New report form in 2020

This year you will have to prepare reports for 2020. The balance sheet form was approved by order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. This is a standard reporting structure that has not changed for several years.

IMPORTANT!

From 06/01/2019, a new balance sheet form was introduced according to OKUD 0710001. The form was approved by Order of the Ministry of Finance No. 61n dated 04/19/2019, it should be applied to reporting for 2019. Use the current form, otherwise inspectors will reject the report.

Form No. 1 of the balance sheet provides for two separate forms for preparation, but the rules for filling them out are no different.

The first document is a standard structure. The report on this form is filled out for founders and other users of information. The second balance sheet format has only one difference: the tabular part of the document is supplemented with line codes. The report is intended for submission of information to the territorial statistical office and other authorities. Check whether you have prepared the correct form for Rosstat and the tax authorities.

Who submits the balance sheet

All Russian organizations and official representative offices of foreign companies are required to report on their financial and economic situation for the reporting year. This is regulated by the Law “On Accounting” No. 402-FZ.

The law provides “indulgences” for certain categories of economic entities that have the right to keep accounting records in a simplified form. But regardless of the method of accounting, basic or simplified, Form No. 1 is mandatory for all economic entities - legal entities.

Sections of Form 1 of the Balance Sheet

The balance sheet is made up of assets and liabilities.

Let's look at the procedure for filling out Form 1 of the balance sheet .

The asset consists of 2 sections:

- The first lists non-current assets.

Data on fixed assets, intangible assets, financial investments for long periods (more than a year), etc. are entered here.

- The second indicates current assets.

All assets considered short are entered here. They mean the following indicators: “receivables”, whose repayment period does not exceed a year, inventories, financial investments for short periods (less than a year), etc.

The passive contains 3 sections:

- The first reflects capital and reserves.

This includes data on all types of company capital, which includes, for example, authorized capital, as well as profit before its distribution.

- The second reflects obligations that have a long period of fulfillment (long-term).

This includes all obligations with a maturity period exceeding 12 months.

- The third reflects obligations that have a short period of fulfillment (short-term).

This refers to obligations whose maturity does not exceed one year. This capacity usually includes various loans, business accounts payable, etc.

Each balance line corresponds to a specific code. All of them are listed in Appendix No. 4 to Order No. 66n.

When and where to submit reports

For 2020, prepare reports in Form No. 1 to several authorities at once: the Federal Tax Service and Rosstat - for all organizations, to the Ministry of Justice and (or) to the Ministry of Finance of Russia - for non-profit organizations and public sector employees. Upon additional request, accounting records are provided to the founders or owners of the company.

IMPORTANT!

The balance sheet must be submitted to the Tax Inspectorate and Rosstat for 2020 no later than 90 calendar days from the first day of the year following the reporting period. That is, no later than 03/31/2020.

If March 31st falls on a weekend, the transfer rule applies. This means that the deadline for submission is postponed to the first working Monday. But in 2020 the due date is working Tuesday.

For public sector organizations, different deadlines for submitting reports have been established, earlier ones. This information is communicated to institutions in the prescribed manner.

IMPORTANT!

Reporting submitted to the Ministry of Finance, the Ministry of Justice or the founder does not cancel the obligation to report to the Federal Tax Service and territorial statistical bodies within the specified time frame.

Sample balance sheet form 1

The form consists of a “header” and two tables: assets and liabilities. Let's fill in each part of the balance sheet sequentially.

Fill out the header:

At the top we indicate on what date the balance sheet is drawn up. We will give an example of the organization Confectioner LLC, which reports for the calendar year 2012.

Accordingly, the balance sheet date is December 31, 2012.

Next, we write the name of the organization, its individual code OKPO, INN, type of activity OKVED, approved by the classifier of statistical authorities.

In the line “organizational and legal form” we write LLC, “form of ownership” - private, also here you need to note the corresponding property codes: OKFS, OKOPF. For LLC - code 65. For private ownership, the corresponding code is 16.

All numerical entries in the balance sheet will be expressed in thousands; accordingly, in the “unit of measurement” line of the balance sheet we will indicate the code 384. For millions of rubles, the corresponding code will be 385.

In the last line of the “header” we indicate the legal address of the organization, that is, the address where it is officially registered.

We fill out the “Assets” table of the balance sheet:

This table consists of two sections: non-current assets and current assets. As mentioned above, to fill out Form 1 we will use the data from the balance sheet.

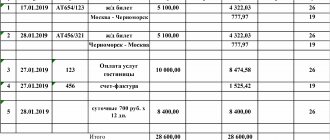

Opposite each type of asset (in the balance sheet these are called balance sheet items) the corresponding amount is written, rounded (for our case) to thousands of rubles. The first column indicates data as of the reporting date of the reporting period (for our sample, 12/31/2012), the second column shows data as of the end of the previous year (12/31/2011), and the third column shows data as of the end of the year preceding the previous one (12/31/2010). ).

Section I Non-current assets Form 1: (click to expand)

- intangible assets (1110): the residual value is indicated, obtained as the difference between the accounting value of intangible assets (debit 04 “Intangible assets) and accrued depreciation (credit 05 “Amortization of intangible assets”), the data from line 1120 is not taken into account here;

- research and development results (1120): data on completed research and development works (R&D), data for this article is taken from the account. 04 “Intangible assets” sub-account “R&D”;

- intangible and tangible exploration assets (1130-1140): data on search, exploration of mineral deposits, as well as on the equipment used for this.

- fixed assets (line 1150): we also indicate the residual value obtained as the difference between the accounting value of fixed assets (debit account 01 “Fixed Assets”) and accrued depreciation (credit account 02 “Depreciation”);

- profitable investments in tangible assets (1160): data on fixed assets accounted for in account 03 “Income-generating investments in tangible assets” are also determined by their residual value.

- financial investments (1170): the organization’s financial investments for a period of more than 12 months are indicated (composed of debit 58 “Financial investments” and debit 55 “Special accounts in banks” subaccount “Deposits”);

- deferred tax assets (1180): the balance of account 09 “Deferred tax assets” is taken;

- other non-current assets (1190): all other non-current assets that were not reflected in previous articles are indicated.

- Total for section I (1100): the values of lines 1110-1190 are summed up.

Section II Current assets form 1:

- inventories (1210): all inventories available to the enterprise are taken into account (data relating to materials, raw materials are taken: account 10 “Materials”, 15 “Procurement and acquisition of material assets”; related to production: 20 “Main production”, 21 “ Semi-finished products of own production", 23 "Auxiliary production", 28 "Defects in production", 29 "Service production and facilities"; relating to goods and finished products: 41 "Goods", 42 "Trade margin", 43 "Finished products", 44 “Sales expenses”, 45 “Goods shipped”, as well as 97 “Deferred expenses”;

- VAT on acquired assets (1220): the balance of account 19 “VAT on acquired assets” is indicated, that is, the VAT that was presented by suppliers but not accepted for deduction;

- accounts receivable (1230): the amount of debt of counterparties to the organization, data is taken from accounts that record relationships with various counterparties: suppliers (account 60), buyers (account 62), personnel (70, 71, 73), tax office and PF (68 and 69), founders (75), other counterparties (76);

- financial investments (1240): investments for a period of less than 12 months;

- cash and cash equivalents (1250): all funds of the enterprise in rubles (account balance 50 and 51), foreign currency (account balance 52), checks, letters of credit (account balance 55 for subaccounts “Checks”, “Letters of Credit”);

- other current assets (1260): all other current assets that are not reflected in the previous lines are indicated;

- total for section II (1200): the sum of the values of lines 1210-1260.

Balance (1600): the data of lines 1100, 1200 are summed up.

We fill out the “Liabilities” table of the balance sheet, form 1:

The liability table of Form 1 consists of three sections: capital and reserves, long-term liabilities, short-term liabilities.

Section III Capital and reserves:

- authorized capital (1310): credit balance of account. 80 “Authorized capital”;

- own shares (1320): debit balance of account. 81 “Own shares (shares)”;

- revaluation of non-current assets (1340): if the organization revalued intangible assets and fixed assets, then the amount by which the value of non-current assets increased (credit balance account 83 “Additional capital”);

- additional capital without revaluation (1350): credit balance of account. 83 minus the amounts specified in line 1340);

- reserve capital (1360): if the organization creates reserve capital from retained earnings, then this data is reflected in this line (debit 82 “Reserve capital”);

- retained earnings (uncovered loss) (1370): data is taken from account 84 “Retained earnings (uncovered loss”).

- Total for section III (1300): the sum of the values of lines 1310-1370.

Section IV Long-term liabilities:

- borrowed funds (1410): loans to an organization for a period of more than 1 year (loan 67 “Settlements on long-term loans and borrowings”);

- deferred tax liabilities (1420): credit 77 “Deferred tax liabilities”;

- estimated liabilities (1430): credit 96 “Reserves for future expenses”, the period for fulfilling these obligations is over 1 year;

- other liabilities (1450): all liabilities not reflected above for a period of more than 1 year are indicated;

- total for section IV (1400): the sum of the values of lines 1410-1450.

Section V Current Liabilities: (click to expand)

- borrowed funds (1510): loans with a maturity of less than 1 year (loan 66), as well as long-term loans with a repayment period of less than 1 year (loan 67);

- accounts payable (1520): debt to suppliers (account 60), customers (62), personnel (70, 71, 73), budget (68 and 69). founders (75), other counterparties (76) for a period of less than 1 year;

- deferred income (1530): data from account 98 “Deferred income” (credit balance);

- estimated liabilities (1540): loan 96 “Reserves for future expenses”, maturity period less than 1 year;

- other liabilities (1550): all other short-term liabilities with a maturity of less than 1 year that are not reflected above are indicated;

- total for section V (1500): sum of lines 1510-1550.

Balance (1600): sum of line values 1400, 1500.

Upon completion of the balance sheet form 1, the values of lines 1700, 1600 must match. And this is logical. After all, liabilities are the sources of asset formation; each accounting entry (accounting entry) is made simultaneously as a debit to one account and a credit to another. If you have any discrepancies when filling out form No. 1, then you need to look for an error in accounting. The task is painstaking and long, but there is no other way out.

See here for the procedure for filling out a balance sheet for small businesses. In this article you will find a sample of filling out Form 2, here for Form 3, and here for Form 4.

in .xls format

(approved by Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66 (as amended by Order of the Ministry of Finance of the Russian Federation dated October 5, 2011 No. 124n)

Deadlines for “special” cases

Please note that for newly formed, liquidated and reorganized enterprises the deadlines are somewhat different. Let's consider the dates for submitting the balance sheet in Form 1 for the following companies:

- Creation. An organization that was formed before 09/30/2019 is required to report according to generally accepted rules, that is, before 03/31/2020. But those companies that were formed after September 30, 2019 must report not in 2020, but in 2021. That is, for the reporting period of 2020 plus the period of existence in 2020.

- Reorganization. The company is required to report three months after making the latest changes to the Unified State Register of Legal Entities. This rule is established not only for companies that continued their activities, but also for “merged” companies that completed their activities.

- Liquidation. An institution that has officially completed its activities is required to provide reporting no later than three calendar months from the date of making the relevant entries in the Unified State Register of Legal Entities.

Please take into account the established guidelines for due dates. Otherwise, administrative and tax liability is provided for the organization and responsible employees.

How to fill out your balance

When filling out the financial reporting form in Form No. 1, follow section 4 of Order No. 43n of the Ministry of Finance of the Russian Federation dated July 6, 1999 (as amended on January 29, 2018). Key rules for filling out the reporting document:

- fill out the report indicators in accordance with the actual account balances as of the reporting date, formed taking into account the requirements of PBU and the company’s accounting policies;

- reflect the indicators in monetary terms in the currency of the Russian Federation - in rubles, in thousands of rubles or in millions of rubles;

- Transactions made in foreign currency are recalculated at the rate established on the day of the transaction;

- if the company has a branch network, then at the end of the year a single balance sheet is formed (parent company plus branches);

- include indicators that exist for no more than 12 months as short-term assets and liabilities, and indicators that exist for more than one year as long-term assets;

- property and fixed assets should be reflected at “net” value, that is, taking into account depreciation and other costs provided for by PBU.

We offer a cheat sheet for filling out form No. 1.

This is what a completed sample balance sheet for 2019 looks like:

Balance sheet form 1 – form 2020

The current balance sheet form, Form 1, was approved in Order of the Ministry of Finance No. 66n dated 07/02/10. Data on the assets and liabilities of the enterprise as of the reporting dates of the current period and the two previous ones are entered into this form. You can download the current 2020 balance sheet form in Word or Excel format (with or without codes).

If you analyze Form 1 of the financial statements, it becomes clear that all assets and liabilities in the balance sheet are divided into short-term and long-term. In this case, the first ones include those objects whose repayment period (circulation) does not exceed 12 months, the second ones – those exceeding 12 months. This requirement for data reflection is the same for all organizations, regardless of legal form and field of activity.