The process of recognizing a person’s financial insolvency takes place in a strict, common order for everyone after filing a claim and confirming the presence of signs indicating bankruptcy. If the case of a legal entity is being considered, there can be two outcomes: the adoption of measures for economic recovery with the restoration of normal activities of the organization or its liquidation. In any case, a debtor declared bankrupt is not released from his debt obligations.

How to initiate the opening of proceedings, the procedure for filing a bankruptcy petition with the arbitration court and samples of bankruptcy claims will be discussed below.

When is the bankruptcy procedure carried out?

Circumstances due to which a person may become insolvent can be different:

- Economic crisis of the organization;

- Problems in production leading to debt;

- Loss of customers and suppliers;

- Lack of demand for services and goods;

- Ineffective leadership.

All these factors entail a decrease in profits and the appearance of debt that the legal entity is no longer able to repay. If debts are not repaid within 3 months, monthly payments are not made, there are not enough assets to cover monetary obligations, and the amount of debts exceeds 300,000 rubles, you can file an application to declare the LLC (limited liability company) bankrupt. This rule applies to all legal entities and individual entrepreneurs, including the developer, who cannot realize his responsibility to investors.

Who and under what conditions can declare themselves bankrupt?

According to the law, individuals can exercise the right to bankruptcy if they owe creditors more than 500 thousand rubles. At the same time, they were unable to pay their debts over the past 90 days.

Other citizens - individual entrepreneurs, peasant (farm) households, as well as organizations - can also declare themselves bankrupt. They stand apart from personal bankruptcy and are subject to the rules on insolvency of legal entities.

Religious organizations, political parties, and government institutions cannot use this right. That is, those that were not created for the sake of making a profit from their activities. Peasant farms, individual entrepreneurs, and legal entities can also file a request in court if there is at least a 3-month delay in mandatory payments. But for the latter, the amount of debt must exceed 300,000 rubles, while for the first two groups it is enough to accumulate a debt of 10,000 rubles. For natural monopolies and strategic enterprises, the indicated threshold is the highest - 1,000,000 rubles.

This is also important to know:

Consequences of termination of bankruptcy proceedings

There is one very significant nuance at this point. No one forces an individual to go to court with such a statement; this is his right, which he may not use. But for a legal entity everything is much more serious. Such a debtor is simply obliged to declare himself bankrupt, otherwise he is breaking the law.

How to file a bankruptcy petition

To draw up a claim, you should refer to the norms of the Arbitration Procedure Code of the Russian Federation and Article 39 of the Federal Law “On Insolvency”. Some differences in the application for declaring a debtor bankrupt (both an individual and a legal entity) will depend on who exactly is filing it.

The standard claim form includes the following information in sequence:

- The name of the judicial authority where the application is being made;

- Data of the debtor, bankruptcy creditor;

- The amount of money that the plaintiff demands from the defendant;

- Justification of the requirements (what obligations led to the debts, the deadline for their fulfillment and delays);

- A court decision recognizing claims (not necessary if the creditor is a bank);

- A link to documents that confirm the existence of debts and a list of attached papers;

- Date, signature of the applicant.

To draw up a statement of claim for bankruptcy, it is advisable to consult with a specialized lawyer, since an incorrectly completed application will be rejected by the court. By neglecting the requirements, you risk wasting time and incurring unnecessary expenses: a state fee is paid for each filing of a claim.

What information should it contain?

The application contains general information about the parties to the case, a descriptive part indicating the reason and grounds for the debt, as well as the applicant’s demands (on the appointment of an arbitration manager, on the introduction of bankruptcy proceedings against the debtor and the supervision stage).

The content of a claim to declare a company bankrupt varies depending on who files it: the debtor himself or the creditors. If the debtor himself applies for insolvency, he must include information from clause 2 of Art. 37 127-FZ:

- The amount of monetary obligations to creditors that the debtor considers justified . The statement also lists the reasons for the debt.

- The amount of debt obligations to employees in terms of outstanding wages and severance pay.

- The amount of debt to citizens for compensation for harm to life and health.

- The amount of debts for obligatory payments, taxes and fees.

- Justification for the impossibility of paying off creditors' claims in full.

- Information about legal proceedings that are ongoing against the debtor.

- Information about the property owned by the debtor , as well as the amount of receivables.

- Information about the debtor company indicating its details : OGRN and TIN.

- Information about current accounts in banks indicating the account number , bank, its BIC, correspondent account.

- Information about the attached documents.

- Other information that may be relevant to the bankruptcy case.

If an application to the arbitration court is submitted by a bankruptcy creditor, then he will not be able to indicate all the debts of the legal entity for obvious reasons. The bankruptcy creditor must note how much the bankrupt owes him and on what basis such an amount arose (clause 2 of Article 39 127-FZ). It is worth noting that the amount of debt obligations must be documented.

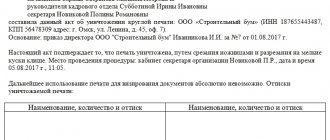

A sample application for declaring a debtor-legal entity bankrupt can be viewed here.

Copies of the statement of claim must be sent to other participants in the bankruptcy case. So, if the application is submitted by the creditor, then a copy is sent to the debtor, if by the debtor, then to the creditors. Copies of documents confirming the sending of the application are attached when submitting the application to the court.

Who can file for bankruptcy

There are three main categories of persons who have the right to file for bankruptcy:

- Directly the debtor himself or his legal representative by proxy;

- A creditor to whom the defendant has an outstanding debt;

- Supervisory agencies, such as the tax service.

Of course, we are talking about situations where the amount of debt is large.

If a debtor has several creditors, the law allows them to unite to achieve a common goal and file a class action. Before this, a meeting is held, the progress and decisions of which are recorded in an act.

Procedure for drawing up the document

An application for declaring bankruptcy is drawn up according to the general rules established by procedural legislation. It must indicate:

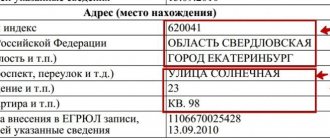

- To which arbitration court is the documentation package submitted, its index and address.

- Who is the applicant, address, phone number.

- What is the amount of state duty?

- Grounds for going to court - loan agreements, term, amount and reason for delay, evidence of inability to pay bills, legal norms that give the right to apply.

- Other information relevant to this case.

- What is the request to the court?

- List of applications.

- Date, signature.

Everything that is stated in the application must be documented by the court. This:

- Confirmation of sending/delivery of a package of documents to persons participating in the case.

- Extracts and certificates indicating the existence and duration of debt.

- Documents confirming deterioration of financial situation.

- Documents confirming the existence of an organization or individual entrepreneur.

- List of creditors/debtors with breakdown of their debt and details of persons.

- If there is sufficient property to pay off the debt - evidence of it.

- Power of attorney with the participation of a representative.

- Document confirming payment of state duty.

All papers must be submitted in originals, but the court will also accept duly certified copies. This entire kit can also be sent by email, which simplifies the process somewhat.

We recommend other articles on the topic

- Settlement agreement in a bankruptcy case

- Appointment of an arbitration manager, requirements for his candidacy

- How does the bank bankruptcy procedure proceed, possible grounds and consequences

- The effectiveness of the financial recovery of the organization

- What is a self-regulatory organization of arbitration managers?

- The role of the arbitration manager in bankruptcy proceedings

Deadlines

The objective time frames established for the consideration of a bankruptcy case vary. In the best case, the decision to recognize the company as a debtor will be made within seven months.

This is also important to know:

Vicarious liability without bankruptcy procedure: conditions for liability

However, situations are possible when bankruptcy extends over several years.

An attempt to financially improve the company, which may not bring results, may affect the increase in the period, the amount of debt, the amount of property that is on the debtor’s balance sheet, the number of creditors, etc.

If we consider the timing of the procedure in more detail, we can provide the following general information:

| Indicators | Description |

| Within a month from the moment of detection of signs of bankruptcy, the debtor is obliged to file a voluntary application for insolvency | the same period is given to the government agency that discovered the problem to go to court |

| Observation phase | lasts no more than six months |

| Once a case is opened, creditors have one month to apply for inclusion in a special register | only in this case will they be able to become voting members of a special body - the meeting of creditors, which is endowed with the right to make general decisions and petition the court |

| If a financial recovery procedure is prescribed | the maximum period for its implementation is two years |

| For external control | According to the law, no more than one and a half years are allowed |

| Bankruptcy proceedings | lasts no more than six months |

At any stage of the procedure for declaring a legal entity insolvent, a settlement agreement can be reached between the debtor and creditors.

In this case, a debt repayment schedule is drawn up that suits all parties, a petition is submitted to the court, and the case is closed.

Where to file for bankruptcy

The claim is filed in arbitration (office) at the location or registration of the person declared financially insolvent. Depending on whether the application to the bankruptcy court is correctly drawn up and executed, and what documents are attached to it, then either proceedings are opened in the case, or it is rejected (if the claim is found to be unfounded).

The court appoints an arbitration manager, one of whose tasks is to inventory and evaluate the debtor’s property, as well as to compile a register of creditors and their claims.

This register will include only those creditors who declared their rights in a timely manner, that is, within 30 days after the discovery of irrefutable signs of insolvency. No one is automatically added to the list.

In fact, it is not prohibited to make claims even after the allotted thirty-day period has expired, but such creditors find themselves at the very end of the list and can wait for their money for more than one year.

Before we jump into the bankruptcy filing example, let's look at what you need to prepare ahead of time and how long the court process can take.

What kind of document is this

A bankruptcy petition is a written document compiled and filed in compliance with all rules provided by law regarding it. You can also fill out the appropriate form on the arbitration court website. In the text of the document, the interested party indicates the basis for applying to the court. Simply, here we are talking about why the situation of insolvency has arisen, why the person is no longer able to pay his debts.

Along with filing a statement of claim in court, the applicant will be required to pay a state fee in the amount of 6,000 rubles. This participant is also obliged to deposit with the court a fee for the work of the financial manager. It is the latter who will manage all the applicant’s affairs related to the material side. If there are not enough funds for this remuneration for a one-time contribution, then you can write a petition for installment payments.

Bankruptcy claim - sample:

This is also important to know:

Who is a financial manager and what role does he play in bankruptcy?

List of required documents

The list of attached papers depends on whether the debtor himself or his creditor files the claim. In the first case, it is enough to prepare evidence of financial insolvency; in the second, you should first go to the magistrate’s court and wait for a decision on the existence of debts.

Documents for the LLC bankruptcy application from creditors:

- Confirmation of sending a copy of this claim to the defendant;

- Receipt for payment of state duty;

- The decision of the magistrate's court on the existence of debts;

- Documents on the basis of which the debt arose (agreements, invoices, invoices, etc.);

- Power of attorney for the right to file a claim (if necessary).

Papers that the debtor prepares if he files the bankruptcy claim himself:

- Confirmation of sending a copy of the claim to all creditors;

- Receipt for payment of state duty;

- Constituent documentation;

- Decisions regarding the situation if there have been previous appeals to the court;

- Copies of papers indicating the amount of debt;

- List of creditors;

- Current bank accounts;

- Inventory of property and its estimated value.

For each individual case, the list of documents can be supplemented.

What documents should I attach?

The documents that are attached to the bankruptcy application can be divided into the following groups:

- General documentation on the debtor company.

- Accounting and financial documentation of the company.

- Documents on existing debts to creditors and regarding obligatory payments.

- Documents on property that belongs to the debtor.

The documents that are attached to the statement of claim for declaring the company bankrupt are listed in Art. 38 127-FZ:

- Documents confirming payment of the state duty . Its size is 6,000 rubles. It is also possible to attach a request for an installment plan when paying the state fee.

- A copy of the company's registration certificate as a legal entity and constituent documentation.

- A copy of the protocol on the appointment of the head.

- Power of attorney to represent interests (if a representative applies).

- Documents confirming the sending of a copy of the application to the participants in the case.

- Documents confirming the occurrence of debt : contracts, payment documents, invoices, acts, extracts, court decisions, etc.

- Certificate of debts to the budget and extra-budgetary funds.

- Calculations of debt obligations to employees for wages and severance pay.

- Certificate from the Federal Tax Service about company accounts.

- Certificate about the amount of funds in the cash register and in accounts.

- Table with a breakdown of information about the amount of accounts receivable . It indicates a list of companies that owe the applicant: their name, legal address, TIN, KPP, grounds for the occurrence of debt obligations.

- Copies of documents that confirm the amount of receivables presented in the relevant list . These can be contracts, payment documents, reconciliation acts, executive documents, etc.

- Certificate about the size of warehouse stocks with a breakdown of information , goods in the warehouse and indicating the storage locations of materials.

- Certificate of the amount of fixed assets with breakdown by components and location.

- Certificate of real estate on the debtor’s balance sheet (indicating their location).

- Information about capital construction projects.

- The company's balance sheet as of the latest reporting date.

- The decision of the owner of the property of the debtor company to apply to the arbitration court with the debtor’s application.

- The decision of the owner of the property of the debtor in the status of a unitary enterprise to apply to the court for bankruptcy.

- Minutes of the meeting of the debtor's employees , at which a representative of the employees was selected to participate in the arbitration process (if the meeting was held before the start of the bankruptcy procedure).

- Certificate of absence of employees.

- Report on the value of the company's property , which is prepared by an independent appraiser.

- Documents confirming that the manager has access to state secrets (if necessary).

Terms of bankruptcy stages

Regarding the processing time of insolvency cases, three main stages can be distinguished:

- Collection of documents, preparation and filing of a claim - from 10 days to 2 months.

- Identification of creditors and property of the bankrupt, financial analysis and recognition of the person as insolvent - from 3 to 5 months.

- Bankruptcy proceedings, valuation and sale of property, debt collection - up to 6 months.

If the court ordered the adoption of measures for economic recovery, the process may drag on for a longer period.

Conditions for out-of-court bankruptcy

From September 1, 2020, the law on extrajudicial bankruptcy comes into force, which will be carried out free of charge at the MFC.

Basic requirements for bankruptcy and features of the procedure:

- The debt limit is 50,000-500,000 rubles.

That is, debtors whose total debt for all obligations is no more and no less than the specified limit will be able to go bankrupt for free.

If a person does not indicate any debts in the application, they will not be written off.

There is also a risk that a potential bankrupt will be excluded from the register and will not be able to get rid of debts for free.It is necessary to indicate all debts: for credit cards, for alimony, for enforcement proceedings, and so on. But some types of obligations are not written off at all (as in the judicial bankruptcy procedure). These are alimony, subsidiary liability, compensation for damage to third parties and unpaid compensation to former employees (the latter applies to individual entrepreneurs).

- Requirement for enforcement proceedings.

Citizens in respect of whom enforcement proceedings have previously been completed due to lack of property will be able to receive free debt write-off in accordance with clause 1.4 of Art. 46 No. 229-FZ.

You can check data on closed enforcement proceedings in the following ways:

- through the State Services portal: https://epgu.gosuslugi.ru/. In this case, a citizen can check himself;

through the FSSP website: https://www.fssprus.ru/. The register is publicly available; you just need to use a search engine and indicate the personal data of a certain person.

- The procedure will be carried out without an arbitration manager.

The debtor does not pay for anything: neither for MFC services, nor for publications. All actions to accept applications and include citizens in the EFRSB register will be carried out through the MFC. Read more about the procedure and terms of the simplified procedure in this article.

What should you pay attention to? Those who have gone through personal bankruptcy in court know about the list of property that cannot be taken from the debtor under any circumstances: neither in bankruptcy, nor as part of collection by bailiffs, nor in any other way.

Closed enforcement proceedings in the FSSP due to lack of property means that the debtor has no other property except:

- the only house or apartment (room) of which he is the owner;

- household appliances, furniture and other household items;

- agricultural buildings, livestock, tools for cultivating the land, and so on;

- food products, cash in the amount of 10,000 rubles;

- a car that a person needs for work or due to disability;

- working tools and equipment with which a person earns his living.

All of the above property cannot be seized. If, apart from this, the debtor has nothing, and the income is no more than the minimum wage, the enforcement proceedings are closed due to the lack of property. Further, such a debtor can apply for recognition of extrajudicial bankruptcy of an individual.

Sample application for bankruptcy of an individual

To write a claim, a typical example of a bankruptcy petition for citizens is presented below:

(Name of the arbitration court)

(Full name of the applicant, passport details,

address, tax identification number, place of employment,

Contact details)

(Details of all creditors)

Statement of claim for bankruptcy of an individual

At this time I am in a difficult financial situation due to ___________________________. As of “___”_______20___, the size of my debts is ________ (duplicate the amount in words) rubles. This is the debt for the period from “___”_______20___ to “___”_______20___.

Since I do not have the funds to pay off the debt, I cannot meet the demands of the creditors.

As of the date of filing the claim, my property has:

- (List property),

as well as _________ rubles in current account No. ______________ in bank _______________.

According to Article 213.3, paragraph 2 of the Federal Law “On Bankruptcy”, requirements for citizens arise in case of failure to fulfill financial obligations within three months and the amount of debt exceeds 500,000 rubles, unless there are other circumstances.

In accordance with Article 213.4, paragraph 1 of this Law, an individual is obliged to file a claim for bankruptcy if it is impossible to fulfill financial claims to creditors, if the debt totals 500,000 rubles or more.

Taking into account the above, and also referring to Articles 125 and 223–224 of the Arbitration Procedure Code of the Russian Federation, I ask:

- Declare me (full name) bankrupt.

- Appoint a financial manager from (indicate the name of the self-regulatory organization).

- Set the manager's remuneration in the amount of _______ rubles per month.

I am attaching to the application:

- (List of all attached documents)

“___”_________20___ (Signature)

Legal expenses, including monthly payment for the work of the administrator, are borne by the debtor. This rule applies to both citizens and legal entities.

Claim for bankruptcy of a legal entity

The plaintiff must apply to the arbitration court to declare the debtor insolvent. It is this category of courts in the Russian Federation that considers disputes related to economic activities and various corporate conflicts.

The creditor, initiating bankruptcy proceedings, intends to obtain the maximum possible compensation from the debtor. But it's not that simple. Russian legislation is more adapted to the owners of debtor enterprises.

You can often find the withdrawal of assets before the start of bankruptcy proceedings or the preservation of the organization’s property through the use of a scheme with a controlled creditor and a loyal manager and other attempts to avoid the loss of property.

Most corporate bankruptcy cases are related to clearing a business of debts and continuing to operate further, but still some creditors manage to fully or partially collect debts.

The main thing is that the creditor’s lawyer handling the claim has the appropriate qualifications, and no time is wasted.

As a result of the bankruptcy procedure, two outcomes are possible:

- liquidation of a legal entity - debtor;

- repayment of debts to creditors.

This is also important to know:

Interested person in a bankruptcy case of legal entities

Since 2020, credit organizations have received certain privileges when filing claims. In particular, they do not necessarily need to obtain confirmation of the debt through the court; it is enough that the debtor has been in debt for more than 3 months.

Start of the procedure

Before starting the bankruptcy procedure, it is necessary to prepare a statement of claim and all the necessary documents to submit it to the court. Depending on the size and nature of the work of the debtor organization, this may require quite a lot of time.

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

A prerequisite for starting the procedure in relation to a legal entity is that it has a debt to creditors in the amount of at least 300,000 rubles, the repayment period of which occurred more than 3 months ago.

After the court makes a decision to accept the application and begin the proceedings, a date for the first hearing is set. During this process, the court appoints a bankruptcy trustee by random selection or taking into account the wishes of the creditor.

Previously, a debtor in self-bankruptcy had the opportunity to choose a bankruptcy trustee. The managers and actual owners of the debtor enterprise took advantage of this and appointed a loyal manager, which in the future facilitated the preservation of property.

After appointment, the bankruptcy trustee opens a register of creditors, and also gets acquainted with all reports and necessary documents.

The task of the bankruptcy trustee is to ensure the repayment of obligations to creditors to the maximum extent possible.

Quite often, bankruptcy trustees are forced to challenge the latest transactions of the previous management aimed at withdrawing the assets of the debtor enterprise, search for the property of the organization or owners, etc.

The creditor must submit his demands for repayment of the debt to the court or bankruptcy trustee. Only then does he have the right to be included in the register of creditors and a chance to receive at least a partial amount of the debt.

Guarantees and liability

Subsidiary liability serves as a guarantee that during bankruptcy, not only the rights of the debtor, but also his creditors will be taken into account and protected.

It represents the liability of managers, founders or other persons controlling the debtor enterprise if the debtor’s property is insufficient to satisfy all claims received from creditors.

In practice, it is not always possible to hold the founders or directors of an organization accountable. In court, creditors will have to prove the guilt of these persons.

A person who controls the debtor organization should not be held liable if he provides evidence in court that he acted in good faith and reasonably.

Person making a decision on voluntary bankruptcy

To confirm the fact of voluntariness

announcement does not matter why the company declared bankruptcy - whether it exercised its right or fulfilled its obligation. In both cases, her decision is considered voluntary. However, it (that is, the decision) can only be made by the authorized body of the legal entity: the manager (managers) or the founders themselves.

However, sometimes it happens that the company’s liquidator is forced to make such a decision. This happens when, during liquidation, he suddenly finds out that the company will not be able to fulfill its obligations to all creditors. In this case, the liquidator acts as an applicant in court (Decision of the Arbitration Court of the Ryazan Region in case No. A54-5490/2013 dated 01/09/2014)

.

Procedure for submitting an advertisement

This advertisement is posted directly on the publication's website. Its Internet address is https://www.vestnik-gosreg.ru. Until recently, you had to download a program to submit a message, but today there is no need for this. However, before composing an advertisement, a person must register on this website and create a personal account. All this is absolutely free. The message (as well as other necessary information) is filed in the “Insolvency Notices” section. The process consists of three sequential stages: filling out an application, receiving an invoice and submitting documents, as well as tracking generated applications.

The procedure itself is completely automated. The system provides for drop-down phrases (“icons”), as well as its complete logical completeness. It lies in the fact that the applicant will not be able to move to the next stage if he leaves any column unfilled.

In the very first column, you must select the type of message: about the introduction of a monitoring procedure, about holding a meeting of creditors, about the introduction of external management, and so on. When you hover the cursor over the column, it will show drop-down phrases and the applicant will only have to click on the option he needs.

Next, the person fills out the remaining information: legal entity form, address, information about the process, procedure, etc. In this case, the text of the ad itself is generated automatically. You can, of course, remove the icon (or “checkmark”) about automatic text generation, but the editors (more precisely, the representative office) will still correct it and make it standard. Therefore, writing an erroneous text is simply impossible.

After this, information about the manager, information about the SRO, information about the meeting of creditors, the agenda, and so on are filled in.

Depending on the type of procedure, location of the court, form and name of the legal entity, the announcement will sound approximately as follows: “By the determination of the Arbitration Court of such and such a subject of the Russian Federation, the Joint Stock Company “Horns and Hooves” is undergoing an external management procedure. Administrative Manager Bender Ostap Ibrahimovich - with this message notifies of the holding of a meeting of creditors."

At the end of the application, the subject chooses the method of submitting documents: through the website using an electronic digital signature or in person at the representative office. Here we especially emphasize the phrase “method of filing documents”

. The fact is that the text goes to the publishing house immediately after its creation, but the generated documents (certificate, application, extract from the Unified State Register of Real Estate, powers of attorney, etc.) must be provided additionally.

Having sent the text, the applicant waits for its approval. The answer comes on the same or the next day. Along with the final version of the text, the sender also receives an invoice for payment. Having paid the required amount (based on the calculation of 210.97 rubles per sq. cm), you need to wait for confirmation of receipt of the money by the publishing house. A corresponding entry will appear next to the account. As soon as the contractor confirms receipt of the money, you can generate a final package of documents and send it through the website using an electronic signature or take it personally to the representative office.

It is worth noting that messages must be printed at almost all stages of the procedure: the beginning and end of bankruptcy, supervision, external management, bidding, and so on. That is, the matter will not be limited to one single announcement.

The publisher publishes the message within ten days from the date the text is received by the newspaper. The only mandatory condition is payment for services no later than three days before the publication of the next issue.

The problem of voluntary declaration of bankruptcy

In the last few years, the announcement of voluntary

bankruptcy of a legal entity has become a very rare occurrence. And not the least role in this was played by the practice of joint liability of managers, as well as founders of the company for its debts. In addition, bankruptcy in the presence of debt to the budget almost always results in the Federal Tax Service denying such citizens the registration of new companies or appointment to a management position. Therefore, entrepreneurs increasingly prefer to postpone making the difficult decision about voluntary bankruptcy.

Such inaction, in fact, constitutes an administrative offense. Responsibility for it is provided for in Art. 14.13 Code of Administrative Offenses of the Russian Federation. As a result, a whole wave of cases under this article poured into arbitration courts. The applicant for them is, as a rule, the territorial Federal Tax Service or (much less often) the prosecutor's office. Controlling authorities check the financial position of the company or individual entrepreneur and, if they find out that the entity is actually bankrupt, they send an application to arbitration. Managers of insolvent debtors who persistently do not declare their voluntary bankruptcy are subject to punishment in the form of a fine or disqualification (Decision of the Arbitration Court of the Tver Region in case No. A66-12339/2017 of October 30, 2017)

. Many of them are subsequently still deprived of the opportunity to hold leadership positions in companies for a certain period of time, as well as act as founders.

Submitting an application

The debtor can submit an application to the court to declare a civil person bankrupt in person, by power of attorney or remotely. The legislation establishes the following methods of sending documents:

- personally by applying to the arbitration court at your place of residence;

- with the help of a trusted intermediary who represents the interests of the debtor;

- by mail, letter with inventory and notification;

- through a confirmed account on the State Services portal.

How the documents were sent will not affect the court's decision. It is more important to indicate complete and reliable information in the submitted documentation, supported by indisputable facts and documents. Failure to comply with the conditions established by law will result in the rejection of this application.

Who can file a claim for the insolvency of a legal entity?

In accordance with Art. 224 of the Arbitration Procedure Code of the Russian Federation, paragraph 7 No. 127 of the Federal Law, certain persons may file an insolvency claim with the court, namely:

- the debtor himself;

- lender;

- bankruptcy lender;

- authorized bodies;

- former employees or other team members who have not received full payment in the form of salary or funds paid upon leaving work.

The debtor must apply for recognition of insolvency in the following situations:

- If it is known that covering debts will contribute to the development of an inability to make mandatory payments.

- The founder of the company, shareholders or owners made a common decision to file a bankruptcy petition in court.

- If debts are covered with existing tangible property, it will lead to more serious problems in the process of economic activity.

- There are facts and signs confirming the insolvency or shortage of property.

- Lack of wages or other benefits and payments for more than three months.

Each applicant has its own peculiarities of filing a claim for bankruptcy of a legal entity, a sample of which can be seen at the end of the article. Table 1 describes the main persons who have the right to go to court regarding the debtor's insolvency.

| Applicant | Deadline for filing a claim | Causes and conditions |

| Debtor | 30 days from the date of discovery of the impossibility of covering debts or circumstances that will definitely lead to this in the future. | Lack of sufficient funds in the account to repay existing debt obligations. |

| Creditor | There are no restrictions. | Having a debt that has not been repaid within 90 days. In addition, there was no desire or initiative to take any action to eliminate the problem that had arisen. |

| Authorized body | One month with the same conditions as for the debtor. | It was revealed that the company was unable to pay its debts at the closing stage. |