The legal topic is very complex, but in this article we will try to answer the question “Fines for non-payment of taxes in 2020”. Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

If you do not transfer the specified amount to the budget within the agreed period, then the account will be arrested for exactly that amount. The remaining money can be used at your own discretion. To release the seized funds, you will need to pay the debt and show documents confirming this to the Federal Tax Service.

The author of this article once owed the PF exactly 5 kopecks. Due to sloppiness in a hurry, I didn’t think so. I had to spend several days visiting the PF management and writing explanatory notes. And payments back then were only in paper form. For one bank payment he charged 3 rubles. In a word, then he always overpaid a little.

Why can fines and penalties be imposed on us?

The “Simplified Taxation System” (USN, Simplified) has significantly simplified the life of many entrepreneurs, regardless of the type of their business activity. It is very attractive, but only as long as we regularly fulfill our obligations as taxpayers. If we stop making the necessary payments to various funds and the budget on time and within the prescribed time limits, then all kinds of fines and penalties come into force. There will be no favors for anyone.

Let’s say you “forgot” to buy and register a cash register - get it and sign for it: the fine will be from 25 to 50% of the sale amount (and at least 10,000 rubles). So, they sold goods for 500 rubles, the receipt was not punched, but ten thousand, please, pay.

What can a simplified individual entrepreneur be fined for without employees?

A simplified individual entrepreneur has an obligation to regularly submit reports. If you do not submit your tax return on time, you will have to pay a fine from the Federal Tax Service, since this is an offense. Sanctions for it are prescribed in Art. 119 Tax Code: 5% of the tax amount for each month of delay.

Insurance premiums

Some of the activities of individual entrepreneurs are subject to mandatory licensing. This applies to cases if the entrepreneur is a private detective, or, for example, he has a bus on which he transports passengers.

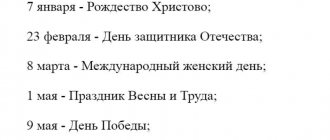

- For the fourth quarter of 2020 - January 19, 2020 (inclusive);

- For the 1st quarter - until April 19 (inclusive);

- for the 2nd quarter - until July 19 (inclusive);

- for the 3rd quarter - until October 19 (inclusive);

- for the 4th quarter - until January 19, 2020 (inclusive).

We recommend reading: I bought it for 600 and sold it cheaper, do I have to pay tax?

What is its meaning? The simplified taxation system for individual entrepreneurs, as well as for legal entities, means the replacement of individual taxes and fees established by the Tax Code of Ukraine (hereinafter referred to as the Tax Code) with the payment of a single tax. At the same time, simplified accounting and reporting rules are being introduced.

Should legal entities - unified companies - pay the unified social tax?

In order to create comfortable conditions for uniform workers, the Ministry of Revenue and Duties of Ukraine introduced the electronic service “Electronic Taxpayer Account”, the subsystem of which provides the mode “Maintaining a Book of Accounting for Income and Expenses in Electronic Form and Formation of a Tax Return.” You can view it on the website https://cabinet.sfs.gov.ua/login.

Then the first day for calculating penalties is April 28. The last day for accrual of penalties is the day when the advance payment was finally transferred to the budget. To find out the number of days for which you will have to pay penalties, you simply need to sum them up. But he paid the tax on time for the year in the amount of 14,200 rubles and did it on February 20. Question: what amount of penalties will he be charged? Now let's calculate the size of the penalties using the formula given above.

Then the inspectors will take measures to force you to pay the budget. One of these measures is the accrual of penalties. But in some cases, you can delay the payment of taxes and penalties by postponing it to a later date. This article will tell you what consequences await an entrepreneur’s organization if the tax is not paid on time and how the payment of tax and penalties can be legally postponed.

When to pay the single tax simplified tax system and what penalties await defaulters?

At the same time, the Tax Code does not equate violation of the procedure for calculating and paying advances to situations of violation of the legislation on taxes and fees with subsequent prosecution. It follows from this that there is no fine for failure to pay an advance under the simplified tax system, as well as for other taxes. Penalties for such delays are calculated according to the rules given in Article 75 of the Code.

For late declaration, the penalty is 5% for each full or partial month of delay. It is calculated based on the amount of simplified tax for the year (Article 119 of the Tax Code of the Russian Federation). The minimum fine for late payment for individual entrepreneurs and legal entities is 1000 rubles. The tax authorities will issue such a fine for zero reporting. The maximum fine is 30% of the tax amount. This is if you have delayed your declaration for more than six months.

We recommend reading: Is there a Discount for Pensioners on Train Tickets in 2020

What kind of FSSP fines are these?

Added FSSP fines are fines for late payment of traffic fines.

According to Part 1 of Art. 32.2 of the Code of Administrative Offenses of the Russian Federation, any traffic fine must be paid within 60 days from the date the resolution on the offense comes into force. The law gives another 10 days to appeal. On the 71st day from the date of the decision, the traffic police fine is definitely considered overdue from the point of view of the bailiff.

If a regular traffic police fine has not been paid within the first 70 days after the decision is issued, the data on it is transferred to the bailiffs and can be submitted to the court. From this moment on, the debt becomes the responsibility of the Federal Bailiff Service. The FSSP begins searching for the debtor. At the same time, the court may add additional amounts to the fine. At this stage, the citizen incurs a FSSP fine.

The new fine is transferred to the Federal Bailiff Service. The main task of the bailiff is to search for the debtor and force him to repay the debt.

Using one fine as an example:

Fine for declaration under simplified tax system in 2020

10 working days after the deadline for submitting the declaration (March 31 for companies and May 4 for individual entrepreneurs), the inspectorate will block all accounts (clause 3 of Article 76, clause 6 of Article 6.1 of the Tax Code of the Russian Federation). And you will be forced to bring a declaration.

Fine for declaration under simplified tax system

Tax authorities issue a tax fine after a desk audit of the declaration. Keep in mind that based on the results of the cameral, the inspector may charge additional simplified tax for payment. This means that the fine will be calculated based on the amounts that the inspector calculates.

The main punishment for violating tax laws is a monetary penalty: a fine for failure to submit an individual entrepreneur’s declaration or the accrual of fines and penalties for late payment of the payments themselves. But there are also exceptions. In case of large or especially large non-payment of taxes, an individual entrepreneur falls under criminal liability (Article 198 of the Criminal Code of the Russian Federation).

Useful legal information on the topic: “Fine for non-payment of tax” with a description from professionals. The page collected data on the topic with comments from professionals. You can ask all questions to the duty lawyer.

Extenuating circumstances

The amount of advance payments amounted to 30,000 rubles. (10,000 rub. + 15,000 rub. + 5,000 rub.), which is 5,000 rub. (16.67%) more than the tax calculated for the year (RUB 25,000). Accordingly, penalties accrued on advance payments are subject to reversal by 16.67%. Their size will be: for half a year - 10.31 rubles. [RUB 12.37 - (12.37 rubles x 16.67%)], and for nine months - 8.03 rubles. [9.63 rub. — (RUB 9.63 x 16.67%)].

If the taxpayer requests a deferment due to the seasonal nature of the activity, he must provide a document confirming that the share of seasonal work brings him at least 50% of the total income from sales. This rule applies from January 1, 2011.

Penalties are assigned and calculated by the tax authorities, but everyone who has committed a fine would like to know in advance what the amount of penalties will be. This can be done based on the figures specified in regulatory documents, but this requires constant monitoring of changes in legislation.

Documents for obtaining a deferment

A penalty is a type of sanctions provided for the presence of a delay in tax payment or for the fact that payment has not been made in full. In addition, it is relied upon if errors were made in the declaration, which led to a reduction in the amount of tax and the formation of a debt to the budget.

Payment must be made by April 25, July 25, and October 25, respectively. If you are late with these advance payments, then fortunately for you there is no fine for this violation, but you will be charged a penny of 1/300 of the Central Bank refinancing rate.

We recommend reading: Benefits for a third child in 2020 Novosibirsk

Reasons for late payment

Practice shows a large percentage of the application of penalties to persons who violate traffic rules. Car owners do this everywhere, either on purpose or through negligence. In any case, punishment will always follow in the form of an attempt to fine the person or apply other measures of influence.

Speaking about failure to pay a fine on time, it should be understood that such actions are not always characterized as a deliberate attempt to avoid punishment and responsibility for violating traffic rules. There is even a definition of those reasons that can be considered valid, which can help avoid more severe measures against the offender.

Regardless of whether the fine payment terms were violated intentionally or through negligence, such an act will be considered illegal. Accordingly, non-payment will result in sanctions under any circumstances.

Speaking about reasons that can be considered valid, the following options should be pointed out:

- Business trip. Departure must occur at the time the fine is issued. The business trip itself is taken into account only if it is considered long-term, that is, it affects the entire period for paying the fine.

- Disease. The nature of the disease must be considered severe and require special medical treatment.

- Detention. This should be carried out suddenly and act as a measure of liability also for committing another offense.

In some cases, if a citizen simply forgot, without the intent to hide from the sanction, additional means of enforcement may not be applicable if the penalty is eventually paid.

It should be understood that any reason must have confirmation. Simply giving an explanation that a person was sick will not work. You need to prepare medical documents, undergo treatment, obtain a conclusion, a travel certificate, and so on. Otherwise, this will be a standard evasion and violation of the law, for which the state traffic inspectorate will be able to obtain additional enforcement measures.

At the same time, statistics show forty percent of cases where fines are not paid, and a significant part of these are formed due to the adherence of drivers and the desire to avoid prosecution for as long as possible.

Penalty for late tax according to the simplified tax system

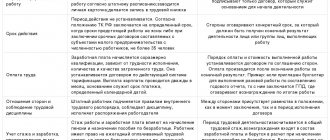

The simplified tax system was developed specifically to reduce the tax burden on small businesses. An additional advantage of the simplified tax system is submitting the declaration once at the end of the year (Article 346.19 of the Tax Code of the Russian Federation). It is in this report that the full tax amount will be calculated. The report is submitted simultaneously with the final payment of the tax.

Why do you get fined on the simplified tax system?

Many entrepreneurs traditionally prefer to submit the declaration in person by printing out the completed form. Some simplifiers send their authorized representative to the tax inspector. The main thing here is not to forget to confirm the authority of such a person using a power of attorney. If there is no time to visit the Federal Tax Service, the company has the right to send a report by mail. The most convenient and fastest way is to send a declaration via the Internet. From the Kontur.Accounting web service you can send a declaration in one click.

If a taxpayer applying a simplified tax regime receives an advance, then there is no benefit. This is explained by the fact that the company will be liable to the enterprise that transferred the advance amount.

- KBK.

- Basis of payments (TP – transfer in the current year).

- Tax period (Q - quarterly transfers).

- Type of transfer (AB – transfer of advance amount).

- The purpose of the payment (advance payment for a certain period (1st quarter, six months, etc.), which is sent to the state budget in connection with the organization’s work under a simplified regime), it is worth indicating the object of taxation.

Questions that arise ↑

- decision of the authorized body to seize the property of the enterprise;

- a decision of the court to take measures to suspend movement on the company’s account, seize the taxpayer’s finances or property.

All documents comply with the current legislation of the Russian Federation. That's all! Submit your reports on time and there will be no problems. Good luck in business! Fine and penalties for failure to pay an advance payment under the simplified tax system Organizations and entrepreneurs using the simplified tax system must make advance payments to the budget three times a year - prepayment of tax.

But it can be terminated early. First, the firm can pay the tax early to avoid paying any more interest. Secondly, you may be deprived of an installment deferment if the company violates its terms, for example, does not pay current tax payments on time. In this case, the Federal Tax Service will send you a decision by mail to terminate the deferment of installments.

Penalty size

The tax office itself calculates penalties, so you don’t have to waste your time on calculations.

But it’s still useful to know why they require penalties from you and how they were calculated for you. This way you can estimate your expenses in advance if you suddenly missed a deadline, and you can even check the tax office. Penalties are calculated for each day of delay - the longer you do not pay, the more penalties will be charged. If the amount of the debt and the duration of the delay are small, few penalties will be charged: 0.72% of the tax for the month of delay.

The key rate is set by the Central Bank. Take into account the one that was valid during the period of delay. You can find it on the website of the Central Bank of the Russian Federation. From September 17, 2020, the key rate is 7.5%, and from December 17 - 7.75%.

Penalties begin to accrue the day after the deadline for payment expires, and end on the day you remit the tax. That is, for the day when you paid the debt amount, there will be no more penalties. This position is shared by the Ministry of Finance in a letter dated July 5, 2020, and the Tax Service in a letter dated December 6, 2017.

For example, October 25 is the last day to pay taxes, and you transferred the money only on October 29. Penalties will be accrued for 3 days - October 26, 27 and 28.

Submit reports in three clicks

Elba - online accounting for individual entrepreneurs and LLCs. The service will prepare reports, calculate taxes and free up time for useful things.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months