Each individual entrepreneur must carefully monitor the state of his budget payments. Having debt is a very unpleasant thing for a businessman for several reasons. On the one hand, the formation of debts entails responsibility; they will have to be repaid with an overpayment in the form of penalties, and often also a fine. On the other hand, partners can check the debt, and then business reputation will suffer, even if an underpayment is made. That is why it is worth finding out how to find out the tax debt of an individual entrepreneur for the entrepreneur himself and his counterparties.

Methods for checking individual entrepreneurs' tax debts

Depending on whether the entrepreneur himself or his business partners need information about individual entrepreneur debts, there are several ways to obtain the relevant data. All of them are divided into two groups. The first includes options for obtaining information online, the second includes personal contact with government agencies.

Online check

A businessman can check the debt under an individual entrepreneur using the Federal Tax Service website and the State Services Internet portal. To use the tax service website, you must:

- Register to create a personal account.

- Go to the electronic services section.

- Select the “Pay taxes” link with the coin drawn next to it.

- Click on the taxpayer’s personal account icon (the little man next to the computer monitor).

- Log in by entering your password.

- Indicate your last name and Taxpayer Identification Number.

Without registering in your personal services account, it is impossible to check tax debt using the TIN for individual entrepreneurs. To register, you can use the password and login received from the Federal Tax Service on a special registration card, a qualified electronic signature, or an access account to the State Services resource.

Important! This section of the Federal Tax Service website provides information on debt on personal income taxes, as well as land and transport taxes. Here you can also send an online application to the tax authorities, receive 3-NDFL notification forms and information about the need to make mandatory payments.

The second option to look at an individual entrepreneur’s tax debt is to use the “Find out about your debts” subsection on the State Services portal. To obtain information you need:

- Go to the services section.

- Open the “Taxes and Finance” item.

- Click on the tax debt link.

- Enter your details, including TIN.

Only persons with a confirmed account on State Services can check debt in this way.

Important! The resource allows you to customize the interface so that data on debts to the state budget is displayed on the main page.

The third way is to find information about debts on the FSSP website. However, here information is available only if there is a writ of execution for debt collection in the form of a resolution of the Federal Tax Service or a judicial act. Registration is not required on this site.

As you can see, in all of the above cases you need to know the TIN. This is an individual taxpayer number, which is assigned once and for all during the registration procedure. If the personal data of an individual entrepreneur changes, adjustments are made to the state register, but the TIN does not change.

At one time, the number was included in a special certificate that was issued to entrepreneurs. This order was subsequently cancelled. Accordingly, an entrepreneur may simply forget the number or lose the paper on which the TIN is recorded.

This problem can be solved very simply. There is a special section on the Federal Tax Service website where information about the last name, first name, patronymic of a businessman, his date of birth, and passport details is entered. In response, the system issues a TIN.

Important! The TIN should not be confused with the OGRNIP. The second abbreviation also denotes an identification number, but it refers specifically to the registration of an entrepreneur, not a taxpayer.

Checking an individual entrepreneur's own debts using the TIN is possible through a personal account provided to clients of some banks. This service is offered free of charge:

- Sberbank;

- VTB;

- Tinkoff Bank;

- Binbank;

- Alfa Bank.

Entrepreneurs who have an account with one of the listed financial institutions can gain access to information and immediately pay the arrears.

Offline

To obtain information about a businessman’s debts, you can contact the Federal Tax Service by filling out a request for a certificate of settlements with the budget. If there is such a request, tax authorities are required to provide information. In practice, the inspector issues one of the certificate options: on the status of settlements or on the fulfillment of payment obligations. Both forms are approved by law.

There is a certain difference between these certificates. The first indicates the amount of debt at the time of drawing up the document. The second contains only information about the fulfilled or unfulfilled obligation. Tax authorities have 5 days to prepare the document.

To find out how the debts reflected in the statement of payment status were formed, you will have to request an extract of transactions for payments to the budget. It displays the history of payments to the individual entrepreneur and taxes accrued to him for the selected period.

A certificate on the status of settlements is required by taxpayers to provide to various authorities, for example, to a bank to obtain a mortgage or other loan. The request is submitted to the tax office by registration in person or through a representative with a power of attorney certified by a notary.

How to find out the tax debt of individual entrepreneurs and LLCs using TIN: all methods

If we are not talking about a third-party legal entity, then the methods for searching for information about debt are quite standard.

At the Federal Tax Service office

An individual entrepreneur can obtain the information he needs by personally contacting his Federal Tax Service. Theoretically, this method is also suitable for a legal entity. An accountant usually does not spare his time on travel and queues when it is urgent to unblock a partially frozen current account.

Due to the introduction of a new version of the Federal Tax Service's software since the beginning of this year, the tax base is increasingly “freezing.” In order not to admit this fact, inspectors often tell the representative of the legal entity that a power of attorney is not enough, a request is necessary.

On the tax service website

If the debt check is scheduled, then it is advisable to conduct it online. Even those who do not transmit reports via telecommunication channels have this opportunity: just create a personal account on the tax service website. For this:

- click on the link (see Fig. 1)

- please register.

Registration methods depend on how you will verify yourself:

Rice. 1

This method is often called checking the individual entrepreneur on the tax website using the TIN, since to enter your personal account you need to enter the TIN. If you use the TIN in the service, then the maximum that you can get is extracts from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs, for example, to check the OGRNIP.

On "State Services"

Search through the public services service is available only for legal entities:

An organization can use the link and then follow the algorithm posted on the site:

The main difficulty when registering for a legal entity is that the manager or representative must have State Services. Common problems with a manager (his authorized representative):

- lack of time (desire) to personally visit one of;

- loss of your SNILS card (it is required for registration along with your passport).

Receiving it takes a lot of time, and finding out the amount of tax to pay in order for the tax authorities to unblock the account is usually necessary urgently.

On the website of bailiffs (FSSP)

Our company promptly monitors the occurrence of tax debts among clients and takes measures to eliminate them. Clients often come to us when the Federal Tax Service has already turned to bailiffs for help. Accounting is often neglected, and we are forced to use the service to search.

More details

Where to find out debts on contributions to the Social Insurance Fund and Pension Fund

Debt can be generated not only for tax payments, but also for contributions to the Social Insurance Fund and Pension Fund. Each individual entrepreneur is required to pay insurance premiums for himself or for his employees, if any.

There are several ways to find out about the accumulation of debt to the pension fund:

- Through the payer’s personal account on the fund’s Internet resource. There is a section of electronic services, which provides access to information about previous payments, existing arrears, and preparation of payment documentation. You are allowed to use the service after completing the registration procedure.

- Through the State Services portal in the notification section about the status of the personal account.

- Through the FSSP database, if the Pension Fund filed a statement of claim demanding the collection of arrears from the debtor. The data will appear in the system if the judicial authorities have satisfied this requirement and transferred the case to the bailiffs.

You can simply contact the Pension Fund of the Russian Federation to obtain a reconciliation of accounts and clarify the debt.

Contributions to the Social Insurance Fund go to pay for sick leave and social benefits. Their payment is carried out regularly within the time limits regulated by law, but for individual entrepreneurs a voluntary payment procedure is provided. This means that every entrepreneur has the right to decide for himself whether he wants to receive social payments. If there is such a desire, you need to pay a fixed amount annually.

It is possible to find out about debts to the Social Insurance Fund by submitting a written application to this fund. The answer will be ready within five days. You can also submit an electronic request, then the information will be provided within 1-2 days. When submitting reports, existing arrears will also be visible.

Alternative payment methods using a Sberbank card

Property taxes can be paid directly on the Federal Tax Service website or through the State Services website.

On the Federal Tax Service portal

This method is only suitable if you already have access to the taxpayer’s personal account on the tax service website (to obtain it, you should contact any branch of the Federal Tax Service, where you will be given a password for your personal account). Log in to your account using your INN and password.

1 In the new version of your personal account, you are immediately shown the amount of taxes to be paid. To the right of the amount there is a line “Details”. When you click on it, a window will open with all the taxes that need to be paid - leave a checkmark next to the property tax and click “Return to payment”. Next, click the “Pay Now” button.

2 You will be offered three methods - payment by credit card, payment generation and payment through the credit institution’s website. To pay by credit card, check the box indicating consent to the processing of personal data and click on the “pay” button.

3 You will be automatically redirected to the payment processing page, where you need to enter your card details and confirm the payment.

4 When you select “Generate receipt”, the service will offer to save your tax notices in PDF format. You can print them if necessary.

5 By going to the payment tab “Through the website of a credit institution” you will be asked to select from a list the bank through which the payment will be made. This could be Alfa Bank, Gazprombank, Tinkoff and others (you will see the full list on the website).

6 When you select the desired bank, the system will redirect you to the Internet banking page, where you will be asked to log into your personal account for further payment.

By the way, I recommend that you watch the video where I show how to pay taxes at a discount:

Video: Pay taxes online with a discount

On the State Services website

Payment using the State Services portal is considered the safest way:

1 On the State Services website, log into your personal account.

2 Open the “Tax debt” tab - it’s second from the top in the menu on the right.

3 Go to the payment tab “By receipt number”.

4 Enter your number and proceed to payment.

5 Next, you will need to enter your card details and confirm the payment.

When paying through State Services, no commission is charged.

How to control and pay debt

Regular debt checking using the online resources of the State Services or the Federal Tax Service does not take much time and does not create any difficulties. But it becomes possible to minimize the consequences of debts by paying them off as soon as possible.

Paying debts determined by tax authorities is also very simple. You can do this through:

- personal account on the Federal Tax Service resource or in a mobile application;

- third party online services;

- Internet banking or banking application;

- terminal or bank cash desk if you have a receipt.

The Federal Tax Service website offers the “Pay Taxes” service, which allows you to generate payment documentation and make payments online. Payments are processed through partner banks.

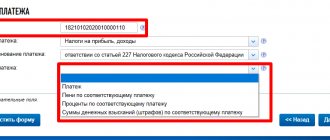

First you need to go to your registered personal account and click the search button. At the same time, information on the presence of debt is provided. Followed by:

- Select debts to pay - there may be several of them, for example, for taxes and late fees or for different taxes. You need to tick the appropriate boxes.

- Select payment format.

- Select a bank to make a payment and wait for the transition to the online banking service.

- Enter your password and ID.

- Sign in.

- If necessary, enter the one-time code received via SMS.

On the page that opens, you must select the amount to pay and confirm the action. After completing the transaction, you can print out a confirmation receipt.

How to pay tax debts of individual entrepreneurs?

In addition to the usual payment methods, online payment methods are possible for individual entrepreneurs, for example, through the website at this link

Rice. 6

If online payment is not suitable, choose cash payment. The generated payment document is available for printing and saving in PDF format:

Despite the fact that the State Services portal does not provide a search for tax debts for individual entrepreneurs, it still allows you to pay them off. If you select the portal as a payment method on the Federal Tax Service website (see Fig. 6), the following window will open:

The most accessible payment method is by bank card. Sometimes additional authorization using a bank SMS password is required.

Another service offering to pay taxes is Sberbank Online, which includes the Federal Tax Service as recipients if you go through the chain Transfers and payments / Taxes, Fines, Duties, Budget payments / Taxes, work patents / Search and payment of taxes to the Federal Tax Service:

For enforcement proceedings, you can pay directly on the bailiffs portal:

In what cases does it appear?

The taxation system provides for a number of contributions and fees that individual entrepreneurs must pay. The duties of the Federal Tax Service include sending demands for payment of taxes to entrepreneurs. But in some cases debt is formed:

- if the notification did not arrive, it was lost;

- if the individual entrepreneur postponed payment for too long;

- if a businessman simply forgot to pay tax;

- if payments to the budget were not made when the businessman did not have available funds;

- if the individual entrepreneur is away and technically could not make the payment.

Entrepreneurs calculate some taxes themselves, sometimes making mistakes. If the tax is not paid on time, regardless of the reasons, a debt arises. For some time it grows, and a penalty is charged on the amount of the arrears. If a businessman pays off debts in a timely manner, the matter is limited to the cost of paying off penalties. But when the collection is carried out by the Federal Tax Service or the FSSP, you will have to pay the tax itself, a penalty, a fine, reimbursement of legal expenses and a fee for compulsory collection.

How to find out how much to pay

Before you find out how to pay property tax for individuals through Sberbank Online, you need to obtain payment details and calculate the amount of taxes.

Unlike legal entities, who need to know the size of the tax base, the current interest rate, take into account benefits and many other things, individuals simply receive a receipt indicating the amount to be paid. All calculations are made by the tax office, and notifications are sent to property owners no later than a month before the deadline for payment - December 1 of the current year in accordance with Article 52 of the Tax Code. If December 1st falls on a weekend, the payment deadline is moved to the next business day.

The tax office sends notifications and payment receipts in two ways:

1 By registered mail.

2 Through the taxpayer’s personal account on the Federal Tax Service website.

The absence of a letter in the mail does not mean that you do not owe the state anything. Therefore, if the letter has not arrived for some reason, then it is better to visit the tax office yourself and get payment details there, or check your personal taxpayer account on the tax service website - if it is available, then by default this is where receipts for payment are sent first . The receipt contains all the details necessary for payment - these are the ones you will need to indicate when making the payment.

Note: To gain access to the taxpayer’s personal account, you must first visit a branch of any tax service in any region with a passport and TIN. There you will be given a login and password. You can’t just go to the site and register yourself.

Is there a statute of limitations

If the tax is not paid on time, the Federal Tax Service sends the payer a demand to fulfill financial obligations. Tax authorities have the right to recover underpayments in an indisputable manner. Such a decision is made within 2 months after the end of the period allotted for paying the tax and specified in the request. After this period, collection is possible only through court.

Taxpayers have the right to submit an application to the courts within six months after the end of the period specified in the request. Accordingly, the statute of limitations for paying taxes is 4 months.

Is it possible to check a counterparty by TIN?

It will not be possible to check whether a counterparty has a debt using the Taxpayer Identification Number (TIN) on the Federal Tax Service website. To obtain data on debts, you can check by name through the FSSP website. If an entrepreneur owes money to the budget and bailiffs are handling his case, it is better to refrain from doing business with such a counterparty.

Important! Data on the debt of legal entities is available on the Federal Tax Service resource.

Options for paying property taxes for individuals. persons via Sberbank Online

Sberbank clients can choose one of several options for paying property taxes:

- Sberbank Online;

- Sberbank mobile application;

- ATMs and payment terminals of Sberbank;

- Sberbank offices;

- State Services website;

- Federal Tax Service website.

The easiest and most convenient way is to use Sberbank Online services, since you don’t even have to leave your home to do this, unlike visiting an office or finding an ATM.

Sberbank Online is a platform through which you can perform any transactions with your accounts and cards, including paying tax contributions online.

This Sberbank function simplifies the procedure for repaying debts and saves time; all payment card holders have access to it.

Before we move on to the instructions themselves, I want to tell you that there are four options for paying taxes through Sberbank Online:

1 By document index;

2 Search and payment of overdue taxes using TIN;

3 According to arbitrary details;

4 Payment by QR or barcode.

Further in the instructions we will pay according to the Document Index. It is available both through the website and through the mobile application. The second option using the TIN is used only if you did not have time to pay before December 1, that is, the overdue tax is paid. The third option is less convenient than the first, since you will have to enter more data; it is suitable for those who do not have a document index. And finally, the fourth option is available only to owners of smartphones with the Sberbank Online mobile application installed. This is a convenient option, since you don’t need to fill in the details; you just need to point the camera at the barcode.

Let's look at each option in more detail:

Consequences of debt for individual entrepreneurs

If you fail to pay your debts on time, the entrepreneur will enjoy numerous benefits:

- accrual of penalties on the amount of arrears;

- launching a collection procedure;

- charging a fine;

- forced debiting of funds from the account by decision of the tax authority;

- blocking an individual entrepreneur's account;

- opening of court proceedings;

- transferring the collection case to bailiffs.

There is even criminal liability for non-payment of taxes with a penalty of imprisonment of up to 1 year.

Paying taxes is the responsibility of every individual entrepreneur. In certain circumstances, it may create a debt, but you can find it out quickly through online services or by submitting a request to government agencies. Some resources make it possible to immediately pay off your debt via the Internet.