Fixed assets are company assets that serve for a long time and are replaced with others only as they wear out. Depreciation of fixed assets is considered to be the gradual loss of property's own use value. During operation or, conversely, downtime, any object of production assets consistently wears out - buildings are destroyed, spare parts and parts wear out, machines, vehicles and equipment fail. We will discuss OS wear, its types and calculations that allow us to determine the percentage of wear of an object in our article.

Depreciation of fixed assets: physical and moral

So, OS wear and tear is the loss of value during operation or inactivity. It can be physical or moral. Physical manifests itself as the loss of technical qualities and characteristics under the influence of time and production processes. Physical wear and tear is divided into productive (in which a loss of value occurred during operation) and unproductive (when an object wears out after being in storage for a long time).

Moral wear and tear is when the value of an object decreases as a result of the appearance on the market of its improved analogues with higher productivity and lower cost.

By studying the logic of physical and moral wear and tear, the duration of wear of a certain OS object is established. These studies form the basis for the calculated standard service lives (SLI) of property and depreciation rates.

Types of depreciation of fixed assets

The loss of value of fixed assets is caused by various factors. Depending on them, there are several types of wear. For ease of perception, they are presented in the table.

| Type of wear | Causing factors | Example |

| Physical | Loss of value is due to physical, biological, chemical and other similar characteristics of fixed assets | Destruction of the rail bed as a result of operation Livestock death Corrosive destruction of the pipeline |

| Obsolescence of the first kind | The emergence of analogues of fixed assets that cost much less | The cutting equipment uses the latest artificial diamonds, which makes them cheaper |

| Obsolescence of the second kind | The emergence of similar equipment with greater productivity. |

Depreciation and amortization of fixed assets

In order to timely replace fixed assets with worn-out resources without damaging the company’s activities, it is necessary to provide a mechanism for transferring the value of retired assets to manufactured products. This is how the depreciation fund is replenished, the funds of which will subsequently be used to purchase new fixed assets. Only under this condition is reproduction of the PF possible.

Thus, depreciation and reproduction of fixed assets are inseparable categories, and the process of successively transferring the cost of fixed assets to manufactured products in order to accumulate funds for the reproduction of fixed assets is called depreciation. The sinking fund is a special reserve that is a financial resource for capital investments.

Depreciation: formula

It is measured in months, determined by the organization independently at the time of acquisition of the main asset.

3) Depreciation of fixed assets is a cost indicator. This is part of the price of the main asset, which is included every month in the cost of production (costs, expenses) in order to slowly (over the period of required use) recoup the costs of purchasing the main asset. Depreciation amount for each

the fixed asset increases monthly until it becomes equal to its initial cost. This is the balance of account 02 Depreciation of fixed assets.

4) The percentage of depreciation is determined as the ratio of the amount of accrued depreciation to the initial price, expressed as a percentage. The percentage of wear increases from month to month, and becomes equal to 100% by the end of the required use period.

Let me give you an example. We purchased equipment for 360,000 rubles. The period of its required use was determined to be 3 years (36 months).

For the first year of operation, depreciation was calculated (RUB 360,000 36 months) x 12 months. = 120,000 rub.

This means that the percentage of wear after 1 year of operation is equal to: 120,000. 360,000 x 100% = 33%.

After 3 years of operation, depreciation will be charged in the amount of 360,000 rubles.

and the wear percentage will become 100%.

EBITDA: Earnings before interest, taxes, depreciation and amortization

Interesting posts

Similar articles that you will probably be interested in:

- How to calculate depreciation of fixed assets

The article talks about how depreciation of fixed assets (FPE) and intangible assets (IMA) is calculated, and will draw attention to the features inherent...

- What is depreciation of fixed assets

4.2. Depreciation of fixed assets Depreciation is the gradual transfer of the price of fixed assets to the cost of production (work, favors). In balance...

- How to calculate the depreciation rate

Modern methods of calculating depreciation Let's calculate the monthly depreciation rate: K = 100% = 1.04% So, every month the machine will be charged...

- Depreciation of vehicles

The price of vehicles, like other fixed assets, is repaid through depreciation over the period of required use...

- How to calculate the percentage of depreciation of a building

1. How to calculate the percentage of wear and tear on a house. (the text below is taken from the discussion here, the mentioned regulatory document can be downloaded here: paragraph 5)…

- How to determine depreciation group

In the work of every enterprise or organization, fixed assets are used. which are part of the organization’s property, used as...

Wear calculation

The transfer of the cost of fixed assets to the company's products is carried out by charging depreciation of fixed assets. It is based on the calculation of depreciation, based on the principle of gradualism. Depreciation expenses are considered to be amounts that form part of the cost of fixed assets and are then transferred to the price of the product. They form the cost item “depreciation” in the cost of the product. Their size is set as a percentage according to standards calculated on the basis of approved OS classifiers.

All fixed assets are divided into 10 depreciation groups, and the main criterion for division is the service life of the object. For example, the 1st group includes OSes with a service life of no more than 2 years, and the 10th group includes objects whose operation is expected to last over 30 years. Tax accounting is guided by the determination of the depreciation group of an object based on the classifier, accounting - establishes it based on considerations of expected operation.

The depreciation rate is the percentage of depreciation of fixed assets, the calculation formula of which is the ratio of one unit to the number of months of effective operation of the facility. We can assume that depreciation is an expense calculated as a percentage of the cost of the asset, allocated to production costs and included in the cost of the product.

25. Depreciation of fixed assetsDepreciation –

monetary expression of depreciation, reflecting the transfer of the cost of the asset to the manufactured product (service).

Physical wear and tear

- This is the wear and tear of the means of labor due to industrial consumption.

Obsolescence

- this is a reduction in the cost of production of existing PFs and the invention of more advanced means of labor.

Sinking fund (FA)

reflects the total cost of the PF, which must be transferred to the manufactured product or service for the entire service life, i.e., the amount that, by the time of disposal of the PF, would ensure the possibility of their reproduction:

F

=

PV

+

KR

+

M

+

L

,

where PV

– full replacement cost of the PF;

KR

– the cost of major repairs during the depreciation period;

M

– the cost of modernization during the depreciation period;

L

– liquidation value of fixed assets minus the costs of their dismantling.

The volume of annual depreciation charges is the ratio of the volume of the depreciation fund to the service life of the asset in years.

The percentage ratio of the volume of annual depreciation charges to the total replacement or original (PP) cost is called the depreciation rate.

Absolute amount of depreciation

is defined as the difference between the full, initial or replacement cost and the residual cost, taking into account wear and tear or replacement cost taking into account wear and tear. The ratio of the amount of depreciation of fixed assets to their total cost is the depreciation coefficient.

The inverse indicator is the suitability coefficient,

characterizing the unworn part of fixed assets.

The form of depreciation, which is based on the condition that the process of depreciation of fixed capital occurs evenly throughout its entire service life, is called linear:

E.A.

= (

V

1 –

V n

+1) /

n

,

where E

A

is the annual depreciation fund;

V – the full initial cost of fixed assets at the beginning of the first year;

V

n+1

– value of funds at the time of disposal (after

n

years of service).

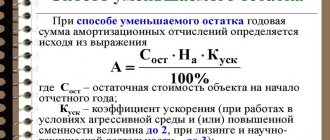

The accelerated depreciation method is determined by multiplying the cost of the asset minus depreciation (residual value) at the beginning of the year by an amount equal to (2 / n), where n

is the service life of the assets).

The annual depreciation fund with increasing depreciation is calculated using the formula:

E.A.

= (

V

1

r

) / [(1+

r

)

n – f

+ 1 – 1],

where E

A

is the annual depreciation fund;

V

1 – full initial cost of fixed assets at the beginning of the first year;

r

– discount interest rate;

n

– service life of fixed capital (in years) – estimated.

Table of contents

Degree of depreciation of fixed assets

To determine the degree of wear, an indicator such as wear coefficient is used. It shows how worn the object is, i.e. the user will find out to what extent the upcoming replacement of the object is financed as it wears out. It is calculated by the ratio of the amount of accrued depreciation to the original cost of the object.

For example, a company operates a machine with wear and tear, i.e. depreciation charges, in the amount of 20,000 rubles. The initial cost of the machine is 100,000 rubles. Let's calculate the degree of depreciation of fixed assets - this can be done using the formula:

K = AO / PS x 100, where AO is the amount of accrued depreciation, and PS is the original cost.

K = 20,000 / 100,000 x 100 = 20%

This means that the object is worn out by 20%, i.e. The accumulation of the depreciation fund for the purchase of a new machine is 20%. Thus, the depreciation of the enterprise's fixed assets is equal to the amount accumulated for their reproduction.

Comparison of depreciation and wear

Based on a comparison of the concepts of depreciation and depreciation, the following differences can be distinguished: - by time of occurrence - depreciation is accrued as a result of depreciation of fixed assets, i.e. is its consequence; - depreciation is the monetary equivalent of depreciation of fixed assets, while depreciation does not have a monetary expression; - depreciation does not necessarily depend on the level of depreciation - the cost of an object can be fully depreciated, while it has not yet been subjected to complete physical wear and tear and is subject to future use; The opposite situation also occurs - when equipment breaks down before its cost is completely written off; - companies can independently determine depreciation rates; - in accounting, the term depreciation is not used, only depreciation; depreciation is a representation from the field of financial review; - the term depreciation is enshrined in law, while there is no legal definition of depreciation; - depreciation is a decrease in the value of fixed assets and an indicator of equipment obsolescence, and depreciation is a transfer to the cost of manufactured products, which allows the restoration of the fixed asset fund .

The fixed asset must be payable and bring economic benefits. If the operation of a fixed asset does not generate revenue, then there is no point in the organization spending its financial sources on its contents. Depreciation shows whether the fixed asset is suitable for subsequent use, and the amount of depreciation indicates the degree of its payback and financial return.

Fixed assets or funds are means of labor that are used by an organization for more than 12 months or one production cycle and are not prepared for subsequent resale.

Depreciation rate of fixed assets: formula for calculating the balance sheet

You can find data on accrued depreciation of fixed assets in the notes to the balance sheet. They are in the form of Appendix No. 5 to the balance sheet, which was part of the financial statements until 2011. Despite the fact that the mandatory nature of this form has been cancelled, it is used to explain the dynamics of OS in the period under review. The formula used to calculate the amount of depreciation of fixed assets, in relation to the explanations, looks like this:

K = gr.5 lines 5200 f.5 / gr. 4 lines 5200 f.5 x 100

Analysts consider the depreciation rate of a fixed asset together with the serviceability rate of the fixed asset, calculated as the ratio of the residual value to the original value. These indicators characterize the state of the asset and have an analytical meaning, often conditional, since the method of calculating depreciation plays an important role.

Shelf life indicator

The serviceability coefficient of fixed assets is an indicator opposite to the depreciation indicator. It is calculated as the ratio of the original (replacement) cost to the collected amount of depreciation (depreciation). The resulting total can also be multiplied by 100%. This indicator shows the share of unworn fixed assets. The indicator is calculated at the beginning and end of the reporting year. The fitness indicator can be calculated by subtracting from one or 100% the value of the wear indicator. If you sum up the wear and serviceability indicators, you get a total of 1 or 100%. Let's say the wear rate is 0.3 or 30%, respectively, the serviceability rate will be 0.7 or 70%. The serviceability indicator must exceed the wear rate and, as a percentage, be more than half of the total cost of fixed assets. The enterprise must control the degree of deterioration and serviceability of its fixed assets, update and modernize them in a timely manner. Fixed assets in good condition are the key to an uninterrupted production process, reducing the cost of finished products and increasing the company’s revenue.