The assessment is performed by experts with >5 years of experience . We have all current qualification certificates in areas (real estate, movable property, business)

We always meet project deadlines . It is important for us to show results in a short time

The price includes free support for Reports (corrections, elimination of comments)

the most polite employees communicate with you .

We bring complex projects to fruition . People turn to us in situations where other experts have failed

The problem of objective assessment of a business and the value of its assets is relevant for every entrepreneur. When investing in a business, an entrepreneur expects to at least return the invested funds when selling it, and at maximum, make a profit.

In this regard, many investors began to resort to the services of calculating and assessing the value of the organization’s assets. In order to fully understand the significance of this assessment, we propose to understand what this procedure is.

Most people understand assets as a tool for generating income that can be sold if necessary. But this is only partly true. An asset is all of a company's or individual's property, not just the portion that generates direct income. Asset valuation in this context is a set of measures to calculate the value of all property of an enterprise as of a specific date.

An important component of the entire procedure is the calculation and assessment of the value of net assets, which serve as the main indicator of the efficiency of the enterprise. This is the value of assets obtained by subtracting all liabilities from the market value of the company (total assets). Net asset value is especially important when assessing performance during a crisis.

Assessing the value of business assets is necessary for a number of reasons:

- the ability to systematize basic information about the organization, which allows you to develop tactics and development strategies and further evaluate the implementation of assigned tasks, adjusting them depending on external circumstances;

- obtaining real information about the financial condition of the company and its work, analyzing the results;

- reducing the risk of loss of investments and increasing the efficiency of cash distribution;

- the state uses such information when developing economic policy;

- For the banking system, an objective assessment of assets is a kind of guarantor of stability, since assets are often used as collateral for lending.

When assessing assets, material objects are taken into account, the value of which can be calculated according to specific criteria, and intangible property - copyrights, patents, licenses, etc.

What are net assets?

The concept of net assets is directly related to the functioning of companies such as OJSC, CJSC, LLC, PJSC, as well as banks and mutual investment funds.

Net assets show the market price of that part of the property that will be available to the shareholder after paying all debts, for example, in the event of bankruptcy of the organization. This is where the name “pure” comes from.

The value of net assets is an indicator for assessing the quality of a company's past and present activities, as well as its opportunities for growth and existence in the market.

One of the mandatory elements of organizing a joint stock company is the authorized capital, which is formed from funds from the purchase of shares. At the beginning of the enterprise, the amount of capital coincides with the amount of net assets. In the future, net assets play the role of a guarantor for undertaken obligations to creditors.

The authorized capital remains unchanged (it is fixed in the charter and can only be changed at a general meeting), however, the amount of net assets may change depending on the performance of the company. If there is retained earnings at the end of the reporting period, then net assets are growing. If there are uncovered losses, then it is reduced.

We can say that net assets are an indicator of the stability of an enterprise, which provides guarantees of protection for both shareholders and creditors and investors.

Calculation value

Net assets are considered not only as an important indicator of the financial position of the enterprise. The higher this parameter, the more attractive the company is to investors, since they are confident that they will not lose their investments. If this parameter is relatively low, then there is a risk of bankruptcy, which does not appeal to anyone. It is important to regularly monitor the status of net assets and prevent them from falling critically.

In general terms, this calculated indicator can be called an indicator of the company’s well-being/failure; on the basis of it, the owner can evaluate how his managers work and make management decisions.

Overall asset valuation

The assessment of the value of assets of joint-stock companies and other types of legal entities is carried out on a voluntary or mandatory basis.

An assessment is required in the following situations:

- when conducting transactions with municipal, regional or federal property;

- when restructuring an organization (sale, takeover, liquidation, merger, etc.);

- in transactions with shares (purchase, conversion, issue);

- if disputes arise about the value of the property (mortgage, tax, marriage and other disputes);

- when making settlements in transactions with shares and shares using non-monetary resources;

- to calculate the amount of insurance premiums and payments.

In other cases, the assessment is carried out voluntarily. This is explained by the impossibility of planning development without information about the real value of the company on the market. In any field of activity, an objective assessment will help make informed decisions for further development:

- carry out changes in the management of the organization;

- carry out company reorganization;

- draw up business plans based on real data;

- use property as collateral based on its real value (overall creditworthiness);

- invest funds in the most profitable projects;

- carry out purchase and sale transactions without the risk of losing funds due to inflated prices.

Assessment allows you to make decisions that would simply not be possible without it. For example, reduce inefficient or redundant production or switch to renting production assets instead of maintaining them yourself. In addition, when lending secured by property with an appraisal, you can demand better terms from the bank for the transaction. The same can be said in the case of negotiations with investors.

Net Asset Valuation

Assessing the value of the net assets of joint-stock companies is a regular necessary procedure, the implementation of which is prescribed by law. Net asset value:

- characterizes the degree of protection of the interests of investors and creditors;

- used to justify the price of company shares;

- necessary to calculate the share of a participant leaving the company;

- used during reorganization;

- used as a tool to adjust the company's capital structure;

- serves as an indicator to identify the approach of a crisis in an enterprise;

- regulates the payment of dividends to participants (if the indicator is below the authorized capital and reserve fund, or if it becomes so after deductions, no payments are made).

In addition, the law requires that the relevant authorities be informed if, based on the results of the annual report for the second year of existence, the net asset indicator is lower than the authorized capital. If the value of net assets falls to the minimum amount of authorized capital or less, the organization is subject to dissolution.

The assessment of the size of net assets can be carried out as part of the overall assessment of all assets or separately.

Net assets. Competent determination of net asset value.

Every business entity must be able to calculate the value of net assets.

The assets of an organization are everything that belongs to it (property, investments, obligations of third parties to it), everything that generates profit and that can be converted into cash.

Along with the specified property and investments, the organization, during its existence, always has obligations to third parties. Net assets (also used the prefix “net”, net assets) are all that will remain at the disposal of the company after it pays off all its liabilities. The term “own funds” is used as a synonym in the economic literature and some regulatory sources. At its core, this is what the organization owes to the business owners, founders, in economic terms, the so-called “price of business”, since the owners of the company in the event of its liquidation or bankruptcy can count on paying off debts to them last, after the organization's obligations to other creditors will be repaid.

On the other hand, own funds act as a financial guarantee for the organization’s fulfillment of obligations to third parties. In socially significant activities, the requirements for the amount of equity capital in the relevant area (for example, in banking, insurance) are very high.

This concept has extremely important practical application, and therefore this material is devoted to the study of the algorithm for assessing the value of the net assets of LLCs and JSCs and the analysis of some important cases of application in activities. Hereinafter, in the text of the Federal Law “On Limited Liability Companies” dated 02/08/1998 N 14-FZ will be referred to as “Federal Law No. 14-FZ”, Federal Law “On Joint-Stock Companies” dated 12/26/1995 N 208-FZ - “Federal Law No. 208-FZ” "

Please note that there is currently a single Procedure for determining the value of net assets , approved by Order of the Ministry of Finance of the Russian Federation dated August 28, 2014 N 84n (hereinafter referred to as the Procedure) for various organizational and legal forms of legal entities - JSC, LLC, state and municipal unitary enterprises, production cooperatives , housing savings cooperatives, economic partnerships, with the exception of credit organizations and joint-stock investment funds.

Note. The credit institution calculates, in the manner established by the Bank of Russia, the amount of its own funds (capital).

Is it necessary to assess the state of net assets for trust management?

The net assets of an enterprise show the market value of the part of the property that is available after the debts of the enterprise are paid off, for example, in the event of bankruptcy. The value of net assets shows the effectiveness of the past and present activities of a legal entity, and the company’s ability to expand its business.

Art. 1012 of the Civil Code of the Russian Federation gives an understanding of what trust property management is. One party transfers property to the other party under an agreement, the latter specifies the term of trust management. The party that carries out the trust does so in the interests of the founder or beneficiary. The trustee does not acquire the owner's title to the property he manages. The property management agreement, along with other civil law transactions, has the following features:

- The customer's property is transferred to the management office as part of the contract.

- The trustee acts solely in the interests of the customer.

- The contract is real, that is, it is considered concluded from the moment the property is transferred.

- Remuneration. Art. 864 of the Civil Code of the Russian Federation provides that the trustee receives remuneration for the service. It is expressed in a fixed monetary amount or as a percentage of the income received.

The Bank of Russia issued Letter No. 38-1/491 dated June 23, 2020 “On calculating the net asset value of a mutual investment fund.” This letter specifically states the need to calculate the value of property.

Results

, any organization, be it a JSC or an LLC, faces a situation where it is necessary to determine the cost of the asset Companies must constantly monitor the current value of this indicator in order to prevent a crisis situation in the enterprise, the most negative consequence of which could be its liquidation. You should also know the current value of net assets when paying dividends or when paying a participant who decides to leave the company the value of his share in the organization. Therefore, you need to remember that all the necessary basis for calculating net assets as of the current date can be obtained by preparing interim financial statements at the end of the previous month. In addition, the correct calculation of the amount of net assets is important for the investor.

For this purpose, it is advisable for the organization to draw up the most detailed and transparent certificate calculating the value of such a company indicator. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Stages of business assessment

As a rule, third-party experts are brought in to assess the value of an enterprise's assets. Of course, you can try to carry out all the calculations yourself, but without proper experience, the assessment result is unlikely to be close to reality. Special knowledge and experience are required to collect and analyze all the necessary information.

The entire assessment process is divided into four stages:

- Preliminary. At this stage, a preliminary study of the enterprise’s industry and the situation in this market segment takes place.

- Elementary. Visiting the site and obtaining all necessary documentation, as well as studying open sources.

- Analytical. Market research, analysis of the company’s activities and forecast of further development, taking into account external and internal factors that can influence it.

- Final. Carrying out all types of calculations (cost of movable and immovable property, intangible assets, economic indicators, balance sheet, profitability, etc.).

During the process, the appraiser needs to study a huge number of papers, ranging from constituent documents to auditors' reports and debt obligations.

The assessment of the net asset value is carried out at the last stages, since its determination requires indicators of the sum of all assets of the organization that are taken into account.

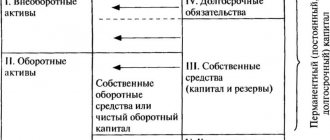

What does a balance sheet asset reflect?

The main form of mandatory reporting for any enterprise, regardless of industry, scale of operation, number of personnel and legal status is the balance sheet. To get a clear picture of the state of property, liabilities, and finances, it is enough to study the balances of accounts as of a given date. The balance sheet assets reflect all the necessary indicators in a certain grouping. Monetary valuation allows you to summarize information about your own property, and the principle of double entry ensures equality of parts of Form 1 with proper organization of accounting. The current document was approved by order No. 66n dated 07/02/10.

The assets of the balance sheet reflect information on:

- Non-current assets - this section contains information on fixed assets that are regularly used in the company’s activities over a long period of time. This includes buildings, equipment, structures, vehicles, and other fixed assets. Additionally, information is provided on intangible assets, various long-term investments, and other non-current assets.

- Current assets - this block collects data on consumable inventories, VAT balances, cash, receivables, existing short-term investments, and other current assets.

Attention! Under any conditions, assets in the balance sheet, line 1600, are equal in amount to liabilities, line 1700.

Types of assets

When assessing the value of a business, as already mentioned, all property is considered. It can be divided into three categories:

- material resources (real estate and movable property);

- financial resources (stocks, securities, bank accounts);

- intellectual property (patents, copyrights, brands, etc.).

Each type of asset has its own valuation features that should be taken into account. Therefore, let's look at the valuation of the most common types of assets.

Real estate

Any structure or building is subject to wear and tear. In addition, its cost depends on factors such as location, availability of all necessary communications, proximity to transport hubs, design features, etc.

Price may also vary. This happens due to changes in market demand, inflation, profitability and other reasons. If a property can generate income, then it is considered profitable. The assessment of such objects is carried out after studying the income and prospects.

Movable property

This category includes equipment (production and transportation vehicles, office equipment), furniture, materials, etc. Movable property is considered as tangible property used for production.

Most often, equipment is assessed because it is constantly in use and is subject to severe wear and tear, which requires its replacement or modernization.

Mandatory equipment assessment is carried out in a number of cases:

- write-off;

- purchase and sale transactions;

- insurance;

- lending;

- registration of contributions to the authorized capital.

Business

Business assessment means determining its current and forecasting future performance. In order to make calculations, it is necessary to analyze the financial, organizational and technological conditions of the enterprise.

This type of assessment is necessary when conducting financial transactions, merging organizations, and also when dissolving a company.

The obtained indicators allow us to determine the level of attractiveness of the company for investors and its main financial interests.

Securities and shares

The peculiarity of securities is that they do not belong to material goods and at the same time have a price. The value of such assets depends on the value of the rights of the owner of the enterprise to which they relate.

There are four types of securities:

- stock;

- bonds;

- bills;

- futures.

Only shares that generate constant income, the amount of which may vary slightly, are perpetual. Bonds and bills are characterized by stable income, while futures are the most unstable asset in this regard. In addition, different types of securities provide different rights. Shares allow you to manage a company, while futures can only be bought and sold.

The difficulty in valuing this type of asset lies in the need to take into account stock market fluctuations. The cost will vary depending on quotes, reputation and reliability of the enterprise, profitability, etc.

Intangible property

Or intellectual property and various rights. This type of property has expressible value and generates profit, but does not have material embodiment. This type of assets is typical for manufacturing and high-tech enterprises, as well as creative enterprises (book publishing, film industry, music, etc.).

Intangible assets:

- copyright (books, software, paintings, music);

- right to use property (natural resources);

- patents (trademarks, inventions, industrial designs, etc.);

- trade secrets (information about the technical, financial and managerial components of the production process).

The procedure for calculating and assessing the organization’s net assets

Valuation of assets is a complex and multi-tasking procedure, the implementation of which requires not only certain knowledge, but also experience. Carrying out an assessment yourself without the relevant experience is a risky proposition. The results may not be reliable. The management of such information in entrepreneurial activity can be fatal for the business. Therefore, the assessment of the value of enterprises is often entrusted to independent specialists from specialized companies.

Asset valuation activities are regulated by Law No. 135-FZ “On Valuation Activities in the Russian Federation”. According to the requirements, the assessment is made without taking into account the influence of extreme circumstances. The procedure is carried out on a voluntary basis to ensure fair competition in the market. The valuation takes into account that the business is worth as much as it can generate profit. The maximum net asset size is the minimum result obtained in the calculation. Not only the current state of affairs, but also future income is taken into account in the calculations.

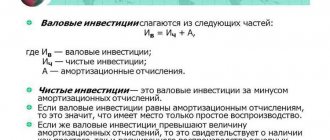

The methodology for calculating the value of net assets is regulated by the order of the Ministry of Finance on the “Procedure for assessing net assets” and has the form:

NA = OA – DO

NA - net assets, OA - the volume of assets accepted for calculation, DO - debt obligations recorded in the financial statements.

When calculating the value of an organization's assets, accounting regulations are taken into account. Therefore, innovations in accounting reporting should be taken into account when assessing.

Information about assets is placed in the documentation on the balance sheet. To assess balance sheet assets, an analysis of the company's current and non-current resources is carried out. Non-current assets consist of intangible property and profitable investments on it, the cost of unfinished construction projects, etc. Current assets include the cost of product inventories, VAT on acquired assets, short-term investments, cash, etc.

Liabilities are also taken into account. Liabilities consist of:

- long-term and short-term liabilities (loans, credits, etc.);

- loan debts;

- debts on dividends;

- reserves for future expenses, etc.

The assessment of net assets in a joint stock company must be carried out annually and quarterly.

How can you document the calculation of a company's net assets?

The legislator does not require the company to draw up any special document confirming the correctness of the calculation of the value of its NAV. At the same time, the value of the indicator itself is subject to reflection in the financial statements, namely in section 3 of the Statement of Changes in Capital (line 3600).

However, if a potential investor requires the value of net assets , then it would not be amiss to provide him not only with the value of the indicator, but also with its calculation. How to do it?

It is best to issue a detailed transparent calculation of the company’s NAV value in the form of a local reference document containing all the necessary calculation tables. There is currently no standard form for such a certificate. However, until 2014, a standard form for calculating the value of the private equity of a joint-stock company was in effect (approved by the order of the Ministry of Finance of the Russian Federation “On the assessment of the net assets of a joint-stock company” dated January 29, 2003 No. 10n and the Federal Commission for the Securities Market of the Russian Federation No. 03-6/pz).

This form can be downloaded from our website.

Despite the fact that the specified order is no longer valid, the form of such a form can be taken as a sample when drawing up a certificate of calculation of the company’s NAV for an investor.

Analysis of net asset indicators

After all calculations, net assets have a positive or negative indicator. Normally, the indicator should be positive, but a negative result means that the enterprise is unprofitable and may lose its solvency in the near future. The only exception is an established enterprise in which investments have not yet had time to pay off for obvious reasons.

A clear indicator of the efficiency of an enterprise is the graph of changes in net asset indicators.

The quality of an organization's activities can be judged by comparing the size of net assets and authorized capital. If the net asset value is higher, the company is operating satisfactorily. If the value of net assets is lower than the authorized capital, then the latter must be reduced. If the authorized capital already has a minimum size, then the question of dissolving the organization is raised.

The amount of net assets, along with the total value of all assets, are one of the main characteristics that help assess the condition of the enterprise and its value on the market. The higher the net assets, the more attractive the company is to investors and creditors. Therefore, it is important to take a responsible approach to the asset valuation procedure or entrust it to specialist appraisers.

Where do the financial statements contain information about the value of net assets?

net assets as accurately as possible, one must have a reliable basis for calculation. Where can I get such a base? In the company's financial statements. Most of the indicators that are necessary to calculate NAV are contained in the company's balance sheet.

A balance sheet is required to calculate net assets , since all assets involved in the calculation must be taken at the value indicated in the balance sheet (clause 7 of Order No. 84n).

For more information about what information from the balance sheet is needed to calculate net assets, see the article “The procedure for calculating net assets on the balance sheet - formula 2015”, as well as in the publication “Net assets - what is it in the balance sheet (nuances)?”.

Please pay attention! The balance sheet, as a rule, is compiled by the company based on the results of the past year. However, if it is necessary to calculate the value of the company’s equity capital as of the current date, then for this it is advisable to draw up interim financial statements, including an interim balance sheet as of the last day of the previous month. Then the value of net assets will reflect the current situation in the company as accurately as possible.

Question answer

Question:

“Where do I get the data to estimate the net asset value?”

Answer:

If you need to estimate the value of net assets to create an overall picture of the enterprise’s business performance, you can obtain information by requesting a certificate of net assets directly from the company (if we are talking about a joint-stock company). In addition, each joint stock company annually publishes reporting data on changes in capital in open sources (Federal Law No. 14).

Financial and economic activities can be analyzed on the basis of the balance sheet posted in public sources. However, as we already said in the video on our YouTube channel, the main difficulty with such interaction is the lack of transcripts of the balance lines -> there is no fundamentally important information for calculation.

Question: “ Book value and estimated value in the net asset method, what is the difference? "

Answer:

The method is based on the use of open data from financial statements (balance sheet) and represents the difference between assets (property) and liabilities (liabilities). Advantages: the calculation methodology was approved by the Ministry of Finance (order No. 84n dated August 28, 2014). The method assumes the possibility of using two types of values: balance sheet and estimated. Book value

In this case, the influence of the market on the value of assets is not taken into account, so the value of net assets will be far from the objective value of the company. Reasons for discrepancies:

- inflation (the original book value of previously purchased equipment may be lower than the current market value of similar equipment due to price changes);

- changes in market conditions (previously purchased equipment may not be worth anything due to moral (functional) obsolescence);

- accounting methods used (residual book value of the car = 0 when applying accelerated depreciation rates does not correspond to the real market value of similar cars);

- other factors.

"Estimated" (market) value

Based on balance sheet data adjusted to market value. At the same time, companies do not account for some items correctly in their balance sheets:

- intangible assets (goodwill, trademark, patents, know-how, etc.);

- staff (competencies, experience);

- organization infrastructure;

- customer base;

- unique IT developments.

Conclusion

The book value differs from the market value, therefore, to eliminate the discrepancies, it is recommended to carry out the calculation at the valuation date. The market value of a company within the framework of the net asset method is as close as possible to real market indicators.

Question:

How to reflect in accounting the costs of assessing the value of premises to calculate net assets?

Answer:

Net assets are determined based on the balance sheet and show the company's equity. The valuation of the premises will affect the calculation of net assets. The cost of assessing the premises will entail the following debit entries:

- In account 60 “Settlements with contractors”;

- Invoice 76 “Settlements with various debtors and creditors.”

By loan:

- The score is 50 "Cash"

- Account 51 “Current accounts”.

These invoices reflect that a payment was made to a third party for services for an independent assessment of the value of the property as part of all expenses.

Required documents

- Copies of constituent documents;

- Organizational structure of the company;

- Accounting data for the last 3-5 years;

- Statement of fixed assets;

- Data on all assets, as well as relevant documents on them;

- Decoding accounts payable and receivable;

- Information on the presence of subsidiaries, holdings (if any), financial documentation on them;

- Business plan for the next 3-5 years.

This list is not exhaustive and is ultimately determined by our specialists together with the Customer.