatory labeling of the following goods:

- Starting from March 1, 2020 – all tobacco products:

- From July 1, 2020 – footwear products;

- From December 1, 2020 - all outerwear, knitwear blouses, leather goods in the wardrobe, home textiles, rubber tires, cameras, perfume.

Violators will be fined from 10,000 to 30,000 rubles for late marking.

In addition, from July 1, 2020, individual entrepreneurs are required to provide a cash receipt for UTII and PSN working in the catering industry.

Increase in excise taxes in 2020

From January 1, 2020, excise taxes on excisable goods will increase by 10%. Excise taxes on alcohol and cigarettes will increase especially significantly.

But the most significant increase concerns fuel rates, since almost all business is related to transportation. And the higher the excise tax rate, the higher the final prices.

Let us remind you that in 2020 there is a sharp increase in gasoline prices. Therefore, the Government decided to roll back the planned increase in excise taxes, which was scheduled for July 1, 2020 (excise taxes are raised twice a year). That is why, most likely, from January 1, 2019, there will also be an adjustment to the Tax Code of the Russian Federation in terms of excise taxes on fuel, but this time in a larger direction, in order to win back losses. Let us remind you that excise tax rates are established in the Tax Code of the Russian Federation until 2020 inclusive, with an increase. And the authorities will continue to correct them.

Cancellation of property taxes in 2020

On January 1, 2020, the Russian authorities introduced a tax on movable property. Organizations must pay tax at a rate of 1.1%.

Now the authorities have decided to completely abolish the tax on movable property. This became known following a meeting of the Government of the Russian Federation. The changes will take effect on January 1, 2020.

“ It is proposed to abolish the tax on movable property, which is difficult for business and disincentives for investment. We hope that they (tax decisions) will be adopted by parliament in the spring session ,” said Finance Minister Anton Siluanov.

Businesses that currently operate on a common system are thinking about switching to a simplified system starting in 2020. This can be done if the number of employees is up to 100 people and the income for 9 months of 2018 is no more than 112 million rubles.

Growth of UTII since 2020

From January 1, 2020, the UTII rate was increased by 4 percent. The tax was increased by order of the Ministry of Economic Development dated October 30, 2017 No. 579. This was the first increase in three years.

The tax calculation involves an inflation coefficient called K 1. In 2014-2016, this coefficient was not raised. It was 1.798.

And for the first time in three years, the authorities increased K1 - in 2020 it was 1.868. Knowing this, it is not difficult to calculate that from 2020, tax collectors will pay UTII almost 4% more than in 2017.

Approximately the same increase is expected in 2020 for UTII.

What changes to expect in the near future

Improvement of legal regulation continues. New laws may be adopted in 2019.

| Expected amendments | Expert commentary |

| Refusal to submit financial statements to Rosstat | Law No. 447 of November 28, 2018 was signed by the President of Russia and published on the state portal. However, the rules come into force only from January 2020 |

| Cancellation of a declaration under the simplified tax system | The corresponding project was developed by specialists from the Russian Ministry of Finance. It is planned that simplified tax payers who use online cash registers will be exempt from the need to submit reports. Entrepreneurs who have chosen gross revenue as the object of taxation will be able to take advantage of the benefit. |

| New form for calculating insurance premiums | Employers will begin reporting using the form after the order of the Federal Tax Service of the Russian Federation comes into force. The regulation number has not yet been assigned. Order No. ММВ-7-11/ [email protected] will cease to apply |

| Tougher penalties for late wages | For violation of deadlines for transferring money, hired employees will have to answer to the fullest extent. Unscrupulous employers will continue to be punished under Art. 5.27 Code of Administrative Offenses of the Russian Federation. At the federal level, a bill to exclude warnings from the list of sanctions is being considered. All culprits will pay a fine |

| Replacing the salary bank at the initiative of the employee | Article 136 of the Labor Code of the Russian Federation allows 5 days for consideration of an employee’s application. This period has not changed in 2020. However, you should be prepared for edits. The issue of increasing the period by 3 times has practically been resolved. The bill successfully passed public hearings and received positive expert opinions. After approval at the government meeting, the document will be submitted to the State Duma of the Russian Federation |

In conclusion, let us remind you about the project to convert work books into electronic format. The idea will begin to be implemented in 2019–2020. They plan to continue discussing the progressive personal income tax rate. Lawyers recommend that businessmen closely follow the news. This approach will allow you to prepare for any changes.