Income Statement: Breakdown of Lines

Generate OFR lines:

- 2110, which indicates the amount of revenue from the sale of inventory items/services/work related to core activities. Line 2110 of the financial results report is equal to the credit turnover (Kr/vol) account. 90/1, reduced by debit turnover (D/v) of accounts 90/3 and 90/4 (VAT and excise taxes);

- 2120, which records (in parentheses) the total costs accompanying the production of goods and materials/services in ordinary activities. Line 2120 of the financial results report is equal to D/v according to the account. 90/2 (minus the amounts corresponding to accounts 44 and 26);

- 2100 informs about the amount of gross profit received. Line 2100 of the income statement = line 2110 – line 2120;

- 2210, where commercial costs are accumulated, i.e. those associated with the sales process. Line 2210 of the financial results statement is defined as D/v by account. 90/2 from credit account. 44;

- line 2220 of the financial results report accumulates management costs and corresponds to D/v according to the account. 90/2, corresponding to the account. 26;

- 2200 of the financial results report records the result of sales, calculated arithmetically: line 2220 = line 2100 - line 2210 - line 2220;

- 2310, where the total of other income is recorded if the company took part in the management capital of other companies or received dividends distributed in its favor. The value of line 2310 corresponds to the amount of Kr/v per account. 91/1, reflected in the analysis of income from participation in the management company of third-party companies;

- Line 2320 records the amount of income from interest on assets provided for use, or upon receipt of a discount on securities. Line 2320 of the financial results report is equal to Kr/v according to the account. 91/1 on analytical information about interest received;

- Line 2330 of the income statement reflects other expenses, which includes interest paid for the year on all loans and discounts. The indicator in it corresponds to D/v according to the account. 91/2 within the framework of analytics on interest paid;

- 2340 reflects other income not included in the listed lines. The value of line 2340 of the financial results statement is found using the formula:

Page 2340 = Kr/v 91/1 – line 2310 – line 2320 – D/v 91/2 with account 68 (VAT, excise taxes);

- 2350, which contains information about other costs not listed above. Line 2350 of the income statement is calculated as follows:

line 2350 = D/rev 91/2 – line 2330;

- 2300 “Profit before tax” is formed in the report by summing up to the data in line 2200 all other income received (lines 2310, 2320, 2340), reduced by the amount of other expenses incurred (lines 2330, 2350)

You can check the correctness of the calculation using the formula: line 2300 = line 2200 + D/v account. 91 in correspondence with account. 99 – Kr/v account. 91, corresponding to the account. 99;

- Line 2410 of the income statement is equal to the amount of declared tax in line 180 of the income tax return. If the company pays another tax while working on the simplified tax system, then line 2410 is crossed out and the tax amount is entered in line 2460;

- Firms applying PBU 18/02 show in line 2421 the amount of the balance of permanent tax assets/liabilities accumulated for the year:

Page 2421 = D/account balance. 99/PNA – Kr/balance on account 99/PNA

A positive result is indicated in parentheses, a negative result without them;

- Line 2430 of the income statement reflects the change in deferred tax liabilities and is calculated as the difference between Kr/v and D/v according to the account. 77. The resulting positive result is written in parentheses, the negative result – without them;

- Line 2450 of the income statement records the change in deferred tax assets and is calculated as the difference between D/rev and Cr/rev according to the account. 09. A positive result is written in parentheses, a negative result – without parentheses;

- Line 2460 reflects other information about indicators not listed above, but having an impact on the profit margin. For example, the differences before the reformation of the balance between the turnover on the account. 99, taxes of enterprises operating on UTII and simplified tax system;

- Line 2400 of the income statement reports the company's profit. The value for the line is calculated by reducing the value for line 2300 by the amount of tax (line 2410) and adjusting for the lines reflecting PNO/PNA and ONO/ONA. The line indicator 2400 should be equal to the turnover according to the account. 99 in correspondence with account. 84;

- Line 2510 is filled in only if production assets were revalued. The value in the line determines the amount of increase in additional capital (Kr/v on account 83 – D/v on account 83);

- Line 2500 determines the amount of net profit (line 2400), adjusted for the results of the revaluation of property (line 2510) and for the result of other operations not included in net profit/loss (line 2520).

The reference information on basic earnings per share (pages 2900 and 2910) is filled out only by the joint stock company.

Having understood the theory of filling out the ODF, let’s move on to drawing up the document using an example.

Relationship between OCB and report

It is convenient to fill out a financial performance report based on the balance sheet compiled for the reporting period. Let's consider line by line which accounting accounts are included in the income statement.

Let's present this in a table similar to deciphering the lines of the statement of financial results. If an enterprise applies a different tax regime without paying income tax, then in line 2411 it is necessary to indicate the tax calculated in connection with the application of the special regime. You can also enter a new line for such a tax. There will be no line 2412 at all, since PBU 18/02 is used only by those who calculate income tax. Small enterprises on OSNO may also not have this line, which exercised their right not to apply PBU 18/02.

The relevant question is whether VAT is reflected in the income statement. As we can see from the table, VAT payers exclude this tax from the amount of sales revenue in the statement of financial results, as well as from other income and from other expenses. VAT is present in the report as part of amounts for transactions not subject to VAT or for non-payers of this tax.

The balance sheet and income statement are designed to provide different characteristics of the state of the enterprise. The balance sheet is designed to show the property and financial condition of the enterprise. The income statement is the result of activities in a certain reporting period. Therefore, there is no direct numerical relationship between the balance sheet and the income statement. The only thing that can be noted:

Preparing a financial performance report: example

Orlet LLC, operating at OSNO, fills out the FFR for 2020 based on the accounting data of the balance sheet (before the reformation):

| Check | Turnover (in rubles) for 2020 | |

| D/t | K/t | |

| 09 "SHE" | 59 000,00 | 55 000,00 |

| 77 "IT" | 63 000,00 | 42 000,00 |

| 90/1 “Revenue” | — | 22 890 000,00 |

| 90/2 “Cost” | 11 885 000,00 | — |

| 90/3 "VAT" | 890 000,00 | — |

| 90/8 “Administrative expenses” | 252 000,00 | — |

| 90/9 “Profit/loss from sales” | 9 863 000,00 | |

| 91/2 “Other expenses”, incl. | 80 000,00 | — |

| 91/9 “Balance of other income and expenses” | 80 000,00 | |

| 99 "Profits and losses" | ||

| 99/01 “Profit/loss” without non-taxable income | 9 863 000,00 | 80 000,00 |

| 99/02 NNP | 2 200 000,00 | |

| 99/02/1 Conditional consumption for NNP | 2 150 000,00 | |

| 99/02/3 PNA | 50 000,00 | |

Based on these data, as well as information for the previous year, the company’s financial financial statements are compiled. Fill out the lines in accordance with the recommendations outlined:

| Line no. | What values does it consist of? | Amount in thousand rubles. |

| 2110 | Kr/v 90/1 – D/v 90/3 | 22890 – 890 = 22000,00 |

| 2120 | D/v 90/2 | 11885,00 |

| 2100 | Page 2110 – page 2120 | 22000 – 11885 = 10115 |

| 2220 | D/v. 90/8 | 252,00 |

| 2200 | Page 2100 – 2220 | 10115 – 252 = 9863,00 |

| 2330 | D/about 91/2 | 80,00 |

| 2300 | Page 2200 + page 2320 – page 2330 | 9863 – 80 = 9783,00 |

| 2410 | Current NNP according to the declaration | 2225,00 |

| 2421 | Including PNA | — 50,00 |

| 2430 | Delayed BUT | 21,00 |

| 2450 | SHE | 4,00 |

| 2400 | Page 2300 – page 2410 + 2421 – 2430 – 2450 | 9783 – 2225 + 50 – 21- 4 = 7583,00 |

After the reformation of the balance sheet, net profit in the amount of 7583 thousand rubles. will be transferred to retained earnings (D/t 99.01.1 K/t 84.01).

Financial results report – example of filling 1:

What needs to be included in form No. 2

This form of reporting is regulated by section 5 of PBU 4/99 “Accounting statements of an organization.” Previously, it was called “Profit and Loss Statement”, but from the annual report for 2012, according to information from the Ministry of Finance of Russia No. PZ-10/2012 “On entry into force on January 1, 2013”, it received a new name, report form about financial results has not changed much, and accountants continue to use the old name as its colloquial name.

The report must include the following accounting data:

- the amount of revenue received during the year;

- cost of sales by organization;

- administrative and commercial expenses of the organization;

- gross profit or loss for the reporting period;

- interest received and paid;

- other income and expenses for the year;

- profit or loss from sales;

- total profit or loss before taxes;

- changes during the year in deferred tax assets and liabilities;

- net profit or loss;

- other reference information.

Filling out a report on financial results under the simplified tax system

For small businesses that apply a simplified tax regime, the legislator allows the use of simplified reporting forms, i.e. enter information without detailing individual articles. This fully applies to the OFR. Let's fill out a simplified statement of financial results based on the same data, taking into account that instead of income tax, “simplified” people pay tax under the simplified tax system.

In this version, line 2120 includes all costs for ordinary activities, i.e. cost, management, commercial, and line 2410 groups all taxes along with changes to IT, ONA, and also taking into account PNO/PNA. In the block of other income and expenses, only line 2330 “Interest payable” is highlighted separately; other income and expenses are also not detailed. The table shows the procedure for filling out the financial results report by line:

| Line | Content | Amount in thousand rubles. |

| 2110 | Kr/v 90/1 – D/v 90/3 | 22 890 – 890 = 22 000,00 |

| 2120 | D/rev 90/2 + D/rev 90/8 | 11 885 + 252 = 12 137,00 |

| 2330 | D/about 91/2 | 80,00 |

| 2410 | Tax under simplified tax system | 2200,00 |

| 2400 | Page 2110 – page 2120 – page 2330 – page 2410 | 22 000 – 12137 – 80 – 2200 = 7583,00 |

This form allows you to compare the main indicators and analyze the dynamics of the company’s development during the process of filling out the financial financial statements.

Statement of financial results of the simplified tax system - example of filling 2:

Which report form to use in 2020

Let's move on directly to the consideration and analysis of the financial results report.

We present to your attention the report form.

This form was approved by Order of the Ministry of Finance dated July 2, 2010 No. 66n as amended by Order of the Ministry of Finance dated April 19, 2019 No. 61n. It must be applied mandatory starting with reporting for 2020. For 2020, it is permissible to submit a report on the previous version of the form.

The need for a new form arose in connection with changes made to PBU 18/02. Let us indicate the innovations introduced into the financial results report in 2020.

It is logical that if in the accounting of 2020, changes to PBU 18/02 have already been voluntarily applied, as allowed by law, then Form 2 - the statement of financial results will be presented on a new form. Otherwise, you can wait another year.

Some categories of taxpayers, for example small businesses, have the right to conduct accounting in a simplified way and submit simplified accounting reports. Its main difference from the usual one is that the simplified financial statement reflects aggregated indicators. Please review the simplified form of financial statements.

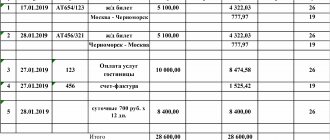

Cash Flow Statement (CDS)

Shows the amount of money in and out of current accounts.

Helps predict the cash gap: the critical point when you don’t have enough money to pay rent, buy goods, or pay salaries to employees.

The cash flow statement shows:

- What amount in the account did the company start the month with?

- How much did you receive and spend during the month?

- How much is left at the end?

The balance is the carryover balance.

It is important that the report reflects all accounts: bank accounts, electronic wallets, cash register, safe, and also records all expenses in three areas of activity:

- operating: purchase and sale of goods, employee salaries, office rental, car leasing;

- investment: purchase and sale of equipment or delivery vehicles, development of an online store;

- financial: loans and payment of dividends.

Additionally, you can break down each area into expense items. This will allow you to track in more detail where the company spends money.

It is not necessary to break it down in too much detail; you can group it into categories. For example, office supplies, water, tea and coffee to the office can be written off as “office needs”, and fuel, car maintenance and minor repairs can be written off as “transport”.

The frequency with which it is necessary to compare the report and the real state of affairs is determined by each entrepreneur for himself. You can do this at the end of each working day, or once a week or month.

Reflection of income tax in an organization

To reflect income tax in the income statement, lines from 2410 to 2450 are used:

- Line 2410 indicates the difference between the total turnover in the debit and credit of account 68 subaccount “Calculations for current income tax” in correspondence with accounts 09, 77, 99;

- Line 2421 reflects the total difference between the debit and credit turnover of account 99/account “Fixed tax liabilities” in correspondence with account 68/account “Calculations for current income tax”;

- Line 2430 reflects the total difference between the turnover in the debit and credit of account 77 in correspondence with account 68 with/account “Calculation of current income tax”;

- Line 2450 reflects the total difference between the turnover on the debit and credit of account 09 in correspondence with account 68 with/account “Calculation for current income tax”.

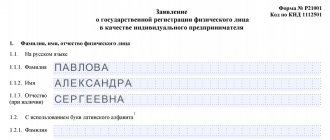

Step-by-step instructions for filling out the document

The preparation of a financial results report must be approached very responsibly and carefully. So, when filling out the report, you need to complete a number of steps:

| Actions | |

| Step 1 | Fill out the tax period for which the financial results report is provided |

| Step 2 | In the “Organization” section, indicate the full name of the organization |

| Step 3 | Specify the taxpayer's TIN |

| Step 4 | Specify the type of economic activity and OKVED |

| Step 5 | Specify the legal form/form of ownership |

| Step 6 | Specify the unit of measurement for the indicator |

| Step 7 | In the “Location (address)” section, indicate the address of the organization |

| Step 8 | In the “Date (date, month)” section, indicate the last day of the reporting period for which the report is provided (December 31, 2016) |

| Step 9 | Specify statistics codes: OKPO, OKOPF / OKFS, OKEY |

| Step 10 | Fill out the table with indicators indicating the necessary explanations |

| Step 11 | Signature and transcript of the manager’s signature |

| Step 12 | The date is indicated at the time of submission of the financial results report |

Filling out the financial results report line by line

When filling out the OKUD Form 0710002, all lines must contain information reflecting the financial condition of the organization for the reporting period:

| Line code | Indicator name | A comment | ||||||

| 2110 | Revenue | Revenue | = | Revenue from the main activity | – | VAT | – | Excise taxes |

· Purchase of goods, materials

· Payment for work performed

· Other expenses provided for by the main activity

2100Gross profitGross profit| = | Revenue | – | Cost of sales |

In case of a negative value, the indicator is indicated in brackets

2210 Selling expenses Selling expenses for core activitiesThe value is indicated in brackets 2220 Administrative expenses Expenses aimed at administrative and economic activities not directly related to production. 2200 Profit (loss) from sales Profit (loss) from sales)

| = | Gross profit | – | Business expenses | – | Administrative expenses |

| = | Other income | – | VAT | – | Excise taxes | – | Line 2310 | – | Line 2320 |

| = | other expenses | – | Line 2330 |

Comparison of indicators in income statements

When analyzing financial results reports, it is possible to evaluate:

- activities of the organization for certain time periods;

- the activities of an organization in comparison with the activities of other organizations in a certain time period.

The table shows example No. 1:

| Index | 2014 | 2015 | 2016 | Absolute deviation (thousand rubles) | Deviation (%) | ||||

| 2015/2014 | 2016/2015 | 2016/2014 | 2015/2014 | 2016/2015 | 2016/2014 | ||||

| Revenue | 50000 | 60000 | 70000 | 10000 | 10000 | 20000 | 20 | 17 | 28,5 |

| Cost of sales | 30000 | 35000 | 45000 | 5000 | 10000 | 15000 | 17 | 28,5 | 50 |

| Gross profit | 20000 | 25000 | 25000 | 5000 | 0 | 5000 | 25 | 0 | 25 |

| Business expenses | 6000 | 8000 | 10000 | 2000 | 2000 | 4000 | 33 | 25 | 67 |

| Administrative expenses | 1000 | 2000 | 3000 | 1000 | 1000 | 2000 | 100 | 50 | 200 |

| Profit (loss) from sales | 13000 | 15000 | 12000 | 2000 | (-3000) | (-1000) | 15 | (-20) | (-8) |

This analysis is indicative for understanding the development of the company, increasing sales volumes and profits. Thanks to this analysis, it is possible to plan the development paths of the enterprise.