Content

- JSC classification

- Characteristics of public and non-public companies

- Table: Comparative characteristics of PJSC and NJSC

- General characteristics of PJSC

- Statutory documents

- Availability of property fund and shares

- PJSC governing bodies

- Forms of management activity

- General characteristics of NAO

- Statutory documents

- Governance bodies of the Nenets Autonomous Okrug

- Property of the Nenets Autonomous Okrug

- NAO shares

- Public and non-public business companies

- Ability to move from one form to another

- Conclusion

Freedom of internal self-organization of non-public societies

The activities of non-public companies, to a greater extent than public ones, are regulated by dispositive norms of legislation, which provide the participants of the corporation with the opportunity to determine the rules of their relationship themselves.

The ability to independently determine the list of public bodies. The Civil Code divides corporate bodies into two main groups: bodies that must be formed in all corporations, and bodies that are formed in certain types of corporations in cases provided for by law or the charter of the corporation itself.

Mandatory bodies include the general meeting of participants (the highest body of any corporation) and the sole executive body (director, general manager, etc.). And the bodies that are formed only in cases provided for by the Civil Code, other laws or the charter of the corporation include: a collegial executive body (board, directorate, etc.), a collegial management body (supervisory or other board), which controls the activities of executive bodies of the corporation and performs other functions, as well as the audit commission. For a public company, in accordance with the law, the formation of most of these bodies is mandatory (only the need to form a collegial executive body is left to the discretion of the company itself), while for a non-public company the formation of only two corporate bodies is mandatory, and the rest are optional.

JSC classification

Until 2014 inclusive, all joint-stock companies were divided into two types: closed joint-stock companies (closed) and open joint-stock companies (open). In the fall of 2014, the terminology was abolished, and a division into public and non-public societies began to operate. Let us dwell on this classification in more detail. It is worth considering that these terms are not equivalent; not only the terms themselves have undergone changes, but also their characteristics and essence.

It is fundamentally wrong to assume that just the name has changed, but the content remains the same. This is far from true.

Characteristics of public and non-public companies

Public joint stock companies (abbr. PJSC) create capital through securities (shares), or by transferring fixed assets into securities. The functioning of such companies and their turnover must fully comply with the Federal Law “On the Securities Market” adopted in the Russian Federation.

Also, taking into account all the conditions set by the legislator, publicity must be mentioned in the title.

Non-public companies include limited liability companies and joint stock companies (JSC).

Let's look at the comparative characteristics using the table below. It clearly presents important criteria for comparative analysis, although this list is not complete.

Registration of a non-public joint-stock company

The cost of registering a JSC at the Business tariff is 7,000 rubles. (The cost of the service includes: Preparation of a full set of documents, delivery and receipt at the tax office, receipt of OKVED codes, production of a seal, preparation of documents for opening a current account, receipt of notifications from extra-budgetary funds of the Pension Fund, Social Insurance Fund)

The cost of registering a JSC at the “Maximum” tariff is 22,000 rubles. (The cost of the service includes: Legal address for 11 months, preparation of a full set of documents, delivery and receipt at the tax office, receipt of OKVED codes, production of a seal, preparation of documents for opening a current account, receipt of notices from extra-budgetary funds of the Pension Fund, Social Insurance Fund)

NEW Now at the 46th Tax Inspectorate it has become possible to submit documents for registration of joint stock companies through the tax electronic service. When filing electronically, the state fee for creating a JSC is not paid, which significantly saves your budget.

Courier departure - Free!

Legal consultations - Free!

Registration of a JSC takes 5-7 working days.

We will tell you how you can register a joint stock company yourself. Well, if you want to not think about anything and quickly create a company, then contact our lawyers and we will help you register a joint-stock company without any problems or delays.

Joint stock companies are the second most popular and widespread type of commercial organization (after limited liability companies). A joint stock company is a type of commercial organization in which the authorized capital is divided into a certain number of securities - shares that certify the liability rights of its shareholders.

Current legislation distinguishes 2 forms of joint stock companies:

- JSC registration;

- PJSC registration.

The most significant differences between a public JSC and a non-public JSC are the following:

1. The ability of a public joint-stock company to conduct an open subscription for its shares, as well as to carry out their free sale (sale) to third parties. In contrast, in a non-public joint-stock company there is no such opportunity, and all shares are necessarily distributed among its shareholders or other strictly defined circle of persons.

2. In a non-public JSC, compared to a public JSC, shareholders have an additional right - mainly the right to shares sold under a purchase and sale agreement by other shareholders of the JSC.

The creation of a joint-stock company is the most complex procedure in terms of content and structure, since it is associated with the issue (carrying out an issue) of shares of a non-public joint-stock company. In view of this, its opening, in particular registration with the Federal Tax Service (tax inspectorate), is advisable to entrust to those persons who professionally specialize in providing this type of services. legal services. The specialists of your Law Firm are ready to offer their clients a full range of services for registering a joint stock company in Moscow.

Registration of a JSC company as a way of organizing a business has certain significant advantages associated with the operational possibility of attracting additional capital (assets) from third parties, a more extensive system of governing bodies of the company (for example, the presence of a supervisory board), providing to a certain extent a system of checks and balances when managing the affairs of a joint-stock company, etc.

JSC REGISTRATION PROCEDURE

1. Decision to register a JSC company .

The decision to open a non-public JSC is made by a body such as the constituent meeting (it includes all the founders of the non-public JSC) or by a decision of its sole founder (if the JSC is opened by a single person).

The decision to create a joint-stock company shall approve:

- charter of a non-public joint-stock company;

- monetary value of those securities and/or other things and/or property rights and/or other rights that have a certain monetary value, which are subject to contribution by the founders of the JSC as payment for the shares of the JSC in its authorized capital.

When a non-public joint-stock company is created by several founders, this decision on opening must be made by each of them.

2. Conclusion by the founders of the JSC of an agreement on its establishment.

The said agreement is signed by all founders at the meeting and must contain the following information:

- information about the actions that the founders of the joint-stock company must take as part of the joint activities for its establishment.

- size of the authorized capital of a non-public joint stock company;

- types and categories of shares that will be issued by the joint-stock company;

- procedure and amount of payment for JSC shares;

- basic rights and obligations of founders when registering a joint stock company in Moscow.

3. Submission of documents to the Federal Tax Service for the state. JSC registration.

According to the requirements of the current Russian legislation, state registration of a joint stock company is carried out at the tax office at the location of the non-public joint stock company.

In order to register a JSC, the following documents must be submitted to the Federal Tax Service employees:

- Application in form P11001 for legal registration of the JSC with the tax office;

- Minutes of the meeting of the founders of a non-public JSC or the decision of the sole founder of a non-public JSC on the creation of a JSC;

- A JSC company registration agreement signed by all founders;

- Charter of a non-public joint-stock company;

- Original receipt (other document) for payment to the state. JSC registration fees. According to paragraph 1, paragraph 1 of Art. 333.33 Tax Code - registration of a JSC company is subject to a fee, the amount of which is set at four thousand rubles.

Often, employees of territorial divisions of the Tax Service require from applicants documents certifying their rights to the premises (office), which will be the legal address (location of the non-public joint-stock company), as well as a letter of guarantee signed by the owner of such premises (office). In addition, if desired, the applicant can order from the Federal Tax Service a copy of the charter of the company being created, having previously attached documents (receipt) on payment to the state to the above documents. fees for it.

In addition to the above, it is also advisable for the applicant to attach to the above documents an application for the simplified tax system (application for application of the simplified tax system), if the closed joint-stock company intends to use it in its activities. Submission of this application is necessary so that in the future applicants do not have to specifically contact the tax office with this application.

Registration of a JSC company in accordance with current Russian legislation must be carried out by employees of the Federal Tax Service within 5 (five) days from the moment such employees of the Federal Tax Service receive the full set of necessary documents that were indicated above. Upon expiration of this period, the tax office issues to the applicant:

- Certificate of State. registration of a non-public JSC;

- Certificate (TIN) of tax registration. organ;

- Extract from the legal register. persons (Unified State Register of Legal Entities);

- Information letter from the USRPO;

- A copy of the charter, registered by employees of the Federal Tax Service.

When contacting your Law Firm, the employees of our firm will independently carry out all the necessary procedures in order to open a joint stock company and provide the client with the documents (including the above) necessary for him to carry out economic activities (business).

4. Production of seals for JSC.

The production of a seal by a non-public JSC is determined by the requirements of clause 7, Article 2 of the Federal Law “On Joint Stock Companies”, in accordance with which each registered JSC must have its own round seal (with the name and legal address of the JSC). The absence of a seal in a non-public company is recognized as a gross violation of the provisions of the joint stock legislation of the Russian Federation.

5. Obtaining statistics codes from Rosstat.

Rosstat assigns the following codes to each non-public JSC - OKATO, OKOGU, OKPO, OKOPF, OKSF.

To obtain the above codes for a non-public JSC, applicants must submit the following documents to the Service:

- JSC registration certificate;

- Fresh extract from the Unified State Register of Legal Entities;

- A duly issued power of attorney (when submitting documents not by the general director/head of the joint-stock company).

6. Concluding a banking service agreement with a credit institution (opening a current account).

The creation of a joint stock company, as a rule, is carried out for the purpose of carrying out large business. However, Russian legislation (Civil Code of the Russian Federation) allows cash payments between entrepreneurs in an amount of no more than one hundred thousand rubles. If the amount is larger, then payments are made by bank transfer. In view of this, in order to carry out its business activities, a non-public joint-stock company must open accounts with a bank (or several banks).

7. Registration of a non-public joint-stock company with extra-budgetary funds.

The JSC is subject to registration in:

- Pension Fund (PF RF);

- Social Insurance Fund (FSS RF);

- Compulsory Medical Fund. insurance (Compulsory Medical Insurance Fund of the Russian Federation).

According to the current Russian legislation, the relevant information about the joint-stock company is sent (transferred) to the above funds by the tax inspectorate, which carried out the process of registering the CJSC company, within five days from the moment of registration of the JSC.

Based on the information received from the inspection, the relevant states. the fund, within five days from the date of receipt from the tax office, registers the non-public joint-stock company.

8. The process of issuing shares of a non-public joint stock company.

The procedure and procedure for issuing shares of a non-public joint stock company is regulated by the provisions of the current Russian legislation, in particular the following regulations:

- Federal Law “On the Securities Market”;

- Standards for issuing securities and registering securities prospectuses, which were approved by order of the Federal Financial Markets Service N 07-4/pz-n dated January 25, 2007.

According to these regulations, the issue of shares of a non-public company (JSC) is carried out in certain stages.

Stages of issue of shares of a non-public joint stock company:

- adoption by a non-public JSC of a decision on the placement of its securities;

- approval of the above decision on the issue of securities by the company;

- state process. registration of the issue of securities by a non-public company;

- placement of securities by the company;

- the process of state registration by the company of a report on the results of the issue of shares (securities).

Our lawyers can also help you register the initial issue of shares.

The cost of this service is 15,000 rubles. Registration period is 1-1.5 months.

To summarize, it should be noted that the procedure for creating a CJSC includes many different stages, therefore, entities (citizens, individual entrepreneurs, legal entities) wishing to open a JSC need to become more carefully and in detail familiar with the procedure for its creation or delegate the implementation of all the above actions to a specialized legal organization.

Your Law Firm is ready to offer its clients assistance in registering a JSC on a turnkey basis, as well as assistance in providing services within the framework of individual stages of creating a JSC (for example, preparing documents for the tax inspectorate, conducting the process of issuing shares, receiving an information letter from Rosstat, etc.). d.). The main advantage of our Company is the extensive experience of our employees in carrying out these procedures, as well as the efficiency of their implementation.

Prices for our services can be found on the “Our Prices”

Place an order and receive a 5% discount

An initial free consultation about registration services and the procedure for registering a joint stock company can be obtained by calling: +7 and +7 (925) 507-67-40.

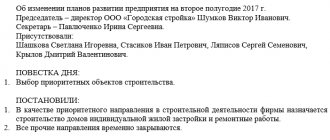

Table: Comparative characteristics of PJSC and NJSC

| Indicators for comparative analysis | PJSC | NAO |

| Name | Availability of the name in Russian, mandatory mention of publicity | Availability of the name in Russian, with the obligatory indication of the form |

| Minimum allowable amount of authorized capital | 100,000 rub. | 10,000 rub. |

| Allowed number of shareholders | Minimum 1, maximum not limited by law | Minimum 1, maximum not limited by law |

| Availability of the right to conduct an open subscription for the placement of shares | Available | Absent |

| Possibility of public circulation of shares and securities | Maybe | Does not have such right |

| Presence of a board of directors or supervisory board | Availability is required | Allowed not to create if there are no more than 50 shareholders |

General characteristics of PJSC

The main features of public joint stock companies are the following:

- The number of shareholders is not limited;

- Free circulation of shares is allowed.

If we talk about the authorized capital, its size is also determined by federal legislation. The formation of the authorized capital of a PJSC occurs due to the fact that shares are issued for a certain amount of money.

The size of the authorized capital in this case is a value that can vary, decrease or, conversely, increase. This depends, first of all, on how the shares are redeemed. As can be seen from the table above, the size of the authorized capital is 100,000 rubles.

As practice shows, control by inspection authorities is stricter than in other cases. This is explained, first of all, by the fact that all the statutory documents indicate that this company is as open as possible to third parties. That is, it is absolutely clear that citizens can purchase company shares. Accordingly, supervisory authorities require maximum transparency and accessibility of all data.

For more complete information on this issue, you should refer to the Civil Legislation of the Russian Federation.

Statutory documents

The main document for a PJSC is the charter. As a rule, it reflects all the provisions governing the activities of the organization, and also records information about openness.

The charter spells out in detail all the procedures for issuing shares, and also contains information on the calculation and procedure for paying dividends.

Availability of property fund and shares

PJSC property funds are formed primarily through the turnover of the organization’s shares. At the same time, the net profit that will be received during the organization’s activities can be included in the property fund. The law does not prohibit this.

PJSC governing bodies

The main body for carrying out management activities in a PJSC is the general meeting of shareholders. It is usually held once a year and is initiated by the board of directors. If such a need arises, the meeting can be held on the initiative of the audit commission, or based on the results of the audit.

It often happens that a PJSC issues a large number of its shares on the market, and then the number of shareholders can number more than one hundred people. Gathering them all at one time in one place is an impossible task.

There are two ways to solve this problem:

- The number of shares whose owners can participate in the meeting is limited;

- Discussions are conducted remotely, using the method of sending out questionnaires.

The meeting of shareholders makes all important decisions on the activities of the PJSC and plans events for the development of the company in the future. The rest of the time, management responsibilities are performed by the board of directors. Let us explain in more detail what kind of control body this is.

In large companies, the number of board members can reach 12 people.

Forms of management activity

Formed on the basis of the legislation of European countries. Usually this:

- Meeting of all shareholders;

- Board of Directors;

- General Director in a single person;

- Control and Audit Commission.

As for the types of activities, it can be anything that is not prohibited by the law of our state. There can be only one main activity.

Some types of activities require licensing, which can be obtained after the PJSC has completed the registration procedure.

The legislation of the Russian Federation requires all PJSCs to post the results of annual reporting on the official websites of the companies. In addition, the results of operations for the year are checked for compliance with reality by auditors.

Help with registration

Registration of an open joint stock company involves a number of time-consuming activities. The head of an established company can use the help of a qualified lawyer with experience in this field. A power of attorney certified by a notary is issued in the name of the invited specialist.

From the moment of confirmation of his powers, the lawyer is engaged in:

- development of the charter;

- preparation of minutes of the general meeting of shareholders;

- drawing up constituent documentation;

- payment of state duty;

- preparing an application for company registration;

- submits documents to the Federal Tax Service;

- receives a certificate of registration;

- after the initial issue of shares, submits an application for its registration with the Federal Financial Markets Service.

You are creating an open joint-stock company in Moscow - we have specialists on staff who are ready to take on all bureaucratic issues. The price for the provision of services by our company is moderate, which makes cooperation with us profitable.

We act officially, having previously concluded an agreement and confirmed it with a power of attorney issued to the specialist. The measures allowing the opening of a company are carried out competently, which guarantees a positive decision by the Federal Tax Service after the first submission of the application.

General characteristics of NAO

Currently non-public are JSC (joint stock companies) and LLC. The main requirements that legislation imposes on NAO are as follows:

- The minimum amount of authorized capital is 10,000 rubles;

- There is no indication of publicity in the title;

- The shares must not be offered for sale or listed on stock exchanges.

An important fact: the non-public nature of the organization implies greater freedom in carrying out management activities. Such companies are not required to post information about their activities in publicly available sources, etc.

Statutory documents

The charter is the main document. It contains all the information about the organization, information about ownership, and so on. If legal problems arise, this document can be used in court.

Therefore, the charter must be written in such a way that all kinds of loopholes and flaws are completely excluded. When the charter is at the drafting stage, you should carefully analyze the regulatory documents, or seek advice from specialists who have experience in developing documentation of this type.

In addition to the charter, an agreement called a corporate agreement can be concluded between the founders. Let's take a closer look at the analysis of this document.

A corporate agreement can be called a kind of innovation, which stipulates the following points:

- All parties to the treaty must vote equally;

- The total price for shares owned by all shareholders is established.

But this agreement implies one clear limitation: shareholders are not obliged to always agree with the position of the management bodies on any issues. By and large, this is a gentleman's agreement translated into legal terms. If the corporate agreement is violated, this is a reason to invalidate the decisions of the shareholders’ meeting.

Let us note that the participants of a non-profit joint-stock company can be its founders, who are also its shareholders. This is due to the fact that the shares cannot be distributed beyond these individuals.

The number of shareholders is also limited; it cannot exceed 50 people. If their number is more than 50, the company must be re-registered.

Governance bodies of the Nenets Autonomous Okrug

In order to manage a non-public joint stock company, a general meeting of shareholders of the company is held. All decisions made at the meeting are certified by a notary, and they can also be certified by the person who heads the counting commission.

Property of the Nenets Autonomous Okrug

After an independent assessment, it can be contributed to the authorized capital as an investment.

NAO shares

- Not addressed publicly;

- Publication by open subscription is not possible.

If we talk about types of activities, then everything that is not prohibited is permitted. That is, if the legislation of the Russian Federation does not prohibit a specific type of activity, it can be carried out.

In general, the essence of NAO is that these are companies that simply do not issue shares to the market; these are closed joint-stock companies that practically existed before the adoption of the new law, but still, this is not the same thing.

There is no obligation to post the results of financial statements for the year for the NAO. Such data is usually of interest only to shareholders or investors, and in this case they are the founders, who already have access to all the necessary information.

Package of documents for registration of JSC

To register an open joint stock company, an application form P11001 is submitted to the Federal Tax Service. Attached to the document:

- list of founders (approved at the general meeting of shareholders and confirmed by the minutes);

- Charter of the company (with a copy) and memorandum of association;

- to confirm the legal address, a certificate of ownership of office premises or a lease agreement;

- orders for the appointment of the head and chairman of the board of directors;

- copies of passports and TIN certificates of the founders;

- receipt of payment of state duty for services rendered.

In Russia, the creation of OJSC by foreign legal entities is permitted. They are provided upon registration with the tax authorities to confirm the status of the founder.

Public and non-public business companies

The definition of business companies includes public and non-public organizations engaged in commercial activities, in which the authorized capital consists of shares. The property fund is created from contributions made by the founders.

Business companies are also classified into public and non-public.

Ability to move from one form to another

The law does not prohibit changing one organizational form to another. For example, it is quite acceptable to transform a non-profit joint-stock company into a PJSC. What actions need to be taken for this:

- Increase the size of the authorized capital to 1000 minimum wages;

- Develop documentation that will confirm that the rights of shareholders have changed;

- Conduct an inventory of the property fund;

- Conduct audits with the involvement of auditors;

- Develop an updated version of the charter and all related documentation;

- Carry out the re-registration procedure;

- Transfer the property to the newly formed legal entity. face.

As a result of the legislative reforms carried out, many changes have occurred in corporate law. Traditional concepts have been replaced by new ones.

Although all the changes took place back in 2014, in some cities you can still see signs with familiar CJSC or LLC. But all new organizations are registered exclusively as public or non-public companies.