Report on the intended use of funds received or Form 6: which is correct?

As part of the current forms of annual financial statements recommended for use (approved by order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n), there is a document called a report on the intended use of funds.

It is often also called Form 6, despite the fact that the serial numbering of the forms for reports given in Order No. 66n is not used, and only five report forms are given in this document. Where did the name come from, referring to the form number, and is its use legal? The origin of the name, Form 6 of the report on the intended use of funds, is due to Order No. 67n of the Ministry of Finance of Russia dated July 22, 2003 - a document that is no longer in force, which, before Order No. 66n came into force (and it became mandatory for use in reporting for 2011), approved recommendations for use accounting forms. Order No. 67n contained 6 report forms, and in each of them, under the official text name, there was an indication of the serial number of the form. The numbers were distributed as follows:

- No. 1 - balance sheet;

- No. 2 - profit and loss statement;

- No. 3 - statement of changes in capital;

- No. 4 - cash flow statement;

- No. 5 - appendix to the balance sheet;

- No. 6 - report on the intended use of the funds received.

The forms approved by Order No. 66n do not have an indication of the form number, and only five forms themselves are given in this document: the form corresponding to the appendices to the balance sheet is excluded from them. However, for accountants who compiled reports for the years preceding 2011, the use of numbering of the compiled forms, which simplifies the indication of their name, remained common. However, such a reference can only be used informally, since the current document approving the accounting forms does not contain report numbers.

IMPORTANT! As of reporting for 2020, accounting forms, including Form 6, are in effect in a new edition. Read more about the changes here. Find out about changes in the reporting procedure in 2020 from this publication.

What does the report include?

The legislative basis for reports on the intended use of funds received is fixed by order of the Ministry of Finance dated July 2, 2010 No. 66n, which also approved the form of this document. It is necessary to use the unified form; changing it (except for the options established by law) is prohibited.

The report includes data on funds received and spent. They are indicated line by line, depending on the source of income and direction of costs.

Cash receipts (lines 6100 - 6200):

- entrance, membership, targeted and voluntary fees;

- charitable donations;

- profit from business or other income-generating work (NPOs have the right to engage in this);

- all other income.

Directions of expenses (lines 6320 – 6350):

- social and charitable events;

- conferences, meetings and similar events;

- remuneration of management staff;

- business trips;

- property maintenance;

- acquisition and renewal of fixed assets, inventory and other property.

On the second sheet of the report, individual provisions of the report are deciphered. If transcripts are not required, the sheet is not filled out.

The report on the intended use of funds is filled out using a unified form

Who rents it out

This report is mandatory for all forms of non-profit organizations, including HOAs. These are all organizations created not for the purpose of making a profit, but to solve other problems. For example, to help low-income people (charitable organizations) or to effectively manage property (homeowners' associations). In the course of their activities, these organizations collect and earn money, and therefore must report to the state and stakeholders.

Who submits a report on the intended use of money:

- public associations;

- Cossack societies;

- charitable foundations;

- autonomous organizations;

- associations and unions;

- homeowners associations.

Reporting on the intended use of funds: who submits it?

So who is required to submit a report on the intended use of funds?

In Order No. 67n, the answer to this question was unambiguous: Form 6 was recommended to be drawn up by non-profit organizations (clause 4 of the instructions on the scope of accounting forms). A similar recommendation (albeit with a slightly different wording, referring to public organizations that do not conduct entrepreneurial activities) was also in the original version of Order No. 66n (subparagraph “c”, paragraph 1). But at present (Order of the Ministry of Finance of Russia dated December 4, 2012 No. 154n) there is no indication in the text of Order No. 66n as to who is affected by the preparation of a report on earmarked funds. Thus, this form must be drawn up by all recipients of targeted funding, i.e. not only non-profit structures, but also commercial organizations receiving targeted funds.

Organizations that do not receive targeted funds do not prepare a report on them, since they do not have the data to fill it out.

Options for a report form on the intended use of funds

The report form recommended for use on the use of targeted funds does not exist in a single version. Order No. 66n approved two of its forms:

- complete, given in Appendix No. 2.1;

- simplified, contained in Appendix No. 5.

Simplification implies a reduction in the number of lines in the report by combining data on a number of indicators (subparagraph “a”, paragraph 6 of Order No. 66n) and the absence in the form of a column intended to indicate the number of explanations.

The simplified form can be used by persons who have the right to simplify accounting and the formation of simplified accounting records. These persons include (Clause 4, Article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ):

- small businesses that meet the criteria specified in the law “On the development of small and medium-sized businesses...” dated July 24, 2007 No. 209-FZ;

- non-profit organizations subject to the Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ;

- participants of the Skolkovo project who received this status in accordance with the law “On the Skolkovo Innovation Center” dated September 28, 2010 No. 244-FZ.

Simplification of reporting is not available (Clause 5, Article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ):

- for legal entities required to audit their accounting records;

- housing and housing-construction cooperatives;

- credit consumer cooperatives and microfinance organizations;

- public sector organizations;

- political parties;

- associations of lawyers and notaries, legal consultations;

- non-profit structures acting as a foreign agent.

Procedure for filling out the intended use report

The procedure for filling out a report on the intended use of funds is not separately described anywhere. The logic for entering data into it follows from the content of the report itself and the notes available under the main table.

The main table is preceded by data about the reporting entity (its name and codes characterizing basic information about it: OKPO, INN, OKVED, OKOPF, OKFS), as well as information about the year for which the report is being prepared, the date of creation and the applied unit of measurement of the entered indicators.

The purpose of filling out the main table is to reflect, taking into account the analytics of receipts and disposals, the process of changing the balance of target financing funds accounted for in the organization (when applying the chart of accounts of accounting, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, they are shown on account 86). In this case, a comparison of data from the current and previous years is provided.

The top and bottom rows of the table indicate information about fund balances, respectively, at the beginning and end of the year. Intermediate lines are divided into two groups: with information about receipts and about the expenditure of funds received. For each of the groups, the forms given in Order No. 66n offer a specific breakdown of analytical lines, focused on the most frequently occurring reasons for receipts and expenditures. In full form, for these reasons, the following are highlighted:

- in receipts - lines: for entrance, membership and target fees;

- voluntarily contributed funds;

- income resulting from the activities of the reporting entity;

- other funds received;

- for the purposes for which the legal entity received appropriate funding, highlighting information about expenses for charity and social assistance, informational events, and other procedures;

In a simplified form, revenues combine data on contributions and voluntarily contributed funds, and in expenditures there is no detailing of the four main groups of lines. In addition, the simplified form is distinguished by the absence of total figures related to income and expenses.

At the same time, if necessary, the report writer can supplement the form proposed by Order No. 66n with the required number of lines (clause 3 of Order No. 66n).

You will find a line-by-line procedure for filling out the report in the Guide from ConsultantPlus, having received free trial access to the system.

Instructions for filling

Line 010 of the report displays the balance of target funds at the beginning of the current year.

In accounting, the receipt of financial capital is reflected in the debit of income accounts, in the process of their distribution and other sources with account 86.

For this reason, line 010 should include the credit balance of such funds at the beginning of the calendar reporting year.

Documents for download (free)

- Report on the intended use of funds

Displaying the fact of receiving funds for the intended use

When crediting finances that must be directed purposefully, it is necessary to display all information in lines 020-070.

To create maximum comfort in drawing up a report, analytical accounting must be created on the account, which clearly gives an idea of all types of financial receipts.

Line 020 displays the total amount of funds received during the calendar year based on entry fees made.

It is worth noting that the amount of entrance fees is formed by the constituent documentation, and their purpose is to create initial savings of the company’s working capital.

Line 030 includes the total amount of funds received from membership fees.

The reduction of membership fees refers to financial receipts from members of the organization itself throughout the reporting period. Their main purpose is considered to be to cover various expenses associated with their work activities.

In line 040 it is necessary to indicate financial receipts exclusively from voluntary contributions.

Please note: the terminology “voluntary contributions” refers to funds in any amount that were deposited into the company’s account voluntarily. They can be produced by any persons (individuals and legal entities) in any size. Moreover, they can also apply as foreign citizens.

The source of financing can be used to perform various tasks related to the development of the company's work activities.

In line 050 “Profit received from the company’s labor activities” information is entered on the income that the company was able to receive during the reporting period in the process of carrying out its labor activities.

Income can be generated as a result of various lectures, exhibitions, and so on, as provided for in the organization’s charter.

Line 060 includes other financial receipts during the reporting calendar year.

This list may include various donations for the development of the organization, charity events, etc.

Use of targeted funds

In the “used” category, it is necessary to display information about actual financial expenses incurred during the reporting calendar year.

It is worth noting that in accounting, the valuation of financial costs of non-profit companies is formed on the same accounts that are used by commercial enterprises, but the write-off is carried out to a debit account, which takes into account the sources of covering costs incurred as a result of work activities.

According to Federal Law No. 7, non-profit enterprises are required to create income and cost estimates.

The cost estimate is formed for the calendar reporting year in the context of individual expense items with mandatory consideration of the specifics of the labor activity of a non-profit enterprise. In the process of determining the nomenclature of financial cost items, it is possible to build on the “Funds Used” section of Form 6.

At the end of the calendar reporting year, it is necessary to approve the actual implementation of the estimate, otherwise the excess costs according to the estimate will not be recognized by employees by the tax inspectorate, which is directly related to the labor regulations.

Depending on the goals pursued by the organization’s charter, events can be of several subtypes, namely:

- from a trade union point of view - organizing recreation, various children's parties, making subsidies, and so on;

- social orientation - providing various assistance to low-income citizens who have suffered from various accidents, and so on.

Other types of targeted events include conferences, meetings, and so on. They can be organized by programs that are approved by the local governing body of the company and must summarize the results of work activities.

Depending on the scale of the event and the goals pursued, members and participants of the organization can take part in them, including those citizens who were awarded invitations and are related to the topic.

All financial costs of such activities should be displayed in line 082.

In line 083 it is necessary to display all other costs that relate to the organization of target events (with the exception of those already displayed in lines 081 and 082).

In line 090, it is necessary to separately display the funds spent on maintaining the management staff of a non-profit company. It must be taken into account that all displayed costs must be directly related to the content of the organization’s management in the part that is dedicated to performing certain tasks.

When conducting business, all financial costs cannot be covered by targeted revenues, since a mechanism for distributing such costs must be developed.

In line 091 “Wage-related costs” you must display:

- wages, which are accrued to employees at established tariff rates;

- various bonuses and other monetary rewards;

- possible compensation payments;

- wages of those categories of employees who carry out their work activities part-time;

- contributions to various extra-budgetary funds.

All financial costs that are directly related to wages must be within the accepted budget.

In line 092 “Cash payments not related to wages” it is necessary to indicate the following payments:

- for the required vacations (annual and additional, if they are provided for by the type of employment);

- for student leave, which is provided in accordance with current legislation;

- average earnings that are maintained during the performance of any government or public works;

- compensation for previously unused vacation.

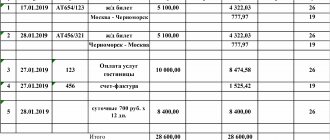

Line 093 “Financial expenses for business trips” indicates expenses for business trips of employees not only within the territory of the Russian Federation, but also beyond its borders, in particular:

- the price of travel to the place of performance of one’s work duties;

- cost of renting residential premises;

- payment of daily allowance and so on.

Line 094 “Costs for maintaining premises, vehicles and other property” indicates financial losses for renting non-residential real estate, paying for utilities, repairing and renting vehicles, and so on.

Line 095 should indicate all financial costs for repair work, without which the organization’s work would be impossible.

Line 096 displays other current financial losses, namely:

- telephone payment;

- receiving various consultations;

- office costs and so on.

Line 100 “Purchase of key assets, inventory and other property” includes information that reveals the essence of the financial costs of the investment. This includes possible modernization, reconstruction, acquisition of intangible assets, and so on.

An example of filling out a report on intended use

Let's look at an example of filling out a report on the intended use of funds using specific figures.

Example

For the Nadezhda charitable foundation, which is engaged in helping people who find themselves in difficult life situations, the main source of funds that allows them to carry out the activities provided for in the charter are voluntary donations from legal entities and individuals. The balance of unused funds at the beginning of the year amounted to 30,000 rubles. In 2020, the fund received 7,000,000 rubles as voluntary donations.

In addition, the foundation organizes educational events that generate income from the sale of entrance tickets to them. The net profit from this activity for 2020 amounted to RUB 1,000,000.

The expenses incurred by the fund in 2020 were as follows:

- for charitable payments to people who find themselves in difficult life situations - 6,400,000 rubles;

- for wages, taking into account insurance premiums accrued on the amount of the employee’s income - 1,400,000 rubles;

- for business trips to check the reality of difficult life circumstances for people who need help - 70,000 rubles;

- for cosmetic repairs of premises occupied by the foundation on a lease basis - 100,000 rubles.

The situation was similar in 2020. That is, there were two types of income: voluntarily donated amounts (5,500,000 rubles) and profit from business (900,000 rubles). Funds were used for charitable payments to people in need (5,200,000 rubles), wages and insurance premiums (1,100,000 rubles) and business trips (80,000 rubles). Unused funds at the beginning of the year amounted to 10,000 rubles.

In the main table of the report, fund balances at the beginning of the year will be shown in line with code 6100, and balances at the end of the year - in line 6400. Moreover, the data in line 6100 for 2020 (at its beginning) and line 6400 for 2020 (at its end ) must be the same.

Receipts will be reflected in lines 6230 (voluntary donations) and 6240 (profit from business). Their total amount will appear in line 6200.

In relation to expenses for targeted activities, lines 6310 will be used (it will show their total value) and 6311 (it is intended for expenses in the form of charitable assistance).

As for the costs of maintaining the fund itself, lines 6320 will be used (their total amount will be reflected here), 6321 (expenses related to wages), 6323 (travel expenses) and 6325 (property repair expenses).

The total amount of expenses incurred, equal to the sum of lines 6310 and 6320, will fall into line 6300.

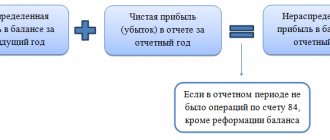

The balance of funds at the end of each year is calculated from the amount of their balance at the beginning of the year by adding the total amount of receipts and subtracting the total amount of expenses from this term, i.e. according to the formula (if compiled using report line codes): 6100 + 6200 - 6300 = 6400.

Please see the completed report on our website.

In the header part of the report, the following information is automatically indicated from the client’s registration card in the SBIS system:

- the period for which it is compiled;

- correction number (if the report is primary, then “0” is indicated);

- name of the organization and TIN;

- code according to the classifier of enterprises and organizations (OKPO);

- type of economic activity and code of this type (OKVED);

- organizational and legal form of ownership and code (OKOPF);

- the unit of measurement in which the report was compiled and its code (OKEI).

A report on the intended use of funds is completed for 2 years: reporting ( column 3

) and previous (

column 4

).

| Indicator name | Line code | Reflection order |

| Balance of funds at the beginning of the reporting year | 010 | Credit balance on account 86 (sub-account “To cover fund expenses”) |

| Funds received | 020 | page 020 = page 021 + page 022 (calculated automatically) |

| Target revenues | ||

| including: targeted contributions from depositors | 021 | Credit turnover on account 86 (sub-account “To cover fund expenses”) in correspondence with accounts: 50, 51, 52, 55 (in terms of target revenues) |

| targeted deductions from the amount of pension contributions (up to 3%) | 022 | |

| Deductions from income from the placement of pension reserve funds (up to 15%) | 030 | Credit turnover on account 86 (sub-account “To cover fund expenses”) in correspondence with account 84 |

| Deductions from income from investing pension savings (up to 15%) | 040 | |

| Income from the placement and use of property intended to support statutory activities | 050 | |

| Other supply | 060 | Credit turnover on account 86 (sub-account “To cover fund expenses”) in correspondence with accounts: 50, 51, 52, 55 (in terms of other income) |

| Total funds received | 070 | page 070 = page 020 + page 030 + page 040 + page 050 + page 060 (calculated automatically) |

| Funds used | 080 | page 080 = page 081 + page 082 + page 083 + page 084 + page 085 + page 086 (calculated automatically) |

| Expenses for maintaining the management staff | ||

| including expenses: related to wages (including taxes and mandatory payments) | 081 | Debit turnover on account 86 (sub-account “To cover fund expenses”) in correspondence with account 26 |

| for payments not related to wages | 082 | |

| on business trips | 083 | |

| for the maintenance of premises, buildings, vehicles and other property (except for repairs) | 084 | |

| for repairs of fixed assets and other property | 085 | |

| other | 086 | |

| Advertising expenses | 090 | |

| Expenses for representation purposes | 100 | |

| Expenses for the acquisition of fixed assets and other property | 110 | Debit turnover on account 86 (sub-account “To cover fund expenses”) in correspondence with account 83 |

| Costs associated with the provision of services from third-party organizations for organizational, information and technical support for non-state pension provision activities | 120 | Debit turnover on account 86 (sub-account “To cover fund expenses”) in correspondence with account 26 |

| Costs associated with the provision of services from third-party organizations for organizational, information and technical support for compulsory pension insurance activities | 130 | |

| other expenses | 140 | |

| Total funds used | 150 | page 150 = page 080 + page 090 + page 100 + page 110 + page 120 + page 130 + page 140 (calculated automatically) |

| Fund balance at the end of the reporting period | 160 | Page 160 = page 010 + page 070 – page 150 (calculated automatically) |

Results

A report reflecting information on the dynamics of targeted financing funds is generated if the reporting entity has such funds. When creating it, the form recommended by the Ministry of Finance of Russia is usually used, which has two forms (full and simplified) and, if necessary, can be supplemented with the necessary lines. Simplification of the report is achieved by combining indicators and is not available to all users of this form. There are no special instructions for filling out the current form, so you need to enter data into it based on the logic of the report form itself.

Sources:

- Federal Law of December 6, 2011 No. 402-FZ

- Federal Law of September 28, 2010 No. 244-FZ

- Federal Law of July 24, 2007 No. 209-FZ

- Federal Law of January 12, 1996 No. 7-FZ

- Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.