With the development of contactless document flow technologies, much attention is paid to the security of papers sent in this way. You can confirm the accuracy of the transmitted information using an electronic digital signature (ED). Why individual entrepreneurs need it and how to get it, we will tell you further.

It should be noted that the electronic signature is generated for an individual – its owner. The only difference is the need to be linked to a specific organization if it is necessary to sign documents transferred on behalf of a legal entity. The entrepreneur acts on his own behalf, so it is no different from that issued for an ordinary individual. And the package of documents for obtaining it will differ from what the organization submits to its authorized representative.

What is an electronic signature for individual entrepreneurs?

An electronic signature is a digital combination that contains information about its owner. A document signed by electronic signature is recognized as legally significant and reliable on a par with that certified by a personal signature.

All features of the use of an electronic signature and its receipt are prescribed in Federal Law dated 04/06/2011 No. 63-FZ.

There are three types of digital signature:

- simple , which is formed using a password, code or other means;

- enhanced unskilled (NEP ) is created using special programs and more accurately identifies the person who signed the document. Allows you to determine whether changes were made after signing. Does not require obtaining a certificate from a certification center;

- enhanced qualified (REC) is the most reliable way to protect your documents transmitted over communication channels. Subject to mandatory certification by a certification center. Requires the use of special software to certify transmitted documents.

How to obtain an electronic signature for an individual entrepreneur

The procedure for obtaining an electronic digital signature for individual entrepreneurs is prescribed by law. A certification center can produce it. Such organizations are accredited by the Ministry of Telecom and Mass Communications, after which they are included in the federal register. To obtain an individual entrepreneur's electronic signature, you must prepare a package of documents:

- originals (or certified copies) of passport and tax registration certificate;

- SNILS, OGRN data;

- power of attorney if documents are submitted through a representative;

- application for signature.

After producing the key, the applicant receives an electronic signature certificate recorded on external media. This document certifies and identifies the owner of the electronic signature.

- Qualified electronic signature for individual entrepreneurs

2 900 ₽

2900

https://online-kassa.ru/kupit/kvalifitsirovannaya-elektronnaya-podpis-dlya-ip/

OrderMore detailsIn stock

- Enhanced electronic signature

2 900 ₽

2900

https://online-kassa.ru/kupit/usilennaya-elektronnaya-podpis/

OrderMore detailsIn stock

- Digital signature for individual entrepreneurs

2 900 ₽

2900

https://online-kassa.ru/kupit/etsp-dlya-ip/

OrderMore detailsIn stock

How to make an electronic signature for an individual entrepreneur

Is it possible and how to make an electronic signature for an individual entrepreneur without contacting specialized centers? No. Self-production of keys and a signature certificate is not only impossible, but also unacceptable from the point of view of the law. Only accredited centers included in the federal register can produce them.

In addition, in the production of CEPs, cryptographic encryption standards are used, which are examined by the FSB for compliance with current requirements.

What might it be needed for?

The scope of application of EP is quite extensive. For individual entrepreneurs it is required in the following cases:

- signing and submitting reports to the tax authority and extra-budgetary funds, if done via the Internet;

- signing electronic forms and documents on the portals of government agencies: Federal Tax Service, State Services, etc.;

- participation in trading platforms at various levels, including government procurement;

- work in EGAIS.

When applying for an electronic signature, an entrepreneur must clearly determine for what purposes he needs it.

Registration of an electronic digital signature on the MICEX ETP “Government Procurement”

Let's assume that this is your first time on the ETP web portal. First you will need to create a new “account”. On the main page of the MICEX “Government Procurement” portal, go to the “For Suppliers” tab. From the drop-down list, select the “Registration of power of attorney” option. An application form will open - you should fill it out:

- enter new user details;

- the CryptoPro CSP modal window will appear - select the desired certificate from the list;

- click the “Submit” button;

- in the next modal window of the crypto application, enter the pin code for the container containing the SKPEP;

- Click "Ok".

Now you will need to fill out the registration form. Information must be provided only in empty lines. Some fields are automatically filled in with data from the submitted document. Don't forget to attach scans of documents confirming the authority of the digital autograph holder:

- decisions on appointment to a position or protocol on election - for the director of a legal entity;

- a power of attorney issued in the name of the owner of the digital signature, and a paper confirming the powers of the person who issued the power of attorney - for an employee of the organization.

Finish filling out the form and click “Sign and Submit.” In the modal window of the crypto module, enter the pin code for the container containing personal information and click “Ok”. After completing these operations, a notification will open asking you to confirm the specified e-mail. A letter containing the appropriate link will be sent to it. Follow it and continue the procedure - enter the login and password for your “account” on the ETP. Select SKEPP and click “Confirm and send”. Wait for the notification about the successful completion of the procedure and start working on the ETP.

Advantages of an electronic signature for individual entrepreneurs

The benefits of use include:

- saving time when many documentary issues can be resolved via the Internet;

- reliability. A qualified electronic signature obtained from a certified certification center is protected from counterfeiting. Therefore, its owner is guaranteed protection of interests and personal data;

- confidentiality of document flow.

Experts note that it is impossible to forge a qualified signature, since a unique chain of characters is used to develop it. The electronic signature keys obtained during generation are stored on a USB drive, which are inextricably linked with the owner’s personal code. If stored and used correctly, it is not possible to break the signature cryptography.

If, after applying the electronic signature, changes are made to the document, it will be distorted, which will help draw a conclusion about interference and invalidate the document.

The cost of producing an electronic digital signature for the tax office

The cost of producing an electronic signature for the Federal Tax Service is not regulated by the Ministry of Telecom and Mass Communications. The final price has the right to be determined by the certification center itself. That is why this service can cost from 1 to 15 thousand rubles. The average price for an enhanced qualified digital signature for submitting reports to the tax authorities ranges from 900 rubles to 4 thousand (depending on who acts as an applicant - an individual or legal entity, individual entrepreneur).

Additionally, when producing an digital signature, the following are paid:

- USB key on which the digital certificate itself is recorded;

- license for Crypto-Pro software, which is the only certified software for working with enhanced qualified keys in the Microsoft Windows family of operating systems.

As for the Crypto-Pro license, there are two types: limited and unlimited. The first works only for a certain period of time (6 or 12 months), the second, as the name suggests, has no such restrictions.

The important thing is that it is not necessary to buy this software directly from a certification authority. Everyone has the right to purchase a license independently directly from the developer on the official website www.cryptopro.ru, which will allow additional savings. To work with digital signature for tax reporting, you will need program version 3.6 or higher (currently the current version is 5.0, updates are released regularly, you do not need to install them manually).

How to obtain an electronic signature for an individual entrepreneur in the tax office in your personal account?

Amendments to the Tax Code have made it possible for taxpayers to fully use the capabilities of their Personal Account on the official website of the Federal Tax Service. This made it possible to send documents signed with an enhanced non-qualified signature, which makes them equivalent to those signed with one’s own hand.

It is used to send the following documents:

- applications for credit or refund of overpaid taxes;

- applications for tax benefits for individuals (property, transport, land);

- messages about existing real and movable property;

- filing the 3-NDFL declaration and its annexes;

- other documents.

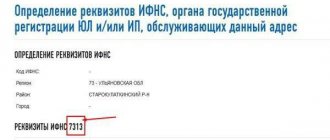

Step-by-step instructions for obtaining a certificate through the Tax Authority consist of the following points:

- Log in to the taxpayer's personal account.

- Go to the "Profile" icon.

- In the window that opens, a link “Obtaining an electronic signature verification key certificate” will appear, which we need to follow.

- On the page that opens, you will be asked to install the software that is necessary to work with the electronic signature. It is suggested to download the installation module depending on the system used (Windows or Mac OS). Before generating a request, it is necessary to note where you plan to store the electronic signature key: on a workstation or in the Federal Tax Service system.

- After clicking on the “Generate” button, you need to confirm your personal data.

- On the next page, create a password and repeat it. Remember that it should be a combination of letters, numbers and symbols that is not only easy to remember, but also reliable. The container is named automatically.

- This will be followed by sending a request to generate a certificate (Fig. EP 7). The process of creating it may take a certain amount of time, during which you can continue working in your Personal Account or leave it.

- The next time you log in, a message about this will appear when the certificate is ready. Now you will be able to fully certify documents sent to the tax authority.

Registration of individual entrepreneurs through the State Services portal

The procedure is similar to registration through the Federal Tax Service website. Only in this case, all actions are performed on the portal, so registration and account confirmation are required.

Stages of registering an individual entrepreneur on the public services portal:

- Go to the IP registration service page.

- Select "Send electronic documents".

- Log in to the portal (you can use your electronic signature).

- Prepare documents using the program (in the same way as for the tax authority).

- Upload documents.

- Receive a receipt in your personal account on the portal indicating that the tax authority has received the sent documents.

- Receive a decision on individual entrepreneur registration (extract from the Unified State Register of Entrepreneurs) in your personal account on the portal.

If you plan to interact with government agencies in the future through the State Services portal, you can register (create) an individual entrepreneur account.

Production time and validity

It takes 1-2 business days to produce a certificate and electronic signature key after submitting an application and personal documents. After notification of readiness, the businessman must again go to the certification center with personal documents and receive a certificate and electronic key.

The interests of the entrepreneur can be represented by a trusted person, whose actions are supported by relevant documents.

The validity period of the electronic signature is 1 year from the date of issue of the certificate. After which you will need to get a new one again for the next period.

What is required when registering an electronic signature

First you need to start setting up your workplace. Some certification authorities offer this service. But the help of a specialist is not necessary; you can perform the following steps yourself.

- Update your operating system if possible. The stability of the special software is guaranteed for the latest OS versions.

- In the Windows system registry, specify the CA root certificate. This is done using the CryptoPro program. The root of our CA can be found on the website ca.astralm.ru

- Install cryptographic software, it is important that it meets the requirements of new security standards. Most often they work with CryptoPro or Vipnet

- Install drivers for the media of your electronic signature. This could be a smart card or a token that looks like a flash drive. Issued together with an electronic signature at the CA. You can also download it from the manufacturer's website.

- Install all updates for MS Internet Explorer. Most government services are designed for this web browser. Most sites work with IE.

- If you plan to use CryptoPro CSP, then you will need to install special software provided by the product supplier. Select the option that is compatible with your operating system version. The distribution must be downloaded from the manufacturer’s website, and a license can be purchased at the CA.

- Place the ES certificate in the OS storage and mark it as trusted. This is done using CryptoPro.

After this you can start working. But do not forget to make sure that you have all the information to fill out the electronic forms. On online platforms you will need to enter:

- organization e-mail;

- taxpayer number and OGRN;

- Checkpoints of the organization and each subsidiary, if any;

- the full name of the enterprise, as indicated in the constituent documents;

- Full name of the person who will perform actions on behalf of the company.

What does an electronic signature look like?

An electronic signature is information about the owner attached to a document. This could be a picture in the form of a stamp, like the tax authority received when receiving it electronically. It contains information that the document is certified by electronic signature, there is a certificate number, its owner and other information.

In most cases, the electronic signature is not noticeable, but you can recognize that the document is certified by it using special software. Such an electronic file cannot be edited without breaking the signature.

Extension and reissue of digital signature

Upon expiration of the digital signature, it must be renewed. In essence, this is confirmation of the relevance of the documents that an individual or legal entity provided when creating an electronic key. Experts recommend just renewing it - it will cost less, and if you also contact the same certification center that originally issued the certificate, then you will not need to collect all the documents again (with the exception of a civil passport and an extract from the Unified State Register of Legal Entities, Unified State Register of Individual Entrepreneurs).

The owner of the digital signature has the right to request re-issue of the electronic key at any time, but in this case you will also need to purchase a new USB token (only it will cost about 1 - 2 thousand rubles).

What is the difference between a qualified electronic signature and an unqualified one?

The requirements for an unqualified EP are less stringent than for a qualified one. To obtain it, you do not need to have a certificate or contact a certification center. This signature is used:

- for signing tax reporting and primary documents;

- to participate on some trading platforms.

A qualified electronic signature is the most reliable in terms of protecting electronic document flow. Requirements regarding it include:

- issuance only to accredited CAs;

- confirmation by key verification certificate

A document signed by the CEP has legal force and is accepted in legal disputes.

Basic information about digital signature

The use of an electronic signature (ED or EDS) is regulated by Law No. 63-FZ of October 4, 2011. In accordance with it, electronic signature means information in electronic form that is attached to a file with a document or is otherwise associated with it. This information is used to identify the person who signed the document.

Depending on the degree of reliability, an electronic signature can be simple, unqualified (NEP) and qualified (CEP).

What is a simple electronic signature can be most easily explained using the example of an online bank. To enter it, the user must enter his identification data: login / password, and often a digital code that he receives via SMS. To confirm a transaction, such as a money transfer, you also usually need to enter a code. So, a login-password pair or a phone number-code pair is an example of a simple electronic signature.

The use of unqualified electronic signature protects information more reliably, since cryptographic means are used to generate it. It will ensure the safety of the document from making changes to it after signing. But such a signature is not universal. The parties must agree that the documents signed by the NEP have legal force, and put this in writing.

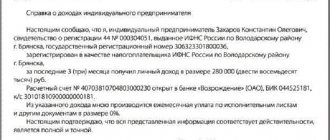

For example, a non-qualified digital signature can be generated in the personal account of an individual on the tax service website. A file will be generated that contains basic information about the citizen in encrypted form. If he needs to send any application or income declaration to the Federal Tax Service, this file will be attached to the document. After reading the encrypted information, the system will determine that the signature was put by the person who had the right to do so.

A qualified signature differs from an unqualified signature in that for its formation, cryptographic protection means are used, which are certified by the FSB of the Russian Federation. How to obtain such an electronic signature for an individual entrepreneur? It is issued in certification centers accredited by the Ministry of Digital Development, Communications and Mass Communications (as the Ministry of Telecom and Mass Communications is now called). Its authenticity is confirmed by a certificate that the user receives on electronic media. This signature is universal. That is, there is no need to obtain consent for its use with each counterparty separately - you can issue one electronic signature and sign all documents with it.

For example, if we talk about an individual entrepreneur, a qualified signature will allow him to certify internal documents in his business, sign reports and other papers for the Federal Tax Service, funds and other supervisory authorities, and enter into agreements with suppliers, contractors and clients. EPC is a complete analogue of a handwritten signature and replaces it, regardless of whether the parties agreed on electronic document management.

Let's move on to the issue of electronic signature specifically for individual entrepreneurs. Let's consider what type of digital signature is relevant, how to obtain it, and whether it can be done for free.

Where else can you use a signature?

The electronic signature key for the tax office allows you to use all the functions of the State Services portal, including:

- submission of certificates and requests to Rosreestr;

- registration or amendments to the Unified State Register of Legal Entities, Unified State Register of Individual Entrepreneurs;

- obtaining extracts from the Unified State Register of Legal Entities, Unified State Register of Individual Entrepreneurs, and any other departments;

- receiving notifications of fines and paying them;

- work with housing and communal services (entering readings, registering devices, payment);

- making an appointment with a doctor and interacting with the facilities of the Ministry of Health;

- work with PF;

- Civil registry office services (you can submit an application remotely);

- payment of state fees;

- submitting applications for issuing or changing a passport;

- participation in trades and auctions on electronic platforms (including those where government tenders are considered).

This is just a basic list of services. You can get acquainted with their full range on the official website www.gosuslugi.ru. This is especially true for an enhanced qualified signature.