Who must submit a balance sheet?

The balance sheet is one of the financial reporting forms.

The legislation establishes that all legal entities, regardless of their organizational form and the applicable taxation regime, must prepare and submit reports to tax and statistical authorities. This obligation also applies to non-profit organizations and bar associations. Balance sheets and profit and loss statements do not have to be submitted only to entrepreneurs, as well as branches of foreign companies. But they can do this on their own initiative.

Attention! Previously, some organizations were exempt from preparing a balance sheet, but currently such provisions are no longer in effect. Business entities classified as small businesses are given the right to submit reports in a simplified form. It includes a balance sheet in Form 1 and a statement of financial results in Form 2, so enterprises must send it to regulatory authorities.

Accounting for beginners from postings to balance sheet: reading a balance sheet using an example

How to read a balance sheet using an example? Let's look at this using the data from the report of Prestige LLC.

| Indicator name | Line code | As of 12/31/2020 | As of 12/31/2019 | As of 12/31/2018 |

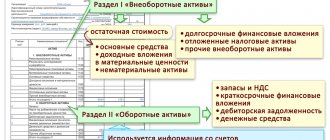

| I. NON-CURRENT ASSETS | ||||

| Fixed assets | 1150 | 750 | 779 | 810 |

| Financial investments | 1170 | 50 | – | – |

| II. CURRENT ASSETS | ||||

| Reserves | 1210 | 112 | 118 | 116 |

| Accounts receivable | 1230 | 56 | 49 | 51 |

| Cash and cash equivalents | 1250 | – | 10 | 12 |

| BALANCE | 1600 | 968 | 956 | 989 |

| III. CAPITAL AND RESERVES | ||||

| Authorized capital | 1310 | 10 | 10 | 10 |

| Reserve capital | 1360 | 4 | 3 | 2 |

| retained earnings | 1370 | 511 | 478 | 315 |

| V. SHORT-TERM LIABILITIES | ||||

| Accounts payable | 1520 | 443 | 465 | 662 |

| BALANCE | 1700 | 968 | 956 | 989 |

A fleeting glance at the balance sheet - and the first conclusions: the company does not apply PBU 18/02 - SHE and IT are absent from the balance sheet (perhaps the legal entity is related to a small business). The balance sheet currency has not changed sharply over the past 3 years (fluctuation 1–3%), no borrowed funds were attracted, profits grew steadily, which indicates the financial stability of the organization.

Balance due dates

According to the general rules, the balance sheet - Form 1 must be submitted as part of the reporting for the past year no later than March 31 of the following year. This deadline must be observed when submitting balance sheets and other forms to the Federal Tax Service and statistics.

In addition, under certain conditions, an audit report must be sent to Rosstat as an attachment. The deadline is set for ten days, but no later than December 31 of the following year.

Some organizations need to submit financial statements and publish them due to the type of activity they carry out, or according to other criteria defined by law. For example, tour operators must send their reports to Rostrud within three months from the date of their approval.

The legislation provides for separate deadlines for organizations that registered after September 30 of the reporting year. Due to the fact that their calendar year may be determined differently in this case, the due date may be set by such organizations on March 31 of the second year after the current one. For example, Rebus LLC received an extract from the Unified State Register of Legal Entities on October 25, 2017; the accounting report must be submitted for the first time on March 31, 2020.

Attention! Accounting statements are usually submitted based on the total for the year. However, it is possible to present it quarterly. In this case it is called intermediate. Such documentation is very often needed when applying for loans from banks, company owners, etc.

How to make a balance sheet - example (step by step instructions)

The procedure for drawing up the balance sheet is based on filling out the corresponding lines according to the balance sheet data for the reporting period, taking into account the requirements of PBU 4/99. To fill out the balance sheet, indicators are taken from the “turnover” in the form of an expanded balance for all accounting accounts. Fixed assets and intangible assets are reflected in the balance sheet minus depreciation. If the company's work results in a loss, its amount is reflected in parentheses as a negative number.

Each column of the balance sheet has a special encoding specified in Appendix No. 4 to Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. Based on the line names, you can understand how to fill out the balance sheet.

Example of a balance sheet form

Let's look at an example of how to fill out the balance sheet of an enterprise created in 2020.

To do this, we will need input data based on the indicators of the balance sheet of Iskra LLC for 2017:

| № | Name | Balance line | Amount, thousand rubles |

| 1 | Fuel | Reserves | 2720 |

| 2 | Production equipment in workshops | Fixed assets | 9000 |

| 3 | Items for resale | Reserves | 734 |

| 4 | Tara | Reserves | 215 |

| 5 | Buyers' debt | Accounts receivable | 7 |

| 6 | Cash register | Cash | 70 |

| 7 | VAT on purchases | VAT on purchased assets | 1700 |

| 8 | Production materials | Reserves | 2200 |

| 9 | Securities | Financial investments | 113 |

| 10 | Computer programs | Intangible assets | 750 |

| 11 | Money in the current account | Cash | 4000 |

| 12 | Advance issued to employees for reporting purposes | Accounts receivable | 12 |

| 13 | Transfers on the way | Cash | 112 |

| 14 | Debt to suppliers | Accounts payable | 1250 |

| 15 | Tax debt | Accounts payable | 1600 |

| 16 | Wage arrears | Accounts payable | 1000 |

| 17 | Obtained a long-term bank loan | Long-term borrowed funds | 120 |

| 18 | Authorized capital | Authorized capital | 10 123 |

| 19 | Reserve capital | Reserve capital | 5800 |

| 20 | revenue of the future periods | revenue of the future periods | 340 |

| 21 | Profit received in the reporting year | retained earnings | 1400 |

How to fill out the balance sheet in this case: the indicators need to be posted on the corresponding lines of the balance sheet form and the totals must be summed up.

Where is it provided?

The provisions of federal laws establish that Form 1 balance sheet and Form 2 profit and loss statement, and in certain cases other forms, must be submitted:

- Federal Tax Service - reporting must be submitted at the place of registration of the company. Therefore, branches and other separate divisions do not submit it, and only the parent company submits consolidated statements. This must be done at the place where it is registered, taking into account these departments.

- Rosstat - currently submitting reports to statistical authorities is mandatory. If this is not done, then, just as in the first case, the company and officials may be held liable.

- For the founders and other owners of the company - this is due to the fact that each annual report of the organization must be approved by its owners.

- To other bodies, if the relevant regulations define such a duty.

Attention! Banks may be asked to provide reporting when applying for various types of loans and borrowings from them. Especially if you take out a loan to open or develop a business.

Currently, when concluding contracts, many large companies ask for Form 1 Balance Sheet, Form 2 Profit and Loss Statement. This should be done at the discretion of the company management.

However, at present, many specialized companies through which you can submit reports have a service that allows you to obtain all the necessary information about a partner according to his TIN or OGRN. This data is provided by the Federal Tax Service itself based on previously submitted reports.

You might be interested in:

Form 6-NDFL: deadlines, instructions for filling

Interrelation of the balance sheet with other forms of reporting

Some balance sheet lines must be equal to lines from other forms of financial statements. Let's consider this relationship using the formulas, where BB is the balance sheet, FFR is the financial results statement, OIC is the statement of changes in capital, ODDS is the cash flow statement.

- Line 1370 BB = Line 2400 OFR

- Line 1180 BB (difference between indicators at the end and beginning of the reporting period) = Line 2450 OFR

- Line 1420 (the difference between the indicators at the end and beginning of the reporting period) = Line 2430 OFR

- Line 1130 BB = Line 3100 OIC “Authorized capital”

- Line 1320 BB = Line 3100 OIC “Own shares purchased from shareholders”

- Line 1360 BB = Line 3100 OIC “Reserve capital”

- Line 1370 BB = Line 3100 OIC “Retained earnings (uncovered loss)

- Line 1250 BB = Line 4500 ODDS at the beginning and end of the reporting period

Correctly filling out the balance sheet is an important component of the annual financial statements of an enterprise.

Delivery methods

The OKUD form 0710001, which is part of the annual report, can be submitted to the Federal Tax Service and Rosstat in the following ways:

- Personally by a company representative to an inspector or Rosstat specialist.

- By sending through the postal service - in this case, the letter is subject to requirements for the content of the inventory, and it must also be valuable.

- Through an electronic document management system - in this case, the company must have an appropriate electronic digital signature (EDS) and enter into an agreement with a special operator. You can also send the aileron file with reporting through the tax website; you will also need an enhanced digital signature.

Attention! The legislation stipulates the submission of the report in electronic form if the number of employees of the organization is more than 100 people.

Balance sheet form 2020 free download

Balance sheet form 1 form 2020 free download in Word format.

Balance sheet form 1 form 2020 download free in Excel format.

Balance sheet with line codes form download in Excel format.

Download a sample of filling out the balance sheet in Form 1 for 2020 in PDF format.

How to fill out a balance sheet using Form 1

Title part

After the name of the form, it is indicated on what date it is being generated. The actual date of submission of the report must be entered in the table, in the line “Date (day, month, year)”. Next, the full name of the subject is written down, and opposite in the table is its OKPO code.

After this, his TIN is indicated on the next line in the table. Next, you need to indicate the main type of activity - first in words, and then in a table using the OKVED2 code. Then the organizational form and form of ownership are indicated.

On the contrary, the corresponding codes are entered in the table, for example:

- The code for LLC is 65.

- for private property - 16.

On the next line you need to choose in what units the data in the balance sheet is presented - in thousands or millions. The table displays the required OKEI code. The last line contains the address of the subject's location.

Assets

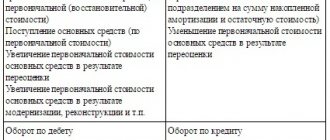

Fixed assets

Line “Intangible assets” 1110 is the balance of account 04 (except for R&D work) minus the balance of account 05.

Line “Research results” 1120 - account balance 04 for sub-accounts that reflect R&D;

Line “Intangible search requests” 1130 - account balance 08, subaccount of intangible costs for search work.

Line “Material search requests” 1140 – account balance 08, subaccount for the costs of material assets for search work.

Line “Fixed assets” 1150 - account balance 01 minus account balance 02.

Line “Income-bearing investments in MC” 1160 - the balance of account 03 minus the balance of account 02 in terms of accrued depreciation on assets related to income-generating investments.

Line “Financial investments” 1170 - account balance 58 minus account balance 59, as well as account balance 73 in terms of interest-bearing loans over 12 months.

Line “Deferred tax assets” 1180 - account balance 09, it is possible to reduce it by account balance 77.

Line “Other non-current assets” 1190 - other indicators that need to be reflected in the section, but they are not included in any line.

The line “Total for section” 1100 is the sum of lines from 1110 to 1190.

Current assets

Line “Inventories” 1210 - the sum of indicators is entered in the line:

- account balance 10 minus account balance 14, or account balances 15, 16

- Balances on production accounts: 20, 21, 23, 29, 44, 46

- Balances of goods on accounts 41 (minus the balance on account 42), 43

- account balance is 45.

Line “Value added tax” 1220 - account balance 19.

Line “Accounts receivable” 1230 - the sum of indicators is entered:

- Debit balances of accounts 62 and 76 minus the credit balance of account 63 in the subaccount “Reserves for long-term debts”;

- The debit balance of the account is 60 for advances made for the supply of products and services.

- Debit balance of account 76, subaccount “Insurance payments”;

- The debit balance of the account is 73, excluding the amounts of loans on which interest is accrued;

- Debit balance of account 58, subaccount “Granted loans for which interest is not accrued.”

- Debit account balance 75;

- Debit account balance 68, 69

- The debit balance of the account is 71.

You might be interested in:

Deadlines for submitting reports in 2020 in the table, changes, amount of fine for failure to submit

Line “Financial investments” 1240 - the sum of indicators is entered:

- account balance 58 minus account balance 59;

- account balance 55, subaccount “Deposits”;

- account balance 73, subaccount “Loan settlements”.

Line “Cash” 1250 - the sum of account balances 50, 51, 52, 55, 57 is entered.

Line “Other current assets” 1260 - indicators that should be shown in the section, but were not included in any previous line.

The line “Total for section” 1200 is the sum for lines from 1210 to 1260.

Line “Balance” 1600 - the sum of lines 1100 and 1200.

Passive

Capital and reserves

Line “Authorized capital of the organization” 1310 - account balance 80.

Line “Own shares” 1320 - account balance 81.

Line “Revaluation of non-current assets” 1340 - account balance 83 in terms of the amounts of revaluation of fixed assets and intangible assets.

Line “Additional capital” 1350 – account balance 83 without the amounts of additional valuation of fixed assets and intangible assets.

Line “Reserve capital” 1360 - the sum of account balances 82, as well as 84 in terms of special funds.

Line “Retained earnings (uncovered loss)” 1370 - account balance 84 without special funds.

Line “Total for section” 1300 - the sum for lines 1310, as well as from 1340 to 1370 minus line 1320.

long term duties

Line “Borrowed funds” 1410 - account balance 67, including the amount of loans and interest accrued on them.

Line “Deferred tax liabilities” 1420 - account balance 77, it can be reduced by account balance 09.

Line “Estimated liabilities” 1430 - account balance 96 for the subaccount of estimated liabilities for more than 12 months.

Line “Other liabilities” 1450 - credit balances of accounts , , 68, 69, , 76 for which liabilities with a maturity period of more than 12 months are reflected.

Line “Total for section” 1400 - the sum for lines from 1410 to 1450.

Short-term liabilities

Line “Borrowed funds” 1510 - account balance 66, including loan amounts and interest accrued on them.

Line “Accounts payable” 1520 - The amount of indicators is entered in the court:

- Balances of accounts 60 and 76, which show the debt to suppliers and contractors;

- The balance on the credit of account 70, except for the debt on payment of income on shares and shares;

- The balance on the credit of the sub-account “Settlements on deposited amounts” of account 76;

- Credit balances of accounts 68 and 69;

- Account credit balance 71;

- Balances on the subaccounts “Calculations for claims” and “Calculations for property insurance” on account 76;

- Credit balances on accounts 76 and 62 for advances received;

- Credit balance on the subaccounts “Calculations for the payment of income” of account 75 and “Calculations of income for the payment of income on shares” of account 70

Line “Deferred income” 1530 - loan balances for accounts 86 and 98.

Line “Estimated liabilities” 1540 - balance from account 96 in the subaccount of estimated liabilities for less than 12 months;

Line “Other short-term liabilities” 1550 - other short-term liabilities that cannot be included in the previous terms of Section V.

The line “Total for section” 1500 is the sum for lines from 1510 to 1550.

Line “Balance” 1700 - the amount for lines 1300, 1400 and 1500.

How to prepare a balance sheet?

The essence of creating a balance sheet is to fill out all lines of the approved Form No. 1, the composition of which the enterprise has the right to adjust in accordance with the peculiarities of conducting business activities and the property used.

Both the Asset and Liability balance sheet consist of a sequence of lines, each of which records a certain indicator of the financial condition of the organization.

Each line has the name of an indicator and a fixed serial number, which reflects the position of the indicator in the hierarchical structure of the table.

So, for example, in the “Non-current assets” section in the Balance Sheet, the first line corresponds to number 110 (if the management of the enterprise increases the number of lines in form No. 1, the number may have a larger number) and is called “Intangible assets”.

The value of this row is usually obtained by adding the values of rows numbered 111 to 119, if such exist.

After all the rows in the Asset table are filled in, to obtain the final value, it is necessary to add up the results of the first two sections of the balance sheet, which were obtained by summing the other rows in a hierarchical sequence.

Consignment note – sample filling. How to write an explanatory note to the balance sheet?

The same principle works in the Passive table.

The first section of this table, “Capital and Reserves,” has serial number 310, since it is the third main section of the entire balance sheet and is formed by adding the rows that are in its subgroup of the hierarchy, that is, rows numbered from 311 to 319.

Filling out the balance sheet can be done starting from any table (Liability or Asset)

The main condition for the correct preparation of a balance sheet table is the exact correspondence of the value of each line and the indicator entered into it, as well as the presence of monetary values in all lines established by the enterprise.

There are exceptions when the amount for some indicator may be zero, in which case it is necessary to provide explanations for this item in the financial report.

As a rule, all indicators are displayed in numbers that mean thousands of rubles, for example, if the value of an organization’s real estate is 10,000,000 rubles, then 10,000 must be written in the balance sheet asset in the corresponding line.

Of course, if the company has a larger scale, and their cash turnover is mainly in the millions, then you can enter numbers by removing the last six digits, and indicate the numerical unit million rubles in the title of the indicator column.

The final numbers of the Asset and Liability balance sheets must coincide, since, in fact, the Asset reflects everything that the organization has, and the Liability balance sheet provides a description of where all the listed Assets were obtained from.

For a more detailed description of the preparation of the balance sheet, we will consider the principle of filling out each line of the Liability and Asset tables.

Common mistakes when filling out a balance

When filling out a balance sheet, novice accountants often make the following mistakes:

- Accounts receivable and payable are shown as a collapsed indicator. This is a mistake - in the balance sheet you need to show separately the debt to debtors or creditors and separately - received or paid advances. Profits and losses should be reflected using the same principle.

- The amount of the advance received should not be reflected in pure form, but together with the VAT received with this payment.

- Fixed and intangible assets are reflected at historical cost. This is not true. These values must be adjusted to the amount of accrued depreciation for each type of property.

- Interest-free loans are shown as part of financial investments. This is incorrect; they should be shown as part of accounts receivable by maturity.

- Negative indicators are written with a minus sign. According to the instructions for filling out the form, negative values must be shown in parentheses without a minus.