Selecting a code for a type of economic activity from a special classifier is an important part of the state registration procedure. The business owner must determine in advance what kind of activity he will be engaged in, and then select the appropriate OKVED code. Next, we will look at what the OKVED code “Provision of accounting services” will be in 2020. It should be understood that choosing the correct code is of great importance, since submitting not a single reporting form to the tax service and the Social Insurance Fund is possible without it.

OKVED “Accounting services”: from which classifier should the code be taken?

In 2020, only one edition of the reference book is relevant - OK 029-2014 (NACE Rev. 2), or OKVED2. You can view the directory on the official website of the Federal Tax Service. The new classifier came into effect on July 11, 2020. It differs markedly from previous editions, since similar activities are grouped into sections. Therefore, an entrepreneur will be able to quickly find the OKVED code “Accounting services” in the classifier.

Read also: Is it possible to carry out activities without OKVED

How to open an accounting services company

Before starting to provide accounting services, the question may arise: does an entrepreneur need to have the knowledge of a professional accountant?

As in any business, knowledge of the specifics is a definite plus, but not a requirement. You can entrust the control function over the work of personnel to a highly qualified accountant; the main thing in this case is to find him. The cost of paying such a specialist is a minus.

Licensing

Do I need to obtain a license to provide accounting services? No, don't. Accounting services are not subject to licensing. If you decide to provide audit services, in this case a license is required.

What permits are needed for an accounting services business? No special documents are needed, regular registration with the tax office, as an entrepreneur or legal entity, and that’s all.

LLC or individual entrepreneur

Which organizational and legal form to choose: individual entrepreneur or LLC? If you have a partner(s) in the business, then open an LLC to give everyone a share.

If there are no partners, then register an individual entrepreneur:

- fines for violations are 10 times less;

- There is no need to keep accounting records;

- there are no problems with cashing out and spending proceeds;

- regulatory authorities are always more loyal to individual entrepreneurs than to companies;

- no need for a legal address, place of registration - registration of the entrepreneur;

- easy to register and close.

Tax system

There are three taxation options (a patent for individual entrepreneurs, as well as UTII do not apply when providing accounting services):

- regular taxation system;

- simplified “income”;

- simplified “income minus expenses”.

The most optimal option when providing accounting services is the simplified “income”.

Cash machine

If clients pay for accounting services in cash, you will need a cash register.

You can ask the client to transfer cash to a current account at the nearest bank branch so as not to spend money on cash registers. But this is convenient if the bank is located in the same building where your office is located. Otherwise, the client may leave to look for a bank and never return.

Range of services

What services can an accounting services firm provide? Here is a sample list:

- Drawing up primary documents;

- Accounting;

- Preparation and submission of zero reports;

- Preparation of accounting and tax reporting;

- Restoration of accounting records;

- Development of accounting policies;

- Setting up accounting in the organization;

- Payroll;

- Personnel accounting;

- Consulting.

It is imperative to include in the services provided the registration of individual entrepreneurs and LLCs, and for this it is not at all necessary to hire a lawyer.

These are basic services, they are often provided along with legal and auditing services, and they also produce stamps, provide legal addresses, open bank accounts, and so on.

Staff

The following employees will be needed:

- The person involved in registering individual entrepreneurs and LLCs with the tax office;

- Courier;

- Primary accountant (accountant assistant);

- Accountants, leading firms are the main employees.

Organizations providing accounting services must be responsible for the quality of their services. If an accountant makes a mistake, the client may have problems: fines, penalties, blocking of the current account, and so on. The client can file a claim, terminate the contract, and the business reputation of the company will be tarnished.

Therefore, it is imperative to develop an internal control system and empower some employees with such powers. They can be called differently: internal auditors, auditors, controllers. The main task is to monitor the timely submission of reports, the correctness of tax calculations and reporting. This will provide additional control over the quality of services.

If the company is small, such control can be exercised by the director, deputy or head of the accounting department. What an employer will forgive his staff accountant, he will not forgive an organization providing accounting services:

- Lost primary documents will need to be restored;

- Compensate for costs when additional taxes and penalties are assessed.

Many firms providing accounting services insure their liability to the client.

The company will need one more specialist - a system administrator, and we cannot do without him. It is advisable that he understands accounting programs and ensures the smooth functioning of accountants. The system administrator can only be invited if a problem occurs.

Office rental

Many experts advise renting an office near the tax office. This makes sense, but is not at all a necessary condition. The main thing is that the office is located in a decent location: near bus stops, parking lots, and not in an industrial zone or residential area, but for example, in a business center.

And the office should look decent: if not luxurious, but renovated and with normal furniture, so that the client feels comfortable (and the employees too).

The size of the office depends on the number of staff. It is advisable (not necessary at the initial stage) to have a separate room for the manager to communicate with clients in a private environment. Coworking is perfect for this - renting a workplace, not a whole office, with the provision of furniture, office equipment, internet, tea/coffee.

A coworking space must have a meeting room. Yes, you have to pay for it, but usually the price is not high, and the first hour is free. Be sure to find out if there is a coworking space in your city. Go and see the conditions, maybe this is a better option than an office.

There are government-funded coworking spaces with free visiting hours, and there are those where the first day is free.

Business development

To successfully develop a business, you need customers, and you need to attract them through advertising. The following methods are suitable for this:

- Brand promotion - creating a trademark, for example, naming and making this name recognizable in your city (signboard, advertising, business cards, advertising brochures, etc.);

- Internet promotion - website creation;

- Advertising in the city - placing advertisements in local newspapers, websites, and on television.

Despite the rapid development of the Internet in the country, small businesses are poorly promoting themselves on the Internet. Many companies do not have the simplest business card website with contacts and a minimum of information about themselves, or the websites are such that it would be better not to have them at all.

It’s so convenient for the client: go to the website, see prices, list of services provided, contacts, directions. Using the website, the client can easily pay for services: by credit card or using an electronic wallet. If the site contains useful thematic articles, this is an additional plus. The information on the site must be current and truthful.

What will be the OKVED code “Accounting services”?

The OKVED code “Accounting Services” is selected as follows:

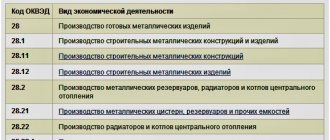

- In the OKVED2 classifier you need to find section M.

- Then go to class 69.

- Subclass 69.2 groups activities related to the provision of accounting services.

Subclass 69.2 consists of three subdivisions:

- 69.20.1 – conducting a financial audit (services are provided by audit companies and individual auditors);

- 69.20.2 is the OKVED code for the provision of accounting services;

- 69.20.3 – provision of services in the field of tax consulting (including preparation of documentation and representation of clients’ interests in the divisions of the Federal Tax Service).

Subgroup 69.20.2 includes the following services:

- accounting;

- preparation of accounting reports;

- accounting consulting;

- compilation and consolidation of financial statements.

Class 69.20 does not include:

- generation of summary data (cipher 63.11 is used);

- collection of payments on invoices (code 82.91 is used);

- management consulting (code 70.22 is used).

How many digits should the code contain? Previously, it was allowed for it to consist of three or more digits. But today the coding of the type of activity must contain at least four digits. For example, code 69.2 is invalid. But encoding 69.20 can be chosen as the main one, then the organization or individual entrepreneur will be able to carry out all the types of activities that it combines.

What services does an accountant provide - TOP 5 main types

The range of accounting services is very wide and varied.

Let's look at the most popular types.

Type 1. Accounting support

Leadership among accounting services belongs to accounting support for the activities of the customer company.

Accounting support is the services of an outsourcing company or private accountant for maintaining the customer’s records.

Benefits received from accounting support:

- savings on labor costs;

- official contract;

- the cost of services of the executing company is an expense recognized when taxing profits;

- guarantees of compensation for damage incurred due to the fault of the performer;

- professional approach;

- high quality;

- continuity of record keeping (no vacations, sick leave, etc.).

Accounting support can be full or partial.

Example

Marina, having graduated from college with honors, was able to immediately get a job as chief accountant at Kuznets LLC.

The newly appointed chief accountant did not experience fear, since she had excellent theoretical training, and she also had some practical skills (during the holidays she worked as an assistant accountant).

However, after a couple of weeks, Marina’s optimism diminished. Yes, and there was a reason! Although the LLC is small, there are 12 employees, there are several types of activities, and wages to employees are calculated in several forms (salary, piecework and bonuses).

While Marina had practically no problems with accounting for various types of activities (and she had someone to consult with if necessary), then there was trouble with wages and deductions, especially with personalized accounting.

There was no opportunity to ask the former chief accountant. There was only one way out: to outsource the wage accounting area.

By signing an agreement with, Marina not only solved problems with the salary area, but also acquired a professional consultant on other accounting problems.

Type 2. Restoration of accounting and tax records

In Russia, representatives of small and medium-sized businesses love to save money. They save both where necessary and where saving is undesirable, and sometimes even strictly prohibited.

They often save on accounting. They reason like this: the turnover is small, there are few employees, I will do everything myself!

And instead of transferring accounting to a specialist, they begin to draw up primary documents and create contracts from time to time.

Of course, such “accounting” will lead to problems that can only be solved by its restoration by professionals.

Accounting restoration is bringing the company’s accounting records into full compliance with the norms of current legislation.

The main reasons for restoring accounting:

- departure of the chief accountant;

- no accounting records were kept;

- interruptions in management;

- Inaccurate data was found in the accounting.

The recovery process includes a number of procedures.

Procedures for restoring accounting and tax accounting:

- assessment of the accounting status of the customer company;

- collecting, organizing, bringing primary documents into full compliance with the standards;

- conducting reconciliations with counterparties, tax authorities and funds;

- adjustment of reporting data;

- submission of updated (clarified) reporting to regulatory authorities;

- development of recommendations for further accounting for the customer.

Restoration of accounting records can be complete or partial.

Type 3. Advisory services

The next equally common type of accounting is consulting services.

Consulting services in the field of accounting and tax accounting are the services of specialists from accounting firms who provide professional advice on maintaining such accounting.

Consultations may not only be required by an inexperienced specialist; An experienced accountant sometimes also faces difficult situations.

Consultations can be obtained either one-time or on an ongoing basis. Accounting consultants can give advice orally or in writing, by phone, through the feedback form on the website of the consulting company, or during a personal visit to the office.

Important! Receive consulting services only from professionals. Otherwise, such consultants will do more harm than good.

Type 4. Accounting setup

There are times in the activities of organizations when accounting is required.

Accounting is a set of procedures that allows you to create an effective accounting and tax accounting system for a company.

A company may require such a service in several cases:

- when creating a company (setting up accounting “from scratch”);

- the company has a new type of activity;

- the company became a participant in the investment project.

When setting up accounting, specialists develop accounting procedures and forms of necessary documents.

An approximate list of documents and activities carried out when setting up accounting:

- accounting policy (accounting and tax);

- document flow diagram;

- working chart of accounts;

- forms of primary documents;

- accounting instructions;

- internal documentation (job descriptions, orders, etc.).

The setting process is especially relevant if the company plans to conduct accounting independently in the future.

Modern and professional accounting allows the company to begin its activities in strict compliance with the legislation of the Russian Federation, and this in turn serves as the basis for the development of a successful business.

Type 5. Preparation and submission of reports

The service of preparing and submitting reports is also popular. There are several reasons for this.

The main reasons for the demand for services for the preparation and submission of reports:

- the person responsible for reporting lacks professionalism;

- insufficient time to independently compile and send reports;

- an electronic digital signature has not been issued for sending reports via electronic communication channels.

Customer benefits from the service:

- saving time;

- reduction of technical and accounting errors;

- only current reporting forms;

- guarantee of correctness of reports;

- timely delivery;

- protection of transmitted information from third parties.

Additional codes

In addition to the main OKVED “Accounting Services” encoding, in 2019 a business entity will be able to indicate related ones. At the same time, there are no differences for legal entities and individual entrepreneurs; they have the right to take from the classifier those codes that suit them best. The main activity will be the one that accounts for the largest portion of gross value added. All other activities will be secondary.

Read also: Changing OKVED codes: step-by-step instructions

An organization or individual entrepreneur providing accounting services may use the following OKVED encodings as additional ones:

- 70.22 – provision of advice on commercial activities;

- 74.90 - other activities not included in any grouping of section M. This may include the provision of commercial services, auditing of accounts and other activities requiring high professional knowledge and practical experience.

The number of codes that a business owner can choose as additional is not limited by current legislation. However, you should also not specify a lot of extra encodings “in reserve”.

Read also: List of licensed activities 2020 according to OKVED

Premises and equipment

To organize a business providing accounting services, when opening an individual entrepreneur, it is not necessary to rent an office. At first, you can open an accounting office at home and meet clients on their territory. When the volume of work increases and there is a need to attract new employees, you can already think about an office with an area of 40-50 square meters. Such a room will be quite enough to accommodate 5 computer desks for your accountants.

You may be interested in: Flowers in glycerin - 2 manufacturing technologies

The best office location is close to potential clients. In addition, you should conduct a competitor analysis so as not to rent premises next to some well-promoted company that also provides accounting services. Another very good idea would be to rent a room next to the tax office, so that clients can do several things related to the company’s reporting in one place at the same time.

As for equipment, if you work from home for the first time, you will only need a computer, Internet, office equipment and licensed programs. For an office, you will have to allocate money to renovate the premises and purchase furniture.

Be sure, before you organize a business in accounting services from scratch, you need to acquire a working phone number, which you will need to advertise when promoting your office.

Staff

Opening your own accounting department at first may be possible without involving partners, but when business starts to improve, you will need to hire several qualified accountants. A mandatory requirement is work experience, because... Your little-known company should not be tarnished by unskilled workers.

You can even find employees via the Internet. Many female accountants are interested in how to make extra money on their knowledge while on maternity leave. Look for appropriate forums and offer cooperation.

What happens if the entrepreneur indicated the wrong OKVED code?

This question is very relevant for beginning entrepreneurs. If the OKVED code “Accounting services” was incorrectly indicated in the application for state registration, the culprit faces a fine under Article 14.25 of the Code of Administrative Offenses of the Russian Federation. The fine is up to 5,000 rubles.

For businessmen who did not inform the tax office on time about the change in type of activity and did not indicate the new OKVED code, the consequences may be more severe:

- payment of administrative fines;

- refusal to refund VAT;

- blocking of current account;

- submission of additional tax returns;

- refusal to receive professional tax deductions for personal income tax;

- payment of contributions for “injuries” to the Social Insurance Fund at increased rates;

- problems with banks and clients.

What are the prospects for such income?

Accounting services as a business is a rather promising area, because... Most entrepreneurs, when they open a small business from scratch, do their own reporting and other paperwork.

This is due to the fact that not all businessmen initially have enough start-up capital to hire an accountant. Therefore, the manager himself begins to understand zero reporting and other matters, devoting less time to his business. As a result, there comes a time when a lot of paperwork accumulates and you urgently need to look for a specialist who will help solve the problem.

In order not to complicate running a business, remote accountants have recently become popular; they handle company reporting from home or in their own office, earning slightly less than a full-time employee. The benefit is mutual - the businessman saves time and money, you get the opportunity to earn money on accounting services. Interested in the idea? Then read on to learn how to open your own accounting for a woman!

You may also be interested in our article: Ready-made business plan for a law firm.

Austaffing, OKVED code

Outsourcing and outstaffing

Outstaffing is the removal of personnel from the staff. In ordinary language, these are people performing work on the customer’s territory, with all the standards of labor discipline, but at the same time they are considered personnel of the performing organization, which pays them wages.

Only legal entities or employment agencies (private) can offer labor to other organizations. If an entrepreneur wants to arrange outstaffing, he must create and sign an agreement with an employment agency. Then the agency creates and approves contracts with employees.

What is Outsourcing, OKVED code

Outsourcing is the process of a company transferring part of its production or business processes to another company that is an expert in this field.

Employees are not included in the organization's staff and are not present on its territory throughout the day. The customer draws up a civil contract, and the performing company enters into a labor contract.

You can select the OKVED outsourcing encoding for 2020 according to the following codes:

- 69.10 – activities are carried out in the field of law;

- 69.20 – accounting services;

- 70.22 – consultations on commercial activities;

- 66.19.4 – financial affairs;

- 78.30 – personnel selection;

- 82.99 – additional business services.

If the owner has any questions or doubts regarding the choice of encoding, he can safely submit a request to the territorial administration.

Outsourcing and outstaffing, you can choose the OKVED encoding with the help of relevant organizations that will help not only choose the encoding, but also clarify all the questions of interest about the activity.

If the documents when registering with the Federal Tax Service were filled out incorrectly, this will lead to unpleasant results and you will have to pay a fine. An individual entrepreneur is obliged to fulfill, and will obey, the law of the Russian Federation.

How are tax regimes and OKVED codes related?

All special, or preferential, tax regimes (USN, UTII, Unified Agricultural Tax, PSN) have restrictions on the type of activity; if you intend to engage in certain types of activities, and at the same time choose a regime in which such activities are not provided for, then there is a conflict of interest here . It will be necessary to change either the tax regime or the desired OKVED.

Free tax consultation

For example, under the simplified tax system 2020 it is impossible to carry out insurance activities, extract minerals, except for common ones, or produce excisable goods. With UTII 2020 and PSN, you can only provide certain types of services and engage in certain types of trade.

Read more: Types of activities covered by patent in 2020 for individual entrepreneurs

Unified agricultural tax is generally intended only for activities related to agriculture and fisheries. True, the general taxation system (OSNO) has no restrictions related to the types of activities, but it has the highest tax burden.

Main code OKVED-2 2019

We recommend choosing the code: Activities for the provision of accounting services as the main type of activity.

69.20.2 - Activities for the provision of services in the field of accounting

This group includes: - activities related to maintaining (restoring) accounting, including the preparation of accounting (financial) statements, accounting consulting; on the adoption, compilation and consolidation of accounting (financial) statements

When studying and entering OKVED digital codes into the registration application, many novice entrepreneurs unknowingly make a number of mistakes. In order to help avoid them, we’ll talk in detail about what to rely on and in what order to act when choosing codes from the all-Russian classifier.

- Not all codes are equivalent when entered into the constituent documents of an enterprise or individual entrepreneur. The first code chosen is considered the main one, since it must correspond to the type of activity that is prioritized at the enterprise. All other codes play an additional role and are of a secondary nature. Every organization must have at least one code from OKVED; without it, registration with the state is simply impossible;

- All actually and formally possible types of economic activity carried out on the territory of Russia have their own special digital designation, which is included in OKVED. In turn, OKVED consists of sections and subsections, groups and subgroups. When choosing digital ciphers, you should go from large to small. That is, you need to start by defining the scope of activity, and gradually, through sections and groups, reach any specific type of activity. At the same time, you need to try to select codes so that they correspond as much as possible and reflect the essence of the actual work performed and services provided;

- The digital code from OKVED allowed for registration must consist of at least 3 characters. 3 numbers imply a subclass of the section and, as a rule, they are chosen by those entrepreneurs who do not want to limit their actions within this section in any way. However, it is still preferable to specify four-digit ciphers that are narrower in terms of practical application;

- If suddenly a newly created organization plans to engage in those works or services that, under Russian law, are subject to mandatory licensing or require special permission, it is best not to act at random, but to consult with specialists. They will help you more accurately designate the name of a particular type of activity and select the correct digital code, which will protect you from all sorts of troubles in the future.

Attention! If problems arise in selecting OKVED codes, it is enough to study Appendix “A” to the classifier. It is an excellent assistant and contains quite detailed explanations for all types of activities.

The applicant’s idea of the proposed activity codes does not always coincide with the logic of the structure of the OKVED classifier. For example, it is understandable when it comes to activities related to the rental of apartments and offices. The following OKVED codes are suitable:

- 68.20 Rent and management of own or leased real estate

- 68.20.1 Rent and management of own or leased residential real estate

- 68.20.2 Rent and management of own or leased non-residential real estate

Also, quite logically, activities related to trade or the provision of taxi services are structured. But, for example, a designer associated with Internet advertising can work under the following OKVED codes:

- 18.12 Other types of printing activities

- 74.20 Activities in the field of photography

- 62.09 Activities related to the use of computer technology and information technology, other

- 73.11 Activities of advertising agencies

- 73.12 Representation in the media

- 90.03 Activities in the field of artistic creativity

- 90.01 Performing arts activities

- 62.01 Computer software development

Ready-made sets of OKVED codes by type of business

As such, there is no liability for activities not in accordance with OKVED. Both judicial practice and letters from the Ministry of Finance confirm that an entrepreneur is not subject to liability for carrying out activities not specified in the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities.

At the same time, if you operate under an OKVED code that is not registered or was not entered later, you may be brought to administrative liability in the amount of up to 5,000 rubles under Art. 14.25 of the Code of Administrative Offenses of the Russian Federation for “...failure to submit, or untimely submission, or submission of false information about a legal entity or an individual entrepreneur.”

But here you need to be careful. The fact is that the calculation of contributions for workers for insurance against industrial accidents and occupational diseases occurs according to the tariffs for the main type of activity. The more risky (traumatic or provoking occupational diseases) the activity is, the higher the insurance premium rate.

Before April 15 of the year following the reporting year, employers must submit to the Social Insurance Fund documents confirming the main type of activity, in the manner prescribed by Order of the Ministry of Health and Social Development No. 55 of January 31, 2006. Organizations submit such confirmation annually, and individual entrepreneurs - employers only if they have changed their main type of activity. The main type of activity is considered to be the type of activity from which the income received is higher in comparison with the income from other activities for the previous year.

If confirmation is not submitted, then the FSS sets the highest tariffs of all types of activities specified by the policyholder, and this is where excessively specified OKVED codes can turn out to be very inappropriate.

The entire “reinforced concrete” logic of tax officials is based on their constant desire to not recognize the taxpayer’s right to a tax benefit or to reduce the tax base. Everything comes into play here, including the refusal to accept expenses for transactions with counterparties if they do not indicate the type of activity for which the business transaction took place.

Most often, such refusals are associated with the recognition of expenses when calculating income tax and VAT refund. Judges in such disputes, as a rule, side with the businessman, but if you do not want to bring the matter to court, then it is better to make sure that your partner has the required OKVED code.

Another important point is when tax authorities unreasonably try to prove that activities under an unspecified OKVED code are, in principle, not entrepreneurial. In particular, there are known denials of the right to apply a tax rate of 6% for an entrepreneur on the simplified tax system for income if he received this income under unspecified OKVED codes. The Federal Tax Service is trying to tax such income with personal income tax at a rate of 13%, as received by an individual from activities not related to business.

- OKVED codes are a statistical designation of the code of activities that the applicant indicates in the application for registration of an individual entrepreneur or LLC.

- You must indicate at least one activity code in the application; the maximum number of OKVED codes is theoretically unlimited.

- There is no point in indicating as many codes as possible in the application (just in case), because... When registering an individual entrepreneur, among them there may be those for whose management it is necessary, in addition to the usual package of documents, to present a certificate of no criminal record.

- If you have chosen a special tax regime, then when choosing OKVED codes you must take into account restrictions on the types of activities in this regime.

- If there are employees, the main type of activity must be confirmed with the Social Insurance Fund before April 15: for organizations annually, for individual entrepreneurs only if the main code is changed, because The rates of insurance premiums for employees depend on this.

- There is no liability for activities not according to the specified OKVED codes, but for untimely (within three days) notification of a change in codes, an administrative fine of up to 5 thousand rubles may be imposed.

- If you or your counterparty do not have the appropriate OKVED codes, tax disputes are possible, with a refusal to reduce the tax base or apply another tax benefit for the transaction.

69.20.2 - Activities for the provision of services in the field of accounting

This grouping includes:

- activities related to maintaining (restoring) accounting, including the preparation of accounting (financial) statements, accounting consulting; on the adoption, compilation and consolidation of accounting (financial) statements.

Business plan for accounting services

Brief investment memorandum

Currently, outsourcing services of professional accountants are extremely popular. This is due to many factors. Firstly, this is constantly changing legislation. Secondly, it is becoming more and more expensive to employ a professional accountant and a team. As a result, the payback period for the project is 11 months, and the break-even point falls on the 3rd month of the company’s operation.

To organize a business providing accounting services, you will need to rent a premises with an area of 80 m2. It is advisable to locate the premises in the central part of the city with convenient access roads, parking and public transport stops. In addition to renting the premises, you will need to hire 9 employees.

The company will provide reporting, accounting and financial support services. The average number of orders is 95 pcs. Of these, most of them are for consulting services, the rest for the preparation and maintenance of financial statements. The cost of services varies from 2,500 rubles to 15,000 rubles. As a result, the financial indicators of the project will be as follows:

Initial investment - 557,000 rubles

Monthly profit - 110,000 rubles

Payback period - 11 months

Break-even point - 3 months

Return on sales - 24%

Description of business, product or service

Accounting services are always in demand. They are used by both individual entrepreneurs and large businesses. It is also worth noting that the demand for these services is very high.

Within this business, the main activity will be consulting services. At the opening stage, clients will be offered the following types of services:

- Preparation and maintenance of balance sheet/accounting for individual entrepreneurs and LLCs

- Preparation of zero reporting

- Accountant advisory services

- Preparing a company for an audit

- Supporting financial issues of legal entities and individuals.

These services will be offered during the business opening stage. As the company grows, it can also begin to provide tax consulting services, management accounting, and also implement various IT solutions.

Licensing for this activity is not required, but it is worth noting that in order to open and successfully develop this business, you will need to have skills and experience working in accounting or a similar firm. This will allow, firstly, to quickly attract your first clients, as well as quickly earn a reputation and attract new clients.

To organize a business, you will initially need to rent office space. It is advisable to look for premises in the central part of the city. The minimum area of the premises is 80 m2 and includes a waiting room for clients, 2 meeting rooms and an office for staff. There is also a technical area (bathroom, technical room, warehouse).

To organize a business you will also need the following equipment:

- Computer desk (8 pieces)

- Document cabinet (3 pieces)

- Computer chairs (8 pieces)

- Chairs for visitors (3 pieces)

- Computers (8 pieces)

- Cash register

- Printer-scanner

With this equipment, the company will be able to provide a full range of services to its customers.

In addition to organizational issues, company employees need to refresh their knowledge in the field of accounting regulation in the Russian Federation. These legal acts include:

- Federal Law “On Accounting”

- Regulations on accounting and financial reporting in the Russian Federation

- Chart of Accounts

- Accounting Regulations

- Regulations on documents and document flow in accounting

- Instructions and guidelines for the application of certain accounting provisions

These provisions must be followed in order to provide professional services to our clients. High professional competencies will allow you to attract clients faster and get larger clients.

Description of the sales market

The success of this business is determined by the quality of services provided, as well as the presence of regular customers.

The main target audience is both individuals and legal entities. The largest share is occupied by legal entities - 80%, while individuals account for 20%. Individuals will seek financial advice or enter into contracts for new businesses.

The main difficulty of this business is high competition. Therefore, when opening, it is advisable to already have a small client base, as well as build a potential client base.

Competition can be dealt with in different ways. These include price competition, the use of various loyalty programs, and providing discounts on other services. The most effective way is to package a range of products at lower prices, which will allow you to constantly maintain occupancy, as well as get maximum profit per client.

Sales and Marketing

To quickly attract customers, you will need a competent marketing and advertising strategy. To create a campaign, you can hire either a private marketer or an advertising agency.

Given the high level of competition, the advertising campaign and promotion channels must be analyzed carefully. This will significantly reduce costs and get maximum returns.

The main online channels include:

- contextual advertising

- Targeted advertising on social networks

- Advertising on your own website

The main offline channels include:

- Advertising on banners and billboards

- Advertising in print media

- "Cold calls

- Business events

Since the main clients are legal entities and personal contact with the client plays a decisive role here, the greatest attention should be paid to offline channels, namely attending various events and “cold” calls.

Production plan

In general, it will take 2 months to open this business. To organize a business you will need to do the following:

- Register - IP

- Find a room

- Make repairs

- Purchase equipment

- Start hiring staff

- Start advertising

- Get started

| Stage/duration, weeks | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| Individual entrepreneur registration | ||||||||

| Selection of premises | ||||||||

| Repair | ||||||||

| Equipment purchase | ||||||||

| Hiring | ||||||||

| Start of an advertising campaign | ||||||||

| Beginning of work |

Initially, to open a business, you will need to register a legal entity - individual entrepreneur (OKVED - 74.12 “Activities in the field of accounting and auditing”). Next, you will need to submit an application to the tax office to switch to the simplified tax system (“income-expenses”). The next step is to open a bank account and purchase a cash register.

Once all legal documents have been received, you can begin searching for premises and concluding a lease agreement. It is advisable to look for a premises with a major renovation. The next stage will be the renovation of the premises. Repairs can be made cosmetically. This will allow you to significantly save on the initial investment in the project.

Then you can start purchasing equipment and hiring staff. Purchasing equipment will take no more than one week, while hiring staff can take up to 2 weeks.

The next step is to start an advertising campaign. As soon as the first clients appear, you can conclude contracts and officially begin work.

Organizational structure

To open a business, you will need to hire the following specialists:

- Director

- Project manager

- Accountant-consultant (4 people)

- Secretary

- Cleaning woman

- Sales Manager

As a result, the total number of personnel will be 9 people. The director of the company can be either the owner or an employee. To achieve maximum business performance, the director must have experience in the industry and extensive professional experience. His responsibilities will include company development, as well as negotiations with potential clients.

The project manager is directly involved in the execution of customer orders and interacts with consultants and the director of the company. Accountant consultants also fulfill client orders, prepare documents for project managers, and collect necessary information from open sources.

The secretary receives guests and helps organize work in the office, monitors the availability of office supplies, etc. The sales manager is engaged in attracting clients, making cold calls, and collecting a database of potential clients.

The cleaning lady cleans the office in the evening. The company's accounting is carried out in-house. The advertising agency is outsourced.

Payroll fund, rub.

| Fixed expenses | Salary | The number of employees | Sum | Average salary per month per employee |

| Director | 60 000 | 1 | 60 000 | 60 000 |

| Project manager | 50 000 | 1 | 50 000 | 50 000 |

| Accountant-consultant | 35 000 | 4 | 140 000 | 35 000 |

| Secretary | 20 000 | 1 | 20 000 | 20 000 |

| Cleaning woman | 15 000 | 1 | 15 000 | 15 000 |

| Sales Manager | 15 000 | 1 | 15 000 | 35 594 |

| Insurance premiums | 90 000 | |||

| Total payroll | 390 000 |

The full calculation of the payroll for 24 months, taking into account the bonus part and insurance contributions, is presented in the financial model.

Financial plan

Capital costs for starting an accounting services business, rub.

| Name | Quantity | Price for 1 piece. | Total amount |

| Computer desk | 8 | 4 000 | 32 000 |

| Filing Cabinets | 3 | 3 000 | 9 000 |

| Computer chairs | 8 | 1 500 | 12 000 |

| Chairs for visitors | 3 | 3 000 | 9 000 |

| Coffee table | 1 | 4 000 | 4 000 |

| Computer | 8 | 28 000 | 224 000 |

| Cash register | 1 | 8 000 | 8 000 |

| Printer-scanner | 1 | 8 000 | 8 000 |

| Total: | 306 000 |

The total capital costs for equipment are 306,000 rubles. Of this, 224,000 rubles must be spent on purchasing computers. Also, 32,000 rubles will be spent on a computer desk.

Investments for opening, rub.

| Investments for opening | |

| Registration, including obtaining all permits | 10 000 |

| Repair | 96 000 |

| Signboard | 15 000 |

| Promotional materials | 20 000 |

| Website creation | 15 000 |

| Rental during renovation | 80 000 |

| Equipment purchase | 306 000 |

| Other | 15 000 |

| Total | 557 000 |

The total investment for opening a business providing accounting services is 557,000 rubles. The largest costs are for the purchase of equipment (306,000 rubles), renovation of the premises (96,000 rubles) and its rental (80,000 rubles).

Monthly costs, rub.

| Monthly costs | |

| Payroll (including deductions) | 410 594 |

| Rent (15 sq.m.) | 80 000 |

| Public utilities | 8 000 |

| 20 000 | |

| Purchase of office supplies | 15 000 |

| Unexpected expenses | 15 000 |

| Total | 548 594 |

Average monthly costs are 548,594 rubles. Of this, an average of 410,594 rubles goes to the wage fund, and 80,000 rubles to rent premises. The average monthly profit is 113,686 rubles.

The sales plan for 24 months, taking into account seasonality, the forecast of investment efficiency and the calculation of economic indicators of the business are presented in the financial model.

Risk factors

The main risks when starting this business include:

- Lack of clients

To reduce this risk, it is necessary to create and begin to develop a potential client base even before opening, as well as hire a good advertising agency with experience in promotion in this industry.

- High competition

To reduce this risk, you need to carefully study potential competitors in your region and their competitive advantages. This will allow us to identify their weaknesses and provide better service to customers.