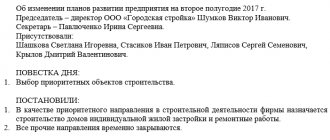

Author: Ivan Ivanov

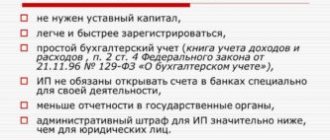

Choosing an organizational and legal form for conducting business is an important step in its development. It is necessary to carefully evaluate all the pros and cons of each, choose what will be most profitable and convenient, taking into account all possible legal prohibitions and restrictions.

A limited liability company is one of the most common organizational options, which has a number of advantages and disadvantages, but is one of the simplest and most convenient.

What is LLC

LLC is a commercial organization created for the purpose of making a profit.

An LLC is a legal entity established by one or more persons. The authorized capital of several founders is divided into shares, which is regulated by the constituent documents. The peculiarity of an LLC is that its participants are liable for obligations only within the limits of their shares, without being liable for personal property.

All information about the organization, including the size of its authorized capital, name, and legal address is contained in the Charter. It regulates the main provisions of its activities, the procedure for making decisions, and the transfer of shares from one participant to another (and third parties).

LLC Features:

- The number of participants should not exceed 50 people.

- Participants - individuals and legal entities.

- The highest management body is the meeting of participants.

- The authorized capital is formed based on the size of shares. Its minimum amount is 10,000 rubles.

- Contribution of the authorized capital is permitted both in cash and with other rights or things that can be valued in monetary terms.

LLC is the most popular form of legal entity, as it opens up more opportunities compared to individual entrepreneurs, while the complexity of accounting and resolving legal issues necessary for activities is at approximately the same level.

What should be contained in the charter?

The charter serves as the main document of the LLC. According to Art. 12 of the law, it should contain the following provisions:

- information about the full and abbreviated name of the company;

- information about the locality in which it will be located;

- the structure of management bodies, as well as their competence and the procedure for making decisions on the activities of a legal entity;

- legal status of a participant in the organization;

- the procedure for transferring shares in the authorized capital between persons;

- regulations for storing company documentation and transferring it to participants in the company and third parties.

The list may be supplemented with other conditions if required by law.

The problem with a large number of companies is carelessness when creating them. Often, publicly available documents with few amendments are used as the charter.

It is better not to count on luck and carefully study the documents proposed for approval.

Purposes of creation

The main purpose of creating a limited liability company is entrepreneurial activity.

In turn, the goal of entrepreneurial activity is to make a profit. The organization's charter must contain the purpose of its creation. As a rule, the goal is to expand the market for goods and services, as well as to make a profit.

At the same time, the subject of the company’s activity is determined, which is selected in accordance with the types proposed by law (selected from the OKVED list). This could be the provision of any services, the sale of goods, the implementation of advertising activities, trade and much more.

Some types of activities are available to an organization only after obtaining a special license. An LLC can include any licensed activity in its Charter, without necessarily obtaining a license.

An LLC may acquire rights, perform any actions and bear obligations in order to achieve its goals specified in the Charter. At the same time, the organization has the right to engage in any activity unless it is prohibited by law.

Procedure for establishing an LLC

The creation of a limited liability company begins with the adoption of an appropriate decision.

It must be documented and resolve a number of mandatory issues (Article 11 of the Federal Law “On LLC”). When establishing, you need to decide on the following:

- what will be the corporate name of the organization;

- in what locality it will be located (location);

- what will be the authorized capital of the LLC;

- it is necessary to approve the text of the organization’s charter;

- approve the governing bodies of the legal entity;

- form an audit commission or appoint an auditor (if the number of participants in the organization is more than 15).

If at least one of the specified points is missing from the document, the tax office has the right to recognize it as not presented.

Forms of making a decision

The establishment of an LLC requires a unanimous decision of the participants on all necessary issues. Exceptions include issues of election to positions or bodies of society, when the right to form them by a qualified majority of 75% of the votes is granted. If the shares are not determined, then each participant has 1 vote.

As for the design, it differs depending on how many founders participate in the creation of the organization. If such a person acts alone, then the decision of the sole participant is formalized.

In cases where there is more than one, it is necessary to draw up minutes of the general meeting of founders. The following requirements apply to it:

- The date and location of the event must be reflected.

- It is necessary to indicate the chairman and secretary.

- The agenda of the meeting is indicated.

- The submission of each question to a vote and the voting results on them are reflected.

Phased opening with one founder

The founder must decide on several points, such as the name of the organization, the choice of activity, and the size of the authorized capital.

It is recommended to select in advance the place of registration of the organization, that is, its legal address. If the company will be located in rented premises, it is necessary to obtain a letter of guarantee from the landlord.

The name of the organization must be in Russian, it is acceptable to use numbers. Many argue that it is unacceptable to create an LLC if a company with the same name already exists. This is wrong. In practice, identical names are often found; such companies are distinguished by other details (TIN, OGRN, etc.).

If there is only one founder, there is no need to decide on the distribution of profits. In addition, the package of documents required for registration will be slightly different. To register you will need:

- The decision to create an organization.

- Application on form P11001.

- Charter (2 copies).

- A document confirming payment of the duty.

This is the required minimum. Additionally you will need:

- A letter of guarantee or a document confirming ownership of the premises.

- Application for transition to a simplified taxation system.

You should carefully consider the choice of taxation system. Some types of activities prohibit the use of the simplified tax system.

To register an LLC with one founder, it is recommended to perform the following sequence of actions:

- Making a decision to create an LLC. Signed by the sole founder. The document is printed on one side of the sheet.

- Preparation of an application in form P11001. Fill out either by hand in block letters or from a computer. The easiest way is to use the special program “Generation of documents for state registration.” It is distributed free of charge and can be downloaded through the tax website nalog.ru.

- Development of the charter. Two copies will be required.

- Payment of state duty. For 2020 it is 4,000 rubles. Payment must be made on behalf of the founder.

- Registration of LLC with the tax office. The founder must have a passport with him. There is no need to certify the P11001 application by a notary when submitting it in person.

- Receiving documents confirming registration. Delivered within 3 business days.

The registration process should not pose any difficulties, with the exception of filling out application P11001. Not all sheets are filled out, but only those that are necessary in a particular case. If the sheet is not filled out, then it is not attached. The signature on the last sheet is placed in the presence of the registrar, that is, directly at the tax office.

Required documents

The creation of a limited liability company is accompanied by the preparation of the following documents:

- minutes of the general meeting or a sole decision on opening (depending on the number of participants);

- charter of the enterprise;

- agreement on establishment;

- registration application.

If a company is opened by one founder, then he needs to prepare a written decision on the creation of a limited liability company. The document displays information about the approval of the company's charter, the amount of authorized capital, and the location of the legal entity.

The creation of a limited liability company by several participants implies the presence of minutes of the general meeting of founders. A company with at least 2 founders is required to hold a vote with all participants present. Based on the results of the meeting, it is necessary to prepare a protocol on the creation of a limited liability company. The document must be signed by authorized persons.

At the same time, the founders must develop a charter - the main constituent document of the company. The document contains the full and short name of the company, the purpose of its creation, location, competence of participants in the structure of the regulatory body of the enterprise, the legal basis for the status of the founders and the transfer of shares of the authorized capital. The charter may contain additional provisions that do not contradict Article 12 of the Federal Law No. 14-FZ dated 02/08/1998.

At the initial stage, it is necessary to draw up an agreement between members of the organization (if there are several of them). It is drawn up in order to systematize the actions associated with opening a company and forming the authorized capital (volume, distribution of shares). The agreement on the establishment of a limited liability company is not considered a constituent document and is intended to regulate relations within the company.

The final stage of preliminary preparation of documents is drawing up an application in form P11001. A sample document can be obtained from the territorial office of the Federal Tax Service or downloaded on the Internet. The applicant's signature must be notarized.

Is it possible to avoid going to a notary? Yes, if all founders are present when submitting documents to the registrar. The application is accompanied by sheets indicating the types of activities selected according to the classifier.

Registration process with two or more founders

Registration of an LLC with two or several founders is not much different from the registration process with one founder. But there is still a difference. First of all, it concerns the package of necessary documents.

To register an LLC with two or more founders you will need:

- Minutes of the founding meeting. Signed by all participants.

- Agreement on the establishment of an organization.

- Filling out form P11001. With several founders it will be slightly different, the number of pages will be larger.

- Preparation of the LLC Charter.

- Payment of duty. It will also be 4000 rubles. Paid on behalf of any of the founders.

- Submitting documents to the tax office. You cannot sign yourself. All founders sign the application directly to the tax office.

- Receiving documents confirming registration.

In general, the registration process is the same. There should be no difficulties, with the exception of form P11001. It is also recommended to use a special filling program.

Documents for download (free)

- Form P11001

- Form P11001

- LLC Charter

- Power of attorney to submit (receive) documents

- Application for transition to simplified tax system

- LLC Protocol

- Letter of guarantee to the legal address

- LLC establishment agreement

- Receipt for payment of state duty

- Sole founder's decision

LLC establishment agreement

Several years ago, the founding documents of an LLC included a memorandum of incorporation. Due to the fact that it actually duplicated the provisions of the charter and did not contain important features, the legislator repealed this provision.

Instead, an agreement on the establishment of an LLC is provided. It represents a document signed by all participants and distributing the rights and responsibilities associated with the creation of the organization, as well as the main provisions contained in the charter.

The requirements for it are contained in Part 5 of Art. 11 law.

The establishment agreement must contain:

- the procedure for carrying out actions related to the creation of a company;

- volume of authorized capital;

- procedure and timing of formation of the authorized capital;

- the size and nominal share of each of the participants.

As for the actions to create an LLC, these include filing an application for state registration, submitting it for this procedure and receiving documents. The parties also have the right to instruct one of the participants to draw up a draft charter, deposit money into a temporary bank account and perform other necessary operations.

The Treaty of Establishment serves as the basis for a number of future articles of association. However, it is not checked during state registration. An agreement is not required if the company is founded by a single person.

Price

The cost of registering an LLC will depend on whether you submit documents yourself or through a representative.

If you submit and develop all the documentation yourself, you will only need to pay a state fee. If documents are submitted through a representative, you will need to issue a notarized power of attorney, the cost of which at the moment is a little more than 1,000 rubles.

Next, you will need to have the signature on the application certified by a notary. The cost will range from 1000 rubles to 2000 rubles.

It is possible to open an LLC by ordering the entire process from a third party. The average cost is 5,000 rubles. However, this amount does not include the fee and notary fees.

Registration of a company will ultimately cost from 4,000 rubles to approximately 12,000 rubles.

Basic provisions on joint stock companies in the Russian Federation

From the point of view of current Russian legislation, a joint stock company is a commercial organization whose authorized capital is divided into a certain number of shares certifying the obligatory rights of the company's participants (shareholders) in relation to the company.

Let us note the main features of this organizational and legal form:

In 2020, the creation of a joint-stock company is carried out by decision of its founders (founder);

A joint stock company is considered created from the moment of its state registration;

The location of the company is determined by the place of its state registration;

The highest governing body of the company is the general meeting of shareholders;

The constituent document of a JSC is its charter;

The authorized capital of a joint stock company is made up of the par value of shares acquired by shareholders;

The minimum amount of the authorized capital of a public joint-stock company in 2020 is 100 thousand rubles, non-public - 10 thousand rubles;

A joint stock company is liable for its obligations with all its property;

At the same time, the participants of the joint-stock company are not liable for the obligations of the company and bear the risk of losses only within the limits of the value of their shares;

The company, in turn, is not liable for the obligations of its shareholders.

Actions after registration

The actual creation of a company does not end with its registration. Next you need:

- Open an organization current account. This can be done at any bank.

- Create an order for the appointment of a director and the person responsible for maintaining accounting records, and draw up employment contracts.

- Order a print if necessary.

There is no need to submit applications to the funds; the tax office will do everything on its own and send notifications about this to the legal address of the organization. Statistics codes can be found on the website kodyrosstat.rf and printed out yourself.

If it is necessary to use the simplified tax system, you must submit a corresponding application within 30 days after registration, if it was not submitted at the time of registration. Otherwise, OSNO will be applied.

If required, you need to register a cash register and also obtain licenses.

Application for registration

The procedure for creating a joint stock company involves filling out a card in form P11001. It is filled out when creating any type of legal entity. All numbers and letters on the form must be in capitals. Abbreviations are allowed only according to the rules that are provided for regions, countries and certain localities, street names, and so on.

The company name, abbreviated and full names must be written exclusively in Russian. For each founder, it is necessary to fill out Sheet “N”. The founder himself must sign the sheet filled out for him; the signature must be certified by a notary.

The decoding of OKVED codes is not written down, only the digital four-digit value is indicated. It will be necessary to indicate the nominal value of the shares (section 7). If a public JSC is being registered, then it is necessary to additionally fill out Sheet “K”. This is where information about the registrar with whom you must first conclude an agreement is indicated.

The main thing is to remember that the creation of a closed joint stock company, like an open enterprise, is impossible. You can only open a public or ordinary JSC.

Examples

The creation of organizations engaged in certain types of activities may have some peculiarities. The package of documents for creating an LLC will be the same, however, it is necessary to include the necessary types of activities in the Charter.

Tour operator

Using the example of a travel agency, the legislator established that a tour operator can only be an LLC, and an individual entrepreneur can only be a travel agency. Their status differs in the amount of responsibility.

If a company is engaged in activities related to tourism, it can choose the simplified tax system. Obtaining a license is also not required. If the founders are serious about their activities, it is recommended to obtain a license, which will increase the level of trust of potential clients.

Construction company

The process of creating and registering a construction company is no different from creating a regular LLC. The same package of documents will be required, and the required types of activities should be indicated in application P11001.

A special feature of the activities of a construction company is the need for licensing. The license is obtained after the registration of the LLC. Some categories of construction will also require SRO membership.

A permit must be obtained for each construction. A design license and an engineering license are also required.

Grocery store

Registration will also be simple.

A standard package of documents will be required; the appropriate types of activities are selected and indicated in application P11001. After this, you will need a document confirming ownership of the retail space or a lease agreement for it. After which a sanitary passport is issued, as well as permits from the SES and State Fire Department.

The next step is to sign a contract for waste removal. Without this, the operation of grocery stores is impossible. If you plan to sell alcoholic beverages, you must obtain the appropriate license.

It is important to take into account the requirements for retail space and store location (for example, the sale of alcoholic beverages near educational institutions is prohibited).

These documents must be submitted to the Consumer Market Department. If everything is completed correctly and the documents were submitted within a month, the authority will issue a trade permit.

After obtaining permission, it is necessary to certify workplaces, register the cash register and ensure the presence on the trading floor of a book of complaints and suggestions, the text of the law “On the Protection of Consumer Rights”, copies of licenses and trade permits, emergency telephone numbers, certificates of inspection of the cash register and scales .

The difficulty of opening a grocery store lies not in its registration, but in subsequent actions, since a number of permits and licenses are required.

However, if you carry out all the steps correctly and prepare the necessary documents, the registration will be completed without any problems.

Kinds

Before deciding to create a joint stock company, you should decide whether it will be a public or non-public company. Their main difference is that the first involves an open subscription to shares. Such companies will have to open their accounting and financial statements and invite an auditor annually. Otherwise, these types of organizations are no different.

The procedure for creating commercial organizations

Stages of creating a commercial organization:

1. Determination of the composition of founders and participants of a commercial organization. The legislation of the Russian Federation provides for special rules regarding the composition and number of founders of a commercial organization;

2. The participants select the organizational and legal form in which business activities will be carried out;

3. Constituent documents. At the initial stage of creating a commercial organization, it is necessary to develop and approve constituent documents depending on the organizational and legal form;

4. Choosing the name of a commercial organization. According to Article 54 of the Civil Code of the Russian Federation, legal entities have their own name, the content of which indicates the organizational and legal form;

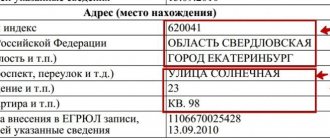

5. Determining the location of the organization. According to Article 52 of the Civil Code of the Russian Federation, the constituent documents of a commercial organization must indicate its location. As a general rule, the location of a Legal entity is the place of its registration;

6. Formation of authorized (share) capital and authorized (share) fund. In business companies, an authorized capital is formed, which is a set of contributions, shares, shares at par value, founders, and participants of organizations registered in the constituent documents. In business partnerships, a share capital is formed, which does not act as a minimum guarantee of the rights of creditors, therefore its size is determined in the constituent documents. In production cooperatives, a mutual fund is formed, which is formed through share contributions. When creating state and municipal enterprises with the right of economic management, an authorized capital is formed, the size of which is determined by the owner of the enterprise;

7. State registration is a procedure for state registration of business entities, these are acts of the authorized federal executive body, carried out by entering into the unified state register information on the creation of a reorganization, liquidation of legal entities, acquisition by an individual of the status of an individual entrepreneur, termination of its activities and other information about individuals and legal entities;

8. Availability of a seal;

9. Registration with statistical authorities;

10. Registration with the tax authority;

11. Opening a current account in a bank;

12. Registration with state social funds.

State registration of business entities, concept, content, procedure for implementation

State registration of legal entities and individuals is carried out in accordance with Federal Law No. 129 Federal Law dated 08.08.?? “On state registration of legal entities and individual entrepreneurs” State registration is carried out by the Ministry of Taxes and Duties. Registration is carried out at the location indicated by the founders in the application of the permanent executive body. And in its absence, another body or person who has the right to act on behalf of a legal entity without a power of attorney. The law establishes a registration period of no more than 5 working days from the date of receipt of documents by the registration authority. Documents can be sent by mail. The expiration date is the date of receipt of documents by the registration authority.

For state registration of a legal entity, the following individuals may be applicants:

1. The head of a permanent executive body, a registered legal entity or another person who has the right to act in the interests of the legal entity without a power of attorney;

2. Founder, founders of a legal entity upon its creation;

3. The head of a legal entity, acting as the founder of a registered legal entity;

4. Another person acting on the basis of the authority provided for by the Federal Law or a special regulatory act.

Article 13 of Federal Law No. 129 specifies a list of documents provided to the registered body upon registration:

1. Application;

2. The decision to create a legal entity;

3. Constituent documents;

4. An extract from the register of foreign legal entities, the corresponding country of origin or other evidence of equal legal force of the legal status of the foreign legal entity-founder;

5. Document confirming payment of the state fee.

For individuals:

1. Application;

2. A copy of the main document of an individual, if he is a citizen of the Russian Federation;

3. A copy of a document established by the Federal Law or recognized by an international treaty of the Russian Federation as an identification document of a foreign citizen registered as an individual entrepreneur;

4. For stateless persons, a copy of a document confirming the origin and, if possible, belonging to a specific country of the stateless person is provided.

The registration authority has no right to require documents other than those specified in the registration law.

Refusal of state registration is permitted in the following cases:

1. failure to provide the documents required for state registration as determined by the “Law on State Registration”;

2. submission of documents to an improper registration authority;

3. if the founder of the legal entity is a legal entity being liquidated or if the legal entity arises as a result of the reorganization of the entity being liquidated.

The decision to refuse state registration must contain the grounds for refusal with a mandatory reference to violations provided for by the law on registration. Refusal to state registration may be appealed in court.

State registration of an individual as an Individual Entrepreneur is not allowed unless his state registration as such has expired, or a year has not elapsed from the date of the court’s decision to declare him insolvent (bankrupt) or the decision to individually terminate his activities as an individual entrepreneur, or the period for which the entrepreneur is deprived of the right to engage in entrepreneurial activity by a court verdict has not expired.

Lecture No. 4 09.30.09