Who will pay the environmental tax?

It applies to organizations and individuals, including individual entrepreneurs, engaged in economic and other activities in Russia that cause harm to the environment.

For reference! Initially, a new environmental tax was planned from January 1, 2020. Then the project provided for its introduction a year later. The transition period is considered until January 1, 2021.

In practice, this means that tax will have to be paid by everyone who generates waste. An exception is made for municipal solid waste (MSW). For their disposal, the population pays a fee to regional operators. But they will be charged a tax to the state budget.

In addition, environmental tax should not be paid by business entities, as well as individuals whose activities:

- Does not pollute the environment, they are not registered with environmental agencies, for example, with Rosprirodnadzor;

- Implemented at IV category facilities;

- Generates exclusively MSW.

The indicated IV category must be documented. To do this, you must obtain a certificate of registration.

Territorial tax authorities independently register all business entities that are subject to environmental taxation. Entrepreneurs do not need to further deal with this issue, go and submit applications to the Federal Tax Service.

The tax is new, environmental. From 2020

From January 1, 2020, the Tax Code will be supplemented with a new tax - environmental tax. The explanatory note to the bill states that the level of tax burden for bona fide taxpayers will remain at the same level. But life shows that he will improve. In this article, we will figure out what to prepare for now, and how not to become a taxpayer of an environmental tax with negative consequences.

The new bill practically duplicates the existing Art. 16 Federal Law of January 10, 2002 N 7-FZ “On Environmental Protection” in terms of payment for negative environmental impact (NVOS): taxpayers, the object of taxation, the tax base, rates and coefficients, and the tax period remain unchanged. Where does the increase in tax burden come from?

According to the Board of the Accounts Chamber for 2020, the execution of federal budget revenues administered by Rosprirodnazor amounted to 3.8 billion rubles, or 44.2% of the initial forecast.

It was recognized that Rosprirodnadzor collects money into the budget poorly. According to the “Main Directions of Budget, Tax and Customs Tariff Policy for 2020 and the Planning Period of 2020 and 2021”, the administration of insurance premiums by the Federal Tax Service led to an increase in their receipts by 7.2% (or 455.7 billion rubles) compared to 2016 year, while the growth rate of revenues outpaced the growth rate of average wages. Thus, the choice of the payment collector is predetermined - the Federal Tax Service, which demonstrates a constant increase in budget revenues. Rosprirodnadzor, however, tried to point out that if the environmental tax is collected by the Federal Tax Service, then it certainly will not go to nature, but the instrumental weight of Rosprirodnadzor is not even close to that of the tax authorities.

We will tell you how to maintain business margins and minimize the negative factors of VAT growth at our unique seminar “Business in an era of change: real tax optimization”, which will be held on September 27-28 in Moscow, in an expanded format, but closed mode without photos and videos. .

Now it is necessary to turn to theory, which is important for further understanding of the problem. Art. 4.2 of the Law “On Environmental Protection” subdivides NVOS objects depending on the level of such impact into four categories: 1 - significant, 2 - moderate, 3 - insignificant and 4 - minimal. Categories are determined on the basis of Government Decree No. 1029 of September 28, 2020, in particular, to be assigned to category 4, the presence of stationary sources of environmental pollution at the site is required. If they are not there, there is no fee for the NVOS, this is, in particular, stated in the Letter of Rosprirodnadzor dated October 31, 2016 No. AS-09-00-36/22354: “It should be noted that the presence of stationary emission sources at the site is a mandatory feature category IV NVOS facility... if there are no stationary sources of emissions at the facility, such an object is not subject to registration as an NVOS facility.”

This position is correct if the facility generates production and consumption waste, but there are no other types of negative impact on the environment. Such an object is not subject to registration as an object that has a negative impact on the environment (it is not included in the state register of objects, an application for registration is not submitted) - Letter of Rosprirodnadzor dated March 20, 2017 N ВС-06-02-29/5525 “On payment for negative impact on the environment.”

Clause 1 of Article 1 of the chapter “Environmental Tax” defines taxpayers as organizations and individual entrepreneurs carrying out activities that, in accordance with the legislation of the Russian Federation in the field of environmental protection, have a negative impact on the environment.

In the absence of criteria for an NVOS object, organizations and individual entrepreneurs are not taxpayers (for example, freight vehicles are not stationary sources of emissions and are not objects of NVOS). Clause 2 of the same article indicates that organizations and individual entrepreneurs carrying out activities at objects of category 4 are not taxpayers, subject to confirmation by an appropriate certificate of registration.

This raises several problems:

1. It is necessary to determine whether the object provides NVOS.

2. If yes, obtain a certificate of registration of a category 4 object.

According to data received through the portal of Rosprirodnadzor “PTO UONVOS”, currently 91,223 objects are registered in the federal register of NVOS objects, in the regional - 158,805, for a total of 250,028 objects that have a negative impact on the environment. 134,807 objects were submitted but rejected by Rosprirodnadzor as not meeting the criteria of the NVOS.

Responsibility for failure to state the object of the NVOS is provided for in Art. 8.46 Code of Administrative Offenses of the Russian Federation (from 30 to 100 thousand rubles). From 2020, liability will already arise under clause 2 of Article 116 of the Tax Code of the Russian Federation: conducting activities by an organization or individual entrepreneur without registration with the tax authority on grounds. Sanction - a fine of 10% of the income received during the specified time as a result of such activity, but not less than 40 thousand rubles.

It is difficult to say how many objects have not been registered, but, for example, in December 2020, courts of general jurisdiction considered 37 cases under Art. 8.46 Code of Administrative Offenses of the Russian Federation. All decisions were made in favor of Rosprirodnadzor (in the overwhelming majority it was a fine of 30 thousand rubles). Let us note that if Rosprirodnadzor kept records of NVOS facilities, then tax authorities will keep records of taxpayers providing NVOS.

According to paragraph 2, part 1, article 16.1 of Law No. 7-FZ, payers of fees for waste disposal when disposing of waste, with the exception of solid municipal waste, are legal entities and individual entrepreneurs whose economic and (or) other activities generated waste. The same provision is contained in Article 1 of the Environmental Tax chapter.

Clause 2 Art. 3.1. Chapter “Environmental Tax” defines the tax base as the volume or mass of production and consumption waste actually generated and disposed of, minus the mass of waste actually used or sent for recycling.

In judicial practice, there are still disputes regarding the determination of the volume of waste and its exceeding established limits: for example, on August 1, 2018, the Court of Justice of the Republic of Tatarstan made a decision in case No. A65-41566/2017, which is interesting for its typicality. Rosprirodnadzor appealed to the Arbitration Court with an application to the LLC to recover 1,911,520 rubles. 04 kop. fees for NVOS for 2014. During the inspection, it was revealed that the company disposed of waste at landfills in a larger volume than indicated by the organization in the report for the disputed period. The defendant tried to argue that Rosprirodnadzor did not prove that the company had waste in the specified volume, moreover, the company is not the owner of the waste and, as a result, the person obligated to pay for the NVOS, since it transferred the waste to a specialized organization for disposal at the landfill.

The court’s conclusions are interesting and can easily be applied to tax disputes after 2020: the fact that the amount of construction material purchased by the company does not correspond to the amount of waste subsequently disposed of does not refute the authenticity of acts of waste transfer to a third party. For the purposes of the Law, the quantity of available construction materials is not of decisive importance, nor is the establishment of a cause-and-effect relationship between the number of objects built by the company and the mass of waste generated as a result of such construction. Key importance is attached to the amount of disposed waste, which in the case under consideration is confirmed by the acts of the company itself, drawn up within the framework of contractual relations with a third party.

In addition, the waste was transferred to a specialized organization under a contract for the provision of waste collection services for the purpose of its further disposal. The said agreement does not contain any conditions for the transfer of waste into the ownership of a third party. In this regard, the acceptance of waste by a third party for its further transportation and transfer for disposal does not entail the transfer of ownership of it to a third party, which means that payment for the NWOS must be made by its owner.

True, Rosprirodnadzor was unable to prove that the resulting difference in waste represents broken concrete products and the calculation of fees based on the highest density of waste turned out to be unfounded and incorrect. The organization was charged 594 thousand rubles.

It is easy to imagine that if the plaintiff were not Rosprirodnadzor, but the Federal Tax Service, the subject of the dispute would not be limited only to the volume and density of unaccounted for waste; in particular, questions could be raised about the purchase of building materials, the validity of the costs of their transportation, the discrepancy between the volumes of waste and the purchased materials etc. But even if the organization turned out to be crystal clear, and the violations were limited only to the environmental tax, fines and penalties would be added.

In general, the chapter “Environmental tax” is dotted with reference norms to environmental legislation, which gives the state the opportunity in the future, without changing the provisions of the Tax Code of the Russian Federation and “without increasing” the tax burden, to make changes to environmental legislation (at the level of Government Resolutions), tightening the requirements for environmental assessments, production environmental control, list of pollutants, etc. The issue of qualifications of Federal Tax Service employees when checking the correctness of the calculation of environmental tax, implantation of environmental tax into automated control systems of the Federal Tax Service, etc. remains open.

Of course, nature must be protected, and the negative effect of the environmental tax does not even come close to the effect of an increase in VAT to 20%, but in combination with a decrease in the purchasing power of the population and rising inflation, multiplied by the strengthening of the fiscal function of the Federal Tax Service - business (primarily production and construction) will receive an additional increase in the tax burden.

We talk in detail about the environmental tax, VAT 20%, as well as legal ways to optimize taxation at an extended closed seminar on September 27-28, 2020 in Moscow. Come!

What is considered the object of taxation?

All enterprises that cause damage to the environment are recognized as objects of taxation.

Such an object is recognized as environmental pollution that occurred as a result of:

- Emissions of pollutants into the atmosphere;

- Discharge of wastewater into bodies of water if it contains pollutants;

- Generation and handling of hazard class IV waste.

Environmental pollution is excluded from taxation if:

- Activities are financed by the state budget of any level;

- Waste is generated at facilities that do not harm nature;

- Waste after waste accumulation is disposed of within 11 months from the date of generation.

In the second case, an official conclusion will be required. This will require an examination, coordination with the local environmental agency, and obtaining appropriate documentary evidence from it.

Liability for non-payment of environmental fees

If an entrepreneur fails to pay the fee on time, he receives a demand for voluntary repayment of the debt. If within a month from the date of receipt of the demand it is not fulfilled, the amount is recovered through the court (Resolution dated October 8, 2015 No. 1073). For a negligent payer, the following liability is provided for failure to submit reports on time or distortion of information in them:

- Administrative. Provided for in Article 8.5 of the Code of Administrative Offenses of the Russian Federation. The fine for individual entrepreneurs and officials will be 3,000-6,000 rubles, for legal entities - 20,000-80,000 rubles.

- Based on 19 . Article 7 of the Code of Administrative Offenses of the Russian Federation. For officials and individual entrepreneurs, the fine will be 300-500 rubles, for legal entities – 3,000-5,000 rubles.

The law does not currently provide for a fine for non-payment of the fee. All financial issues are resolved through the court. If the judicial authority decides to oblige the entrepreneur to pay the ES, but no payments are received, a forced recovery is made. It can threaten to slow down financial processes in the company, and therefore the debt should be repaid in advance.

What is the basis for calculating environmental tax?

At each economic entity, a calculation is made of the volume of emissions that pollute the environment, as well as the waste generated and disposed of. The data is entered into the appropriate strict reporting journals. It is these volumes of polluting waste that will become the basis from which fiscal payments will be calculated and withheld.

In this case, the mass that is sent for processing and disposal will be subtracted from the volume of waste generated. This makes it possible for business entities to reduce the tax base through the prompt disposal of hazardous waste and emissions.

In addition, it should be taken into account that environmental tax rates have increased significantly when compared with the environmental fee. For example, for dioxins they amount to 13.4 billion rubles. for 1 ton.

Already in 2021, environmental tax rates will be regularly adjusted. They will be multiplied by a coefficient that takes into account changes in the consumer cost of goods in the country.

Coefficient 2 is also applied when calculating the amount of the fiscal fee if the enterprise’s activities are carried out in a territory protected by law. The coefficient also changes if the enterprise takes measures to reduce environmental pollution. According to the Legislator, this will stimulate the acceleration of the introduction of treatment technologies.

Who is required to report on the environmental fee?

The entire list of goods that must be disposed of in a certain percentage of the produced/imported quantity is listed in the above decree. In addition to the product itself, the packaging of this product, as well as the product in this packaging, must also be recycled. If previously the issue with packaging (the obligation to dispose of it) was not yet clear, now Rosprirodnadzor has a clear position on this issue: the manufacturer/importer is obliged to ensure recycling.

Why are these particular types of goods indicated in the Resolution?

When compiling this document, Rosprirodnadzor took into account only those goods and groups of goods for which the country already has the capacity to ensure their recycling. This innovation was aimed at reducing the amount of waste in the country and developing the waste management industry.

Who is required to pay the environmental fee?

If a company produces or imports goods specified in Decree 1886-r and does not ensure disposal according to the criteria specified in this resolution, then in this case an environmental fee must be calculated and paid. Standards and rates, as well as calculation rules, are all specified in the same Resolution.

How to calculate and pay environmental tax?

The period for paying environmental tax is 1 year.

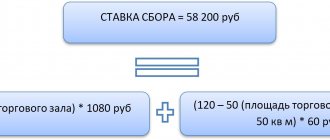

The period for paying environmental tax is 1 year. Its size is calculated for each object by multiplying the tax base, the stipulated rate and the corresponding coefficients. The results obtained for each object are summarized.

The legislator obliges to make advance payments for the environmental tax during the year. Subjects using special regimes are exempt from this obligation. Advance payments are made quarterly in the amount of 25% of the tax paid for the previous period. At the end of the period, the difference in fiscal tax between the periods (current and previous) is paid additionally.

The amount of tax can be reduced by the amount of costs incurred in connection with activities aimed at reducing the harmful impact on the environment. These expenses must be documented.

What does environmental tax reporting look like?

The rules by which environmental fees should be collected are described in Resolution 1073 of December 8, 2018.

In order to fully report on the environmental fee, 3 types of reports should be compiled and sent to Rosprirodnadzor:

- 1. Declaration of the quantity of goods and packaging that were put into circulation during the previous year (Decree 1417 of 12/24/15)

- 2. Report on how recycling standards have been met (Resolution No. 1342 of 12/08/15)

- 3. Calculation form for the amount for the environmental fee. (Order of Rosprirodnadzor No. 488 dated 08.22.16)

All 3 types of reports should also be submitted according to certain rules:

- 1. To Rosprirodnadzor at the place of activity - if you are a manufacturer of goods

- 2. To the central office of Rosprirodnadzor (Moscow) - if you are an importer of goods

- 3. To the central office of Rosprirodnadzor - if you are both an importer and a manufacturer

The deadline for submitting reports is until April 1st The deadline for paying the fee for environmental fees is until April 15th

Responsibility for non-compliance with the requirements of the environmental fee.

The current Code of Administrative Offenses does not yet provide for an article on non-payment of environmental fees. But Rosprirodnadzor has leverage over enterprises in resolving the issue of collecting arrears of payments, such as:

- 1. A claim for payment of an environmental fee on a voluntary basis is sent to the organization with subsequent submission to the court.

- 2. Failure to report on environmental fees may result in prosecution under Article 8.5. Fine up to 80,000 rubles.

Who doesn't pay the environmental fee?

Those organizations that produce/import goods not specified in Resolution 1886-r, if the standards for disposal of goods specified in Resolution 2491-r are met. If goods from the list are exported outside the Russian Federation.

To avoid possible fines and easily report for the environmental fee, order this service from. The cost of 3 reports for the environmental fee in our company is from 12,000 rubles.

Send a request to our email and we will prepare all the necessary reports for you quickly and efficiently.

Fine for non-payment of eco-tax

If the tax is not paid, a fine is imposed on the business entity:

- In the amount of 20% of the unpaid amount - for unintentional delay;

- In the amount of 40% of the unpaid amount - for intentional actions. A penalty is also charged.

If the amount of late paid fiscal fees exceeded 5 million rubles. within 3 years, the perpetrators are brought to criminal liability. The amount of the penalty is 1/300 of the Central Bank refinancing rate for each day the debt exists.

Waste reporting for SMEs in 2020

9 years have already passed since this reporting was introduced for small and medium-sized businesses. It was submitted annually by January 15 and was called “Report on the generation, use, disposal and disposal of waste by small and medium-sized businesses.” The procedure and form for submitting a report for SMEs operating NDC facilities related to the federal level of environmental supervision in accordance with Resolution No. 903 of 08/28/15 was regulated by Order of the Ministry of Natural Resources of the Russian Federation dated 02/16/2010 N 30. For facilities at the regional level of supervision, forms and the order was established by local authorities. After the changes came into force last year, it was not clear whether it was necessary to submit these reports for 2020. Let’s look at the requirements of the law:

Federal Law dated June 24, 1998 N 89-FZ (as amended on August 2, 2019) “On production and consumption waste”

Article 18. Standardization in the field of waste management

[…]

3. For legal entities or individual entrepreneurs carrying out economic and (or) other activities at category I facilities, determined in accordance with legislation in the field of environmental protection, waste generation standards and limits on their disposal are established on the basis of a comprehensive environmental permit provided for by law in the field of environmental protection.

4. Legal entities and individual entrepreneurs carrying out economic and (or) other activities at objects of category II, defined in accordance with legislation in the field of environmental protection, include information on the volume or mass of waste generated and disposed of in the environmental impact declaration in accordance with environmental legislation.

5. Legal entities and individual entrepreneurs carrying out economic and (or) other activities at objects of category III, determined in accordance with legislation in the field of environmental protection, submit to the federal executive body authorized by the Government of the Russian Federation or the executive bodies of state power of the constituent entities of the Russian Federation in accordance with their competence, in a notification procedure, reporting on the generation, use, neutralization, and disposal of waste.

6. When carrying out economic and (or) other activities at objects of IV category, determined in accordance with legislation in the field of environmental protection, the development of waste generation standards and limits on their disposal and reporting on the generation, use, neutralization, and disposal of waste is not required.

[…]

These provisions came into force on January 1, 2020. Before this period, Article 18 stated that small and medium-sized businesses that generate waste must submit reports on the generation, disposal, neutralization and disposal of waste. Last year, the majority of SMEs submitted these reports. At the same time, the reporting form that enterprises operating category III facilities must submit, and which is specified in the law, was not established during 2019. In addition, according to the provisions of Federal Law No. 219-FZ, enterprises operating category III facilities will have to submit similar reports in the area of impact on atmospheric air, the form of which has also not been established today.

At the end of 2020, several enterprises sought clarification from authorized authorities regarding the need to submit reports for SMEs. The answers, as always, are vague. One of the responses to a request to the Ministry of Natural Resources of the Moscow Region nevertheless explained that the division into SMEs when considering waste management issues is no longer used; only the division depending on the category of NDC objects is applicable. In accordance with this, reporting of this kind should only be provided by enterprises operating category III NVD facilities. Thus, all other categories are exempt from this reporting, and for category III its form is not established. Most likely, reports will be accepted in the forms and in the order in which SME reports were accepted.

Get a waste license

Tax return: deadlines and features of submission

The tax return for environmental tax is sent to the tax authorities at the location of the taxpayer. Submission of a declaration on paper is excluded; only the electronic format and submission of the document through an electronic document management operator are taken into account.

Deadline: March 25 of the year following the expired tax period.

Calculate environmental impact fees and environmental fees using the online service.

To learn more

Form 2-TP (waste) sample 2020

One of the most stable types of reporting as a subject of environmental reporting 2020 this year also did not escape changes. Moreover, the form of the order changed twice in a year. That is, the first changes occurred with the release of the order by Rosstat Order No. 459 dated August 19, 2019, and 4 months later the new Rosstat Order No. 766 dated December 12, 2019. Thus, according to Order No. 459, not even one report, which clearly shows us the pace of change in environmental legislation.

The new form 2-TP (waste) comes into force from the 2019 report. It must be provided by the following persons:

- business entities operating in the field of industrial and consumer waste management;

- regional operators for the management of municipal solid waste (hereinafter referred to as MSW);

- MSW management operators.

Let us recall that previously this form was submitted by a wider range of people (comparison of three regulations regarding requirements for the range of persons):

| Order of August 10, 2020 N 529 | Order of Rosstat dated August 19, 2019 N 459 | Order of Rosstat dated December 12, 2019 N 766 |

| Federal statistical observation form N 2-TP (waste) “Information on the generation, processing, disposal, neutralization, transportation and disposal of production and consumption waste” is provided by legal entities and individual entrepreneurs engaged in the management of production and consumption waste (hereinafter referred to as respondents ). | 2. The form […] is provided by legal entities and individuals engaged in business activities without forming a legal entity (individual entrepreneurs), carrying out activities in the field of industrial and consumer waste management, regional operators for the management of municipal solid waste (hereinafter referred to as regional operators) , operators for handling municipal solid waste (hereinafter referred to as operators). Legal entities and individual entrepreneurs that are not classified as small and medium-sized businesses are examined on a continuous basis. Small and medium-sized businesses are surveyed on a sample basis. Selective statistical observations of the activities of small and medium-sized businesses are carried out in relation to small and medium-sized businesses engaged in processing, recycling, disposal, and disposal of waste. | 2. The form […] is provided by legal entities and individuals engaged in business activities without forming a legal entity (individual entrepreneurs), carrying out activities in the field of industrial and consumer waste management, regional operators for the management of municipal solid waste, operators for the management of solid municipal waste. Legal entities and individual entrepreneurs that are not classified as small and medium-sized businesses are examined on a continuous basis. The form is not provided by legal entities and individual entrepreneurs belonging to small and medium-sized businesses that generate only solid municipal waste weighing less than 0.1 tons, who have entered into an agreement with a regional operator and do not carry out activities in the field of industrial and consumer waste management (processing , recycling, neutralization, waste disposal). |

Thus, economic entities related to SMEs should not submit Form 2-TP (waste), provided that three conditions are simultaneously met for them:

- only MSW weighing less than 0.1 tons is generated;

- an agreement has been concluded with a regional operator for the management of MSW;

- There are no activities for processing, recycling, neutralization, or disposal of waste.

Form 2-TP (waste) must be submitted to the Rosprirodnadzor TO by February 1. In general, the differences in the new order are insignificant; for example, more detailed explanations have been given on the issue of who should fill out this or that section of the form and in what cases, and the form of some sections has changed.

Registration with tax authorities

Correct preparation of environmental tax reporting plays an important role. It represents a single declaration; there is no need to submit intermediate forms. The period within which it is provided coincides with the period of time established by law for the transfer of payment. The Federal Tax Service, located at the payer’s address, acts as the control body for document submission.

All data specified in the reporting documentation must receive official confirmation from the authorized territorial structure that functions in the field of environmental protection.

It is also worth taking into account the fact that the accrual and payment of environmental tax for 2020 is not carried out. The amendments will come into force exclusively on January 1, 2020. If by a certain point in time the taxpayer has incurred penalties, fines, arrears, they will be compensated in the classical manner.

Registration of a subject as a taxpayer is carried out at the address of his residence. This happens within 30 days from the date of registration with the state. The nuances of the procedure are subject to regulation by the Federal Tax Service.